Emerging Market Links + The Week Ahead (June 17, 2024)

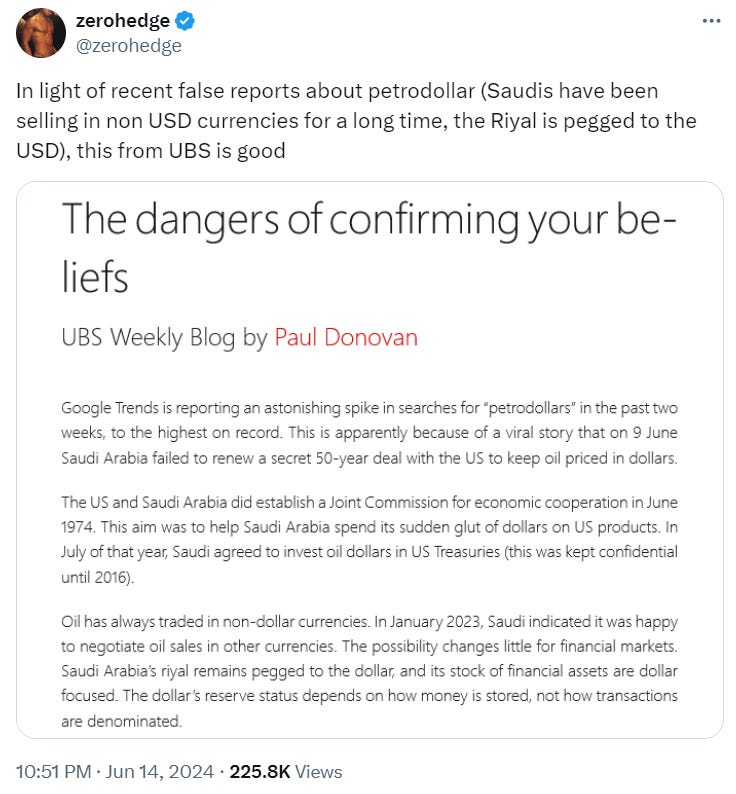

Last week, there were apparently stories circulating the crypto world and the Twittersphere that a so-called Petrodollar agreement between the US and Saudi Arabia had expired. Zerohedge had to set the record straight by tweeting out a screenshot of a UBS report that conveniently left off the last paragraph:

The screenshot below contains the last paragraph of the UBS piece:

In other words, reports of the Dollar’s demise have been greatly exaggerated and don’t believe everything you hear or want to believe…

Many people in emerging and frontier markets (where there is often a dearth of investment options) also view the dollar in the same manner as they view gold, Toyotas, and high quality (usually Japanese made) white goods – as a store of value and that belief is not going to change overnight. Long into the declines of the Roman and Spanish empires, people still had and were using Roman coins and Spanish pieces of eight. They may have transacted less in them, but they still kept them as a store of value…

Finally, Martin Armstrong often points out in interviews that unlike just about every other country, the USA has never cancelled its currency – which appears to be a tradition in Europe: Europe’s Practice of Cancelling Currency – The Dirty Little Secret Everyone Overlooks & European Tradition of Cancelling the Currency (and this is not even counting what happened to old currencies in places like France, Russia, China, South Vietnam, etc. after revolutions, etc.).

$ = behind a paywall

-

🌐 Publicly Listed Stock Exchange Stocks (Mid-2024) Partially $

-

There are close to 30 publicly listed stock exchange stocks or other types of publicly listed exchanges (e.g. futures, commodities, etc.) in developed, emerging or frontier markets.

-

-

🌐 EM Fund Stock Picks & Country Commentaries (June 16, 2024) Partially $

-

Why EM investors need to resist latching on to the latest theme (long India, short China), China trip report, evolving BRICS, digesting South Africa + India elections, India infrastructure bets, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 PDD: Untapped Growth Engine With Hidden Cash Potential (Seeking Alpha) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo shows strong momentum and fast-growing operations with a relatively low multiple due to geopolitical risks.

The business generates compounding power through network effects, leading to fast growth and economies of scale.

PDD has significant cash reserves that offer upside optionality for growth, but investors should be aware of the inherent risks of Chinese tech stocks.

🇨🇳 Temu has launched in Brazil, despite all the challenges (Momentum Works)

Last Wednesday (5 June 2024), Temu went live in Brazil, bringing the total number of countries Temu is available in to 70.

Some thoughts (and facts)…:

Would be interesting to watch how far they would grow, and whether they would eventually pose a serious threat to MercadoLibre (NASDAQ: MELI) and Amazon.com (NASDAQ: AMZN) alike.

🇨🇳 DiDi drives back into growth lane, as aggregators encroach on its turf (Bamboo Works)

The company often called the ‘Uber of China’ reported a fifth consecutive quarter of double-digit revenue growth, as it reportedly eyes a listing in Hong Kong

DiDi Global (OTCMKTS: DIDIY)’s first-quarter revenue grew 14.9% to 49.1 billion yuan, marking a fifth straight quarter of double-digit growth

The ride hailing app has moved past earlier regulatory headwinds, but has lost market share to competition and smaller rivals using aggregating platforms

🇨🇳 Zhihu answers investor doubts with improving margins (Bamboo Works)

The company often called the ‘Quora of China’ posted a sharply higher gross margin in the first quarter, but its revenue fell for the first time since its 2021 IPO

Zhihu Inc (NYSE: ZH)’s revenue fell 3.3% in the first quarter, marking its first-ever decline since its New York listing

The company, often called the “Quora of China,” boosted its gross margin by more than 5 percentage points, and said it expects to achieve non-GAAP profitability by year-end

🇨🇳 Lenovo makes critical calculation with Middle East pivot (Bamboo Works)

The PC giant’s new tie-up with the Alat unit of Saudi Arabia’s sovereign wealth fund will give it access to new funds and help it establish a regional headquarters in Riyadh

Saudi Arabia’s Alat subscribed to $2 billion worth convertible bonds from Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF), which the PC giant will use to help strengthen its financial position

Lenovo is stepping up its development efforts in the Middle East and Africa to reduce its exposure to the U.S.

🇨🇳 UP Fintech reaps benefits from early move overseas (Bamboo Works)

The online brokerage posted solid revenue growth in the first quarter as it gained traction in Hong Kong, its newest offshore market

UP Fintech Holding (NASDAQ: TIGR)’s revenue increased 19% year-on-year in the first quarter as its number of funded accounts grew 15%

The online brokerage has entered Hong Kong as its latest new market under a stepped-up international expansion after a major clash with the Chinese regulator

🇨🇳 Caixin Explains: How the EU’s new tariff hikes will affect China-made EVs (Caixin) $

The European Union has decided to provisionally impose extra tariffs of up to 38.1% on battery-electric vehicles shipped from China as part of an ongoing investigation finding that state subsidies are enabling Chinese electric-car makers to undercut their EU rivals, despite divisions in Europe over the issue.

