Emerging Market Links + The Week Ahead (January 22, 2024)

Freightwaves has reported that Energy shipper Shell (NYSE: SHEL) along with the big three Japanese tanker and bulker owners (MOL, NYK and K-Line) have halted all Red Sea transits.

Other energy problems are brewing as Occidental Petroleum Corp (NYSE: OXY)’s CEO has stated in a recent interview: “2025 and beyond is when the world is going to be short of oil.” Oilprice.com has also noted how Oil industry executives have been warning that new resources, new investments, and new supply will be needed just to maintain the current supply levels as older fields mature.

Finally, Brazil’s Lula is betting on a return to state capitalism which he defended in a recent speech while Argentina’s Milei gave a speech at Davos that defended capitalism and libertarian principles…

$ = behind a paywall

(Note: Nothing for last week as I was preparing to and traveling back to SE Asia from the USA…)

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Transforming Alibaba: Understanding Alibaba’s most radical changes in history (Momentum Works)

In March 2023, following Jack Ma’s return to China, Alibaba announced its biggest restructuring in history. The group will be “split” into six independent units with a “1+6+N” structure.

That announcement kickstarted a year of drastic changes in leadership, people, organisational structure and much more…

What exactly has been happening? What do the co-founders, who came back to take up the roles of Group Chairman and CEO, have in mind?

Perhaps the frequency of mentions of certain keywords during Alibaba Group’s most recent earnings call offer a good glimpse. The most mentioned words are: cloud (61 times), Taobao (52 times) and AI (48 times), in contrast to once paramount important GMV (only 8 times) and brands (only 11 times)

🇨🇳 Pinduoduo (PDD US): Another Strong Beat Around the Corner (Smartkarma) $

We expect PDD Holdings (NASDAQ: PDD) to report the highest growth in topline for 4Q23 over last three years. In particular, we believe its bottom line will beat by wide margin.

But easy days are gone for PDD’s domestic e-commerce business and high base will kick in from 1Q24, resulting in tough comps, notable deceleration and potentially short-term share price volatility.

We see 20% upside to current PDD valuation by assigning 20xPE to our US$12 billion adjusted net profit estimate for 2024.

🇨🇳 Weimob shops breakup plan, but investors aren’t buying it (Bamboo Works)

The e-commerce services provider said it is exploring a spinoff for its marketing services arm, with plans to list it separately on China’s A-share market

Weimob (HKG: 2013 / FRA: 36W / OTCMKTS: WEMXF) shares fell 12% after it announced it is exploring a spinoff for its marketing services arm for a separate listing on China’s A-share market

The company said the unit being spun off is worth 3.6 billion yuan, but the market values the business at less than half that amount

🇨🇳 Lenovo: Positives Are Priced In For This AI PC Play (Seeking Alpha) $

AI PCs are expected to drive a meaningful increase in worldwide PC shipments going forward; leading PC maker Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) is seen as a proxy for the AI PC investment theme.

Lenovo currently trades at a Price-To-Earnings Growth, or PEG, multiple of of 1.02 times, which implies that the stock is at a fair valuation.

I make no changes to my existing Hold rating for Lenovo, after assessing its prospects and valuations.

🇨🇳 Three executives fined $93 million by CSRC for manipulating stock price (Caixin) $

Three executives at a publicly listed company and private equity firms were fined a total of 661 million yuan ($93 million) by China’s securities regulator for conspiring to manipulate the company’s stock price and illegally pocket

65 million yuan.Wu Xian, chairman of Shenzhen JT Automation Equipment Co. Ltd. (SHE: 300400), was found conspiring with Chen Lei, chairman of Shenzhen Junru Asset Management Consulting Co. Ltd., and Lin Jianwu, chairman of Shenzhen Huihaihong Financing and Investment Development Co. Ltd., to use collaborated accounts to manipulate JT’s stock price between November 2017 and April 2019, according to a statement posted on the website of the China Securities Regulatory Commission (CSRC).

