Emerging Market Links + The Week Ahead (January 29, 2024)

Caixin has reported how the China tourism sector has posted a patchy recovery as the post-COVID rebound peters out with many domestic tourists opting to travel on a budget.

Nevertheless, European luxury goods makers LVMH and Richemont have said that Chinese demand for luxury goods is strong. Some top international luxury brands are also building bigger, flashier flagship stores in China to boost growth, while others are shuttering outlets and refocusing marketing efforts online.

Meanwhile, a recent Maybank report forecasts a tourism recovery in Southeast Asia that is likely to be fastest this year in the casino jurisdictions of Malaysia and Singapore, as well as in Thailand. However, they expect outbound China tourists to return to pre-pandemic levels only in late 2025.

In other words, there are some bright spots (and not so-bright spots) and investors need to be very selective in terms of picking geographies, sectors and individual stocks.

$ = behind a paywall

-

🇮🇳 moneycontrol India Stock of the Day (December 2024) Partially $

-

Crompton Greaves, Ami Organics, Cantabil Retail India, Deccan Cements, Gabriel India, Godrej Consumer Products, KEC International, Aditya Birla Capital, Life Insurance Corporation of India, Zomato Limited, Global Health Limited (Medanta), ESAF Small Finance Bank Limited, Cyient DLM Ltd, Galaxy Surfactants, Hindalco Industries, SAMHI Hotels, Craftsman Automation & Hindustan Aeronautics

-

-

🇨🇳 🇭🇰 CMBI Research China & Hong Kong Stock Picks (December 2023) Partially $

-

Some quick observations about Chinese F&B products or brands who have ventured to SE Asia.

-

Tongda Group Holdings, Luxshare Precision Industry, Xiaomi Corp, Xtep, J&T Global Express, Topsports, Shengyi Tech, BeiGene, Kingdee International Software Group, GigaCloud Technology, NIO Inc, WuXi Biologics, CSPC Pharmaceutical, Cafe De Coral & JOYY Inc

-

-

EM Fund Stock Picks & Country Commentaries (January 28, 2024) $

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 State investors jump on board NEV maker Leapmotor’s bandwagon (Bamboo Works)

As the global war for NEV market share intensifies, the company could get an edge through its joint venture with U.S.-European auto giant Stellantis

Zhejiang Leapmotor Technology Co Ltd (HKG: 9863) has added $84.3 million to its war chest with new share purchases by two state investors, following a much larger $1.6 billion infusion from Stellantis last year

The Hangzhou-based startup shipped 144,155 vehicles last year, up 30% from 2022, making it China’s 10th largest EV maker

🇨🇳 Transsion climbs global smartphone leader board with its move out of Africa (Bamboo Works)

The company posted 68.6% growth to become the world’s fourth largest smartphone seller in last year’s fourth quarter, as it expands beyond its original African stronghold

Shenzhen Transsion Holdings Co Ltd (SHA: 688036) shipped 28.2 million smartphones in last year’s fourth quarter, making it the world’s fourth largest seller

The company aims to replicate its success in Africa by expanding into markets in South Asia, Latin America and Southeast Asia, which have a combined population of over 4 billion

🇨🇳 Yum China (9987 HK/YUMC US): Earnings And Derating Risks Not Priced In (Smartkarma) $

China’s catering industry has changed compared to pre-COVID19, where overall average selling price (ASP) is continually under pressure, and customers are increasing seeking value-for-money options due to weaker consumer sentiment.

YUM China (NYSE: YUMC)‘s same-store-sales growth could be under pressure if the company cannot raise ASP easily like in previous years.

Yum China’s historical valuation should not be used as a benchmark, given that the growth profile has changed (new store openings reaching a plateau; sustained increased competition; lower ASP pressure).

