Emerging Market Links + The Week Ahead (July 29, 2024)

As mentioned last week, Korea is hoping to tackle the “Korea discount” with a proposal to lower the highest bracket inheritance taxes from 50% to 40% while several significant changes to the IPO book building and lockup results disclosure polices are set to take effect in August.

However, a controversial restructuring proposed by the Doosan conglomerate that has provoked strong opposition from minority shareholders who will see their interest in the company reduced by more than half, while Doosan’s holding company (controlled by family shareholders) will see its interest in Doosan Bobcat (KRX: 241560) triple from 14% to 42%…

$ = behind a paywall

-

Mirae Asset Securities’ Korean Stock Picks (June 2024) (Partially $)

-

Japan, Korea & Taiwan stock index + June stock research: LG Innotek, LG Energy Solution, APR Co Ltd, Samsung Electronics, Yuhan Corp, Jusung Engineering, HYBE, NAVER, Haesung DS & KCTech.

-

-

🇯🇵 🇰🇷 🇹🇼 Japan, Korea & Taiwan Stock Index (Partially $)

-

Frontier & Emerging Market Stock Index (Mid-2024)

$ = behind a paywall / 🗃️ = Archived article

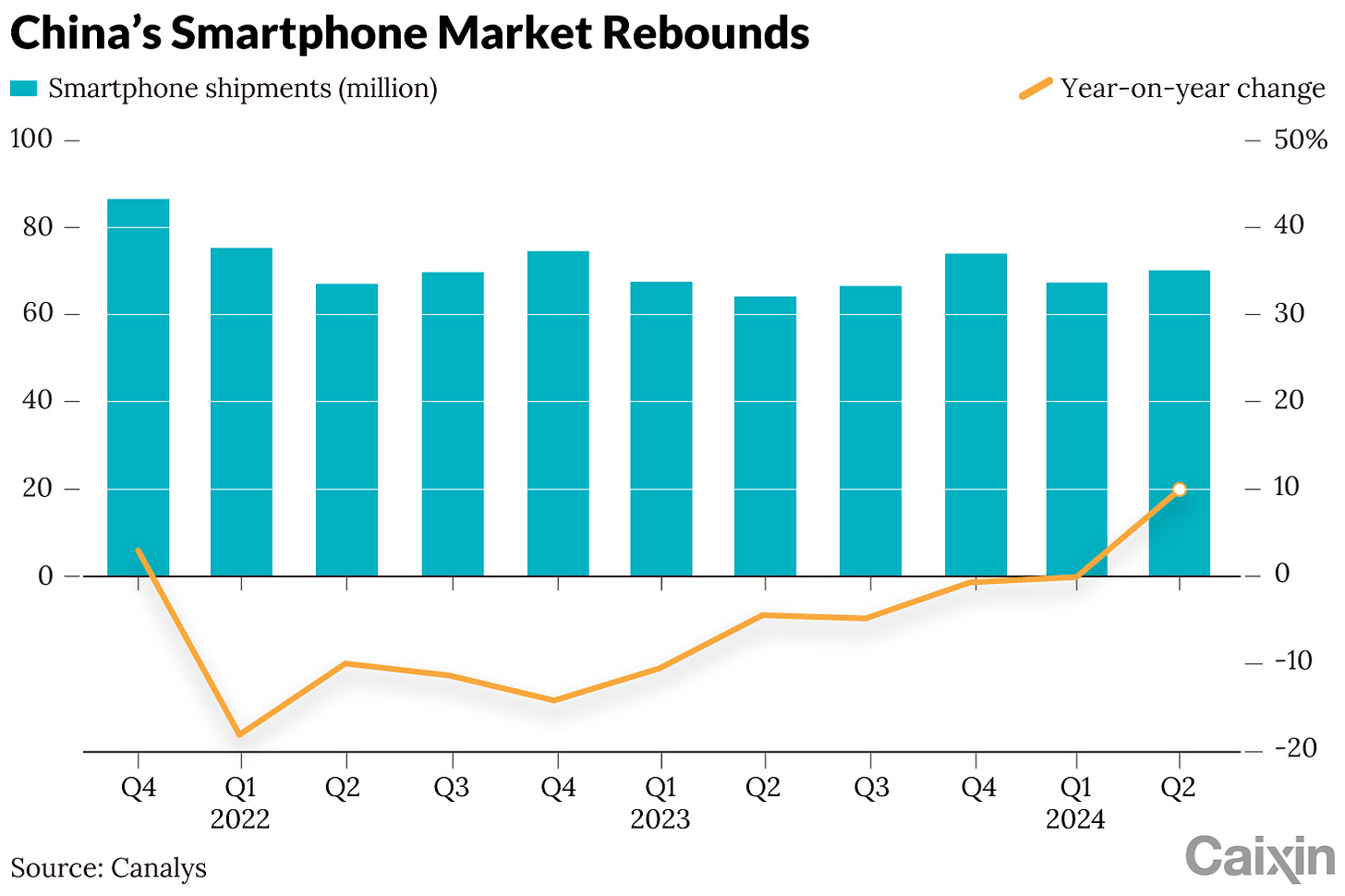

🇨🇳 Charts of the Day: China’s Smartphone Brands Take a Bite Out of Apple (Caixin) $

Chinese smartphone shipments surged in Q2, surpassing Apple, with Vivo, Oppo, and Honor leading the market.

Huawei’s shipments increased 41% to 10.6 million, achieving a 15% market share; Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) reentered the top five with a 17% increase.

The Chinese market grew 10% YoY, driven by heavy discounts and promotions, with domestic brands integrating AI features and planning overseas expansion.

🇨🇳 (Meituan (3690 HK, BUY, TP HK$160) TP Change): Resilient Catering & Eased Competition Support Growth (Smartkarma) $

We expect Meituan (SEHK: 3690)’s C2Q24 rev. and non-IFRS NI to be 0.7% and 12.3% higher than cons, driven by resilient catering demand and eased competition.

We expect Meituan in-store OPM improve to 33%/35% in 2Q24/2H24 supported by increasing commission rate and cutting BD cost.

We maintain the stock as BUY rating and raise TP by HK$4 to HK$160/share to factor in the better profitability.

🇨🇳 Pinduoduo Emerges Stronger as Rivals like Alibaba and Douyin Struggle with Low Prices (Investing in China)

PDD Holdings (NASDAQ: PDD) or Pinduoduo Dominates with Low Prices, Forcing Rivals like Alibaba (NYSE: BABA), Douyin, Tmall, and Taobao to Rethink Strategies.

