Emerging Market Links + The Week Ahead (July 22, 2024)

The Wall Street Journal has done a video segment about how major American brands (Apple, Nike, Starbucks and McDonald’s) are loosing market share in China to new domestic rivals – something that’s already starting to hit their bottom lines given their dependence on the country. Not covered in the video is how Chinese brands are increasingly internationalizing and spreading into other markets like SE Asia e.g. Bubble tea and other drinks chain Mixue already has a number of outlets in Kuala Lumpur, etc.

As mentioned in the past, American and other Western brands are the subject of boycotts in Malaysia, Indonesia, and (no doubt) in other Muslim countries over their ties (or perceived ties) to Israel – something Chinese brands don’t have to worry about.

Finally and as noted in a podcast covered in yesterday’s post, many western companies have spent considerable amounts of money on share buybacks rather than investing in their businesses (like into more product R&D) – helping Chinese companies like appliance maker Haier Smart Home (HKG: 6690 / SHA: 600690 / OTCMKTS: HSHCY / OTCMKTS: HRSHF) to dominate global markets at the expense of western brands…

$ = behind a paywall

-

🇨🇳 CMBI Research China & Hong Kong Stock Picks (June 2024) Partially $

-

Is China running out of dollars?

-

United Energy Group, Xiaomi Corp, Bosideng International Holdings, Proya Cosmetics, BOE Varitronix, Q Technology (Group) Company, Prudential PLC, FIT Hon Teng, Sunny Optical, Haidilao International Holding, Kuaishou Technology, Innovent Biologics, Cafe De Coral, Zhihu Inc, ImmuneOnco Biopharmaceuticals (Shanghai), Meituan, NIO Inc, Sichuan Kelun-Biotech Biopharmaceutical, Dingdang Health Technology Group & Ke Holdings

-

20+ high conviction stock ideas: Li Auto, Geely Automobile, Zoomlion Heavy Industry, Zhejiang Dingli, JNBY, Haier Smart Home, Vesync, Kweichow Moutai, BeiGene, Shenzhen Mindray Bio-Medical Electronics, PICC Property and Casualty, Tencent, Alibaba, PDD Holdings, Amazon.com, Netflix, Kuaishou Technology, GigaCloud Technology, CR Land, FIT Hon Teng, Xiaomi, BYD Electronic International, Zhongji Innolight, NAURA Technology Group & Kingdee International Software Group

-

-

🌐 EM Fund Stock Picks & Country Commentaries (July 21, 2024) Partially $

-

Janus Henderson Corporate Debt Index, Georgia geopolitical concerns, India requires detailed explanations for key corporate resignations, CEE outlook, various fund quarterly reports & outlooks, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Why McDonald’s, Apple and Other U.S. Brands Are Losing in China (WSJ)

Major American brands like Apple, Nike, Starbucks and McDonald’s are rapidly losing market share in China to new domestic rivals. Chinese tech company Huawei, sportswear brand ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF), Luckin Coffee (OTCMKTS: LKNCY) and fast-food restaurant Tastien are eating away at these American brands’ market dominance.

WSJ’s Jonathan Cheng explores how Chinese brands are squeezing their U.S. rivals out.

Chapters:

0:00 Chinese restaurant Tastien

1:00 China’s importance to U.S. brands

2:54 Chinese nationalism

3:57 Rapid expansion

5:32 What’s next?

🇨🇳 The Naspers/Tencent & Prosus/Tencent Stub: Entry Levels so Attractive It Looks Too Good to Be True (Smartkarma) $

Discounts likely set for a re-rating as market continues to overreact to appointment of CEO amid good set of results.

The discounts of both Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY) and Prosus (JSE: PRX / AMS: PRX / OTCMKTS: PROSY / OTCMKTS: PROSF / ETR: 1TY) have continued to widen since the appointment of Fabricio Bloisi to Group CEO was announced in May (effective 10 July).

At the end of June, the group released its strongest set of results in years, delivering on consolidated ecommerce profitability ahead of target.

🇨🇳 J&T ditches low-price strategy to focus on customized deliveries (Bamboo Works)

The upstart logistics provider has moved on from its controversial pricing-based strategy, as it continues to log rapid growth

J&T Global Express Ltd (HKG: 1519)’s average daily parcel volume in China rose 36.3% in the first half of this year to 48.5 million

The company launched its Tuyouda premium service last year, offering customized features targeting businesses in specific sectors.

🇨🇳 YTO’s global expansion drives into Central Asia with KazPost (Bamboo Works)

The logistics company will partner with Kazakhstan’s postal service to develop express delivery services in the country and broader Central Asia

YTO International Express and Supply Chain Technology Limited (HKG: 6123 / OTCMKTS: YTOEF) will form a logistics joint venture in Kazakhstan with the nation’s postal authority, with authorized capital of up to $1 million

The two sides aim to develop logistics services in Kazakhstan and other Central Asian markets

🇨🇳 Zhihu (ZH US/2390 HK): Negative EV Play Launches a Share Buyback at HK$9.11/US$3.50 (Smartkarma) $

(Q&A online content community) Zhihu Inc (NYSE: ZH) has launched a conditional share buyback offer to acquire a maximum of 46.9m Class A ordinary shares (15.93% of outstanding shares) at HK$9.11 (US$3.50 per ADS).

The offer is conditional on shareholder approval by a majority of votes cast at the EGM. There is no minimum acceptance condition. The EGM vote is done due to irrevocables.

Zhihu’s share buyback returns 19% of cash not subject to government controls, below (game-centric live streaming platform) Douyu International Holdings (NASDAQ: DOYU)’s comparable 34%. The minimum pro-ration is expected to be around 34%.

🇨🇳 Slipping AsiaInfo dials up revenue contraction, losses

The telecommunications software maker said its revenue fell about 10% in the first half of the year, as it lost money for the first time since its 2018 Hong Kong listing

AsiaInfo Technologies Ltd (HKG: 1675 / FRA: 51N / OTCMKTS: ASNFF) said it expects to report its revenue fell between 7% and 13% in the first half of 2024, as it lost between 70 million yuan and 120 million yuan for the period

The company is falling victim to China’s slowing economy, combined with a wind-down in 5G spending by the country’s three main wireless carriers

🇨🇳 Sohu.com Inc (Nasdaq: SOHU): A Net-Net with $1.3B in Cash and Valuable Real Estate ($400m+) Trading at $460m Market Cap with a $150m Buyback (Altay Capital – Mostly Value Investing)

The cash is off-shore and founder owns 1/3 of outstanding shares and has bought back stock at higher prices.

