Emerging Market Links + The Week Ahead (June 24, 2024)

The Financial Times has noted that China’s super-rich are eyeing the exit 🗃️ and how they are going to places like United Arab Emirates, the USA, Singapore, Canada, and even Japan, but the article did not mention Malaysia – despite the fact that it’s only a 5-6 hour flight away with plenty of Chinese language schools and familiar food that makes settling in the country easy.

Malaysia has just (sort of…) announced revised requirements (yet again…) for the Malaysia My Second Home (MM2H) programme – assuming what’s being reported will actually be the FINAL requirements given how many changes there have been in recent years with all the different governments that have come and gone. Effectively, what originally started as a retirement scheme to lure Western and Japanese retirees and then high net worth people of all nationalities, has been turned into a property buying scheme to help local real estate developers clear their glut of high-end properties – especially the Forest City (ghost town) in Johor just across from Singapore.

Outside of the SEZ where Forest City is located, Malaysian states usually have RM1-2M minimum purchase price restrictions for foreigners to buy property in non-Bumi gazetted areas – meaning you have almost no hope of ever selling the property as locals generally cannot afford something above the RM500k+ level (and that’s where the glut begins…).

Whether the new rules will attract new PRC applicants desperate to get their money out of China (potentially taking more than a haircut at both ends) or Singapore retirees to help clear the property glut will be interesting to watch as reactions so far (e.g. on the MM2H- Malaysia My 2nd Home Programme group Facebook group) have been less than positive…

$ = behind a paywall

-

🇨🇳 🇭🇰 CMBI Research China & Hong Kong Stock Picks (May 2024) Partially $

-

May: JOYY Inc, Baozun, NAURA Technology Group, CSPC Pharmaceutical, Atour Lifestyle Holdings, Weibo Corp, Topsports, Ke Holdings, Bilibili, NetEase, Xiaomi Corp, PDD Holdings, Kuaishou Technology, Tongcheng Travel Holdings, XPeng, Trip.com, Li Auto, Mobvista, Sany Heavy Equipment International Holdings, iQIYI, Baidu, JD.com, ZTO Express, Tencent, Alibaba, Huya Inc, Tencent Music Entertainment Group, Xtep, GigaCloud Technology, FIT Hon Teng, BeiGene, PICC Property and Casualty Co Ltd, EVA Precision Industrial Holdings, China Pacific Insurance (Group), United Energy Group, Yum China, Shanghai Henlius Biotech, Joinn Laboratories China, WuXi AppTec, China Life Insurance, Amazon.com, BYD Electronic International Co Ltd & Zoomlion Heavy Industry

-

20+ high conviction stock ideas: Li Auto, Zoomlion Heavy Industry, Weichai Power, Zhejiang Dingli Machinery, Xtep, Bosideng International Holdings, Haier Smart Home, Vesync, Kweichow Moutai, BeiGene, China Pacific Insurance (Group), PICC Property and Casualty, Tencent, Alibaba, PDD Holdings, Amazon.com, Netflix, Kuaishou Technology, GigaCloud Technlogy, CR Land, FIT Hon Teng, Xiaomi, BYD Electronic International, Zhongji Innolight, NAURA Technology Group & Kingdee International Software Group

-

-

🌐 EM Fund Stock Picks & Country Commentaries (June 23, 2024) Partially $

-

Investing in India’s growth, SA moves from a Zimbabwe valuation to just a poor valuation, Nigeria reforms to help bank stocks, Comfortdelgro, Mobileye, Vietnam + Sri Lanka trip reports, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Recent Thoughts on China (Citrini Research)

Our Takeaways on China from our Annual Review

These companies are expected to benefit from China’s efforts to rely more on its own semiconductor production rather than importing from other countries.

NAURA Technology Group (SHE: 002371): Chip-making (deposition + etching) player.

Piotech (SHA: 688072): Piotech is a rising star in the chemical vapor deposition (CVD) area, which is key in chip production.

Hygon Information Technology (SHA: 688041): With a solid track record in making server CPUs, Hygon is emerging as a strong competitor to big names like Intel and AMD.

Cambricon Technologies Corp (SHA: 688256): This company is developing top-notch AI chips and software, aiming to replace foreign suppliers like Huawei and Nvidia in the Chinese market.

Hua Hong Semiconductor (HKG: 1347 / FRA: 1HH / OTCMKTS: HHUSF): As a leading semiconductor foundry in China, Hua Hong is critical for manufacturing chips designed by other companies. Its role in producing a wide range of semiconductors supports China’s goal of self-sufficiency in technology.

🇨🇳 CATL’s Productivity Campaign Draws Criticism Over Grueling Work Hours (Caixin) $

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has launched a “Strive for 100 Days” campaign, resulting in some employees working “896” schedules (8 a.m. to 9 p.m., six days a week).

This “896” work schedule is similar to the criticized “996” culture but lacks official company documentation.

CATL aims to boost productivity amid its rapid global expansion, having surpassed LG Energy Solution (KRX: 373220) as the top EV battery supplier outside China.

🇨🇳 Didi Quashes Hong Kong IPO Rumors and Focuses on Core Operations (Caixin) $

Didi Global Inc. is focusing on core operations and has no set timetable for a new IPO, despite rumors.

Other Chinese ride-hailing firms like Dida Inc., Ruqi Mobility, and Caocao Chuxing are progressing with their IPOs in Hong Kong.

Despite slower revenue growth, Didi remains the industry leader with a gross transaction value of 19.4 billion yuan in 2023, and it posted a non-GAAP net profit of 1.36 billion yuan.