The bloc formally notified carmakers including BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF), Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) and SAIC Motor Corp (SHA: 600104) of the new duties to be implemented from July 4, the European Commission said in a statement Wednesday.

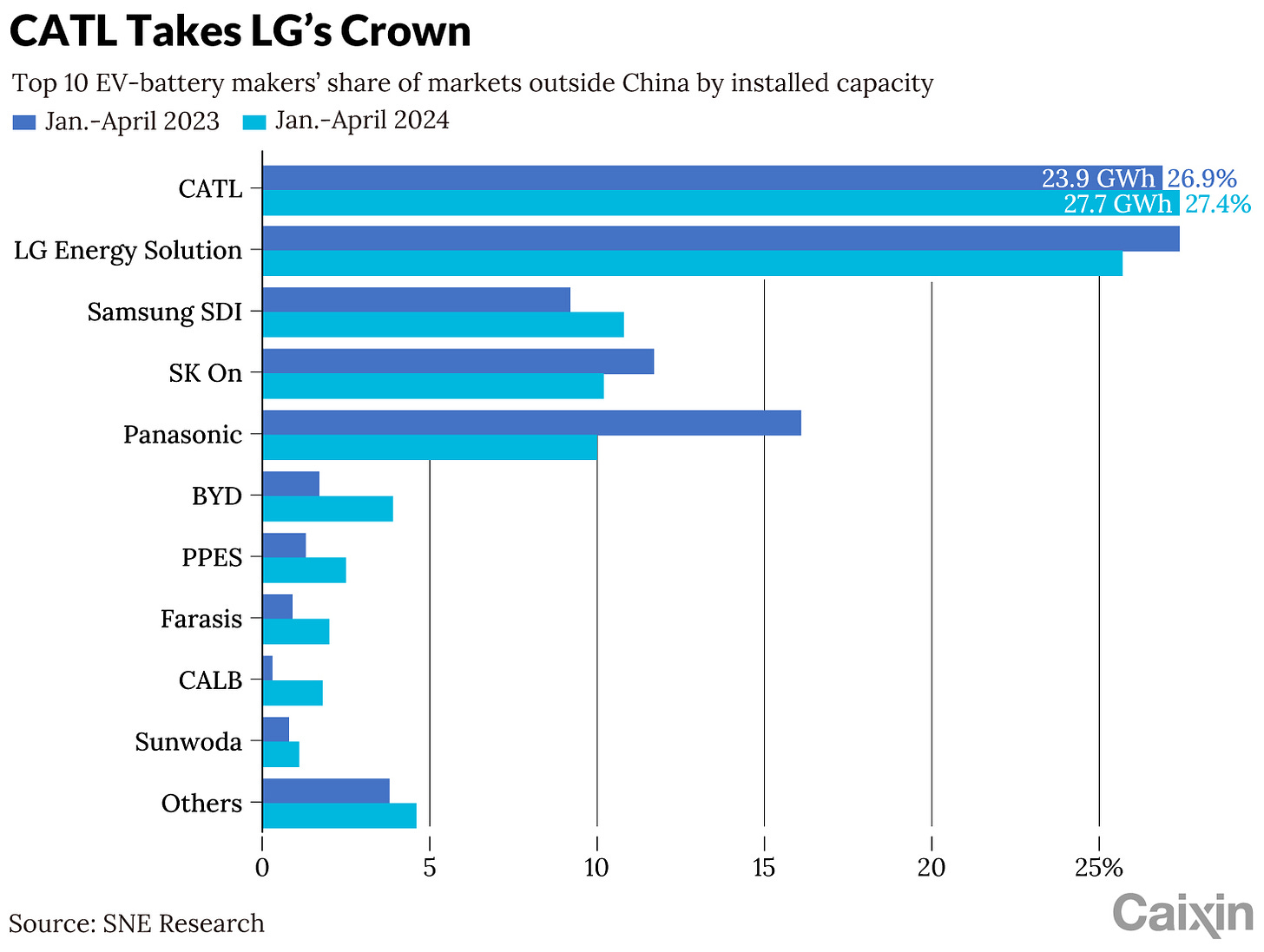

🇨🇳 CATL Overtakes LG as Top EV Battery Supplier for Markets Outside China (Caixin) $

🇨🇳 Shares of Warren Buffett-backed BYD jump after EU unveils lower than expected tariff (FT) $ 🗃️

BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF)

🇨🇳 U.S. Politicians Want to Add Two Chinese Battery Makers to Import Ban List (Caixin) $

A number of republican politicians are calling on the Biden administration to add two Chinese electric vehicle battery makers to an import ban list, accusing the companies of using forced labor in their supply chains.

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), the world’s largest maker of batteries for electric cars as well as a partner to Ford, and Gotion High-tech Co (SHE: 002074 / FRA: 24U0), a battery company partially owned by Volkswagen AG, should be added immediately to an import ban list, the politicians said in two letters sent to Robert Silvers, the Department of Homeland Security Undersecretary.

🇨🇳 Nio in diversification drive as it tries to stem its flood of red ink (Bamboo Works)

With more losses piling up in this year’s first quarter, the high-end EV maker is betting on two new brands targeting the middle and lower parts of the market

NIO Inc (NYSE: NIO)’s loss widened 9.5% year-on-year in the first quarter to 5.26 billion yuan

The company focuses on higher-end electric vehicles, but plans to tap the middle and lower parts of the market with the launch of two new brands

🇨🇳 China Merchants Group pushes forward plan to consolidate cargo operations (Caixin) $

What’s new: China Merchants Group Ltd. (CMG) is pushing ahead with a major restructuring as the state-owned conglomerate moves to consolidate its container line operations amid a global shipping boom.

Antong Holdings (SHA: 600179) plans to issue shares to China Merchants Energy Shipping (SHA: 601872) to buy the latter’s 100% stake in a container liner and 70% stake in a ro-ro shipping company, according to a stock exchange filing dated Thursday.

🇨🇳 China Trip Notes (5/27~6/5) (East Asia Stock Insights) $

Thoughts on Chinese consumers and more

I visited China for 10 days, splitting my time between Beijing, Chongqing, and Datong. It was a mix of family visits, leisure, and business.

I have family in Beijing, so that’s where I usually go, but Chongqing and Datong were new experiences for me. I was impressed with both cities (in different ways) and enjoyed my stays at both.

Staying at leading Chinese brands like Atour Lifestyle Holdings (NASDAQ: ATAT) and JI (H World Group (NASDAQ: HTHT) is comfortable even by Western standards, while still being affordably priced at 300-500 RMB (US$40-70) per night. They may not offer full-service facilities like spas, swimming pools, or five-star restaurants, but they meet the needs of most domestic travelers with comfortable, well-equipped rooms and good customer service.