Earlier this year, BABA 0.00%↑ Alibaba’s Tmall and Taobao, along with others like JD.com (NASDAQ: JD), Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) and Douyin E-commerce, adopted aggressive low-price strategies to compete with Pinduoduo. However, this approach has proven unsustainable for several reasons:

🇨🇳 In Depth: How China’s E-Commerce Titans Are Squeezing Global Rivals (Caixin) $

Chinese e-commerce platforms Shein, Temu, AliExpress, and TikTok Shop, collectively known as the “four little dragons,” are gaining global market share with competitive pricing and effective supply chains.

In 2023, these platforms accounted for over $100 billion in gross merchandise value (GMV), attributable to strategies like low-price models and consignment services.

Regulatory scrutiny in the U.S. poses challenges, with potential restrictions on operations due to concerns over trade rules, intellectual property, and market practices.

🇨🇳 Meitu looks for new growth story as China’s economy slows (Bamboo Works)

The beauty app operator expects to report its adjusted profit rose 80% or more in the first half of the year, representing a sharp slowdown from the growth rate in 2023

Meitu Inc (HKG: 1357 / FRA: M5U / LON: 0ZNC / OTCMKTS: MEIUF) said its profit rose 30% or more in the first half of this year, while its adjusted profit rose by 80%

Analysts and investors are relatively cool on the company, reflecting worries about its heavy exposure to China’s slowing economy

🇨🇳 FAST NEWS: Newborn Town’s core businesses shine (Bamboo Works)

The Latest: Social networking platform operator Newborn Town (HKG: 9911 / OTCMKTS: NWBTF) said Thursday it expects to report that revenue from its social networking business reached between 2.055 billion yuan ($283 million) and 2.085 billion yuan in the first half of 2024, up 65.3% to 67.7% from the same period of last year.

Looking Up: Revenue from the company’s innovative business is expected to increase by 46.6% to 61.8% to 192 million yuan to 212 million yuan, mainly due to the increase in revenue from casual games and traffic diversion business, as well as the results from active investment in social commerce business.

Take Note: In the second quarter of this year, the average monthly active users of its social networking business reached 28.55 million, representing a quarter-on-quarter growth of approximately 0.02%, which was significantly slower than the 2.6% increase in the first quarter.

🇨🇳 China’s Kuaishou looks to cash in on AI-powered video generation (Caixin) $

Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) has begun charging users for its AI-powered video generator Kling, with subscription fees ranging from 66 to 7,992 yuan.

Kling, launched in June, allows text-to-video generation and has seen major upgrades since; over 1 million people have applied to test it.

Competing Chinese companies are also developing similar AI technologies, spurred by the success of OpenAI’s Sora.

🇨🇳 Zhihu (2390 HK/ZH US)’s Cheeky Buyback (Smartkarma) $

Back on the 19th July, online Q&A play Zhihu Inc (NYSE: ZH) announced the buyback of 46.92mn ordinary A shares (15.9% of shares out) at HK$9.11/share (US$3.50/ADS).

Assuming the buyback is fully taken up, chairman Yuan Zhou’s stake will increase to 44.4% from 42.9% currently (held via A shares and the weighted-voting B shares).

The key condition is a simple majority vote from independent shareholders. Zhihu is sitting on net cash of US$764mn. A significantly larger buyback, or higher price, could have been initiated.

🇨🇳 In Depth: Electric Cars Are Draining the Batteries of China’s Insurers (Caixin) $

Insurers in China face profitability challenges with NEVs due to high risk and regulatory pricing constraints despite increased premiums.

NEVs are more prone to claims, expensive to repair, and heavily used in the ride-hailing industry, leading to higher insurance loss ratios.

Proposed reforms might allow insurers to set more flexible pricing, but the existing cap on the autonomous pricing coefficient still poses constraints on profitability for high-risk NEVs.

The SU7, Chinese tech giant Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF)’s debut NEV, retails for 215,900 yuan ($29,735). However, getting it insured costs around the same as a combustion-engine vehicle more than twice its price.

🇨🇳 Xiaomi revs up electric vehicle gambit (Bamboo Works)

China’s answer to Apple has won a license to self-produce its own EVs after finding initial success with its inaugural model, the SU7

Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) received regulatory clearance to mass produce electric vehicles independently, a crucial move as it seeks to ramp up its high-stakes EV drive

The smartphone maker’s big EV ambitions could be undermined by production bottlenecks, quality issues and a weakening consumer demand

🇨🇳 FAST NEWS: RemeGen scales back A-share fundraising plan (Bamboo Works)

The Latest: Novel drug maker RemeGen (HKG: 9995 / SHA: 688331 / FRA: REG / OTCMKTS: REGMF) announced Wednesday that it has reduced its fundraising target through a planned issue of new A-shares from a previous 2.55 billion yuan ($350 million) to as much as 1.95 billion yuan.

Looking Up: Net proceeds from the proposed issuance will be used for new drug development.

Take Note: The reduction of nearly 600 million yuan in RemeGen’s capital-raising target may reflect weak demand for the shares.

🇨🇳 China Mengniu: Dairy Industry Outlook And Leadership Changes Are In The Spotlight (Seeking Alpha) $

A Hold rating for China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) considers both the unfavorable dairy market prospects and the favorable changes to the company’s leadership team.

The Chinese dairy sector is expected to underperform in 2024, taking into account negative takeaways from corporate disclosures and industry data.

The appointment of a new CEO and a new chairman for China Mengniu has positive read-throughs for the company’s corporate growth strategy in the long run.

🇨🇳 Nongfu Spring lands in deep water as price war intensifies (Bamboo Works)

The bottled water giant has waded through a series of online controversies this year, most recently a disputed report about chemical residue in one of its products

Hong Kong’s consumer watchdog was forced to correct a report that had sparked concern about the safety of Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) water, admitting it had applied the wrong testing criteria

Fierce competition in China’s bottled water market has pushed prices down to levels last seen 10 years ago, squeezing producers’ profits

🇨🇳 Jiumaojiu sinks as consumers shun its pricey ‘sauerkraut fish’ (Bamboo Works)

The operator of a trendy mid-range restaurant chain is getting undermined by rising popularity of ‘poor man’s meals’ from competitors

In a stunning reversal, Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU) warned it expects its profit for the six months through June to sink nearly 70% year-on-year

Shares of the operator of a popular mid-range restaurant chain sank 11% after the profit warning and a concurrent announcement on a sales downturn

🇨🇳 WH Group serves up Smithfield spinoff to support overseas expansion (Bamboo Works)

China’s biggest meat producer said it will spin off its U.S. pork subsidiary for a separate listing in New York

WH Group Ltd (HKG: 0288 / FRA: 0WH / 0WHS / OTCMKTS: WHGLY / WHGRF) plans to list its Smithfield pork subsidiary as early as this year in a U.S. IPO that could raise $1 billion or more

Potential Chinese anti-dumping tariffs against European pork could throw a spanner into the company’s recent European expansion

🇨🇳 Chinese Auto Dealer Rebuts Claims It’s Reluctant to Save Stock From Delisting Territory (Caixin) $

China Grand Automotive Services Group (SHA: 600297)’s stock has been suspended after falling below the 1 yuan threshold, with the company explaining that most of its 11.2 billion yuan in cash is restricted.

