Emerging Market Links + The Week Ahead (July 8, 2024)

Caixin has reported how Microsoft is shutting physical stores in China in a shift to online-only sales plus Amazon is shutting down their Chinese Kindle e-bookstore as both can no longer compete effectively with local competitors.

At the same time, Momentum Works has noted how many are sceptical about Amazon’s new discount service to compete with Temu and Shein in the USA just as Beijing bolsters their backing for overseas E-Commerce warehouses.

However, the anti-CCP Epoch Times (via ZeroHedge) has reported how Amazon no doubt intends to take on their Chinese eCommerce competitors…:

The top prosecutor in Arkansas warned on July 2 that Americans should be wary of using the Temu marketplace app because it’s effectively a “data theft business.”

“The threat from China is not new, and it is real,” Arkansas Attorney General Tim Griffin told Fox Business on July 2, a week after his office filed a lawsuit against the company. “Temu is not an online marketplace like Amazon or Walmart. It’s a data theft business that sells goods as a means to an end.”

The USA has 50 elected Attorney Generals and all it takes is one who wants some attention from cable news channels (and some campaign donations to run for another political office…) to throw monkey wrenches into the best laid US expansion plans of Temu and Shein…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Alibaba – back of the envelope valuation (Investing in China)

The primary reason I’m writing this is that I recently saw an article projecting Alibaba’s free cash flow for the next 10 years, predicting a market value of 600 billion US dollars or even a trillion US dollars. You really can’t make that up.

Alibaba (NYSE: BABA) is a well-researched and followed stock, making it challenging to have a unique analytical edge. The primary opportunities for gains lie in having a different time horizon or a different perspective.

The current situation for Alibaba is straightforward, I wrote in more details here and also here.

Let me summarize the main points:

🇨🇳 Why many are sceptical about Amazon’s new discount service (Momentum Works)

The key success factor is not Amazon.com (NASDAQ: AMZN)’s size, but its leadership, people and organisation

Last week, Amazon announced it would open a dedicated section offering low cost, unbranded items shipped directly from China. Reports from Chinese and international media see this as a major attempt by Amazon to counter the growth of Chinese rivals especially Temu and SHEIN.

Under the scheme, sellers will send the goods (typically below US$20 in value) directly to Amazon’s warehouses in China, and Amazon will handle the cross border shipping and last mile fulfilment. Amazon expects that the end-to-end fulfilment cost will be almost half of the current FBA model.

Unlike Temu’s full consignment model, sellers for Amazon’s low price service will be able to set their own prices, with Amazon providing guidelines on the upper limits.

According to media reports, the low price service will be activated as soon as this autumn, in markets including but not limited to the US. Details are to be finalised.

🇨🇳 Is shunned Shein the future for blockbuster China IPOs? (Bamboo Works)

The fast fashion sensation’s plan for a London listing may be coming unglued, after it abandoned a New York IPO plan for similar politically motivated reasons

Shein may end up listing in Hong Kong, after its New York IPO plan collapsed and its latest London plan faces similar geopolitical pressures

The case shows how blockbuster IPOs by Chinese firms are becoming more difficult in New York, though some major listings may still succeed

🇨🇳 Analysis: Why Kindle Couldn’t Keep the China Fire Burning (Caixin) $

Amazon.com Inc (NASDAQ: AMZN) shut down the Kindle e-bookstore in China, concluding its exit by ceasing downloads and customer service for Kindle users.

Originally popular, Kindle’s market share declined due to competition from domestic apps and a shift towards smartphone reading.

The trend reflects broader U.S. tech companies’ retreat from China, including Microsoft’s retail closures (Microsoft Shuts Physical Stores in China in Shift to Online-Only Sales) and LinkedIn and Airbnb ceasing operations.

🇨🇳 Game operator ZX sees creative future in AI (Bamboo Works)

The owner of the Tan Wan platform has invested HK$100 million to set up a subsidiary to apply artificial intelligence to the gaming industry

ZX Inc (HKG: 9890) revenue fell 26% to 6.51 billion yuan last year

The share price has been on a roller coaster ride since the company’s Hong Kong IPO last year

🇨🇳 BYD’s Uzbekistan Plant Begins Mass Production of Plug-In Hybrids (Caixin) $

BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) has started producing plug-in hybrids at its new plant in Uzbekistan, with an initial capacity of 50,000 units annually.

The plant, a joint venture with Uzavtosanoat JSC, will initially manufacture the BYD Song Plus DM-i SUV and BYD Chazor.

BYD has expanded aggressively overseas, exporting nearly 98,000 passenger cars in Q1 2024 and planning a factory in Hungary.

🇨🇳 Chenqi bets big on robotaxis in Hong Kong IPO (Bamboo Works)

The ride-sharing company’s listing could raise up to $167 million as its shares get set to debut next Wednesday

Shares of Chenqi Technology (HKG: 9680) will make their trading debut next week, as the company banks on its new robotaxi segment to sell investors on its future

The firm hopes to differentiate itself in the crowded ride-sharing market with its status as one of only three companies offering robotaxis in addition to manned vehicles

