Emerging Market Links + The Week Ahead (June 9, 2025)

Nikkei Asia recently reported:

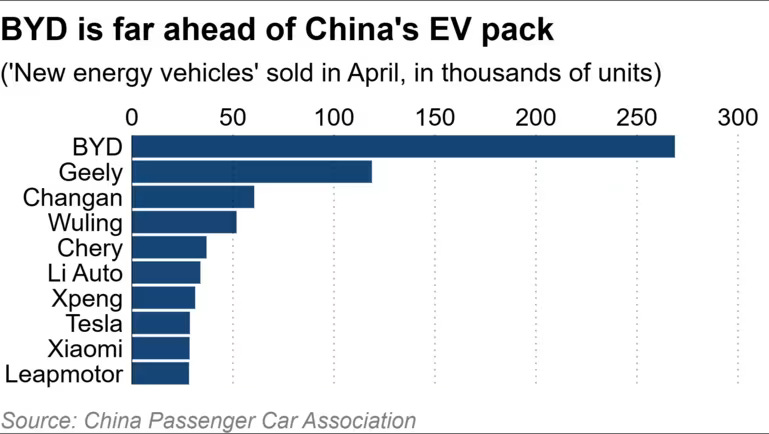

🇨🇳 BYD price bombshell raises specter of wider China EV consolidation (Nikkei Asia) 🗃️

Discounts of up to 34% add to pressure that could squeeze out weaker players

Thanks to the campaign, drivers will be able to get a BYD for as little as around $7,700.

But the low prices have renewed concerns over a race to the bottom in the industry, sending the stock prices of BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) and other Chinese EV makers plunging. BYD shares dropped over 8% on Monday, and continued to decline on Tuesday, sliding as much as 4.2% in morning trading.

At around the 1:25:47 mark in the latest episode of The China Show (which provides a good reality check as the pair previously lived in and rode around China on ATVs for years doing another YouTube show), they discussed the Trump vs. Elon saga and the China EV angle to it which can be summarized by the screenshots below:

They explained how Chinese EV makers are getting EVs registered, plated and insured which gets them counted as sales to be added to their sales data and to receive government subsidies. Then they end up in a field to rust or to eventually be sold as bad quality second hand / used cars for a discount (perhaps in emerging markets…).

The China Show then explained how Chinese EVs are increasingly a huge Ponzi scheme in the same manner as when shared bicycles got pumped out by the millions some years ago only to end up rusting in fields (as one of the hosts explained in this old video that also delved into the Chinese mindset where if somebody does something successful, everyone starts doing it e.g. speculating in properties, opening hotpot restaurants/coffee shops, making shared bikes, etc)…:

Finally, China is also bringing in foreign influencers (aka “Speed,” etc.) to promote Chinese EVs, but no American EV subsidies (“Big Beautiful Bill”) means almost no EV sales in the USA…

And for the more conspiracy minded: No Chinese EVs on American roads also means no Chinese cars filming every inch of America or potentially being turned into weapons, etc…

$ = behind a paywall

-

🌐 Emerging Market Stock Picks (May 2025) Partially $

-

Plus asking DeepSeek for some insights about the Indonesia, Malaysia, Singapore, Thailand, UAE, South Africa & Mexico stocks covered in this post, etc.

-

🇮🇩 Indonesia – Indosat Ooredo Hutchison Tbk PT, Bank Rakyat Indonesia (Persero) Tbk PT, Bank Tabungan Negara (Persero) Tbk PT, Bank Mandiri (Persero) Tbk PT, Bank Negara Indonesia (Persero) Tbk PT, Aneka Tambang Tbk PT, PT Merdeka Copper Gold Tbk, Bank Jago Tbk PT, Alamtri Resources Indonesia Tbk PT, Astra International Tbk PT, Mitra Adiperkasa Tbk PT, Bank Central Asia Tbk PT, Bumitama Agri Ltd, Indo Tambangraya Megah Tbk PT, Mayora Indah Tbk PT, Indofood Sukses Makmur Tbk PT, Indofood CBP Sukses Makmur Tbk PT, XLSmart Telecom Sejahtera, Global Digital Niaga TBK PT, Telkom Indonesia (Persero) Tbk PT, Bukalapak.com Tbk PT, PP London Sumatra Indonesia Tbk PT, Perusahaan Gas Negara Tbk PT, Charoen Pokphand Indonesia Tbk PT, Sumber Alfaria Trijaya Tbk PT & Astra Agro Lestari Tbk PT

-

🇲🇾 Malaysia – IHH Healthcare Bhd & Frencken Group Ltd

-

🇸🇬 Singapore – Seatrium Limited, SATS Ltd, Singapore Telecommunications Ltd, SIA Engineering Company Ltd, AEM Holdings Ltd, Delfi Ltd, Singapore Airlines Ltd, ComfortDelGro Corporation Ltd, Karooooo Ltd, NetLink NBN Trust, SEA Ltd, Mapletree Industrial Trust, Genting Singapore Ltd, Wilmar International Ltd, Venture Corporation Ltd, APAC Realty Ltd, UMS Integration Ltd, Mapletree Logistics Trust, Daiwa House Logistics Trust, AIMS APAC REIT, Frasers Logistics & Commercial Trust, United Overseas Bank Ltd, Frasers Hospitality Trust, CDL Hospitality Trusts, CapitaLand Investment Ltd, Sheng Siong Group Ltd, Grab Holdings Ltd & ISDN Holdings

-

🇹🇭 Thailand – Amata Corporation PCL, BGrimm Power PCL, Siam Wellness Group PCL, Axtra Future City Freehold and Leasehold Real Estate Investment Trust, Berli Jucker PCL, Stecon Group, Osotspa PCL, Warrix Sport PCL, Chularat Hospital PCL, WHA Industrial Leasehold REIT, Thailand Future Fund, WHA Premium Growth Freehold And Leasehold Real Estate Investment Trust, PTG Energy PCL, Minor International PCL, Central Retail Corporation PCL, Hana Microelectronics PCL, Srisawad Corporation PCL, Com7 PCL, Praram 9 Hospital PCL, Muangthai Capital PCL, CH Karnchang PCL, Bangkok Chain Hospital PCL, Charoen Pokphand Foods PCL, Airports of Thailand PCL, Tidlor Holdings PCL, Bangkok Expressway and Metro PCL, Bangkok Dusit Medical Services PCL, TQM Alpha PCL, KCE Electronics PCL, Rajthanee Hospital PCL, Erawan Group PCL, Ekachai Medical Care PCL, Master Style PCL, PTT PCL, CP ALL PCL, Bangchak Corporation PCL, Central Plaza Hotel PCL, Frasers Property Thailand Industrial Freehold & Leasehold REIT, PTT Global Chemical PCL, SVI PCL, Indorama Ventures PCL, Thai Oil PCL, Thai Union Group PCL, PTT Oil & Retail Business PCL, IRPC PCL, Global Power Synergy PCL, Star Petroleum Refining PCL, Central Pattana PCL, Home Product Center PCL, Bumrungrad Hospital PCL, Mega Lifesciences PCL & Siam Cement PCL

-

🇦🇪 United Arab Emirates (UAE) – Investcorp Capital

-

🇿🇦 South Africa – The Good Old Days of Thriving Conglomerates, Afrimat & Famous Brands Ltd, Nampak Ltd, Stadio Holdings Ltd, Tiger Brands, Rainbow Chicken, Renergen, Blue Label Telecoms, PPC Ltd & CA Sales Holdings