This writeup was inspired by David Orr’s tweet about the U.S. listed Chinese company Douyu International Holdings (NASDAQ: DOYU) paying out a $9.76 special dividend.

Warning: For those unfamiliar with Chinese equities, cash on the balance sheet alone is meaningless. To pay dividends or conduct share buybacks, cash must be held outside China, as money cannot freely leave the country.

Inside Sohu.com Ltd (NASDAQ: SOHU) are 2 businesses. The Changyou business (gaming) is excellent and has been gushing cash for well over a decade and the Sohu business (media/video) which has been a massive money loser.

🇨🇳 Blue Moon shines on livestreaming, consumer staple status (Bamboo Works)

China’s leading laundry detergent maker said its sales rose 38% in the first half of the year, though its net loss also widened as it spent heavily on e-commerce promotions

Blue Moon Group Holdings Ltd (HKG: 6993 / OTCMKTS: BLUMY) posted strong double-digit sales gains in the first half of the year, even as many Chinese consumer brands have recorded revenue declines

The company could be well placed to weather China’s economic slowdown due to its focus on key daily-use products, helped by growth from its e-commerce initiatives

🇨🇳 China’s leading auto dealer faces delisting as stock sinks (Caixin) $

China Grand Automotive Services Group (SHA: 600297) will be delisted from the Shanghai Stock Exchange after its stock traded below 1 yuan for 20 consecutive sessions.

The company’s 2023 revenue was 138 billion yuan, with a net profit of 392 million yuan after recovering from a loss in 2022.

The ongoing price war and aggressive equity expansion impacted the stock, leading to significant operational pressures and negative market sentiment.

🇨🇳 OneConnect in forced divorce from parent Ping An (Bamboo Works)

The financial software services provider will shutter its cloud business, whose main clients were its parent and other related companies

OneConnect (NYSE: OCFT) will shutter its cloud services division, which accounted for nearly half its revenue, after losing most of its customers for the business

The development underscores a major risk for Chinese companies that rely too heavily on business from their parent and other related companies

🇨🇳 Bromate Levels in Ganten and Nongfu Spring Bottled Water Hit E.U. Limit (Caixin) $

Bromate at EU’s 3 micrograms/liter max limit was found in Ganten and Nongfu Spring bottled waters, though it’s below the 10 micrograms/liter limit of the US, Japan, and WHO.

The Consumer Council of Hong Kong detected no microplastics but found metal impurities in 90% of 30 sampled bottled waters, all within regulatory limits.

Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF)’s stock fell 4.56% on concerns over bromate levels, broader rumors, and market confidence; potential safety measures for certain groups are recommended for bottled water use.

🇨🇳 Part 2: Chinese hot pot chains – Jiumaojiu $9922.HK (Investing in China)

This article continues my series on Chinese hot pot chains, although Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU) is not a pure hot pot chain itself. You can find the first part here. Please note that the previous article had a more food-focused blog style, which received some criticism. In this article, I will concentrate on the business aspects, discussing food only when it is relevant to the investment thesis – I learned my lesson!

Jiumaojiu International Holdings Limited operates a total of 726 restaurants across various brands, showcasing the success of their expansive growth strategy. The brand breakdown includes 578 Tai Er restaurants, 62 Song Hot Pot restaurants, 68 Jiu Mao Jiu restaurants, and a smaller number of other brand restaurants such as Lai Mei Li Grilled Fish and Fresh Wood.

🇨🇳 Kweichow Moutai’s Impossible Trinity (Moatless Musings)

Is the most profitable spirits company in the world still a golden goose?

Naturally, it was only appropriate that I start with the biggest (former) publicly listed company in China’s domestic capital markets. If you followed me on Twitter for a while and cared about investing in China, you’ll have noticed my ‘infatuation’ with Kweichow Moutai (SHA: 600519). Additionally, the company’s stock price movement of late has even attracted the attention of The Economist – as the self anointed resident Baijiu expert on Substack, I feel obligated to chime in.

I first wrote about Moutai back when ‘Here is a Thread’ was popular – in which I discuss the genesis of the product and the history of Moutai, as well as the business/social dynamics upon which the baijiu (‘white liquor’) industry was built and why specifically Moutai came out in the lead. I also wrote about how Moutai has an “ex-factory price significantly below retail price” issue.

But it’s been over 3 years since that thread and many things have changed:

🇨🇳 Is 361 Degrees’ kid power losing momentum? (Bamboo Works)

The sportswear retailer’s second-quarter update shows that growth is slowing in its children’s sportswear business that has been a recent focal point

361 Degrees International Limited (HKG: 1361 / FRA: 36L / OTCMKTS: TSIOF) said its kids-branded products business rose by ‘mid-single-digits’ in its latest quarterly business update, down from earlier recent growth rates

Retail sales for the sportswear maker’s core brand grew 10% year-on-year in the three months to June

🇨🇳 Plunging prices push lithium mining giants into the red (Bamboo Works)

The industrial metal used in electric car batteries has dropped 85% from its price peak to around $90,000 per ton, hit by a supply glut and slowing vehicle sales

Chinese mining giants Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) and Ganfeng Lithium Group (SHE: 002460 / HKG: 1772 / OTCMKTS: GNENY / GNENF) are set to drop from healthy profits to deep losses in the first half of the year

Falling demand and huge oversupply leave the price of lithium carbonate with little room to rise

🇨🇳 Hanking shines on gold mine sale (Bamboo Works)

The miner’s shares rocketed after it pocketed a tidy profit on the sale of one of its Australian gold assets

China Hanking Holdings Ltd (HKG: 3788) pocketed a A$150 million profit from the sale of one of its Australian gold mines, benefiting from record-high prices of the precious metal

The gold miner will distribute one-third of its net proceeds from the sale to shareholders as a special dividend

🇨🇳 JinkoSolar finds rare bright spot in new Saudi tie-up (Bamboo Works)

The company unveiled a $1 billion joint venture with two local entities to produce cutting-edge solar panels in the Middle East

JinkoSolar Holding Co., Ltd (NYSE: JKS) is forming a $1 billion joint venture with two local partners in Saudia Arabia with annual capacity of 10 GW of solar cells and 10 GW of solar modules

The tie-up comes as Chinese solar companies expand their manufacturing globally, and as Saudi Arabia diversifies its economy beyond energy

🇨🇳 Cover Story: China’s Once-Booming Online Healthcare Sector Sees Its Vital Signs Sink (Caixin) $

China’s internet medical service market has grown to 380 billion yuan ($52.2 billion) but struggles with profitability, intensified by a slowing economy and capital market cooling.

Companies like HaoDF and Ping An Good Doctor have cut jobs significantly, and valuations of the sector have dropped amid investor caution.