🇨🇳 Shein: Fast Fashion, Slow IPO (WSJ)

🇨🇳 China’s Cross-Border Ecommerce Platforms Try to Lure More Sellers With Better Terms (Caixin) $

China’s major e-commerce players, including Alibaba (NYSE: BABA)’s AliExpress, PDD Holdings (NASDAQ: PDD)’ Temu, and Shein, introduced a “semi-consignment” business model to enhance logistics and sales.

The semi-consignment model allows merchants more control over pricing and quicker delivery by using overseas inventory, compared to the full-consignment model.

This new model diversifies services and helps platforms respond to increased regulatory scrutiny, especially regarding U.S. air freight and de minimis rules.

🇨🇳 🇮🇩 Thoughts on TikTok layoffs at Tokopedia (Momentum Works)

Last Friday (14 June), TikTok announced a round of layoffs of ‘the combined entity’ of TikTok Shop and PT GoTo Gojek Tokopedia Tbk (IDX: GOTO.JK), the latter being the former top ecommerce platform that TikTok acquired in recent months to (re)gain access to Indonesia’s ecommerce market.

The rumours of layoffs started spreading at the beginning of the month, with famous Indonesian tech blogger Ecommurz revealing information on Instagram:

While we would not verify the authenticity of the information above, there has also been rumours of the scale of layoffs, from hundreds to thousands. We think that the 450 figure reported by Bloomberg is probably more trustworthy. Bloomberg also reported that TikTok Shop/Tokopedia in Indonesia had a combined employee count of about 5000.

Some thoughts about the unfolding events:

🇨🇳 EHang: Investors Underestimate How Much The Chinese Government Wants This (Seeking Alpha) $

(Autonomous aerial vehicle (AAV) technology platform) EHang Holdings (NASDAQ: EH) is now in execution mode, collecting large orders, expanding production, and ramping revenues.

The Chinese government wants to push the eVTOL sector to take a leading role, bringing about strategic initiatives, strong subsidies, and introducing first infrastructure projects.

Regional actors in China are already supporting EHang with activities such as building vertiports and placing large orders, indicating a promising future.

Even though the share price is still widely unresponsive to the progress, the company holds great potential and I reiterate my Strong Buy.

🇨🇳🌍 West China Cement (2233 HK): African Cement Play At 4x 2024E PE (SmartKarma) $

West China Cement (HKG: 2233 / FRA: WFG1 / OTCMKTS: WCHNF) is a cement company based in Western China. Sales volume in Africa in 2023 was 2.6 million tons, up 117% from 1.2 million tons in 2022.

The company has 2 million tons of cement capacity in Mozambique, 1.5 million tons in Congo, and 1.3 million tons in Ethiopia.

The company is trading at 4x 2024E PE. I believe the risk reward is quite high here.

🇨🇳 Bloks Group IPO: Exceptional Revenue Hyper-Growth and Profitability Are Unique Among Toy Makers (SmartKarma) $

Bloks Group, a fast-growing toy company and leader of assembly character toys, filed for a Hong Kong IPO. The company is headquartered in Shanghai, PRC, and has 410 full-time employees.

Bloks Group has raised $200M+ to date from investors, including YF Capital, Legend Capital, Source Code Capital, Gaorong Capital and SinoMedia Asia Pacific.

The Chinese toy maker has delivered an exceptional revenue hyper-growth of 169% y/y in 2023. Elite operating metrics and impressive financial profile make IPO attractive for investors.

🇨🇳 🇭🇰 Diary from Hong Kong and Shenzhen: On the ground research … (Roiss’ Conclusions)

and the small caps I also bought

It took quite some time, but I have now finished buying the rest of my stocks in Hong Kong. I will now go over a list of net nets in Hong Kong to find companies, that don’t have the best quality, but are cheap enough. Gold miners are another interesting point to look at.

🇭🇰 Left Field Printing (HKEX:1540) (Praya’s Substack)

Left Field Printing Group (HKG: 1540) is a book printer led by proven capital allocators, with an unappreciated strategically advantaged position. The company is a subsidiary of Lion Rock Group (HKG: 1127), one of the largest book printers in the world.

Today, Left Field prints for Penguin Random House; Macmillan; Hachette and practically all other small/medium publishers.

🇭🇰 Sa Sa Intl (178 HK): Every Coin Has Two Sides (SmartKarma) $

Despite missing market consensus, (Hong Kong-based chain store company selling cosmetics, personal care, skin care, fragrance, hair care, body care products, as well as health and beauty supplements) Sa Sa International Holdings Ltd (HKG: 0178)‘s FY24 result still have silver linings. Its resumption of dividends with a 70% payout ratio is welcoming.

Tax credit in 2H23 has distorted comparison. At pre-tax level, 2H24 profit has gone up by 29.5%. Cost management is solid, generating a 0.9pp FY24 operating margin expansion.

While overall 1Q25 sales have dropped, mainland China sales surged 83.9%. The macro environment should have bottomed and government efforts to attract tourists will pay off.

🇭🇰 Hong Kong Exchanges: Focus On Q2 Results Preview And Full-Year Prospects (Seeking Alpha) $

Hong Kong Exchanges & Clearing (HKG: 0388 / 80388 / FRA: D9I / OTCMKTS: HKXCF)‘s Q2 2024 financial results are expected to be strong considering recent Average Daily Turnover or ADT data.

But I have a negative opinion of the company’s 2H 2024 and full-year prospects, taking into account the Hong Kong market’s IPO outlook and the Hang Seng Index’s recent underperformance.

My decision is to retain a Hold rating for HKEX after previewing its Q2 results and evaluating its full-year prospects.

🇭🇰 Techtronic Industries: Good Reasons To Stay Positive (Seeking Alpha) $

My view of (Hong Kong-based power tools manufacturer) Techtronic (HKG: 0669 / FRA: TIB1 / OTCMKTS: TTNDY / OTCMKTS: TTNDF)‘ leadership transition, the company’s share repurchases, and the prospects of rate cuts is favorable.