-

Latin America – Mercadolibre Inc

-

🇲🇽 Mexico & Central America – Fomento Economico Mexicano SAB de CV, FIBRA Prologis, Alsea SAB de CV, Genomma Lab Internacional SAB de CV, La Comer SAB de CV, Grupo Aeroportuario del Pacífico or GAP, Wal-Mart de Mexico SAB de CV, Grupo Comercial Chedraui SAB de CV, America Movil SAB de CV, CEMEX, Grupo Aeroportuario del Centro Norte or OMA, El Puerto de Liverpool SAB de CV, Coca-Cola Femsa SAB de CV & GMexico Transportes

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 Zeekr privatization hits a speed bump (Bamboo Works)

At least six of the new energy vehicle maker’s minority shareholders have sent letters to the NEV maker saying a proposed privatization price is too low

Six minority shareholders of ZEEKR Intelligent Technology Holding Limited (NYSE: ZK) have protested that a proposed offer to privatize the company is too low, according to a Reuters report

The company’s stock currently trades at a price-to-sales ratio of just 0.63, less than a third of most of its major peers like Zhejiang Leapmotor Technology Co Ltd (HKG: 9863) and XPeng (NYSE: XPEV)

🇨🇳 Sany constructs new IPO bid, as low ROE threatens to undermine its valuation (Bamboo Works)

The construction equipment maker’s new Hong Kong listing bid comes after it pulled the plug on previous IPO attempts in Hong Kong, Switzerland and Germany

Sany Heavy Industry (SHA: 600031) has applied to list in Hong Kong, hoping to sell investors on its status as the world’s biggest seller of excavators

The heavy construction equipment maker’s overseas business has been outpacing its domestic sales, accounting for over 60% of its revenue last year

🇨🇳 Didi Global (DIDIY US) (Asian Century Stocks) $

China’s leading ride hailing platform at 8.4x 2029e P/E with a HK listing catalyst

DiDi Global (OTCMKTS: DIDIY) — US$23 billion) is China’s largest ride-hailing company.

You can think of Didi as the “Uber of China.” Open the app and specify a destination, and Didi will then match you with a driver to take you there. Payment is done seamlessly via the app.

Didi has been an incredible success story. It has almost 700 million users in China and beyond, with a significant presence in Brazil and Mexico. Supporting these markets are roughly 25 million drivers, many working full time.

The Chinese government also pressured Didi to delist from the NYSE. Today, Didi trades over the counter on the US Pink Sheets market, which means lower reporting requirements. Didi doesn’t offer earnings calls with investors. And it issues press releases instead of quarterly reports.

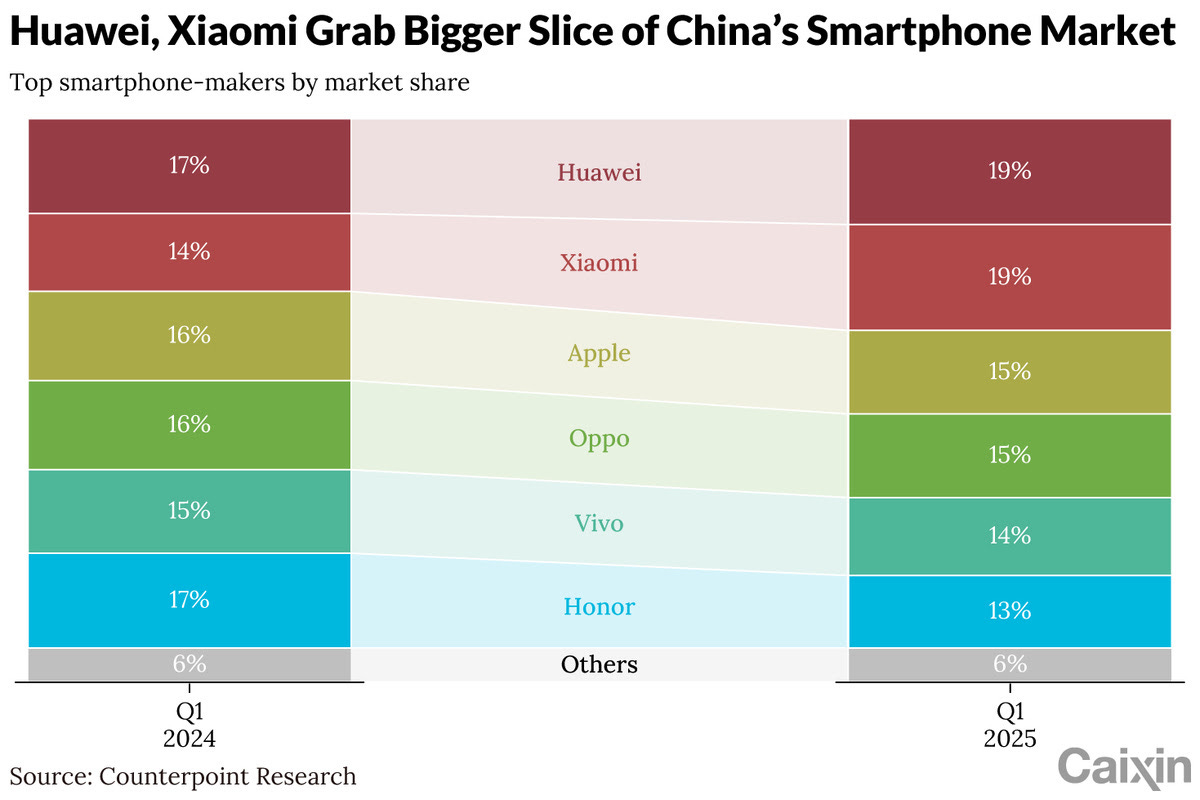

🇨🇳 Chart of the Day: Huawei, Xiaomi top China smartphone sales ranking (Caixin) $

Huawei Technologies Co. Ltd. and Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF) stood together at the top of China’s smartphone shipments rankings for the first quarter of this year, as the tech giants pushed for chip self-sufficiency amid rising trade tensions between Beijing and Washington.

In the three months through March, Huawei took the top spot with an 18% year-on-year increase in shipments, giving it 19% of China’s smartphone market, according to a report published by Counterpoint Research.

Xiaomi, which also had 19% of the market, boosted its first-quarter shipments by 40% year-on-year, the report said, without giving a total.

🇨🇳 ACM Research (ACMR): Undervalued semiconductor maverick leveraging its dual citizenship (Dragon Invest)

Fabricating alpha in China from the U.S.

ACM Research (NASDAQ: ACMR) is perhaps one of the most undervalued opportunities that I can find anywhere globally. In fact, I’ll go as far as to say that ACMR maybe even puts the myriad of net nets that I’ve covered to shame. As you can tell, I’m completely gushing over this company and for good reason. So now well you might be asking, “but Dragon, what impresses you so much about this thing?”, I hear you and so let’s begin by diving deep into into an overview and the history of the company.

I’m really glad to be back, there’s going to be 3-4 more stock ideas releasing in the next two weeks or so. I had planned to cover this stock when I initially bought it at around 18 USD but it quickly ballooned to 25 USD before I finished the write up and I cashed out my gains because well a 60% increase in two weeks isn’t very healthy despite the prevailing discount. I think 20-22 USD is a very attractive entry price for this stock and I’ll be looking to add again at that price.