🇨🇳 China-linked self-driving startup TuSimple to delist from Nasdaq (Nikkei Asia)

Tusimple Holdings Inc (NASDAQ: TSP), a U.S.-based developer of self-driving truck technology with Chinese ties, has applied to delist from Nasdaq, with its market value dwindling to around 1% of its peak amid commercialization delays and rising interest rates.

TuSimple expects its stock to go off the market around Feb. 8, and will deregister with the Securities and Exchange Commission as well, according to Wednesday’s announcement. The company told shareholders that their holdings will not change.

TuSimple has been repeatedly investigated by U.S. regulators over concerns about technology transfer to China and business dealings with Chinese companies.

🇨🇳 Asian Dividend Gems: Minsheng Education (Asian Dividend Stocks) $

Minsheng Education (HKG: 1569) is a highly undervalued Chinese education stock with high dividend yields. Market cap of the company has declined by nearly 90% from Jun 2018 to today.

Minsheng Education’s dividend yield averaged 5.1% from 2020 to 2022. Estimated dividend yield is 14.6% in 2023.

Minsheng Education mainly provides educational services in China. The company is one of the leaders of China’s private higher education industry.

🇨🇳 Anta in foot race to separately list its Amer unit in New York (Bamboo Works)

Shares of China’s leading sportswear maker initially jumped after it announced IPO plans for its Finland-based foreign unit, but later gave back the gains

Revenue for ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF)’s Amer unit jumped by nearly 30% in the first three quarters of last year, but its net loss also grew

Bocom International estimates a successful listing for Finland-based Amer could save up to 600 million yuan in annual interest expenses

🇨🇳 (Luckin Coffee(LKNCY US, BUY, TP US$43) TP Change): Weak Earnings in 4Q23 but Better Outlook in 2024 (Smartkarma) $

In 4Q23, we expect Luckin Coffee (OTCMKTS: LKNCY) revenue to increase 93% YoY to RMB7.1bn, and expect GPM/OPM to decline (5.8)/(1.3) ppt YoY to 19.0%/8.2%, respectively.

We cut 4Q23 operating income by 12%. In 2024, we raised our revenue estimate by 5% due to the speed up of new store opening schedule.

Furthermore, as price competition eased, we expect Luckin to offer less low-priced drinks, thus driving up OPM in 2024.

🇨🇳 With cost pressures down, China’s duty-free leader gets in the groove (Bamboo Works)

China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) has significantly lowered its costs with new lease agreements at Beijing and Shanghai airports, as investors eye potential for new tourism stimulus

China Tourism Group Duty Free’s profit grew 33.5% last year, while its revenue rose 24.2% to 67.6 billion yuan

The duty-free store operator’s fourth-quarter profit surged by 275.6% year-on-year

🇨🇳 Travelsky (696 HK | BUY | TP:HKD9.92): Forget 2023, Think of 2024-25 Which Will Be Much Better (Smartkarma) $

Travelsky Technology (HKG: 0696 / FRA: TVL / OTCMKTS: TSYHY / TSYHF) issued its 2023 operating statistics and a profit warning that is far below market expectations, the share price has plunged by 36%

Our analysis suggests that staff cost, commission, and systems costs have soared. This will be contained when traffic accelerates and absorbs these fixed cost items

Our target price of HKD9.92 (+21% UPSIDE) is based on 2024 PE 14.8x (1SD below mean). Keep an eye, worthwhile trade, due for a bounce

🇨🇳 IFlytek hives off health unit to fund AI medical drive (Bamboo Works)

The iFlytek (SHE: 002230) group aims to list its Xunfei Healthcare subsidiary on the Hong Kong stock market, using the proceeds to deploy large AI models for medical services

Xunfei Healthcare has posted rising revenue since its launch, but the firm racked up a loss of more than 280 million yuan in the past two years

The financial condition of the parent company, iFlytek, may have been a factor in the decision to spin off the subsidiary despite a Hong Kong market slump and weak healthcare stocks

🇨🇳 IMAX China (1970 HK) (Asian Century Stocks) $

IMAX China (HKG: 1970 / FRA: IMK / OTCMKTS: IMXCF) – US$313 million) is the Chinese subsidiary of America’s IMAX Corporation (NYSE: IMAX)- a leading provider of high-end cinema equipment.

