Emerging Market Links + The Week Ahead (January 6, 2025)

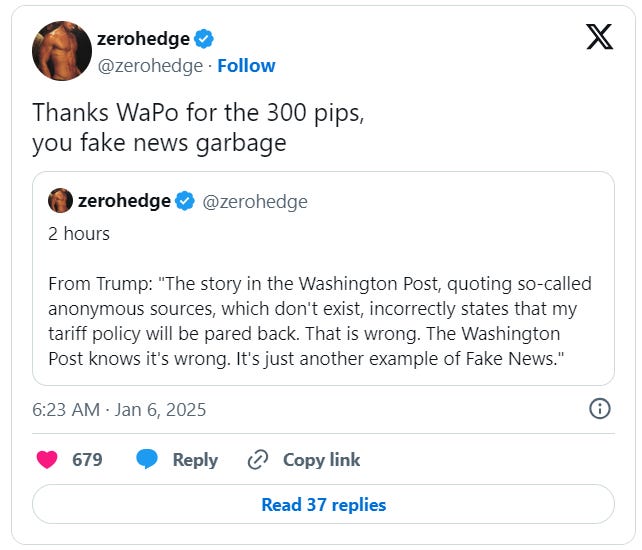

This morning, alternative financial news site Zerohedge ran this headline and did not mince words on the platform formerly known as Twitter: Dollar Reverses Losses After Trump Blasts WaPo’s “Fake News” Tariff Report

Investors better prepare themselves for four years of “anonymous sources” from the legacy corporate media moving the dollar (and other markets) for either market manipulation OR policy “trial balloon” purposes…

Meanwhile, CNBC has reported that foreign phone sales have plunged 47% in China and I am not surprised. As discussed in our December 2 post, I recently had to replace my Redmi Note 9 phone (Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF)) bought in 2020 for a Redmi 13 108MP super clear camera smartphone. Xiaomi’s Redmi series of phones have better features than comparatively priced Samsung phones in Malaysia. In fact, I only did a cursory online search of comparable Samsung options after going to the same shop where I had bought my Redmi Note 9 and an Asus phone (ASUSTEK Computer Inc (TPE: 2357 / OTCMKTS: ASUUY)) before (Taiwan based Asus seems to have stopped selling phones in the Malaysian market with the small shop I have been buying phones from switching their focus to Xiaomi products…).

Finally, I am still visiting family in California where the weather has been fairly dry to get yard work done outside – hence why posts are latter than normal…

$ = behind a paywall

-

moneycontrol India Stock of the Day (Q4 2024) (Partially $)

-

NCC Limited, Icici Prudential Life Insurance Company, Sirca Paints, HG Infra Engineering, MAS Financial Services, Prudent Corporate Advisory Services Ltd, Vijaya Diagnostic Centre, Hindustan Unilever Limited, Endurance Technologies Ltd, Syrma SGS Technology, EIH Ltd, Tbo Tek Ltd, Medi Assist Healthcare Services, Indian Overseas Bank / HG Infra Engineering / LTIMindtree / Saakshi Medtech / Asian Paints Ltd, Persistent Systems, Colgate-Palmolive (India), Gabriel India, Va Tech Wabag, Tarsons Products Ltd, Transport Corporation of India, Shivalik Bimetal Controls, Cello World Ltd, Central Depository Services, Galaxy Surfactants, Swiggy Ltd, Prince Pipes and Fittings Ltd, NTPC Ltd, Godrej Consumer Products, V.I.P. Industries Ltd, Home First Finance, Amber Enterprises, Protean eGov Technologies Ltd, Trent Ltd, CE Info Systems Ltd (MapMyIndia), KEC International, Metro Brands Ltd, Computer Age Management Services Ltd, Aditya Birla Capital, SG Mart Ltd, Wipro Ltd, Aptus Value Housing Finance India, Juniper Hotels, AU Small Finance Bank Ltd, HDFC Bank, Cochin Shipyard, Crompton Greaves, PG Electroplast Ltd, Landmark Cars Ltd, Rainbow Children’s Medicare Ltd, Manappuram Finance Ltd, V-Guard Industries Ltd, Krsnaa Diagnostics, Nazara Technologies, 360 One WAM, Data Patterns (India) Ltd, Lemon Tree Hotels & Craftsman Automation

-

-

EM Fund Stock Picks & Country Commentaries (2024 Highlights) (Partially $)

-

Research highlighted in our 2024 posts with a focus on specific stocks or stock picks, podcasts or other pieces that could be considered “evergreen” for the info they contain, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 US adds Tencent and CATL to list of companies working with China’s military (FT) $ 🗃️

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750)

US-listed shares of WeChat owner fall after US Department of Defense discloses designation

Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / SGX: HTCD / OTCMKTS: TCEHY’s US-listed shares fell as much as 9.8 per cent after the Pentagon designated the tech giant as a Chinese military company operating in the US.

The gaming and social media group, which owns ubiquitous Chinese messaging app WeChat, was added to a list of dozens of companies the defence department considers to be working with the Chinese military directly or indirectly, according to a federal document published on Monday.

🇨🇳 Weimob gets early Christmas ‘gift’ from WeChat (Bamboo Works)

The provider of services to e-commerce merchants on WeChat is expected to benefit from the platform’s new ‘Send Gifts’ program

Weimob (HKG: 2013 / FRA: 36W / OTCMKTS: WEMXF)’s share price doubled in four days last month as investors bet the company will benefit from a new gift-giving feature on WeChat

Sun Taoyong, chairman of the company that provides services to e-commerce merchants, took the opportunity to sell down his stake

🇨🇳 Alibaba sells stake in Chinese hypermarket operator at steep discount (FT) $ 🗃️

🇨🇳 Meituan (3690 HK): Online Drug Sales Is the First Sweet Spot of O2O Vs. E-Commerce (Smartkarma) $

O2O has made a huge impact on China’s e-commerce scene in 2024. The Coupang, Inc. (NYSE: CPNG)-invented model suits mega cities with dense population and order volumes;

Online drug O2O, in particular, has gained momentum because drugs, prescription and non-prescription have robust storage and distribution needs on the ground for O2O use;

Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY)‘s drug sales has grown its overall market share from 3.6% in 2022 to 7.1% in 2024. We project it to grow to 12.3% by 2030.