🇨🇳 Temu’s Parent PDD Holdings Posts Double-Digit Sales Growth, Faces Profit Squeeze in Competitive E-Commerce Arena (LongYield)

PDD Holdings (NASDAQ: PDD) or Pinduoduo expects near-term challenges due to sustained ecosystem investments and an uncertain external environment. The company emphasizes long-term intrinsic value over short-term financial performance, indicating that profitability may remain under pressure as it continues to support merchants and consumers. Key risks include:

Analyst commentary reflects concern over the Q1 2025 earnings miss, with the stock price drop indicating investor caution. However, some analysts may view PDD’s long-term strategy positively, particularly if it leads to sustainable growth. The company’s strong cash position and strategic focus provide a foundation for future opportunities, though investors should approach with cautious optimism given the near-term challenges.

🇨🇳 Natan’s Notes #1: The PDD Crash (Natan’s Substack)

🇨🇳 Qudian: A slow-motion privatization? (Bamboo Works)

The company said it is contemplating winding down its last-mile delivery service after stiff competition caused its revenue to plunge in the first quarter

Qudian (NYSE: QD)’s revenue fell by more than half in the first quarter, as the company said it is considering closing its last-mile delivery business due to intense competition

The company’s outstanding share count has shrunk by about a third over the last three years, and it could use its large cash holdings to keep buying back stock and privatize

🇨🇳 Cover Story: China’s bank deposit insurance plan is seen needing new support (Caixin) $

In the spring of 2019, a quiet but historic event shook China’s banking sector: Baoshang Bank collapsed. It was the first true bank failure in the country since the founding of the People’s Republic, and the first real test of a deposit insurance system created four years earlier. That test would define the future of financial risk management in China.

Today, the bank born from Baoshang’s ashes — Mengshang Bank — is not only alive but profitable. It reported 2024 net income of 180 million yuan

($25 million), up 65.2% from the previous year, excluding losses booked from merging with a dozen rural banks. Its bad loan ratio dropped to 1.02%, while provision coverage surged to nearly 300%.

🇨🇳 Yeahka secures bridgehead in U.S. payments market (Bamboo Works)

Yeahka (HKG: 9923 / FRA: 4YE / OTCMKTS: YHEKF)

The Chinese fintech has cleared one of many regulatory hurdles to enter the U.S. digital payments business after gaining a state-level operating license

After getting U.S. federal clearance, the firm is now adding the required permits from individual states, starting with Arizona

The company’s overseas revenue is rising fast, helping to offset a saturated Chinese market

🇨🇳 UP Fintech gets lift from tariff-induced market volatility (Bamboo Works)

The online stockbroker’s revenue and net profit grew substantially in the first quarter as its trading volume surged on volatility in global stock markets

UP Fintech Holding (NASDAQ: TIGR)’s revenue jumped 55% year-on-year in the first quarter, and its net profit surged 150%

The online stockbroker benefitted from increased market volatility as uncertainty about U.S. tariffs led to higher frequency stock trading

🇨🇳 Cango’s ownership, board take shape as bitcoin mining transformation nears completion (Bamboo Works)

The company will be controlled by two asset managers tied to Singapore’s Antalpha Ventures, while Cango (NYSE: CANG)’s co-founders’ voting rights will drop to 12.07%

Enduring Wealth, a company tied to Singapore’s Antalpha Ventures, will hold a controlling 36.74% of Cango’s voting rights after the company’s transformation to a bitcoin miner

Cango co-founders Zhang Xiaojun and Lin Jiayuan will see their voting rights in Cango drop to a combined 12.07% post-transformation, from a previous 92.5%

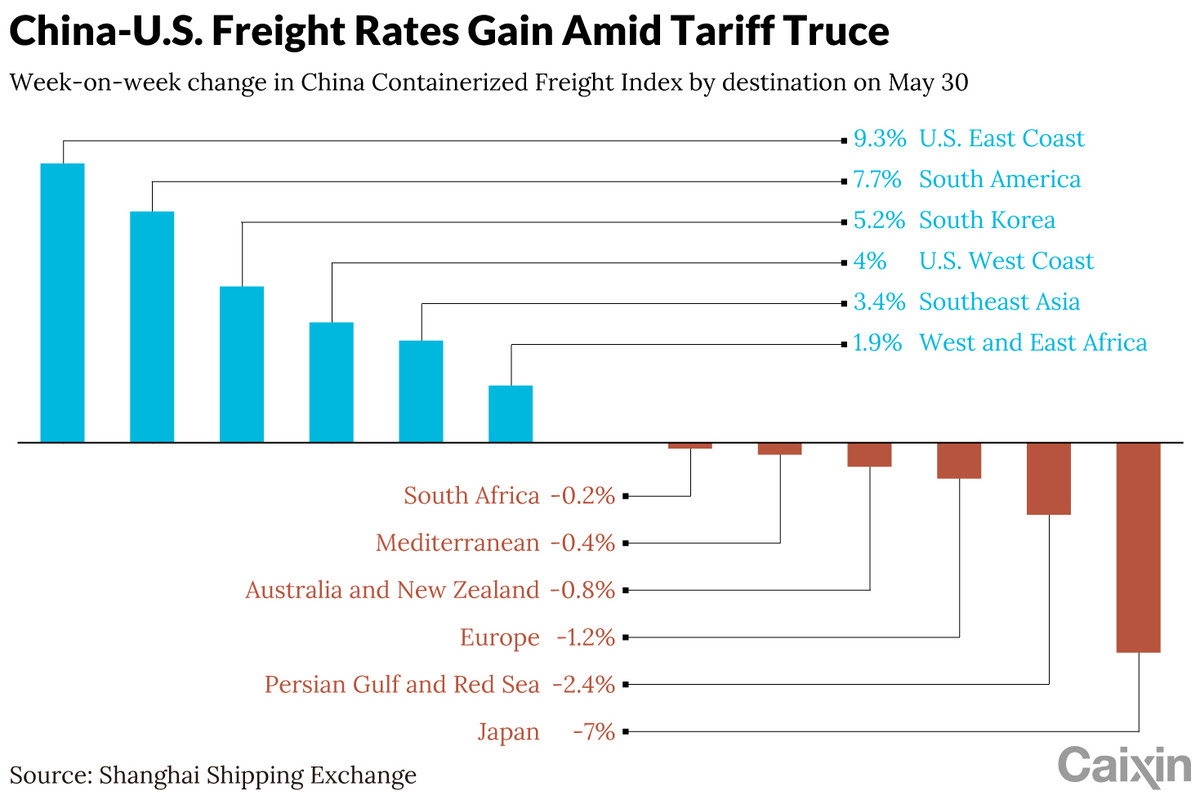

🇨🇳 Maersk rethinks China strategy as shipping rates pitch wildly (Caixin) $

A months-long cycle of plunging and soaring container shipping rates on China-U.S. routes has prompted shipping giant AP Moeller-Maersk A/S (CPH: MAERSK-A / MAERSK-B / FRA: DP4B / OTCMKTS: AMKAF) to adjust its China operations by better integrating logistics and expanding its air cargo network.

Denmark-headquartered Maersk, which ships about 7 million twenty-foot equivalent units (TEUs) of Chinese exports annually, saw its volume on China-U.S. routes fall by 30% to 40% by the end of April compared with levels prior to the Trump administration’s “reciprocal tariffs,” said Silvia Ding, managing director of Maersk Greater China.

🇨🇳 Charts of the Day: Soaring shipping costs (Caixin) $

Container shipping rates on China-U.S. routes surged as Chinese exporters raced to move goods ahead of an expiring tariff truce.