The firm has raised 17.37 billion yuan since 2015 to support business expansion and denied claims of purchasing overpriced intangible assets.

Grand Automotive sold 713,000 vehicles and earned 138 billion yuan in revenue in 2023, reporting a net profit of 392 million yuan after a previous loss.

🇨🇳 Home Appliance Giant Midea Takes a Step Closer to Hong Kong IPO (Caixin) $

Midea (SHE: 000333) has registered for a Hong Kong IPO, planning to issue up to 650.8 million shares to fund global expansion.

The company must complete the IPO within 12 months and has not provided a timetable or pricing details.

Midea, generating 40% of revenue from overseas markets, aims to use IPO proceeds to enhance global R&D, upgrade its sales network, and increase overseas sales.

🇨🇳 FAST NEWS: Strawbear Entertainment profit surges business boom (Bamboo Works)

The Latest: TV drama producer and distributor Strawbear Entertainment Group (HKG: 2125) forecast on Tuesday it expects to report a net profit of 29 million yuan ($3.99 million) to 39 million yuan for the first half of this year, up 20 to 28 times year-on-year.

Looking Up: The profit jump came on the back of big revenue gains as the company adjusted its broadcast drama series strategy, resulting in improved popularity for its programs.

Take Note: After adding back equity-settled share award expenses, the company’s adjusted profit for the first half of the year will range between 36.7 million yuan and 46.7 million yuan, up 164% to 236% year-on-year.

🇭🇰 FAST NEWS: TVB forecasts positive interim EBITDA (Bamboo Works)

The Latest: Television Broadcasts Ltd. (HKG: 0511 / FRA: TBCN / OTCMKTS: TVBCY / TVBCF) announced Monday that based on its current business performance, it expects to achieve positive EBITDA (earnings before interest, tax, depreciation and amortization) in the first half of this year, which is a significant improvement compared with the EBITDA loss in the same period last year.

Looking Up: The company’s advertising revenue from its terrestrial free-to-air channels in Hong Kong and myTV Super platform recorded double-digit and 30% year-on-year growth in the second quarter of this year, respectively.

Take Note: The average weekday prime time TV rating points of its main free-to-air channel, TVB Jade, dropped from 17.2 in the second quarter of last year to 16.5 in the second quarter of this year.

🇭🇰 Giordano exposed by China overreliance (Bamboo Works)

The clothing retailer warned that its net profit fell by up to 47% in the first half of this year amid slumping sales in its key Greater China markets

Giordano International (HKG: 0709 / FRA: GIO / OTCMKTS: GRDZF) said it will report a net profit of HK$100 million to HK$130 million in the first half of this year, down sharpy from HK$190 million a year earlier

The clothing chain is the latest in a growing number of retailers being pressured by weak consumer spending in China

🇭🇰 Samsonite (1910 HK) - 2024 update (Asian Century Stocks) $

Broken merger arb situation turned value stock.

I first wrote about Samsonite International SA (HKG: 1910 / FRA: 1SO / OTCMKTS: SMSOF) in July 2022. It’s the world’s biggest luggage brand, with a 15% market share across its key brands: Samsonite, Tumi, and American Tourist.

Back then, the global travel recovery was still uncertain. However, as the recovery materialized, Samsonite’s revenues recovered nicely. Meanwhile, margins have hit an all-time high thanks to robust cost control.

Samsonite now trades at a headline P/E of 8.7x. Management has initiated a buyback program, stating that it considers the shares undervalued. Plans are now in place to unlock that value, with any event likely to occur before the end of 2025.

🇭🇰 DFI Retail: A Beneficiary Of Health And Convenience Trends (Rating Upgrade) (Seeking Alpha) $

I upgrade my rating for DFI Retail Group (SGX: D01 / FRA: DFA1 / OTCMKTS: DFIHY) to a Buy, taking into account its growth and valuations.

The company’s convenience and health & beauty segments are expected to benefit from growing demand for ready-to-eat offerings and health products, respectively.

The favorable growth prospects for DFI Retail aren’t completely reflected in its price and valuations as evidenced by the stock’s attractive PEG multiple of 0.55 times.

🇭🇰 HK listed Palasino upgrades Czech casinos with new slots (GGRAsia)

🇹🇼 Taiwan Dual-Listings Monitor: TSMC and ASE Premium Trading Range Blow-Outs During Recent Sell-Off (Smartkarma) $

🇰🇷 Block Deal Sale of Kumho Tire: More Shares Likely to Be Sold by Creditors (Douglas Research Insights)

Woori Bank (Woori Financial Group (NYSE: WF)) completed a block deal sale of 11 million shares of Kumho Tire Co (KRX: 073240) (3.83% of outstanding shares) on 18 July.

After the recent sales by Woori Bank and the Export-Import Bank of Korea, the creditors’ stakes in Kumho Tire has been reduced to 19.17%.

Despite Kumho Tire’s recent improvement in financial performance, we are more concerned about the additional stake sale by the financial institutions that still own 19.2% stake in the company.

🇰🇷 Doosan Robotics: 2Q 2024 Results Analysis (Douglas Research Insights)

Doosan Robotics (KRX: 454910) reported disappointing 2Q 2024 results. It generated sales of 14.4 billion won (up 10.1% YoY) and operating loss of 7.9 billion won in 2Q 2024.

After the disappointing results in 2Q 2024, it is likely that the consensus will lower their sales and profit estimates of Doosan Robotics for the next three years.

The consensus is likely to lower sales estimates by at least 15-20%+ in the next two years. In addition, the profit margin estimates are likely to be reduced materially.

🇰🇷 Seoul push to end ‘the Korean discount’ hits a snag (FT) $ 🗃️

Critics of a Doosan group restructuring argue the country needs a fiduciary duty standard for shareholders

In this case, however, critics argue the merger is being pushed through at a time when Doosan Bobcat (KRX: 241560) — which made an operating profit of more than $1bn last year — is grossly undervalued by the market and lossmaking Doosan Robotics (KRX: 454910) grossly overvalued.

“The result is that shareholders in Bobcat will see their interest in the company reduced by more than half, while Doosan’s holding company, controlled by family shareholders, will see its interest in Bobcat triple from 14 to 42 per cent,” argues Brown.