The Chinese business is separately listed in Hong Kong under the ticker 1970 HK. It’s been given an exclusive license to sell IMAX theater systems to exhibitors within Greater China.

Since IMAX China’s IPO in 2015, the share prices has been on a long-term slide. The main reason is that installation revenue hit a peak shortly after the IPO. At that time, recurring revenue streams like maintenance and film conversion fees were small relative to the total, failing to make up for falling installations.

🇨🇳 Will Pagoda’s ambitious 10-year plan bear fruit, or is it destined to wither on the vine? (Bamboo Works)

China’s leading fruit seller has announced a plan to become king of the global fruit industry over the next decade

Shenzhen Pagoda Industrial Group (HKG: 2411 / FRA: D0V) has unveiled an ambitious plan to boost its annual GMV to more than 100 billion yuan by 2034

The fruit retailer is speeding up store openings, aiming for 10,000 outlets in 10 years, compared with 6,000 last June

🇨🇳 Country Garden Pledges to Deliver More Than 480,000 Homes in 2024 (Caixin) $

Chinese property developer Country Garden (HKG: 2007 / OTCMKTS: CTRYF / OTCMKTS: CTRYY) vowed to deliver more than 480,000 homes in 2024, a more modest target than 2023 after it failed to achieve its 700,000-unit goal last year.

The focus of 2024 is still to “guarantee delivery, guarantee operation and guarantee credit,” of which delivery is the bottom line that Country Garden “must firmly hold,” Chairwoman Yang Huiyan said at the developer’s annual meeting Monday.

🇨🇳 Aoyuan gets relief from debt restructure, as its fate stays tied to property market (Bamboo Works)

Several courts have approved the struggling developer’s offshore debt restructuring plan, which will save Aoyuan billions of dollars in interest payments

China Aoyuan Group (HKG: 3883 / FRA: 47C / OTCMKTS: CAOYF) has restructured its offshore debt with a plan that includes some refinancing, and the issue of common shares and perpetual and convertible bonds.

Aoyuan expects to save up to $4.9 billion in interest payment on its foreign debt over the next eight years through the plan

🇭🇰 Tigre de Cristal exit due to Russia-Ukraine war: Summit (GGRAsia)

Summit Ascent Holdings Ltd (HKG: 0102) confirmed a majority-owned subsidiary is to sell, for US$116-million, G1 Entertainment LLC, the gaming licence holder of the Tigre de Cristal casino resort in the Russian Far East. It cited “uncertainties arising from the ongoing Russia-Ukraine conflict”.

The Wednesday filing said Summit Ascent’s stock – in a trading suspension on the Hong Kong Stock Exchange since January 11 – would remain suspended “pending the publication of the inside information announcement” as defined under bourse rules.

The update also said the deal would go ahead despite the “disapproval” of most of the board at Summit Ascent and its Hong Kong-listed parent Let Group Holdings Ltd (HKG: 1383).

🇭🇰 Bud APAC (1876 HK): Nursing a Hangover; Now Comes a Passive Overhang Smartkarma)

Budweiser Brewing Company APAC Limited (HKG: 1876 / OTCMKTS: BDWBY / BDWBF) has seen investors run for the hills over the last year. The halving of the stock price could mean deletion from passive portfolios.

Other Hong Kong listed brewers, China Resources Beer Holdings or CR Beer (HKG: 0291 / FRA: CHK / OTCMKTS: CRHKY / CRHKF) and Tsingtao Brewery (SHA: 600600 / HKG: 0168 / FRA: TSI0 / OTCMKTS: TSGTF / TSGTY) have been beaten down too and have underperformed their Asian peers.

The deletion from passive portfolios could provide a buying opportunity in Budweiser Brewing APAC (1876 HK) at the end of February (or earlier if the stock drops due to positioning).