🇨🇳 $ATAT 101 – Atour Lifestyle Holdings (East Asia Stock Insights)

Atour Lifestyle Holdings (NASDAQ: ATAT) (“the Company”, “ATAT”, “Yaduo”) is the largest upper-midscale ‘manachised’ hotel operator in China. As at 1Q24, the Company boasted 1,302 hotels (~148k rooms) in operation in China, with 97% of total rooms under the capital-light manachised model. Under this model, Atour is only responsible for sending the Hotel Manager and the “Commissar”

Atour collects a capital-light stream of royalties from its franchisees, provides supply chain services, and sells retail products. In turn, the franchisee is responsible for CapEx + location (lease or owned building) and the costs of hotel staff. The Hotel Manager +“Commissar” are also paid for by the franchisee (they are technically on the payroll of Atour, but Atour is reimbursed by franchisees via “monthly hotel managers’ fee”).

Given its capital-light business model and strong cash position, we believe Atour has a high capacity for returning capital to shareholders.

Management has expressed intention to pay dividends this year, and they can be more aggressive in returning capital to shareholders now, especially that Legend Capital has substantially completed its liquidation (with liquidity being less of a constraint for conducting share repurchases).

🇨🇳 Luckin’s Small Step into Non-Coffee Drinks Is a Big Step of Its Future Directions (SmartKarma) $

Luckin (OTCMKTS: LKNCY) launched lemonade drinks with raging success of 5.08 mn cups sold for the first week, ~10% of store sales. Market cheered to send the stock higher;

We view it with mixed feelings. While it is margin accretive and sales enhancing, is not conducive to improving coffee penetration and cultivating consumers’ habit for drinking coffee;

We see Luckin as increasingly one of, instead of the, street drink company, because lemonade is actually the top selling SKU of all milk tea vendors in China.

🇨🇳 Luckin Coffee: Profitable Growth At A Discount (Seeking Alpha) $

China’s coffee market is booming, and it is now likely the world’s biggest.

After doubling its store count in 2023, Luckin (OTCMKTS: LKNCY) holds a market-leading position in China, with its nearest competitors, Starbucks Corp (NASDAQ: SBUX) and Cotti Coffee, struggling to catch up.

Luckin’s Gross Margin of 55% meant that despite the high SG&A costs associated with rapid expansion, it remained profitable.

Luckin’s shares look extremely inexpensive, even after factoring in a China discount.

🇨🇳 Yoox Net-a-Porter exits China to focus on more profitable markets (FT) $ 🗃️

(Richemont (SWX: CFR / JSE: CFR / FRA: RIT1) owned) Luxury ecommerce platform’s decision comes at a time of weaker economic momentum in the mainland

Yoox Net-a-Porter operated in China under a joint venture with Chinese ecommerce group Alibaba (NYSE: BABA), which will be liquidated, according to a person familiar with the matter.

🇨🇳 AI drugs researcher QuantumPharm makes market debut on long road to profit (Bamboo Works)

The newly floated biotech can boast big-name backers and counts more than a dozen biopharma heavyweights among its customers, but it is still awash with red ink

QuantumPharm (HKG: 2228)’s revenues have grown at a compound annual growth rate of 66.7% over the past three years, powered by a bumper contract with Eli Lilly

But the company struggles with client retention, shedding a big chunk of its customer base each year

🇨🇳 InnoScience flies below the radar with rare Hong Kong microchip IPO (Bamboo Works)

The company’s revenue grew fourfold last year as the cutting-edge gallium nitride (GaN) technology behind its microchips and wafers began to mature

InnoScience has filed for a Hong Kong IPO, making it a rare Chinese chip company to try to raise funds from international investors

The company’s revenue grew fourfold last year as its cutting-edge technology matures, but it could face future challenges from lawsuits and geopolitics

🇭🇰 CK Asset: How I would play a recovery of China / Hongkong (Bos Invest Substack)

Quality assets, diversification abroad for Chinese valuation, and low leverage.

My idea is if I can buy CK Asset Holdings Ltd (HKG: 1113 / FRA: 1CK / OTCMKTS: CHKGF) for the value of its international assets I get upside in China/Hongkong for free. In addition, this means the company has more means to sit out the downturn and enough dry firepower to benefit from a recovery.

🇭🇰 L’Occitane International: All Eyes On Privatization Offer (Seeking Alpha) $

The HK$34 per share privatization offer price for L’Occitane International (HKG: 0973 / FRA: COC / OTCMKTS: LCCTF) is +3.8% above its last traded stock price.

Shareholders have the option to accept a “Potential Alternative Share Offer” which might offer greater upside in the scenario that the company is subsequently listed elsewhere at a higher P/E.

I assign a Buy rating to L’Occitane after assessing the potential privatization offer.

🇰🇷 Block Deal Sale of 3.6% Shares of Enchem (Douglas Research Insights) $

After the market close on 14 June, it was reported that Woori PE/other investors will be selling 705,384 shares of (battery electrolyte maker) Enchem Co Ltd (KOSDAQ: 348370) in a block deal, representing 3.6% of outstanding shares.

The block deal discount rate ranges from 6.9% to 8.92%, resulting in potential block deal sale price of 270,500 won to 276,500 won.

We would not subscribe to this block deal and we are concerned about the valuations of Enchem after a sharp share price appreciation this year.

🇰🇷 Another Block Deal Sale of Ecopro Materials (Douglas Research Insights) $

Shares of Ecopro Materials (KRX: 450080) are down 16% today to 112,300 won, due to another block deal sale of by BRV Capital in the after hours trading on 13 June.

After the second block deal sale on 14 June, BRV’s stake declined further from 21.2% to 18.2%.

This block deal sale at a big discount is likely to raise overhang concerns about further block deal sales by BRV Capital in the coming months/years.

🇰🇷 Woori Bank: New Catalysts Ahead (Seeking Alpha) $

Woori Financial Group (NYSE: WF)

South Korea’s economy is recovering after a slowdown caused by a decline in tech exports.

The country’s equities market is showing signs of improvement.

The bounce back in the economy is a positive sign for South Korea’s overall economic health.

🇰🇷 Proposed Merger Between Rebellions and Sapeon – To Challenge Nvidia (Douglas Research Insights) $

On 12 June, SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) confirmed that its affiliate Sapeon plans to merge with its competitor Rebellions by end of this year.

Sapeon and Rebellions’ largest global competitor is NVIDIA Corp (NASDAQ: NVDA). A key aim of the merger is to challenge Nvidia and try to take away its global dominance in AI chips.

If the combined Sapeon and Rebellion can take away just 1% market share resulting in 1% of Nvidia’s market cap, this would suggest valuation of US$31 billion.

