Emerging Market Links + The Week Ahead (January 28, 2025)

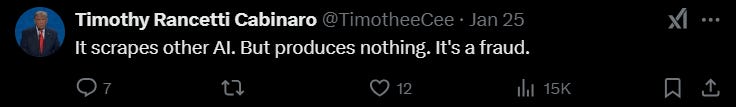

Chinese New Year is about to start with China potentially giving Silicon Valley a huge lump of coal in the form of DeepSeek – a new AI platform that already has the bears over at ZeroHedge and other alt-media sites off to the races:

Like many people, I played around with ChatGPT etc and was less than excited (and I am not even talking about its ability to produce “historical” images of black Vikings and black popes…). Internet and especially Google search have gotten so bad that any sort of “AI” help (I do like the AI search on the Brave browser for simple search queries) is better than nothing these days…

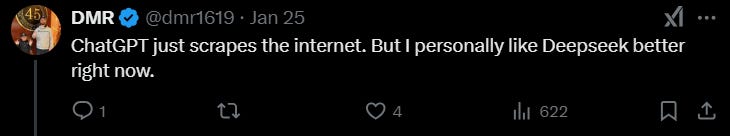

However, Marc Andreessen, who was recently on Joe Rogan explaining why he and other Silicon Valley types became Trump supporters after listening to the Biden Admin’s plans to have a couple of BIG companies effectively controlled by them in control of all AI development, has this take:

In other words, maybe Silicon Valley/Biden Admin’s focus on DEI/diversity hiring, censoring people they don’t like, and expensive/politically correct/woke AI has blown up in their faces – and wallets…

Finally, note that these weekly links collection posts will be back to getting published around Monday morning EST time…

$ = behind a paywall

-

🇨🇳 China & Hong Kong Stock Picks (December 2024) Partially $

-

CLSA’s Feng Shui Index 2025 report

-

China Hongqiao, Vesync, Hesai Group, VSTECS Holdings Ltd, Hansoh Pharmaceutical Group Company, China Resources Beverage Holdings (CR Beverage), Waterdrop, Tencent Music Entertainment Group, Foxconn Interconnect Technology (FIT Hon Teng), Luckin Coffee, Sany Heavy Equipment International Holdings, SenseTime, LK Technology Holdings Ltd, Bosideng International Holdings & Meituan

-

CMB International’s 2025 China Strategy Outlook:

-

-

🌐 EM Fund Stock Picks & Country Commentaries (January 26, 2025) Partially $

-

China investing now a tactical game, what Trump means for EMs + China, Sri Lanka trip report, 2 Polish stocks, European companies become more shareholder friendly, more December/Q4 fund updates, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 Tencent’s E-Commerce Play: The WeChat Mini Shop Revolution (The Great Wall Street – Investing in China)

Forget Alibaba (NYSE: BABA) and JD.com (NASDAQ: JD)—Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY) is quietly building a dominant e-commerce ecosystem through WeChat. Here’s what investors need to know.

Investors outside mainland China have an incredible ability to ignore Tencent, Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY), and basically any company that isn’t listed in the U.S. No 13F filings, no Wall Street hype cycles, no constant ADR drama. Meanwhile, smaller, far less relevant companies get dissected like they’re the second coming of Apple. Tencent—the single most dominant company in China, shaping everything from payments to entertainment—somehow gets treated like a background character while people write essays about Baidu (NASDAQ: BIDU), a company that has spent the last decade perfecting the art of irrelevance. It’s genuinely mind-blowing. But fine, let’s fix that. Tencent’s latest e-commerce push is quietly becoming one of the most important shifts in Chinese tech, and as usual, no one is paying attention.

🇨🇳 (JD.com, Inc (JD US, BUY, TP US$52) TP Change): C4Q24 Preview: Still the Safe Choice into 2025 (Smartkarma) $

We expect JD.com (NASDAQ: JD) C4Q24 revenue/non-GAAP NI to be RMB337bn/9.7bn, 1.6%/6.5% above consensus, benefiting from trade-in subsidies and logistics;

With 2025 having four quarters of trade-in subsidy vs. 2024’s one quarter and smartphone’s participation, JD.com is on solid growth footing in our universe.

We raised JD.com’s TP from US$50 to US$ 52 TP and maintain BUY rating.

🇨🇳 East Buy ends superstar influencer addiction – but at a big price (Bamboo Works)

The livestreaming e-commerce company’s revenue declined and it fell into the red in the first half of its fiscal year after the departure of its key online salesman Dong Yuhui

East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF)’s revenue fell over 20% in the six months to November and it swung into the red following the departure of its star online salesman

Shares of the company’s parent, New Oriental Education (NYSE: EDU), dropped 23% last week, weighed down by East Buy’s results and softness in its core education market

🇨🇳 Lopal steers back towards profitability after tough two years (Bamboo Works)

The maker of cathode materials for lithium iron phosphate batteries appears to be on the mend after slipping into the red in 2023 and 2024

Jiangsu Lopal Tech Co Ltd (SHA: 603906 / HKG: 2465 / FRA: 9OU) said it expects to report a loss of 595 million yuan to 697 million yuan for all of 2024, or about half the 1.23 billion yuan it lost in 2023

The company’s inventory-related write-downs and accounts receivables both fell sharply last year, indicating its situation is stabilizing

🇨🇳 Fu Shou Yuan (1448.HK) – Investment Strategy May Need to Be Adjusted (Smartkarma) $

(Burial and funeral services) Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF)‘s performance in full-year 2024 is likely to fall short of expectations. The current pain point is declining performance growth due to difficulty of expanding beyond Shanghai region.

If Fu Shou Yuan’s dividends/stock buybacks are lower-than-expected, we don’t think the stock is worth holding for the long term, since long-term revenue growth rate would fall to single digit.

Since high growth is difficult to achieve, it’s better to buy at a low price (e.g. PE of 10x). When valuation bounces back to 15x PE, investors could consider taking profits.

🇨🇳 Suntien picks up as it digests massive wind power buildup (Bamboo Works)

The wind farm operator said its power generation stabilized in the second half of last year as it curbed its spending on new projects

China Suntien Green Energy Corp (HKG: 0956 / SHA: 600956 / FRA: 9C6 / OTCMKTS: CSGEF) said its green power generation dropped 0.93% last year, easing from 3.57% decline for its core wind power in the first half of the year

The company’s profits from its wind and solar power business fell 10% in the first half of last year, as its utilization and tariff rates sagged

🇨🇳 GAPack (468 HK): Now What As XJF’s Offer Gets Up (Smartkarma) $

🇨🇳 BeiGene heads for profit milestone after hemorrhaging cash (Bamboo Works)

BeiGene (NASDAQ: BGNE)

With a blockbuster drug under its belt and another product approved for U.S. sale, the biopharma firm says it is on track to post an annual operating profit this year

Global sales of the firm’s flagship drug for blood cancers reached $1.82 billion in the first nine months of 2024 and could top $2 billion for the full year

The company has built a global clinical team to speed up the testing and launch of new drugs, aiming to become less reliant on research partners

🇨🇳 Henlius (2696 HK): Deal Break as HKEx Merger Arb Rulebooks Are Rewritten (Smartkarma) $

Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF) shareholders have voted against Shanghai Fosun Pharmaceutical (HKG: 2196 / SHA: 600196 / FRA: 08HH / OTCMKTS: SFOSF)’s HK$24.60 offer. The minority participation rate was high, and the NO vote comfortably cleared the threshold.

The China Traditional Chinese Medicine (HKG: 0570 / OTCMKTS: CHIZF) and Henlius deal breaks have rewritten the HKEx merger arb rulebook. The Henlius deal break offers several lessons.

The 27.5% share price decline since 9 January points to a well-flagged deal break. Nevertheless, precedent deal-breaks suggest that the shares remain vulnerable and could touch HK$15.

🇨🇳 Shanghai Henlius Biotech (2696 HK) – About the Deal Break and the Valuation Outlook (Smartkarma) $

Lin Lijun voted against the privatization, which is in line with our analysis. Lin and some other long-term investors expressed their “dissatisfaction” by opposing the privatization due to disappointing Cancellation Price.

Due to deal break, Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF)’ share price could be under pressure in short term. Investors may need to wait until the implementation of biosimilar VBP in 2025 to see situation clearly.

Despite biosimilar VBP, we remain optimistic about the outlook of Henlius, because its future development positioning will not be limited to just biosimilars, but will focus on internationalization.

🇨🇳 Dpc Dash (1405 HK) – Thursday, Oct 24, 2024 (Smartkarma) $

DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF) is the master franchisee of Domino’s Pizza in China, currently operating 768 stores

Despite current lack of profitability, DPC Dash has potential to become second largest player in Chinese pizza market in four years

Strong leadership team and focus on value for consumers position DPC Dash to capitalize on low number of pizza stores per population in China compared to other key markets

🇨🇳 Battered Lanvin hopes for better 2025 as executive revolving door keeps turning (Bamboo Works)

China’s answer to global luxury brand operators has named a new top executive, as it struggles with frequent departures and the worst global luxury goods market in 15 years

Lanvin Group Holdings Ltd (NYSE: LANV) has named Andy Lew as its new chief, replacing Fosun Group veteran Eric Chan after just one year

The luxury brand operator’s Lanvin and Sergio Rossi labels both got new creative directors last year, as the CEO for its Wolford label left after just six months

🇨🇳 China National Building Material (3323 HK): H Share Buyback Vote on 19 February (Smartkarma) $

The IFA opines that the China National Building Material (HKG: 3323 / FRA: D1Y / OTCMKTS: CBUMF) share buyback, which will acquire a maximum of 841.7 million H Shares at HK$4.03, is fair and reasonable.