🇭🇰 Techtronic Industries: Watch Share Repurchases And 2024 Outlook (Rating Upgrade) (Seeking Alpha) $

(Hong Kong-based power tools manufacturer) Techtronic (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF) has bought back one million of its shares in recent months, which I think has favorable read-throughs relating to its valuations and cash flow.

Techtronic Industries is expected to perform better in 2024 as compared to 2023, with growth drivers such as rate cuts and channel destocking this year.

I upgrade my rating for Techtronic Industries to a Buy following a review of the company’s financial prospects for 2024 and its recent share buybacks.

🇹🇼 Alchip Technologies GDR Offering – Has Been Riding on an Unwavering Momentum over the past Year (Smartkarma) $

(Fabless semiconductor company) Alchip Technologies (TPE: 3661 / OTCMKTS: ALCPF) is looking to raise US$415m in its GDR offering. As per the firm, the proceeds from the GDR offering will be used to purchase raw materials.

Offering 3.7m GDRs, the deal wouldn’t be a very large one for the firm to digest at just 1.6 days of its three month ADV.

The deal is very well flagged one and momentum on the stock has been very strong.

🇹🇼 What Stories TSMC Investor Conference Telling Us About Customers, Supply Chains, and Competitors (Smartkarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) expects 2024 semi sector in recovery with 20-25% y/y growth itself, driven by AI customers. By controlling capex, more rooms to raise dividends but no growth for equipment vendors.

Faster ramp on N3, likely N3E, N3P than competitor’s. TSMC expects 3nm from 6% of sales in 3Q23, 12.7% in 4Q23 to 15% in 2024, 3x y/y increase in 2024.

TSMC reports a nearly 30% q/q drop on IOT and consumer IC demand and sees weakness on 12″ mature technology despite better demand 8″ specialty technology.

🇰🇷 South Korea casino op GKL posts US$33mln profit in 2023 (GGRAsia)

Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, reported net income of KRW44.08 billion (US$32.8 million) for full-year 2023, based on preliminary, unaudited figures included in a Thursday filing to the Korea Exchange.

The result compared with a net loss of KRW22.74 billion in 2022, a year during which the company’s business was negatively impacted by disruption caused by the Covid-19 pandemic.

Grand Korea Leisure runs three foreigner-only casinos in South Korea under the Seven Luck brand: two in the capital Seoul, and one in the southern port city of Busan.

The group is a subsidiary of the Korea Tourism Organization, which in turn is affiliated to South Korea’s Ministry of Culture, Sports and Tourism

🇰🇷 Korean Air – US Blocking of JetBlue/Spirit Continues Trend of M&A Opposition (Smartkarma) $

The US Supreme Court has just blocked JetBlue’s planned acquisition of Spirit Airlines, ruling on the side of the US DOJ, which had sued to block the proposed deal.

Reuters has reported that the European Commission should approve Korean Air/Asiana imminently following analysis of concessions provided. However, the US and Japan also need to approve the deal.

In “Korean Air – Plan B should Asiana merger fail to gain approval” on 26 October 2023, we highlighted Korean Air is well positioned to continue as a standalone entity.

🇰🇷 Orion Corp: Concerns About Diversification into LegoChem Bioscience (Smartkarma) $

On 15 January, Orion Corp (KRX: 271560) announced that its subsidiary PAN Orion Corp will purchase a 25.7% stake in Legochem Biosciences (KOSDAQ: 141080) for 549 billion won.

LegoChem Bio specializes in antibody-drug conjugate (ADC) technology. Legochem Bio signed a total of 13 technology transfer contracts amounting to 8.7 trillion won in the past 9 years.

Most investors in Orion Corp would rather have the company focus on its core confectionery/snack business, rather than expand into high risk/high reward biotech business.

🇰🇷 Insiders Are Buying Shares In These Korean Companies in January 2024 (Smartkarma) $

🇰🇷 44% of Korean Stocks Are Trading Below Book Value – FSC Wants to Improve This (Following Japan) (Smartkarma) $

FSC Chairman Kim Joo-hyun mentioned that too many companies in Korea are trading below book value and the FSC plans to implement changes to improve upon this issue.