🇰🇷 Korean Food Goes Global (Douglas Research Insights) $

One of the key themes this year that has worked well has been Korean food & beverage stocks that have significantly outperformed KOSPI.

Some of the best selling Korean foods (especially overseas) include Samyang Foods Co Ltd (KRX: 003230)‘ instant noodles, CJ Seafood Corp (KRX: 011150)‘s seaweed products, and Wooyang Co Ltd (KOSDAQ: 103840)‘s frozen gimbab.

We prefer a basket approach to investing in Korean F&B stocks. A basket of top 10 F&B stocks in Korea has outperformed the market YTD and this outperformance could continue.

🇰🇷 Tender Offer of Jeisys Medical by Archimed Group (Douglas Research Insights) $

On 10 June, it was announced that France’s Archimed Group is conducting a tender offer of 55.72 million shares of Jeisys Medical (KOSDAQ: 287410) (72% of outstanding shares).

The tender offer period will run from 10 June to 22 July. The tender offer price is 13,000 won.

Archimed also signed a contract to purchase the entire stake (23.2%) held by Kang Don-Hwan (Chairman of Jeisys Medical) and (3.2%) held by a Director Myung-Hoon Lee.

🇲🇾 GEN Malaysia tells AGM upbeat on homeland, NY: report (GGRAsia)

Bigger numbers of tourists from Singapore, Indonesia, China and India travelling to Malaysia have helped boost first-quarter leisure and hospitality revenue for Genting Malaysia (KLSE: GENM)’s monopoly casino resort business in its home market. That is according to comments attributed to management and reported by Malaysian Chinese-language news outlet, Sin Chew Daily.

Genting Malaysia also runs casinos in the United States – via associated businesses – and in the Bahamas, the United Kingdom, and Egypt.

At the Wednesday meeting, Genting Malaysia management reportedly told shareholders the firm’s involvement with the upstate gaming business could help it gain one of the three downstate New York gaming licences that might be decided by late 2025.

🇵🇭 Manila Trip Report – An emerging Pacific tiger? (Part 1) (Pyramids and Pagodas)

Exploring the ground truths Southeast Asia’s fastest growing economy and unearthing investment gems amid Manila’s madness

Initially planned around meeting a Chairman of an exciting listed company (to be covered separately), Altraman’s recent trip to Manila quickly morphed into a slew of meetings with other enterprises. His first stop was the The Philippine Stock Exchange, Inc (PSE: PSE / OTCMKTS: PSKXF) – the holding company itself being a potential play on the market as a whole, where he learned of catalysts such as soaring fintech-driven retail investor participation and government reforms to slash transaction costs. Further afield in Quezon, Altraman met with D&L Industries (PSE: DNL / OTCMKTS: DLNDY), a raw materials manufacturer serving many of the country’s blue chips and multinationals. The ramping up of a major new production facility should allow it to move up the value chain and double revenues.

We will be releasing a two-part Series covering Altraman’s recent trip to Manila, sharing economic insights and highlights of meetings with three locally-listed companies. The first piece provides a glimpse of the country’s past, present, and future amidst enduring inequalities and details two of the investor meetings.

🇸🇬 🇨🇳 China Yuchai: Turning Bullish On Buyback Plan And Improved Outlook (Rating Upgrade) (Seeking Alpha) $

China Yuchai International Limited (NYSE: CYD)‘s potential shareholder yield has been boosted by a new $40 million share repurchase program.

CYD’s outlook has become better, taking into account its peer’s industry sales projection and the latest monthly LNG (Liquefied Natural Gas) HDT (Heavy-Duty Truck) sales numbers.

I raised my rating for CYD to a Buy after assessing its buybacks and growth prospects.

🇸🇬 Great Eastern Holdings (GE SP): Playbook as OCBC Offer Declared Final, IFA Opines NOT Fair (SmartKarma) $

Great Eastern Holdings (SGX: G07 / OTCMKTS: GEHDY) IFA opines that the Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) S$25.60 offer is NOT fair but reasonable as it is below the valuation range of S$28.87-S$36.19 per share.

In response, OCBC declared the price final, and the final closing date is 12 July. Great Eastern will likely breach free float requirements and be suspended when the offer closes.

The offer will likely follow the Boustead Projects/Boustead Singapore blueprint, where SGX RegCo eventually (took seven months) enabled dissenters to receive a fair offer with a 24% uplift.

🇸🇬 Better Buy: Keppel DC REIT Vs Mapletree Industrial Trust (The Smart Investor)

We compare two popular industrial REITs to determine which makes the better investment choice.

After comparing two healthcare REITs last week, we now move back to looking at the industrial REIT space.

This round, we look at two popular industrial REITs – Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF) and Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MINT.

Keppel DC REIT is a pure data centre REIT with a portfolio of 23 data centres located across nine countries as of the first quarter of 2024 (1Q 2024).

MINT, on the other hand, is a diversified industrial REIT with 140 properties across three countries as of 31 March 2024.

🇸🇬 Share Prices of These 3 Singapore Stocks Shot Up 36% or More Year-to-Date: Can Their Run Continue? (The Smart Investor)

These three stocks have performed impressively this year, but could there be more upside for the remainder of 2024?

These businesses could have what it takes for you to add them to your buy watchlist.

Riverstone Holdings (SGX: AP4) is a manufacturer of cleanroom gloves used in highly controlled environments and premium nitrile gloves used in the healthcare industry.

Centurion Corporation Ltd (SGX: OU8) owns, develops, and manages purpose-built workers’ accommodation assets (PBWA) in Singapore and Malaysia and student accommodation assets in Australia, the UK, and the US.

Grand Banks Yachts (SGX: G50), or GBY, is a manufacturer of luxury recreational motor yachts under the Grand Banks, Eastbay, and Palm Beach brands.

🇮🇳 The Beat Ideas- Patel Engineering: Turnaround Play? (SmartKarma) $

Patel Engineering Ltd (NSE: PATELENG / BOM: 531120)‘s large order book, strategic sectors focus, and successful debt reduction through QIP and restructuring.

Strong financial resilience, projected revenue growth, and robust order pipeline signal promising future prospects.

Poised for growth strong order pipeline and increased government focus on Infrastructure, Hydro Power segment and Irrigation segment.

🇮🇳 Hyundai plans to list India business unit in one of country’s biggest IPOs (FT) $ 🗃️

South Korean carmaker seeks to capitalise on booming demand in world’s third-largest auto market.

The South Korean automaker will sell up to 142mn shares, or 17.5 per cent, of its holding in Hyundai Motor India on local exchanges, according to the draft prospectus seen by the Financial Times.