The share buyback seems designed to enable the CNBM parent company to bypass the creeper rule and squeeze the shorts.

The fortuitous material derating of peers has helped make the buyback attractive. Therefore, the votes should pass, and the minimum acceptance condition should be met.

🇨🇳 Guotai Junan/Haitong Sec Merger: The Many Index Flows Around the Corner (Smartkarma) $

Haitong Securities (H) (6837 HK) and Haitong Securities (A) (600837 CH) (Haitong Securities Co Ltd (SHA: 600837 / HKG: 6837 / OTCMKTS: HAITY / HTNGF)) shares will stop trading after 5 February following the merger with Guotai Junan Securities Co Ltd (SHA: 601211 / HKG: 2611 / FRA: 153A / OTCMKTS: GUOSF)

There will be small buying in Guotai Junan Securities (2611 HK) at the close on 5 February and there should be more buying in the A-shares and H-shares in March.

There will also be a stock added to the Shanghai Shenzhen CSI 300 Index (SHSZ300 INDEX) to bring the number of index constituents back to 300.

🇨🇳 Haitian looks for new financial flavor in Hong Kong IPO (Bamboo Works)

China’s condiment king and leading soy sauce brand plans to use proceeds from the listing to fund its bid to bring its flavors to the world

Foshan Haitian Flavouring & Food (SHA: 603288) has filed to list in Hong Kong, reporting its profit grew 11.2% to 4.82 billion yuan in the first three quarters of last year

The leading soy sauce maker has distributed more than 26 billion yuan in dividends over the past 10 years, with an annualized dividend payout rate exceeding 50%

🇨🇳 Guming (Good Me) IPO: Key Facts and Financials at First Glance (Smartkarma) $

Guming Holdings (GUM HK), a leading player in China’s freshly-made branded beverage sector, is widely expected to launch its IPO soon.

Guming’s Good Me brand is China’s largest mid-priced freshly-made tea store brand in terms of store count as well as GMV.

Guming reported robust revenue and profit growth for first nine months of 2024 led by new store openings, although same-store sales declined due to rising competition and weak consumer spending.

🇨🇳 Guming Holdings (Good Me) IPO: The Bull Case (Smartkarma) $

Guming Holdings (GUM HK) (Good me), a freshly-made tea store brand, is pre-marketing an HKEx IPO to raise US$300 million, according to press reports.

Guming is China’s largest mid-priced freshly-made tea store brand and the second largest freshly-made brand across all price ranges, regarding GMV in 2023.

The bull case rests on a rising market share, strong franchisee profitability, top-tier revenue growth, high margins, cash generation and a strong balance sheet.

🇨🇳 Guming Holdings (Good Me) IPO: The Bear Case (Smartkarma) $

Guming Holdings (GUM HK) (Good me), a freshly-made tea store brand, is pre-marketing an HKEx IPO to raise US$300 million, according to press reports.

In Guming Holdings (Good Me) IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

The bear case rests on under-pressure store KPIs, unsustainable historical growth rates, declining contract liabilities, margin pressure due to competition and a sizeable pre-IPO dividend.

🇭🇰 Panama starts audit of China-linked port operator amid Trump takeover threat (Caixin) $

Panamanian authorities have started an audit of a Chinese-linked company that operates two ports at either end of the Panama Canal, as President Donald Trump threatens to take back the waterway, citing China’s influence on the key U.S. trade route.

An audit team from the Office of the Comptroller General has begun a financial and compliance review of Panama Ports Co., which is controlled by a subsidiary of Hong Kong billionaire Li Ka-shing’s CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF), the office said Tuesday on social media platform X. The action is “aimed at guaranteeing the efficient and transparent use of public resources,” the office said.

🇲🇴 Many listed Asia-casino stocks had downward trend in 2024 (GGRAsia)

🇲🇴 Fresh Macau offers aid Wynn amid China hurdles says Fitch (GGRAsia)

Casino operator Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF), and its parent Wynn Resorts Ltd (NASDAQ: WYNN), have had their issuer default ratings affirmed at ‘BB-’, with a ‘stable’ outlook, by Fitch Ratings Inc.

Fitch stated it expected the Wynn group’s Macau operations “to grow marginally” in 2025 to 2028.

“A weaker Chinese economy, a decline in the value of the Chinese currency… relative to the Macau pataca – which is fixed to the U.S. dollar – and potential tariffs” on Chinese exports, “are likely,” said the rating agency in a Tuesday update.

Though it added regarding the Macau business: “This will be offset by continued visitation growth from new amenities, expansion projects throughout Macau and increased visas” for Macau visits issued by the mainland authorities “from certain Chinese provinces”.

🇲🇴 JPM forecasts LVS Macau EBITDA at US$2.7bln for 2025 (GGRAsia)

(Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) / Las Vegas Sands (NYSE: LVS))

“For 2025, we reduce our aggregate Macau property level EBITDA (forecast) to US$2.66 billion, from our prior US$2.8 billion – down 5 percent –, representing levels that are – hopefully – ultimately conservative,” wrote JP Morgan analysts Joseph Greff, Samuel Nielsen and Pritesh Patel in a Wednesday memo.

The JP Morgan team stated: “Our assumptions in Macau reflect a greater than expected impact from President Xi’s visit in December, some lingering renovation impacts at the Londoner (Macao) – which should largely abate through the first quarter of 2025 –, and what we think is likely below normal VIP hold in Macau.”

🇹🇼 TSMC: A Strong AI Stock For 2025 (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Will Keep Processing Bigger Gains (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Demand Outlook Offsets Likely Peak In Gross Margins (Seeking Alpha) $ 🗃️

🇹🇼 Why Taiwan Semiconductor Is A Buy: Capitalizing On AI And HPC Trends (Seeking Alpha) $ 🗃️

🇹🇼 United Microelectronics: Growth Opportunities On Volume Recovery, But Pricing Remains A Risk (Seeking Alpha) $ 🗃️

🇹🇼 Investing In United Microelectronics’ Wandering Finances (Seeking Alpha) $ 🗃️

🇹🇼 Hon Hai Precision: New-Found Focus On AI Is Paying Off (Seeking Alpha) $ 🗃️

🇰🇷 Shinhan Financial: 2025 Will Be A Good Year (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇰🇷 Samsung Cracks The AI Puzzle With Galaxy S25 (Seeking Alpha) $ 🗃️

🇰🇷 LG Display Co. Q4 Results: Lackluster Performance And An Uncertain Future (Seeking Alpha) $ 🗃️

🇰🇷 LG Display: Not Off To A Good Start In What Could Be A Difficult 2025 (Seeking Alpha) $ 🗃️

🇰🇷 DoubleDown Interactive: Net Cash 65% Of Market Cap, 25% FCF Yield Make It A Buy (Seeking Alpha) $ 🗃️

🇰🇷 DoubleDown Interactive: The House May Not Always Win (Seeking Alpha) $ 🗃️

🇰🇷 Kangwon Land 4Q sales up 6pct y-o-y at US$240mln (GGRAsia)

Fourth-quarter sales at Kangwon Land (KRX: 035250), operator of the Kangwon Land complex (pictured), South Korea’s only casino open to locals, rose 5.9 percent year-on-year, to KRW344.34 billion (US$239.7 million). Judged sequentially, final-quarter sales fell 8.3 percent, the firm said in a Thursday filing to the Korea Exchange.

The group had already on Monday outlined its annual net income for 2024, which went up by circa 34 percent year-on-year, mainly due to a hike in non-operating income.

🇰🇷 Kangwon 2024 net income up 37pct but modest sales gain (GGRAsia)

Net income for the 12 months to December 31 at Kangwon Land (KRX: 035250), operator of South Korea’s only casino open to locals, rose 33.6 percent year-on-year, while sales rose 2.8 percent.

The reasons for the improvement in net income was due to an increase in non-operating income during the period, said the firm in the Monday filing to the Korea Exchange.

Net income for the firm, which runs the Kangwon Land resort (pictured) and its casino in an upland area outside the capital Seoul, was nearly KRW455.38 billion (US$317.0 million) for the year, compared to KRW340.88 billion a year earlier.

🇰🇷 Samsung Life Insurance: Implications of Classifying Samsung Electronics as a Long-Term Holding (Douglas Research Insights) $

Samsung Life Insurance (KRX: 032830) is considering on a special measure of classifying its stake inSamsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) as a long-term holding stock of up to 10 years.

If Samsung Life Insurance’s stake in Samsung Electronics is classified as a long-term holding, Samsung Life Insurance cannot sell Samsung Electronics stocks for at least 5 years.