According to Korea Exchange, 1,111 companies out of total listed in KOSPI and KOSDAQ in Korea (2,538) are trading at below 1x book value (PBR) (liquidation value).

According to the Capital Group, about 39% of companies in the TOPIX trade below book value, compared to just 5% for companies in the S&P 500 Index.

🇰🇷 Hyundai Hyms IPO Bookbuilding Results Analysis (Smartkarma) $

Hyundai Hyms (shipbuilding equipment and related services) reported excellent IPO bookbuilding results. IPO price has been determined at 7,300 won per share, which is 16% higher than the high end of the IPO price range.

A total of 2,099 institutional investors participated in this IPO book building. The demand ratio was 681 to 1. Hyundai Hyms IPO will start trading on 26 January.

Given the solid upside, we expect investors to push up the share price above the high end of our IPO sensitivity analysis (9,092 won) in the first day of trading.

🇸🇬 AEM: When Inventory Fell off the Truck On the Way to Penang… (Smartkarma) $

AEM Holdings (SGX: AWX / OTCMKTS: AEMFF) (Innovative, full-stack solutions, tailored for advanced semiconductor technologies) had a bizarre announcement on Sunday evening the 14th of January 2024: inventory was “lost” on the way to Penang from its Singapore factory.

Given AEM’s stellar corporate governance reputation up until now, this raises more than a few eyebrows: how is this even possible?

4Q23 results, due in a month, will feature a large restatement of FY23 results and lead to a major earnings loss. Any recovery is delayed into FY25.

🇸🇬 Singapore Exchange’s Share Price is Hitting a 52-Week High: Can the Bourse Operator Continue to Do Well? (The Smart Investor)

The bellwether Straits Times Index (SGX: ^STI) has declined by around 3% since the beginning of 2024.

Despite this dip,Singapore Exchange Limited (SGX: S68 / FRA: SOU / SOUU / OTCMKTS: SPXCF / SPXCY), or SGX, saw its share price scale a 52-week high of S$9.98 recently.

We dig deeper to determine if SGX can continue to do well in 2024.

🇸🇬 Flex: Growth Potential After The Nextracker Spin-Off (Seeking Alpha) $

Flex (NASDAQ: FLEX) experienced a stock drop post-spin-off of Nextracker (NASDAQ: NXT).

Despite the dip, Flex showcases strong financials, positive guidance, and a decade-long history of returns.

Nextracker’s spin-off and market reaction offers an attractive entry point, with Flex focusing on growth and profitability.

🇮🇩 PT Avia Avian (AVIA IJ) – A More Glossy Future (Smartkarma) $

Avia Avian (IDX: AVIA / FRA: P2C) is Indonesia’s largest paint manufacturer with a strong track record, selling a wide range of architectural solutions products, with a countrywide distribution network.

The company continues to add to its product portfolio by adding more affordable products to cater for consumers trading down due to inflationary pressures depressing disposable incomes.

Avia Avian continues to add to its distribution network and has introduced express delivery that allows retailers to take more products but less inventory. Valuations are attractive with supportive dividends.

🇹🇭 Berli Jucker (BJC TB) – Well-Crafted Consumer Package (Smartkarma) $

Berli Jucker PCL (BKK: BJC / BJC-F / OTCMKTS: BLJZY) remains a core proxy for consumer recovery and increasing tourism numbers in Thailand, with earnings set to recover in 2024 driven by modern retail and packaging.

Modern retail through Big C has resumed its expansion momentum across all formats with Big C Mini driving growth and supporting its omnichannel efforts, with rental income also recovering.

The packaging business was impacted by the sluggish Vietnamese economy which impacted aluminium cans but new products and strong performance from glass should support growth in 2024. Valuations look depressed.

