Emerging Market Links + The Week Ahead (June 10, 2024)

South African, Indian and now Mexican elections have led to some surprises – in case of the latter, its the Mexican elite who were surprised given how out of touch they are with their own people. Modi’s party not doing as well as expected in the Indian elections seemed to surprise the international media and investors (but should not derail Indian reforms or growth that much) while who the ANC will partner (as the ANC is between a rock and a hard place) with has investors on edge.

Meanwhile, Caixin has noted the Red Sea crisis is causing gridlock as Chinese exporters try to beat U.S. tariff deadline. Apparently, this surge in Chinese exports has increased congestion at docks around the world with Southeast Asian ports like Singapore hit the hardest.

Finally, the Financial Times has reported that Chinese hotels have been told to stop rejecting foreigners 🗃️. This has long been a headache outside cities frequented by foreigners and its not even clear why its still happening or what rules are being enforced. Luckily for me, Trip.com (NASDAQ: TCOM)’s Ctrip.com site has always had good English language customer service and would even call a property to double check whenever I used their chat customer help service.

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China E-Commerce: Stabilizing Property Market Matters a Lot (SmartKarma) $

A stabilizing property market matters more than other factors such as industry rivalry and shareholder return policies for the performance of leading China e-commerce players in our view.

China’s worst property market downturn is probably behind us. This will gradually help restore consumer confidence and lift consumer propensity to spend, improving growth outlook for China e-commerce sector.

We believe China e-commerce players will in general benefit from a stabilizing housing market. Alibaba (NYSE: BABA) remains the most attractive play in the space.

🇨🇳 (Meituan (3690 HK, BUY, TP HK$156) TP Change): Counting on Execution to Navigate the Uncertainties (SmartKarma) $

Meituan (SEHK: 3690) reported C1Q24 revenue 6.0%/6.2% higher our estimate/consensus, and adjusted net income 19%/29% higher than our estimate/consensus. The stock fell on lower takeout order and in-store revenue guidance for C2Q24;

The stock has two uncertainties: (1) Strategic moves by Douyin and Eleme, (2) success of overseas expansion. There are no easy answers to these two questions but we believe the corner has been turned

We maintain the stock as BUY rating and raise TP to HK$156/share to factor in the improvement in profitability.

🇨🇳 MT/ Meituan (3690 HK): 1Q24, Total Revenue Up by 25% and Initiatives Loss Down by 45% (SmartKarma) $

Total revenue increased by 25% YoY and all business lines grew strongly.

In 1Q24, the operating losses from new initiatives decreased by 45% YoY, but new initiatives revenue still grow.

We conclude that the price target can be double of the market price.

🇨🇳 Kuaishou unveils a rival to Sora that produces video from text (Caixin) $

China’s short-video platform Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY) unveiled its text-to-video model “Kling” on Thursday, joining other Chinese tech firms in the race to rival OpenAI’s Sora with artificial intelligence-powered video generation.

Using technology similar to Sora, Kling can generate 1080p high-definition videos lasting up to 2 minutes, Kuaishou said. The model is capable of producing large-scale realistic motions, simulating physical world characteristics and combining concepts and imagination.

🇨🇳 Transformation gobbles up Smart Share Global’s profits (Bamboo Works)

The company known for its network of Energy Monster smartphone recharging stations fell into the red in the first quarter, ending a streak of four consecutive quarterly profits

Smart Share Global (NASDAQ: EM)’s revenue plunged more than 50% in the first quarter, as revenue from its core charging services tumbled amid its business transformation

The company is gradually shifting operational responsibilities for its network of Energy Monster power bank cabinets to third-party business partners

🇨🇳 DouYu: A headless fighting fish swimming against the tide (Bamboo Works)

The livestreaming game operator’s revenue fell 30% in the first quarter, accelerating from a 23% decline the previous quarter, as its chairman remains missing amid a criminal investigation

Most of Douyu International Holdings (NASDAQ: DOYU)’s key metrics fell by 20% or more in the first quarter, including a 30% revenue decline and 24% drop in its average revenue per user

The company has been led by a three-member interim management committee since its chairman and CEO was detained last November on suspicion of illegal gambling activity

🇨🇳 Weibo pins hope on Olympics to boost its advertising revenue (Bamboo Works)

The veteran Chinese social media platform been losing market share to video-based competitors such as Douyin, Kuaishou and Xiaohongshu

Weibo Corp (NASDAQ: WB)’s first-quarter revenue fell 4%, hit by declining income from advertising and value-added services

The company is banking on the Olympics and summer vacations to boost revenues later in the year

🇨🇳 RoboSense Technology: Pre-IPO Investors and Shareholders May Sell Shares As IPO Lock-Up Ends in July (SmartKarma) $

Shares of RoboSense Technology (HKG: 2498), a mass producer of LiDAR products and perception solutions, rose ~86% since IPO and outperformed Hesai Group and Hang Seng Index on a YTD basis.