🇰🇷 FSS Orders Doosan Group to Resubmit the Merger Plan – “Merger Plan Is Not Illegal, But Is It Fair?” (Douglas Research Insights)

On 24 July, the Financial Supervisory Service (FSS) ordered the Doosan Group to resubmit the merger plan.

It is rare for FSS to reject companies’ merger reports but there has been an exception this time since this deal is egregiously negative to many minority investors.

Doosan Group needs to resubmit a revised merger plan within next three months. Otherwise, the securities report involving the merger plan of the Doosan Group companies will be considered withdrawn.

🇰🇷 Doosan Bobcat Employees Involved In Major Breach of Duty + Doosan Group Pushes Ahead With Merger (Douglas Research Insights)

On 26 July, it was reported in the local media that there has been a major breach of duty by nearly 40 current/former employees at Doosan Bobcat (KRX: 241560).

The fact that this material breach of duty was not revealed prior to the merger announcement adds to the argument that this merger/split/delisting should be either cancelled or redone.

We remain negative on all major companies involved in this deal including Doosan Bobcat and Doosan Robotics (KRX: 454910). The breach of duty at Doosan Bobcat adds to the fire.

🇰🇷 Shinsung Tongsang: Tender Offer Fails and How to Take Away Customers From Uniqlo (Douglas Research Insights)

(Knitwear & fashion stock) Shinsung Tongsang (KRX: 005390) shares rose 10% to 2,510 won today after it was announced that the tender offer failed. Basically, the tender offer failed because the tender offer price was too low.

Only 26% of the 31.664 million shares responded to the tender offer. Accordingly, the shareholding ratio of Chairman Yeom and his related parties increased from 77.98% to 83.88%.

Top Ten has benefited from executing its strategy well (such as employing Lee Na-Young in advertisements to grab customers from Uniqlo). Overall, we remain positive on Shinsung Tongsang.

🇰🇷 Archimed Group Plans to Conduct a Second Tender Offer for Jeisys Medical (Douglas Research Insights)

In the first tender offer, 42.5 million shares of Jeisys Medical (KOSDAQ: 287410) were purchased by Archimed Group. Post tender offer, Archimed now owns an 82.1% stake in Jeisys Medical.

On 24 July, it was announced that Archimed will be conducting a second tender offer for Jeisys Medical. The second tender offer will be made for 17.2% of common shares.

It could be difficult for Archimed to gain more than 95% stake at the end of the second tender offer. Rather, a third tender offer is likely in 2025.

🇰🇷 Magnachip Semiconductor: Rolling The Dice On A Speculative Turnaround (Seeking Alpha) $

The charts have leaned bearish for a long time for Magnachip Semiconductor Corp (NYSE: MX), but the last few months have been more neutral and some would even say bullish.

The headline numbers have been getting worse in recent years, but growth has returned under the hood, and they are expected to get better.

A low valuation for MX is arguably justified if MX keeps contracting, but not if MX returns to growing the top line and the bottom line thereafter.

Long MX is a bet with risks attached, and it may not necessarily pay off, but there is enough to think it will in due time.

🇰🇷 Kakao Group Founder Kim Beom-Su Gets Arrested – What’s Next? (Douglas Research Insights)

As a result of the arrest of Kim Beom-Su, the near term impact on the Kakao companies (including Kakao (KRX: 035720), Kakao Bank, Kakao Pay (KRX: 377300), and Kakao Games (KRX: 293490)) is clearly negative.

Given that this is a highly publicized event, it is likely that this legal case will be PROLONGED and finally decided by the Supreme Court which could take several years.

Some of the scenarios include Kakao Group selling partial stakes in Kakao Bank and SM Entertainment Co Ltd (KOSDAQ: 041510) but this is likely to get dragged on, resulting in further uncertainty.

🇰🇷 Hanwha Energy Acquires An Additional 5.2% of Hanwha Corp Through a Tender Offer (Douglas Research Insights)

After the market close on 24 July, Hanwha Corporation (KRX: 000880) announced that Hanwha Energy secured an additional 5.2% stake in Hanwha Corp through a tender offer.

A total of 3.9 million shares have been applied for the tender offer as of 24 July (65% of targeted amount).

We believe that the Hanwha Group is likely to grab more shares in Hanwha Corp through an additional tender offer sometime in the next 6-12 months.

🇸🇬 SATS: Watch Dividend Re-Initiation And Long-Term Targets (Rating Upgrade) (Seeking Alpha) $

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) has recently resumed dividend payments after suspending distributions for three consecutive fiscal years (FY 2021-2023).

The company has set ambitious long-term financial goals, which I think are achievable and will drive a re-rating of its valuations.

I have raised my rating for SATS to a Buy, as I am positive on the company’s dividend re-initiation and prospects for the long run.

🇸🇬 Keppel DC REIT’s 1H 2024 DPU Tumbles Nearly 10% Year on Year: Should Income Investors Be Concerned? (The Smart Investor)

The data centre REIT still sees robust fundamentals within the sector that can act as long-term tailwinds.

The next REIT to report its latest results is Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF)).

The data centre REIT faced similar headwinds to Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), which released its first quarter of fiscal 2025 results earlier last week.

Should income investors be concerned about this dip? Let’s dig deeper to find out.

Drag from Guangdong data centres

Robust portfolio metrics

Leverage still under 40%

Acquisitions and capital recycling

Get Smart: Data centres are still seeing healthy demand

🇸🇬 iFAST Corporation Hikes its 2Q 2024 Dividend by 36%: Can the Fintech Continue Raising its Dividends? (The Smart Investor)

The group released a sparkling set of earnings for the quarter which saw its assets under administration hit a new record.

The news keeps getting better for iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF).

Let’s dig deeper into the group’s latest results to find out.

An impressive set of results

Record AUA amid healthy inflows

Hong Kong ePension contribution

iFAST Global Bank seeing more traction

Get Smart: Well-positioned to deliver higher dividends

🇸🇬 Mapletree Logistics Trust Reports an 8.9% Year-on-Year Fall in DPU: Does the Industrial REIT See a Recovery Soon? (The Smart Investor)

The logistics REIT is seeing headwinds that caused its distributable income to dip.

Mapletree Logistics Trust (SGX: M44U / OTCMKTS: MAPGF), or MLT, is facing several headwinds.

Does the REIT see a recovery on the horizon?

🇸🇬 Beyond Singapore Banks and S-REITs: 2 Unlikely Dividend Gems in Singapore (The Smart Investor)

HRnetGroup and The Hour Glass offer consistent dividends and growth potential, making them compelling options for income-seeking investors.

Here are two examples which stand out.

HRNetGroup (SGX: CHZ): A recruitment leader with a strong track record

Founded in 1992, HRnetGroup has emerged as a dominant force in Asian recruitment, operating across 17 cities.