🇨🇳 Four things to know about Tianqi Lithium’s reversal of fortunes (Caixin) $

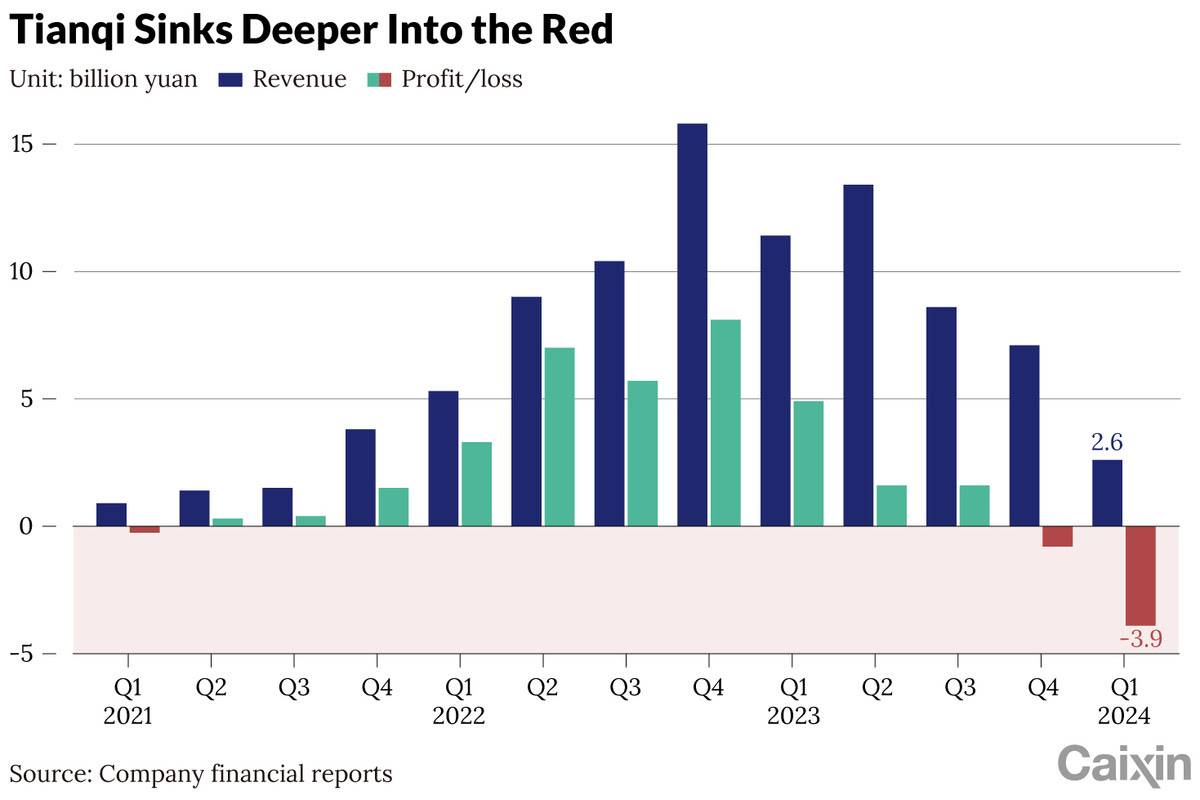

Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) faced significant financial trouble due to plummeting lithium prices and heavy debts from earlier aggressive investments, leading to a 48% drop in stock price this year and a 3.9 billion yuan net loss in Q1 2024.

The Chilean government’s move to nationalize lithium assets and the rejection of Tianqi’s request for a shareholder vote on the SQM-Codelco partnership further compounds Tianqi’s financial issues.

Analysts have drastically cut profit estimates for Tianqi, with significant concerns about future profitability and the negative impact of global lithium market dynamics and political risks.

🇨🇳 ATRenew’s latest ESG report shows improving carbon emissions, gender diversity (Bamboo Works)

The recycling specialist showcased a continued reduction in greenhouse gas emissions intensity and its progress in other corporate responsibility efforts in its fourth annual ESG report.

ATRenew (NYSE: RERE)’s greenhouse gas emission intensity continued to decline in 2023, as it also took steps to further reduce other forms of pollution from its operations

The company’s latest ESG report shows it’s proactively boosting its disclosures as future mandatory requirements look increasingly likely

🇨🇳 Fu Shou Yuan (1448 HK) (Asian Century Stocks)

Fu Shou Yuan International Group (HKG: 1448 / OTCMKTS: FSHUF) (1448 HK - US$1.4 billion) is China’s largest death care provider, conducting funerals and operating cemeteries across 40 cities in 19 provinces.

The company was founded in Shanghai in 1994 by taking over assets from a collectively owned enterprise. And its Shanghai operations continue to be important for the business, representing close to 50% of revenues.

Fu Shou Yuan’s main business is selling burial plots to families of recently deceased individuals. It also sells funeral services, sells its landscaping expertise to third parties and constructs cremation machines for sale in China and beyond.

🇨🇳 Miniso’s penny-wise empire finds big bucks in rich countries (Bamboo Works)

The seller of cheap lifestyle goods opened a massive store in Paris last month, the latest step in its ambition to win over bargain hunters worldwide

MINISO Group Holding (NYSE: MNSO) accelerated its new store openings abroad in the first quarter to offset sluggish sales in its home China market

About a third of the retailer’s revenue comes from stores outside China, as it moves to lower its reliance on shaky domestic demand

🇨🇳 Part 1: Chinese hot pot chains – a primer (Investing in China)

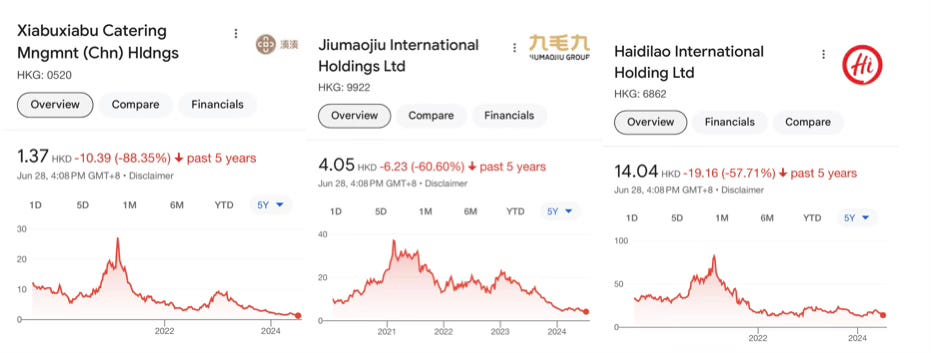

With COVID-19 lockdowns ended and Chinese restaurant chains’ stocks plummeting, I recently took a closer look at these stocks with a particular focus on hot pot restaurants.

I will cover Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF), Xiabu Xiabu Catering or XBXB (HKG: 0520 / FRA: 0XI / OTCMKTS: XIAXF), and also Jiumaojiu International Holdings (HKG: 9922 / FRA: 3YU), which is not a pure hot pot play but has a chain called Song Hot Pot Factory that serves hot pot.

🇨🇳 Once branded a copycat jeweler, Zhou Liu Fu seeks gold in Hong Kong (Bamboo Works)

The company, whose name resembles two popular Hong Kong rivals, has filed for a Hong Kong IPO after its application to list on China’s A-share market went nowhere

Zhou Liu Fu has applied for a Hong Kong IPO, reporting its net profit rose nearly 15% last year to 660 million yuan

The jeweler is controversial due to its heavy reliance on franchising, and also because its name resembles two popular Hong Kong rivals

🇨🇳 Shunned by investors, Henlius hangs up on its Hong Kong listing (Bamboo Works)

The Fosun-backed drugmaker’s privatization comes as its stock price has wilted over 60% since its IPO five years ago and it failed to use the listing to raise additional funds

Despite sagging shares and a newly announced privatization plan, Shanghai Henlius Biotech (HKG: 2696 / OTCMKTS: SGBCF)’ business has been improving, including a net profit of 546 million yuan last year

By fully absorbing Henlius, parent Fosun Pharma stands to directly benefit from the rapid growth of the unit’s high-quality assets

🇨🇳 Shenzhen Yuejiang Technology IPO Preview: Dobot Files to List IPO on Hong Kong Stock Exchange (Smartkarma) $

Shenzhen Yuejiang Technology (Dobot), a China-based cobot company, filed for a Hong Kong IPO. Cobots are robots with operational robotic arms intended for collaboration within a shared space.

Dobot was backed by CICC, CRRC VC, Greenpine Growth, Qianhai Equity, and China Internet Investment Fund, among others. The company was founded in 2015 in Shenzhen, PRC.

The offering may attract significant investor interest after South Korea’s robotics company Doosan Robotics (KRX: 454910) could raise ~$318M in October 2023.