The Shanghai Containerized Freight Index, which tracks spot freight rates from the port city to major global export destinations, and the Ningbo Containerized Freight Index, a key regional indicator for freight rates on Chinese exports, each skyrocketed on May 30 from the previous week, marking the highest weekly increases ever recorded on China-U.S. routes, according to data from the Shanghai and Ningbo shipping exchanges.

🇨🇳 QuantaSing excites investors with new toy tune (Bamboo Works)

The adult education company’s shares have tripled since it disclosed a plan to enter the collectible toy business through a major acquisition that closed on March 31

QuantaSing Group Ltd (NASDAQ: QSG) closed its purchase of collectible toy developer Letsvan at the end of March, and expects the purchase to make a “significant” revenue contribution in its June quarter

Revenue from the company’s core adult education services plunged by 40% in its latest quarter, as it focused on customer quality over quantity

🇨🇳 MINISO Group Holding: Clear Growth Path Ahead (Seeking Alpha) $ 🗃️

🇨🇳 Why Starbucks Isn’t Even Trying to Fight the Coffee War in China (The Great Wall Street – Investing in China)

While Luckin Coffee (OTCMKTS: LKNCY) and Cotti Coffee slash prices and launch new drinks overnight, Starbucks Corp (NASDAQ: SBUX) watches from the sidelines.

There’s a full-blown coffee war raging in China. I recently ordered a coffee from Cotti on JD.com (NASDAQ: JD) delivered to my door for 1.68 RMB. Yes, you read that right: 1.68. That’s well below raw material cost, unless they’ve figured out how to roast sawdust.

Not too long ago, coffee in Shanghai hovered around ¥20 per cup. Then came the battle between Luckin, Cotti, and others, dragging prices down to ¥9.9 (about $1.37),a price point that has somehow become the new normal. Now consumers expect it. And while ¥9.9 sounds absurdly cheap if you’re used to paying 5, 6, or 7 dollars for a burnt bean latte in the West, I never understood that pricing to begin with. If you’ve ever looked at raw material costs, it’s a scam wrapped in a foam top.

🇨🇳 CMOC Group Limited (HKEX: 3993) – High-Growth, Low-Cost Producer Positioned for Re-Rating (Smartkarma) $

China Molybdenum or CMOC Group Limited (SHA: 603993 / HKG: 3993)

EBITDA more than doubled (25% CAGR) over 3 years, with copper and cobalt output up ~3.5x and ~5.7x on ramp-up of TFM and KFM.

$4.3 bn invested in DRC; low-cost leaching drives margins; gold entry via Cangrejos adds diversification and long-term optionality.

Strong cash flows, growth pipeline, and ~4x EV/EBITDA valuation position CMOC for sustained upside amid rising energy transition metal demand.

🇨🇳 China Northern Rare Earth (Ticker: 600111.SH): Dominant Force Riding REE Upswing (Smartkarma) $

Prices surge: In April 2025, China curbed rare earth exports, citing environmental and strategic concerns. Prices of dysprosium and terbium jumped 25–30%, triggering severe shortages for EV, defense, and tech firms. Global supply chains face delays, prompting urgent diversification, stockpiling, and rising geopolitical risk around critical material access.

EXECUTIVE SUMMARY

China Northern Rare Earth (CNREH) (SHA: 600111) 🇼 posted a 727% YoY net profit surge in Q1 2025, driven by rising PrNd prices and strong volume growth, earnings momentum could continue amid recovering demand and operational leverage.

With exclusive access to the Bayan Obo mine—holding the world’s largest REE reserves—CNRE commands a near-monopoly in China’s rare earth supply chain.

Its dominant 70% share of national separation quotas ensures structural pricing power and long-term resource security.

🇨🇳 Chinese skincare company refutes ‘false advertising’ claims (Caixin) $

Chinese collagen skincare developer Giant Biogene Holding (HKG: 2367) has refuted claims that one of its best-selling products is falsely labeled, the latest development in a spat with a domestic rival.

In a social media post Wednesday, Hong Kong-listed Giant Biogene defended the Comfy-branded skincare essence as having a concentration of recombinant collagen exceeding the 0.1% weight per weight amount required under Chinese cosmetics labeling rules, citing test results it commissioned from several third-party laboratories.

🇭🇰 The Worst Stock Index in the World: The HK GEM Index (The Great Wall Street – Investing in China)

Where Bad Decisions Go Public

Recently, I’ve come across a couple of stock pitches featuring companies listed on Hong Kong’s GEM board. Some of these pitches were halfway decent. Others? Even more fishy than the GEM market itself.

So here’s your friendly reminder: don’t buy GEM stocks.

The GEM index is down 99% since its peak. It peaked 1,823.74 (July 2007) and is currently at 17.63. That’s not a typo. Ninety-nine percent. This index is completely broken. The GEM index even beat the OMX Iceland 15 which was down −97.1% and discontinued in 2009 after financial crisis. HK 1 Iceland 0!

🇭🇰 Everbright stock soars on Circle IPO as stablecoins excite investors (Caixin) $

China Everbright Ltd (HKG: 0165 / FRA: EVI / OTCMKTS: CEVIF)’s stock surged after renewed enthusiasm for stablecoins, as investors reacted to the rising valuation of Circle Internet Group (NYSE: CRCL) ’s initial public offering (IPO) and policy tailwinds in both the United States and Hong Kong — 10 years after Everbright’s early bet on the USDC issuer.

Shares of the Hong Kong-based financial services company jumped by as much as 26.6% on Tuesday before paring gains to close up 15.5% at HK$5.43 ($0.69). The rally was driven by renewed attention to Everbright’s early investment in Circle, the company behind USDC, the world’s second-largest stablecoin by market value.

🇭🇰 Futu: In A Bull Rush, Buy The Brokerage That Sells Shovels (Seeking Alpha) $ 🗃️

-

🌏 Futu Holdings Ltd (NASDAQ: FUTU) – Digitized brokerage & wealth management platform in China, Hong Kong, USA, etc.

🇭🇰 Health And Happiness: Positive On Growth Prospects And Capital Allocation (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇭🇰 Regencell Bioscience: The Most Overvalued Stock In Biotech (Seeking Alpha) $ 🗃️

-

🌐 Regencell Bioscience (NASDAQ: RGC) – R&D & commercialization of Traditional Chinese Medicine (TCM) for the treatment of neurocognitive disorders & degeneration (ADD, autism, etc.).

🇭🇰 China Overseas Land: Consider Short-Term Challenges And Medium-Term Share Gains (Seeking Alpha) $ 🗃️

🇲🇴 Studio City International: Macau’s Growth Streak Comes With A Catch (Seeking Alpha) $ 🗃️

🇲🇴 City of Dreams Sri Lanka casino to open in August: local partner (GGRAsia)

The casino at City of Dreams Sri Lanka, to be managed by Melco Resorts & Entertainment Ltd (NASDAQ: MLCO), is due to open “in August”. That is according to a statement by John Keells Holdings PLC (CSE: JKH), the casino group’s local partner on the project in Sri Lanka’s capital, Colombo.

Krishan Balendra, John Keells’ chairperson, said in its annual report dated May 27: “The completion of the remaining elements of the City of Dreams Sri Lanka integrated resort project is progressing well, with the fit-out and finishing works relating to the 113-key Nuwa hotel and the casino near complete for its planned opening in August 2025.”