🇨🇳 LVMH & Richemont Said Chinese Demand for Luxury Goods Is Strong; POSITIVE for China Tourism Group (Smartkarma) $

European luxury goods maker enjoyed its best week in the past 52 weeks, spurred by better-than-expected results by LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF), the industry leader and widely viewed as the bellwether

China’s market was cited as resilient and very strong in certain categories, defying the general market perception that Chinese demand is soft

The key European luxury goods share price has risen by an average of 8.2% YTD, China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) share price performance has lagged. Good buying opportunity

🇫🇷 LVMH’s Stellar Returns (Compounding Quality) $

Key takeaways:

Revenue: €86.2 billion (13% organic growth versus 2022)

Profit from recurring operations: €22.8 billion (+8% compared to 2022)

Net profit: €15.2 billion (+8% compared to 2022)

Double-digit organic revenue growth in Europe, Japan, and the rest of Asia

Negative currency impact in the second half of the year

LVMH will propose a dividend of €13 per share (dividend yield: 1.9%)

🇨🇳 In Depth: Luxury Brands’ Strategies Diverge Amid Weak Economic Recovery in China (Caixin) $

While some top international luxury brands are building bigger, flashier flagship stores in China to boost growth, others are shuttering outlets and refocusing marketing efforts online, underscoring a reshuffle in the world’s third-largest luxury market.

Despite the Chinese mainland luxury market showing strong performance in the first quarter of 2023 following the country’s reopening, growth slowed progressively as macroeconomic concerns arose, according to Bain & Co. Inc. in a report (China’s luxury market expected to grow at mid-single-digit in 2024) Thursday.

🇨🇳 Amer Sports (AS US) IPO: Valuation Insights (Smartkarma) $

🇨🇳 ArriVent wows investors with promising China-developed lung cancer treatment (Bamboo Works)

The drug startup’s shares rose 11% on their first trading day, after it raised $150 million in an upsized IPO underwritten by three major investment banks

Arrivent Biopharma (NASDAQ: AVBP) raised $150 million in an upsized IPO, marking one of the strongest performances for a China-linked IPO in New York over the last two years

The company has licensed global rights, excluding Greater China, to furmonertinib, a highly targeted drug used to treat non-small-cell lung cancer

🇨🇳 Junshi hopes new scientist CEO can cure its woes (Bamboo Works)

The biotech company has been dogged by multiple challenges recently, including declining revenue, ongoing losses and a recent rejection by one of its overseas partners

Junshi Bio (SHA: 688180) has appointed its former deputy general manager and president of global R&D as its new CEO

The innovative drug maker has struggled from instability in its R&D and commercialization teams, whose key executives have changed several times in recent years

🇨🇳 New Oriental Education (EDU US/9901 HK): A Better Business Model In The Post “Double Reduction” Era (Smartkarma) $

New Oriental Education (NYSE: EDU) reported better than expected FY2Q24 results last night, with sales up 36% yoy and net profit up 183% yoy.

The company further guided a 42-45% sales growth in FY3Q24, well above market consensus.

The visibility for the next 2-3 years is actually quite high post-“double reduction” policy.

🇨🇳 Bilibili: Several Challenges To Deal With In The Near-Term (Seeking Alpha) $

Bilibili (NASDAQ: BILI) can make progress towards breakeven in 2024 through cost rationalization measures.

Challenges in the video game business and high youth unemployment in China pose risks to Bilibili’s medium-term outlook.

Bilibili’s long-term opportunity lies in attracting more attention from advertisers and potential partners as the incomes of its user group rise.

🇭🇰 More Hong Kong Stocks Priced For Liquidation (Smartkarma) $

🇭🇰 Is Cathay Pacific Stock Worth Your Buy? (Seeking Alpha) $

Cathay Pacific Airways Limited (HKG: 0293 / OTCMKTS: CPCAY)‘s passenger service recovery is slow compared to other airlines, with only 45% of capacity recovered in H1 2023.

The airline’s cargo operations have been more successful, with plans to recover 85% of capacity by the end of 2023.

Despite the slow recovery, there is upside potential for Cathay Pacific stock, with a projected price target of $6.90.

🇹🇼 Asian Dividend Gems: FSP Technology (Asian Dividend Stocks) $

While the world is trying to transition to more renewable energies, FSP Technology (TPE: 3015) could be a beneficiary of reliable power energy supply products.

FSP Technology’s dividend yield averaged 8.1% from 2020 to 2022. The company has a strong balance sheet. Net cash as a percentage of market cap is 40%.