Online pharmaceutical sales have grown, with JD Health (HKG: 6618 / 86618 / FRA: 8ZN / 8ZN0 / OTCMKTS: JDHIY) becoming a leading provider, but the sector faces stiff competition and demands for rapid delivery.

🇨🇳 Kintor Pharma eyes regeneration with over-the-counter cosmetic treatments (Bamboo Works)

The Suzhou-based drug developer said it will commercialize its hair-loss product despite disappointing clinical testing results, as it shifts away from cancer drugs

Kintor Pharmaceutical (HKG: 9939 / OTCMKTS: KNTPF) announced it will commercialize its KX-826 as an over-the-counter hair-loss drug, after it failed to show efficacy in clinical trials

The new product could provide the company’s first recurring revenue, though it could face difficulty competing with regulator-approved products like Rogaine

🇨🇳 China Shineway Pharmaceutical (2877.HK) – Negative Growth in 24H1 Seems Inevitable (Smartkarma) $

Three business segments of China Shineway Pharmaceutical Group (HKG: 2877 / FRA: C1S / OTCMKTS: CSWYY / CSWYF) showed negative YoY growth in 24Q1. 24Q2 performance could remain sluggish. We’re not optimistic about the 24H1 results due to the high base in 23H1.

It is expected that Shineway’s growth in 24H2 would pick up. If revenue growth of Shineway in 2024 full-year could be double-digit (e.g. 10-15% YoY), it is already good.

Shineway is undervalued. It has sufficient cash (cash balance of RMB5.9 billion by 2023) and is willing to distribute dividends (usually twice a year). Shineway is suitable for long-term holding.

🇨🇳 Noah Holdings: China’s Largest Private Wealth Management Company (Koneko Research)

Consistently Profitable, High Dividend Payout, Growth, Net-Net Valuation

Noah Holdings Limited (NYSE: NOAH / HKEX: 6686) is an investment advisor to high net worth Chinese clients. I estimate a one-year potential price return of +122% (adjusted for the 7/3 dividend of $2.12/ADS). Key financial data:

🇨🇳 Pre-IPO Bloks Group – High Growth May Not Be Sustainable (Smartkarma) $

The key for high growth in 2023/24Q1 lies in its assembly character toys with renowned IPs, which may not be sustainable or even collapse if Bloks fails to renew license agreements.

The advantages of Bloks in development prospects, self-developed IPs, brand stickiness are not obvious. The latest valuation reached RMB7.2 billion, but the founder has already cashed out before IPO.

Hong Kong stock market has been “lukewarm” to toy companies. Except Pop Mart, valuation/share price of peers are quite weak.How to gain investor/market’s recognition for Bloks is a question mark.

🇭🇰 Pacific Textiles (1382 HK) (Asian Century Stocks)

Hong Kong activist investor David Webb just bought a 5.0% position in Hong Kong-listed Pacific Textiles (HKG: 1382 / FRA: WHE / OTCMKTS: PTEXF)- US$299 million).

Pacific Textiles is the preferred supplier of knitted fabrics for Japanese fast-fashion brand Uniqlo. It also sells knitted fabrics to lingerie companies like Victoria’s Secret, Calvin Klein, Triumph, and Maidenform.

When most people think of textile businesses, they picture factory floors full of young people cutting and sewing fabrics. But that’s only the downstream part of the industry, and it tends to be labor-intensive and commoditized.

The only problem with fabric manufacturing is that it requires high utilization rates. Pacific Textiles was founded in 1997 and did well until 2015. But then, several issues emerged:

🇲🇴 Wynn 2Q Macau EBITDAR likely at US$300mln : analysts (GGRAsia)

JP Morgan Securities LLC forecasts that the Macau operations of casino operator Wynn Resorts Ltd (NASDAQ: WYNN) have produced property-level earnings before interest, taxation, depreciation, amortisation, and rent (EBITDAR) of about US$300 million in the second quarter of 2024.

That would represent a sequential decline of 11.7 percent on the US$339.6-million EBITDAR recorded in the first quarter by Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF).

🇲🇴 Melco Resorts 2Q EBITDA likely weaker on reinvestment: JPM (GGRAsia)

JP Morgan Securities LLC has lowered its estimate for property-level earnings before interest, taxation, depreciation and amortisation (EBITDA) for Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) in the second quarter of 2024.

The institution now expects Melco Resorts’ property level EBITDA to be US$313 million, down from its prior forecast oft US$336 million. Of the latest quarterly estimate of US$313 million in group-wide property level EBITDA, JP Morgan expects US$260 million to be generated by the casino firm’s Macau operations.

In the Macau market, Melco Resorts operates the casino resorts City of Dreams, Studio City and Altira, as well as the slot halls under the “Mocha Club” brand.

The company also runs a property in the Philippine capital Manila, and gaming venues on the Mediterranean island of Cyprus. The group announced in April an investment in a casino resort in Colombo, the Sri Lankan capital, with gaming operations there expected to “commence in mid-2025”.

🇲🇴 Melco Resorts: Not Willing To Roll The Dice With The Debt Stack (Seeking Alpha) $

Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) shares have declined 11% while the market has gone up 9% since initial coverage.

Since the initial write-up, the company appears to be making good (but slow) progress.

The macro situation is improving for travel and demand for resorts and gaming has led to Melco Resorts’ improving financial position, paying down debt steadily.

Recent results show growth in Macau, but I have concerns remain about high capex costs, high interest expenses, and leverage ratios.

🇹🇼 Island of riches: Taiwan reaps benefits of AI boom (FT) $ 🗃️

🇹🇼 TSMC Shatters Q2 Expectations Bolstered by Strong AI Chip Demand (Smartkarma) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM)‘s Q2 revenue hits NT$673.51 billion, exceeding expectations amid strong demand for advanced chips.

TSMC to grapple with tight supply through 2025, striving to meet soaring global demand across various sectors.

TSMC on track for 2025 mass production of 2nm chips, enhancing capabilities for more powerful and efficient technologies.

🇹🇼 3 Key Takeaways From TSMC’s Q2 2024 Beat And Raise (Seeking Alpha) $

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM)‘s Q2 beat and raise continues to solidify its path towards a $1 trillion market cap.

The robust results and upbeat outlook corroborate sustained demand for HPC hardware given ongoing AI momentum, complemented by a stronger-than-expected cyclical recovery in consumer devices.

This continues to highlight the competitive value in Taiwan Semiconductor’s technology advantage, given its sole capability in producing at the most advanced nodes and packaging processes critical to high-growth innovations like AI.