Founder-Led LiDAR company priced its IPO at HK$43/share and raised ~HK$1B gross proceeds in January. RoboSense shares fell on first day of public trading on the Hong Kong stock exchange.

Today, RoboSense Technology became the most valuable LiDAR company in the world and is now valued at roughly $4.6B.

🇨🇳 Fourth Paradigm tries to shift investor perception with new platform launch (Bamboo Works)

The AI company whose products help enterprises improve their efficiency said its revenue rose 28.5% in the first quarter

Beijing Fourth Paradigm Technolgy Co Ltd or 4Paradigm (HKG: 6682) said its first-quarter revenue rose 28.5%, while its gross margin slipped on higher R&D spending as it launched a new platform

The company’s stock is undervalued compared with its peers, with its shares now down nearly 10% from their IPO price last September

🇨🇳 Onewo (2602 HK): Major Share Repurchase Mandate Announced (Up To HKD5.8bn, 20% Of Current MKT CAP) (SmartKarma) $

Onewo Inc (HKG: 2602), a leading China property management company with the controlling shareholder being Vanke (HKG: 2202 / SHE: 000002 / FRA: 18V / OTCMKTS: CHVKF / CHVKY), announced a major share repurchase mandate last night.

The company intends to repurchase its shares in the open market up to HKD5.8bn, which is around 20% of the current market cap.

The company is trading at 13x 2024E PE on around 15% net profit growth in 2024E, and at 5% forward dividend yield.

🇨🇳 Weak China car market puts brakes on Cheche’s growth (Bamboo Works)

The Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY)–backed auto insurance platform’s revenue was flat in the first quarter, underscoring challenges for companies across China’s auto ecosystem

Cheche (NASDAQ: CCG)’s net revenue rose 1% year-on-year in the first quarter, lagging growth rates for the value and number of transactions on its platform

The results indicate both insurance underwriters and Cheche are facing pricing pressure from growing competition in a sluggish auto market

🇨🇳 Pop Mart (9992 HK): Accelerating Momentum Internationally; Raising My Estimates (SmartKarma) $

In 1Q24, Pop Mart International Group (HKG: 9992 / FRA: 735)‘s international sales grew around 250% yoy, and made up around one quarter of sales (vs. 17% of sales in 2023).

I now expect 39% sales growth in 2024, driven by 140% yoy growth in the international business and 18% growth in domestic China business.

I further expect a 50% yoy growth in net profit growth in 2024 driven by a 0.8ppt increase in gross margin and 0.5ppt in operating leverage.

🇨🇳 Can pillow sales prop up Atour’s soft stock? (Bamboo Works)

Investors were unimpressed by the hotel operator’s strong first-quarter profit growth, reflecting continued caution about the company’s prospects

Atour Lifestyle Holdings (NASDAQ: ATAT)’s first-quarter profit surged more than 14-fold to nearly 260 million yuan

The hotel operator’s retail business selling in-room items to guests has become a major growth driver, with quarterly sales more than tripling year-on-year

🇨🇳 FAST NEWS: Trip.com issues $1.3 billion convertible notes (Bamboo Works)

The Latest: China’s leading online travel agent Trip.com (NASDAQ: TCOM) announced on Wednesday that it plans to issue $1.3 billion of convertible senior notes due 2029, with an option to issue up to an additional $200 million principal amount of the notes.

Looking Up: This issuance of convertible notes allows the company to obtain a large amount of capital at only 0.75% per annum. In addition, it will help reduce the company’s debt ratio if investors convert the notes into stock at maturity.

Take Note: If investors convert the convertible notes into shares, this will result in an expansion of the company’s share capital and dilution of existing shareholders’ equity.

🇨🇳 UPDATE: China Medical System (CMS, 867 HK) – A Cheap Play on China’s Pending Health Care Crisis (SmartKarma) $

A high disease burden, high demand for chronic treatment, and an ageing population makes China an excellent opportunity for an established pharma company.

With 1/3 of the market cap in cash, a healthy payout ratio, and a FPE of under 8, China Medical System Holdings Ltd (HKG: 0867 / FRA: 2M7C / OTCMKTS: CHSYF) is one of the bargain beneficiaries in the Chinese healthcare space.

The founder/CEO recently purchased 8m shares. He last bought shares in 2020-2021. The share price almost tripled afterwards.

🇨🇳 Coffee goes off the boil in China as Tims, Luckin and Starbucks report Q1 slump (Caixin) $

China’s coffee market declined in the first quarter, as leading brands like Tim Hortons (Restaurant Brands International Inc (NYSE: QSR)), Luckin Coffee (OTCMKTS: LKNCY), and Starbucks Corp (NASDAQ: SBUX) struggled to meet expectations amid economic uncertainties and shifting consumer behaviors in the world’s fastest-growing coffee market.

TH International (NASDAQ: THCH), known as Tims China and the exclusive operator of Canadian brand Tim Hortons coffee shops in China, released its financial results for the first quarter Wednesday. Despite a 3.1% increase in revenue, growth was primarily driven by franchise and other revenues, while self-operated store revenue rose a mere 0.2% year-on-year, and same-store sales fell by 11.7%. The company reported a net loss of 143 million yuan ($20 million), a slight improvement from the same period last year.