FSP Technology provides power supply products used for personal computers, industrial power, renewable energy, and batteries.

🇰🇷 Temu and AliExpress Taking Away Meaningful Market Share from Coupang in Korea (Smartkarma) $

In this insight, we discuss how Temu and AliExpress have been taking away meaningful market share away from Coupang (NYSE: CPNG) in Korea in the past year.

Temu’s MAU skyrocketed in the past year in Korea. Temu’s MAU surged from zero in January 2023 to 3.28 million as of December 2023.

One could argue that Coupang’s valuations are overvalued relative to its Chinese competitors such as PDD Holdings (NASDAQ: PDD).

🇰🇷 A Sharp Downturn in Price Momentum of Rechargeable Battery Stocks in Korea in January 2024 (Smartkarma) $

In this insight, we discuss the sharp share price declines of rechargeable battery related stocks in Korea so far in 2024.

The top 20 market cap rechargeable battery related stocks in Korea are down on average 15.9% YTD, underperforming KOSPI which is down 6.7% in the same period.

Many rechargeable battery related names in Korea continue to have lofty valuations. The 20 rechargeable battery names are trading at median P/E of 79.7x in 2023 and 39x in 2024.

🇰🇷 LG Display: Positive Earnings Results Overshadowed By The Need For Cash (Seeking Alpha)

LG Display (NYSE: LPL) reported its first profit in almost two years, but LPL is likely to fall into the red as soon as the next report.

LPL has been forced to raise cash due to losses, which is set to continue with LPL set to issue a huge number of shares in 2024.

LPL has become a bet on OLED technology, but the race for supremacy in the display market remains wide open.

Long LPL does not look warranted given the circumstances, but short LPL does not look all that appealing either.

🇰🇷 Mohegan Gaming’s Inspire Resort to Launch the First Foreigners Only Casino in Korea in 19 Years (Smartkarma) $ & Mohegan Inspire okayed for S.Korean casino licence (GGRAsia)

On 24 January, Mohegan Gaming & Entertainment announced that it has received the final approval to open a foreigners-only casino at its Inspire resort complex in Incheon, South Korea.

This will become the first new foreigners-only casino in Korea in 19 years. Currently, there are 17 foreigners-only casinos in Korea.

The opening of the Inspire Resort in Incheon, Korea will likely have a negative impact on the foreigners only casino operators in Korea including Paradise Co Ltd (KOSDAQ: 034230).

🇰🇷 Korean Air – Another US Example Of A Ruling Against Consolidation Raises Asiana Merger Questions (Smartkarma) $

The US Department of Transport (DOT) has ordered the termination of Delta and Aeromexico’s joint venture from October 2024 due to access restrictions in Mexico City.

This follows the (unrelated) US blocking of JetBlue’s planned acquisition of Spirit Airlines on the grounds that it would negatively impact consumers.

Each case is different, but the US has previously voiced concerns regarding Korean Air (KRX: 003490)‘s planned merger with Asiana Airlines (KRX: 020560), and the bar continues to rise for M&A/JV approval globally.

🇮🇳 HDFC Bank: An Update (Value Punks)

….and a few lessons from ITC Ltd (NSE: ITC / BOM: 500875) (and other compounders)

Many moons ago, I had coverage of ITC, another Indian blue chip stock, which is India’s largest tobacco (cigarette) company with 80% volume and 90%+ revenue market share – a monopoly in an addictive product. As you can imagine, this is a very profitable business.

Is HDFC Bank (NYSE: HDB) still a compounder stock?

I encourage readers to delve into our Deep-dive on HDFC Bank (its free for all readers) to grasp the full context of the discussion below.

🇮🇳 Sify Technologies: Positive Outlook On India Data Centers Momentum (Seeking Alpha) $

Sify Technologies (NASDAQ: SIFY) reported its fiscal Q3 results highlighted a climb in adjusted EBITDA.

The company is re-calibrating its strategy to focus on high-margin opportunities including growing demand for data center capacity in India.

The stock has been volatile but we see a path for stronger earnings as a bullish tailwind in 2024.

🇮🇳 Brainbees Solutions (FirstCry) Pre-IPO – The Positives – Carving Its Niche (Smartkarma) $

FirstCry is looking to raise up to US$700m in its upcoming India IPO.