🇮🇳 ICICI Bank: Mixed Read-Throughs From Investor Conference And Indian Election (Seeking Alpha) $

There were positive takeaways from ICICI Bank (NYSE: IBN)‘s commentary at an investor event relating to different aspects of its business like funding and expenses.

On the other hand, demand for loans in India might possibly weaken, assuming that fewer new capital investments are given the go-ahead because of a narrower win for the ruling party.

A Hold rating for IBN is maintained, considering the bank’s mixed outlook in view of recent developments.

🇮🇱 Ituran: Undervalued Company With Solid Growth Potential (Seeking Alpha) $

Ituran Location and Control Ltd (NASDAQ: ITRN) provides location-based services for connected cars.

Q1 FY24 earnings show strong performance with record revenues and subscriber growth.

Using Benjamin Graham’s valuation method, ITRN is undervalued with a potential upside of 45%, despite technical chart concerns.

🇿🇦 Sibanye Stillwater: Time To Test The Waters (Rating Upgrade) (Seeking Alpha) $

We have decided to upgrade Sibanye Stillwater Ltd (NYSE: SBSW)‘s stock on the basis of an enhanced operational and commodity pricing outlook.

Upward-sloping PGM and Gold futures curves provide a reason to be positive about precious metals prices, especially considering gold’s tail hedge properties.

Sibanye’s U.S. PGM production has improved after a series of externally-driven delays.

South African operations might improve amid various project expansions and favorable election results.

A non-dividend-paying Sibanye might discourage many. However, we think it is time to test the waters before a recovery is fully in motion.

🇿🇦 Gold Fields: Assessing Its Production Guidance Shift (IOL)

Gold Fields (NYSE: GFI) has lowered its production guidance due to an isolated incident at its Salares Norte mine in Chile.

Although a material event, we think investors overreacted to Gold Fields’ production downgrade.

We believe numerous positives exist within Gold Fields’ operating framework, namely a lower cost base in Ghana, ongoing quality at the South Deep mine, and no structural concerns in Australia.

However, we remain concerned about GFI stock’s valuation and, therefore, maintain our hold rating.

🇿🇦 Renergen’s shares rise as it resumes helium production (IOL)

The share price in Renergen (JSE: REN / ASX: RLT / FRA: 9960 / OTCMKTS: RGNNF / RGNTF), the operator of South Africa’s only onshore producer of LNG and helium at a site in Virginia in the Free State, yesterday leapt 4.08% after it reported that it had resumed the production of helium this week.

Renergen has been at the receiving end of a lot of flak from some of the investor community, who claim that the delays and other problems belie a project that is at its heart not likely to be commercially viable.

Renergen is planning to list on the Nasdaq index so it can begin operation Phase 2.

🇿🇦 MultiChoice losses double on currency and less subscribers (IOL)

.SUPERSPORT and DStv owner, MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF), which is being acquired by global broadcaster Canal+, more than doubled its losses in 2024.

This was after its subscriber numbers fell, substantial currency headwinds and an increase in investment spending such as for the launch of Showmax.

🇿🇦 Telkom shares surge on expected whammy profit for the full year (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1) climbed 5.7% to close at R24.99 per share yesterday on news that normalised headline earnings per share (HEPS), a core measure of profitability would climb by as much as 205% in the year to end-March.

Telkom, which recently sold its masts and towers business Swiftnet for R6.75 billion, said next-generation revenues grew by approximately 7% and now comprise almost 80% of its total revenue.

🇿🇦 Spar share price surges as steps to stabilise group are implemented (IOL)

The Spar Group (JSE: SPP / OTCMKTS: SGPPF) passed the interim dividend and was also unlikely to pay a final dividend in the interests of preserving cash and to reduce debt, CEO Angelo Swartz said yesterday.

Swartz said consumers were struggling globally, with high inflation and interest rates and low growth and while first half trading was weaker than expected, an improvement was anticipated in the second half.

The interested buyer of SPAR Poland planned to continue operating the SPAR brand in that country. The group owns the SPAR retail brand in South Africa, Switzerland, South West England, Ireland, Poland and via joint venture in Sri Lanka.

Swartz said the focus for the next six months would be on the performance of SPAR Southern Africa, and getting the right level of returns from Spar Switzerland.

🇿🇦 Lucky Star lifts Oceana’s interim earnings after stronger operating profit (IOL)

Interim headline earnings per share in Oceana Group (JSE: OCE / FRA: O1F) jumped 84.6% to 578.8 cents for the six months ended March 31, driven by a 57.1% surge in operating profits which amounted to R1 billion for the same period.

The fishing and food processing company also lifted half-year after tax profits from total operations by 86.1 % to R716 million, mainly driven by record half-yearly earnings from the company’s US-based Daybrook Fisheries.

Oceana CEO Neville Brink said prudent cash and capital management had allowed the group to invest in its business, including upgrades to factories and vessels to improve efficiencies, expand the Lucky Star brand and take advantage of bolt-on acquisition opportunities.

🌎 Harding Loevner – MercadoLibre: Alternative Payment Systems Boosts Core Offering (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI)‘s alternative payment system, Mercado Pago, has helped differentiate its offerings and boost market share in Latin America’s competitive e-commerce industry.

Mercado Pago’s success in Mexico, providing digital payments and credit to underserved populations, has strengthened MercadoLibre’s market position against rivals like Amazon and Walmart.

As Mercado Pago’s credit business grows, the company must navigate funding and regulatory challenges to maintain its competitive edge and promote financial inclusion in Latin America.

🇦🇷 Lithium Argentina: A Progress Report And Insider Buying (Seeking Alpha) $

Ganfeng invests $70 million in the south Pastos Grandes project, gaining 14.8% ownership.

Lithium Argentina Corp (NYSE: LAAC)‘s Cauchari-Olaroz project shows progress with improving lithium purity and an increase in lithium production.

The long-term goal for Cauchari-Olaroz project is over 60,000 tonnes of battery grade lithium produced annually. Combine that with the southern projects and we should see much larger long-term output.

A director just purchased over $194,000 of stock on the open market. This is a strong vote of confidence in the future of the company.

🇦🇷 Lithium Americas: A Few Bullet Points On The Latest Share Price Debacle (Seeking Alpha) $

Lithium Argentina Corp (NYSE: LAAC) shares have dropped below $3.

Thacker Pass is a significant lithium find, and LAC’s other holdings in the McDermitt Caldera region are also valuable.

Despite the current low prices, the demand for lithium in various industries, including batteries and electronics, remains strong.

Here is the good, the bad, and the ugly.

🇧🇷 Nu Holdings: The Market Is Still Sleeping, Here Are The Catalysts (Seeking Alpha) $

Nu Holdings Ltd (NYSE: NU) stock has risen 40% YTD, now 3x higher from the January 2023 lows.

Despite this, the stock is undervalued and trading close to its IPO price.