🇨🇳 WH Group Ltd ADR: Where Pigs Make Money (Seeking Alpha) $

WH Group Ltd (HKG: 0288 / FRA: 0WH / 0WHS / OTCMKTS: WHGLY / WHGRF) is a growing producer, processor, and distributor of fresh meat from hogs, packaged processed meats, and poultry.

China’s dominance in various industries, including hog meat production, makes WH Group a worthwhile long-term buy opportunity.

The stock is slightly risky due to geopolitical vagaries and headwinds facing the global pork and packaged meat businesses.

🇨🇳 Are Chinese Stocks Ripe for Your Picking? (The Smart Investor)

After a tough 2023, are Chinese stocks still a viable investment option? Or should investors remain cautious?

Here are three Chinese stocks that have performed well throughout this period.

China National Offshore Oil Corporation (CNOOC) (HKG: 0883 / SHA: 600938 / FRA: NC2B) is China’s largest offshore oil and gas producer. The state-owned business covers oil and gas exploration and development, refining services, and other operations in the energy industry.

China Mobile (HKG: 0941 / 80941 / FRA: CTM) is a leading Information and communication technology (ICT) services provider in mainland China and Hong Kong.

Haitian International (HKG: 1882 / FRA: HI6) is one of the leading global companies in the manufacturing of plastic injection moulding machines.

🇨🇳 Test results for new cancer drug take Akeso investors on wild ride (The Smart Investor)

Shares in the Chinese pharmaceutical company swung back and forth as investors tried to make sense of clinical trial data for an immunotherapy drug billed as a potential world beater

A Chinese clinical trial has indicated that Akeso (HKG: 9926 / FRA: 4RY / OTCMKTS: AKESF)’s bispecific antibody is more effective than Merck’s top-selling Keytruda for treating a type of lung cancer, although investors were initially disappointed with the outcome of another study

The ivonescimab drug been approved for marketing in China and the company has shipped a first batch worth more than 100 million yuan

🇨🇳 CSPC Pharma weighs up diet drug for bigger bottom line (The Smart Investor)

After three years of sluggish growth, the company has delivered higher quarterly earnings from sales of existing drugs and is exploring new avenues in the weight-loss business

CSPC Pharmaceutical Group (HKG: 1093 / FRA: CVG / OTCMKTS: CHJTF) beat market forecasts with double-digit growth in first-quarter revenues and profits, driven by rising sales of drugs to treat strokes and dementia

The company has dozens of candidate drugs in the pipeline, under the direction of a reconfigured management team

🇭🇰 MTR Corporation (66 HK) (Asian Century Stocks) $

Hong Kong public transport monopoly and property developer at 13x forward P/E

MTR Corporation (HKG: 0066 / OTCMKTS: MTCPY) (US$21 billion) is the operator of Hong Kong’s world-famous MTR subway system.

It runs 99 MTR stations and 68 light rail stops, handling over 5 million passengers each day. And it’s a complete monopoly, with zero competition in the rail sector.

The company has been given a concession to run the MTR system for 50 years, from 2007 to 2057. Chances are high though that it will be extended for another 50 years at no extra cost. If so, MTR will retain its monopoly until 2107.

What makes MTR unique is that it only only operates Hong Kong’s MTR system, it also builds property in and around its stations.

🇲🇴 Melco Resorts renews US$500mln share repurchase plan (GGRAsia)

Casino developer and operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) says its board approved a new three-year share repurchase programme. The firm’s management is authorised to carry out on-market repurchases up to an aggregate of US$500 million, the company announced on Monday.

“The new programme is effective immediately and replaces the three-year share repurchase programme that was announced in June 2021 and which has expired,” stated the U.S.-listed casino operator.

Melco Resorts operates casinos in Macau, as well as City of Dreams Manila (pictured) in the Philippine capital. It also has a monopoly licence in the Republic of Cyprus, where its flagship resort is City of Dreams Mediterranean. The company has recently announced investment in the casino portion of a resort in Sri Lanka.

🇹🇼 ChipMOS: Still On Track To Go Higher (Seeking Alpha) $

The stock has struggled in the last couple of months, but there is reason to believe the bull case remains warranted.

ChipMOS Technologies (NASDAQ: IMOS) hit a new 2024 low on the back of the first contraction in revenue in many months, which challenges the notion demand is improving.

There is an argument to be made the market overreacted because there were exceptional circumstances at work, which led to the revenue contraction.

There are a number of arguments to be made in favor of long IMOS, which is why it is worth backing despite the recent price action.

🇰🇷 Growing Investor Interest And Value Enhancement Plan Make KB Financial A Buy (Seeking Alpha) $

Investors are paying more attention to listed Korean banking companies, as evidenced by recent news articles and analyst reports.

KB Financial Group (NYSE: KB) will be announcing details of its new value enhancement plan in the fourth quarter of the current year, which might include capital return improvement and corporate restructuring initiatives.