FirstCry is India’s largest multi-channel retailing platform for Mothers’, Babies’ and Kids’ products in terms of GMV, for the year ending Dec 2022 (9M23), according to RedSeer.

In this note, we talk about the positive aspects of the deal.

🇮🇳 MakeMyTrip: Record Quarter, But Pricey Stock (Seeking Alpha) $

Makemytrip (NASDAQ: MMYT), India’s largest online travel company, has released its Q3 2024 earnings report, beating expectations and breaking records for gross bookings, revenue, and profit.

The company’s revenue increased by 25.6% YoY to $214.2 million, and gross bookings increased by 21.7% YoY to $2.1 billion.

While the stock has performed well, with a 61.03% increase over the last year, the company’s high forward P/E ratio suggests it may be overvalued compared to travel industry peers.

🇮🇱 G. Willi-Food International: Where Cash Is King And Portfolios Nourished (Rating Upgrade) (Seeking Alpha) $

G. Willi-Food International (TLV: WLFD) stock is now considered a Buy opportunity, despite headwinds and risks out of its control.

The company’s share price has experienced a decline due to the war and an excessively generous dividend but is in recovery mode rising from $8 to over $11.

The domestic economy in Israel is normalizing, and the share price of G. Willi-Food has steadily climbed, up 47.5% over the last 5 years.

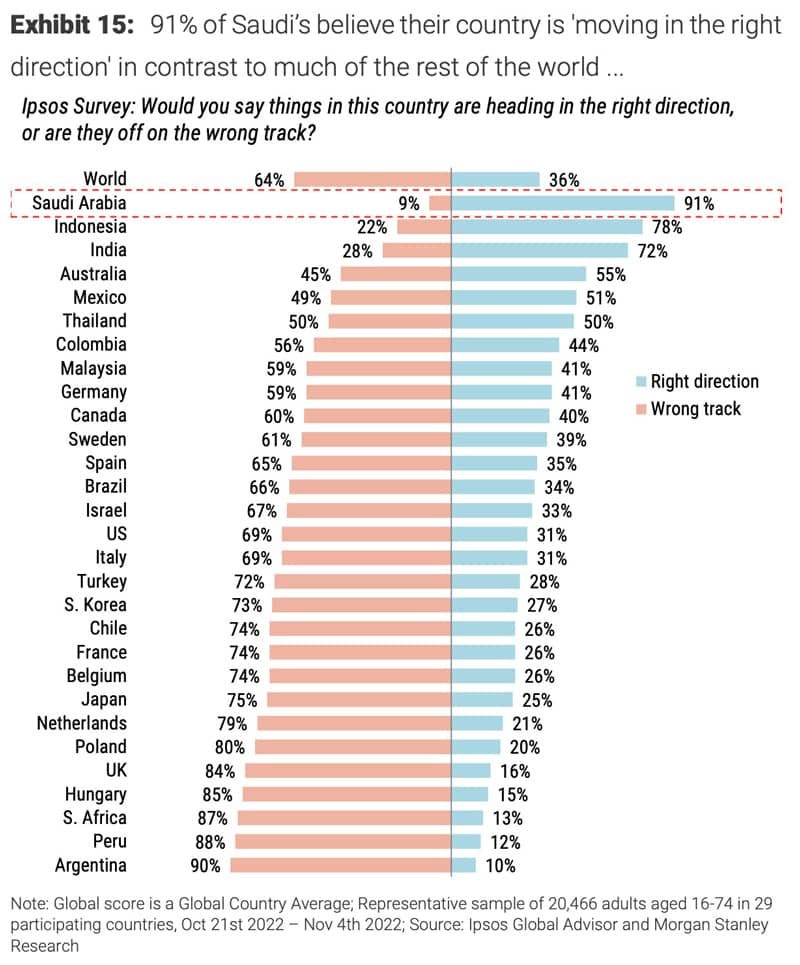

🇸🇦 Tadawul – the booming Saudi Arabian stock exchange (Undervalued Shares)

For Saudi Arabia, that moment had come in 2021. After launching a set of restructuring measures in 2017, Saudi Tadawul Group Holding (TADAWUL: 1111), as both the company and the stock market are called, went public. The IPO seemed even more notable and consequential than the 2019 IPO of national oil company Saudi Arabian Oil Co (TADAWUL: 2222)), which had stirred up a lot of international media attention.