Several near-term catalysts are expected to drive the stock significantly higher.

🇧🇷 Braskem Looks To Exit A Period Of Painful Spread Compression (Seeking Alpha) $

Braskem (NYSE: BAK) has faced significant margin pressure as resin spreads have shrunk due to weaker demand in construction, industrial, and consumer markets and disadvantageous naphtha cost exposure.

Although resin demand should be bottoming out, capacity additions in China and the U.S. leave Braskem vulnerable to an export market that is smaller and dominated by low-cost supply.

I expect below-average EBITDA margins for the next three years and long-term revenue growth of around 3%, but that can still support a fair value as high as $10 today.

M&A rumors aren’t going away, but it remains to be seen if regular shareholders will see any benefit.

🇧🇷 Braskem: Likely Waiting To Be Purchased (Seeking Alpha) $

Braskem (NYSE: BAK)‘s controlling holding, Novonor, is looking for a buyer for its stake in the company.

The proposals to purchase this stake exceed the company’s current market cap by two times.

For this reason, I believe that the dangerous risks, such as the sinking of Maceió, are already in the price, bringing a good opportunity.

🇧🇷 BrasilAgro: Good Structural Trends, Bad Cyclical Trends (Seeking Alpha) $

The company (Brasilagro – Co Brasileira De Proprieda (NYSE: LND / BVMF: AGRO3)) focuses on the agricultural real estate market, earning from crop production and sale of farms, with key crops being soybeans, corn, and sugar cane.

Short and medium-term results may be under pressure due to the commodity price outlook.

Furthermore, valuation based on the EV/EBITDA multiple does not offer a good margin of safety.

🇧🇷 Azul: Preparing For Takeoff (Seeking Alpha) $

Azul Sa (NYSE: AZUL / BVMF: AZUL4) presented good operational trends in its 1Q24 results. It is worth remembering that the airline sector was the most affected by the pandemic and has not yet fully recovered.

Another highlight of 1Q24 was the codeshare agreement with competitor Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4), and in my view, this agreement will enhance the company’s business model.

The valuation shows a 15% discount for Azul compared to its peers when we use the comparative analysis method with the EV/EBITDA multiple.

🇧🇷 Embraer: Ready To Fly Even Higher (Seeking Alpha) $

Embraer (NYSE: ERJ) is an excellent option to capture the improvement in the aviation sector in 2024.

The company’s reliance on exports mitigates risk from the Brazilian economy.

Embraer has good financial indicators and a favorable valuation, making it an attractive investment option with a potential 9.6% upside.

🇧🇷 Ultrapar: Potential Regulatory Problems And Unattractive Valuation (Seeking Alpha) $

Ultrapar Participaçoes (NYSE: UGP) faces challenges with increased competition due to the possible return of state-owned Petrobras (NYSE: PBR) in the fuel distribution segment.

New changes to tax rules could further increase sectoral uncertainties.

The valuation is not attractive, both compared to peers and compared to its own history.

🇲🇽 Share Loss And Margin Compression At Grupo Bimbo Leave A Sour Taste (Seeking Alpha) $

Grupo Bimbo SAB de CV (BMV: BIMBOA / FRA: 4GM / OTCMKTS: GRBMF / BMBOY) shares have underperformed, as the company has missed lowered expectations for a few quarters now and seen both volume share losses and margin compression.

Management doesn’t yet seem to want to address the market share issues in the U.S., including the risk that continuing with above-average pricing could drive more share to private label.

Limited additional leverage from lower input costs and wage pressures add further complications to the price/margin/share trade-offs.

Bimbo shares don’t look expensive now, but I’d prefer to see some stabilization in U.S. volume trends across its major categories before getting more bullish.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China’s stock exchanges to tighten controls on high-frequency trading (Caixin) $

China’s stock exchanges plan to impose stricter rules and extra fees on high-frequency trading — one type of controversial trading that has been blamed for fueling market turmoil this year.

The stock exchanges in Shanghai, Shenzhen and Beijing each released draft rules on Friday for program trading — which includes quantitative trading, whereby investors employ mathematical models and algorithms to make trading decisions and execute transactions. The rules, which are similar on the three bourses, are open for public comment through Friday.

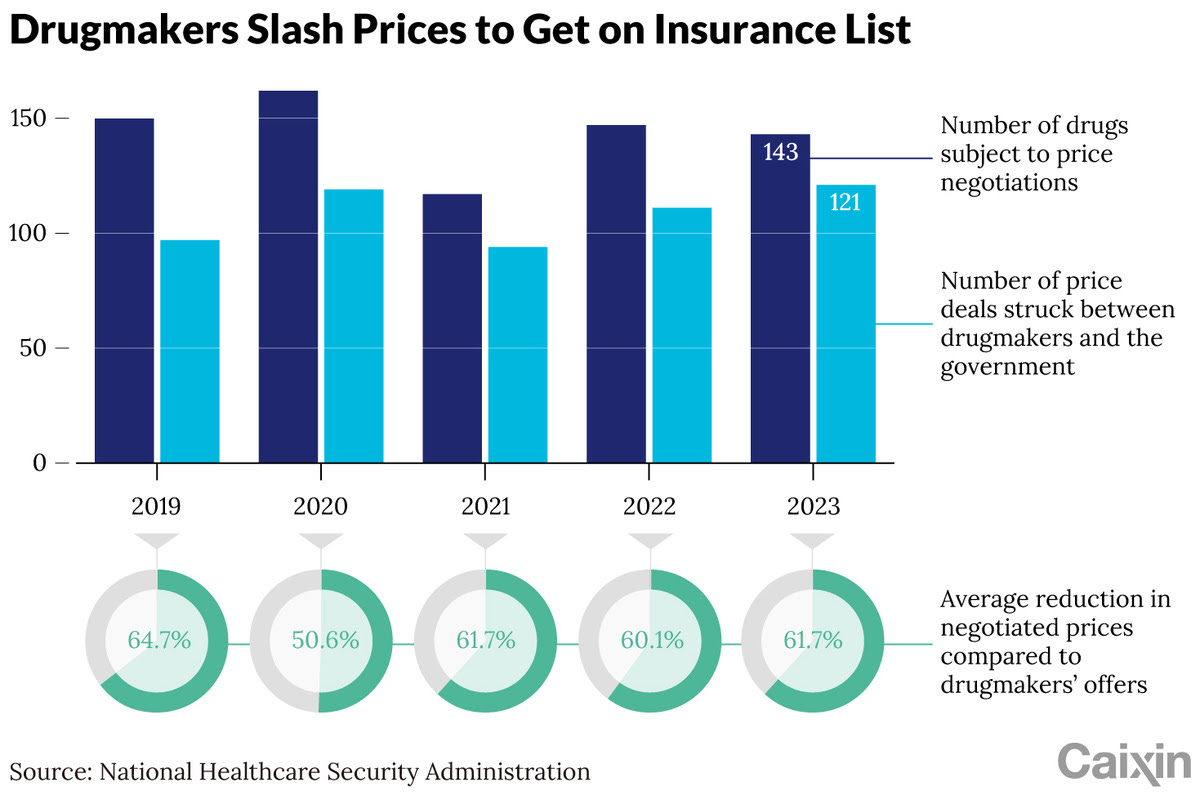

🇨🇳 In Depth: How China’s pricing regime penalizes innovative drugmakers (Caixin) $

For nearly a decade, China’s domestic drug pricing policy has frustrated pharmaceutical companies.