🇨🇳 NetClass offers lesson in diversity with globalization strategy (Bamboo Works)

The edtech company’s shares have performed well since their Nasdaq debut last month, helped by its new venture outside the fickle China market

Shares of NetClass Technology Inc (NASDAQ: NTCL) have climbed by 11% in the two weeks since the company raised $9 million in its Nasdaq IPO

The Shanghai-based provider of smart classroom software is getting a revenue boost from its global operation run from a second headquarters in Hong Kong

🇨🇳 China’s electric-vehicle leader BYD posts record sales in 2024 (FT) $ 🗃️

(BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) / BYD Electronic International Co Ltd (HKG: 0285))

Bigger companies beat targets as intense competition rocks world’s biggest car market

Li Auto (NASDAQ: LI), China’s first profitable EV start-up, Stellantis-backed Zhejiang Leapmotor Technology Co Ltd (HKG: 9863) and smartphone maker Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) also surpassed their targets, selling 500,000, 290,000 and 135,000 EVs respectively during 2024.

🇨🇳 IM Motors steers clear of EV shockwaves with funding deal (Bamboo Works)

The SAIC Motor Corp (SHA: 600104)’s electric vehicle unit has secured its financial base despite disappointing car sales and jitters over the abrupt collapse of a rival firm

IM Motors raised 9.4 billion yuan in a Series B financing in 2024

The maker of high-end electric cars plans to launch EVs with extended ranges in the coming year to increase its market share

🇨🇳 Foreign phone sales plunge 47% in China, spelling trouble for Apple (CNBC)

In November, foreign mobile phone shipments in China stood at 3.04 million units, down 47.4% year on year, according to CNBC calculations using official Chinese data.

Apple accounts for the majority of foreign mobile phone shipments in China, with major competitors like Samsung forming just a tiny part of the market.

The figures highlight the mounting pressure Apple is under in the world’s largest smartphone market as a result of rising competition from domestic brands.

🇨🇳 China Mengniu: Financial Improvement Potential Is Underappreciated (Rating Upgrade) (Seeking Alpha) $ 🗃️ (?)

🇨🇳 Inmagene Bio charts backdoor to U.S. listing with offshore acquisition (Bamboo Works)

The biotech company’s merger with Ikena Oncology (NASDAQ: IKNA) will bring in $175 million in fresh funds, including $75 million from an oversubscribed private placement

Inmagene Bio plans to merge with Ikena Oncology, after which it will continue its clinical trials for IMG-007, a monoclonal antibody co-developed with Hutchmed (NASDAQ: HCM)

The unusual path to a U.S. listing owes partly to the background of company founder and Chairman Jonathan Wang, who has extensive experience in capital management

🇨🇳 CALC steers through interest turbulence in search of smoother air (Bamboo Works)

The aircraft-leasing unit of China Everbright Group has sold more than 10 aircraft this year as part of an effort to renew its fleet and lower interest payments

China Aircraft Leasing Group’s (CALC (HKG: 1848)) profit fell more than 30% in the first half of this year due to rapidly rising interest payments

The company’s future profit path could hinge on the Fed’s pace of monetary easing in 2025

🇨🇳 Energy Monster snuffed out by sputtering Chinese economy (Bamboo Works)

The rented power bank provider, officially known as Smart Share Global Ltd (NASDAQ: EM), announced a management-led plan to take the company private at a big premium

Smart Share Global announced that a group led by its chairman has offered to take the company private at a roughly 70% premium to its latest stock price

The provider of rented power banks was a victim of China’s slowing economy, and may have worried investors with plunging revenue as it shifted to an asset-light business model

🇨🇳 Canvest (1381 HK): Attractive Spread with Steady Progress in Precondition Satisfaction (Smartkarma) $

(Water supply, sewage treatment, solid waste treatment, and gas supply businesses) Grandblue Environment Co Ltd (SHA: 600323) continues to make steady progress in satisfying the precondition for its HK$4.90 privatisation offer for Canvest Environmental Protection Group (HKG: 1381 / FRA: 0XC).

Two of the five preconditions are satisfied, and another will be satisfied by 20 January. The long stop date of 17 July provides ample time to satisfy the remaining two.

Although the peers have materially re-rated, the offer implies a premium compared to peer multiples. Vote risk remains low, aided by selling by a shareholder with a blocking stake.

🇨🇳 Mixue pours up strong growth in China’s overheated bubble tea market (Bamboo Works)

The country’s leading premium tea chain has relaunched its Hong Kong IPO, reporting 42% profit growth in the first nine months of last year even as many of its rivals reported declines

Mixue has relaunched its Hong Kong IPO, as it faces stiff competition from rivals using similar budget-friendly pricing strategies to serve increasingly cautious consumers

The leading bubble tea chain outpaced its rivals by adding 7,737 stores in the first nine months of last year, driving a 21.2% revenue increase to 18.7 billion yuan

🇨🇳 Bloks Group IPO (0325.HK): Global Offering, The Initial Price Range Is Seen As Attractively Valued (Smartkarma) $

Shanghai-Based Bloks Group, a leader of assembly character toys in China, has announced the initial price range for its IPO in Hong Kong.

The offering is expected to be between HK$55.65 and HK$60.35, implying a market cap of ~HK$14B or ~$1.8B at the midpoint of the price range.

Assuming IPO offer price of HK$58.00, UBS AM Singapore, Greenwoods AM and Fullgoal Investors have agreed to invest ~HK$388M or ~$50M in the offering.

🇭🇰 Café De Coral: It’s About Both The Costs And The Top Line (Seeking Alpha) $ 🗃️

-

🇭🇰 🇨🇳 Cafe De Coral (HKG: 0341 / OTCMKTS: CFCGF) 🇧🇲 – Asia’s largest publicly-listed restaurant & catering groups. Businesses include quick service restaurants, casual dining chains, institutional catering & food processing. 470+ dining outlets. 🇼 🏷️

🇭🇰 DFI Retail’s Sales Make The Stock A Buy (Seeking Alpha) $ 🗃️

🇭🇰 CK Asset (1113.HK) – Property conglomerate no more? Re-defining itself amidst underreported international diversification (Pyramids and Pagodas) $

A well-timed overseas shopping spree has shored up the balance sheet and positions the Company to seize recovery opportunities back home

CK Asset Holdings (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF), with a market cap of USD 14.37 billion, originally part of the Cheung Kong Group, was established as a standalone entity in 2015 and rebranded from Cheung Kong Property Holdings Limited in 2017. Hong Kong’s richest man, Li Ka-shing built his wealth by founding and building this company into a diversified global empire spanning property, hospitality, and infrastructure.