Formerly 100% owned by Saudi Arabia’s sovereign wealth fund, Tadawul was opened up to public market investors in an effort to open up the country to foreign investment. It has already succeeded to a higher degree than you might think.

🇹🇷 Turkcell Still A Buy, Even With Rising Inflation (Seeking Alpha) $

Turkcell (NYSE: TKC) has shown potential to absorb additional inflation impacts without significantly affecting its financial health.

New, higher-margin businesses like digital services and payment services are growing faster than its core business.

Under three DCF scenarios considering different margin outcomes, the price targets for Turkcell range from $5.50 to $6.20.

🇳🇬 Nigeria’s tier 1 banks: Worth a look? (Capital Markets Africa)

Imara Asset Management thinks so. The company’s latest monthly market update is bullish about Nigeria’s biggest banks despite deep macro challenges

The latest monthly market update by Imara Asset Management is bullish about Nigeria’s biggest banks.

🇱🇺 🌎 Tenaris: Steeling Against High Rates With A Rock-Solid Balance Sheet (Seeking Alpha) $

Businesses globally are preparing for a new reality of high interest rates as central banks raise rates to combat inflation.

Tenaris S.A. (NYSE: TS), an oilfield equipment and services company, stands out with its strong balance sheet and low debt levels.

Tenaris has reported impressive financial results, including increased sales volumes, high margins, and substantial cash flows, making it an attractive investment option.

🇦🇷 IRSA’s Potential May Take Years And Is Not An Opportunity (Seeking Alpha) $

IRSA Inversiones y Representaciones Sociedad Anónima (NYSE: IRS) is one of Argentina’s leading real estate developers.

Its most important assets are the Buenos Aires’ leading malls and a vast and valuable landbank.

Further, the valuation of both lands and malls is based on a damaged Argentinian macroeconomy. This leaves a substantial upside opportunity.

However, the realization of that potential is not dependent on IRSA, but rather on availability of credit and political support. This may take years.

I believe the discount is not sufficient to justify the potentially long wait for value.

🇦🇷 Cresud Is Not An Opportunity Even Under Bullish Assumptions (Seeking Alpha) $

Cresud Sa (NASDAQ: CRESY) is an Argentinian conglomerate with investments in IRSA (NYSE: IRS) and Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3), as well as rural land properties and agritech companies.

The company’s stock does not offer a great opportunity as most of the upside comes from eliminating export taxes in Argentina, which is unlikely.

Cresud’s complex accounting and the burden of export taxes on its agricultural operations make it difficult to justify its current valuation.

🇧🇷 GOL – Chapter 11 Filing In a Bid to Ensure Financial Sustainability (Smartkarma) $

Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4) has filed for CH11 in a New York court and will look to restructure, as major competitors/peers LATAM Group, Avianca and Aeromexico did when COVID struck, disadvantaging GOL.

To illustrate GOL’s disadvantage; in 9M23, GOL’s financing costs outweighed its EBITDAR to drive a negative PBT, whereas LATAM’s PBT represented 29% of EBITDAR, despite lower EBITDAR margins of 22%.

Based on recent precedents, we expect the process may take two years.

🇧🇷 Braskem: Mounting Troubles Impacting Financial Performance (Seeking Alpha) $

Braskem (NYSE: BAK) is a petrochemical firm operating in Brazil, the U.S., Europe, and Mexico.

The company’s financial performance has been declining, with reduced margins and losses in operating income.

BAK is facing potential financial impact and legal issues due to an environmental incident in Maceio, Brazil.

🇧🇷 The Pros And Cons Of Investing In CI&T (Seeking Alpha) $

CI&T (NYSE: CINT) is rated as a Hold due to a mix of pros and cons.

The stock trades at undemanding valuations, and the company’s new AI platform might help to expand its client base.

There are good reasons to be worried about CINT’s customer and geographical concentration risks.

