Emerging Market Links + The Week Ahead (January 8, 2024)

Foreign funds accelerated their China stock sell-off in December according to Morgan Stanley. China and Hong Kong stocks saw a combined net outflow of $3.8 billion from active long-only managers – the worst month in 2023 and the third-largest monthly outflow on record – with government measures to boost investor sentiment so far doing little to stem these declines.

Nevertheless, and as a tweet covered in our January 1st post mentioned, China is the world’s second largest economy and there will always be investible pockets. But they probably aren’t going to be the growth stocks of yesterday (aka the big tech names like troubled Alibaba who’s Lazada subsidiary has just announced layoffs) that many investors are still enamored or more familiar with.

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🌏 With big layoffs, Lazada is digging in (Momentum Works) & Lazada cuts staff amid speculation of upcoming IPO (The Straits Times)

Note: Lazada is now a subsidiary of Alibaba (NYSE: BABA).

This week, news emerged that Lazada is laying off people across multiple locations including Singapore, Indonesia, Thailand, Vietnam, China. People affected received notice on 2nd of January and the talks with HR are still happening as we speak.

It seems that Lazada is digging in for the long term, conserving resources, and becoming more agile.

Some thoughts:

🇨🇳 Inside the crisis at Alibaba: how China’s best-known tech group lost its way (FT) $ 🗃️

🇨🇳 East Buy drama offers lesson on the power of key influencers (Bamboo Works)

The clash between the e-commerce company’s CEO and its top livestreaming host touched off a roller coaster ride for its shares

East Buy Holding Ltd (HKG: 1797 / OTCMKTS: KLTHF) fired its longtime chief Sun Dongxu after the chairman of its parent company sided with the company’s top online influencer in a dispute

Such disputes could become less common as livestreaming e-commerce platforms move away from costly and fickle human influencers to computer-generated virtual hosts

🇨🇳 Joyy stuck with unwanted China business after $3.6 billion Baidu sale collapses (Bamboo Works)

The livestreaming company may be forced to find a new buyer for its Chinese business at a far lower price after its sale to Baidu announced in 2020 failed to get regulatory approval

JOYY Inc (NASDAQ: YY)’s $3.6 billion sale of its China livestreaming business to Baidu (NASDAQ: BIDU) has collapsed, more than three years after the deal was first announced

Joyy stopped including the China livestreaming business in its financial results as early as 2021, and was recasting itself as a Singapore-based livestreaming company

🇨🇳 Anta Sports (2020 HK): In-Line 4Q23 Operational Update + Submission Of Amer Sports Listing On NYSE (Smart Karma) $

ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) announced a set of in-line 4Q23 operating data.

In addition, the company has filed a registration statement with the U.S. SEC on January 4 for a proposed listing of Amer Sports on the New York Stock Exchange.

Anta currently trades at a forward PE of 17x based on estimated 2024 earnings, compared to a historical forward PE of 24x since 2017.

🇨🇳 Li Ning wants to be China’s answer to Nike (FT) $ 🗃️

Li Ning (HKG: 2331 / FRA: LNLB / FRA: LNL / OTCMKTS: LNNGY / LNNGF)

🇨🇳 China Tourism Group (601888 CH | BUY | CNY): New Duty-Free Contracts with Airports, Slight Negative (Smart Karma) $

China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) announced last week a new supplementary contract for its duty-free airport businesses in Beijing and Shanghai airports

The new deal aims to promote collaborations between the airports and CTG, acting like true partners. However, we think it is more positive for airports and slight detriment to CTG

Maintain our Bullish call with an unchanged target price of CNY106 (+27% UPSIDE), based on the company’s lowest recorded PE ratio in the past 10 years of 23.2x into FY24

🇨🇳 Fosun Tourism embarks on new journey with departure of big-name director (Bamboo Works)

Henri Giscard d’Estaing has left the board of Fosun Tourism (HKG: 1992), which is refocusing on China and Southeast Asia, to ‘devote additional time and attention’ to his role leading Club Med

Longtime Club Med President Henri Giscard d’Estaing has resigned from the board of the company’s parent, Fosun Tourism

Club Med’s business has rocketed post-Covid, dampening speculation that Fosun Tourism may be considering a sale of the French resort operator

🇨🇳 China’s largest bubble tea makers Mixue and Guming apply for Hong Kong IPO (Reuters)

Mixue, which has roughly 36,000 stores, is looking to raise $500 million to $1 billion in its Hong Kong IPO, while Guming, with 9,000, is aiming to raise $300 million to $500 million, according to a source with direct knowledge of the matter.