There is an increasing probability that if Samsung Life Insurance classifies its stake in Samsung Electronics as a long-term holding, the current ownership stake structure involving Samsung Group remains intact.

🇰🇷 A Hostile M&A Fight for T’Way Air (Douglas Research Insights) $

An M&A fight for T’Way Air (KRX: 091810) has officially erupted as Daemyung Sono Group sent a letter to the current management requesting several management improvement measures including resignation of existing management.

Currently, T’Way Air’s largest shareholders are T’Way Holdings and Yelimdang which combined have 30.07% stake in T’Way Air. Daemyung Sono is the second largest shareholder with a 26.77% stake.

From Daemyung Sono Chairman Seo Jun-Hyeok perspective, entering the aviation industry is attractive because it can create synergy with existing hotels and resort businesses.

🇰🇷 HMM: Material Improvement in Corporate Value Up Plan (Douglas Research Insights) $

On 22 January, HMM (KRX: 011200) (formerly Hyundai Merchant Marine) announced its new Corporate Value Up plan which included five major items.

They include higher shareholder returns, achieve average sales growth of 9% and ROE of 4% in the next three years, and improve communication with stakeholders and shareholders.

The company plans to implement total shareholder returns of at least 2.5 trillion won within one year, which represents 14.8% of its market cap.

🇰🇷 Hana Micron: Split into Hana Semiconductor Holdings and Hana Micron (Douglas Research Insights) $

Hana Micron (KOSDAQ: 067310) announced its plan to split into Hana Semiconductor Holdings and Hana Micron (a newly established company).

Existing shareholders will receive shares of the two companies in equal proportions according to the split ratio which is 32.5% for Hana Semiconductor Holdings and 67.5% for Hana Micron.

We remain negative on Hana Micron. The valuation of the company remains stretched. In addition, there are increasing concerns about the company’s new plan to split into two different companies.

🇰🇷 Korea Zinc: An Important Legal Decision to Disallow Appointment of Directors Using Cumulative Voting (Douglas Research Insights) $

On 21 January, there was an important legal court decision to disallow the appointment of directors using the cumulative voting system at the Korea Zinc (KRX: 010130)‘s EGM on 23 January.

This legal decision is likely to favor MBK/Young Poong Precision Corporation (KOSDAQ: 036560) alliance in the control of Korea Zinc. The market increasingly favors the likelihood of MBK/Young Poong alliance winning this proxy battle.

Therefore, the chance of a further M&A battle has been reduced which is likely to further decline in the share price of Korea Zinc.

🇰🇷 Korea Zinc: Cross Shareholding Limitation System Loophole (Douglas Research Insights) $

The proxy battle at the EGM for the control of Korea Zinc (KRX: 010130) is scheduled for 23 January.

One day prior to the EGM, Korea Zinc’s Chairman Choi is trying to capitalize on the “cross-shareholding limitation system” in order to retain control of the company.

In our view, it appears that the legal case regarding the cross shareholding limitation system is in favor of MBK/Young Poong Precision Corporation (KOSDAQ: 036560) alliance.

🇰🇷 TXR Robotics IPO Preview (Douglas Research Insights) $

🇰🇷 Seoul Guarantee Insurance Corp IPO Preview (Significantly Lower IPO Price Range) (Douglas Research Insights) $

Seoul Guarantee Insurance Corp (SGIC) is trying for another attempt at an IPO at much lower IPO price range. The IPO price range is from 26,000 won to 31,800 won.

At the high end of the IPO price range, the IPO offering size is 222 billion won. The IPO price range has been lowered by 34% to 39%.

Despite the company’s consistent record of generating positive operating profit, its lack of sales growth and declining operating margins in 2024 remain key concerns.

🇰🇷 Dongbang Medical IPO Book Building Results Analysis (Douglas Research Insights) $

Dongbang Medical reported excellent IPO book building results. The IPO price has been finalized at 10,500 won. The demand ratio from the institutional investors was 910 to 1.

Our base case valuation of Dongbang Medical is target price of 13,609 won per share which is 30% higher than the IPO price of 10,500 won.

Dongbang Medical specializes in the manufacturing and distribution of acupuncture needles, various cosmetic devices, and other medical devices.

🇰🇷 Doosan Enerbility: Thoughts on the IPO of Doosan Skoda Power (Douglas Research Insights) $

Doosan Skoda Power is getting ready to complete an IPO on the Prague Stock Exchange. The IPO is aiming to gather up to 2.53 billion crowns, or about US$105.5 million.

Post IPO, Doosan Power System plans to maintain a 67% ownership. Doosan Enerbility (KRX: 034020) owns a 100% stake in Doosan Power Systems.

If Doosan Skoda Power is valued at 8.3 billion crowns and if we annualize the company’s net profit to 473 billion in 2024, this would suggest a P/E of 17.5x.

🇲🇾 British American Tobacco (Malaysia): Consider Regulatory Headwinds And Market Potential (Seeking Alpha) $ 🗃️

🇵🇭 Digiplus user signups doubled to 40mln in 2024: report (GGRAsia)

Philippine-listed DigiPlus Interactive (PSE: PLUS), an investor in gaming services including bingo and a digital sportsbook platform, says it doubled its registered-user tally, to more than 40 million last year. That is according to a Thursday briefing by the company, reported by local media outlets.

The firm’s chairman Eusebio Tanco was cited as saying he was hopeful the user base would continue to grow, following the company’s entry into the Brazil market, and the recent move by the Philippine Amusement and Gaming Corp (Pagcor), the regulator in its home market, to reduce the fee paid by electronic games (e-Games) operators to 30 percent of gross gaming revenue (GGR).

Philippine news outlet BusinessWorld quoted Mr Tanco as stating: “Our aim is really to do better than the year past. We also try to manage the expectations of investors. They don’t expect us to have those hyper growth (rates) every year.”

🇸🇬 Sea Limited: Thriving Growth Trifecta In Shopping, Gaming, And Lending (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Millennium & Copthorne Hotels (MCK NZ): City Dev’s Unattractive Takeover Offer (Smartkarma) $

Millennium & Copthorne (NZE: MCK / MCKPA) disclosed a conditional takeover offer from City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY) at NZ$2.25, a 25.0% premium to the undisturbed price of NZ$1.80 (17 January).

The key condition is a 90% minimum acceptance condition, which will be an issue as the offer is materially below NTA on a historical cost and market-value-based approach.

CDL has three options to address shareholder resistance: lower the minimum acceptance threshold, increase the offer price, or continue extending the close.

🇸🇬 How to play AI and green energy? (Smartkarma) $

The magic acronyms: FPSO, FSRU, and FLNG

Specifically, shipyards focused on building floating energy assets like FPSO (Floating Production Storage and Offloading Vessel), FSRU (Floating Storage Regasification Unit), FLNG, oil rigs, and drill ships.

Seatrium Limited (SGX: S51 / FRA: S8N / OTCMKTS: SMBMF) was formed in 2023 from the merger of Sembcorp Marine and Keppel Offshore & Marine. The company’s shares are listed in Singapore and Germany. However, Seatrium Limited’s history began long before the merger.

🇸🇬 Keppel Ltd: Part V – Is Keppel’s Fund-Raising Strategy Sustainable in the Long Run? (Corporate Monitor)

🇸🇬 Keppel Ltd: Part V – Transforming into a Global Asset Manager. Is Keppel’s Fund-Raising Strategy Sustainable in the Long Run? (Corporate Monitor)

This report analyzes Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF)’s ambitious S$200 billion fund-raising strategy, questioning its sustainability. The report finds that Keppel lacks a strong core product. Its launching of numerous funds suggests a “land grab” approach rather than a strategic build. The report contrasts Keppel’s approach with successful asset managers like Blackstone, highlighting the shortcomings of Keppel’s model. Ultimately, the report expresses significant reservations about Keppel’s fund-raising strategy.

🇸🇬 4 Semiconductor-Related Singapore Stocks That Could Soar in 2025 (The Smart Investor)

World Semiconductor Trade Statistics (WSTS) has revised its growth expectations for 2024 upwards and expects a 19% year-on-year increase in the semiconductor market to reach US$627 billion.

This momentum is expected to continue this year with an 11.2% year-on-year increase, bringing the semiconductor market valuation to US$697 billion.

Here are four attractive semiconductor stocks that could ride on this wave to do well this year.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, is a supplier of high precision tools and parts in the wafer fabrication and assembly processes for the semiconductor industry.

UMS Integration Ltd (SGX: 558 / OTCMKTS: UMSSF) provides equipment manufacturing and engineering services to original equipment manufacturers (OEMs) of semiconductors and their related products.

AEM Holdings (SGX: AWX) provides comprehensive semiconductor and electronic test solutions.

Frencken Group Ltd (SGX: E28) is an integrated technology solutions company that serves customers in the life sciences, automotive, healthcare, and semiconductor industries.