GGRAsia has approached Melco Resorts, asking for confirmation of the casino launch date.

🇲🇴 Macau govt’s reduced 2025 GGR forecast not a surprise: CreditSights (GGRAsia)

The Macau government’s revision of its gross gaming revenue (GGR) target for 2025 to MOP228.0 billion (US$28.2 billion), down from MOP240.0 billion was “not a complete surprise,” stated CreditSights Inc in a Thursday memo.

That is “given the softer-than-required monthly GGR prints since the start of the year,” wrote analysts Nicholas Chen and David Bussey.

They added: “We view the new target as more conservative and in-line with the sector’s performance year-to-date.”

🇹🇼 ASE Technology: Powering The Future Of Semiconductors With Innovation And Global Scale (Seeking Alpha) $ 🗃️ (?)

🇹🇼 TSMC: Unfurling The Sails For International Growth Tailwind (Seeking Alpha) $ 🗃️(?)

🇹🇼 TSMC: Inside The World’s Most Crucial Chipmaker (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Supply Chain Deterrence Supports China-U.S. Peace (Seeking Alpha) $ 🗃️

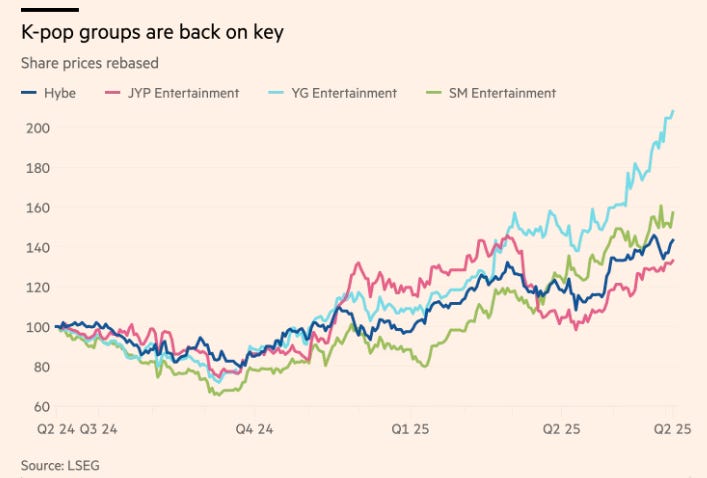

🇰🇷 K-pop’s global growth depends on fancy geopolitical footwork (FT) $ 🗃️

🇰🇷 Lee Jae-Myung Becomes the New South Korean President – Four Investment Themes That Could Outperform (Douglas Research Insights) $

Now that Lee Jae-Myung has become new South Korean President, the uncertainty revolving who will lead South Korea in the next five years is now over.

In this insight, we discuss four investment themes (related to Lee Jae-Myung becoming the new South Korean President) that could outperform the market for the remainder of 2025.

The four investment themes include Korean Holdcos/Quasi Holdcos, Korean Cultural Contents, Securities, and SK Group Companies.

🇰🇷 The thorny path for South Korea’s new president (The Asset) 🗃️

🇰🇷 Lee Jae-Myung’s 20 Trillion Won+ Supplementary Budget: Free Money, Don’t Worry and Be Happy (Douglas Research Insights) $

One of the major policies that Lee Jae-Myung’s new administration is likely to push through is the 20 trillion won (US$15 billion)+ supplementary budget.

The aim of this policy is to revive the sluggish domestic economy. It is a classic “spend first, worry later” government policy.

The supplementary budget is basically sacrificing the balance sheet of the entire South Korea at the expense of short term economic stimulus which may have just limited impact.

🇰🇷 Paradise Co’s casino sales reach US$61mln in May (GGRAsia)

Casino sales at Paradise Co Ltd (KOSDAQ: 034230) rose 10.3 percent year-on-year to nearly KRW83.54 billion (US$61.1 million) in May, according to a Wednesday filing to the Korea Exchange. Judged sequentially, last month’s tally was up 24.2 percent.

The company is an operator in South Korea of foreigner-only casinos, including a venture at Paradise City (pictured) in Incheon, done jointly with Japanese entertainment conglomerate Sega Sammy Holdings Inc.

🇰🇷 Grand Korea Leisure’s casino sales up 4pct y-o-y in May, to US$22mln (GGRAsia)

Grand Korea Leisure Co Ltd (KRX: 114090), an operator in South Korea of foreigner-only casinos, reported casino sales of almost KRW30.64 billion (US$22.3 million) in May, according to a Wednesday update filed to the Korea Exchange.

Grand Korea Leisure runs three foreigner-only, Seven Luck-branded, casinos. Two are in the capital Seoul, including one at Gangnam. Its third is in the southeastern port city of Busan.

The company is a subsidiary of the Korea Tourism Organization, which in turn is affiliated to the country’s Ministry of Culture, Sports and Tourism.

🇰🇷 Top 30 Best Performing Stocks in KOSPI in Past Week and Surging Price of Samsung Life Insurance (Douglas Research Insights) $

In this insight, we also provide a list of 30 top performing stocks in KOSPI in the past one week (in terms of price performance and trading value).

We also discuss the surging share price of Samsung Life Insurance (KRX: 032830) which suggests a near-term regulation change that could require the company to partially dispose its stake in Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF).

With Lee Jae-Myung becoming the new South Korean President, the probability of Samsung Life Insurance being forced to sell its stake in Samsung Electronics has risen much more.

🇰🇷 NAV Valuations of Top Five Largest “Pure” Holdcos in Korea (Douglas Research Insights) $

Holding companies have been the best performing asset class in the Korean stock market in the past month.

In this insight, we provide updated NAV valuations of the top five, largest “pure” holdcos in Korea including SK Square (KRX: 402340), SK Inc (KRX: 034730 / 03473K), LG Corp (KRX: 003550 / 003555), Hanjin Kal (KRX: 180640), and HD Hyundai.

The NAVs of these five holdcos are about 18% higher than their current prices on average.

🇰🇷 Updated NAV Valuations of Doosan Corp, Hanwha Corp, CJ Corp, GS Holdings, and Lotte Corp (Douglas Research Insights) $

🇰🇷 A Visit to Daiso in Seoul – A Retail Giant Crushing the Competition (Douglas Research Insights) $

I recently visited Daiso near Seoul Station. Daiso is one of the few off-line stores that has been crushing the competition in Korea in the past several years.

Amid continued weak economy in Korea in the past several years, Daiso has thrived through its detailed execution of focus on low priced products with highest value to consumers.

Able C&C Co Ltd (KRX: 078520) is a prime example a company capitalizing on the strong demand for cosmetic products at Daiso.

Daiso is a competitor to not just the offline retail stores such as E-Mart (KRX: 139480), Olive Young, and Lotte Shopping Co Ltd (KRX: 023530), but also to e-commerce platforms such as Coupang, Inc. (NYSE: CPNG), 11st, and Gmarket, as well as CVS brands such as GS25 (GS Retail (KRX: 007070)) and CU BGF Retail (KRX: 282330). It also competes against global brands such as Miniso Korea and IKEA Korea.

🇰🇷 An Update on Samsung Electronics Chairman Lee Jae-Yong and His Family Members’ Inheritance Tax Payments (Douglas Research Insights) $

This insight provides an update on the inheritance tax payment requirement by the Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) Chairman Lee Jae-Yong and his family members.

Lee Jae-Yong has a final installment of 480 billion won in inheritance taxes to be paid in April 2026.