Yet as with all Hong Kong conglomerates, sentiment is poor and there is an inherent discount to this stock. Even without applying any discount, the share price reflects fair value for overseas non-property holdings and REITs, investors seem to have written off the potential for a longer term rebound in the HK / China property market.

🇹🇼 TSMC: Why I Took Profits (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇰🇷 Lotte Tour 2024 casino net revenue up 93pct y-o-y (GGRAsia)

Full-year 2024 casino net revenue at Lotte Tour Development (KRX: 032350) rose 93.3 percent year-on-year, to KRW294.65 billion (US$200.7 million). The firm’s hotel revenue for 2024 stood at KRW84.52 billion, down 7.8 percent year-on-year.

🇰🇷 Paradise Co casino revenue down m-o-m, full-year up 10pct (GGRAsia)

December casino revenue at Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only casinos, went down 1.4 percent sequentially, to KRW70.74 billion (US$48.18 million), the firm said in a Monday filing to the Korea Exchange.

The December tally took Paradise Co’s full-year casino revenue to KRW818.79 billion, up 10.2 percent from 2023.

On December 26, South Korea announced visa-easing measures for tourists from China, with an official citing also, measures to counter what was described as the negative impact on the inbound-visitor market, of the political crisis.

🇰🇷 Palantir’s Influence on the Political Rallies in Korea & HD Hyundai’s 34% Stake in Palantir Korea (Douglas Research Insights) $

In this insight, we discuss the increasing importance of Palantir Technologies (NASDAQ: PLTR) on influencing the political rallies in Korea.

In addition, we discuss how HD Hyundai Electric Co Ltd (KRX: 267260)‘s 34% ownership of Palantir Korea is likely to improve the positive sentiment on HD Hyundai.

Our sum-of-the-parts valuation analysis of HD Hyundai suggests implied market cap of 11 trillion won or target price of 139,845 won per share (63% upside from current levels).

🇰🇷 Alpha Generation Through Share Buybacks in Korea: Bi-Monthly (November and December 2024) (Douglas Research Insights) $

In this insight, we discuss the alpha generation through companies that have been buying back their shares in the Korean stock market in November and December 2024.

On average, the share buyback announcements for the 52 companies that announced share buybacks in Korea represented 2.2% of outstanding shares.

Major companies that have announced share buybacks in Korea in the past two months include Celltrion (KRX: 068270), Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF), Doosan Bobcat (KRX: 241560), and Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF).

🇸🇬 Bitdeer: The Bitcoin Miner To Watch In 2025 (Seeking Alpha) $ 🗃️

🇸🇬 Can You Still Buy Singapore Banks? (The Smart Investor)

With banks trading close to their all-time highs, should you still add them into your investment portfolio?

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) led the pack with a stunning 44% share price increase in 2024.

Oversea-Chinese Banking Corp (OCBC) (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) came in second with a 28.4% share price gain while United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF), or UOB, came close with a 27.7% jump.

With the three lenders logging big gains last year, is there still room to buy the local banks?

“Higher for longer” interest rates

Better non-interest income

Excess capital

An optimistic outlook

Get Smart: Room for further growth

🇮🇳 GNA Axles – A Positive Shift in the Business Cycle Could Be Approaching (Smartkarma) $

GNA Axles Ltd (NSE: GNA / BOM: 540124) is a cyclical play driven by revival of the tractor industry in India and pre-buying in commercial vehicles(trucks) in the U.S. market.

A good monsoon in India in 2024 is expected to revive domestic tractor demand, while changes in emission regulations in the U.S. are likely to increase truck sales.

The company is currently valued at a comfortable 18x trailing P/E, with a 15% RoE and RoCE.

🇮🇳 Monthly Sales Overview of Indian Listed Tractor Companies (December 2024) (Smartkarma) $

Favorable reservoir level, an uptick in Kharif Harvest, and strong sowing for the Rabi season are expected to drive good demand for tractors in the medium term.

We summarize the sales volume published by listed players Mahindra & Mahindra (NSE: M&M / BOM: 500520 / OTCMKTS: MAHMF), and Escorts Kubota Ltd (NSE: ESCORTS / BOM: 500495).

Positive management commentary augurs well for uptick in tractor OEM stocks and related auto ancillary companies like GNA Axles Ltd (NSE: GNA / BOM: 540124) in medium term.

🇮🇳 Steep Discount on Land Acquisition by Reliance Sparks Corporate Governance Debate (Smartkarma) $

Reliance Industries Limited (NSE: RELIANCE / BOM: 500325) bought 5,286 acres of prime industrial land in Navi Mumbai, which was sold for a surprisingly low INR 2,200 cr whose economic value is around INR 1 Lakh cr.

This complex transaction done at a steep discount raises corporate governance issues for other shareholders like Jai Corp (Jio Financial Services (NSE: JIOFIN / BOM: 543940)) owing to valuations, disclosure lapses and minority shareholder rights.

We delve into details of the deal structure and what it means for respective companies’s shareholders.

🇮🇱 ICL Group: Expanding Phosphate Solutions To Fortify Their Market Position! – Major Drivers (Smartkarma) $

Icl Group Ltd (NYSE: ICL) , a multinational company involved in the manufacturing of fertilizers, specialty chemicals, and functional food ingredients, released its third-quarter results for 2024.

The company reported sales of $1.753 billion, marking the third consecutive quarter of sales growth.

Adjusted EBITDA was $383 million, up 11% year-over-year.

🇹🇷 Turkcell: Executing Well Through Hyperinflation, But Macro, Governance, And Capital Deployment Concerns Remain (Seeking Alpha) $ 🗃️ (?)