Techtronic Industries’ P/E multiple can re-rate to a level closer to or on par with its key customer, Home Depot (NYSE: HD).

I remain bullish on Techtronic Industries based on my assessment of various developments and the stock’s valuations.

🇹🇼 Silergy (6147.TT): The Wafer Demand Is Projected to Increase by 30-40% QoQ from 2Q24 Onwards. (SmartKarma) $

We presume (integrated circuit product stock) Silergy (TPE: 6415 / OTCMKTS: SLEGF) is likely to see demand recovery or inventory rebuilding starting from 2Q24.

Silergy’s wafer demand is projected to increase by 30-40% QoQ from 2Q24 onwards.

Silergy’s primary focus remains on China, Taiwan, and Korea, but the US market is promising for potential growth.

🇹🇼 Taiwan Semiconductor Manufacturing Company (TSMC) – US ADR (TSM) (Long-term Investing)

🇰🇷 LS Materials: A Sharp Increase in Short Selling Post Block Deal Sale (Douglas Research Insights)

On 14 June, KeiStone Partners sold 2.51 million shares (3.7% of outstanding shares) of LS Materials (KOSDAQ: 417200) at the block deal sales price of 26,350 won per share.

In the next several weeks/months, there will likely be increased concerns about additional selling of LS Materials by KeiStone Partners.

Due to recent block deal sale, higher short selling volume, and concerns about additional selling by Keistone Partners, LS Materials shares could face further weakness in the next 6-12 months.

🇰🇷 Webtoon Entertainment IPO: Favorable Risk/Reward IPO Valuation and Limited Downside Potential (SmartKarma) $

Webtoon Entertainment, a South Korean global storytelling platform and the world’s largest digital comics platform, filed for an IPO in the United States.

The company offers 15M shares at a price range between $18.00 and $21.00, implying a market cap of roughly $2.5B at the midpoint based on 129.3M outstanding shares.

I have a positive view of the upcoming Webtoon Entertainment IPO and I think risk/reward is more favorable for IPO investors given the company’s improving profitability and strong cash position.

🇰🇷 Webtoon Entertainment IPO Valuation Analysis (Douglas Research Insights) $

Webtoon Entertainment announced that it is targeting a valuation of up to US$2.7 billion in the upcoming IPO. The IPO price range is from US$18 to US$21 per share.

The company is aiming to raise as much as US$315 million in this IPO. Blackrock Asset Management has indicated interest of purchasing up to US$50 million in this IPO.

Our base case valuation of Webtoon is market cap of US$3.6 billion or target price of US$27.9 per share (33% higher than the high end of the IPO price range).

🇰🇷 Sanil Electric IPO Preview (Douglas Research Insights) $

Sanil Electric is getting ready to complete its IPO in late July in KOSPI. The IPO price range is from 24,000 won to 30,000 won per share.

The company is planning is raise between 182.4 billion won and 228 billion won in this IPO. The book building for the institutional investors lasts from 9 to 15 July.

Sanil Electric is best known for making special transformers used for special purposes in environments with severe weather changes, such as offshore wind power, solar power, and offshore plants.

🇰🇷 Innospace IPO Bookbuilding Results Analysis (Douglas Research Insights) $

Innospace reported solid IPO bookbuilding results. Innospace’s IPO price has been determined at 43,300 won won, which is at the high end of the IPO price range.

Our base case valuation of Innospace is target price of 51,481 won per share (12 month view), which is 19% higher than the IPO price.

Innospace is involved in the satellite launch vehicle production and launch service business.

🌏 Investing Idea: Discover Southeast Asia’s Fastest Growing Businesses Over the Next Three Years (The International Investor)

SFP Tech Holdings (KLSE: SFPTECH), an investment holding company, provides engineering supporting services in Malaysia and internationally.

Moshi Moshi Retail Corporation (BKK: MOSHI / BKK: MOSHI-F) engages in the retail and wholesale of lifestyle products in Thailand.

Phuoc Hoa Rubber (HOSE: PHR) plants, processes, and trades in rubber and rubber wood in Vietnam.

Geo Energy Resources (SGX: RE4 / FRA: 7GE / OTCMKTS: GRYRF), an investment holding company in Singapore, engages in the mining, production, and trading of coal in China, Indonesia, South Korea, India, the Philippines, and Thailand.

DigiPlus Interactive (PSE: PLUS), through its subsidiaries, manages and operates general amusement, recreation enterprises, hotels, and gaming facilities in the Philippines. The company was formerly known as Leisure & Resorts World.

Digital Mediatama Maxima (IDX: DMMX) operates an integrated marketing platform in Indonesia.

🇸🇬 5 Singapore Stocks with Dividend Yields Higher Than Your CPF Special Account (The Smart Investor)

In particular, the CPF Special Account (SA) carried an interest rate of 4.08% from 1 July 2024 to 30 September 2024.

Here are five stocks with dividend yields higher than the CPF SA interest rate.

Straits Trading Company (SGX: S20 / FRA: W2F / OTCMKTS: SSTVF / STTSY), or STC, is a conglomerate with operations and financial interests in resources (Malaysia Smelting Corporation Berhad), property (ESR Group), and hospitality (Far East Hospitality Holdings).

Far East Hospitality Trust (SGX: Q5T), or FEHT, owns a portfolio of 12 properties with 3,015 hotel rooms and serviced residences in Singapore.

Uni-Asia Group (SGX: CHJ), or UAG, is an alternative investment group that manages handy dry bulk ships and properties.

UMS Holdings (SGX: 558 / OTCMKTS: UMSSF), or UMS provides equipment manufacturing and engineering services to original equipment manufacturers of semiconductors and related products.