🇨🇳 🇭🇰 When it comes to online shopping, two China firms are making sure Hong Kong delivers (Caixin) $

Hangzhou Sf Intra-City Industrial Co Ltd (HKG: 9699) and Cainiao Network Technology (Alibaba (NYSE: BABA)) are major Chinese firms expanding in Hong Kong’s express delivery market, with plans for rapid delivery services and guaranteed delivery times.

Hong Kong’s delivery sector has experienced significant growth, with the transport, warehouse, postal, and express delivery services seeing a 19.5% year-on-year increase in early 2023.

The Hong Kong government is focusing on developing a modern logistics system to boost efficiency and meet the rising e-commerce demand.

🇭🇰 Asian Dividend Gems: Chow Tai Fook Jewellery (Asian Dividend Stocks)

Chow Tai Fook Jewelry Group’s (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF)‘s shares are down 28.2% YTD, sharply underperforming the Hang Seng Index which is up 6% in the same period. We believe this divergence is excessive.

Chow Tai Fook’s dividend yield averaged 4.8% from FY20 to FY24. Its annual dividend payout averaged 107% in the same period.

Chai Tai Fook is currently trading at attractive valuations. It is trading at P/E of 10.1x, EV/EBITDA of 7.5x, and P/B of 2.9x based on FY25 consensus earnings estimates.

🇭🇰 Esprit puts trademark up for sale after slipping out of style (Bamboo Works)

The clothing company was at the cutting edge of fashion in the 1980s but has struggled with competition from newer brands and is left with a shrunken market cap

Esprit Holdings Ltd (HKG: 0330 / FRA: ESHB / ESHA / OTCMKTS: ESPGY / ESHDF) announced it is in talks with a third party about selling its trademark and domain names in Greater China for $47.5 million

The deal is unlikely to offer a major boost for Esprit or result in a special dividend

🇭🇰 CK Hutchison Holdings: A ‘China Discount’ Is Not Warranted (Seeking Alpha) $

CK Hutchison (HKG: 0001 / FRA: 2CKA / OTCMKTS: CKHUY / CKHUF) trades at an inexpensive valuation both in terms of earnings multiples and relative to its sum of the parts valuation.

The company’s limited geographic exposure to Greater China makes a “China discount” unwarranted, in my opinion.

I believe that, at the current share price, the stock is undervalued by up to 40 percent.

CK Hutchison pays attractive dividends, yielding around 6.7 based on last year’s cumulative distributions.

🇭🇰 AIA Group: Consider Share Buybacks And Q2 Outlook (Seeking Alpha) $

AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF)‘s enlarged share repurchase program suggests that the stock’s potential 2024 shareholder yield could be in the high-single digit percentage range.

The increased regulatory scrutiny of Mainland Chinese Visitors’ insurance sales in Hong Kong might possibly affect AAGIY’s near-term financial performance.

My rating for AIA Group remains as a Hold following my assessment of the company’s future shareholder capital return and Q2 results.

🇭🇰 🇧🇩 Issue#5 : 3 Cheap oddball stocks (Bargain Stocks Radar)

The first in Beximco Pharmaceuticals (DSE: BXPH / LON: BXP / FRA: R2WA), a Bangladesh based company that is listed in Dhaka, and also London with the ticker BXP. The London-listed shares are technically depositary receipts, not shares.

The company manufactures and markets generic pharmaceuticals. These products include solid, liquid, creams, and ointments, suppositories, metered dose inhalers, dry powder inhalers, nasal sprays, etc. I suggest visiting their website to see the full range of products.

Moving from Dhaka further east, the next company to highlight is San Miguel Brewery Hong Kong (HKG: 0236), a microcap listed in HK.

As the name suggests the company is engaged in the beer business, both manufacturing/distribution of it’s own brand, and distribution of imported brands into Hong Kong and southern parts of China.

🇰🇷 What Did NPS Buy and Sell in Korean Stock Market in 2Q 2024? (Douglas Research Insights) $

On 4 July, (National Pension Service) NPS disclosed the details of the ownership changes for 112 listed companies in Korea, of which 87 were listed in KOSPI and 25 in KOSDAQ.

In 2Q 2024, the NPS reduced its investments in defense and military stocks and increased investments in cosmetics, shipbuilding, and food companies in Korea.

NPS reduced its capital allocation to the military & defense sector. NPS reduced its stake in LIG Nex1 Co (KRX: 079550) (-2.32%), Poongsan Holdings Corporation (KRX: 005810) (-2.24%), and Hanwha Aerospace (KRX: 012450) (-1.02%).

🇰🇷 Alpha Generation Through Share Buybacks in Korea: Bi-Monthly (May and June 2024) (Douglas Research Insights) $

In this insight, we discuss the alpha generation through companies that have been buying back their shares in the Korean stock market in May and June 2024.

On average, the share buyback announcements for the 13 companies that announced share buybacks in Korea represented 1.7% of outstanding shares.

Major companies that have announced share buybacks in Korea in the past two months include Celltrion (KRX: 068270), SK IE Technology Co Ltd (KRX: 361610), and NCsoft (KRX: 036570).

🇰🇷 Gap Trades in Korean Prefs Vs Common Share Pairs in 3Q 2024 (Douglas Research Insights) $

In this insight, we discuss numerous gap trades involving Korean preferred and common shares in 3Q 2024.

The recent push for Korea Value Up program has helped to push up prices of numerous Korean preferred stocks including Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF).

On a longer timeframe (3-4 years), we believe this discount could narrow further to the 20-25% range, which provides additional opportunities for the Korean preferred shares to further make gains.

🇰🇷 Korean Holdcos Vs Opcos Gap Trading Opportunities in 3Q 2024 (Douglas Research Insights) $

In this insight, we highlight the recent pricing gap divergences of the major Korean holdcos and opcos which could provide trading opportunities in 3Q 2024.

Of the 38 pair trades, 21 of them involved holdcos outperforming opcos in the past six months, suggesting increased capital allocation to Korean holdcos relative to their opcos.

These pairs could generate trading opportunities in terms of their pricing gaps closing reversal (Doosan Corp (KRX: 000150) vs. Doosan Enerbility (KRX: 034020); Hyundai Mobis (KRX: 012330) vs Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) ).

🇰🇷 SK Telecom: Top Dog In The Telecommunications Space (Seeking Alpha) $

SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) is a top player in the telecommunications space worthy of a Buy rating, taking into account market share data and third-party research.

SKM is the leading mobile services provider in South Korea, with an estimated market share in the 40%-50% range.

SK Telecom was recently named by Omdia as the No. 1 telecommunications company with regard to AI competitiveness.

🇰🇷 Battery maker SK On declares ‘emergency’ as EV sales disappoint (FT) $ 🗃️

🇰🇷 S.Korea needs white paper on Korean-style IRs: scholar (GGRAsia)

South Korea needs a policy “white paper” on the role and future of its own casino industry, in the face of a “big threat” competition-wise from a Japanese integrated resort (IR) with casino, MGM Osaka, due to open in 2030.