🌎 Codere Online: Delisting Is A Major Concern (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌎 The Worst Seems To Be Behind For DLocal (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: A Top E-Commerce Play For 2025 And Beyond (Seeking Alpha) $ 🗃️

🌎 Arcos Dorados: MFA Renewal, Argentinian Recovery To Drive Earnings (Rating Upgrade) (Seeking Alpha) $ 🗃️

-

🌎 Arcos Dorados Holdings Inc (NYSE: ARCO) – World’s largest independent McDonald’s franchisee. Exclusive right to own, operate & grant franchises of McDonald’s restaurants in 20 Latin American & Caribbean countries & territories. 🇼 🏷️

🇧🇷 Tariffs May Not Affect Braskem, And It’s A Buying Opportunity (Seeking Alpha) $ 🗃️

🇧🇷 BB Seguridade: Undervalued Defensive Opportunity After A Tough Year (Seeking Alpha) $ 🗃️

🇧🇷 Vasta Is An Interesting Company, But Also A Hold For The Time Being (Seeking Alpha) $ 🗃️ (?)

-

🇧🇷 Vasta Platform Limited (NASDAQ: VSTA) – High-growth education company providing end-to-end educational and digital solutions for private schools operating in the K-12 educational segment. 🏷️

🇧🇷 StoneCo: Hitting A Stone Wall Hurts (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: Time To Be Greedy (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Expanding Production At Attractive Breakeven Economics (Seeking Alpha) $ 🗃️

🇧🇷 Ambev: Improving Performance At 6x FCF (Seeking Alpha) $ 🗃️

🇲🇽 Kimberly-Clark de Mexico: Undervalued And A 6.5% Dividend Yield (Seeking Alpha) $ 🗃️

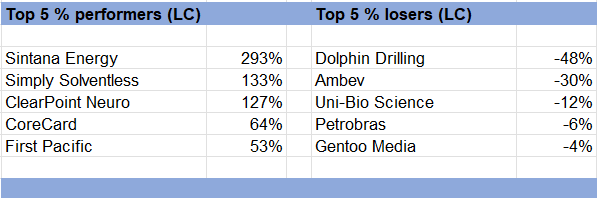

🌐 Dragons and Snakes (Jam_invest) $

The year of the Dragon lived up to the prediction of ‘good financial luck’. The portfolio delivered strong results, led by triple digit performance from three Canadian/U.S. small/microcaps.

The Chinese Zodiac horoscope prediction was spot on for the year of the Dragon. It was indeed a year of ‘good financial luck’. If the predictions hold up, then the year of the Snake – 2025 – looks to become a consolidation year with ‘very stable wealth’.

This post goes through the winners and losers of 2024, and has the updated HK (sub)portfolio going into 2025. HK stocks represent about 14% of my overall portfolio. Cash stands at 20% of the total portfolio.

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 How to invest in a much-changed China (FT) $ 🗃️

(Swetha Ramachandran is a global equity manager at Artemis)

🇨🇳 The contradictions of Xi Jinping (FT) $ 🗃️

🇨🇳 Years of Repeat Central Planning Mistakes Have Doomed China’s Economy (MishTalk)

Other than exports, no country wants to be like China.

There is still rampant belief that China is this big nation of savers, and US trade deficits are the other side of the coin.

Here’s my question: China now has a debt to GDP ratio of nearly 300 percent. So where the heck is the saving either in China or here?

🇨🇳 US investors in China venture funds brace for new tech rules (FT) $ 🗃️

🇨🇳 In Depth: Venture Capital in China Flounders as State Takes Over (Part 1) (Caixin) $

Editor’s note: Venture capital in China is in crisis as government guidance funds overwhelm the industry’s traditional modus operandi. In the first of a two-part series, we examine how these funds have disrupted the country’s investment landscape. In Part 2, we look at how the government is trying to resolve the problems.

“Recently I feel like I’ve turned into the Minister of Investment Promotion,” lamented Jin Yuhang, founding partner and chairman of Dingxing Quantum, a venture capital (VC) investment firm based in Southwest China’s Sichuan province.

🇨🇳 Slide in land sales persists as China’s property developers pushed to the brink (Caixin) $

Land sales across China have fallen to their lowest levels in years, with a nearly 20% decline in 2024, underscoring the persistent struggles in the property market that are crippling the ability of developers to expand.

As of December 29, land sales in 300 Chinese cities totaled only 1.38 billion square meters, a 16% year-on-year drop, according to property data provider China Index Academy.

🇭🇰 In Depth: After Bruising Year, Hong Kong’s Wealth Managers Have Reasons to Be Cheerful (Caixin) $

Can Hong Kong surpass Switzerland to become the world’s No. 1 cross-border wealth management center?

“There are 2,700 single-family offices in Hong Kong, and the industry has predicted that Hong Kong will become the world’s largest cross‑boundary wealth management center by 2028,” the city’s leader John Lee said in his 2024 policy address in October.

Lee was likely citing Boston Consulting Group’s (BCG) Global Wealth Report 2024, which predicted that Hong Kong would surpass Switzerland in the next few years.

🇰🇷 South Korean investors pile into US equities as domestic stock market languishes (FT) $ 🗃️

🇰🇷 End of Mandatory Lock-Up Periods for 57 Companies in Korea in January 2025 (Douglas Research Insights) $

We discuss the end of the mandatory lock-up periods for 57 stocks in Korea in January 2025, among which four are in KOSPI and 53 are in KOSDAQ.

The ban on short selling of Korean stocks which is still in place is likely to be lifted on 31 March 2025.

Some of the companies mentioned in this insight which highlights the end of the major lockup periods could help to narrow down the list of candidates for potential shorting.

🇰🇷 Gap Trade Opportunities in Korean Prefs Vs Common Share Pairs in 1Q 2025 (Douglas Research Insights) $

In this insight, we discuss numerous gap trade opportunities involving Korean preferred and common shares in 1Q 2025.

Among the 27 major pair trades (prefs vs. common shares), 20 of the pref stocks outperformed their common shares counterparts in 2024.

The 27 Korean preferred stocks’ average prices declined by 1% from end of 2023 to end of 2024 (excluding dividends), outperforming their common counterparts which were down on average 3.7%.

🇰🇷 Korean Holdcos Vs Opcos Gap Trading Opportunities in 1Q 2025 (Douglas Research Insights) $

In this insight, we highlight the recent pricing gap divergences of the major Korean holdcos and opcos which could provide trading opportunities in 1Q 2025.

The recent martial law cancellation and numerous impeachments of acting Presidents have raised political uncertainty in Korea resulting in widening of some gaps among numerous holdcos and opcos in Korea.

Of the 38 pair trades, 25 of them involved holdcos outperforming opcos in the past six months and the other 13 opcos outperforming holdcos in the same period.