Once Lee makes the final inheritance tax payment next year, he can start to reinvest his dividend income in various Samsung Group affiliates including Samsung C&T Corp (KRX: 028260 / 02826K).

🇰🇭 🇮🇩 🇲🇾 🇵🇭 🇸🇬 🇹🇭 🇻🇳

🌏 What’s Next for Southeast Asia’s Data Center Boom? (Asianometry)

In May 2025, I rode along with the research firm SemiAnalysis on a datacenter information field trip in Malaysia and Singapore. They did not sponsor this video. I paid my own way. We drove out to actual data center sites. We went through some impressive security, and sat down with the operators to talk about their jobs and the industry. And to an extent, we went inside. I was allowed to photograph a few things. In other places, I can only do a quick and ugly sketch. The datacenter boom in Southeast Asia is hot. But challenges loom due to shortages in certain resources, as well as world geopolitics. In today’s video, some first-hand notes and observations from the heart of the data center boom in Southeast Asia.

🌏 Chinese assets and brands attract strong followings in Asean (The Asset) 🗃️

Chinese assets have become an attractive option for Asean investors seeking to diversify their global portfolios amid the shockwaves unleashed by the US tariffs, suggesting China and Southeast Asia are bound to further strengthen the interconnection of their trade and financial markets.

Earlier this month, Shanghai Stock Exchange ( SSE ), in association with China Galaxy Securities ( CGS ), launched an online roadshow targeting Asean investors. It is the first in a series of Asean-focused events that the bourse operator is holding to attract more long-term capital into China’s equity markets.

“We are seeing great interest from Southeast Asian investors in Chinese equities during the roadshow,” says Angela Cheng, chief macro strategist and head of research at CGS International, in a speech keynoting the roadshow.

🇮🇩 Indonesia bank stocks up 10% amid uncertain outlook (The Asset) 🗃️

Indonesian banking stocks posted a strong performance in May, with the IDX-Pefindo Prime Bank Index recording a monthly gain of nearly 10%. However, the outlook remains uncertain amid global trade tensions and slowing economic growth. Amid these challenges, Indonesian investors prefer more stable and safer high-dividend equities, particularly bank stocks.

The IDX-Pefindo Prime Bank Index tracks the performance of 10 investment-grade Indonesian banking stocks, including Bank Rakyat Indonesia Tbk PT (IDX: BBRI / FRA: BYRA / OTCMKTS: BKRKF / BKRKY), Bank Mandiri Tbk PT (IDX: BMRI / FRA: PQ9 / OTCMKTS: PPERF), Bank Negara Indonesia (IDX: BBNI / FRA: BKE1 / OTCMKTS: PBNNF / PTBRY), Bank Central Asia (BCA) Tbk PT (IDX: BBCA / FRA: BZG2 / OTCMKTS: PBCRF), Bank Tabungan Negara (Persero) Tbk PT (IDX: BBTN / FRA: TA2), Bank Cimb Niaga Tbk PT (IDX: BNGA / FRA: NKX / OTCMKTS: PTNAF), Bank Syariah Indonesia, Bank Danamon Indonesia, Bank Permata Tbk PT (IDX: BNLI / FRA: 85C), and Bank Pan Indonesia Tbk PT (IDX: PNBN / FRA: PTQ).

🇲🇾 Telekom Malaysia: Q1 Miss And Balance Sheet Strength Draw Attention (Seeking Alpha) $ 🗃️

🇲🇾 GEN Malaysia says it now has full ownership of Empire Resorts (GGRAsia)

Global casino operator Genting Malaysia (KLSE: GENM OTCMKTS: GMALY / GMALF) says it has completed the acquisition of the stake it did not control in loss-making, United States-based Empire Resorts Inc.

Genting Malaysia announced in May that it was proposing to acquire the remaining 51 percent of Empire Resorts. The stake was held by the private investment vehicle of Malaysian entrepreneurs the Lim family, also controller of Genting Malaysia and its parent, Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY).

The deal involved a total cash consideration of US$41 million. At the same time, a US$40-million debt previously owed by Empire Resorts to the Lim family’s private investment vehicle will now be owed to Genting Malaysia.

🇸🇬 Grab: I Think There’s Nice Room To Run (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: $200 Inbound (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Is TikTok Shop a threat? (Global Equity Briefing)

Sea Limited (NYSE: SE). Equity Research! Part 2/3

Welcome to Part 2 of the Sea Limited Deep Dive!

In Part 1, we explored how Sea came to be and how this fast-growing technology company from Singapore makes money! (Read Below)

Today, we are looking at Sea’s competition and exploring the risks the company must manage while operating a fintech and e-commerce business in Southeast Asia!

Additionally, we will discuss the management team and look at the moats of the company.

🇸🇬 Is Sea Limited a buy? (Global Equity Briefing)

Sea Limited (NYSE: SE). Equity Research! Part 3/3

In Part 1, I explored how Sea came to be and how this fast-growing technology company from Singapore makes money!

In Part 2, I looked at Sea’s competition and explored the risks the company must manage while operating a fintech and e-commerce business in Southeast Asia!

Today, I will tell you what the opportunities are, how do the finances look like, and most importantly, I will look at the valuation!

Let’s finish the Deep Dive!

🇸🇬 Sea Limited 1Q-2025 Earnings Review (Saadiyat Capital)

Transitioning from a growth story to a Stalwart

Sea Limited (NYSE: SE)’s recent earnings show a lot of positive points that took the market by surprise. The gaming division had its best quarter since 2021 with bookings growing at >50%. Consensus was way lower as the markets overlooked the prowess of SEA’s gaming division which after all provided the financial pathway for Shopee to grow and capture more market share during the company’s early stages. The gaming market as seen by more traditional players like Ubisoft and Take Two Interactive is entirely IP slot dependent and if a company has produced more good content than average, it tends to do well earnings wise. This is one example of where SEA Limited can continue to surprise investors and deliver share gains. In this report, we look to explore all the segments and use management commentary to see what lies for the company in the coming quarters and years.

🇸🇬 Karooooo Is Scaling Efficiently In An Underpenetrated Market (Seeking Alpha) $ 🗃️

-

🇸🇬 🇿🇦 Karooooo (NASDAQ: KARO / JSE: KRO) – Leading provider of an on-the-ground operations cloud that maximizes the value of data. The Cartrack SaaS platform provides insightful real-time data analytics & business intelligence reports. 🏷️

🇸🇬 Singapore Airlines: A Sell On Unconvincing Outlook (Seeking Alpha) $ 🗃️

🇸🇬 Are Dividend Cuts a Death Knell for Your Singapore Stock? (The Smart Investor)

🇸🇬 Share Prices of These 5 Singapore Stocks Have Broken Through Their 52-Week Highs: Are They Worth a Second Look? (The Smart Investor)

🇸🇬 5 Singapore REITs Whose Share Prices Fell by Double-Digits This Year: Are They a Bargain? (The Smart Investor)

The REIT sector may remain under pressure, but discerning investors may find a bargain among these five REITs.

Mapletree Industrial Trust (SGX: ME8U / OTCMKTS: MAPIF), or MIT, is an industrial REIT with a portfolio of 141 properties across six property segments.

Frasers Logistics & Commercial Trust (SGX: BUOU / OTCMKTS: FRLOF), or FLCT, owns a portfolio of 114 properties with a portfolio value of S$6.8 billion as of 31 March 2025.