That is according to Yang Hyung-eun, a researcher of the Institute of Amusement Industry Studies at Osaka University of Commerce, in Japan.

His thoughts are in an opinion article in the Korea Times, published last week.

South Korea has 18 casinos, but only one of them – Kangwon Land (KRX: 035250) – has gaming facilities open to local players. Regional competition for players is building in the wake of factors including China’s campaign on mainlanders gambling while overseas.

🇰🇷 Paradise: Expansion into High End Hotel Likely to Destroy Shareholder Value (Douglas Research Insights) $

On 2 July, Paradise Co Ltd (KOSDAQ: 034230) announced that it will construct a new high end luxury hotel in Seoul spending about 500 billion won to 550 billion won.

We believe that this construction of the new luxury hotel will have a negative impact on shares of Paradise.

Rather than investing a large sum of money to build a new hotel, many investors would rather have preferred Paradise to increase share buybacks and dividends.

🇰🇷 ABL Bio Capital Raise of 140 Billion Won (Douglas Research Insights) $

On 2 July, ABL Bio (KOSDAQ: 298380) announced a capital raise worth 140 billion won.

The capital raise involves 5.77 million new shares (10.7% of outstanding shares post capital raise) at 24,229 won per share (current price is 24,150 won).

The proceeds from the capital raise will be used to develop next-generation ADCs (Antibody Drug Conjugates), including bispecific antibody ADCs.

🇰🇷 Hanwha Energy Launches Tender Offer of 180 Billion Won Worth of Hanwha Corp (Douglas Research Insights) $

On 5 July, Hanwha Energy announced a tender offer of 8% stake in Hanwha Corporation (KRX: 000880) worth 180 billion won.

The tender offer price is 30,000 won. Hanwha Energy will launch a tender offer for up to 6 million shares of Hanwha Corp, representing 8% of outstanding shares.

Hanwha Corp’s 34% stake in Hanwha Aerospace (KRX: 012450) which is worth 4.2 trillion won. (191% of Hanwha Corp’s market cap).

🇰🇷 Shift Up IPO Book Building Results Analysis (Douglas Research Insights) $

(Leading game developer) Shift Up reported solid IPO book building results. Shift Up’s IPO price has been determined at 60,000 won won, which is at the high end of the IPO price range.

The demand ratio was 226 to 1. Shift Up will start trading on 11 July.

Our base case valuation of Shift Up is market cap of 5.7 trillion won or target price of 95,510 won (59% higher than the IPO price of 60,000 won).

🇰🇷 🇦🇺 IPO Watch: 3 High-Growth Companies Going Public or Recently Listed (The Smart Investor)

Discover the next big IPO success stories following the impressive growth of Arm and Reddit.

Here are some reputable companies going public or currently in the process of applying for an IPO.

Owned by South Korea’s internet giant NAVER (KRX: 035420 / OTCMKTS: NHNCF), Webtoon Entertainment (NASDAQ: WBTN) is one of the world’s largest platforms for online stories and comics.

Headquartered in Singapore, Shein is one of the biggest players in the fast and affordable fashion industry.

Guzman y Gomez (ASX: GYG / FRA: W92), the Mexican food chain well-known to Singaporeans, has gone public recently. Founded in Sydney in 2006, GYG now operates over 200 outlets in Australia, Singapore, Japan and the United States.

🇮🇩 Telekomunikasi Indonesia: Brilliant Entry Point For Indonesia’s Leading Telecom Giant (Seeking Alpha) $

PT Telkom Indonesia Persero Tbk (NYSE: TLK) is a leading telecom company in Indonesia with ample growth potential and strong financial performance.

Shares have sold off due to pricing concerns, underperforming the iShares MSCI Indonesia ETF by 17 percentage points.

The Indonesian telecom market has the potential to become one of the world’s largest, with Telkom Indonesia well-positioned to outperform.

🇮🇩 Hyundai and LG Energy open Indonesia’s first battery cell factory (FT) $ 🗃️

South-east Asian country wants to move up electric vehicle value chain

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) and LG Energy Solution (KRX: 373220) have opened a $1.1bn battery cell plant in Indonesia as the south-east Asian country works to build an electric vehicle ecosystem.

🇵🇭 International Container Terminal Services: Positive Outlook (Rating Upgrade) (Seeking Alpha) $

International Container Terminal Services (ICTSI) (PSE: ICT / OTCMKTS: ICTEF)‘ or ICTSI’s full-year 2024 results will benefit from higher tariffs for its key Manila International Container Terminal asset.

ICTSI’s inorganic growth prospects are favorable, and a potential short-term catalyst might be the conclusion of the Durban Container Terminal deal.

I upgrade my rating for ICTSI to a Buy, after assessing its outlook and valuations.

🇸🇬 SATS and SIA Engineering Are Seeing an Aviation Recovery: Can Their Share Prices Soar to Greater Heights? (The Smart Investor)

The aviation and travel demand recovery has benefitted a slew of aviation-related companies. Can their share prices hit a new high?

Despite this recovery, shares of aviation-related companies SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) and SIA Engineering Company Ltd (SGX: S59 / FRA: O3H / OTCMKTS: SEGSF), or SIAEC, have not done so well.

With a sustained aviation recovery underway, can both companies see their share prices heading higher?

SATS: Record revenue with a return to profitability

SATS: Clear plans to grow the business

SIAEC: Higher profits along with twice-yearly dividends

SIAEC: Gearing up for further growth

🇸🇬 Sembcorp Industries’ Share Price Has Dipped 10% This Year: Can the Utility Specialist See a Rebound? (The Smart Investor)

Does Sembcorp Industries (SGX: U96 / FRA: SBOA / OTCMKTS: SCRPF) have what it takes to see its share price scale new heights?

Over the next two years, the utility and urban development group saw its share price leap 69% and 57.1% in 2022 and 2023, respectively, to end at S$3.38 and S$5.31.

Can the blue-chip group see a potential rebound and see its share price surpass its recent 52-week high of S$6.10?

Multi-year financial improvement

A multi-prong growth model

2028 strategic plans

Recent business developments

🇸🇬 Grindrod Shipping: Major Shareholder’s Takeover Attempt Successful, Stock Will Likely Delist Soon (Seeking Alpha) $

The Selective Capital Reduction plan was approved by the Extraordinary General Meeting and Grindrod Shipping (NASDAQ: GRIN) shareholders will likely receive 14.25 USD per share after the Singaporean High Court approves the decisions.

Taylor Maritime Investments (LON: TMIP / TMI / FRA: 91E / OTCMKTS: TMILF) will likely become the sole shareholder and Grindrod shares will be delisted from NASDAQ and JSE.

The best option, in my opinion, for current shareholders is to wait Singaporean High Court’s approval of the decisions and receive 14.25 USD per share.