🇮🇳 In charts: has the ‘India trade’ run out of steam? (FT) $ 🗃️

🌍 Africa Has Entered a New Era of War (WSJ) $ 🗃️

🇵🇱 Polish wealth managers warn against tax changes for family foundations (FT) $ 🗃️

Structure was set up in 2023 to encourage money to stay in the country

About 3,000 family foundations have been set up in Poland since the law was introduced in May 2023, shortly before a change in government that returned Prime Minister Donald Tusk to office.

🌎 Why Spanish firms have cooled towards Latin America (Economist) $ 🗃️

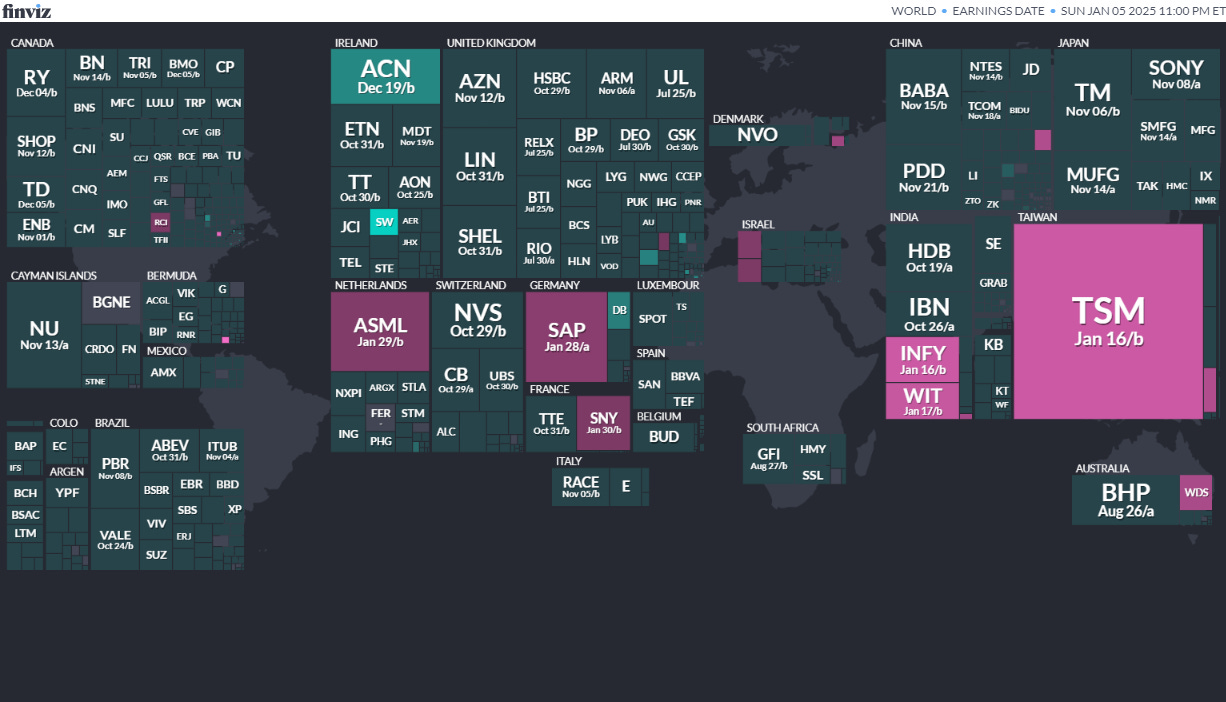

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

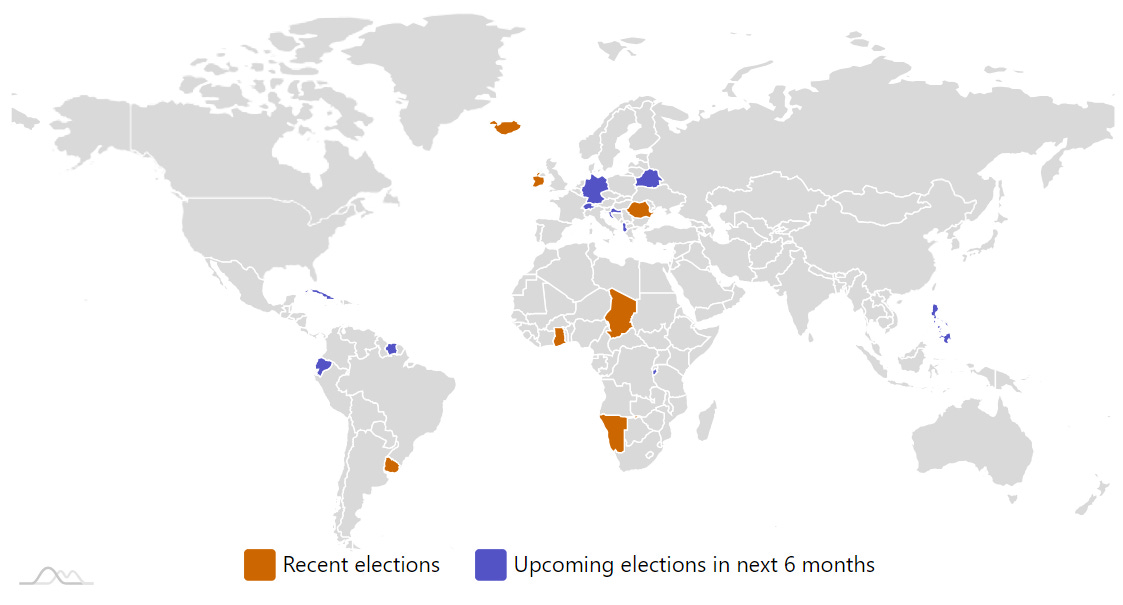

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Skyline Builders Group Holding SKBL Dominari Securities, 1.5M Shares, $4.00-4.00, $6.0 mil, 1/6/2025 Week of

Through our subsidiary, Kin Chiu Engineering, we offer construction services for roads and drainage projects in Hong Kong. (Incorporated in the Cayman Islands)

Kin Chiu Engineering, our subsidiary, is an approved public works contractor. The company works mostly as a subcontractor. However, it is qualified to serve as a main contractor.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended March 31, 2024.