🇹🇼 Himax Technologies Is Still A Great ‘Buy’ (Seeking Alpha) $

Himax Technologies (NASDAQ: HIMX) stock showed almost 32.5% total return since my last “Buy” rating update, outperforming the S&P 500. How much growth is left? Let’s find out.

HIMX’s financial performance in Q1 exceeded expectations, with a strong balance sheet and growth prospects.

I can say that the price increase that seems to be “pricing in” a potential margin expansion may be justified.

According to my calculations, Himax stock’s growth potential could be more than 50% if current EPS projections for 2025 are close to the mark.

The forecast for the second half of 2024 is significantly better than for the first half. I’ve decided to reaffirm my “Buy” rating for the medium to long term.

🇰🇷 Korea Small Cap Gem #29: Com2Us (Douglas Research Insights)

(One of the top 10 game companies in Korea) Com2Us (KOSDAQ: 078340) / Com2uS Holdings Corp (KOSDAQ: 063080)‘s net cash (including long-term financial investments) is 151% of its market cap. It is trading at P/B ratio of only 0.45x.

The company paid out 2,600 won in DPS in FY23. If we assume the same DPS, this would suggest a dividend yield of 6.7% at current price of 38,900 won.

Com2Us is a turnaround story. It had an operating profit of 1.2 billion won in 1Q 2024, improving from an operating loss of 13.3 billion won in 1Q 2023.

🇰🇷 Kangwon Land 2Q net profit up 64pct y-o-y, to US$108mln (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured) – a resort with the only casino in South Korea open to locals – reported on Friday a second-quarter net profit of KRW149.8 billion (US$107.9 million), up 64.2 percent from a year earlier. Judged sequentially, second-quarter net profit rose by 59.5 percent from the KRW93.9 billion in the opening quarter of 2024.

Kangwon Land Inc announced in April a KRW2.5-trillion new phase for its property, which will triple the size of its casino space by 2032.

In May, the casino firm outlined to GGRAsia some of the steps it was taking to boost its appeal to foreign players, including potential upgrade of facilities and services offered to VIPs.

🇰🇷 Examining Market Interest in the Potential Samsung C&T and SDS Restructuring (Smartkarma) $

Maximizing Lee Jae-yong’s dividend income is crucial, making Samsung SDS (KRX: 018260)‘s ₩5.5T cash assets key, thus prompting the merger of Samsung C&T Corp (KRX: 028260) and Samsung SDS’s BPO division.

With no legal risks for Lee Jae-yong, Samsung C&T needs the merger to increase assets and avoid forced holding company conversion, making the acquisition of Samsung SDS’s BPO division necessary.

We should target a setup for likely appraisal rights for C&T. Monitor and capture the spread between the stock price and appraisal rights exercise price.

🇰🇷 SK Innovation’s Merger with SK E&S: Bad Timing for SK Innovation and Higher Risks from RCPS (Douglas Research Insights)

On 17 July, SK Innovation (KRX: 096770) officially announced a merger with SK E&S. The merger ratio between SK Innovation and SK E&S has been set at 1 to 1.1917417.

We believe this is the wrong timing for this merger from SK Innovation’s point of view. SK Innovation is trading at near three year lows.

This merger is likely to generate backlash from KKR which holds SK E&S redeemable convertible preferred stock (RCPS) worth 3.1 trillion won.

🇰🇷 SK Innovation and SK E&S to Discuss a Potential Merger on 17 July (Douglas Research Insights)

SK Innovation (KRX: 096770) and SK E&S plan to hold a board meeting on 17 July to discuss the potential merger between the two companies.

If this merger is successful, it would create the eighth largest company in Korea with a combined assets of 106 trillion won (US$77 billion).

Although the merger ratio is not yet available, we believe that this potential merger could potentially benefit SK E&S and SK Inc (KRX: 034730) but could be negative on SK Innovation.

🇰🇷 Sanil Electric IPO Book Building Results Analysis (Douglas Research Insights)

(specialized transformer manufacturer) Sanil Electric reported excellent IPO book building results. The IPO price has been determined at 35,000 won, which is 16.7% higher than the high end of the IPO price range.

The demand ratio from 2,205 institutional investors was 414 to 1. Sanil Electric (062040 KS) IPO will start trading on 29 July 2024.

Our base case valuation of Sanil Electric is market cap of 1.8 trillion won or target price of 58,593 won (67% higher than the IPO price of 35,000 won).

🇰🇷 POSCO: Yield Play With Long-Term Growth Potential (Rating Upgrade) (Seeking Alpha) $

My rating for Posco (NYSE: PKX) is raised to a Buy. PKX is an attractive investment candidate offering both an enticing shareholder yield and favorable growth prospects for its battery materials business.

I estimate that the stock boasts a potential mid-single digit percentage shareholder yield for 2024, after assessing its recent treasury stock cancellation announcement.

The company has set a goal of expanding its battery materials unit’s top line by a CAGR of +32% for the coming three years.

🇰🇷 I-Scream Media IPO Valuation Analysis (Douglas Research Insights)

(Digital education platform) I-Scream Media

Our valuation analysis suggests a base case implied market cap of 567 billion won or implied price per share of 41,450 won.

This suggests a 3% upside to the high end of the IPO price range. We would not subscribe to this IPO due to lack of upside.

Our base case valuation is based on P/E of 18.8x using the company’s net profit of 30.2 billion won in 2023.

🇸🇬 An Unlikely Investor (Dirtcheapstocks Substack)

Case study. A rapidly growing software business selling for 3x FCF.

Azeus Systems Holdings (SGX: BBW) had two business segments.

IT services business: This is what established Azeus long ago. It’s an “okay” business. It has gross margins in the 25-35% range. There were more years of profit than loss, but overall it wasn’t a great business.

Software: This was the engine that would propel Azeus’ success. In 2014, Azeus launched a software solution for boards of directors.

For the purpose of this write up we’ll only look at the software side of the business. The IT services business was moderately profitable, but the majority of intrinsic value was inside the software segment. This is what Nick would’ve focused on as well.

🇸🇬 4 Singapore Stocks That Have Significantly Outperformed the Straits Times Index (The Smart Investor)

These four stocks have seen their share prices surpass the bellwether Straits Times Index’s performance, but can they continue to shine?

Valuemax Group (SGX: T6I) provides pawnbroking and secured moneylending services and also retails and trades pre-owned jewellery and gold.

Yoma Strategic Holdings (SGX: Z59 / FRA: O3B / OTCMKTS: YMAIF) owns a diversified portfolio of businesses in real estate, mobile financial services, leasing, food and beverage, and investments in Myanmar.