The Hour Glass (SGX: AGS): A luxury watch retailer with a strong brand

With a mission to be the watch world’s leading cultural retail enterprise, it has become a go-to destination for watch enthusiasts and collectors.

🇵🇭 Philippines-listed DigiPlus says not affected by POGO ban (GGRAsia)

🇮🇳 Cipla (CIPLA IN): Starts FY25 On Firm Note; EBITDA Margin Ahead of Guidance Range (Smartkarma) $

In Q1FY25, CIPLA Ltd (NSE: CIPLA / BOM: 500087) posted 7% YoY revenue growth to INR66.9B. Despite surging R&D expenditure, EBITDA increased 26% YoY to INR17.2B, leading to 154bps margin expansion to 25.6%.

Record high quarterly revenue in the U.S. market, double-digit revenue growth in India branded prescription business, and continued strong momentum in South Africa drove overall performance.

Cipla is well-positioned for mid-to-high single-digit revenue growth through FY27. Sitting on a robust cash balance of INR90B, Cipla is eyeing on M&A. Valuation still looks reasonable.

🇮🇳 Narrative and Numbers | Shoppers Stop (SHOP IN) | FY24 (Smartkarma) $

Shoppers Stop (NSE: SHOPERSTOP / BOM: 532638) is a leading retailer in India specializing in fashion and beauty brands with 12 department stores, 7 premium home stores, and 87 specialty beauty outlets,

SHOP has also launched its value retail format INTUNE in June 2023 generating excitement and interest around the same.

It seems SHOP is trying to play all cards of the retail game, i.e., premium, beauty, and value fast fashion, but so far has shown no signs of success.

🇮🇳 Infosys: Growth Is At The Inflection Point (Seeking Alpha) $

Infosys (NYSE: INFY) is near a growth inflection point with improving operating indicators.

Recent earnings show sequential growth and margin improvement.

INFY is expected to continue trading at a premium valuation due to strong performance and growth potential.

🇮🇳 The Beat Ideas: Garware Technical Fibre- A Niche Technical Textile Player (Smartkarma) $

Garware Technical Fibres (NSE: GARFIBRES / BOM: 509557) focuses on value-added products and has increased R&D investment significantly, with substantial growth in sports nets and geo-synthetics.

The company’s strong export market presence, high-margin profile, and diversification will improve the margins in the future.

With refocus on the domestic market and growing demand for value-added products, Garware Technical Fibres (GTFL IN) is poised for significant growth with capex coming online.

🇿🇦 Quantum Foods shareholder demands a meeting to oust the chairperson (IOL)

The tussle between two shareholders for control of poultry group Quantum Foods Holdings (JSE: QFH) heated up yesterday after one of the protagonists demanded a meeting to oust the chairperson, in what one analyst described as an “ongoing battle between legends for a company that makes no money”.

Quantum Foods Holdings said yesterday its 18% shareholder Country Bird Holdings (CBH) had demanded a shareholder meeting to discuss the proposed removal of chairperson, Wouter Hanekom.

Clark said the poultry sector had struggled for the past three months as input costs had increased again and there was an inability by producers to push through price increases to financially strapped consumers. He said this was also evidenced by the recent low share prices of Rainbow Chicken (JSE: RBO), which on Wednesday traded at only R3.51, below the R3.65 that the company had listed at on the JSE last month.

🇿🇦 Mr Price sales surge in June as GNU drives up consumer optimism (IOL)

Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY)’s sales indicate that positive consumer sentiment was created by the formation of the Government of National Unity (GNU) last month, and this also translated into higher balances at retail store tills.

The budget clothing and homeware retailer’s sales picked up sharply by 12.7% in June, the last month of its first quarter trading period, compared to the market’s growth of 10.3%, the group said in a trading statement yesterday.

🇿🇦 Anglo American, BHP and Glencore shed value on exposure to weaker commodities (IOL)

BHP Group (NYSE: BHP), Glencore (LON: GLEN / JSE: GLN / FRA: 8GC / OTCMKTS: GLNCY / OTCMKTS: GLCNF) and Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) have been trading weaker on the JSE in the past seven and 30 days, and analysts attributed this to the exposure they have to minerals and commodities whose prices are under pressure from geopolitical tensions and shifting investor focus.

Anglo American will report interim financials today against indications that it is making progress with the disposal of Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY) and reported plunging earnings in Kumba Iron Ore (JSE: KIO / OTCMKTS: KIROY / KUMBF). The dual-listed company opened yesterday’s trade session on the JSE marginally weaker before overturning the share losses into a 1.70% increase, strengthening to R526.79 per share in the afternoon.

🇿🇦 Amplats itching to lower costs, rises on JSE despite dip in interim earnings (IOL)

About R2.6 billion in half-year dividends, steady and less acrimonious progress in retrenchment of 3 700 employees from its workforce and a 5% firming up in its refined platinum group metals (PGM) production left Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY)’s (Amplats) share price stronger on the JSE yesterday.

Shares in the world’s biggest platinum producer on the JSE climbed up by 3.14% in afternoon trade to R630.15, momentarily reversing its losses 4.51%, 16.41% and 36.62% in the past seven days, 90 days, and year-to-date comparatives, respectively.

🇿🇦 Sibanye-Stillwater delays releasing results by two weeks after cyberattack (IOL)

Sibanye Stillwater Ltd (NYSE: SBSW) yesterday said it would delay by two weeks the release of its half-year financial results after a cyberattack on its IT system earlier this month caused limited disruption to its global operations.

The diversified mining company said that as a result, the publication of its operating and financial results for the period ended June 30, 2024, would be delayed, and the announcement and presentation had been rescheduled to Thursday, September 12, 2024.

🇿🇦 Impala Platinum: A PGM Producer In A Leading Producing Country (Seeking Alpha) $

Platinum and palladium underperformed gold and silver in the first half of 2024.

South Africa leads in platinum production, while South Africa and Russia are tied in palladium output.

Impala Platinum Holdings (JSE: IMP / LON: 0S2J / FRA: IPHB / OTCMKTS: IMPUY / IMPUF) is a top South African PGM producer with potential for growth.

🇿🇦 Vodacom still growing strongly into Africa’s financial and digital services sector (IOL)

Vodacom (JSE: VOD / OTCMKTS: VODAF / VDMCY) grew its revenue 1.5% to R36.2 billion in its first quarter to June 30, but revenue growth of its financial service offerings across Africa was much stronger.

Group service revenue increased 10% on a normalised basis, above a medium-term target. South Africa service revenue grew 1.8%, supported by an improved prepaid performance, the group said in a trading update yesterday.

CEO Shameel Joosub said they celebrated Vodacom’s 30th birthday in the first quarter, having signed up its first customer on June 1, 1994, when the network was switched on in South Africa.