🇸🇬 4 Singapore Stocks Posting Higher Profits: Are They a Buy? (The Smart Investor)

🇮🇳 Infosys: IT Services Giant Hit By Negative Sentiment And Weak Q4 Outlook (Seeking Alpha) $ 🗃️

🇮🇳 MakeMyTrip Ltd: Still Well Positioned To Grow (Seeking Alpha) $ 🗃️

🇮🇳 Yatharth Hospital: Decoding Disclosure Lapses & Red Flags (Smartkarma) $

Yatharth Hospital & Trauma Care Services Limited (NSE: YATHARTH / BOM: 543950) successfully completed a QIP, raising Rs. 625 crore which was followed by the stock falling by nearly 26% in the following month.

The company and its subsidiaries has recently been facing a significant challenge with an investigation by the Income Tax Department and the attachment of company assets.

The document released on December 17, 2024 has confirmed the search and seizure operations conducted on October 19, 2023, targeting Yatharth and two of its subsidiaries.

🇮🇳 #89 India Insight: PepsiCo-Tata Launch, Nykaa Fuels M&As, India Targets $1T Exports (Smartkarma) $

PepsiCo Inc (NASDAQ: PEP) and Tata Consumer Products (NSE: TATACONSUM / BOM: 500800) have partnered to launch a fusion snack, combining Kurkure with Ching’s Secret Schezwan Chutney.

India aims for $1 trillion in exports by 2030, with $250 billion from the engineering sector, including automobiles and equipment. Infrastructure, energy transition, and innovation are key growth drivers.

India’s beauty and personal care industry is heading into a consolidation phase, with M&As on the rise. FSN E-Commerce Ventures (NSE: NYKAA / BOM: 543384)’s successful buyouts and challenges faced by D2C brands are fueling this trend.

🇮🇳 #90 India Insight: Dixon’s $3 Bn Display Fab, Blinkit Expansion Burns Cash, HAL Delays (Smartkarma) $

Dixon Technologies (NSE: DIXON / BOM: 540699) plans to invest $3 billion to establish a display fabrication facility in India, aiming to capitalize on government subsidies and enhance its position.

Zomato Limited (NSE: ZOMATO / BSE: ZOMATO) Quick Commerce Business, Blinkit is rapidly expanding its dark store network in India’s competitive quick-commerce market, leading to short-term losses but aiming for long-term gains.

Hindustan Aeronautics (NSE: HAL / BOM: 541154) aims delivering 16 LCA Mk1A jets to the IAF by 2025, a history of delays and a recent unconfirmed report raise questions about the program’s timeline.

🇮🇳 Dr. Reddy’s Laboratories (DRRD IN): Q3FY25 Result- Subdued US Business Dents Margin; Somber Outlook (Smartkarma) $

Dr. Reddy’s Laboratories Limited (NYSE: RDY) reported Q3FY25 US business revenue of INR33.8B, up 1% YoY, mainly dragged by lower contribution from Lenalidomide. Q3FY25 EBITDA margin deteriorated to 27.5% (Q3FY24: 29.3%).

Limited growth catalysts remain major overhang. No near-term key launches lined-up to fill the void created by Lenalidomide. Moreover, paltry new launches in the U.S. entail limited revenue visibility.

Lack of near-term catalyst and bleak growth outlook justify cheaper valuation of Dr. Reddy’s. We do not consider Dr. Reddy’s as value buying opportunity and remain bearish on the name.

🇮🇳 Kalyan Jewellers- Grey Areas Surrounding Inventory (Smartkarma) $

Kalyan Jewellers India Ltd (NSE: KALYANKJIL / BOM: 543278), one of the largest Indian jewellery player, has been under the limelight for various allegations and misconducts, including possibility of inventory overstatement.

In this insight, we try to look at the inventory from the forensic lens and uncover the disparity in accounting.

We also note that operating cash flows are boosted by movement in metal loans while company also has several RPT with promoters, especially on the purchases side.

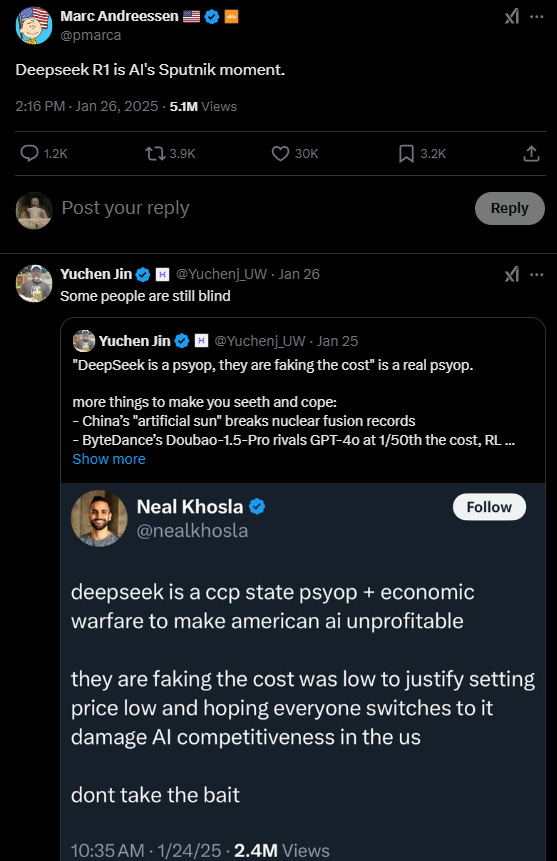

🇹🇷 Turkey’s Syria gambit pays off with potential windfall for construction companies (Pyramids and Pagodas)

The post-Assad equities rally among Turkish builders may have overlooked a key player, ignoring its past success in a similar geopolitical scenario

We believe potential reconstruction efforts (with an estimated price tag of USD 400 billion) present significant opportunities for Turkish companies – especially in sectors such as construction, cement, steel, and logistics. We outline how one company may have been overlooked in the post-Assad Turkish construction equities rally, with a brief look at its performance in a market with similar geopolitical considerations, as well as the how-to and pitfalls of investing in this market.

Before we dive into that, we emphasize that this article is based on best case scenario thinking, based on hopes that the shaky coalition of rebel forces can cooperate in governing Syria, whatever form that may take.

🇲🇺 Alphamin Resources Amid Rising Tin Prices And Stronger Production (Seeking Alpha) $ 🗃️

🇿🇦 The Bottom Fishing Club: Sasol Represents Deep Value In Energy (Seeking Alpha) $ 🗃️

🇿🇦 Sasol: Guidance And Agreements With International Corporations Indicate Significant Undervaluation (Seeking Alpha) $ 🗃️

-

🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇿🇦 Naspers Limited: IPO Prospects Are Regionally Dependent (Seeking Alpha) $ 🗃️

🇨🇿 Colt CZ Group: Why I Am Upgrading This Arms Stock To Buy (Seeking Alpha) $ 🗃️

🇬🇷 Aegean Airlines: A Speculative Buy Opportunity With Risks (Seeking Alpha) $ 🗃️

🇬🇱 Energy Transition Minerals – the crazy Greenland micro-cap (Undervalued Shares)

Even worse, Greenland politicians have manoeuvred the territory into a very difficult situation financially.

Greenland’s ruling party appears to have broken laws and investment regulations, which the government has now been taken to court for.

This is a serious legal case indeed, and the claimant is financially backed by the world’s leading litigation financier. Their track record is a win or partial win in 92% of all cases they fund, and they are stumping up a double-digit million amount to make sure the case has its best shot at coming out favourably. The backing of this particular litigation funder gives this case against Greenland a significant amount of credibility.

If the claimant is successful, Greenland could face USD 11.5bn in damages – 4x the size of Greenland’s GDP.

Energy Transition Minerals (ASX: ETM / FRA: G7PA / OTCMKTS: GDLNF) (ISIN AU0000250250, AU:ETM) has since 2006 been working to develop the Kvanefjeld resource project in Greenland, the world’s second-largest deposit of rare earth minerals, and the sixth-largest uranium deposit.