🇧🇷 TIM S.A. Q4 Earnings Preview: Inflation Surprise (Seeking Alpha) $

TIM Brasil (NYSE: TIMB) is projected to announce Q4 revenue of $1.27 billion, with earnings per share of $0.41, which aligns with full-year guidance and the 2023-2025 strategic plan.

Inflation in Brazil, which has been a concern for telecom companies, improved more than expected, providing a favorable backdrop for TIMB.

TIMB’s acquisition of Oi Group’s Mobile business in 2022 has exceeded expectations, with strong service revenue and EBITDA growth.

I continue to maintain a buy rating on TIMB stock, with a price target of $18.90.

$ = behind a paywall / 🗃️ = Archived article

🌍 Saudi Tankers Given Passage Through Red Sea By Houthis, Alongside Russia & China (Zero Hedge)

China and Russia aren’t the only countries being given a “pass” from Yemen’s Houthi rebels, but Saudi Arabia is also exporting crude oil through the Red Sea as if in perfectly normal times (well, almost).

As we’ve been chronicling, a who’s who of major tanker and container shipping companies have halted their Red Sea transit, instead opting for the much longer journey around the Cape of Good Hope in Africa. This typically adds some $1 million to the total transport bill for a tanker, LSEG Shipping Research data shows.

🌏 Fraud in Asia (Asian Century Stocks)

Tan & Robinson’s book Asian Financial Statement Analysis is probably the definitive book on how to spot fraud and misrepresentation in this part of the world.

Be careful of companies with high margins, poor cash flows, fast-growing balance sheets and complex corporate structures with frequent related party transactions.

I have great respect for the detailed work that short-sellers carry out. In my experience, high-profile short-seller reports should always be taken seriously.

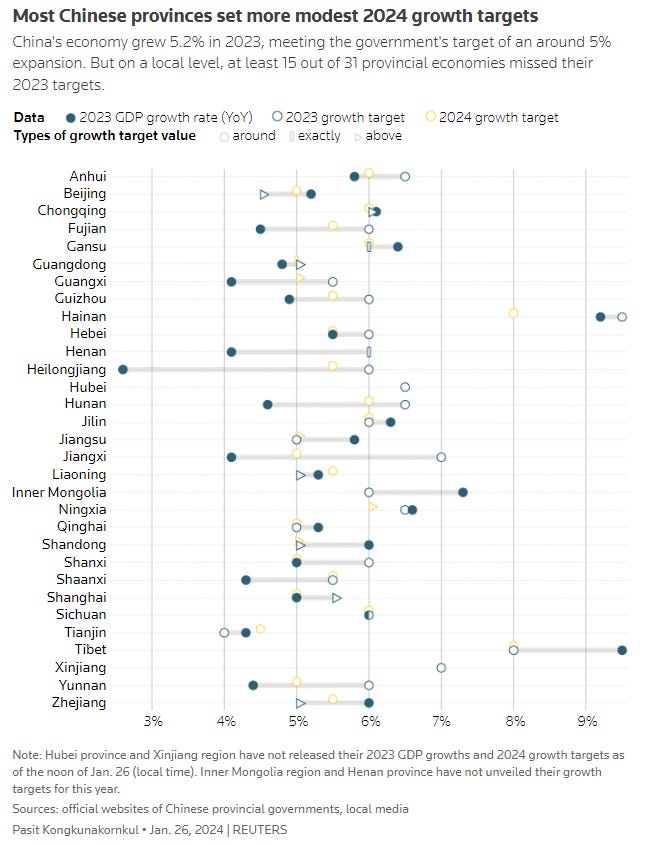

🇨🇳 Chinese provinces target modest 2024 growth after missing previous goals (Reuters)

Around half Chinese provincial economies miss 2023 GDP targets

Some debt-laden regions lower growth goals this year

Major regional powerhouses set 5%, or higher, growth targets

🇨🇳 China approves more video games in sign of further easing of restrictions on sector (Caixin) $ & China regulator removes draft video game rules from website; shares jump (Reuters)

China approved more publishing licenses for new video games in January than in December, reinforcing hopes that Beijing will ease its clampdown on the industry futher after proposed tighter restrictions sent investors fleeing from gaming stocks in December.