Frencken Group Ltd (SGX: E28) is a technology solutions company serving customers in the analytical life sciences, automotive, healthcare, industrial, and semiconductor sectors.

Tianjin Pharmaceutical Da Ren Tang Group (SGX: T14) is a pharmaceutical company that manufactures and distributions medicines throughout China.

🇸🇬 Grab’s Path To Profitability Mirrors Uber’s; We See Huge Upside In This Forgotten Stock (Seeking Alpha) $

Grab Holdings Limited (NASDAQ: GRAB) went public in 2021 as the ‘Uber of Southeast Asia’ but shares have dropped over 72% since the debut.

The Company’s financials are surging, and we see a path to bottom-line profitability by late this year or early 2025.

With a reasonable-looking valuation, we see an inflection in profitability as a catalyst that could cause a re-rating in the stock to the upside.

This is similar to what happened with Uber Technologies, Inc (NYSE: UBER) after we called it out in June of last year.

We rate GRAB stock a ‘Strong Buy’.

🇮🇳 New position in KSB: Pumps & Valves a cheap company in an attractive industry (Bos Invest Substack)

KSB SE & Co (ETR: KSB / FRA: KSB / OTCMKTS: KSVRF) is a leading producer of pumps & valves. It was founded in 1871 in Germany, sells & services globally, p/e of 7.4 and has a highly valued Indian subsidiary.

Well-known companies with large listed Indian subsidiaries are:

British American Tobacco plc (NYSE: BTI): (55B GBP) with its stake (now 25.5% was 29%) in ITC Ltd (NSE: ITC / BOM: 500875) 5.65T rupiah (52.9B GBP for 100%, 13.5B GBP for 25.5%). 25% of market cap.

Unilever (NYSE: UL): (109B GBP) with its 60% stake in Hindustan Unilever Limited (HUL) (NSE: HINDUNILVR / BOM: 500696) 6.1T rupiah (57B for 100%, 34.2B GBP for 60%). 31% of market cap.

KSB has an even better proposition. The Indian subsidiary KSB Ltd (NSE: KSB / BOM: 500249) is highly valued on the Indian stock market at 172.55B rupiah (1.9B euros). KSB holds 40.54% share which is worth 770M euros. Market cap of KSB is 1.15B so stake in Indian Subsidiary good for 10% of revenue is 67% of market cap. The value of KSB Limited is 57M euros on the balance sheet.

🇦🇪 Yalla Group’s Growth Slows Amid Macroeconomic Headwinds (Downgrade) (Seeking Alpha) $

Yalla Group (NYSE: YALA) provides a social media networking platform for Middle Eastern users.

Revenue growth has slowed and is expected to slow further from forward guidance and macroeconomic headwinds.

The social media market in the MENA region is expected to reach $59 billion by 2029, but piracy and lax copyright enforcement may hinder growth.

My outlook for Yalla Group Limited is downgraded from Buy to Neutral (Hold).

🇿🇦 Telkom cuts staff, rewards management and continues with its value unlock strategy (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1)’s permanent staff had shrunk by 15% by the end of its financial year to March 31, its six prescribed officers were paid 51% more, and the group’s financial performance was still far from where it should be.

This was according to the group’s annual report released on Friday, in which chairman Mvuleni Qhena said their operational and financial performance had significantly improved over the year, but were “far from where it should be.”

🇿🇦 SA listed property stocks likely to benefit from stronger earnings growth next year (IOL)

Listed property company share prices reflect the many challenges that the sector has had to face outside of its control, but the outlook for 2025 and thereafter looks more promising, investment analyst Keillen Ndlovu said yesterday, on behalf of the SA Reit Association.

He said in an online event that the sector has in recent years been viewed less favourably by institutional and retail investors, despite a relatively strong uptick in share prices since October. For instance, the All-Share Index was currently trading around its historic highs, while listed property shares are at the same level as what they were in 2010.

He did however anticipate more institutional investment in the sector this year, with for instance, the Public Investment Corporation, which manages government employee pension fund investments, already earlier this year having increased its shareholdings in Growthpoint (JSE: GRT), Redefine Properties Ltd (JSE: RDF / BLN: R7H1), SA Corporate (JSE: SAC) and NEPI Rockcastle (JSE: NRP / AMS: NRP).

🇿🇦 Pick n Pay plunges 16% on JSE as stock adjusts for new rights offer & Pick n Pay presses reset button on SA stores as it pursues R4bn rights offer (IOL)

Pick ‘n Pay (JSE: PIK / FRA: PIK) share price dropped by 16% in mid-morning trade on the JSE yesterday before narrowing down to a 14.84% just before lunch time, with analysts saying this was in line with the stock adjusting for the new rights offer in the company.

The troubled chain grocer is seeking to raise R4 billion to settle its debt and turnaround strategy under a rights offer that the company has set to conclude at the beginning of next month.

Pick n Pay will also unbundle and separately list the budget grocery chain Boxer, into which it is also rebranding some of its struggling stores.

🇿🇦 Retail sales accelerate, boost hope for Q2 GDP growth & Big business optimistic about improvement in trade conditions – Sacci (IOL)

SHOPPING activity has remained the hope for economic growth in the second quarter of 2024 as retail sales continued to accelerate in May after mining and manufacturing production failed to grow in the same month.

Data from Statistics South Africa (Stats SA) yesterday showed that retail trade sales rose by 0.8% year-on-year in May, up from a 0.7% increase in April, mainly driven by general dealers.

Stats SA’s deputy director for distributive trade statistics, Raquel Floris, said six of the seven retail groups registered a rise in sales, and general data, which includes supermarkets, drove much of the upward momentum, rising by 1.7% year-on-year.

🇿🇦 SA small caps a bargain hunter’s paradise after Sasfin, Bell premium buyouts & R5bn buyout offer drives Bell Equipment to 45% surge on JSE (IOL)

Small cap stocks on the JSE have become a haven for bargain hunters and there are likely to be more buyout offers to minority shareholders and delistings following similar schemes by Bell Equipment Ltd (JSE: BEL / FRA: B2K / OTCMKTS: BLLQF) and Sasfin Holdings (JSE: SFN) earlier this week, which were well appreciated by the market.

Sasfin and Bell soared on the JSE on Monday after dangling buyout offers to minority shareholders at premiums of 65% and 71%, respectively.

🇵🇹 🇵🇱 🇨🇴 #39 Jerónimo Martins (Kroker Equity Research)

Unknown retail giant

When I was writing my analysis on Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) some time ago, I discovered that Poland’s largest retailer is Biedronka, which is actually owned by the Portuguese company Jeronimo Martins SGPS SA (ELI: JMT / FRA: JEM / OTCMKTS: JRONY / JRONF). Given the prevalent focus on Dino Polska, I was intrigued to delve deeper into Jerónimo Martins. I hope you find this short format both enjoyable and insightful. While there is much more to discuss about the business, my analysis aims to focus on the core aspects and the key investment thesis.