The risk of Greenland losing the case was highlighted in a long-read article in Danwatch, an award-winning Danish independent media and research centre specialised in investigative journalism on global issues:

🇱🇺🌎 Updating On Tenaris And Its Upside Into 2025E, Fully Valued After 20% RoR (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Why Petrobras Could Be The Value Stock Your Portfolio Needs (Seeking Alpha) $ 🗃️

🇧🇷 Inter Stock Offers Huge Upside With Huge Risks (Seeking Alpha) $ 🗃️

-

🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 Nu Holdings: CEO Reveals Bold Plans (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: Rapid Growth Meets Rising Profitability (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: The Noise Is Real, But So Is The Potential (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Nubank: We’re Doubling Down On Our Favorite Fintech In 2025 (Seeking Alpha) $ 🗃️

🇧🇷 XP: Weathering The Storm In Brazil’s Financial Turmoil (Seeking Alpha) $ 🗃️

-

🌎 XP Inc (NASDAQ: XP) – Wealth management & other financial services (fixed income, equities, investment funds & private pension products). 🇼

🇧🇷 Banco Santander Brasil: Slow And Steady Growth As Q4 Approaches (Seeking Alpha) $ 🗃️

🇧🇷 Azul’s Restructuring Misses Key Details And May Come With Massive Dilution (Seeking Alpha) $ 🗃️

🇧🇷 Telefonica Brasil: The Dividend Story Remains Compelling (Seeking Alpha) $ 🗃️

🇨🇱 Compania Cervecerias Unidas Is Less Efficient And More Expensive Than Peers (Seeking Alpha) $ 🗃️

🇨🇱 Enel Chile Offers An Interesting Yield For A Relatively Derisked Strategic Plan (Seeking Alpha) $ 🗃️

-

🇨🇱 Enel Chile (NYSE: ENIC) – Develops, operates, generates, distributes, transforms and/or sells energy. 🇼

🇲🇽 Volaris: A Hidden Gem With Strong Upside Potential (Seeking Alpha) $ 🗃️

🇲🇽 Vista Energy: A Growth Play In Vaca Muerta (Seeking Alpha) $ 🗃️

-

🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇵🇦 Mr. Market Is No Longer Wrong On Bladex (Seeking Alpha) $ 🗃️

-

🌎 Banco Latinoamericano (NYSE: BLX) or the Foreign Trade Bank of Latin America or Bladex – Founding shareholders were the Central Banks & government entities of 23 countries in the region. Specialized in addressing trade finance needs. 🇼 🏷️

🇵🇦 Copa Holdings: The Exception To The Rule (Seeking Alpha) $ 🗃️

🇵🇦 Event-driven play in copper (TheOldEconomy Substack)

Resource Nationalism as Alpha opportunity

It is time to introduce First Quantum Minerals (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF), a major copper miner with assets in Panama. The article was initially published for TheOldEconomy Paid Member in May 2024.

First Quantum Minerals is one of the world’s largest copper miners. Until it closed its mine in Panama, Cobre Panama, it ranked among the top mines by annual production. In November 2023, the Panamanian government reminded of growing global entropy by closing the Cobre Panama mine, owned by First Quantum. This event reminds us of the rise of resource nationalism.

🌐 Popeyes Cooking Up Partnership With Don Julio In Possible Mass-Market Tequila Blitz To Save Diageo (Zerohedge)

British spirits giant Diageo (NYSE: DEO / LON: DGE) is in dire straits as cash-strapped consumers have dialed back alcohol spending. Goldman analyst Jack McFerran told clients last week that “there is no sign of a bottom, with risks still skewed to the downside” for European shares in the company.

Given that cash-strapped consumers have pulled back on liquor, an oversupply tequila crisis has emerged in Mexico, which has caused agave prices to crash the most since the Dot Com crash.

Given the dire oversupplied conditions in Mexico, coupled with Diageo’s sliding demand for its liquor products, it now becomes entirely clear why the spirits company has explored an unconventional sales channel: partnering with a major QSR (Restaurant Brands International Inc (NYSE: QSR)) to potentially launch Don Julio for the mass market and help jump-start demand to draw down elevated tequila inventories. In return, this could add support for Diageo’s imploding stock.

🌐 Nebius Group: My Updates On Avride Valuation (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 China to Pump $13.7 Billion of Insurance Funds into Stock Markets (Caixin) $

China is planning to inject at least 100 billion yuan ($13.7 billion) in insurance funds into its stock market in the coming months, as part of state-backed efforts to attract long-term investment to strengthen the market, according to the country’s top financial regulators.

“We are preparing to approve 50 billion yuan in the coming days, before the Chinese New Year, to be immediately invested in the stock market,” said Xiao Yuanqi, vice-minister of the National Financial Regulatory Administration, at a Thursday press briefing.

🇨🇳 German election frontrunner warns of ‘great risk’ for companies investing in China (FT) $ 🗃️

🇨🇳 China Will Treat Foreign and Domestic Firms Equally, Vice Premier Tells Davos (Caixin) $

Chinese Vice Premier Ding Xuexiang vowed that China will treat foreign-invested companies and domestic firms equally, in a show of the top leadership’s determination to reassure foreign investors.

Speaking at the World Economic Forum (WEF) Annual Meeting in the Swiss town of Davos on Tuesday, Ding emphasized the importance of continued reform and opening up, listing it as one of the major trends that characterize the Chinese economy.

🇨🇳 In Depth: Venture Capital in China Flounders as State Takes Over (Part 2) (Caixin) $

Editor’s note: Venture capital in China is in crisis as government guidance funds overwhelm the industry’s traditional modus operandi. In the second of our two-part series, we look at how the government is trying to tackle the problem. For Part 1, which examines how state-run funds have disrupted the country’s investment landscape, click here.

The growing drumbeat of complaints about the dominance of government guidance funds (GGFs) in China’s venture capital (VC) and private equity (PE) industry and the distortions they have created in the allocation of investment have finally prompted the country’s top policymakers to intervene.

🇨🇳 Chart of the Day: Over a dozen Chinese provinces set lower GDP targets (Caixin) $

Around half of the Chinese mainland’s provincial-level governments have set 2025 GDP growth targets lower than last year’s, as domestic demand remains tepid and the international environment continues to be unstable.

The goals were announced as local legislative meetings took place in January. Of the 31 provincial-level regions, 15 set targets lower than last year’s.

Targets set by another 15 regions are similar to goals set for last year. Several of the country’s largest regional economies — Guangdong, Jiangsu, Zhejiang, Shandong and Henan — fall into this category.

🇨🇳 China may finally put a lid on coal (FT) $ 🗃️

🇨🇳 TikTok owner asks Chinese staff in Singapore to pay taxes to Beijing (FT) $ 🗃️

TikTok parent ByteDance is asking Chinese employees at its Singapore headquarters to pay tax to their home country or risk losing their ability to cash out on stock options, as Beijing steps up enforcement of its global tax scheme.

🇲🇴 Macau casino sector 2025 EBITDA to grow 9pct: Seaport (GGRAsia)

Seaport Research Partners expects Macau casino property earnings before interest, taxation, depreciation, and amortisation (EBITDA) to rise “circa 9 percent” this year, to about US$8.4 billion.

“By 2027, we forecast EBITDA to rise to US$9.9 billion,” representing a compound annual growth rate of 9 percent between 2024 and 2027, wrote analyst Vitaly Umansky in a Sunday memo.

“In Macau, we forecast GGR (gross gaming revenue) growth of 7 percent in 2025 and over the next several years, which should lead to EBITDA growth of circa 9 percent for the industry,” he stated.

Macau casino GGR for calendar year 2024 stood at MOP226.78 billion (US$28.27 billion), up 23.9 percent year-on-year, according to official data.

🇲🇴 Macau 2025 GGR might top US$30bln, says CreditSights (GGRAsia)

CreditSights Inc says it expects Macau’s casino gross gaming revenue (GGR) to exceed the local government’s 2025 target and reach MOP245.0 billion (US$30.5 billion).

That assumes “further improvements in tourist arrivals and a slight increase in GGR per visitor in 2025,” stated CreditSights, a division of the Fitch group, in a research paper issued on Thursday.

It anticipated that hotel occupancy in Macau to improve this year “with the completion of casino renovations and room conversions”.

“We expect Macau’s GGR to slightly exceed the 2025 target of MOP240 billion and reach MOP245 billion,” wrote analysts Nicholas Chen, David Bussey, and Zerlina Zeng.

🇰🇷 Details of the Major Changes in Delisting Rules in Korea (Douglas Research Insights) $

On 21 January, the FSC announced the full details of the major changes in the delisting rules in Korea, which should help to reduce the “Korea Discount.”

This is one of the biggest ever changes to delisting rules in Korea in the past 30 years.

These changes will be especially important among investors that are interested in small caps in Korea.

🇰🇷 Details of New IPO System Improvement Measures in Korea (Douglas Research Insights) $

The FSC announced the details of its new IPO system improvement measures in Korea on 21 January.

New rules will discourage the rampant first day trading of Korean IPOs. In 74 out of 77 IPOs in 2024, institutional investors were “net sellers” on the listing date.

Rather, the new rules will encourage the investors to take more longer term approach to investing in Korean IPOs.

🇸🇦 Saudi Arabia vows to be ‘fast and furious’ in mining as it reveals $100 billion investment (CNBC)

Saudi Arabia last year increased the valuation of its unexploited mineral resources from $1.3 trillion to $2.5 trillion, boosted by the discovery of rare earth elements and metals.

The kingdom on Wednesday announced a new mineral investment project valued at $100 billion, with $20 billion already in the final engineering phase or under construction.

Investment in critical minerals mining and processing must be happening “as fast and furious as possible” in Saudi Arabia, its energy minister said at the Future Minerals Forum in Riyadh.

🇦🇷 The Argentine Miracle (The American Conservative)

Javier Milei’s administration in Argentina provides a blueprint for politicians looking to uproot entrenched left-wing interests

The patterns here are typical of Milei’s political strategy: proceed from a position of strength, coopt potential allies, avoid unnecessary distractions and taking on too many political fights at once, and then destroy the institutional power of the enemy in a single blow.

Milei’s libertarian populism is of a very different ideological bent than the right-wing populism sweeping Europe and the United States. But, if Milei continues to be successful at creating prosperity for Argentina while destroying the political power of left-wing institutions, the “Milei model” may well become an increasingly attractive option for frustrated populations in America and abroad.