Bubble tea is one of the few bright spots on the consumer front in China, with low-price operators doing particularly well.

Shares in Hong Kong-listed Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF), the country’s only publicly traded bubble tea chain, have dropped roughly 80% since their debut in 2021, when consumer confidence was higher.

🇨🇳 MIXUE Group IPO: The Investment Case (Smart Karma) $

Mixue Group (MIX HK), a world-leading freshly made drinks company, filed for an HKEx IPO to raise US$0.5-1.0 billion.

Mixue is China’s largest and the world’s second-largest freshly made drinks company, in terms of both the number of stores and cups sold in 9M23, according to CIC.

The investment case rests on a strong brand, leading market share, high revenue growth, robust cost control, stable profitability and cash generation.

🇨🇳 With its sale to AstraZeneca, Gracell blazes exit trail for cash-challenged Chinese biotechs (Bamboo Works)

The Chinese cell therapy specialist, whose core product is still in phase 1 trials, will avoid future cash flow difficulties by selling itself to the European giant

AstraZeneca (NASDAQ: AZN) will acquire Chinese cell therapy maker Gracell Biotechnologies (NASDAQ: GRCL) for up to $1.2 billion, representing an 86% premium to the company’s pre-announcement share price

The U.S. FDA announced an investigation into a potential severe risk of T-cell malignancies associated with CAR-T therapy in November, clouding the sector’s prospects

🇨🇳 There’s Something About Air Cargo (Part II) (Smart Karma) $

Air cargo rates from Hong Kong and Shanghai have plunged in the past week, as spot demand dries up post-Christmas rush and reverts to previous (lower) contractual rates

Sea freight rates surged due to the Red Sea/Suez situation, with further increases expected. China to Europe air freight is highly competitive, potentially prompting a shift from sea freight

Chinese air carriers and Cathay Pacific (Swire Pacific Limited (HKG: 0019 / HKG: 0087 / OTCMKTS: SWRAY / OTCMKTS: SWRAF)) will record stronger than expected 2H23 performance on air freight, and we think air freight should continue to be firm in 1Q24

🇭🇰 The Middle East beckons for Hong Kong’s Regal hotel chain (Bamboo Works)

Facing an outflow of western funds, Hong Kong has been wooing Middle East investors and has enlisted Saudi Arabia as a partner in the hotel business

Regal Hotels International Holdings (HKG: 0078 / FRA: RH6B) and its sister property company Cosmopolitan International Holdings (HKG: 0120) have signed a memorandum of cooperation with Saudi Arabia to develop hotels in the Middle East

The partnership envisages an investment of up to $5 billion to build 50 hotels in the region, of which 30 would be in Saudi Arabia

🇲🇴 Fitch upgrades SJM outlook, EBITDA likely to double (Smart Karma) $

See our Macau ADRs list.

Fitch Ratings Inc forecasts SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY)’s earnings before interest, taxation, depreciation and amortisation (EBITDA) to reach HKD3.6 billion (US$461.1 million) this year, up from an estimated HKD1.7 billion in 2023.

For 2025 and 2026, the Macau casino operator’s EBITDA is expected to grow to respectively HKD5.2 billion and HKD6.6 billion, while its EBITDA leverage is expected to decline to 5.3 times in 2025 and 3.7 times in 2026, stated the ratings agency.

In a Thursday report, Fitch said it had revised the outlook on SJM Holdings’ long-term foreign-currency issuer default rating to “stable” from “negative”, and affirmed the firm’s rating at ‘BB-’.

The stable outlook “reflects the robust recovery” in the number of visitor arrivals and gaming revenue in Macau, “despite the economic downturn in China,” said the institution.