“Three decades later, the group serves more than 200 million customers across DRC, Ethiopia, Egypt, Kenya, Lesotho, Mozambique, South Africa and Tanzania, a footprint that covers more than half a billion people and is almost 12 times greater than when we launched,” he said in a statement.

🌎 Millicom International Cellular Q2 Earnings Preview (Rating Downgrade) (Seeking Alpha) $

Millicom (NASDAQ: TIGO)‘s Q2 earnings preview includes EPS of $0.54 and revenue of $1.48 billion, with limited revisions.

DCF analysis suggests a price target of $21.80, a 12% downside from current price, leading to a rating downgrade from buy to sell.

Market has recognized Millicom’s value, but the share price may be overvalued; potential upside from acquisition or further cash flow improvement, but downside risks remain.

🌎 LATAM Airlines Stock A Buy After Relisting? (Seeking Alpha) $

LATAM Airlines Group (NYSE: LTM) shares relisted on NYSE after bankruptcy, with existing shareholders facing 99.9% dilution.

Stock price tumbled as expected, trading 99.87% lower over five years and 98.15% lower over one year.

Market cap of $8.2 billion values LATAM higher than peers, making it a speculative investing opportunity with a hold rating.

🌎 DLocal: Extremely Cheap, But Extremely Risky (Seeking Alpha) $

Dlocal (NASDAQ: DLO)‘s Q1 report showed incredibly poorly performing margins, leading the stock to lose a significant amount of its value.

The underlying payment volumes have continued growing well.

The take rate is a major risk for DLocal in addition to issues in Argentina, which investors should note especially in the short term with DLocal expecting sequential improvements.

The stock is now valued even cheaper, being significantly undervalued unless the risks persist at a higher level than I anticipate as a base scenario.

🇧🇷 Banco Santander (Brasil) Q2: Raising The Recommendation To Hold (Seeking Alpha) $

Banco Santander Brasil (NYSE: BSBR) expanded loan portfolio in profitable segments with controlled NPL.

The recent 15% drop in shares makes P/E more attractive but lacks a margin of safety compared to competitors.

The bank needs stronger results, such as an ROE reaching 20%, for a recommendation upgrade.

🇧🇷 Banco Santander (Brasil) Is Recovering And Has Become An Opportunity (Seeking Alpha) $

Banco Santander Brasil (NYSE: BSBR) reported earnings showing improvement across most fronts after a challenging 2022 and 2023.

The Post-pandemic credit cycle led to NPLs for banks, but Santander is recovering thanks to normalized rates.

2Q24 results demonstrated continued improvement in loan book, NPLs, margins, net interest income, and efficiency ratio, making valuation attractive.

🇧🇷 🇰🇾 StoneCo: Cheap Valuation Is Not Why I Am Bullish (Seeking Alpha) $

As a long-term-oriented investor with an extensive investment time horizon, I am attracted to companies with room to grow. A cheap valuation could sweeten the deal.

I have been bullish on StoneCo Ltd (NASDAQ: STNE) for quite some time and I have remained invested through ups and downs.

My bullish stance on StoneCo stems from recent shifts in Brazil’s payment landscape, the product expansion strategy of the company, and prudent strategic investments.

🇧🇷 Natura &Co: Low Margins And Unattractive Valuation (Seeking Alpha) $

(Group uniting Natura and Avon) Natura &Co Holding (BVMF: NTCO3) invested in internationalization, leading to poor financial indicators and operational difficulties.

Company’s fundamentals are weaker than competitors with low margins.

Valuation is not a bargain, with a downside of 20%, supporting the recommendation to sell shares.

🇧🇷 Gerdau: Underperforming Since My ‘Hold’ Rating (Seeking Alpha) $

Valuation remains so-so with potential for double-digit RoR, but better investment options exist due to macro risks and oversupply in the steel industry.

Gerdau SA (NYSE: GGB)‘s performance has softened, underperforming the market by over 38% since the last article a year ago.

Quarterly results show growth in EBITDA but declining earnings, leading to a cautious “HOLD” rating.

🇧🇷 Vale: High Capital Returns & Discounted Valuation (Seeking Alpha) $

The stock has been thoroughly discounted vs peers that prices in ESG issues.

Chinese steel production and iron ore demand should remain stable on exporting over capacity.

Vale (NYSE: VALE)´s 14% capital return yield and 30% discounted valuation provides solid carry protection.

On a 4x P/cash earnings multiple (vs 5.7x at peers) the YE25 price target of US$12.5 +16%.

🇧🇷 Suzano’s Price Declines Despite Imminent Contribution From New Cerrado Mill (Seeking Alpha) $

Suzano S.A. (NYSE: SUZ)‘s price has fallen possibly from the International Paper bid not going through, but in the meantime, their massive Cerrado pulp facility has become operational.

The new facility adds 25% to their already massive production and does so at lower unit production costs.

EBITDA growth will be considerable, and cash generation will improve in a return to deleveraging form for Suzano, which quarterly produces around 33% of net debt in OpCF.

They also reinstated the dividend last year as a sort of pilot, with substantial scope for dividend growth and payout as deleveraging resumes with Cerrado CAPEX now done.

Significant growth potential, bolstered by a tangible deleveraging return and dividend, comes at a very low TTM P/E of around 9x. Markets don’t seem to be factoring in the return coming on all that Cerrado CAPEX.

🇲🇽 Grupo Mexico: This Quality Copper Mining Powerhouse Is Fully Priced (Seeking Alpha) $

Grupo Mexico (BMV: GMEXICOB / FRA: 4GE / OTCMKTS: GMBXF) operates in key sectors for the green and electrified future, with solid financial management and a history of solid returns for shareholders.

The stock is currently trading at a fair value, its correlation with the copper price could drive the stock lower if the global economic forecasts worsen.

Grupo Mexico is a buy-and-hold name for the long term due to its solid and prudent financials, Tier-1 quality assets, diversified operations, and promising future.

I recommend readers willing to add this name to their portfolios to first add it to their watchlist. For investors already in this name, I recommend holding it for the longer term without adding it here.

🇲🇽 FEMSA’s Mixed Second Quarter Isn’t A Cause For Concern (Seeking Alpha) $

Fomento Economico Mexicano SAB de CV (NYSE: FMX)‘s Q2 results were mixed, with strong performance from Coca-Cola Femsa SAB de CV (NYSE: KOF) driving the upside and offsetting weaker results in other segments.

Weaker growth from Oxxo this quarter isn’t a major concern, as calendar effects (the timing of Holy Week) have a lot to do with it and margins continue to improve.

Ongoing investments in digital and drugstores may irk some investors, but long-term growth opportunities in core businesses remain promising and worthy of further investment.

FMX shares aren’t tremendously undervalued, but mid-to-high single-digit growth can still support a fair value close to $130.