🇸🇬 Flex Provides Exposure To 2 Verticals That Have Strong Secular Tailwinds (Seeking Alpha) $

The Company offers direct exposure to high-growth data centers and automotive verticals.

Demand for data centers, driven by AI, is a key growth driver for Flex (NASDAQ: FLEX), with the company covering 80% of the parts needed for data centers.

Flex’s EPS is expected to grow faster than revenue, supported by higher margins in high-growth segments and strong capital returns.

🇮🇳 Precot Limited: A Niche Technical Textile Player (Smartkarma) $

Precot Ltd (NSE: PRECOT)

Niche Player in Cotton yarn spinning and Technical Textile with decadal experience.

Expansion in Technical Textile during FY24 will significantly improve the margin profile and revenue for the company.

Peer Comparison and assessment at multiple metrics to assess the suitability of investment.

🇮🇳 Infosys: Still A Buy But Watch These Key Levels For Support (Seeking Alpha) $

Lyn Alden discusses the fundamental snapshot for Infosys (NYSE: INFY), highlighting valuation risks and concerns about AI disruption.

Infosys is expected to see higher prices in the coming weeks to months, but with key support levels to watch.

Our methodology suggests potential for Infosys to reach $23, but support at $16 must hold; see more in the article for how we arrive at these price levels.

🇿🇦 Mr Price’s CEO gets a whopping big pay boost from long and short-term incentives (IOL)

(Cash-based omni-channel fashion-value retailer) Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY) CEO Mark Blair’s remuneration increased markedly, by more than 300%, to R45.91 million in the year to March 31, from R10.67m the year before, after he benefited mainly from significantly higher long-term and short-term incentive share awards.

Executive remuneration is closely watched by shareholders because it has an impact on the performance of the company, the direction that the company is going, if the pay is in line with the company’s peers, how the executive performed according to targets and it can also indicate how much the company is willing to spend to attract the right talent to a company.

🇿🇦 Shoprite launches online shopping, bulk delivery service for spaza shops (IOL)

Shoprite Group (JSE: SHP) has introduced an innovative digital solution for its Cash & Carry stores, marking the wholesale brand’s first venture into e-commerce.

This comes as the group has upped its e-commerce game as it announced in May that its Checkers Sixty60 was beta testing the new and improved version of its app, enabling customers to shop for more than 10 000 larger Hyper products, with same-day delivery scheduled within a 60-minute time slot.

These moves come hot on the heels of Amazon’s launch in South Africa in May, bringing a stiff competition in the fast-growing e-commerce retail sector.

🇿🇦 Clicks to sell stake in Unicorn following Constitutional Court judgement (IOL)

The Clicks Group (JSE: CLS / FRA: N1C / OTCMKTS: CLCGY) said yesterday that it would sell its stake in Unicorn Pharmaceuticals following a Constitutional Court decision in March 2023, on regulations that prohibit pharmacies from owning pharmaceutical manufacturers.

Click’s online web site showed it had spent R314 million in new stores and pharmacies, store refurbishments, supply chain and information technology in its year to February 28, 2024.

It plans to accelerate this store expansion programme by opening another 50 to 55 stores in the short term, with a further 10 to 20 pharmacies planned to be opened.

🇿🇦 Bidvest puts its bank up for sale, makes another offshore acquisition (IOL)

Bidvest Group (JSE: BVT / FRA: NQL / FRA: NQL1 / OTCMKTS: BDVSY), which announced yet another offshore acquisition yesterday, plans to sell its bank through a restructuring of its financial services division.

The group announced also that it is acquiring 100% of Canada-based Citron Hygiene from Birch Hill Equity Partners and other investors for an undisclosed sum. Citron serves about 50 000 customer locations from seven branches in Canada, four in the US and 10 in the UK.

Bidvest said the hygiene services market was resilient with compelling unit economics. Structural growth drivers included hygiene and safety standards, a growing population, urbanisation as well as period dignity awareness.

Legislation around free vending of menstrual products in washrooms in North America added further growth momentum. Bidvest believed that the total addressable market in Citron’s North American territories was exponentially bigger than Citron’s current revenue.

🇿🇦 🇿🇼 Tongaat Hulett’s Zim unit skips dividend as it comes under fiscal pressure & Tongaat warns its listing might end after share subscription by Vision (IOL)

(Feedstocks of sugarcane and maize + property stock) Tongaat Hulett (JSE: TON)’s Zimbabwean listed unit – Hippo Valley – has had to divert domestic market volumes to the export market owing to decreasing local sales due to unfriendly fiscal conditions that drove up the cost of doing business during the year to end-March.

Hippo Valley and non-listed Triangle Sugar Corporation make up the Zimbabwe operations for troubled Tongaat Hulett. The company opted to skip a dividend for the year under review.

🇿🇦 Mining stocks recoup June losses after rallying on JSE (IOL)

The majority of mining stocks on the JSE yesterday put up a stronger performance despite mining shares on the local bourse, including Thungela Resources (LON: TGA / JSE: TGA / FRA: 6UP / OTCMKTS: TNGRF), Sibanye Stillwater Ltd (NYSE: SBSW), and Kumba Iron Ore (JSE: KIO / OTCMKTS: KIROY / KUMBF) making up the worst performers in June, with the exception of Pan African Resources (LON: PAF / JSE: PAN / OTCMKTS: PAFRF / PAFRY) which notched up a 50% year-to-date strengthening.

This comes as the Minerals Council called on Minerals and Petroleum Resources Minister Gwede Mantashe to use his reappointment to make the industry investor-friendly and said his return to the portfolio would allow for continuity of policy discussions and interactions.

🇿🇦 Week-long strike ends after rocking Implats’s troubled Bafokeng operation (IOL)

However, analysts said yesterday Implats’s acquisition of shares in Bafokeng Platinum mines had so far been tough, .

Impala Platinum Holdings (JSE: IMP / LON: 0S2J / FRA: IPHB / OTCMKTS: IMPUY / IMPUF) – just like other platinum group metals (PGM) miners such as Sibanye Stillwater Ltd (NYSE: SBSW) – has been facing turbulence to operations owing to low prices for the precious metal.

The South African PGM miners have been forced to retrench workers from shafts and to save head office and regional offices costs.

🇿🇦 Sibanye-Stillwater lays off 11 500 workers in 18 months (IOL)

The company is now consolidating its gold and PGM operations under a single operating structure.

“To optimise the SA region for sustained, safe production, the SA gold and PGM operations will be consolidated into a single regional operational structure with functional support from a streamlined services structure.

“The revised operating model and structure will enable operational teams to focus on core operational outputs, with services support geared towards operational delivery and creating an enabling environment for innovation and sustainability,” the company said.

🇵🇱 Dino Polska SA: Ongoing Price War To Hurt Growth And Margins (Seeking Alpha) $

Sell rating for Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) due to the ongoing price war in Poland.

Competition is intensifying, which should lead to a slowdown in growth and margin compression.

I expect the market to downgrade DINO’s valuation closer to peers if this situation continues.