🇰🇷 Paradise Co casino sales top US$567mln in 2023 (Smart Karma) $

Paradise Co Ltd (KOSDAQ: 034230), an operator in South Korea of foreigner-only gaming venues, reported casino revenue of just above KRW744,15 billion (US$567.8 million) for full-year 2023, up 112.8 percent from the previous year, according to a Tuesday filing to the Korea Exchange.

No commentary on the reasons for revenue fluctuations is given in the company’s monthly updates.

🇰🇷 Woori Financial: Consider International Expansion And M&A (Seeking Alpha) $

Woori Financial Group (NYSE: WF) aims to grow the profit contribution from its overseas banking businesses over time with a focus on specific Southeast Asian markets like Indonesia and Cambodia.

Woori Financial could find it tough to execute on future M&A deals, due to constraints associated with deal pricing and capital adequacy.

I make no changes to my existing Hold rating for WF following an evaluation of Woori Financial’s foreign markets expansion plans and its inorganic growth prospects.

🇰🇷 Hyundai Hyms IPO Valuation Analysis (Smart Karma) $

Our base case valuation of Hyundai Hyms is implied target price of 8,025 won per share, which is 27% higher than the high end of the IPO price range.

We believe Hyundai Hyms’ valuation premium to the comps is appropriate due to much stronger operating profit growth and its strong relationships with HD Hyundai Heavy Industries.

Hyundai Hyms’s main business includes shipbuilding equipment and related services. The company manufactures a wide variety of items necessary for ship construction, such as ship unit blocks and piping manufacturing.

🇰🇷 End of Mandatory Lock-Up Periods for 41 Companies in Korea in January 2024 (Smart Karma) $

🇸🇬 🇲🇾 Return of Chinese tourists to benefit Genting group: Maybank (GGRAsia)

The Genting group’s casino operations in Asia – namely in Singapore and Malaysia – are likely to benefit in 2024 from what Maybank Investment Bank Bhd calls the “en masse return of Chinese tourists”.

Maybank’s analyst Samuel Yin Shao Yang added that the Genting group – via Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) –“may jointly bid for a Thai integrated resort (IR) licence should Thailand liberalise its IR industry”.

In a separate Saturday note on Genting Malaysia (KLSE: GENM), Maybank forecast that visitor arrivals to the firm’s Resorts World Genting – Malaysia’s sole casino resort – “ought to recover to pre-Covid-19 levels this year”.

🇸🇬 Nanofilm Technologies Announced a European Acquisition: Can its Share Price Rebound? (The Smart Investor)

It was a tough year for Nanofilm Technologies (SGX: MZH / OTCMKTS: NNFTF) in 2023.

Shares of the nanotechnology specialist have fallen by nearly a third last year led by lower demand for the group’s products amid a slump in the electronics sector.

Things could be looking up this year, though.

Nanofilm just announced the acquisition of AxynTec for €6.8 million to spearhead its European expansion.

With this acquisition, could the group’s share price see a rebound in 2024?

🇸🇬 Karooooo: Profitable Software Opportunity Based On Cartrack IoT (Seeking Alpha) $

Karooooo (NASDAQ: KARO) is a unique software provider with exposure to emerging markets, offering car tracking software and other services.

The company’s Cartrack platform has seen strong growth and high customer retention rates.

The global expansion of Karooooo presents both risks and opportunities, but the company’s financial profile and valuation are favorable.

🇸🇬 Mapletree Industrial Trust: It Isn’t Just About Rate Cuts (Seeking Alpha) $

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF)‘s unit price increased by 8.2% since the middle of December 2023, as the interest rate outlook has become more favorable.

However, the REIT’s financing cost could still increase going forward due to the expiry of fixed rate hedges and the maturing of debt.

Investors should also pay attention to the REIT’s risks pertaining to tenant health and lease expiry.

I leave my existing Hold rating for Mapletree Industrial Trust stock unchanged, after assessing the REIT’s forward distribution yield and distribution per unit growth outlook.

🇮🇳 Ola Electric IPO: The Bull Case (Smart Karma) $

Ola Electric (1700674D IN), the largest Indian electric two-wheel vehicles (E2W) player, is seeking US$660 million from a primary raise along with a secondary raise at a US$7-8 billion valuation.