ESR-REIT (SGX: 9A4U / OTCMKTS: CGIUF) is an industrial REIT with a portfolio of 72 properties located in Singapore (52), Australia (18), and Japan (2).

Lendlease Global Commercial REIT (SGX: JYEU / OTCMKTS: LLGCF), or LREIT, has a portfolio comprising 313 @ Somerset and Jem in Singapore, along with Sky Complex in Milan, Italy. `

CDL Hospitality Trusts (SGX: J85 / OTCMKTS: CDHSF), or CDLHT, is a hospitality trust with a portfolio of 22 properties comprising 4,924 hotel rooms, 352 build-to-rent apartments, and 404 purpose-built student accommodation assets.

🇸🇬 Positive Profit Alert: 4 Singapore Stocks That Are Growing Their Business (The Smart Investor)

These stocks could be in line to increase their dividends next.

Here are four Singapore stocks that recently announced higher profits.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, is a supplier of high-precision tools and parts for the wafer fabrication and assembly processes of the semiconductor industry.

Old Chang Kee (SGX: 5ML), or OCK, manufactures and sells a variety of local snacks such as curry puffs, spring rolls and fried chicken wings.

Oiltek International Ltd (SGX: HQU) specialises in process technology and renewable energy solutions for the global vegetable oils industry.

Valuetronics Holdings (SGX: BN2 / FRA: GJ7) is an integrated electronics manufacturing services (EMS) provider that provides a full suite of services from conceptualisation and engineering design to production and supply chain support.

🇸🇬 Can SATS See its Share Price Hit S$5 Again? (The Smart Investor)

The ground handler cum airline caterer saw its share price climb 7% in the past year, but can it revisit its pre-COVID highs?

Can SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF) see its share price return back above S$5, similar to the pre-pandemic era of February 2018? Let’s find out.

Embarking on a new flight path

Capital Markets Day: FY2029 targets

A strong set of earnings

Encouraging business developments

Get Smart: Steady as she goes

🇹🇭 Thai govt affirms US$3bln minimum investment per casino resort, thinks industry can add up to 0.8pct to annual GDP (GGRAsia)

Thailand’s government has defended its plan for the country to host a number of casino resorts, pledging strict regulations and transparency. Speaking at a press briefing on Wednesday, government representatives said a legalised casino industry could boost the nation’s gross domestic product (GDP) by 0.8 percent annually, and triple tourist spending in the country.

🇰🇿 Kazakh Oil and Gas Distressed Debt Play (TheOldEconomy Substack) $

The “Stans” as One of The Most Arcane Corners of Oil and Gas Game

I have a new rabbit hole to explore: oil fields in overlooked places like “Stans” in Central Asia and Kurdistan in the Middle East. Both regions face a range of risks, like corrupt politicians and geopolitical uncertainties.

Furthermore, many of the companies there are registered in the UK. Windfall tax, anyone?

Tengizchevroil (Chevron, ExxonMobil, KazMunayGas, Lukoil) operates Tengiz; North Caspian Operating Company (NCOC) manages Kashagan; and Karachaganak Petroleum Operating (Shell, Eni, Chevron, Lukoil, KazMunayGas) runs Karachaganak. These three fields now account for over 66% of national output.

🇮🇳 India’s coal champion reopens dozens of mines (FT) $ 🗃️

🇮🇳 Fairfax India (FFH.U) (Coughlin Capital)

At a recent price of about $18, Fairfax India Holdings Corp (TSE: FIH.U / FRA: F5X / OTCMKTS: FFXDF) trades at a 10% discount to book value of about $20 per share.

A few weeks ago, I initiated a starter position in Fairfax India Holdings, a company I’ve been watching for some time. What caught my eye was a glaring disconnect between the company’s market price and the intrinsic value of its underlying assets.

Currently trading around 0.9x book value, Fairfax India offers a compelling opportunity to invest alongside proven capital allocators in one of the world’s most promising growth markets.

But investing directly in Indian equities can be tricky for foreign investors. Market access issues, corporate governance concerns, unfamiliar business practices, and regulatory complexities create meaningful barriers to entry.

This is where Fairfax India shines – offering a professionally managed vehicle to navigate India’s dynamic but often opaque market.

🇮🇳 Deepak Nitrite: Strategic Integration and Ambitious Expansion (Smartkarma) $

Deepak Nitrite Ltd (NSE: DEEPAKNTR / BOM: 506401) reported stable FY25 consolidated results despite challenging market conditions, with a notable Q4 sequential recovery in revenue and profitability.

The company achieved record production volumes through debottlenecking and optimization, maintained strong domestic market share, and initiated a significant shift to renewable energy.

Management outlined an INR 8,500 Cr investment in the PC resin project, alongside other integration and expansion plans, signaling confidence in future growth and resilience.

🇮🇳 The Beat Ideas: Finolex Industries Ltd ~ Vertically Integrated PVC Manufacturer (Smartkarma) $

Finolex Industries (NSE: FINPIPE / BOM: 500940) is a leading, vertically integrated Indian PVC manufacturer, the 2nd largest in PVC resin and 3rd in pipes & fittings, with captive production offering cost advantage.

Margin recovery in FY26 is targeted post headwinds faced by industry via pricing correction, improved product mix, enhanced discount management, and cost efficiency programs.

Potential ADD/BIS mandates mid-FY26 may curb Chinese imports, possibly enabling a 5–10% domestic price increase, reshaping the market.

🇮🇳 Park Hotels Limited : Record Performance Fuels Ambitious Expansion (Smartkarma) $

Apeejay Surrendra Park Hotels Ltd (NSE: PARKHOTELS / BOM: 544111) reported record Q4 and a “standout” FY25, marked by double-digit growth in revenue, EBITDA, PBT, and PAT.

The company achieved India’s highest occupancy in Q4 FY25 and maintained leadership in upper upscale RevPAR, outperforming industry averages.

ASPHL announced its detailed significant future expansion via development and acquisitions, indicating confidence in sustained growth.

🇮🇳 Godawari Power and Ispat Limited: Capacity Expansion and ESG Focus Drive Future Growth (Smartkarma) $

Godawari Power and Ispat Limited (NSE: GPIL / BOM: 532734) met or exceeded FY25 volume guidance, completed key project commissioning like a new rolling mill, and made significant progress on major capex.

These expansions, coupled with GPIL’s backward integration and ESG focus, are expected to drive revenue growth and maintain margin resilience despite prevailing raw material and finished product price volatility.

GPIL also commissioning most of its plant in FY26 along with better commodity environment will drive growth for the company.

🇮🇳 NMDC Ltd (NSE: NMDC) – Volume-Led Growth Story with Re-Rating Potential (Smartkarma) $

Last 3 Years: NMDC (NSE: NMDC / BOM: 526371) or National Mineral Development Corporation’s PAT grew steadily from Rs3,774 Cr in FY23 to Rs6,693 Cr in FY25 (CAGR ~33%), driven by volume growth and margin expansion.

Guidance & Plans: Targets 55.4 MT (24% growth) in FY26 and 100 MT by 2030, backed by infra, EC capacity, and pellet expansion.

Re-Rating Potential: Meeting volume, margin, and execution targets could trigger valuation re-rating from current below-peer multiples.

🇮🇳 Gujarat Fluorochemicals Limited: Robust Core Business Performance and EV Ramp-Up (Smartkarma) $

Gujarat Fluorochemicals Ltd (NSE: FLUOROCHEM / BOM: 542812) reported strong consolidated Q4FY25 financials, driven by fluoropolymers, with significant PAT growth and reduced net debt.