🇲🇽 Mexican Companies Try Wooing Trump This Time, Rather Than Shunning Him (WSJ) $ 🗃️

Executives troop to Washington for the inauguration in hopes of avoiding tariff hikes

Eight years after Mexican cement giant CEMEX (NYSE: CX) declined to participate in building President Donald Trump’s proposed wall along the U.S.-Mexico border, one of its top executives was in Washington on Sunday with a more conciliatory message.

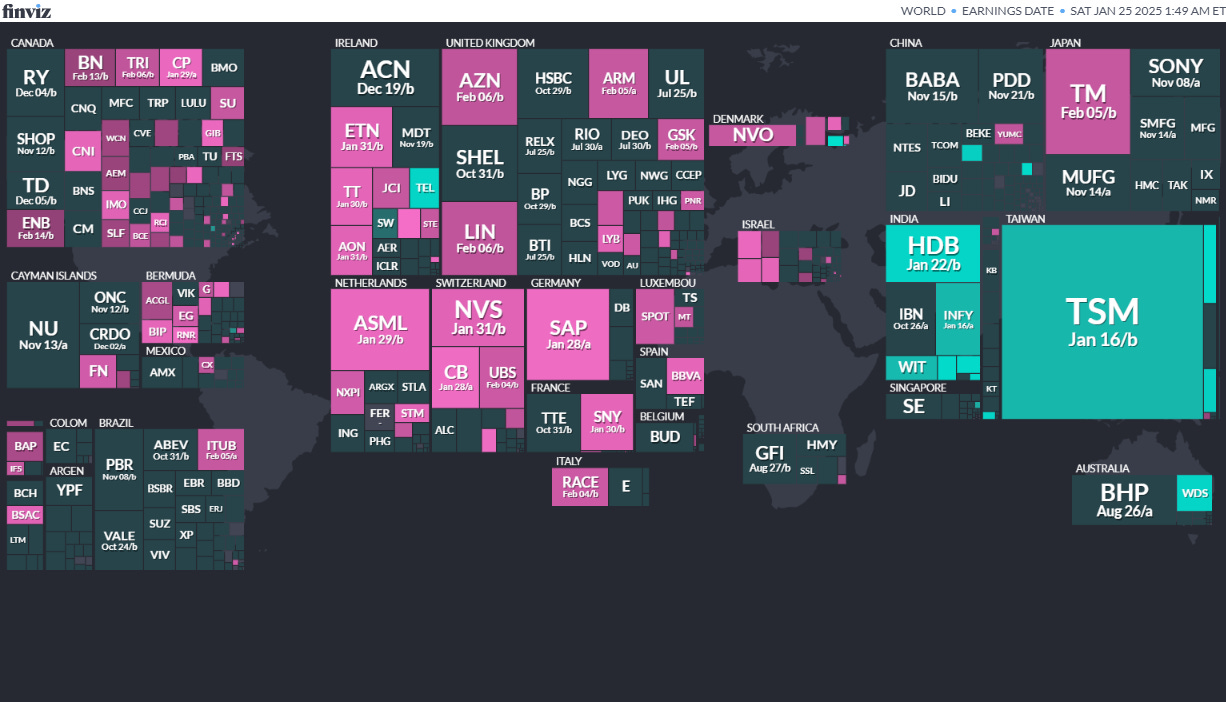

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

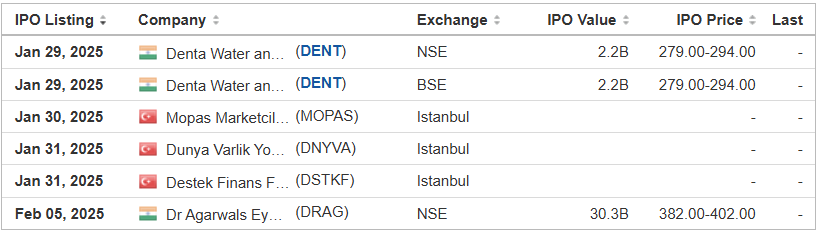

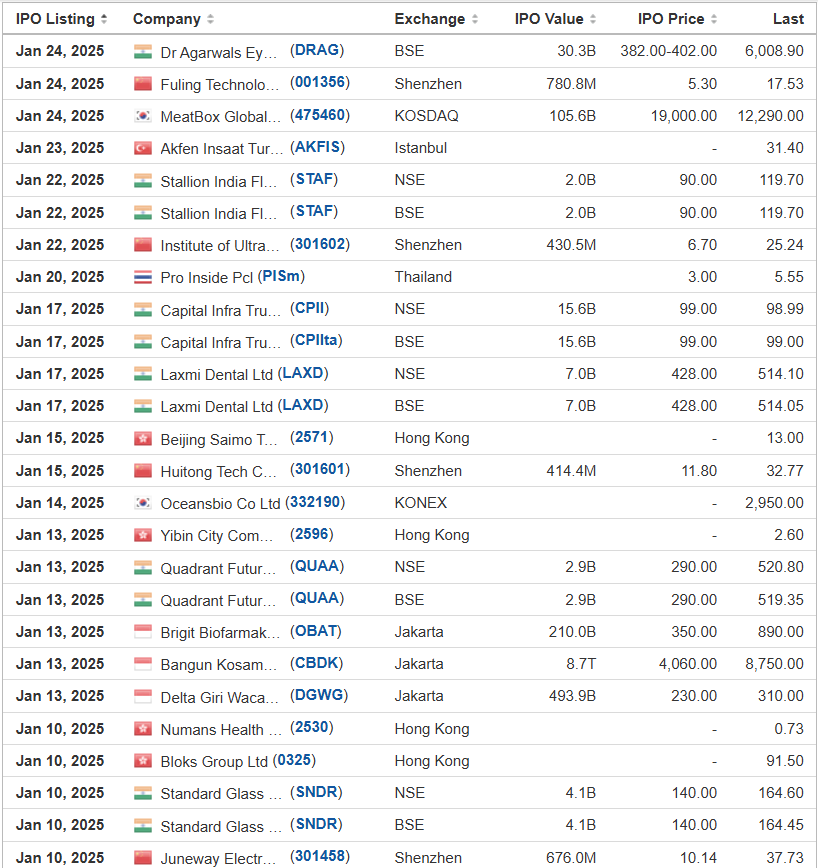

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

FBS Global Ltd. (New Filing December 2024) FBGL WallachBeth Capital, 2.3M Shares, $4.50-5.00, $10.7 mil, 1/28/2025 Tuesday

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing on Dec. 5, 2024. Background: This filing followed the company’s withdrawal of its previous IPO plans in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO. FBS Global’s path to going public began in mid-September 2022 when the Singapore company submitted confidential IPO documents to the SEC.))

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net loss and revenue are in U.S. dollars (converted from Singapore’s currency) for the 12 months that ended June 30, 2024.

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing dated Dec. 5, 2024, in which it kept the same terms from its original IPO filing: The company plans to offer 2.25 million shares at a price range of $4.50 to $5.00 to raise $10.69 million.)

(Note: FBS Global Ltd. withdrew its IPO filing in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO.)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

Smithfield Foods Inc. SFD Morgan Stanley/BofA Securities/Goldman Sachs/Barclays/Citigroup, 34.8M Shares, $23.00-27.00, $870.0 mil, 1/28/2025 Tuesday

(Incorporated in Virginia)

Our Mission

Good food. Responsibly.® At Smithfield, we are helping to feed a world of nearly eight billion people. Our products are found on tables everywhere. We provide families with wholesome, safe and affordable food while finding new and innovative ways to care for our people, communities, animals and planet. It is our responsibility and our promise. We make more than good food. Good is what we do.

Our Company

Smithfield is an American food company and an industry leader in value-added packaged meats and fresh pork with over $14 billion in annual sales. We employ approximately 34,000 people in the United States and approximately 2,500 people in Mexico. We maintain high-quality standards, meeting demand through our strong relationships with thousands of U.S. family farmers and blue-chip global customers. We are a market leader due to our scale, diverse portfolio of strong brands and products and reputation as a trusted partner known for quality. We market our products under a leading portfolio of iconic brands including Smithfield, Eckrich and Nathan’s Famous, among many others.

Our ambition is to be the most trusted food and protein company in North America as we feed people in the United States and around the world, while embracing a culture of responsibility, operational excellence and innovation. We produce and distribute a wide variety of packaged meats and fresh pork products both domestically and abroad. We conduct our operations through three reportable segments: Packaged Meats, Fresh Pork and Hog Production. We are a leading provider of packaged meats in the United States, with the number two branded market position by volume across the 25 key packaged meats categories in which we compete, according to Circana. These 25 key packaged meats categories represent a total addressable market opportunity of $43 billion annually, of which we had an approximate 20% market share by volume (including our private label sales) as of September 2024. We are also the largest fresh pork processor in the United States with approximately 23% market share as of Fall 2023, according to National Hog Farmer. We sell our products across diverse channels including retail and foodservice, distributing in all 50 states in the United States, as well as export markets. We are a leading exporter of pork and pork products, with export sales representing 13% of our total sales for the nine months ended September 29, 2024.