KB’s shares are attractively valued, considering that it is trading at a mid-single digit P/E multiple and a P/B ratio of under 0.6 times.

🇰🇷 Impact on SK Inc Post Record Divorce Ruling for SK Group Chairman Chey Tae-Won (Douglas Research Insights) $

We discuss the outlook for the likely impact on SK Inc (KRX: 034730) post record divorce ruling for the SK Group Chairman Chey Tae-Won and his estranged wife Roh So-Young.

Last week, a South Korean appellate court ordered Chairman Chey to pay 1.38 trillion won to Roh. Chey is appealing this case and the Supreme Court’s ruling is still pending.

It is in the best interest of SK Inc to raise the overall value of the company since the payment of the divorce is mostly based in cash.

🇰🇷 GS Retail: Equity Spin Off of Parnas Hotel and Freshmeat Subsidiaries (Douglas Research Insights) $

On 3 June, GS Retail (KRX: 007070) announced that it will spin off Parnas Hotel and Freshmeat subsidiaries to simplify its business structure and enhance shareholder value.

The company plans to create a new entity tentatively called Parnas Holdings which will include Parnas hotel and Freshmeat (a meat processing company).

We have a positive view of GS Retail’s decision to conduct this equity spin off which simplifies the business structures and it could raise the valuation multiples of GS Retail.

🇰🇷 Initial Thoughts on the Yanolja IPO (Douglas Research Insights) $

Yanolja is getting ready to complete its IPO in the US in the next several months. Softbank invested about US$1.7 billion in Yanolja in 2021.

The valuation of Yanolja could be between US$7 billion to US$9 billion. The company could raise nearly US$400 million in this IPO.

Overall, we are concerned about the valuations of Yanolja if indeed the bankers push ahead with the IPO at the valuation range of US$7 billion to US$9 billion.

Yanolja is the largest travel app in Korea and it is also considered to be one of the largest property management software provider in the world.

🇰🇷 Shift Up Delays the IPO and Stellar Blade Tops Number One Game in the US in April (Douglas Research Insights) $

On 5 June, Shift Up announced that it will be postponing its IPO to July. The original book building period for the institutional investors was from 3 to 13 June.

The final book building date has been postponed to 27 June. The subsequent public offering subscription for general investors was also postponed to 2 to 3 July.

A major investment positive of Shift Up is enormous initial success of Stellar Blade which was the best selling game in the U.S. and numerous other countries in April 2024.

🇰🇷 GKL, Paradise Co May casino rev down m-o-m (GGRAsia)

May sales at Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, fell 9.2 percent month-on-month, to approximately KRW29.45 billion (US$21.47 million). A market rival in the foreigner-only sector, Paradise Co Ltd (KOSDAQ: 034230), reported May casino revenue of nearly KRW78.67 billion, a 5.2-percent decline from April.

🇰🇷 Lotte Tour casino sales at nearly US$20mln in May (GGRAsia)

Lotte Tour Development (KRX: 032350), the promoter of the Jeju Dream Tower casino resort (pictured) on South Korea’s Jeju Island, reported casino sales of just under KRW27.11 billion (US$19.7 million) for May, up 32.9 percent sequentially. Judged year-on-year, such sales rose by 137.4 percent, according to a Monday filing.

Lotte Tour confirmed to GGRAsia in April that the company had opened a marketing office in Osaka, Japan, traditionally an important target market for South Korean gaming firms.

The company also had plans to open a Tokyo liaison office, coinciding with the launch of a direct flight between Jeju and Tokyo, according to a spokesperson.

🇰🇭 Moody’s affirms NagaCorp’s rating, outlook now stable (GGRAsia)

Moody’s Ratings has affirmed the ‘B3’ corporate family rating of Hong Kong-listed Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF), as well as the ‘B3’ senior unsecured rating of the firm’s U.S. dollar bond, the latter guaranteed by the major operating subsidiaries of NagaCorp.

The rating agency changed NagaCorp’s outlook to ‘stable’, from negative, according to a Wednesday report.

NagaCorp, operator of NagaWorld (pictured), a casino resort monopoly in the Cambodian capital Phnom Penh, drew down last week US$70 million of an US$80-million shareholder loan it received in October last year.

🇲🇲 Yoma Strategic – betting on peace in Myanmar (Undervalued Shares)

Yoma Strategic Holdings is an easy play on Myanmar. Its stock is listed on the Singapore Stock Exchange and reasonably liquid.

It has doubled over the past two months but remains way off its pre-war high.

Yoma Strategic Holdings (SGX: Z59 / FRA: O3B / OTCMKTS: YMAIF) (ISIN SG1T74931364, SG:Z59) has been listed in its current form in Singapore since 2006. With a market cap of around USD 145m, it is reasonably accessible for private investors.

Yoma is one of Myanmar’s leading conglomerates, with activities in real estate, mobile financial services, leasing, food and beverages, automotive and heavy equipment.