Ola is the best-selling E2W brand in India in terms of monthly E2W registrations on the VAHAN Portal of the Ministry of Road Transport and Highways.

The bull case rests on rising market share in a growing market, a rapid growth phase, increasing gross margin and a favourable cash conversion cycle.

🇮🇳 Adani stocks regain half of losses from Hindenburg report fallout (FT) $ 🗃️

🇧🇩 Bangladesh Stock Picks | Quarterly Updates | OLYMPI, SQTT, BPML (Smart Karma) $

Olympic Industries Ltd (DSE: OLIS) (one largest manufacturers, distributors and marketers of fast moving consumer goods in Bangladesh) sustained and improved profitability despite the revenue drop.

Square Textiles Ltd (DSE: SQTX) faced challenges in FY23 but now seems to be turning around.

Bashundhara Paper Mills Ltd (DSE: BASH) saw a weak performance driven by lower profitability due higher interest rates on borrowings.

🇬🇷 Titan Cement: Trading At Just 7 Times Earnings (Seeking Alpha) $

Titan Cement (EBR: TITC / FRA: TCJ) has seen strong financial results in 2023, with record earnings and a substantial improvement in margins.

The company’s cash flow statement confirms that it’s generating significant cash and has a strong balance sheet.

Titan Cement has ambitious targets for 2026, including increasing revenue from divisions other than cement and reducing net debt.

🇭🇺 Wizz Air: Potential To Disrupt The Airline Industry With Market Share Growth (Rating Upgrade) (Seeking Alpha) $

Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2)’s revenue is growing impressively, driven by inflationary benefits and the expansion of its fleet.

With its load factor exceeding 90% despite this, Wizz is well-placed to maintain its current trajectory.

Management is planning a significant expansion East alongside market share in Europe, with a substantial orderbook that materially rivals its peers. Should this be delivered, growth will exceed 10%.

Wizz’s margins are fantastic, with scope for an EBITDA margin in excess of 20%. This is currently funding expansion but positions Wizz for substantial distributions in the future.

Wizz is outperforming its peers yet is trading at a ~69% discount, implying value. We believe its performance and valuation now warrant a buy rating.

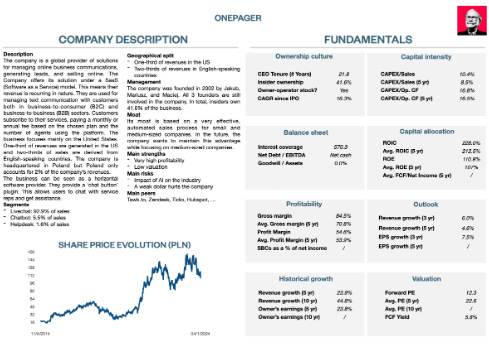

🇵🇱 Buying this Compounding Machine (Compounding Quality)

Text SA (WSE: TXT / LON: 0QTE / FRA: 886 / OTCMKTS: LCHTF)

Over the past few years, the stock has been a Compounding Machine. Since its IPO in 2014, They compounded at 25.1% per year.