HRNetGroup (SGX: CHZ) is a leading staffing and recruitment firm with over 900 consultants in 17 Asian cities.

🇸🇬 Grab: Reducing Costs And Growing Through Tourism (Seeking Alpha) $

Grab Holdings Limited (NASDAQ: GRAB) offers deliveries, mobility, and financial services in Southeast Asia, with a stock price down 70% since its IPO in 2021.

Grab has a dominant market share and a strong brand name. The company will continue to grow due to its newer financial services segment and the rise of tourism in Singapore.

Despite initial losses, Grab’s increasing cost-efficiency and profitability, along with growth in customer base, make it a buy.

🇸🇬 Sea Limited (SE) – Overcoming Sea Change Challenges, Time To Own The Business (Sleep Well Investments) $

Sea overcame a perfect storm to reemerge as the most dominant tech titan in SEA, execution risks reduced, undervalued at 25xFCF with 20% durable growth.

Since 2014, sales have compounded 62% annually and are expected to generate at least $1.5B in free cash flow annually.

🇮🇳 The Beat Ideas- Archean Chemical: The Bromine Leader of India (SmartKarma) $

Archean Chemical Industries (NSE: ACI / BOM: 543657) is largest producer of Bromine and largest exporter of Bromine from India.

The company is doing brownfield and greenfield capex in Bromine derivatives which are Margin accretive.

Archean Chemical Industries (ACI IN) is confident about 30% volume growth in FY25.

🇮🇳 Hyundai Motor India IPO Preview (Douglas Research Insights) $

Hyundai Motor India is getting ready to complete its IPO in 2H 2024. Hyundai Motor India plans to offer up to 142.2 million shares (17.5% stake) to investors.

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) currently owns a 100% stake in Hyundai Motor India. The IPO of Hyundai Motor India could raise as much as US$3 billion.

If Hyundai Motor India (HMI) is valued at US$25 billion and HMC sells a 17.5% stake in the company, HMC’s remaining stake in HMI would be worth nearly US$21 billion.

🇮🇳 Infosys: Holding Steady Amid Client Spending Softness (Seeking Alpha) $

Infosys (NYSE: INFY) provides consulting services globally, but is facing delays in client discretionary projects post-pandemic.

The market for digital transformation consulting is growing, but Infosys Limited’s revenue growth remains slow.

Despite a strong balance sheet, my outlook on Infosys Limited stock is on Hold due to ongoing client spending challenges.

🇮🇳 Infosys Is A Hold Considering Guidance And Project Mix (Seeking Alpha) $

Infosys (NYSE: INFY) is guiding for a modest, low-single digit percentage increase in its top line for fiscal 2025, and it is fair to say that the company’s guidance is unimpressive.

On the flip side, INFY’s project mix is becoming more favorable with a growing number of bigger deals, which indicates that client confidence in the company is rising.

Infosys stock is assigned a Hold rating, taking into account the favorable change in project mix, the lackluster financial guidance, and the stock’s fair valuations.

🇮🇳 HDFC Bank: Negatives Are Priced In (Seeking Alpha) $

I expect HDFC Bank (NYSE: HDB) to report a flat net interest margin and a weaker rate of loan growth for the near future.

HDB’s unappealing prospects are reflected in its valuations, which are already discounted based on peer and historical comparisons.

A Hold rating is awarded to HDFC Bank stock after looking at the company’s prospects and the stock’s valuations.

🇮🇳 Cineline India (NSE:CINELINE) (Valuewala)

Since my last post in November, I have exited 7 stocks – Rajesh Exports (NSE: RAJESHEXPO / BOM: 531500), Sandesh (NSE: SANDESH / BOM: 526725), Ambika Cotton Mills (NSE: AMBIKCO / BOM: 531978), Everest Kanto Cylinder (NSE: EKC / BOM: 532684), Jindal Polymers (Jindal Poly Films Limited (NSE: JINDALPOLY / BOM: 500227) ?), Maithan Alloys (NSE: MAITHANALL / BOM: 590078) and Geojit Financial Services (NSE: GEOJITFSL / BOM: 532285). I have entered one new investment, at a price of ₹125/share, which I am writing about today.

Cineline (NSE: CINELINE / BOM: 532807) is in the business of building, owning, and operating multiplexes, theatres, and entertainment centres. Since 2022, it has operated a chain of multiplexes under the brand name ‘Moviemax’ and is currently the fourth-largest player in the Indian movie exhibition space.

Cineline is on a clear trajectory of revenue growth and has demonstrated its ability to turn an operating profit as it scales. Despite high debt and interest expenses, the sale of non-core assets, particularly the hotel, should significantly reduce debt and interest expenses, leading to net profitability. With the stock trading at a low multiple, I believe it is presently undervalued and can double in the coming years. For these reasons, I have made Cineline the largest position in my portfolio.

🇰🇿 Freedom Holding: Strong FY2024 Results, More Growth To Come (Seeking Alpha) $

(Brokerage etc services) Freedom Holding Corp (NASDAQ: FRHC)‘s FY2024 report showed impressive growth in revenue, EPS, assets, and expansion into new markets.

I think the company’s revenue structure, integration of new companies, and strategic investments in telecom and media indicate a strong growth potential.

Based on my calculations, FRHC is >50% undervalued today.

Despite the many risks associated with FRHC, I have decided to update my rating and maintain my “Buy” recommendation on the stock today.

🇮🇱 G. Willi-Food International Is On Sale (Seeking Alpha) $

G. Willi-Food International (TLV: WLFD)‘s stock is down due to war and other factors but presents a buying opportunity of around $9/share.

The company imports, markets, and distributes kosher foods to Israel and the West Bank which are urbanizing, and losing farmland, but have a prosperous, growing population.