🇰🇿 Kaspi – The future Wechat of Central Asia? – A destination analysis (Atmos Invest – Hunting for 100-baggers)

KASPI (LON: 80TE / FRA: KKS), a fintech business in Kazakhstan, has developed a superapp: Kaspi kz which has been downloaded about 10 million times on Android in a country with 19 million people.

Have they forged the one ring? Can it become the one app in all of Central Asia? Let’s find out.

If you prefer, you can download the 34-page PDF by clicking this button….

🇵🇱 Text: Temporary Problems And An Unusual Dividend Yield Of 6.5% (Seeking Alpha) $

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF) is a customer service platform that offers live chat support, multichannel communication, chatbots, analytics, integration, customization, and security.

In an update reported at the beginning of January, the company showed a worsening in key performance indicators such as churn rate or ARPU.

I think this slowdown in growth is temporary and was impacted by the macroeconomic situation and the change in revenue recognition.

Currently, the P/FCF Ratio is 14x, and the dividend yield is 6.5%, making it a very attractive investment opportunity.

🇧🇷 Totvs: A Long-Term Tech Winner Despite Valuation Raising Eyebrows (Seeking Alpha) $

TOTVS (BVMF: TOTS3) is a Brazilian IT company operating globally, offering business solutions with a strong presence in the Brazilian CRM market.

The investment thesis for Totvs revolves around its classification as a growth company, CRM market leadership, and its recurring revenues.

Totvs demonstrates financial strength through robust revenue generation, a 52% net profit CAGR, and a resilient cash flow.

Valuation concerns, including a stretched P/E ratio, with risks associated with the dynamic tech market and acquisition growth.

Despite these concerns, investing in Totvs for the long term remains appealing due to consistent robust results and growth prospects, particularly in the Techfin segment.

🇧🇷 CTEEP: A Cautious Outlook On The Dividend Thesis In The Current Scenario (Seeking Alpha) $

Companhia de Transmissão de Energia Elétrica Paulista (BVMF: TRPL3 / TRPL4) is a Brazilian utility company engaged in electric power transmission.

CTEEP’s investment thesis is supported by its focus on energy transmission, high cash generation, revenue indexed to inflation, and a robust track record in dividend payments.

The company benefits from the resilience of the electricity sector, employing the RAP model for revenue, and has shown substantial growth in Annual Permitted Revenue over the years.

While CTEEP has historically been a strong dividend payer, a substantial investment plan may impact dividends. Considering potential risks, a hold stance is recommended for investors.

🇧🇷 Cyrela Brazil Realty: Cautiously Bullish On This Brazilian Prime Homebuilding Stock (Seeking Alpha) $

Cyrela Brazil Realty Sa Empreendimentos (BVMF: CYRE3 / OTCMKTS: CYRBY) is a Brazilian real estate company focused on residential property construction and development, primarily in São Paulo and Rio de Janeiro.

The company has a strong presence in the middle- and high-income segments, demonstrating resilience to macroeconomic indicators.

Despite challenges like margin contractions and cash burn, Cyrela sustains positive results with high sales velocity, growing work portfolios, and a favorable valuation.

Cyrela’s financial data indicates negative cash flows, yet its strategic cash use accelerates operating figures.

Valuation analysis suggests Cyrela is relatively affordable, with shares trading below historical averages, justifying a cautiously bullish stance.

🇧🇷 Waiting For A Brazilian Recovery, Vinci Partners Remains Resilient (Seeking Alpha) $

Vinci Partners Investments Ltd (NASDAQ: VINP) is a leading alternative asset manager in Brazil with around BRL 65 billion in assets.

The company has formed a strategic partnership with Ares Management, which includes cross-collaboration in fundraising activities and an equity investment of $100 million.

Vinci has shown resilience and growth in its private strategies, raising BRL 1.2 billion in capital and benefiting from a potential decrease in interest rates in Brazil.

VINP is well-suited to benefit from Brazil’s rates decreasing and trades at an acceptable multiple of recurring earnings.

🇧🇷 BrasilAgro Is A Speculative Play On Crop Prices With No Margin Of Safety (Seeking Alpha) $

Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3) is a land developer and farmer in Brazil, Paraguay, and Bolivia with 215 thousand hectares of land.