The National Press and Publication Administration (NPPA) on Friday issued a new list of 115 domestic titles cleared for smartphones, consoles and personal computers from companies including Shenzhen ZQGame Co. Ltd (SHE: 300052) and 37 Interactive Entertainment Network Technology Group Co. Ltd. (SHE: 002555) The figure marks a slight uptick from December, when the NPPA approved 105 new titles for sale in China.

🇨🇳 China to cut banks’ reserve requirements amid flagging recovery (Caixin) $ & China cuts bank reserve ratio to boost growth as sentiment sours (FT) $ 🗃️

China will reduce banks’ reserve requirement ratio (RRR) by 50 basis points on Feb. 5, central bank Governor Pan Gongsheng said at a news briefing on Wednesday.

The move, which Pan said will release 1 trillion yuan ($141 billion) of liquidity into the financial system, is aimed at providing additional stimulus to the economy, analysts said.

“Compared with the central banks of major international economies, there is still considerable room for adjustment,” Pan said, noting that the current average level of the RRR is 7.4%. “This serves as an effective tool to supplement the long-term liquidity in the banking system.”

🇨🇳 China tourism sector posts patchy recovery as rebound peters out (Caixin) $

China’s tourism industry has been showing mixed signs of recovery following a long bleak winter, as the “revenge travel” rebound of the immediate post-pandemic period in 2023 proved more short-lived than expected, with many domestic tourists opting to travel on a budget.

Domestic trips made during the eight-day Golden Week holiday in October, the typical year-end peak travel season in China, reached 826 million and recorded a modest 4.1% pickup from pre-pandemic levels during the same holiday in 2019, but much slower than the 19% increase recorded during the Labor Day holiday in May, according to data released by the Ministry of Culture and Tourism.

🌏 S’pore, Malaysia inbound visits up, China input lags: Maybank (GGRAsia)

Tourism recovery in Southeast Asia is likely to be fastest this year in the casino jurisdictions of Malaysia and Singapore, as well as in Thailand, says a Friday report from Maybank Research Pte Ltd, adding that the contribution from mainland China is likely to continue to lag.

Referring to a club of Southeast Asian nations, the institution stated: “We forecast total visitor arrivals to ASEAN-6 growing by about +27 percent in 2024 (versus +130 percent in 2023), recovering to 98 percent of pre-pandemic levels by this December. Recovery will be faster in Malaysia, Thailand and Singapore.”

“We expect outbound China tourists to return to pre-pandemic levels only in late 2025,” stated Maybank.

🌐 Bond market thaw offers hope to emerging market borrowers (FT) $ 🗃️

🇦🇷 Argentina’s President Promised a Free-Market Revolution, and Says He’s Delivering (WSJ)

🇨🇱 Chile takes first step towards reforming private pension system (FT) $ 🗃️

Early win on legislation is a boost for President Gabriel Boric

It would also increase the minimum guaranteed pension paid out by the government to poorer people, and replace the deeply unpopular private pension administrators with a public administrator, though Chileans would still be able to choose private funds to invest their pensions. A state-run investing alternative would also be created.