🇸🇬 Riding the AI Wave with Data Centres: 5 Singapore REITs and Business Trusts for Your Watchlist (The Smart Investor)

The rapid expansion of Artificial Intelligence and Machine Learning has led to a higher demand for data centre space. Here are five Singapore REITs and business trusts that stand to benefit from this trend.

🇸🇬 Better Buy: First REIT Vs Parkway Life REIT (The Smart Investor)

🇹🇭 Thai casinos opportunity has risk constraints: analysts (GGRAsia)

“I’m very sceptical at this stage that Thailand is going to have have the wherewithal to actually create an industry with scale,” said Vitaly Umansky (pictured, right), gaming analyst at Seaport Research Partners.

In late March, Thai lawmakers supported a study recommending casinos be permitted in large entertainment complexes proposed for that nation. Thailand’s Ministry of Finance is leading work to examine the feasibility of legalising casino resorts in the country.

Eventually by 2030 there could be in Thailand around two US$1-billion casino properties, Mr Umansky forecast.

🇳🇿 Asian Dividend Gems: Fonterra Shareholders Fund (Asian Dividend Stocks) $

Fonterra Shareholders’ Fund (NZX: FSF / ASX: FSF / OTCMKTS: FTRRF)’s dividend yield was 14.2% in 2023. Its dividend yield averaged 8.7% in the past three years.

Fonterra Co-Operative Group, is a New Zealand based multinational dairy cooperative. Outside investors who are not allowed to hold shares in Fonterra Co-Operative Group can invest in Fonterra Shareholders Fund.

In May 2024, Fonterra announced that it plans to sell off its consumer products businesses and concentrate on business to business sales as a dairy ingredients supplier.

Fonterra is the ninth largest dairy company in the world, based on 2022 sales data. There are two other Asian dairy companies that are among the top 10 in the world including Inner Mongolia Yili Industrial Group Co (SHA: 600887) (China, ranked number 5) and China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) ranked number 8).

🇮🇳 The Beat Ideas: Indiabulls Housing- A New Era in Housing Finance (SmartKarma) $

Indiabulls Housing Finance Ltd (NSE: IBULHSGFIN / BOM: 535789) Raised INR 3,693 crores through rights issue, issued $350 million bond.

Strong balance sheet, low NPAs, poised for growth in the retail housing via its asset light model.

Rebranding to Samman Capital signals new phase of the company with multi-year growth guidance.

🇮🇳 Wipro: Turnaround Interrupted (Seeking Alpha) $

Hopes of an eventual Thierry Delaporte-led Wipro Ltd (NYSE: WIT) turnaround have been dashed.

The next chapter looks to be status quo under company veteran Srini Pallia.

Wipro’s valuation offers little buffer against either governance risks or growth/margin challenges.

🇸🇦 Saudi Aramco’s $12 Billion Share Sale Quickly Sells Out, but Who is Buying? (OilPrice.com)

The Saudi Arabian Oil Co (TADAWUL: 2222) US$12 billion share sale sold out shortly after the deal opened.

Aramco’s share sale comes at a time when oil prices remain depressed mainly due to concerns about weak global demand.

Details of the split between local and foreign investors in the offering are yet to emerge.

🌍 African fintechs driving financial inclusion, profitability – Imara (Capital Markets Africa)

🌍 Asset managers assess Africa’s best investments (FT) $ 🗃️

🇿🇦 Foschini Group share price rises sharply after strong dividend payout (IOL) $

The The Foschini Group (JSE: TFG) share price was the biggest gainer on the JSE on Friday, closing 11.3% higher after it reported a 33% uplift in its final dividend to 200 cents a share for the year to March 31.

The share prices of the two other largest clothing groups on the JSE, Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY) and Truworths International Ltd (JSE: TRU / FRA: IUE / OTCMKTS: TRWKF), were also top gainers on the bourse, with their share prices ending Friday 5% and 5.16% higher, respectively.

TFG chief executive Anthony Thunström said they had grown revenue aggressively at the expense of competitors and had managed costs tightly.

The group has a portfolio of 34 retail brands, with over 4700 outlets in 23 countries on five continents, offering products including fashion and sport apparel, jewellery, cosmetics, electronics, homeware and furniture.

🇿🇲 Exclusive: Zambia’s first REIT lists on local exchange (Capital Markets Africa)

The US dollar quoted REIT is expected to change the fortunes of Real Estate Investments Zambia Ltd.

Real Estate Investments Zambia Plc (LuSE: REIZ), a listed Zambian company, has launched the country’s first ever Real Estate Investment Trust (REIT). The REIT will be traded in US dollars and is expected to change the fortunes of the business, which has been plagued by different problems in recent years.

As for the broader African market, REITs already exist in countries such as South Africa, Ghana, Nigeria, and Kenya.

REIZ Plc is majority owned by Diego Cassilli, a Zambian businessman, via Mauritius-registered LM&C Properties Limited.

🌎 MercadoLibre: Cracks In The Facade? Accounting Changes And Slowdown (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) is a high-quality business with exposure to eCommerce and Fintech in Latin America.