🇬🇬 Coming to the nuisance with Burford Capital $BUR. What is going on? (Value Degen’s Substack)

Burford Capital Limited (NYSE: BUR) is a founder-led international corporate litigation finance firm which for the last fifteen years has been financing large corporate lawsuits, $30 million average size. They use a buy and hold strategy because there is no secondary marketplace to sell half-finished lawsuits. They use not only their own money, but they also have external investors whose capital they deploy for a management fee alongside their own capital.

BUR became a FinTwit favorite when it was announced in September of 2023 that a New York judge found against Argentina in the nationalization of an energy company, YPF Sociedad Anonima (YPF) (Ypf Sa (NYSE: YPF)) and awarded damages of $16 billion. However the case is still under appeal with an estimated timeline for the conclusion of that appeal being sometime in 2025. If Argentina’s appeal fails, BUR’s portion of the $16 billion is described by the CEO as “considerable,” and estimated to potentially be somewhere between $1.4 billion and $6.2 billion depending on the news source. The market cap of BUR sits at $2.8 billion, for comparison.

🇫🇰 Falkland Islands – the next big thing? (Undervalued Shares)

The oldie but goldie among Falkland Islands related stocks is FIH Group PLC (LON: FIH / FRA: FBLM) (ISIN GB00BD0CWJ91, UK:FIH).

When I first reported about this company two decades ago, it was called Falkland Islands Holdings (hence “FIH”). Among other assets, it owned 100% of The Falkland Islands Company, which was granted its Royal Charter in 1852 to settle, develop and exploit the Falkland Islands. The company has since broadened its portfolio to include some investments in the UK, and it also changed its name.

A more specialist, speculative play with much more upside is Rockhopper Exploration (LON: RKH / FRA: R4Y / OTCMKTS: RCKHF) (ISIN GB00B0FVQX23, UK:RKH).

This is a GBP 90m (USD 114m) market cap company that discovered the Sea Lion oil field mentioned in the Daily Telegraph report.

On 23 September 2022, Rockhopper Exploration finalised a deal with Navitas Petroleum (TLV: NVPT) (ISIN IL0011419699, IL:NVPT), an Israel-based energy firm with a focus on the Americas. Navitas Petroleum has both the expertise and the necessary access to capital to make the Sea Lion oil field come into life.

🌎 MercadoLibre: It May Be Just The Beginning Of A Great Rally (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) stock has increased by 21.6% since my bullish call three months ago, outperforming the S&P 500 index. I believe it’s just the beginning.

After MELI’s Q1 results, Wall Street estimates have not increased significantly overall. But the business is blooming as far as I see.

MercadoLibre’s fintech arm, MercadoPago, is driving high-quality growth, with significant increases in total assets under management and credit portfolio.

The company’s operating profit margin could reach 35% by 2028, potentially increasing its stock to $2,300-$2,500 shortly, based on my DCF model.

I believe that MELI’s long-term uptrend will continue – hence my “Buy” rating update today.

🌎 Arcos Dorados: Wonderful Business, Selling For A Discount (Upgrade) (Seeking Alpha) $

Arcos Dorados Holdings Inc (NYSE: ARCO) is the largest QSR operator in Latin America and contributes 4% of McDonald’s systemwide sales.

Arcos shares have been punished alongside McDonald’s, as McDonald’s systemwide sales slow. However, Arcos sales are still showing strong momentum.

The sum-of-the-parts model points to $12/share in equity value.

Raising recommendation to a buy.

🇧🇷 Why Nubank’s NPLs Are Rising: An In-Depth Analysis + Nubank’s Credit Strategy Amid Rising NPLs (Giro’s Newsletter)

Nu Holdings (NYSE: NU), Brazil’s leading digital bank, faces rising non-performing loans (NPLs) despite rapid growth. This post explores the factors behind this trend, including Nubank’s business model, customer demographics, and regulatory challenges, and offers potential solutions.

🇧🇷 A Banker Analyzes Nubank (Multibagger Nuggets)

A deep analysis of Nu Holdings (NYSE: NU) from an insider working at one of the biggest global banks.

Before I start, if you haven’t heard Kris’ conversation with Fede Sandler, this is your reminder to do so because of his original insight and also because his influence can still be seen in the materials both Mercado Libre (NASDAQ: MELI) and NU put out, which is, exceptional.

🇧🇷 Nu Holdings Investment Thesis (The Wolf of Harcourt Street)

Nu Holdings (NYSE: NU) trades on the NYSE having gone public via an initial IPO in December 2021. In May 2024, Nubank became the first bank to reach 100 million customers outside of Asia.

What has been the secret to Nubank becoming the world’s largest digital banking platform outside of Asia and is it worth investing in today?

🇧🇷 BRF: The Recent Rise Is Not A Chicken Flight (Seeking Alpha) $

Brazil is a powerhouse in agribusiness, and BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3) has a prominent position in the poultry market.

The company’s costs have fallen, which should bring even better margins in the short term.

BRFS has an attractive valuation based on the EV/EBITDA multiple and is experiencing very strong momentum.

🇧🇷 Why Vale Could Rebound (Seeking Alpha) $

Vale (NYSE: VALE) has plunged nearly 30% YTD due to falling iron ore prices, but its solid operational performance positions it well in the face of market fluctuations.

Increased iron ore production suggests producers expect a rebound in prices and demand, hinting that Vale’s stock may have found a bottom and could rebound with signs of recovery.

Vale’s investments in nickel and copper for the EV market, coupled with early signs of Chinese economic recovery, support its performance against iron ore price fluctuations.

Vale’s commitment to ESG initiatives enhances its market position, attracting socially responsible investors and reinforcing its long-term growth potential.

🇧🇷 Why Petrobras Stock Deserves A Downgrade (Seeking Alpha) $

I believe Petrobras (NYSE: PBR / PBR-A) stock should be downgraded due to recent management news and other factors, despite some uncertainty already being priced in.

Recent financial data shows declining profitability, margins, and top-line revenue for Petrobras.

The weakening of the Brazilian real further exacerbates these issues and impacts local revenues, which account for 70% of the company’s total turnover.

Petrobras currently trades at 4.5 times next year’s earnings, which is about 60% below the energy sector median figure.

I downgrade Petrobras to “Hold” due to a high likelihood of missing EPS and revenue expectations in Q2.

🇲🇽 🇦🇷 Vista Energia: Best Oil Stock In Latam (Seeking Alpha) $

Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA) should execute a 17% shale oil production CAGR through 2030.

Argentina’s de-risking has made the company and its Vaca Muerta assets highly valuable.

Consensus cash earnings growth of over 30% on a cheap valuation of 5.5x P/E (cash) or 0.2x PEG makes the share compelling.

Vista cash cost of US$20 BOE provides for cash flow to fund US$1bn yearly capex.

🇲🇽 Coca-Cola FEMSA: It’s Time To Buy The Bottler (Seeking Alpha) $

Coca-Cola Femsa SAB de CV (NYSE: KOF) offers an attractive yield and an impressive five-year dividend growth rate of 13.5%.