Since 2016, the national insurance regulator has haggled with companies eager to have their innovative drugs covered by state health insurance, to help lower costs for patients.

This has made profits elusive for these companies. As a result, some have expanded into foreign markets in search of wider margins.

🇨🇳 In Depth: Local Governments Ditch Financing Vehicles to Offload Hidden Debt (Caixin) $

China’s campaign to reduce hidden borrowing parked on the balance sheets of local government financing vehicles (LGFVs) has left many heavily indebted authorities struggling to fund investment and support their economic growth.

Some, including Chongqing, a municipality on an official list of 12 high-risk provincial-level regions, are now attempting to transform some of their LGFVs into market-oriented entities (市场化主体) and offload government liability for the vehicles’ borrowings. The aim is to reduce the authorities’ own debt levels, which they hope will lead to the easing of restrictions imposed by the central government on their ability to borrow money and invest in GDP-boosting projects.

🇨🇳 Weekend Long Read: Why China Is So Keen on Hydrogen (Caixin) $

🇰🇷 Ban on Short Selling Stocks in Korea Extended Until March 2025 (Douglas Research Insights) $

On 13 June, the Korean government announced that it will extend a ban on short selling stocks in Korea until end of March 2025.

For now, the government has not given a 100% go-ahead on the end of the ban on short selling stocks starting 1 April 2025.

However, in our view, the government is likely to allow short selling stocks in Korea once again, sometime in 2Q 2025.

🇰🇷 Korean Government Is Pushing for a Comprehensive Inheritance Reforms – Will They Pass or Fail? (Douglas Research Insights) $

In the past several days, the South Korean Presidential Office has announced that it is pushing for a comprehensive inheritance tax reforms.

Although the Presidential Office mentioned it is pushing to reduce highest inheritance tax rates from 60% to 30%, the more likely scenario is to reduce this rate to about 50%.

The lump sum personal deduction of 500 million won or inheritance tax which has been maintained for nearly 27 years could be doubled to about 1 billion won or more.

🇰🇷 Changes in Law for Allocation of Treasury Shares as New Shares Post Spin-Offs in Korea in 2H24 (Douglas Research Insights) $

On 11 June, the FSC announced that the restrictions on allocation of treasury shares as new shares post spin-offs is expected to be made into law in 2H 2024.

Meanwhile, starting 1 July, the financial regulators will make it more difficult for Korean companies to conduct spin-offs that have separate allocation of treasury shares as new shares.

The top five stocks with highest percentage of treasury shares/outstanding shares are up on average 40.5% YTD.

🌍 Middle East ramps up bid to become global AI hub (The Asset) 🗃️

🇿🇦 ‘We have a deal’ – GNU is unveiled (IOL), Zuma condemns GNU as white-led alliance, vows to expose “white agents” (IOL) & Ramaphosa re-elected South African president after striking deal with opposition (FT) $ 🗃️

🇦🇷 Argentina loses appeal over $1.5bn payment to hedge funds (FT) $ 🗃️

Ruling is setback for Javier Milei’s cash-strapped government as it faces cases brought by former foreign investors

Palladian Partners, HBK Master Fund, Hirsh Group and Virtual Emerald International Limited, which hold about 48 per cent of the securities and which like many emerging market bonds are governed by English law — brought a case against Argentina in 2019 asking to be compensated for their losses and the court ruled in their favour in 2023.