Jerónimo Martins is a major player in the food sector, primarily in distribution, with strong market positions in Poland, Portugal and Colombia. The Group employs 134,379 people and had a market capitalization of 14.5 billion euros on the Euronext Lisbon stock exchange at the end of 2023.

Jerónimo Martins operates a diverse range of key operations across various countries, each with a specific focus and strategic approach.

🇺🇦 Ukraine reconstruction – which stocks will benefit? (Undervalued Shares)

Polish equivalents to the Austrian companies mentioned above would include:

Budimex SA (WSE: BDX / FRA: FBF / OTCMKTS: BDMXF) (ISIN PLBUDMX00013, WSE:BDX), Poland’s largest construction company.

Polimex Mostostal SA (WSE: PXM / FRA: 7F7) (ISIN PLMSTSD00019, WSE:PXM), one of the largest Polish engineering and construction companies and a general contractor in the field of industrial construction.

Fabryka Farb i Lakierow Sniezka SA (WSE: SKA / FRA: 695) (ISIN PLSNZKA00033, WSE:SKA), a manufacturer of paints used in construction. The company previously generated 10% of its revenue in Ukraine.

Outside of these obvious candidates, some lateral thinking helps to find the less-obvious stocks.

Worth mentioning is TTS (Transport Trade Services) S.A. (BVB: TTS) (ISIN ROYCRRK66RD8, BX:TTS), a Romanian-listed company that provides river transport services on the Danube, and port services in Romania’s Port of Constanța on the Black Sea.

Names to keep an eye on include:

LPP SA (WSE: LPP / FRA: 1RY) (ISIN PLLPP0000011, WSE:LPP), a Polish multinational clothing company.

CCC SA (WSE: CCC / FRA: 6RK) (ISIN PLCCC0000016, WSE:CCC), one of the largest European companies in the footwear sector.

Wittchen SA (WSE: WTN) (ISIN PLWTCHN00030, WSE:WTN), a Polish company in the area of luxury purses and suitcases.

Answear.Com SA (WSE: ANR / FRA: 90Z) (ISIN PLANSWR00019, WSE:ANR), a digital sales platform for branded clothing, footwear, and accessories.

Travelling to and from Ukraine would likely increase once peace returns. Travellers could rely on the services of Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2) (ISIN JE00BN574F90, UK:WIZZ), the Hungary-based but London-listed low-cost airline specialised in the CEE region.

🇵🇱 Bowim – Solid steel distributor trading near ATL-multiples (Hidden Zlotys)

Bowim (WSE: BOW) is one of Poland’s largest players in the distribution and processing of steel products, with its own sales network in wholesale and retail and a network of nine distribution sites in Poland. The company also provides production of prefabricated reinforcement units and guides for the mining industry as well as transport services. Customers are mainly companies in steel construction (26%), trade (16%), metal (16%), and construction (16%). Almost all sales are in Poland. BOW has been listed on the Warsaw Stock Exchange’s main list since 2012. The number of employees is about 390. Approximately 70% of purchases are in EUR. The group consists of the parent company Bowim SA and the three subsidiaries Betstal (“prefabrication of reinforcement”), Passat-Stal (“steel service center”) and Bowim-Podkarpacie (75% owned, “sale of steel in the Podkarpacie region”). In 1Q2024, revenues decreased by 21% compared to the same period last year, mainly due to the continued decline in steel market prices and weak market conditions. However, net income increased from 2.5 million PLN to 3.6 million PLN, due to increased efficiency.

🇵🇱 Dekpol SA – Tuchlin transfers his shares to a family foundation (Hidden Zlotys)

During 2Q24, the company sold 121 units (105) and the number of units that will be recognized in the group’s financial results is 64 (73). As of June 30, 2024, the total number of units offered for sale by the group was 950 units (609). However, the development segment only accounts for about 13% of the group’s sales, so the above figures do not provide a complete picture of the second quarter’s performance.

Another interesting aspect is that (General contracting and property developer) Dekpol SA (WSE: DEK / LON: 0R68), along with 34 other companies, is part of the “WIG Construction” index. Despite being the tenth largest in this index, Dekpol’s stock price correlation with the index has been almost non-existent since its IPO in 2015. This could be due to a combination of Dekpol’s low free float, its broader operations that include some manufacturing, and its involvement in the “luxury segment” of many development projects.

🇧🇶 HAL Trust – Unknown Risks And Potential Tax Headaches – It Isn’t Cheap Enough To Own (Seeking Alpha) $

HAL Trust (AMS: HAL / FRA: HA4 / OTCMKTS: HALFF)‘s group structure is opaque, involves trusts and holding companies in a number of tax havens, and requires a thorough legal review.

In the very best case, Hal Trust is trading at fair value before a minority discount is added.

Assessing and understanding all the risks involved would not be a trivial exercise. HAL Trust is not cheap enough to justify the cost of this due diligence.

🇧🇲 NTB: We Know Of No Other Bank Generating ROE In Excess Of 20% And Offering 9% Dividend Yield (Seeking Alpha) $

One of The Bank of N.T. Butterfield & Son Limited (NYSE: NTB)‘s key strengths lies in its well-established trust and asset management business, which offers wealth management services to high-net-worth individuals, family offices, and institutional/corporate clients.

Over the last five years, the company has earned an average return on equity of 23% – and this return has actually increased with higher interest rates (the return on equity was 27% in 2023).

We aren’t alone in viewing NTB equity as undervalued – the folks running the bank agree and the company has been repurchasing shares.

🇱🇺🌎 Tenaris: Up And Down We Go – And Now A Buy (Seeking Alpha) $

Tenaris S.A. (NYSE: TS) is a top player in the energy servicing sector, controlling nearly half of the global OCTG market.

Italy-based with listings in Milan and NYSE, making it an attractive European investment potential.

Rig Direct program enhances customer relationships and production efficiency, adding considerable value to the company.

🇦🇷 Lithium Americas: An Unloved Market Makes Attractive Entry Point (Seeking Alpha) $

Fear has swung the lithium pendulum to the oversold side.

Financing is Lithium Americas Corp (NYSE: LAC)‘ final hurdle before construction.

Lithium Americas’ production is currently slated to start in late 2027 – early 2028.

The patient investor could be rewarded given current price levels.