Financials show decreased sales and profits in Q1 ’24, but management made adjustments to mitigate the impact, stabilize the share price, and maintain the dividend yield.

🇹🇷 Hepsiburada Stock: Blistering Growth And Good Value To Start Fiscal 2024 (Seeking Alpha) $

(eCommerce platform) D-MARKET Electronic Services & Trading or Hepsiburada (NASDAQ: HEPS) reported strong Q1 results, highlighted by 45% revenue growth.

The company is making progress toward sustainable profitability and positive free cash flow.

We remain bullish on the stock.

🇿🇦 Sasol Limited: A Potential Inflection Story (Seeking Alpha) $

Sasol (NYSE: SSL), a diversified company in mining, energy, and chemicals, is at a potential inflection point due to chemical sector recovery and political changes in South Africa.

Operational cost optimizations and the absence of further shareholder value-eroding expansive plans are likely to lead to a significant increase in free cash flow generation.

The increased free cash flow can be used to fund both greater shareholder returns and green energy investments.

Despite high political and operational risks, given the material discount to the replacement value of its assets, the margin of safety seems sufficient to warrant a buy rating.

🇿🇦 Standard Bank interim earnings to be impacted by other African currency volatility (IOL)

Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY) has become the latest South African company whose profits are being whittled away by other devaluing African currencies.

The biggest lender in Africa by assets said yesterday that its headline earnings grew by only low-to-mid single digits in the five months to May 31 after being negatively impacted by currency movements, most notably in Angola, Malawi, Nigeria, and Zambia.

Other listed companies in South Africa with large business interests elsewhere on the continent that have been similarly affected include Telkom SA SOC (JSE: TKG / FRA: TZL1) and cellphone companies such as MTN Group (JSE: MTN).

🇿🇦 Telkom swings to R1.9bn profit from R10bn loss (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1), the third-largest telecoms company in South Africa, has reported a profit of R1.9 billion in the year ended March 31, 2024, up from a loss of nearly R10bn the previous year, partially because it had booked a R13bn impairment in 2023 because of its legacy copper business – and these headwinds were now behind it.

“The question is to what extent they will be able to improve cash flow, which has been a key issue, without materially constraining their capital investments,” said Takaendesa.

He also noted that it would be hard for Telkom to push harder on capital without harming its balance sheet, with it carrying a large amount of debt, or selling an asset that was not core.

🇿🇦 Nampak’s share price shoots up after it predicts return to per share profit (IOL)

Nampak Ltd (JSE: NPK / FRA: NNZ0)’s share price increased 19.3% by midday yesterday on the JSE after the packaging group, which is undergoing massive restructuring due to financial difficulties, said it would likely report a turnaround to a profit on a per share basis for the six months to March 31.

“The most salient first half performance drivers includes a step change in performance of the continuing operations, an effective cost reduction programme, lower foreign exchange losses, improved working capital, progress on asset disposals and lower impairments,” the group said in a trading statement yesterday.

🇿🇦 Sanlam share price rises on MultiChoice deal to expand in Africa (IOL)

Sanlam (JSE: SLM / FRA: LA6A / FRA: LA6S / OTCMKTS: SLLDY) is acquiring 60% of MultiChoice Group Ltd (JSE: MCG / FRA: 30R / 30R0 / OTCMKTS: MCHOY / MCOIF)’s insurance business, NMS Insurance Services (NMSIS), as well as a long-term arrangement to expand insurance and financial service offerings into MultiChoice’s African subscriber base, in a deal of about R2.7 billion.

MultiChoice, which has subscribers in 50 countries in Africa, and which is currently being acquired by French broadcaster Canal+, will use the proceeds from the deal for working capital purposes. Sanlam, which has becoming a pan-African insurance and financial services leader as a core aspect of its strategy, already does business in more than 30 African countries.

🇿🇦 Anglo American Platinum: Forced Selling Risk On Demerger (Seeking Alpha) $

Anglo American Platinum (JSE: AMS / FRA: RPHA / FRA: RPH1 / OTCMKTS: AGPPF / ANGPY) is in plans to be spun off, although Anglo American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) didn’t appreciate the pressure BHP Group (NYSE: BHP) was trying to pile on with the requirements within its merger proposal.

We still maintain there are some positives, but primarily see the forced selling risk if/when it gets spun off.

There are also questions around conditions and other onuses that might be placed on Amplats as a standalone entity, as referred to in the rejection release by Anglo American.

Altogether, it’s not such a great sign that BHP really doesn’t want the PGM business, which we actually quite like on environmental standards and hydrogen.

🇵🇱 CVC Said to Plan IPO of $8 Billion Retailer Zabka in September (Bloomberg) 🗃️

CVC Capital Partners Plc is planning to list Zabka Polska SA in an initial public offering expected to value Poland’s biggest convenience store chain at $7.5 billion to $8 billion, according to people familiar with the matter.

Offering could raise between $1 billion and $1.5 billion

The listing could be largest in Warsaw since Allegro.eu SA (WSE: ALE / FRA: AL0 / OTCMKTS: ALEGF)’s IPO

🇱🇺 🌎 Tenaris: Holding Was The Right Choice, Upgrading To A Buy (Rating Upgrade) (Seeking Alpha) $

(Steel pipe maker) Tenaris S.A. (NYSE: TS) is an attractive company in the energy servicing sector. The company has recently dropped quite a bit, and is now more attractive than a few months ago.

There’s upside to be had, despite the company’s relatively flat growth outlook for 2024 and 2025.

I am upgrading the company to a “BUY” here, from a “HOLD”.