Its current valuation is below historical averages, creating a buying opportunity.

The company has maintained a healthy balance sheet despite inflationary pressures.

🇲🇽 More hidden gems in Mexico P5 (Bos Invest Substack)

An even better way to play a construction boom in Mexico & an in depth analysis of Tequila manufacturer Becle SAB de CV (Cuervo) (BMV: CUERVO / FRA: 6BE / OTCMKTS: BCCLF). Anyone interested in Chemical stocks? please comment.

Corporacion Moctezuma SAB de CV (BMV: CMOCTEZ / OTCMKTS: CMZOF): Mexican cement company. Market cap 66.4B pesos, 7B pesos net cash. 10.3 times earnings. Pure play exposure to Mexico with a nice shareholder yield. Dividend of 6.7% plus share repurchases.

CMR SAB (BMV: CMRB) is a Mexico-based company primarily engaged in the management of restaurants.

Convertidora Industrial SAB (BMV: CONVERA) is a Mexico-based company engaged in the production, distribution and sale of plastic film for food packaging and articles used for party’s decorations.

Axtel SAB de CV (BMV: AXTELCPO / FRA: 4GK / OTCMKTS: AXTLF) is a telecommunications services provider.

Cydsa SAB de CV (BMV: CYDSASAA / OTCMKTS: CDSAF) is active in Chemicals.

Dine SAB de CV (BMV: DINEB) focuses on the construction and promotion of residential and touristic properties, as well as development of large-scale commercial spaces.

🇲🇽 Cementos Moctezuma – Analysis and Valuation (Dola Capital)

A deep dive on the Mexican cement industry and one of the most profitable cement companies in the world.

Corporacion Moctezuma SAB de CV (BMV: CMOCTEZ / OTCMKTS: CMZOF) is a highly profitable unleveraged business–in the past 5 years, it generated an average return on invested capital of 59%.

The company enjoys competitive advantages in production scale and distribution, thanks to its production capacity, location of cement plants and quarries, and the relationships it has built with railway operators that allow it access to railway spurs to load cement directly in its plants.

$ = behind a paywall / 🗃️ = Archived article

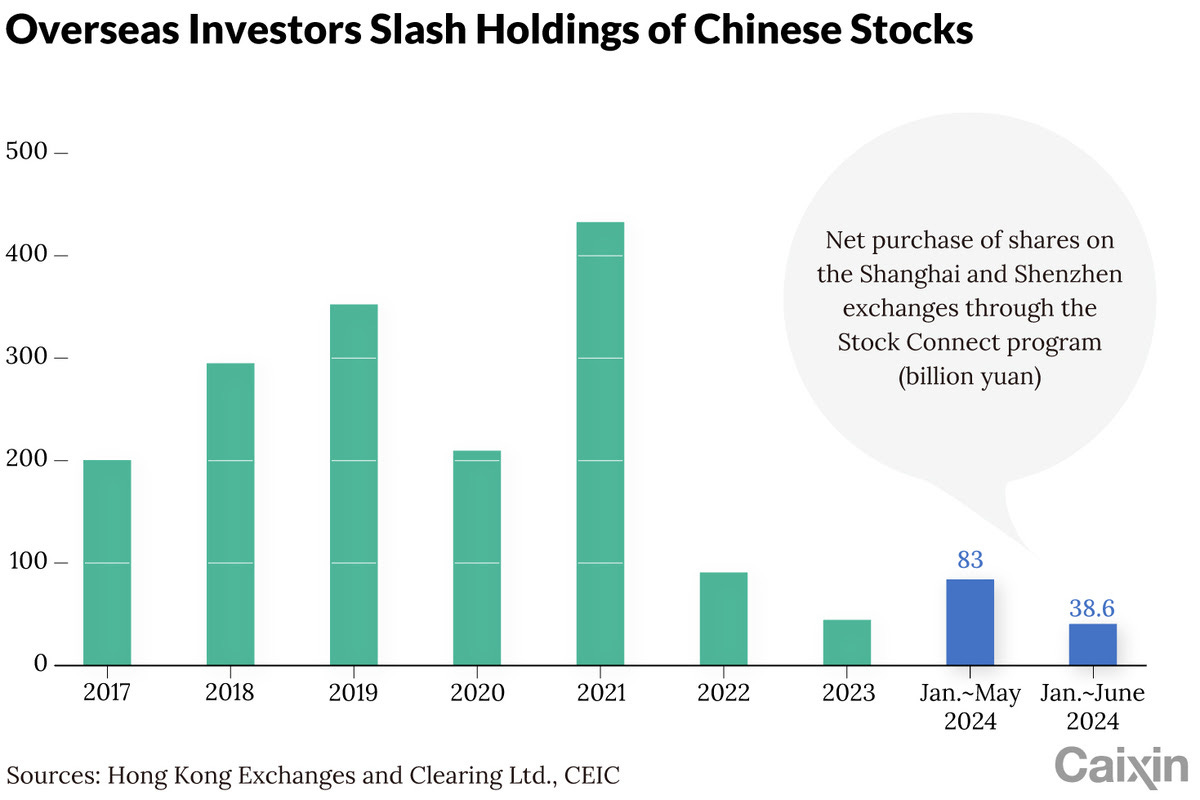

🇨🇳 Analysis: How to Keep Foreign Capital Flowing Into Chinese Stocks (Caixin) $

Net overseas investment in the Chinese stock market via the Stock Connect program reached 83 billion yuan ($11.7 billion) in early 2023.

The surge was driven by better-than-expected earnings of listed companies, eased property market concerns, and favorable foreign market conditions.

Sustaining foreign capital inflows depends on strong economic fundamentals, comprehensive policies, and improved U.S.-China relations.

🇨🇳 New Law to Give Communist Party Bigger Say in Supervising China’s Financial System (Caixin) $

The new draft of China’s Financial Stability Law increases the Communist Party’s role in managing financial risks and unifies fragmented financial regulations.

The financial work leadership agency of the party’s Central Committee will oversee decision-making, coordination, and policy formulation for financial stability.

The Central Financial Commission (CFC) now reinforces centralized leadership over financial work, absorbing the previous Financial Stability and Development Committee.

🇨🇳 Being a director in China has just become much tougher (FT) $ 🗃️

🇨🇳 China stabbing attacks raise concerns of growing social tensions (FT) $ 🗃️

🇨🇳 China exerts new control over its young expats in the US (FT) $ 🗃️

🇨🇳 Beijing Bolsters Backing for Overseas E-Commerce Warehouses (Caixin) $

Beijing has implemented policies to support building overseas warehouses to boost e-commerce globalization amid home market competition.

The effort includes tax reimbursements and industrial funds, with significant growth expected in the e-commerce export warehousing market.

Despite strong demand, challenges remain such as high costs and long investment return cycles.