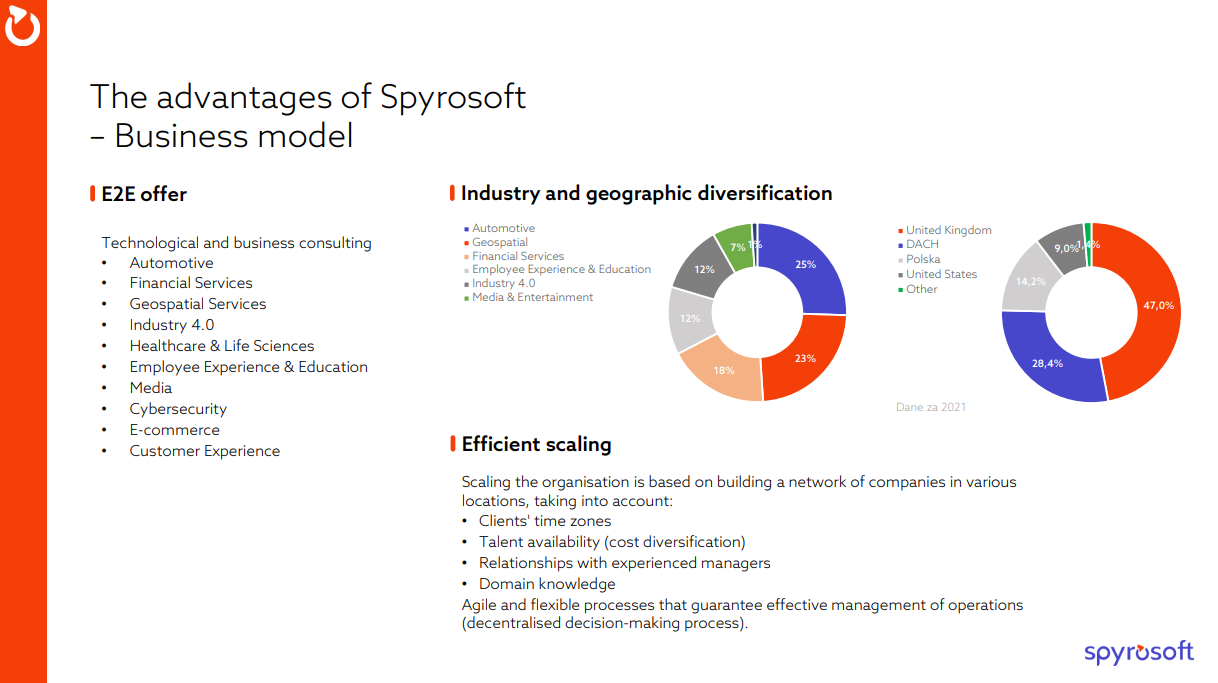

🇵🇱 Spyrosoft S.A. ($SPR.WA): Consolidating A Large Boring Industry (Fundasy Investor)

In the past four years, Spyrosoft SA (WSE: SPR / FRA: 2NP) has delivered nearly a 666% gain for shareholders. In that timeframe, the business has done exceptionally well:

Revenue has increased 1190% (98% cagr)

Shares Outstanding up 4.1% (1.1% cagr)

Book Value / Share is up 2100% (128% cagr)

EPS (Pln) is up 513% (62% cagr)

🇧🇷 Banco BBVA Argentina: Caution Warranted Ahead Of More ‘Shock Therapy’ (Seeking Alpha) $

Like the rest of the banking sector, Bbva Argentina (NYSE: BBAR) is on course for a highly volatile near-term path.

The guidance bar also seems a tad high, and the bank may need to reset expectations sooner rather than later.

There are compelling reasons to own Banco BBVA Argentina stock long term, but re-rated valuations limit the safety margin.

🇧🇷 🇰🇾 StoneCo: More Growth To Come (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) has shown strong growth in its Q3 results, with a 25% YoY increase in total revenue and a 3.3 times increase in adjusted EBT.

The company has a significant amount of cash, equal to about 38% of its market capitalization, and has been buying back shares at a faster rate than ever before.

StoneCo is experiencing rapid growth in both its financial services and software segments, with increased TPV and client base in the financial services business and strong software revenues.

In 2024, STNE should see EPS growth, improved margins, and increased market share, likely benefiting its shares for another positive year.

I calculated the stock’s upside at ~35.8%. It’s still a ‘Buy’.

🇧🇷 Magazine Luiza: Best To Avoid This Brazilian Retailer (Seeking Alpha) $

Magazine Luiza (BVMF: MGLU3 / OTCMKTS: MGLUY) or Magalu’s stock surged 93,000% (2015-2020) but faced a downturn, dropping 71%, 62%, and 20% in 2021, 2022, and 2023 in Ibovespa.

Accounting issues in Q3 2023 impacted shareholder equity, raising concerns about undisclosed irregularities.

Financially, Magalu grapples with increasing debt, equity dilution, and liquidity challenges, with a quick ratio of 0.64.

While valuations align with reality, high leverage, accounting concerns, and short-term pressures warrant a neutral recommendation.