🌎 GeoPark: Strong Earnings and Strategic Argentine Acquisition (THE MODERN INVESTING NEWSLETTER)

Q1 Earnings commentary and a breakdown of a transformational acquisition …

Since I wrote my original article with my thesis on GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O), 3 months have passed and the stock is up by 22% excluding dividends. I gave an update in late March and decided to do the same now, as the company reported Q1 earnings and announced the acquisition of new assets in Argentina.

I continue to hold GeoPark shares in my personal portfolio, as I see the stock as vastly undervalued compared to its fundamentals. The stock trades at 3.7x FCF and a P/E of 4.4x (both FCF and Net Income Q1 annualized). While there was a lot of uncertainty regarding the maturity of the 2027 bond, this is no issue anymore, as the funding facility of Vitol in combination with large cash flows will cover this. Amidst recent volatility in global energy markets, it’s important to prioritize companies like GeoPark with low breakevens (~30$) and experienced management.

🇧🇷 JBS: Positive Momentum And Attractive Valuation (Seeking Alpha) $

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) is the largest animal protein company globally, with a robust business model, geographic diversification, and strong relationships with farmers and distributors.

JBS has good operational indicators and 18% discount in valuation compared to peers, experiencing positive momentum and reducing leverage.

The company’s latest results show all these attributes in improving margins.

🇧🇷 Riding The Vale Rollercoaster: A Bullish Play For Bold Investors (Seeking Alpha) $

Vale (NYSE: VALE) plans to invest $3.3 billion in Brazil and Canada to increase copper and nickel production.

The company aims to expand copper production capacity to 500,000 tons by 2028, focusing on Salobo and Sossego mines in Brazil.

Vale’s shift towards higher-cost commodities like copper and nickel is significant amid potential supply shortages and market trends.

🇧🇷 Vale: China’s Construction Collapse Signals Multi-Decade Peak In Iron Ore Demand (Seeking Alpha) $

As expected, Vale (NYSE: VALE) has declined by ~21% since I last covered it as China’s demand falters and production costs rise.

By 2026, I expect we’ll see even lower iron demand from China as its property bubble collapse accelerates despite government stimulus efforts.

Chinese demand accounts for most of Vale’s sales and is the primary driver of iron ore prices, implying a potentially permanent peak in China’s iron import demand.

As the Middle East and Asia governments pursue “make work” construction projects, I think there is evidence that global iron ore demand may never recover to 2010s levels within the foreseeable decades.

Vale’s copper business growth is not strong enough to offset its iron ore risks, potentially leaving the company mildly overvalued.

🇧🇷 XP Inc.: Lots Of Competition And Little Potential For Appreciation (Seeking Alpha) $

(Brokerage provider of low-fee financial products) XP, Inc (NASDAQ: XP) sees competition advancing in all its businesses, and this is impacting its results.

Despite presenting good financial indicators, competitors are also extremely efficient.

Through a comparative analysis using the P/E multiple, the company has a downside of 15%.

🇧🇷 Nubank’s Credit Strategy Amid Rising NPLs (Giro’s Newsletter)

🇧🇷 🇰🇾 StoneCo: Growing Quickly And Trading Cheaply (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) is a Brazilian fintech company providing payment, software, and banking solutions for MSMBs.

Despite recent volatility, StoneCo has undergone structural renewal and is projected to have over 30% CAGR in adjusted net income until 2027.

StoneCo’s business includes payments, software, and banking segments which create a strong ecosystem around the business services.

🇧🇷 🇰🇾 StoneCo: Misunderstood Pessimism Creates An Attractive Opening (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) investors have endured a disappointing bear market decline.

StoneCo’s Q1 earnings miss has intensified execution risks for STNE to meet its full-year guidance.

Potential political interference by the Lula administration has weakened investor confidence in the independence of Brazil’s central bank.

STNE is valued at a forward adjusted PEG ratio of 0.46, well below its sector median.

I argue why STNE is well-primed for a recovery if investors can overcome their fears and capitalize on its weakness.

🇧🇷 🇰🇾 StoneCo: Stirring Waves In Banking (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) is diverging from its fintech origins, and is more like a bank with each quarter.

Facing challenges with increasing non-performing loans. Investors should keep an eye on this.

Paying 10x forward profits seems cheap, but details matter.

🇧🇷 🇰🇾 StoneCo: Little Margin Of Safety And Skepticism About The Strategy (Seeking Alpha) $

StoneCo Ltd (NASDAQ: STNE) opts for a more capital-intensive business in acquiring. When it comes to granting credit, it has competition from banks that have been doing this for over 50 years.

For this reason, I have the feeling that competitors’ businesses are more complementary.

Despite having the best financial indicators, the valuation has little potential for appreciation in my view.

🇧🇷 Lithium Corporation: Reevaluating The Company’s Production Before Potential Sale (Seeking Alpha) $

Sigma Lithium Corporation (CVE: SGML) aims to support its valuation by expanding production capacity and stabilizing lithium prices.

The company plans to increase concentrate production through infrastructure builds in H2 2024, with a focus on green lithium production and low-cost operating models.

SGML’s valuation metrics suggest the stock may be slightly overvalued, but potential production increases and strategic partnerships could boost its market standings.

🇧🇷 Atlas Lithium Corporation: Nearing Potential Buy Zone (Seeking Alpha) $

Atlas Lithium Corporation (NASDAQ: ATLX) stock has dropped significantly, potentially creating a buy zone below $10 per share.

The company is focused on lithium production in Brazil, with plans to start production in Q4 2024 and reach 300,000 tons by mid-2025.

Atlas Lithium’s DMS processing technology is cost-effective, environmentally friendly, and positions them as a strong player in the lithium production industry.

Shares are a buy with price target of at least $13.

🇨🇱 Enel Chile: Receivables Sales Will Mean Capacity Increases And Less Debt (Seeking Alpha) $

Enel Chile (NYSE: ENIC) should see major working capital improvements, permitting more investment and lower net debt and interest costs.