🇧🇷 What’s the Deal with Braskem? BAK 0.00%↑ (Value Degen’s Substack)

FinTwit Favorite Series

Braskem (NYSE: BAK) is the American Depository Receipt of a massive Brazilian petrochemical company. It has volatility, it has cyclicality, it has deep value, it has a struggle for control, it has BRICS issues, it has communism issues, it has environmental issues, it has tribal issues, it has legal issues, if you can think of it, Braskem probably has a problem with it. But just look at that chart, it’s perfectly degenerate. You can date Braskem, but for pity’s sake, don’t marry her.

🇧🇷 Brazil’s E-commerce Boom: MercadoLibre Dominates (Giro’s Newsletter)

🇧🇷 Vale Production Report 2Q24: Positive Signs Despite Challenges (Seeking Alpha) $

Positive points were an increase in the volume of iron ore production and a possible positive outcome for environmental liabilities.

Negative points were prices lower than expected, due to lower premiums.

Despite the risks, the company trades at a valuation of just 3.6x EBITDA, extremely cheap.

🇧🇷 If The Fed Slashes Rates Too Soon, Vale Could Spike Higher (Seeking Alpha) $

A Fed rate cut in September may ignite a monster rally in industrial-related commodities like base metals.

Vale (NYSE: VALE) is the clear valuation winner in the diversified mega-cap mining group, opening up tremendous upside if iron ore, nickel, and copper climb appreciably and unexpectedly in price.

The trailing 12% dividend yield and 14% free cash flow yield proposition, from one of the world’s largest and lowest-cost metals miners, is hard to pass up.

🇧🇷 Nu Holdings Should Report Well For Q2 – ‘Buy’ Reiterated (Seeking Alpha) $

Nu Holdings (NYSE: NU) stock has outperformed the market by a factor of 2 since April 2024. I believe more will come in the medium term – read on to learn why.

NU’s strong Q1 results show growth in user base, revenue, and margins, supporting my previous bullish thesis.

MS analysts state that they expect the Q2 2024 for the entire Latin American market to be very solid in terms of top-line and earnings growth.

Despite competition and high valuation, according to my updated calculations, NU stock is undervalued by about 19% today.

NU’s high upside potential leads me to the conclusion that I should confirm my buy recommendation today.

🇲🇽 Mexican bottler magic & retail gem. All Mexican stocks P6. (Bos Invest Substack)

🇲🇽 Actinver Research – Cement Sector: Attractive Valuations Strengthened Potential Returns (Sector Update) (Smartkarma) $

The Cement Industry is an essential activity with an attractive growth perspective since cement is one of the most relevant commodities worldwide, especially for emerging economies.

Cement companies such as CEMEX (NYSE: CX) and GCC SAB de CV (BMV: GCC / FRA: AK4 / OTCMKTS: GCWOF) are well positioned to continue capturing the potential growth in their markets through differentiated products and clear targets to reduce CO2 emissions.

Although we expect 2Q24 quarterly results to be weaker, with total EBITDA +1% YoY, any weakness in results is more than priced in at current prices, in our view.

🇲🇽 America Movil: Strong LTV Growth And Encouraging 5G Growth Prospects (Seeking Alpha) $

America Movil SAB de CV (NYSE: AMX) has seen resilient revenue growth in spite of currency headwinds.

Growth in customer lifetime value has also been impressive.

I take a bullish view on America Movil.

🇲🇽 America Movil: Slow And Steady Can Still Win Some Races (Seeking Alpha) $

America Movil SAB de CV (NYSE: AMX) delivered reasonably good Q2’24 results, with inline revenue and outperformance in both service revenue and EBITDA.

Core mobile and broadband performance was fine in both Mexico and Brazil, and there was evidence of improving market conditions in Argentina, Chile, and Colombia.

Management’s Investor Day guidance for capex was reassuring, with intended spending down 10% from the prior 3-year plan despite an ongoing focus on service quality differentiation.

Mid-single-digit growth may not make America Movil the most exciting name out there, but it can support a fair value in the low/mid-$20’s.

🇲🇽 🇦🇷 Vista Energy: Production Keeps Growing, But The Stock Has Reached Fair Value (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)‘s 2Q24 results show 40% production expansion year over year and 20% quarter over quarter.

The company faces challenges with increasing transport costs due to pipeline capacity constraints and regulatory changes in Argentina.

Despite strong operational figures, I believe VIST stock is fairly valued and requires high oil prices for an attractive return.

🌐 Adventures in the nanocap bulkers universe, Part 1 (TheOldEconomy Substack)

In Part 1, I discussed crude and product tanker dynamics. In Part 2, I shared my take on two small tanker companies, Imperial Petroleum (NASDAQ: IMPP) and Top Ships (NYSEAMERICAN: TOPS). It’s time to move on to the other major shipping segment: dry bulk cargo.

So, another two chapters are coming. Today, I review bulk carriers’ market dynamics, and in the following article, I will dig into some nanocap bulk carriers companies.

I published my take on Capesize market dynamics a month ago. In my opinion, large bulkers are the best play. Nevertheless, bulkers generally have similar fundamentals. In other words, dry bulk cement is an asymmetric opportunity for shipping investors.

$ = behind a paywall / 🗃️ = Archived article

🇰🇷 Launch of Korea Value Up Index in September (Douglas Research Insights)

Korea Value-Up index is finally expected to be launched in September 2024 which is likely to include at least 100 companies in KOSPI and KOSDAQ.

There are expectations that Korea’s Value Up index could resemble JPX Prime 150 index which is a Japanese version of the value up index launched last year.

We provide 70 stocks in Korea that could be included in the Korea Value Up index. These 70 stocks could outperform the market in the next several months.

🇰🇷 Korean Stock Market Ranks #1 in Net Inflow of Foreign Funds Among Emerging Asian Countries in 2024 (Douglas Research Insights)

Korean stock market ranked #1 in net inflow of foreign funds among emerging Asian countries so far in 2024.

There has been a net inflow of US$19.4 billion into Korea this year, more than the inflow into China (US$4.9 billion), Taiwan (US$3.6 billion), and India (US$2.0 billion) combined.

Three major factors impacting higher foreign capital inflow into Korean stock market this year included Corporate Value Up program, turnaround of DRAM/semiconductor sector, and political uncertainties in China and India.

🇹🇷 Traders pour billions of dollars into Turkish lira trade (FT) $ 🗃️

🇮🇳 India shifts its strategy on tech (FT) 🗃️

🇿🇦 New Public Works and Infrastructure minister wants to make SA ‘a construction site’ (IOL)

Newly-appointed Public Works and Infrastructure Minister, Dean Macpherson, yesterday acknowledged the slow pace of infrastructure delivery in South Africa, and said a “new vision and reality” was required if the country’s infrastructure was to be rebuilt.