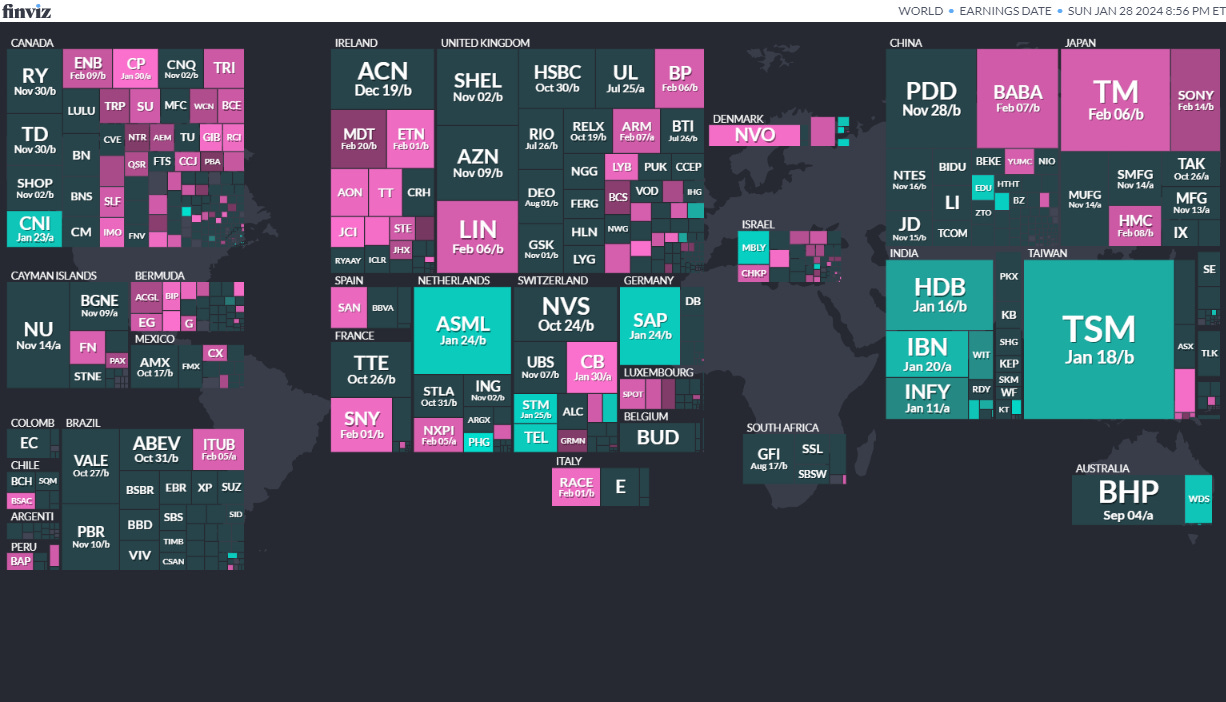

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

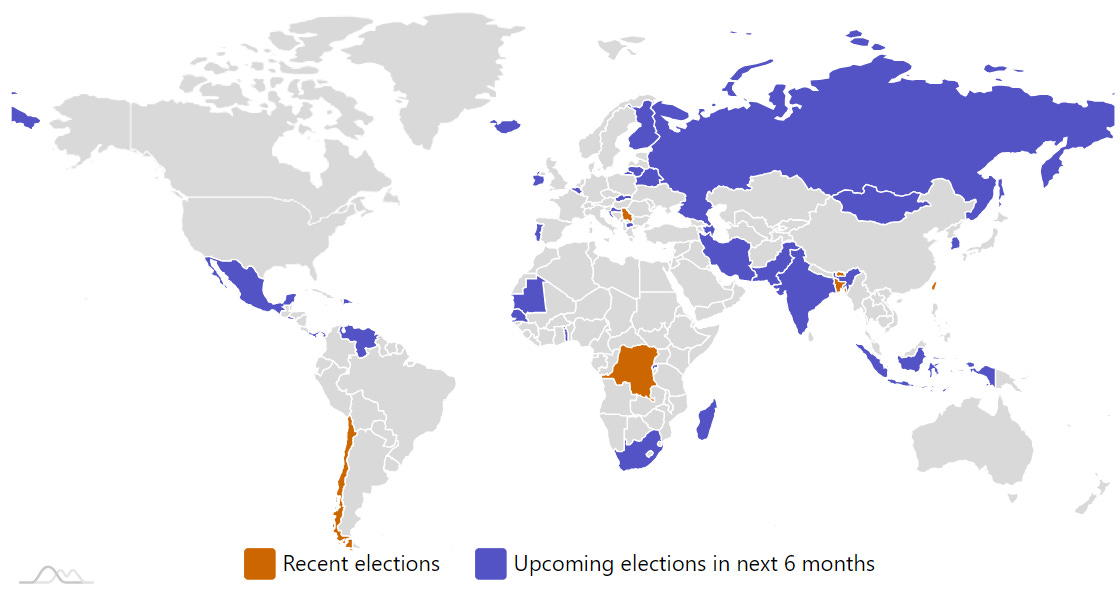

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024