The company’s profitability is dependent on the price of agricultural commodities, particularly soybeans.

The company’s land holdings are valued at a discount to net asset value, but this discount is correlated to commodity prices, too.

In my opinion, the company offers no margin of safety and is therefore a speculative play on agricultural commodity bullishness.

🇧🇷 Minerva: Rise Of A Monopsony (Seeking Alpha) $

Minerva Sa (BVMF: BEEF3) S.A. is South America’s largest export beef meatpacker with a significant market share in Brazil, Paraguay, Uruguay, and Colombia.

The company enjoys scale advantages and operates as a monopsony or oligopsony in most regions where it operates.

Minerva can arbitrage across various factors and offers customers higher supply security and supply chain simplicity.

🇧🇷 JBS Is A Quality Giant Trading At Low Cycle-Average Valuations (Seeking Alpha) $

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) is the largest meatpacking company globally, with a strong market position and expanding into value-added products.

The company’s market power is evident in its growing margins and returns on capital, despite operating in commoditized markets.

JBS’s leverage is manageable, and its long-dated debt maturities and fixed interest rates enhance its value.

🇺🇾 DLocal: Can DLocal Conquer Emerging Markets Despite A Looming Problem? (Seeking Alpha) $

Dlocal (NASDAQ: DLO) is an online cross-border payment platform that enables global merchants to get paid and make payments in emerging markets.

The company offers Pay-In and Pay-Out services, allowing customers to pay for online purchases and enabling users to pay their partners, suppliers, and contractors.

DLocal’s growth trajectory shows dominance in Latin America but challenges in Africa and Asia, while its Total Payment Volume has seen significant growth. Valuation suggests potential upside in the future.

$ = behind a paywall / 🗃️ = Archived article

🌍 Red Sea conflict worsens, forcing more ship detours around Africa (FreightWaves)

Energy shipper Shell (NYSE: SHEL) halted all Red Sea transits on Tuesday, as did the big three Japanese tanker and bulker owners: MOL, NYK and K-Line.

Container-ship diversions around the Cape of Good Hope now appear likely to last for months. Spot rate gains from diversions will almost certainly extend into the period when 2023 annual trans-Pacific contracts are negotiated, pushing up contract rates.

🌐 Occidental’s CEO Sees Oil Supply Crunch from 2025 (OilPrice.com)

The ratio of discovered resources versus demand has dropped in recent decades and is now at around 25%.

Occidental Petroleum Corp (NYSE: OXY) CEO Hollub: “2025 and beyond is when the world is going to be short of oil.”.

Oil industry executives have been warning that new resources, new investments, and new supply will be needed just to maintain the current supply levels as older fields mature.

🇨🇳 Chinese stock rout accelerates as foreign investors sell out (FT) $ 🗃️

🇨🇳 Beijing tells some investors not to sell as Chinese stock rout resumes (FT) $ 🗃️

🇨🇳 China’s Cyberspace Administration is conducting review of Shein -WSJ (Reuters) & Fashion Giant Faces New IPO Hitch: China’s Cybersecurity Police – WSJ (WSJ) 🗃️

China’s internet regulator is looking at how Shein handles information on its partners, suppliers and staff in China, and if the fashion company can protect such data from leaking overseas, WSJ reported, citing people familiar with the matter.

This comes as Shein seeks Beijing’s nod to go public in the United States and could potentially complicate the fast fashion retailer’s listing plans, which have run into political opposition in the United States.

Shein, which according to Reuters sources was valued at $66 billion in a fundraising in May, filed its planned U.S. IPO with the China Securities Regulatory Commission (CSRC) in November.

🇨🇳 Who stands to gain from China’s demographic collapse? (FT) $ 🗃️

🇨🇳 Is deflation really China’s next big export? (FT) $ 🗃️

🇨🇳 China is not alone in having unreliable growth data (FT) $ 🗃️

🇰🇷 🇧🇷 Why Did Korea Get Rich While Brazil Stagnated? (The Emerging Markets Investor)

Conclusion – What will the future bring?