(Note: Dominari Securities is the book-runner with Revere Securities acting as the co-manager. Dominari and Revere replaced the original sole book-runner, Pacific Century Securities, according to Skyline Builders Group’s SEC filings.)

Smart Logistics Global Ltd. SLGB Benjamin Securities/Prime Number Capital, 1.0M Shares, $5.00-6.00, $5.5 mil, 1/6/2025 Week of

We are a holding company whose operating subsidiary in China manages a business-to-business logistics provider, focused on the transportation of industrial raw materials. (Incorporated in the Cayman Islands)

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Smart Logistics Global Ltd. filed an F-1/A dated Dec. 6, 2024, and updated its financial statements through the period ending June 30, 2024. Background: Smart Logistics Global Ltd. filed an F-1/A dated Nov. 20, 2024, and disclosed the terms of its IPO: The company is offering 1 million shares at a price range of $5.00 to $6.00 to raise $5.5 million. Background: Smart Logistics Global Ltd. filed its F-1 for its IPO on Oct. 4, 2024, with estimated IPO proceeds of $10 million.)

Diginex Ltd. DGNX Dominari Securities/ Revere Securities, 2.3M Shares, $4.00-6.00, $11.3 mil, 1/7/2025 Tuesday

(Incorporated in the Cayman Islands)

DSL is the wholly owned subsidiary of Diginex Limited. Accordingly, Diginex Limited owns 100% of DSL and all of DSL’s business lines and subsidiaries.

DSL is an impact technology business that helps organizations to address the some of the most pressing Environmental, Social and Governance (“ESG”), climate and sustainability issues, utilizing blockchain, machine learning and data analysis technology to lead change and increase transparency in corporate social responsibility and climate action. Our products and services solutions enable companies to collect, evaluate and share sustainability data through easy-to-use software. The Group’s principal executive office is in Hong Kong where the CEO, CFO and CTO are based. The Hong Kong office is in a co-working shared space facility with 9 seats and the Hong Kong based employees operate under a hybrid model as they work both from the office and from home with the majority of working hours spent working from home. There is also an executive office in Monaco that is used by the Chairman and COO. DSL has subsidiaries in the United Kingdom and United States, however the subsidiary in the United States is inactive. DSL also outsources a component of IT development and maintenance support to engineers in Vietnam.

Our customers include Coca-Cola, HSBC, Unilever and Reckitt, whose brands include Woolite.

DSL has built several accessible, affordable and intelligent products to help democratize sustainability and offers multiple supporting services to complement the product suite.

DSL’s suite of products includes the following:

digninexESG: is an accredited Hong Kong Monetary Authority award winning cloud based ESG platform that offers end to end reporting from topic discovery, data collection to collaborative report publishing. Our diginexESG platform is ISO-27001 Certified (an international standard to manage information security), official partner of Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), World Economic Forum and signatory of the United Nations Principles of Responsible Investment (UN PRI).

The diginexESG platform guides companies through the entire ESG journey; from materiality assessment & stakeholder engagement, framework & indicator selection, the data collection and collaboration process, report creation, validation and ultimately report publishing. By leveraging machine learning and data analytics, diginexESG is able to drive material efficiencies in the reporting process, and the blockchain-enabled audit trail, whereby a record of each data activity is created and stored on a blockchain, provides greater transparency in the data thus increasing its value. Originally targeted specially at Small and Medium Sized Enterprises (SMEs) around the world who are new to ESG reporting and lack the budget or bandwidth to engage with traditional and often expensive consultants, diginexESG has increased its feature set to include functionality that also targets larger companies with more complex organizational structures. diginexESG has also been adopted by global commercial banks like HSBC to help engage with their diverse customer base at scale.

diginexLUMEN: allows companies to execute comprehensive supply chain risk assessments about working conditions within the supply chain. Supplier information is validated against worker feedback and automated risk calculations enables companies to prioritize issues for mitigation and prevention of adverse impacts and improvement efforts.

diginexLUMEN focuses on broad data collection through complex inter-jurisdictional supply chains with a specific focus on social governance issues such as forced labor due diligence, gender risk and child labor risk. Through the collection of data from suppliers and validation by workers, diginexLUMEN relies on proprietary algorithms to generate risk scores to help companies identify which parts of their supply chain require greater scrutiny. The platform then auto-generates corrective action plans which allow the brands and suppliers to work together to remedy potentially problematic areas and reduce the risk score.

diginexAPPRISE: is a multilingual application that collects standardized, actionable data related to working conditions directly from workers in global supply chains. Through tailored question sets, companies can deploy surveys directly to workers in their supply chain on a variety of topics such as responsible recruitment, gender equality and pulse check living and working conditions. The worker voice tool was initially developed by the United Nations University Institute in Macau (UNU-IIST) in partnership with The Mekong Club – an organization working with the private sector to bring about sustainable practices against modern slavery, and was acquired by DSL on December 14, 2021.

diginexAPPRISE is available both as a standalone tool and also fully integrated into diginexLUMEN.

diginexCLIMATE: is a proprietary carbon footprint calculator based on the GHG protocols that is currently available as an integrated part of the diginexESG platform. This allows companies to seamlessly calculate their Scope 1, 2 and 3 carbon footprint as part of their overall ESG reporting journey. Scope 1 are those direct emissions that are owned or controlled by a company, whereas scopes 2 and 3 indirect emissions are the result of the activities of the company but occur from sources not owned or controlled by it.

DSL also offers the following complementary services:

diginexADVISORY: is a service offered by DSL as a complement to the suite of DSL software license sales. diginexADVISORY provides clients strategy and advisory support at every stage of the sustainability journey, including assurance solutions for credible reporting. We also offer custom framework creation for clients who need more complex reporting templates or who want to set a benchmark for others in their industry. As part of diginexADVISORY we also develop and run one-off or programmatic training sessions covering a range of topics from a general introduction to ESG to complex carbon accounting and emissions.

diginexPARTNERS: is a service whereby DSL develops white label versions of both diginexESG and diginexLUMEN for companies who then want to run either diginexESG or diginexLUMEN as an extension of their own service offering. This service often requires custom technology work up front for our clients that generates initial revenue as well as ongoing service and maintenance licenses which generate ongoing recurring revenue.