🇲🇽 OMA: Near-Term Traffic Challenges, And Longer-Term Uncertainties, But Good Value And Nearshoring Leverage (Seeking Alpha) $

Grupo Aeroportuario del Centro Norte or OMA (NASDAQ: OMAB / BMV: OMA)‘s Q2’24 results beat expectations with better than expected non-aero revenue and cost control, despite challenges in the operating environment and weaker traffic.

OMA’s traffic held up well compared to its peers and per-passenger non-aero revenue continues to grow nicely, as management reaps past investments into cargo and logistics assets.

The traffic outlook for 2024 is not great, with Volaris (NYSE: VLRS) grounding jets for engine repairs and a weaker macro backdrop, but nearshoring could drive meaningful growth over the next 5 years.

There is a risk that the Mexican federal government will take a bigger cut of concession operators’ earnings in the future, but OMA looks undervalued on its core growth potential even assuming lower peak profitability.

🇲🇽 Grupo Aeroportuario Del Pacifico Navigating A Pocket Of Turbulence (Seeking Alpha) $

Grupo Aeroportuario del Pacifico (GAP (NYSE: PAC / BMV: GAPB)‘s second quarter results showcased a lot of the near-term pressures I expected to see this year, including weaker traffic, higher expenses, and weaker margins.

Despite disappointing Q2 results, Pacifico’s leverage to near-shoring and ongoing efforts to grow non-aero revenue offer positives for future growth.

While I believe the government may eventually move to further cap profitability for concession operators like Pacifico, I think they also understand the importance of healthy and profitable operators.

Valuation is looking more interesting as Pacifico navigates through this period of pressure on traffic, but it’s not quite in the clear yet.

🇲🇽 Grupo Aeroportuario Del Sureste: A Better Mix Of Risk, Growth, And Value Today (Seeking Alpha) $

Grupo Aeroportuario del Sureste (ASUR) (NYSE: ASR) posted good Q2’24 earnings; while traffic was down in Mexico, aerospace revenue still grew 24% and per-passenger non-aero revenue continues to improve.

Sureste faces less exposure to engine issues with major Mexican carriers and potential government policy changes, but macro risks to tourism are still present in the near-term.

Concession operators saw a sell-off after the Mexican elections; while there are risks that the government will worsen the terms of concessions, they remain vital parts of the economy.

High single-digit revenue growth and low double-digit FCF growth, underpinned by tourism growth, and a modest discount to long-term valuation norms support a case for a 10%-30% higher share price.

🇲🇽 Why Grupo Aeroportuario del Sureste Stock Is A Strong Buy (Seeking Alpha) $

Grupo Aeroportuario del Sureste (ASUR) (NYSE: ASR) reports lower revenues and EBITDA, but adjusted figures show stable margins and revenue growth in Mexico, San Juan, and Colombia.

Negotiated maximum tariffs in effect have driven revenues in Mexico up despite lower traffic, leading to an 18% EBITDA growth.

Stock price target for Grupo Aeroportuario del Sureste maintained at $430.64 with 39% upside, reflecting stable EBITDA estimates and improved free cash flow conversion.

🇲🇽 Volaris Hardly Flying High Despite Healthy Margins And Progress On Aircraft Groundings (Seeking Alpha) $

Good cost control allowed (Mexican low-cost airline) Volaris (NYSE: VLRS) to report better-than-expected EBITDAR in Q2’24, with EBITDAR up 23% on a 7% revenue decline driven by 17% less capacity.

Engine repair turnaround times are improving, but capacity is still likely to be down 14% in 2024, and prioritizing higher-profit routes can only offset a portion of that headwind.

A weaker Mexican economy and weaker domestic travel is a risk for 2024, but over the longer term, Volaris still has an opportunity to benefit from growing air travel in Mexico.

The market appears to be pricing in a quite pessimistic outlook; there is a lot of risk with emerging market airlines, but Volaris has proven out its low-cost model over time.

🇲🇽 Volaris: A Mispriced Airline Stock With Huge Potential (Seeking Alpha) $

Volaris (NYSE: VLRS) reported the highest EBITDAR for any second quarter, improving full year outlook.

Capacity cut due to engine issues led to a decrease in revenues, but expenses decreased, pointing to margin expansion.

Volaris is more positive on the balance of 2024, expecting improved capacity development and revenue in line with last year.

🇵🇦 Bladex: Q2 2024 Keeps The Performance Trend, The Bank Is Still A Buy (Seeking Alpha) $

Foreign Trade Bank of Latin America or Banco Latinoamericano (NYSE: BLX) reported strong 2Q24 results with continued growth in book size, income, and fees.

The bank’s efficiency ratio is below 25%, making it one of the most efficient globally.

Main risk is a global recession affecting Latin American trade patterns, but the stock remains attractive with a Buy rating.

🇵🇪 Peruvian Cement Sales Keep Falling, Cementos Pacasmayo Is Still Not An Opportunity (Seeking Alpha) $

Cementos Pacasmayo (NYSE: CPAC) is a leading cement manufacturer from Peru. The company has a quasi-monopoly in the north of the country.

Cement has been on a negative trend in Peru for three years. This has affected Pacasmayo, albeit the company enjoys a large infrastructure project.

Pacasmayo’s margins are improving thanks to material costs and new capacity added, despite the fall in volumes.

At an EV/NOPAT of 10x and a P/E of 12x, the stock does not seem attractive at these prices.

$ = behind a paywall / 🗃️ = Archived article

🌏 Asian investors return with cautious optimism (The Asset) $ 🗃️

🇨🇳 Lithium Producers Cut Production as Prices Plunge (Caixin) $

China’s lithium producers are cutting production due to a significant drop in lithium prices, with battery-grade lithium carbonate trading at 87,000 yuan per ton, down 70% from a year ago.

Nearly half of Yichun’s lithium producers are reducing operations, with many upstream mining companies shutting down as prices fell below the 90,000 yuan break-even point for some producers.

Lithium prices surged to 600,000 yuan per ton in late 2022 due to high EV demand but have since fallen due to overproduction and slowing EV demand, resulting in excess supply.

🇰🇷 South Korea Plans To Lower Inheritance Taxes (Douglas Research Insights) $

On 25 July, the South Korean government announced that it plans to lower highest bracket inheritance taxes from 50% to 40%.

This is a significant move since excessively high inheritance taxes has been one of the key reasons for poor corporate governance in Korea.

A reduction in the highest bracket inheritance taxes from 50% to 40-45% is likely sometime in 4Q24 to 2025 which should help to improve corporate governance in Korea.