Brazil missed the boat on the trade globalization of the past 40 years while Korea was a primary beneficiary. However, the world is now changing, as protectionism and industrial policy cycle back into favor.

Korea’s “sandwich” problem has not gone away, and its reliance on foreign markets may now be a liability. Moreover, Korea faces a severe demographic problem with the prospect of a declining population and workforce for decades to come. Regional geopolitical tensions may also be highly destabilizing. On the positive side, Korean society is highly homogeneous, collective, and collaborative and has proven highly adaptive to change.

Demography is a lesser issue for Brazil, though its “demographic dividend” of the past decades will become a drag in the coming years. Deglobalization and the newfound popularity of industrial policy may provide an opportunity for productive investment. On the negative side, Brazil’s highly heterogeneous population, a total lack of collective and collaborative spirit, and fractured politics do not promise an easy turnaround.

🇧🇷 Lula’s playbook: Brazil bets on a return to state capitalism (FT) $ 🗃️

🇧🇷 Lula’s Speech in Salvador (The Emerging Markets Investor)

Transcript

🇦🇷 Argentina’s Milei at Davos (The Emerging Markets Investor)

Transcript

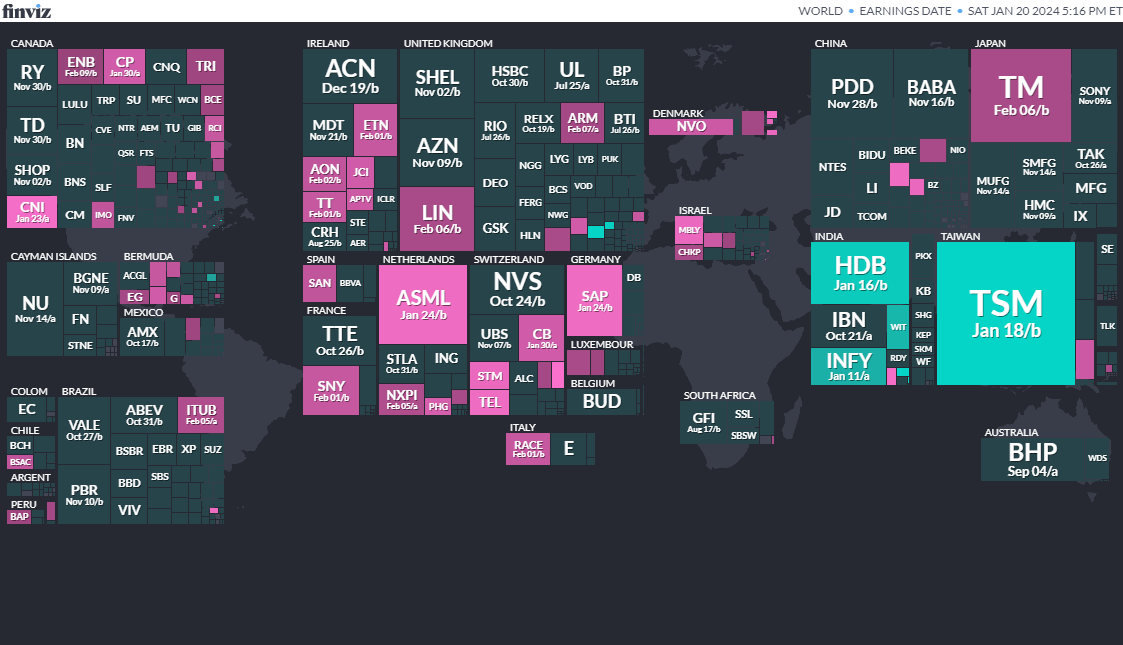

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

TaiwanTaiwanese Legislative YuanJan 13, 2024 (d) Confirmed Jan 11, 2020 -

TaiwanTaiwanese PresidencyJan 13, 2024 (d) Confirmed Jan 11, 2020 -

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024