In addition, DSL develops custom software platforms as part of a project consortiums for organizations like the United States Department of State, United States Department of Labor, and the United Nations.

diginexMANAGEDSERVICES: is service to be offered by DSL to provide oversight and support to clients in operationalizing the rollout of our software products within their organizational structure or supplier base. This service can include training and education, onboarding, data collection and analysis, as well as general on-going support. We will be offering this kind of vertical integration as a service from 2024 onwards and expect it to become an important part of our overall product and service offering.

As of June 2024, DSL has a current headcount of 30, among which 21 are employees in Hong Kong and United Kingdom and 9 are contractors based in France, Germany, Spain, USA, Canada, Dubai, Mexico and Australia.

Note: Net loss and revenue are for the fiscal year that ended March 31, 2024.

(Note: Diginex Ltd. filed its F-1 for its IPO on Sept. 11, 2024, and disclosed the terms – 2.25 million shares at a price range of $4.00 to $6.00 to raise $11.25 million. Background: Diginex submitted confidential IPO documents to the SEC on Feb. 12, 2024.)

FBS Global Ltd. (New Filing December 2024) FBGL WallachBeth Capital, 2.3M Shares, $4.50-5.00, $10.7 mil, 1/8/2025 Wednesday

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing on Dec. 5, 2024. Background: This filing followed the company’s withdrawal of its previous IPO plans in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO. FBS Global’s path to going public began in mid-September 2022 when the Singapore company submitted confidential IPO documents to the SEC.))

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net loss and revenue are in U.S. dollars (converted from Singapore’s currency) for the 12 months that ended June 30, 2024.

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing dated Dec. 5, 2024, in which it kept the same terms from its original IPO filing: The company plans to offer 2.25 million shares at a price range of $4.50 to $5.00 to raise $10.69 million.)

(Note: FBS Global Ltd. withdrew its IPO filing in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO.)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

ALE Group Holding Limited ALEH Dawson James Securities/D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-6.00, $6.3 mil, 1/13/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Decent Holding Inc. DXST Craft Capital/D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-4.50, $6.4 mil, 1/13/2025 Week of

We are a holding company with no material operations of our own. We conduct our operations in China through our subsidiary, Shandong Dingxin Ecology Environmental Co., Ltd., which is our PRC Operating Subsidiary (“Decent China” or “Operating Subsidiary.” (Incorporated in the Cayman Islands)

We specialize in providing industrial wastewater treatment, ecological river restoration and river ecosystem management, as well as microbial products that are used for water quality enhancement and pollutant removal, through our Operating Subsidiary, Shandong Dingxin Ecology Environmental Co., Ltd. Our main services and products include (1) wastewater treatment, (2) river water quality management, and (3) microbial products that are used for water quality enhancement and pollutant removal. For the fiscal year ended October 31, 2023, our revenue primarily comes from (1) provision of wastewater treatment service, representing approximately 25.49% of our revenue; (2) provision of river water quality management service, representing approximately 46.39% of our revenue; and (3) sale of microbial products, representing approximately 28.03% of our revenue.

We have an in–house research and development (“R&D”) team with members possessing technical expertise in engineering and chemistry as well as a sharp business sense that we believe can accurately capture and meet our customers’ needs. As of the date of this prospectus, we own 12 patents and 9 software copyrights.

We have received a number of industry awards and certifications recognizing our success and achievements, including the “Yantai City Industrial Design Center” awarded by the Yantai Municipal Bureau of Industry and Information Technology in 2022, the “Yantai New Special Expertise Enterprise” awarded by the Yantai Municipal Bureau of Industry and Information Technology in 2022, the “High-Tech Enterprise” awarded by the Shandong Provincial Department of Science and Technology, Shandong Provincial Department of Finance, and Shandong Provincial Taxation Bureau of the State Administration of Taxation in 2019 and 2022, the “Shandong Province ‘One Enterprise, One Technology’ Innovative Enterprises” awarded by the Shandong Provincial Bureau of Small and Medium Enterprises in 2015.

Management Team

Mr. Dingxin Sun is the founder, Chairman of the Board and director of the Company. He has accumulated substantial experience in entrepreneurship in the past two decades, during which he founded multiple companies in Shandong, including Yantai Dingxin Environmental Limited, Yantai Sunshine Gymnastic Limited, Yantai Tongqu Wanxiang Cultural Entertainment Limited. Mr. Sun also worked at Sinopec Yantai branch and served as the general manager of the office, where he was responsible for the retail business of more than 200 gas stations under Sinopec. While at Sinopec Yantai branch, he carried out extensive reform of the business model and compensation model of the Yantai branch and successfully boosted the revenue of gas stations.

Ms. Dingyan Sun is the director of our company. She is the sister of Mr. Dingxin Sun. Ms. Sun has 19 years of experience in accounting. Currently, she is serving as the director and cashier of Decent China, where she is responsible for handling and managing the day-to-day cash flow of the company, including tasks such as cash withdrawals, payments, deposits, and maintaining cash ledgers. Previously from December 2020 to November 2021, she served as the manager of Yantai Development Zone Xingshun Petroleum Co., Ltd. where she was responsible for the overall management of the company’s daily operations, including but not limited to gasoline and diesel fuel retailing, bulk customer delivery and financial accounting. From November 2004 to November 2020, she worked as the accountant of Yantai Development Zone Xingshun Petroleum Co., Ltd and was mainly responsible for the day-to-day operations of the gas station, including accounting documents, account statements, oil settlement, expense review and reimbursement, and other financial duties..

Haicheng Xu is our CEO. Since 2012, Mr. Xu has been working for Decent China as the general manager, responsible for all business docking, market development and sales. He is responsible for expanding the business scope and managing ongoing projects, selecting suppliers and implementing safety control. Prior to joining Decent China, Haicheng XU has held managerial positions at Yantai Huaqiao Hotel, Bohai Ferry Group Co., Ltd. and Yantai Dingxin Cargo Limited from 2000 to 2011, where he acquired industrial knowledge and substantial management experience.