Recent accounting changes have complicated the interpretation of key performance indicators and indicate a deceleration in the underlying business.

The stock’s high valuation and potential deceleration make it unattractive in the current environment.

🌎 MercadoLibre: Entry Price Prohibitive In The Near Term (Rating Downgrade) (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) shares have been underperforming the market despite strong revenue and EPS growth.

The company’s success and potential are already reflected in the current price.

Even with very attractive long-term prospects, it’s important to consider entry price and near-term opportunity costs.

🇦🇷 YPF Sociedad Anónima: Structural, Fiscal Tailwinds Driving Equity Gains (Seeking Alpha) $

Ypf Sa (NYSE: YPF) stock has increased by over 95% since the 2023 Argentinian presidential election results.

The new government’s ambitious target of reducing the budget deficit has led to significant spending cuts, particularly in non-discretionary spending.

YPF has potential tailwinds, including record-high oil production in the Neuquen region and the construction of a new oil pipeline, which could be major catalysts for the company.

🇦🇷 Argentina Prepares for Oil IPO As Milei Reform Gets Underway (OilPrice.com)

Argentine oil driller Petrolera Aconcagua Energia SA is making arrangements to join the country’s stock market to raise funds for expansion as President Javier Milei’s reforms start to attract capital back to Argentine markets, the Buenos Aires Times has reported. Last month, Aconcagua revealed that it’s bidding for aging oil fields being sold by state-run giant Ypf Sa (NYSE: YPF) as the company looks to expand its current production clip of 13,500 boe/d. It isn’t clear yet if the Petrolera exploration and production unit would list alone, or if the entire Aconcagua Energía group will be involved in the upcoming IPO.

Aconcagua is hardly alone in its quest to go public. Last year, New York-listed Corporación América Airports (NYSE: CAAP) filed a prospectus that allows it to sell up to US$250 million of new stock in one or several offerings. CAAP stock has jumped 66% over the past year to give the company a valuation of $2.9B.

🇧🇷 Unlocking Value: Why Brazilian Small Caps are a Hidden Gem (Giro’s Newsletter)

iShares MSCI Brazil Small Cap ETF (NASDAQ: EWZS)

🇧🇷 Afya’s Results Are Improving And The Market Is Undervaluing It (Seeking Alpha) $

Afya (NASDAQ: AFYA) reports strong 1Q24 results with revenue up 13%, adjusted EBITDA up 20%, and net income up 77%.

The company increases its total approved seats to 2,500 through acquisitions and organic growth.

Afya’s valuation becomes more attractive as the stock price decreases, trading at an EV/NOPAT ratio of 11x.

🇧🇷 PagSeguro Q1 2024 Earnings: Still A Good Opportunity (Seeking Alpha) $

PagSeguro Digital (NYSE: PAGS)‘s 1Q24 results exceeded market estimates, beating revenue estimates by 6.9% and profit estimates by 9.4%.

The company is expanding its low-risk and profitable products while launching new and promising ones.

Despite the positive factors, PAGS trades with a P/E discount of more than 9% to its peers.

🇧🇷 Cosan: Q1 2024, Waiting For Deleveraging (Seeking Alpha) $

(bioethanol, sugar and energy conglomerate) Cosan SA (NYSE: CSAN) released results with ups and downs in each of its subsidiaries.

The big highlight was the simplification of investment in Vale (NYSE: VALE), while deleveraging is slow.

The company has perennial businesses vital to the energy transition, and remains cheap compared to its peers.

🇧🇷 BB Seguridade: Profitable, Resilient, And Poised For Growth (Seeking Alpha) $

As a key subsidiary of Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)‘, BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) excels in various insurance sectors, such as Rural and Credit Life insurance, leveraging its extensive market reach.

The company has a profitable business model, with a significant market share in essential segments and private partners that increase its reach.

BB Seguridade is a cash-generating machine and a good dividend payer, with a sustainable dividend yield close to 10%. However, it faces risks such as dependence on Banco do Brasil and operational execution.

🇧🇷 BB Seguridade: Decent Results, Valuation Remains Attractive (Seeking Alpha) $

BB Seguridade (BVMF: BBSE3 / OTCMKTS: BBSEY) released decent results, with revenues beating market estimates.

Despite some occasional setbacks, there were excellent operational trends, such as record funding in the pension segment.

Presenting an excellent combination of growth and dividend payments, the company has a 7.5% discount to the average P/E of its peers.

🇲🇽 All Mexican stocks part 3: Bigger is better? First new position found (Bos Invest Substack)

I discuss the valuation of some of Mexico’s largest companies, like America Movil, the largest bank of Mexico, airports, and a new addition to my portfolio.

In part 3 we see some of the more well-known companies of Mexico. America Movil, controlled by Carlos Slim, the richest man in Latin America and 11th in the world with $105B (was the richest man in the world from 2010 till 2013). We will dive deeper into telecom. Furthermore, I will take a serious look at Mexican banking.