There is a tariff regime change for their regulated concession, and it probably will increase compensation due to the higher cost of capital environment.

Hydrology conditions are also good, which means that they have plenty of energy to supply to their market obligations. The direction appears to be good.

🇺🇾 Is DLocal Still a Buy? (Steve Wagner | Invest)

After careful analysis, I decided to purchase additional shares of (online cross-border payment platform) Dlocal (NASDAQ: DLO) for several reasons (refer to my archived DLO articles for a detailed analysis). The primary reason is the significant sell-off, which has created an attractive value opportunity. Investors often overlook that with a new CEO in place, it’s crucial to allow time for their strategies to take effect and yield results over the next few quarters. This patient approach can help avoid emotional decision-making and potentially lead to better outcomes.

DLO is a profitable, cash flow-generative business with a clear stated goal by management of growing gross profit dollars.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 This Chinese Company’s Compliance With The US’ Anti-Russian Sanctions Is Very Consequential (Andrew Korybko’s Newsletter)

Russia and China aren’t “against” one another, but they still prioritize their corresponding national interests. These largely overlap, in which cases they cooperate to pursue their shared goals, but they sometimes diverge and thus lead to developments like Chinese companies complying with US sanctions.

China’s Wison New Energies announced in a LinkedIn post on Friday that they’re immediately stopping all their Russian projects “in view of the strategic future of the company” following the latest imposition of US sanctions against that country’s LNG industry in mid-June. Oilprice.com wrote that this will “deal a blow” to Russia’s Arctic LNG 2 project after Wison was contracted to build its modules, “which are massive, prefabricated structures that facilitate the rapid construction of LNG processing plants.”

Neither the Chinese state nor its companies should therefore be negatively judged for voluntarily complying with US sanctions, but the very fact that this compliance continues occurring should result in members of the Alt-Media Community (AMC) correcting their false perceptions about Russian-Chinese ties. Many top influencers adhere to the dogma that these two see eye-to-eye on everything and are jointly coordinating all their moves in order to accelerate multipolar processes, but that’s not true.

🇨🇳 Exclusive: China seeks cut in foreign card transaction fees to encourage usage (Caixin) $

China is calling on global bank card clearing institutions to cut their fees on transactions made on the Chinese mainland using overseas cards, in an attempt to remove a major obstacle to the government’s intensifying efforts to make it easier for foreigners to make payments.

The Payment and Clearing Association of China (PCAC), a self-regulatory organization overseen by the central bank, has held discussions with international bank card issuers on pushing the fees local merchants are charged for foreign card transactions down to a rate of around 1.5% of the transaction value from the current range of 2% to 3%, Caixin has learned from sources with knowledge of the matter.

Visa and MasterCard announced plans to lower fees to support the initiative, responding to guidelines from the State Council.

🇨🇳 In Depth: Alipay and WeChat Pay’s Smaller Peers Struggle Amid New Crackdown (Caixin) $

Small nonbank PSPs relied on “code stacking” to compete with Alipay and WeChat Pay, but regulatory crackdowns have ended this practice, forcing PSPs to find new compliant business models.

The number of nonbank PSPs has dropped from 270 in 2015 to 179, and recent regulations have introduced harsher penalties and requirements for market access and operations.

PSPs are now diversifying by exploring overseas markets and partnering with SaaS companies to sustain growth, although new ventures face significant challenges and competition.

🇨🇳 🇭🇰 HK 第15部分; The Experts (Jam_invest)

🇨🇳 KPMG Cuts Hong Kong IPO Forecast by 40% Blaming Fed Rate Cuts Delay (Caixin) $ & Chinese Mainland and Hong Kong IPO Markets 2024 mid-year review (KPMG)

KPMG downgraded its expectations for Hong Kong’s initial public offering (IPO) market this year, citing a global decline in dealmaking.

The accounting and consulting firm now expects up to 80 new listing, raising a total of HK$60 billion ($768 million), down 40% from its earlier estimate.

In the first half of 2024, the Hong Kong IPO market raised a total of HK$11.6 billion across 27 deals, representing a decrease of 35% and 15% in funds and deal volume compared with the first half of 2023.

🇨🇳 China’s super-rich are eyeing the exit (FT) $ 🗃️

But capital controls mean getting money out of the country is no easy task

China’s loss is mirrored by the net inflows of wealthy people into other countries. At the top of the leaderboard are the United Arab Emirates, the US, Singapore and Canada. Japan, where Chinese billionaire Jack Ma sojourned for some months in 2022 after falling out of favour in Beijing, is also seeing inflows of millionaires.

🇿🇦 Podcast: Unmasking South Africa’s energy crisis: Insights from Adil Nchabaleng (IOL)

In a gripping episode of the Business Report Insights podcast, Professor Terrence Kommal sits down with Adil Nchabaleng, an esteemed energy expert, to unravel the complexities behind South Africa’s enduring energy crisis.

Guided by Professor Kommal’s probing questions, the conversation kicks off with Nchabaleng’s assertion that the root of the crisis lies in the aggressive push towards privatization. According to Nchabaleng, the aim to transform Eskom from a public utility into a profit-driven entity has led to a neglect of its developmental role within South Africa. He argues that privatization is being presented as a remedy for mismanagement, yet it primarily serves private interests rather than the national economy. This shift, he suggests, has turned Eskom into a “buyer and generator of last resort,” while the private sector assumes a dominant role in power generation.

Nchabaleng dives deeper into the technical and managerial inefficiencies plaguing Eskom, thanks to Kommal’s insightful inquiries. He explains that the operational processes of Eskom, from coal conversion to electricity generation, have been unnecessarily complicated. These complexities, coupled with vested interests, have prevented the company from performing optimally. Nchabaleng points out that despite being the largest revenue generator in South Africa, Eskom’s potential is stifled by mismanagement and conflicting strategies within its leadership.