Francis Zhang has been our CFO since September 2024. Mr. Zhang was the Chief Financial Officer and Director of Jiuzi Holdings Inc (Nasdaq: JZXN) from August 2020 to August 2024. Prior to joining Jiuzi Hoildings, Inc., from February 2019 to July 2020, he served as the Executive Director of Shanghai Qianzhe Consulting Co., Ltd, where he was mainly responsible for overseas M&A projects, and follow-on investments and management of newly formed financial holding groups. From June 2013 to January 2019, he served as the Deputy General Manager of Tebon Innovation Capital Co., Ltd, where he was responsible for business development and asset management. From May 2012 to May 2013, he was the Senior Manager of the Investment Department at Sanhua Holding Group, during which he was in charge of overseas M&A projects, new financial investments, and post-investment management. From May 2010 to May 2012, Mr. Zhang was the Investment & Asset Management Supervisor at China Calxon Group Co., Ltd.’s Capital Management Centre. He handled private placement of newly listed companies, took charge of other capital market financing access, and reviewed and appraised operating investment projects. From August 2006 to May 2010, he served as the Assistant Manager of the Investment Banking Department of KPMG Advisory (China) Limited, where he engaged in several auditing and financial advisory projects, which included public-listed companies and IPO projects.

Note: Net income and revenue are for the fiscal year that ended Oct. 31, 2023. (in U.S. dollars converted from China’s currency)

(Note: Decent Holding Inc. filed its F-1 on Oct. 4, 2024, and disclosed the terms for its IPO: 1.5 million shares at a price range of $4.00 to $4.50 to raise $6.38 million.)

Fitness Champs Holdings Ltd. FCHL Bancroft Capital LLC, 2.0M Shares, $4.00-5.00, $9.0 mil, 1/13/2025 Week of

(Incorporated in the Cayman Islands)

We believe we are a leading sports education provider in Singapore based on the following: (i) in 2023, we were the largest service provider of the SwimSafer Program based on the number of assessment bookings, accounting for approximately 30% of market share; and (ii) we are one of the few swim education providers in Singapore that provides both services to students under training programs funded by the Singapore Government and provision of customized private swimming training services.

We offer general swimming lessons to children and adults, with ladies-only swimming lessons available, as well as aquatic sports classes such as water polo, competitive swimming and lifesaving. We believe in imparting the correct swim stroke techniques and skills to all of our students so that they can learn to swim within the shortest time span in a variety of strokes, ranging from freestyle, breaststroke, butterfly, survival backstroke and side kick. We are one of the largest providers of swimming lessons to children enrolled in public schools under the MOE (Ministry of Education) in Singapore through the SwimSafer program. We have been offering private swimming lessons to children, youth and adults under our brand “Fitness Champs” since 2012. We aim to make swimming an enjoyable and affordable sport for children and adults, for water safety and as a way of keeping fit and healthy.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Fitness Champs Holdings Limited filed its F-1 on Sept. 9, 2024, and disclosed the terms for its IPO – 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million.)

Zhengye Biotechnology Holding Limited ZYBT Kingswood Capital Partners, 1.5M Shares, $4.00-5.00, $6.8 mil, 1/13/2025 Week of

We are a holding company incorporated in the Cayman Islands. Our underlying business is a Chinese company that makes and distributes vaccines for livestock. (Incorporated in the Cayman Islands)

We, through the operating entity, focus on the research, development, manufacturing and sales of veterinary vaccines, with an emphasis on vaccines for livestock. For nearly 20 years, the operating entity has been committed to enhancing the health of livestock. The operating entity markets a diverse range of vaccines, including vaccines for swine, cattle, goats, sheep, poultry and dogs. The operating entity’s products are available in 29 provincial regions across China and are exported overseas to Vietnam, Pakistan and Egypt.

*Note: Net income and revenue are in U.S. dollars (converted from China’s currency) for the 12 months that ended June 30, 2024.

(Note: Zhengye Biotechnology Holding says Kingswood Capital Markets has been named the new sole book-runner, replacing US Tiger Securities.)

(Note: Zhengye Biotechnology Holding Limited increased its IPO’s size to 1.5 million shares – up from 1.25 million shares initially – at a price range of $4.00 to $5.00 – to raise $6.75 million, according to an F-1/A filing dated Aug. 22, 2024. Background: Zhengye Biotechnology Holding filed its F-1 on Jan. 9, 2024, without disclosing terms for its IPO. The company submitted its confidential IPO documents to the SEC in August 2023.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF TSEP – Equity

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF EMEQ – Active, Equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF EQLT – Active, Equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF MCHS – Active, equity, small caps

-

11/07/2023 – Global X MSCI Emerging Markets Covered Call ETF EMCC – Equity, leverage

-

11/07/2023 – Avantis Emerging Markets Small Cap Equity ETF AVEE – Active, equity, small caps

-

09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

-

09/22/2023 – Matthews Pacific Tiger Active ETF ASIA – Active, equity, Asia

-

09/22/2023 – Matthews Emerging Markets Sustainable Future Active ETF EMSF – Active, equity, ESG

-

09/22/2023 – Matthews India Active ETF INDE – Active, equity, India

-

09/22/2023 – Matthews Japan Active ETF JPAN – Active, equity, Japan

-

09/22/2023 – Matthews Asia Dividend Active ETF ADVE – Active, equity, Asia

-

08/25/2023 – KraneShares Dynamic Emerging Markets Strategy ETF KEM – Active, equity, emerging markets

-

08/18/2023 – Global X India Active ETF NDIA – Active, equity, India

-

08/18/2023 – Global X Brazil Active ETF BRAZ – Active, equity, Brazil

-

07/17/2023 – Matthews Korea Active ETF MKOR – Active, equity, South Korea

-

05/18/2023 – Putnam Emerging Markets ex-China ETF PEMX – Active, value, growth stocks

-

05/11/2023 – JPMorgan BetaBuilders Emerging Markets Equity ETF BBEM – Passive, large + midcap stocks

-

03/16/2023 – JPMorgan Active China ETF JCHI – Active, equity, China

-

03/03/2023 – First Trust Bloomberg Emerging Market Democracies ETF EMDM – Principles-based

-

1/31/2023 – Strive Emerging Markets Ex-China ETF STX – Passive, equity, emerging markets

-

1/20/2023 – Putnam PanAgora ESG Emerging Markets Equity ETF PPEM – Active, equity, ESG, emerging markets

-

1/12/2023 – KraneShares China Internet and Covered Call Strategy ETF KLIP – Active, equity, China, options overlay, thematic

-

1/11/2023 – Matthews Emerging Markets ex China Active ETF MEMX – Active, equity, emerging markets

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (January 6, 2025) was also published on our website under the Newsletter category.