Without further delay I will now discuss the following companies on the Mexican stock exchange.

🇲🇽 Wal-Mart de México: From Hold To Buy, Strength In The Face Of Persistent Headwinds (Seeking Alpha) $

Wal-Mart de Mexico SAB de CV (BMV: WALMEX)‘s Q1 revenue growth was strong at 9.8% YoY, signaling favorable tailwinds and a potential decrease in near-term headwinds.

The company’s performance in the core Mexican market is driving growth, with higher revenue and EBITDA figures compared to Central America.

Despite ongoing headwinds, Walmex’s strong growth and potential for continued growth make it a buy, especially with the aggressive store growth cadence.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 ‘Father of emerging markets’ Mark Mobius turns bullish on China stock as property measures restore confidence (SCMP) 🗃️

The 87-year-old fund manager, who last month said China stocks ‘not attractive’, now believes they are ‘beginning to look good’

A recent trip to southern China, where he saw signs of recovery first-hand, had an impact on his thinking too

His new hedge fund, the Mobius Emerging Opportunities Fund, will be offered to global investors in September. It aims to raise up to US$1 billion from sophisticated investors, with a minimum investment of US$500,000.

Mobius and his team will use artificial intelligence tools to look through the financial statements of listed companies in China, Hong Kong, Taiwan, Turkey, India and South Korea to choose 30 stocks which make good use of technology to achieve growth.

🇨🇳 In Depth: Why China’s Tightening Its IPO Regulation (Caixin) $

China introduced new stock market guidelines to address regulatory shortcomings and improve market quality, but they risk undermining the IPO system overhaul from five years ago.

The guidelines, focusing on stricter oversight and regulation, tighten IPO criteria and enhance pre-IPO review responsibilities, potentially deterring small innovative companies.

Analysts predict these measures will decrease IPO activity and overall financing, with a forecasted 56% to 71% drop in IPO proceeds this year.

🇨🇳 Red Sea crisis causes gridlock as Chinese exporters try to beat U.S. tariff deadline (Caixin) $

The combination of capacity constraints due to the Red Sea crisis and a surge in Chinese exports has increased congestion at docks around the world, with Southeast Asian ports like Singapore hit the hardest.

From May 27 to June 2, the punctuality rate of the world’s major ports dropped to just 44.47%, down 4% from the previous week, according to the Shanghai Shipping Exchange’s punctuality rate report released Thursday.

🇨🇳 Welcome in: Chinese hotels are told to stop rejecting foreigners (FT) $ 🗃️

🇨🇳 In Depth: Logistics is getting pricy in China, but reform will be a long haul (Caixin) $

China’s powerful e-commerce economy was built on the back of a robust logistics infrastructure that allows consumers to receive items ordered on platforms within days, or even hours.

That’s the conventional wisdom. But the success story masks deeper flaws and inefficiencies in Chinese logistics. One is that shipping goods in China relies heavily on trucking. The relatively expensive freight mode drove up overall logistics costs to 18.2 trillion yuan ($2.5 trillion) in 2023, equaling 14.4% of China’s GDP — far surpassing the proportions in the USA (7%) and Japan (5%).

🇭🇰 Hong Kong is far from over (AmCham HK)

Earlier this year, the economist Stephen Roach, now teaching at Yale University’s School of Management, wrote a controversial article in the Financial Times asking the question, “Is Hong Kong Over?” (It pains me to say Hong Kong is over (FT) $ 🗃️) in the Financial Times of London. The article caused an uproar in a wounded Hong Kong, in part because Professor Roach had been a resident of Hong Kong from 2007 to 2012, as chairman for Asia with Morgan Stanley. He wrote a follow-up article that was published in the South China Morning Post, explaining why he thought of the article more of a call to action than a death knell, and AmChamHK e-Magazine reprinted both articles, with permission, in its March-April issue.

One of the critics is Kin Chan, partner of Argyle Street Asset Management. Here he is in conversation with AmChamHK e-Magazine editor Edith Terry to talk about his views of Hong Kong’s future. Spoiler alert: He thinks the diverse community that Hong Kong attracts will need a different mindset and skill set than his own, which is impressive enough, with degrees from Princeton and Wharton.

🇮🇳 India’s Largest Exchange Took Major Move To Improve Price Efficiency (Smart Karma) $

Overall, the introduction of the price-linked tick size mechanism by the NSE is a positive development as it leads to improving market efficiency and enhancing price discovery.

This move is likely to benefit investors by reducing slippage costs and improving liquidity, especially for small-cap and mid-cap stocks.

The move is also evidence of intense competition between NSE and BSE. BSE earlier was the only exchange to offer reduced tick size.

🇮🇳 India election strips Narendra Modi of his ‘aura of invincibility’ (FT) $ 🗃️

🇿🇦 ANC risks fraying SA’s international trade, geopolitical interests with unfavourable coalitions (IOL)

Analysts have warned that South Africa is between a rock and a hard place, with future economic progress and stability hinged on the decisions political leaders make before the swearing in of the new government administration later this month.