Our Packaged Meats segment is the cornerstone of our business with a value-added product portfolio and profitability that has more than doubled since 2014. Alongside our Packaged Meats segment, our Fresh Pork and Hog Production segments remain integral parts of our business, providing significant scale and operational benefits in support of our product offerings and our ability to meet demand consistently across economic cycles. We believe our emphasis on value-added packaged meats, along with our commitment to food quality, strong financial position and steadfast devotion to our stated mission, will continue delivering value for our shareholders.

Smithfield’s supply chain includes company-owned and contract farms in the United States and Mexico, as well as long-standing relationships with more than 4,000 independent U.S. family farms who meet our animal care and quality standards. Our model offers a resilient supply chain, providing us with several competitive advantages, including an assured supply of consistent, high-quality protein, the ability to innovate and lead in areas such as group-housed pork and the ability to deliver differentiated products to meet customer specifications. We operate 39 facilities producing fresh pork and packaged meats in the United States and one fresh pork facility in Mexico, and we focus on continually optimizing our operations by identifying opportunities to reduce costs and increase flexibility to meet market demand. Additionally, we remain committed to investing in innovation across our products, packaging and manufacturing processes. We seek to be the supplier of choice to our customers and maintain our reputation for high-quality, safe and delicious products.

A New Smithfield in the Public Eye

Founded in 1936, we began as a pork processing operation named The Smithfield Packing Company. Through a series of acquisitions beginning in the 1980s, we became the largest fresh pork processor in the United States. In 2013, Smithfield was taken private and became a wholly owned subsidiary of Hong Kong-based WH Group, which is publicly traded on The Stock Exchange of Hong Kong Limited. WH Group is a limited liability company incorporated in the Cayman Islands, the shares of which have been listed on the Main Board of the Stock Exchange since August 2014. Through its subsidiaries, WH Group is principally engaged in the production and sale of packaged meats and pork.

Following the acquisition of Smithfield by WH Group, we focused on integrating our independent operating companies into a cohesive business. Our “One Smithfield” initiative unified our operations, brands and employees under one corporate umbrella, achieving synergies and enhancing profitability through disciplined cost management and balance sheet strength.

In recent years, we have transformed into a differentiated American food company with a leading position in value-added packaged meats and fresh pork, and our headquarters remains in our namesake town of Smithfield, Virginia.

In August 2024, we completed a carve-out of our European operations to focus our local management teams on the different market dynamics of North America and Europe. Pursuant to the European Carve-out, our operations in Europe were transferred to WH Group.

Note: Net income and revenue are for the 12 months that ended Sept. 29, 2024.

(Note: Smithfield Foods Inc. filed its S-1 on Jan. 6, 2024, for its IPO without disclosing the IPO’s terms. Estimated IPO proceeds are $100 million, a placeholder figure.)

iOThree Ltd. IOTR Eddid USA/Network 1 Financial Securities, 2.6M Shares, $4.00-6.00, $13.1 mil, 1/31/2025 Friday

We provide the maritime industry with digital solutions. (Incorporated in the Cayman Islands)

We are a leading provider of maritime digital technologies including satellite connectivity and digitalization solutions in Singapore focused on facilitating the maritime industry towards digital transformation. Based on the Frost & Sullivan Report, as of March 31, 2024, we ranked fifth in the Singaporean market based on revenue from the provision of maritime connectivity and digital solutions with a market share of approximately 6.2%. Our company was established to adopt an innovative approach towards the management of solutions accustomed to contemporary needs and drive the digital evolution in the maritime industry.

We have two operating segments: (i) satellite connectivity solution, and (ii) digitalization and other solutions. In the satellite connectivity solution segment, we offer integrated satellite connectivity solution through the provision of satellite connectivity services and the sales and/or lease of satellite network equipment and devices for shipboard network management. In the digitalization and other solutions segment, we are involved in designing digital solutions, providing IT support, and providing shipboard support services for IT and OT applications enablement.

Our digitalization platform — “Just A Really Very Intelligent System” (“JARVISS”) — has been specifically designed to support enhanced integrated solutions, asset optimization and delivery of secured critical applications globally. It hosts a fleet of native applications developed by us as well as third party applications, consolidating essential functions such as IoT and vessel management. Our unique platform seamlessly integrates these applications, simplifying maritime operations and fostering unprecedented efficiency and leads us to be a pioneer of integrated maritime connectivity and digital solution providers. For further details regarding JARVISS, see the section entitled “Business — Our flagship solution — JARVISS”. In addition to JARVISS, our portfolio of digital solutions also encompasses our “V.Suite” solutions, which currently consist of V.SIGHT AI camera surveillance, V.SION AR smart glasses, V.IoT shipboard monitoring and analytics, V.SECURE cybersecurity, and V.WEATHER route optimization, as well as a new ERP system — “Future Ready Intelligent Digital Assistant System” (“FRIDAY”). For details, see the sections entitled “Business — V.Suite” and “Business — FRIDAY”.

Note: Revenue of $8.57 million is in U.S. dollars for Fiscal Year 2024, which ended March 31, 2024.

Note: iOThree Ltd. reported a Fiscal Year 2024 net loss of US$4,446 – an amount too small for the financial chart below.

(Note: iOThree Ltd. disclosed in an F-1/A filing dated Dec. 20, 2024, that Eddid Securities has been named as a new joint book-runner – in the lead left position – to work with Network 1 Financial Securities.)

(Note: iOThree Ltd. cut its IPO’s size by reducing the number of shares to 2.63 million shares (2,625,000 shares) – down from 3.7 million shares originally – and keeping the price range at $4.00 to $6.00 – to raise $13.13 million ($13.125 million), if priced at the $5.00 mid-point, according to to an F-1/A filing dated Oct. 11, 2024. Of the 2.63 million shares in the IPO, the company is offering 2.13 million shares (2,125,000 share) and the selling shareholders are offering an aggregate of 500,000 ordinary shares. The company will not receive any proceeds from the sale of the selling shareholders’ shares. )

(Note: In that F-1/A filing dated Oct. 11, 2024, iOThree Ltd. updated its financial statements for FY 2024 and named Network 1 Financial Securities as its new sole book-runner, replacing Eddid Securities. Background: iOThree Ltd. filed its F-1 on Jan. 24, 2024. The Singapore-based company submitted confidential IPO documents to the SEC on Oct. 19, 2023.)

BeLive Holdings BLVE R.F. Lafferty & Co., 1.8M Shares, $4.00-4.00, $7.0 mil, 2/3/2025 Week of

BeLive Holdings is a holding company with no material operations of its own. It conducts its operations of providing live commerce and shoppable short videos through its indirect wholly owned subsidiaries, BeLive Singapore and BeLive Vietnam. (Incorporated in the Cayman Islands)

Our mission is to be an industry leader in designing, developing and providing technology solutions for live commerce and shoppable short videos.

Our Operating Subsidiaries are BeLive Singapore, which was incorporated on June 18, 2014, under the laws of Singapore, and BeLive Vietnam, which was incorporated on June 16, 2021, under the laws of Vietnam, and which has been a wholly owned subsidiary of BeLive Singapore since incorporation. Through our Operating Subsidiaries, BeLive Cayman primarily engages in the development and provision of live commerce and shoppable short videos solutions.

Our Group’s history began in 2014 when we launched a social streaming mobile application with a focus on empowering users to share their lives while interacting with their audience in real time.

Recognizing a significant potential in e-commerce, we redirected our focus in 2018 towards business-to-business and providing live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces. Our BeLive Solutions enable our customers to leverage the power of interactive and immersive live and video commerce to their online business and enable our customers to curate unique videos that may also be aired real-time as they are simultaneously being recorded, for anytime instant replay. We categorize our BeLive Solutions into(i) an enterprise-grade White Label solution (“BeLive White Label Solution”) which is customized to meet a customer’s unique requirements and which can be integrated into their existing internal system and (ii) a cloud-based software-as-a-service (SaaS) solution (“BeLive SaaS Solution”) for customers who are looking for a quick and cost-effective live commerce and shoppable short video solution without the necessity of building their own infrastructure and technology stack.

On June 9, 2023, as part of a reorganization prior to the listing, BeLive BVI acquired all of the shares of BeLive Singapore from FTAG Ventures Pte. Ltd, a controlling shareholder, Kenneth Teck Chuan Tan, and several other minority shareholders in exchange for shares of BeLive Cayman in the same proportion as their respective shareholdings in BeLive Singapore. Upon completion of such reorganization, BeLive Singapore became a wholly owned subsidiary of BeLive BVI.

Note: Net loss and revenue are in U.S. dollars (converted from Singapore dollars) for the 12 months that ended June 30, 2024.

(Note: BeLive Holdings cut its IPO’s size to 1.75 million shares – down from 3.0 million shares – and reduced the assumed IPO price to $4.00 – the bottom of its previous price range of $4.00 to $6.00 – to raise $7.0 million, according to an F-1/A filing dated Oct. 30, 2024.)