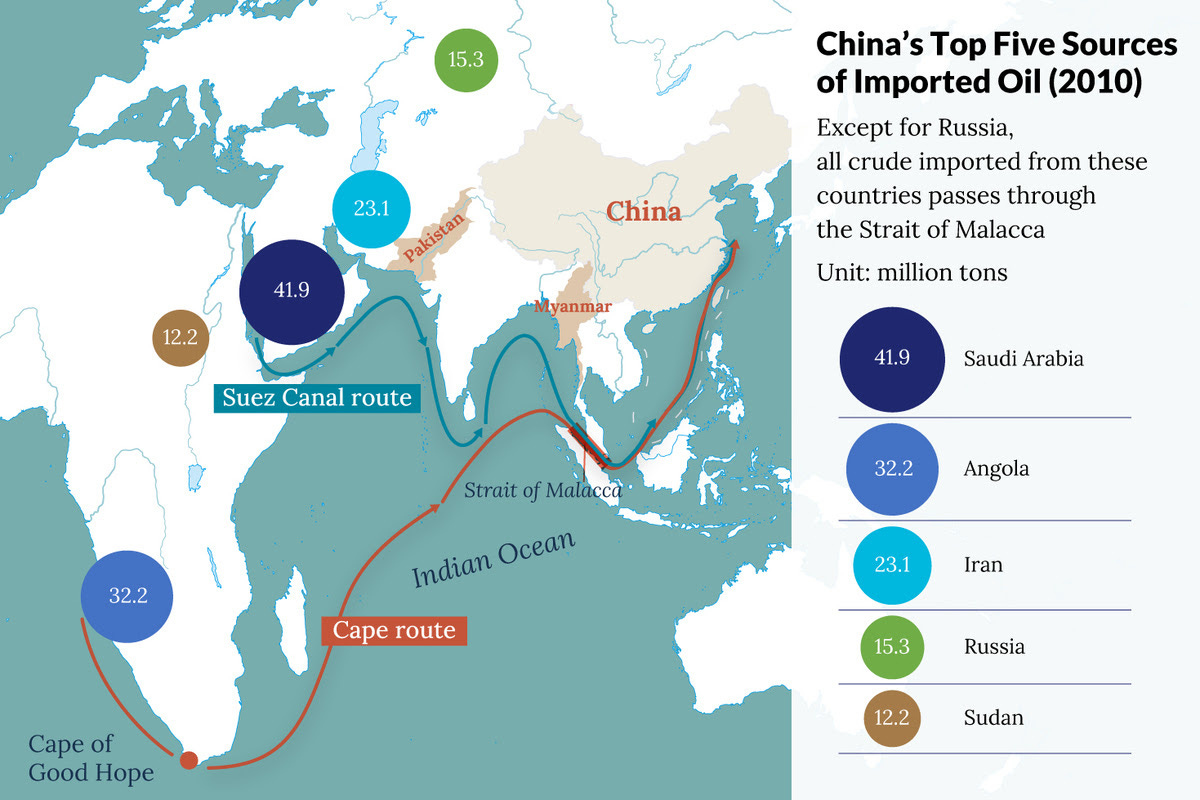

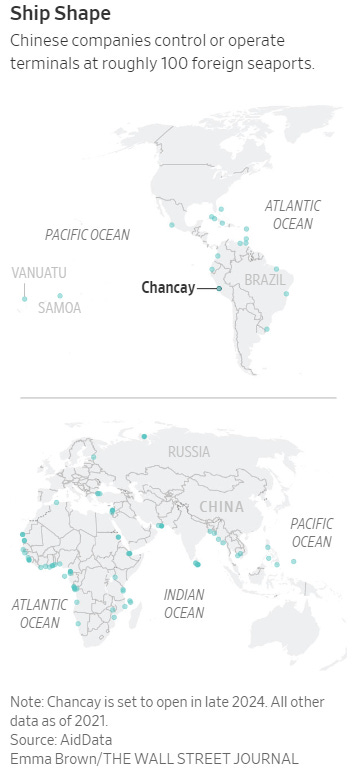

🌎 A New Chinese Megaport in South America Is Rattling the U.S. (WSJ) $ 🗃️

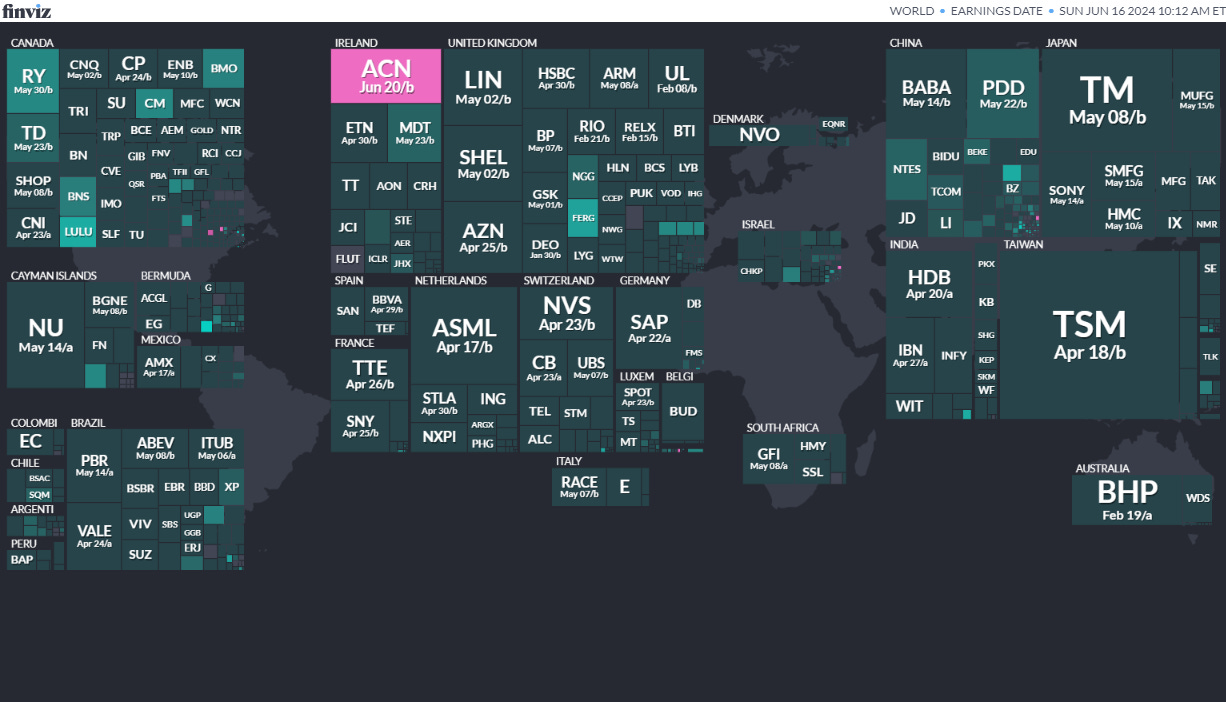

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

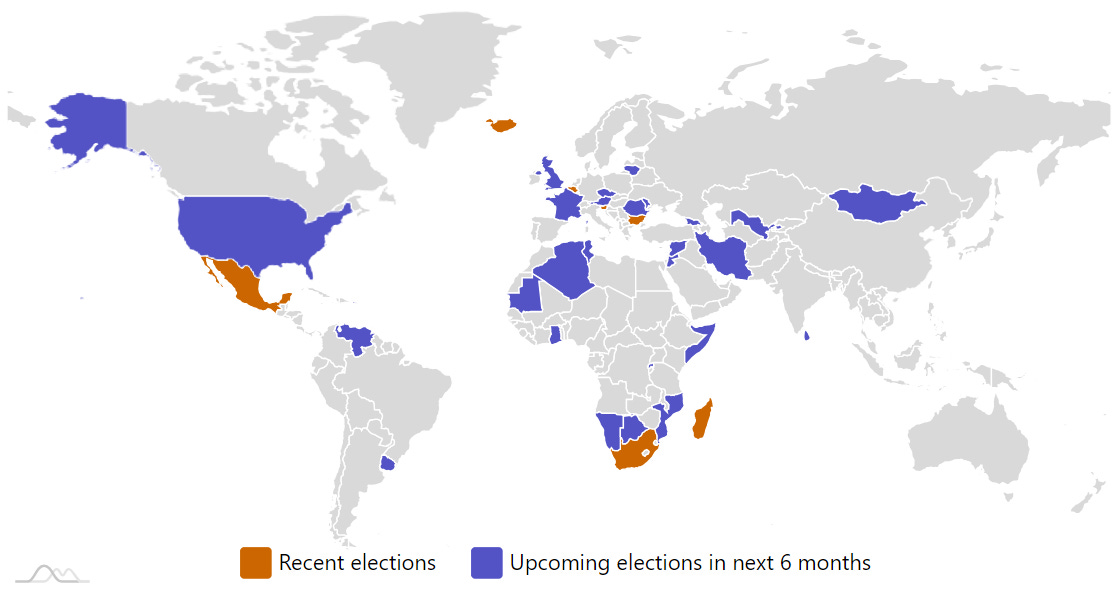

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

BulgariaBulgarian National AssemblyJun 9, 2024 (d) Confirmed Apr 2, 2023 -

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

-

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Romania Romanian Presidency Sep 15, 2024 (t Date not confirmed Nov 24, 2019

-

Czech Republic Czech Senate Sep 30, 2024