🇨🇱 While Enel Chile Continues To Advance, It’s Hard To Cheer Its Value Proposition (Seeking Alpha) $

Enel Chile (NYSE: ENIC) plans to increase its renewable energy capacity to nearly 80% by 2026.

The company aims to expand its battery and energy storage capacity by 700 MW, with an estimated cost of $0.6 billion.

Enel Chile is advocating for regulatory and remuneration reforms in Chile’s distribution segment to support extensive electrification.

Shares do not offer a bargain at today’s levels.

🇨🇴 The Sell-Side Appears Too Negative On Ecopetrol (Seeking Alpha) $

Ecopetrol SA (NYSE: EC) is the most dominant oil producer in Colombia.

Its CAPEX plan highlights continued capital discipline.

The sell-side is too negative on EC and the company’s business model is resilient to lower oil and gas prices.

🇲🇽 Wal-Mart De MeXico: Long-Term Hold With Current Headwinds (Seeking Alpha) $

Wal-Mart de Mexico SAB de CV (BMV: WALMEX)’s Q3 performance was reasonably strong, with operational efficiencies offsetting the lack of operating leverage that we typically see in the retail industry.

Despite a promising entry into Q4, economic headwinds persist, while other trends discussed here could strengthen those headwinds.

If you’ve been a long-term holder of Walmex, consider taking some profits now before the headwinds really kick in.

Those who are underwater or near breakeven should sell the stock, but long-term investors might want to hold on to this retailer, whose growth story is still unfolding.

🇲🇽 I’m Waiting For América Móvil’s Margin Expansion (Seeking Alpha) $

America Movil SAB de CV (NYSE: AMX)‘s Q3 2023 earnings show strength in volume drivers at the expense of rate.

The company is facing headwinds with volatility in FX and macroeconomic factors impacting its performance.

While the stock price has decreased, concerns about long-term value and the need for margin expansion remain, leading to a hold rating.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Foreign funds accelerated China equity sell-off in December -Morgan Stanley (Reuters)

China and Hong Kong equities saw a combined net outflow of $3.8 billion from active long-only managers last month, the worst month in 2023 and the third-largest monthly outflow on record, Morgan Stanley’s quantitative research team said in a report released to clients on Tuesday.

In 2023, Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY), Alibaba (NYSE: BABA), Kweichow Moutai (SHA: 600519) and NetEase (NASDAQ: NTES) topped the weight additions list, while JD.com (NASDAQ: JD), YUM China (NYSE: YUMC) and AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF)) were the most sold, according to Morgan Stanley.

🇨🇳 Bargain-basement Chinese stocks still aren’t cheap enough (FT) $ 🗃️

Drastic measures to boost investor sentiment have so far done little to stem declines

Foreign investors have already started the year by selling a net $740mn worth of Chinese stocks. Bottom-fishing investors should wait until a significant stimulus package, somewhere near the scale of the one Beijing launched during the 2008 global financial crisis, is announced before venturing in.

🇨🇳 In Depth: China’s cash-strapped local governments struggle to revive land sales (Caixin) $

As China’s local governments struggle to increase their fiscal revenue, many have decided to scrap some controls on the price of land, traditionally a key contributor to their coffers, in an effort to kick-start sales that dropped 21% year-on-year by value in the first half of last year after a 23% slump in 2022.

From October to December, at least 17 of 22 major cities had abolished price ceilings on residential land sold at local government auctions, according to real estate data provider China Index Holdings Ltd. (CIH), including the second-tier cities of Chengdu, Jinan, Hefei and Xiamen.

🇨🇳 China services activity picks up, Caixin PMI shows (Caixin) $

Activity in China’s services sector grew at its fastest pace in five months in December, capping a year of consecutive expansion, according to a Caixin-sponsored survey released on Thursday.

The Caixin China General Services Business Activity Index, which provides an independent snapshot of operating conditions in industries such as retail and tourism, rose to 52.9 last month from 51.5 in November.

The Caixin China General Composite PMI, which tracks both manufacturing and services, came in at 52.6 in December, up 1 point from the previous month, indicating faster growth in total business activity.