🇨🇳 Americans Warned To Stop Shopping Via Chinese App Temu (The Epoch Times via ZeroHedge)

The top prosecutor in Arkansas warned on July 2 that Americans should be wary of using the Temu marketplace app because it’s effectively a “data theft business.”

“The threat from China is not new, and it is real,” Arkansas Attorney General Tim Griffin told Fox Business on July 2, a week after his office filed a lawsuit against the company. “Temu is not an online marketplace like Amazon or Walmart. It’s a data theft business that sells goods as a means to an end.”

The suit primarily cites research from Grizzly Research (We believe PDD is a Dying Fraudulent Company and its Shopping App TEMU is Cleverly Hidden Spyware that Poses an Urgent Security Threat to U.S. National Interests), which analyzes publicly traded firms, and alleges that Temu can “purposely … gain unrestricted access to a user’s phone operating system, including, but not limited to, a user’s camera, specific location, contacts, text messages, documents, and other applications.”

In its report, Grizzly Research said that it suspects that Temu is “already, or intends to, illegally sell stolen data from Western country customers to sustain a business model that is otherwise doomed for failure.”

🇰🇷 Three Risk-Off Signals Offset by One Risk-On Signal? (Douglas Research Insights) $

The three risk-off signals include the decline in the Bitcoin price, decline in the copper price, and the first day share price performances of recent Korean IPOs.

These three risk-off signals are offset by one major risk-on signal which includes the U.S. Junk Bond-Treasury Yield spread.

An important risk-off signal is the first day share price performances of major Korean IPOs after listing. We have started to see some weakness on this signal in July.

🇰🇷 Korean Government Announces Corporate and Dividend Tax Incentives Under Corporate Value Up Program (Douglas Research Insights) $

The Korean government announced corporate tax incentives for companies that actively increase capital returns to shareholders and also dividend tax incentives and as part of the Corporate Value Up program.

For companies that provide shareholder returns, a 5% corporate tax amount on the increase will be deducted and the tax burden on increased dividends of the company will be reduced.

For dividends under 20mn won, the tax rate will be reduced from 14% to 9%. Investor can choose lower rate (25% or comprehensive tax rate) for dividends exceeding 20mn won.

🇿🇦 Financial markets remain bullish after SA picks Cabinet (IOL)

The announcement of the new Cabinet of the Government of National Unity by President Cyril Ramaphosa last Sunday, brought calmness to South Africa’s financial markets.

Expectations that the South African economy may grow by more than 2% in 2024 also started to emerge after the new Cabinet was announced.

Six favourable factors underline this possibility. The absence of load shedding since the beginning of April, expected lower interest and inflation rates, a stronger rand exchange rate due to capital inflows, better exports due to better infrastructure and higher global prices for commodities, especially gold and platinum and the expectation of the government budget recording a primary surplus will steer this improved growth.

🌐 Frontier emerging markets stocks soar as investors cheer reforms (FT) $ 🗃️

Argentina’s Merval leads Latin America as heavily indebted nations chart path to growth

Argentina’s Merval index has led Latin American bourses, rising 53 per cent in US dollar terms, while Pakistan’s stock gauge is one of the best performing in Asia, as markets that until recently were seen as very troubled have outperformed larger and more expensive peers.

These so-called frontier markets have been attractive because of their cheap valuations, say investors. In contrast, indices in more established markets such as Mexico and Brazil have declined in dollar terms as capital has been pulled towards surging artificial intelligence stocks in the US.

🌐 The Decline and Fall of the Petrodollar? (Project Syndicate)

Although Saudi Arabia has been pricing its oil exports in US dollars for decades, there has been recent speculation that the country’s leaders may be considering a change. What would that mean for US financial and monetary hegemony?

🌐 The Eclipse of the Petrodollar (Project Syndicate)

Sometimes fake news reveals hidden truths, such as when it was recently reported that Saudi Arabia would end its agreement with the United States to price oil in dollars. Despite the many inaccuracies in these reports, and although the greenback’s global role endures, the momentum for de-dollarization is building.

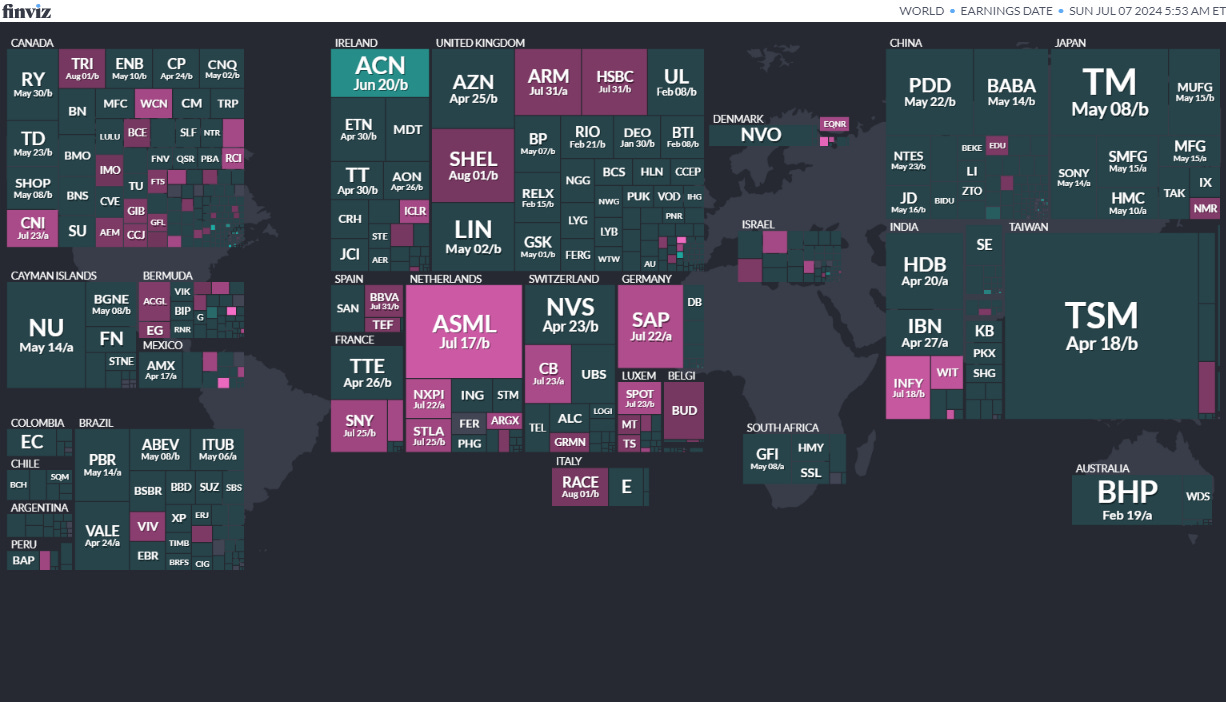

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Romania Romanian Presidency Sep 15, 2024 (t Date not confirmed Nov 24, 2019

-

Czech RepublicCzech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 30, 2024