An outright coalition with the DA was seen as economically sound but politically incorrect while a tie up with either the EFF and or the uMkhonto weSizwe Party (MKP) could saddle President Cyril Ramaphosa with huge radical policy shifts.

🇿🇦 Fitch Ratings warns SA must retrain its governance mandate (IOL)

Fitch Ratings has warned that the ANC’s pursuit of coalition partners to retain its governance mandate, after plunging below the required 50% majority threshold, could significantly affect South Africa’s credit profile.

Fitch Ratings said South Africa’s debt trajectory would face additional risks if the ANC enters into arrangements that rely on support from the MKP or EFF.

🇿🇦 MKP’s radicalism will drive away the private sector from KZN ports sector, warn analysts (IOL)

BMI Country Risk and Industry Analysis, a Fitch Solutions company, has warned that the stated desire by the uMkhonto weSizwe Party (MKP) to reverse the privatisation of the Durban Container Terminal and the Richards Bay Terminal will drive away private sector involvement in the country’s ports sector.

🇿🇦 South African opposition parties cool on Cyril Ramaphosa’s unity government plan (FT) $ 🗃️

Leaders of EFF and MK pour cold water on proposal for coalition that includes centrist DA

“The problem with Cyril is he plays the long game so much he forgets to play the short game,” Steinberg said.

🇲🇽 Five challenges facing Mexico’s Claudia Sheinbaum (FT) $ 🗃️

Big budget deficit and record number of murders top the president-elect’s worries

The fiscal deficit

Organised crime and violence

Pemex’s parlous finances

Relationship with the US

Following López Obrador

🇲🇽 Mexico’s peso hit by election fallout as left-wing party cements its power (FT) $ 🗃️

Currency on track for the worst week since the start of pandemic as investors digest outcome of vote

“The reforms are worrying because they deteriorate the rule of law in the Mexico,” Siller said. “This could contaminate the real economy. Fear translates into caution, and business owners could now opt to pause investment projects.”

🇲🇽 Mexico’s elite struggles to comprehend left’s landslide election win (FT) $ 🗃️

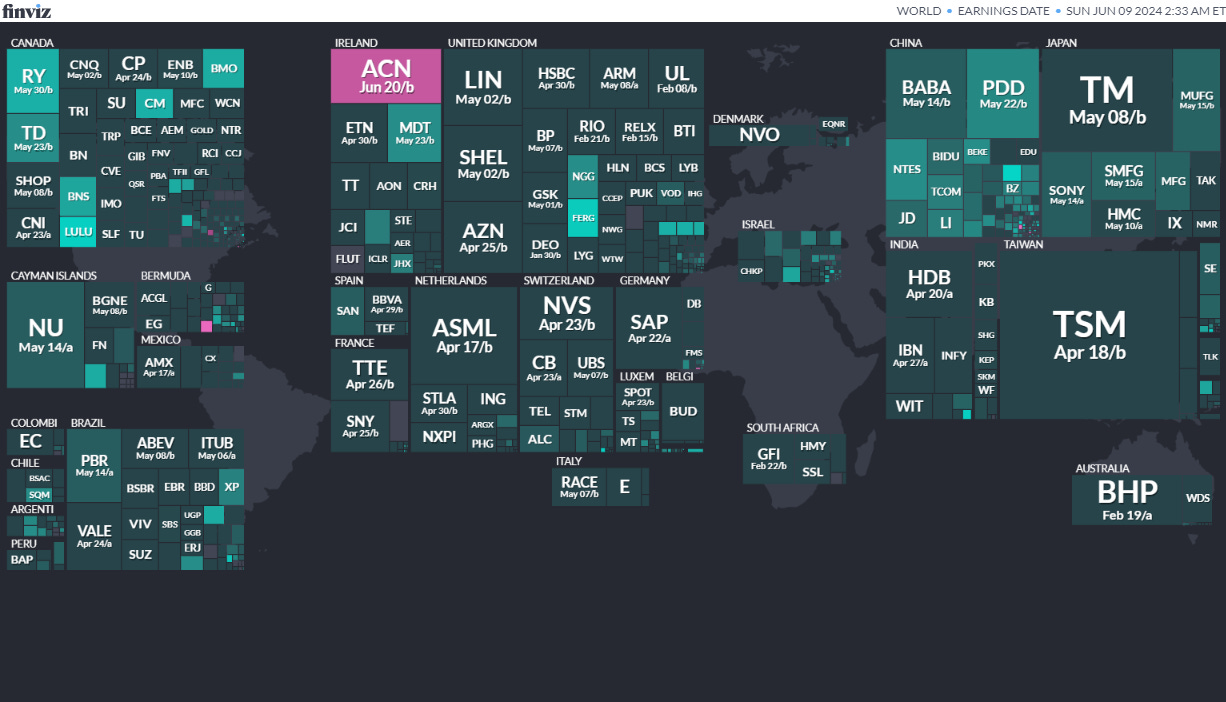

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

MexicoMexican SenateJun 2, 2024