🌐 Emerging market currencies suffer worst start to the year since 2020 (FT) $ 🗃️

🌐 Frontier emerging markets lure investors back with high yields (FT) $ 🗃️

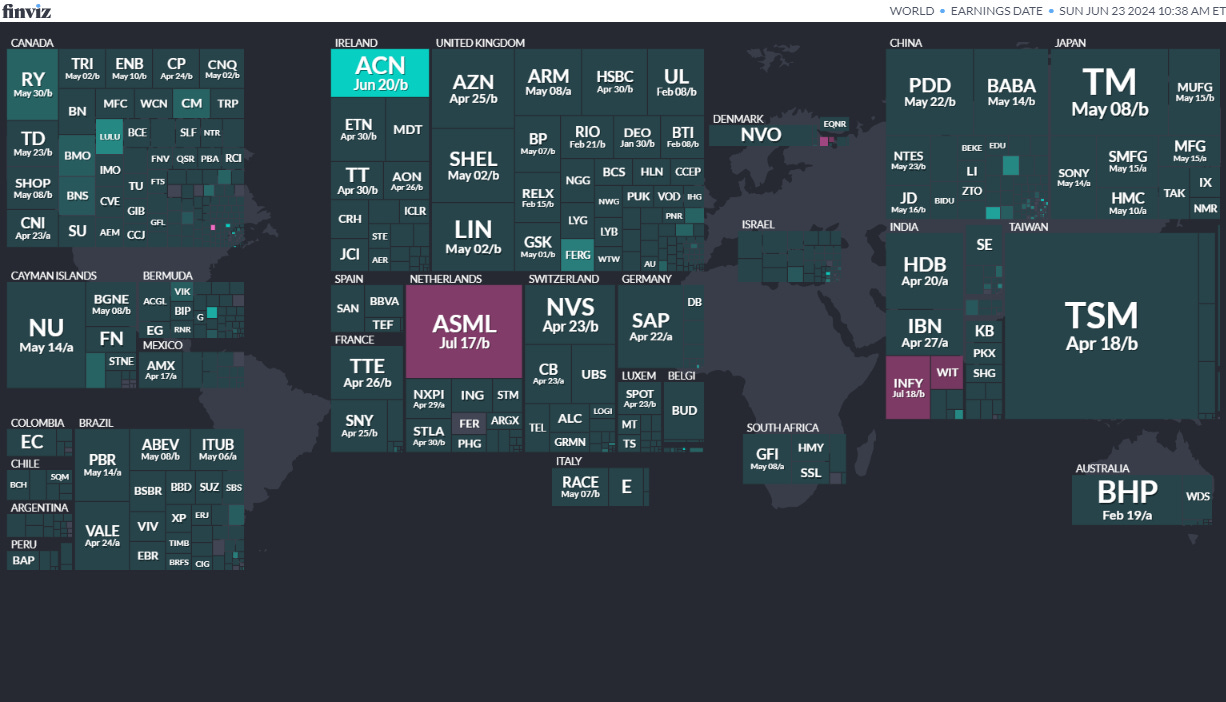

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

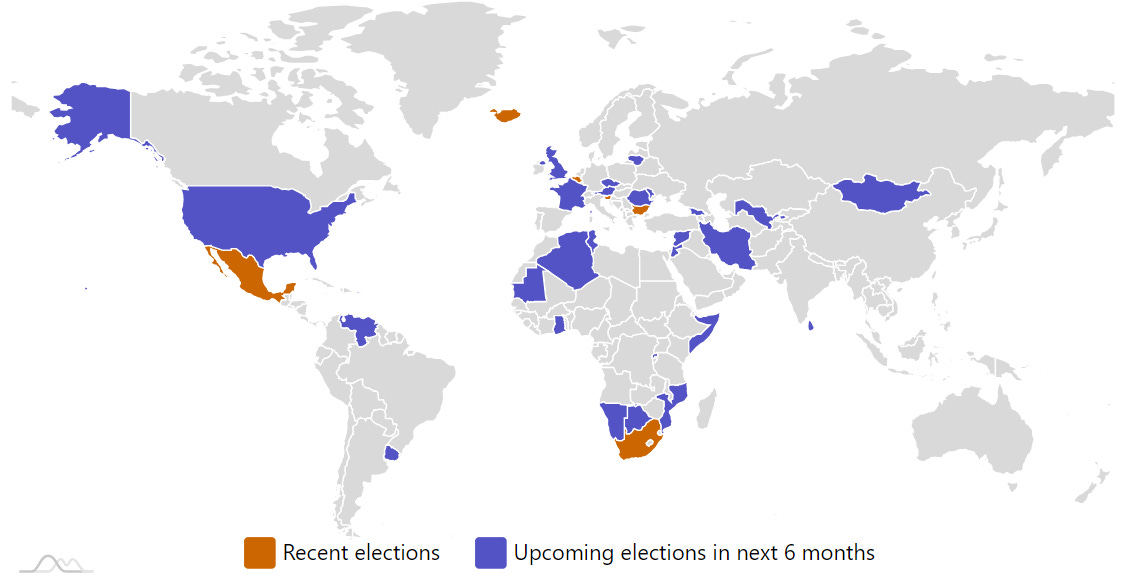

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Mongolia Mongolian State Great Hural Jun 28, 2024 (d) Confirmed Jun 24, 2020

-

Venezuela Venezuela Presidency Jul 28, 2024 (d) Confirmed May 20, 2018

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Romania Romanian Presidency Sep 15, 2024 (t Date not confirmed Nov 24, 2019

-

Czech Republic Czech Senate Sep 30, 2024