(Note: Unless otherwise noted, the share and per share information in this prospectus reflects a 5-for-1 reverse stock split (the “Reverse Split”) of our outstanding Ordinary Shares effective as of February 18, 2024.)

(Note: BeLive Holdings filed its F-1 on July 10, 2024, and disclosed the terms for its IPO: The Singapore-based company is offering 3.0 million shares at a price range of $4.00 to $6.00 to raise $15.0 million. Background: BeLive Holdings submitted confidential IPO documents to the SEC in December 2023.)

Concorde International Group CIGL R.F. Lafferty & Co., 1.3M Shares, $4.00-4.00, $5.0 mil, 2/3/2025 Week of

We provide integrated security solutions and facilities management services in Singapore. (Incorporated in the Cayman Islands)

We deliver security services by combining human expertise with advanced technology. We provide mobile monitoring and response systems, which involve vehicles patrolling designated areas, covering multiple sites within a 24-hour period.

Note: Net income and revenue are for the year that ended Dec. 31, 2023.

(Note: Concorde International Group filed its F-1 on Aug. 27, 2024, and disclosed the terms for its small-cap IPO: 1.25 million shares at $4.00 to raise $5.0 million.)

Eastern International ELOG Maxim Group LLC, 1.6M Shares, $4.00-5.00, $7.2 mil, 2/3/2025 Week of

We handle domestic and cross-border logistics. (Incorporated in the Cayman Islands)

We, through Suzhou TC-Link, provide domestic and cross-border professional logistic services including project logistic and general logistic for company clients. Suzhou TC-Link was established on January 9, 2006 in Jiangsu Province, China.

Our project logistic services mainly include construction project logistics and special cargo logistics for large or precision equipment. Construction project logistics range from a certain stage or the entire process of construction projects, including purchase, packaging, storage, loading and unloading, transportation, fixation, installation of the equipment and machinery for construction as well as other related logistic services. We primarily provide our logistic solution services for new energy projects (including wind power turbine, photovoltaic, renewable energy storage, etc.), chemical equipment, engineering and infrastructure construction projects (including roads and bridges, tunnel construction). Special cargo logistics for large or precision equipment refer to logistic services to the manufacturers or purchasers of special and customized large and/or precision equipment, such as stamping machines, lathe, aircraft engines, and others. We study the operations of our clients, analyze their logistics needs and provide them with specific solutions which will improve the cost efficiency and achieve higher services’ quality). We have provided logistic services in China for wind power turbine projects which were exported to numerous countries, including Vietnam, UAE, Australia, South Africa and Chile.

Our general logistic services refer to the transportation, warehousing, loading and unloading, and distribution of ordinary products. For instance, we provide logistic services for household appliances manufacturers, including the transportation of goods from manufacturing factories to warehouses, and to distributors’ warehouses nationwide, according to customers’ instructions. Delivery can be made in whole truckload or less-than truckload. We have built a network with subsidiaries and offices in Suzhou, Wuxi, Yancheng, Chengdu, Chongqing, Guangzhou, Shenzhen, Kunming, and Mohan, covering most major cities and areas in China.

The Company has offered its cross-border logistic services since 2019, with the focus mainly on inland transportation and railway transportation between Mainland China and Southeast Asia countries for cargoes such as bulk commodities, electronic products, tires, new energy equipment and other machineries. For example, we completed transportation from Laos to China of 707 units of 40ft containers, 914 units of 20ft containers and 244 units of open top containers for rubber, iron ore, barley and Cassava starch in 2022. We also provided service for the shipment of washing machines through China-Europe Railway Express to Europe.

The Company owns 20 trucks and has cooperative relationships with other owners and drivers for over 2,000 trucks for domestic long-distance transportation and less than carload goods. When we receive orders and projects, we make inquires to these drivers/owners and ask them to provide a fee estimate for the job. If they provide reasonable price or their prices are less than costs for which we use our own trucks, we will engage these drivers to undertake the transportation. We will provide them with time and location to load the goods and provide name, contact information and license plate of the driver and truck to our clients. After the delivery is completed, we will collect payment from the clients and pay such drivers directly. The Company also has 4 warehouses/logistic centers in three different provinces, with a total of over 30,000 square meters areas providing general and special storage, distribution and value-added services to clients.

Our total revenues increased approximately by $16.3 million, or 67.4%, from approximately $24.2 million for the year ended March 31, 2023 to approximately $40.5 million for the year ended March 31, 2024. Our net income decreased by approximately $0.1 million, or 8.9%, from net income approximately $1.2 million for the year ended March 31, 2023 to net income approximately $1.1 million for the year ended March 31, 2024.

Note: Net income and revenue are for the year that ended March 31, 2024.

(Note: Eastern International filed its F-1 on Sept. 3, 2024, disclosing terms for its micro-cap IPO: 1.6 million shares at a price range of $4.00 to $5.00 to raise $7.2 million, if priced at the $4.50 mid-point of its range. Background: Eastern International submitted confidential IPO documents to the SEC on March 22, 2024.)

Fitness Champs Holdings Ltd. FCHL Bancroft Capital LLC, 2.0M Shares, $4.00-5.00, $9.0 mil, 2/3/2025 Week of

(Incorporated in the Cayman Islands)

We believe we are a leading sports education provider in Singapore based on the following: (i) in 2023, we were the largest service provider of the SwimSafer Program based on the number of assessment bookings, accounting for approximately 30% of market share; and (ii) we are one of the few swim education providers in Singapore that provides both services to students under training programs funded by the Singapore Government and provision of customized private swimming training services.

We offer general swimming lessons to children and adults, with ladies-only swimming lessons available, as well as aquatic sports classes such as water polo, competitive swimming and lifesaving. We believe in imparting the correct swim stroke techniques and skills to all of our students so that they can learn to swim within the shortest time span in a variety of strokes, ranging from freestyle, breaststroke, butterfly, survival backstroke and side kick. We are one of the largest providers of swimming lessons to children enrolled in public schools under the MOE (Ministry of Education) in Singapore through the SwimSafer program. We have been offering private swimming lessons to children, youth and adults under our brand “Fitness Champs” since 2012. We aim to make swimming an enjoyable and affordable sport for children and adults, for water safety and as a way of keeping fit and healthy.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Fitness Champs Holdings Limited filed its F-1 on Sept. 9, 2024, and disclosed the terms for its IPO – 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million.)

Huachen AI Parking Management Technology Holding Co., Ltd. HCAI Benjamin Securities/D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 2/3/2025 Week of

We specialize in smart parking solutions in China. We also provide equipment structural parts. (Incorporated in the Cayman Islands)

We offer several types of automated parking systems: PSH (lifting and horizontal sliding), PJSA (convenient lifting) and PCS Vertical Lifting, designed to maximize space in urban environments. We also provide equipment structural parts, including conveyor belt components, feeder system parts, and railroad accessories, along with product design consultation and maintenance services for parking systems.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2023.

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. whacked its IPO’s size by 70 percent to 1.5 million shares – down from 5.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $$7.5 million, according to an F-1/A filing dated Dec. 31, 2024.)

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. filed its F-1 on Aug. 14, 2024, and disclosed its IPO’s terms: 5.0 million shares at a price range of $4.00 to $6.00 to raise $25.0 million. Background: Huachen AI Parking Management Technology Holding submitted confidential IPO documents to the SEC on Dec. 19, 2023.)

Smart Logistics Global Ltd. SLGB Benjamin Securities/Prime Number Capital, 1.0M Shares, $5.00-6.00, $5.5 mil, 2/3/2025 Week of

We are a holding company whose operating subsidiary in China manages a business-to-business logistics provider, focused on the transportation of industrial raw materials. (Incorporated in the Cayman Islands)

Note: Net loss and revenue are for the 12 months that ended June 30, 2024.

(Note: Smart Logistics Global Ltd. filed an F-1/A dated Dec. 6, 2024, and updated its financial statements through the period ending June 30, 2024. Background: Smart Logistics Global Ltd. filed an F-1/A dated Nov. 20, 2024, and disclosed the terms of its IPO: The company is offering 1 million shares at a price range of $5.00 to $6.00 to raise $5.5 million. Background: Smart Logistics Global Ltd. filed its F-1 for its IPO on Oct. 4, 2024, with estimated IPO proceeds of $10 million.)

ALE Group Holding Limited ALEH Dawson James Securities/D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-6.00, $6.3 mil, 2/10/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Baiya International Group BIYA Cathay Securities/ Revere Securities, 2.5M Shares, $4.00-6.00, $12.5 mil, 2/10/2025 Week of

(Incorporated in the Cayman Islands)

We, Baiya International Group Inc. (“Baiya”), are an offshore holding company. As a holding company, we have no material operations and conduct all of our operations in China through the VIE, Shenzhen Gongwuyuan Network Technology Co., Ltd. (“Gongwuyuan”), and its subsidiaries, collectively, “PRC operating entities”. We entered into a series of Contractual Arrangements with the VIE and certain shareholders of Gongwuyuan, and this structure involves unique risks to investors. See “Risk Factors — Risks Relating to Doing Business in China” for more information. Neither we nor our direct and indirect subsidiaries own any equity interests in the PRC operating entities.