At the Infrastructure Africa Conference in Cape Town yesterday, his first public engagement after being sworn-in as minister two weeks ago, Macpherson said he and the department did not have “all the answers” or the funding to unlock faster infrastructure development.

🇿🇦 South Africa’s Cyril Ramaphosa vows to turn country into a ‘construction site’ (FT) 🗃️

Presence of pro-market Democratic Alliance in president’s coalition government is fuelling business optimism

Half of all South African households rely on some form of welfare, illustrating the magnitude of the crisis.

🇦🇷 Milei’s market honeymoon ends as investors question economic plan (FT) $ 🗃️

Move to prop up peso triggers nerves over government’s ability to stick to long-term strategy

But investors are concerned that controlling inflation at all costs is now distracting from the other ingredients for Argentina’s long-term recovery: the removal of currency controls, accumulation of reserves and access to international capital markets.

🌐 iShares move to close last physical frontier ETF marks end of era (FT) $ 🗃️

‘Persistent liquidity challenges’ and denuding of the index have ended a 12-year experiment

The impending closure will leave the Luxembourg-domiciled $92mn Xtrackers S&P Select Frontier Swap Ucits ETF (DX2Z) as the world’s only remaining frontier equity ETF, according to data from Morningstar Direct. This fund relies on “synthetic” swap-based replication of the underlying index, rather than directly owning frontier market stocks, as the iShares ETF does.

The demise of FM is part of a wider retreat by the ETF industry from problematic markets, with Global X axing its MSCI Nigeria ETF in March in response to Nigeria’s foreign exchange policies.

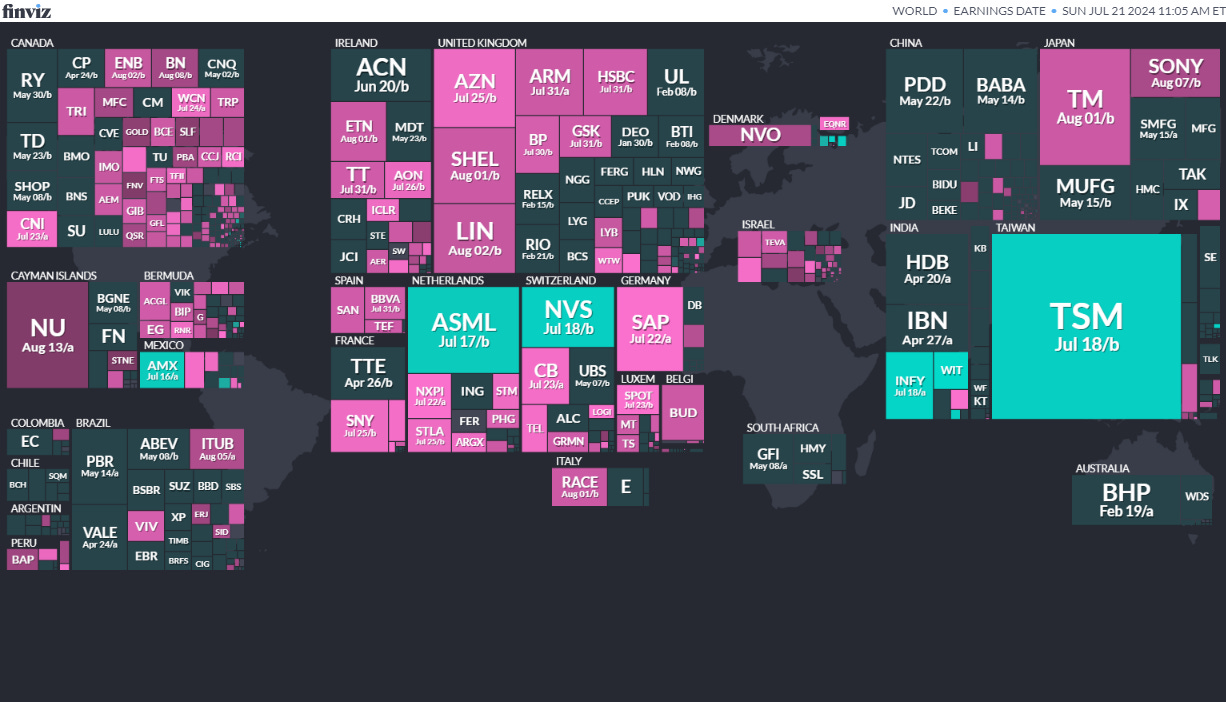

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

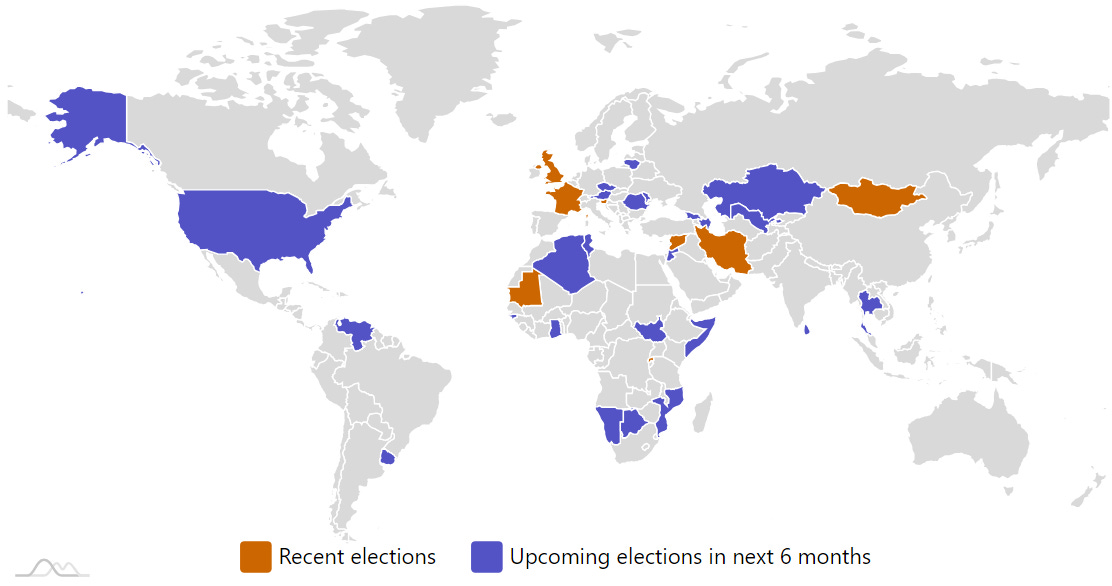

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 30, 2024