🇿🇦 South Africa’s opposition splinters in battle against ANC (FT) $ 🗃️

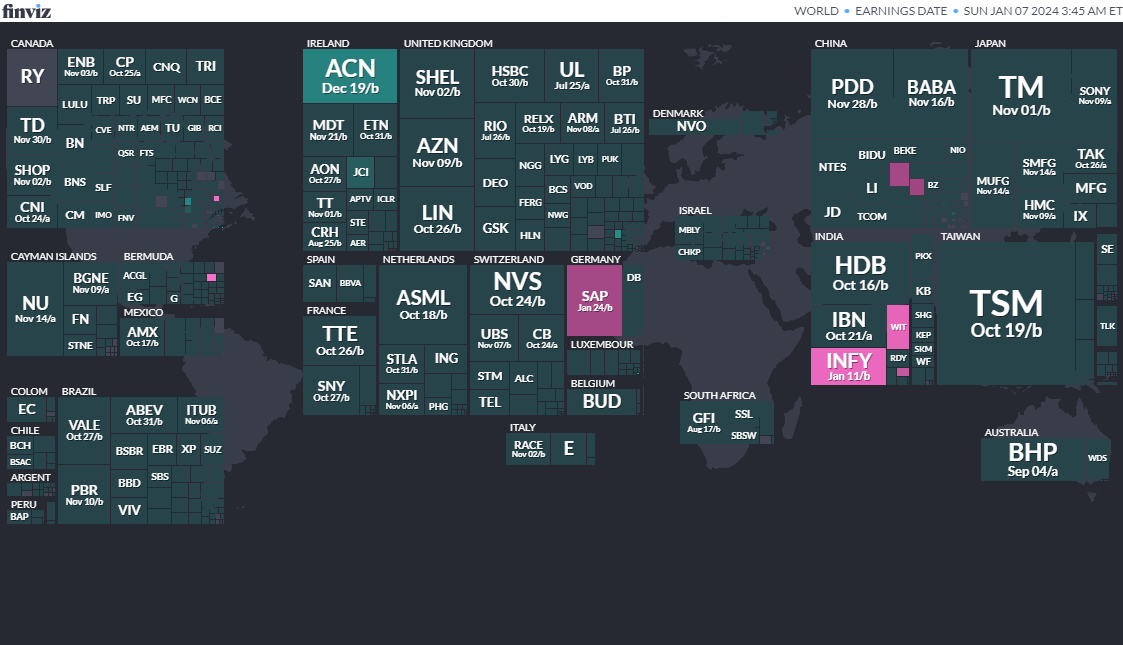

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

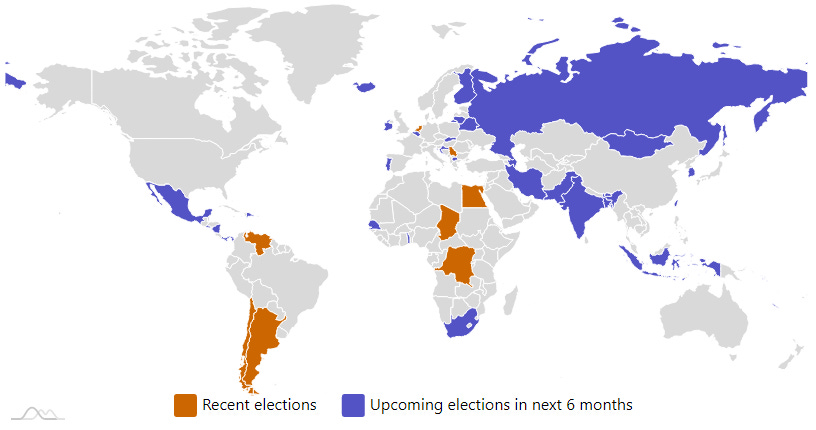

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

BangladeshBangladeshi National ParliamentJan 7, 2024 (d) Confirmed Dec 30, 2018 -

Taiwan Taiwanese Legislative Yuan Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Taiwan Taiwanese Presidency Jan 13, 2024 (d) Confirmed Jan 11, 2020

-

Pakistan Pakistani National Assembly Feb 8, 2024 (d) Confirmed Jul 25, 2018

-

Indonesia Indonesian Regional Representative Council Feb 14, 2024