🇰🇷 New Changes in the IPO Bookbuilding and Valuation Process Disclosure Policies in Korea (Douglas Research Insights) $

Starting 1 August, there will be several significant changes to the IPO book building and lockup results disclosure polices in Korea.

When conducting the comps analysis for IPOs, if there are competing companies that are excluded, then the companies need to provide more detailed reasons as to why they are excluded.

The new, stringent IPO rules are likely to bring about a greater scrutiny on the IPO valuations of newly listed companies in Korea.

🇲🇾 🇸🇬 Johor’s property market is heating up (Asian Century Stocks) $

Singapore is becoming increasingly connected to nearby Johor.

Johor is Malaysia’s southernmost state. Its new chief minister, Onn Hafiz Ghazi, recently announced plans to launch a Johor-Singapore Special Economic Zone to recreate Shenzhen’s success in China.

The plan is still sparse on details. But marrying Singapore’s capital and expertise with the low labor costs and abundance of land in Malaysia makes perfect sense.

In the near term, linkages between Singapore and Johor will also improve thanks to a new railway line from Singapore’s Woodlands MRT to Bukit Chagar in Johor. This will make it easier for Malaysians to live in Johor and commute to work in Singapore. The total travel time across the border is expected to be around 15 minutes.

Towards the end of the post, I’ll discuss some companies that will benefit from these increased linkages between Singapore and Johor.

🌍 Opinion | Africa’s frontier equity markets are booming, but currency woes dampen allure (Capital Markets Africa)

🇲🇽 Exclusive: Declining Mexican crude output could shatter energy independence dream (Reuters)

Mexico will likely need to import crude after 2030

Zama and Trion fields to lift output but others decline rapidly

Mexico could raise output through foreign firm partnerships

🇻🇪 Venezuela’s Maduro Tries to Befriend U.S. Investors in Election Makeover (WSJ) $ 🗃️

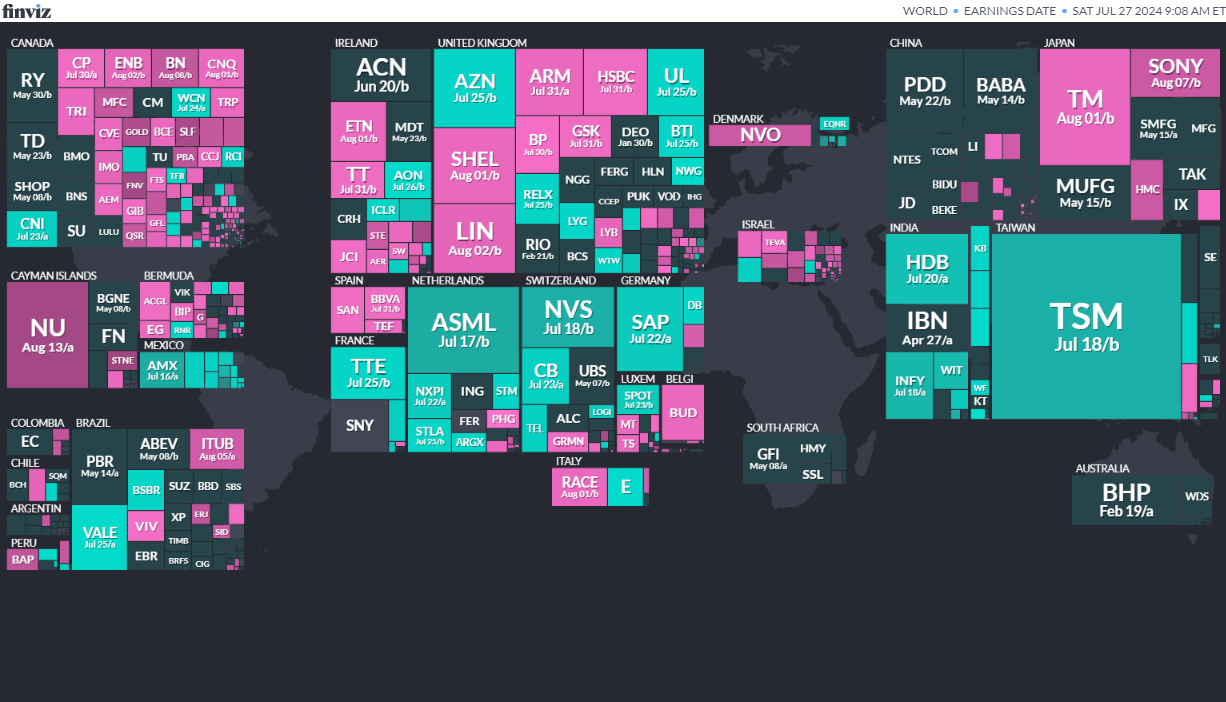

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

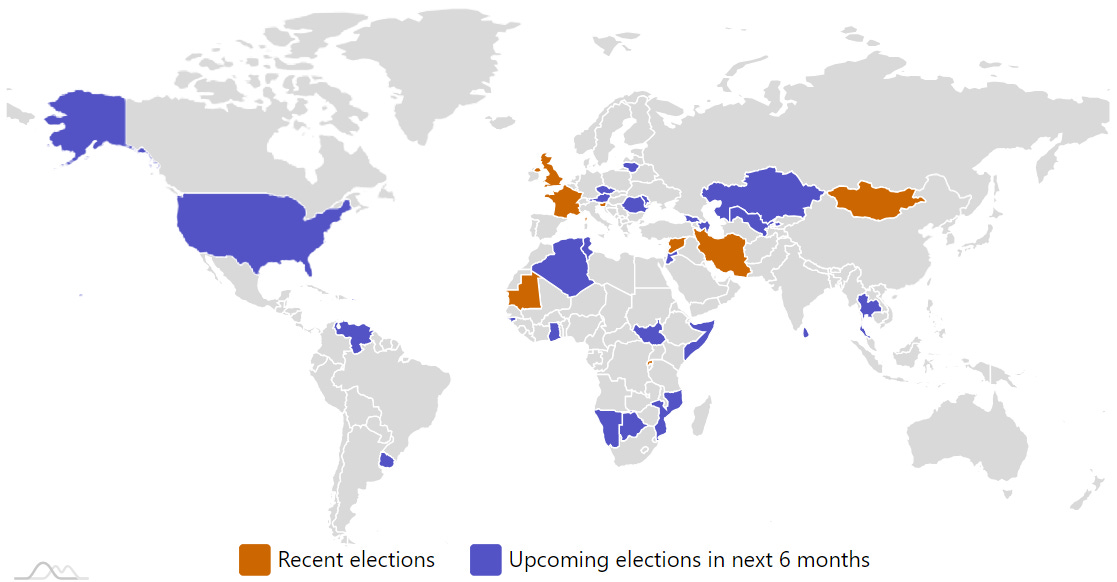

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024