This indicates sustained momentum in core fluoropolymers, potential for significant revenue contribution from the new EV business in the coming years, and an improved balance sheet supporting future investments.

Capex of INR 1,600 crs in FY26 funded via external accruals will expand EV and fluoropolymer capacities, enabling long-term growth across energy, mobility, and specialty segments.

🇮🇳 Time Technoplast Limited: Value-Added Products and Composites Drive Strong Performance (Smartkarma) $

Time Technoplast Ltd (NSE: TIMETECHNO / BOM: 532856)

Strong FY25 financial performance driven by volume growth outpacing revenue, significant PAT increase, and improved margins, particularly from higher-growth value-added and composite product segments.

The strategic focus on higher-margin value-added products, especially composites, is enhancing profitability (margins, ROCE) and positioning the company for future growth in key sectors like clean energy and sustainability.

The consistent execution on strategic targets (ROCE, debt reduction, composite growth) strengthens conviction in the management’s ability to deliver and capitalize on emerging opportunities, despite some project timeline shifts.

🇮🇳 The Beat Ideas: Astral ~ Leader in PVC Pipes, Riding the Restocking Cycle (Smartkarma) $

Astral Ltd (NSE: ASTRAL / BOM: 532830) is a market leader in CPVC and plastic piping systems, with growing presence in adhesives, paints, and water tanks it maintained margins despite industry’s headwinds.

New launches like Fire Pro, OPVC, Drain Pro, and valves are expected to contribute INR 450–500 crore annually, driving high-margin growth and portfolio expansion.

Dealers currently hold just 1–2 weeks of inventory, indicating an imminent restocking cycle that could boost near-term volumes.

🇮🇳 HAL (NSE: HAL) – Strong Visibility, Undervalued Optionality (Smartkarma) $

Over FY22–FY25, Hindustan Aeronautics (NSE: HAL / BOM: 541154)’s revenue grew at a CAGR of ~8%, while PAT rose at ~15% CAGR, with the order book doubling to ₹1.89 lakh Cr, providing LT visibility.

India’s defence indigenization drive, large platform rollouts (LCA Mk1A, LUH, AMCA, engines), positions HAL to address a Rs3–4 lakh Cr opportunity over the next 5–10 years, including exports.

Despite strong earnings growth, zero debt, and long-term JV upside (e.g., Safran engine), HAL trades at a P/E of ~33–38×, below many peers, indicating room for re-rating.

🇮🇳 🇰🇷 Ola Electric: Hyundai Exits Amid Slowing Sales, Delayed Cells and Fundraising Plans. (Smartkarma) $

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) and Kia Corp (KRX: 000270 / OTCMKTS: KIMTF) have exited their investment in Ola Electric Mobility Ltd (NSE: OLAELEC / BOM: 544225) through a combined stake sale worth USD80 million, at a discount to market prices.

The exit marks the end of their 2019 investment in the then-unlisted 2W EV startup and highlights rising investor concerns over Ola Electric’s growth trajectory and operational challenges.

Ola Electric had listed less than a year ago with bullish growth projections, but the stock is down 34% from the issue price and 63% from post-IPO high prices.

🇮🇳 IRCON International – Stable Franchise with Long-Term Tailwinds, Near-Term Execution Hurdles (Smartkarma) $

IRCON International (NSE: IRCON / BOM: 541956) or Indian Railway Construction International Limited

FY25 results reflected margin pressure and a 14% revenue decline due to project completions, with FY26 guidance indicating flat revenue and lower core EBITDA margins (5–5.25%).

Indian Railways’ capex is expected to grow at a 6–10% CAGR over the next decade, offering sustained demand across new lines, electrification, and safety systems.

While valuations appear reasonable, near-term growth visibility remains limited due to a muted order book and transition away from cost-plus contracts.

🇮🇳 The Beat Ideas: Prince Pipes- Margin Recovery and Market Expansion in Full Flow (Smartkarma) $

Prince Pipes and Fittings Ltd (NSE: PRINCEPIPE / BOM: 542907) entered the premium bathware segment with the Aquel acquisition, expanding into lifestyle plumbing beyond traditional piping systems.

This move broadens its addressable market and margin profile, creating cross-selling opportunities across its large dealer network.

With margin recovery likely and industry destocking easing, Prince Pipes appears well-positioned for rerating and multi-year profit growth.

🇮🇳 Vedanta Demerger: Key Highlights, Value Drivers, and Risks (Smartkarma) $

Latest Update: NCLAT has stayed NCLT’s rejection, allowing Vedanta (NSE: VEDL / BOM: 500295)’s five-way demerger to proceed, with completion targeted by September 2025.

Value Concentration: Over 85% of Vedanta’s SOTP value stems from Aluminium and Residual Vedanta, driven by strong EBITDA and asset base.

Upside and Risks: SOTP suggests 20%+ upside, but risks include regulatory delays, execution slippage in aluminium/zinc projects, and commodity price volatility.

🇮🇳 ICICI Lombard (ICICIGI IN) Vs. SBI Life (SBILIFE IN): Mean Reversion Delivers Gains, Trade Exit (Smartkarma) $

Context: This article provides an update on a previously identified pair trading opportunity between ICICI Lombard Insurance (NSE: ICICIGI / BOM: 540716) and SBI Life Insurance (NSE: SBILIFE / BOM: 540719), based on statistical mean reversion analysis.

Key Insights: The trade has now reached its exit signal as the price ratio reverted to its one-standard deviation band, yielding a +9% return.

Why Read It: For investors interested in quantitative trading strategies, this article demonstrates how statistical arbitrage can generate short-term alpha and highlights actionable similar opportunities in the current market.

🇮🇳 Torrent Pharmaceuticals (TRP IN): India Business Drives 11% PAT Growth in Q4; Margin Levers at Work (Smartkarma) $

Torrent Pharmaceuticals (NSE: TORNTPHARM / BOM: 500420) reported a 11% YoY increase in net profit to INR5B on an 8% YoY growth in revenue to INR28B in Q4FY25. Domestic business drove overall performance.

Revenue from domestic market increased 12% YoY to INR15.5B, led by outperformance in focus therapies, aided by strong new launch performance. Torrent continued to outperform IPM.

The company is expanding margins by 75–100bps historically. With improving traction in U.S., double-digit growth in Brazil, and continued strong performance in India, the trend is expected to continue.

🇮🇳 Shyam Metalics & Energy Ltd (NSE: SHYAMMETL) – A Capital-Efficient Growth Play in Indian Metals (Smartkarma) $

Shyam Metalics and Energy Ltd (NSE: SHYAMMETL / BOM: 543299) reported robust FY25 results with 15% revenue growth and 21% EBITDA rise, driven by higher volumes and a shift toward value-added products.

The company is executing a ₹10,025 Cr capex plan to double capacity by FY27, targeting high-margin segments like stainless steel and aluminium foil with backward integration.

With zero net debt, strong cash flows, and a forward P/E of ~14×, Shyam Metalics offers a rare blend of growth, capital discipline, and low leverage in the steel sector.

🇮🇳 BDL IN – Bharat Dynamics: Missile Systems Specialist Strengthening India’s Defence Edge (Smartkarma) $

Bharat Dynamics Ltd (NSE: BDL / BOM: 541143) reported strong FY25 revenue of ₹3,345 Cr and PAT of ₹550 Cr, though EBITDA margins declined to 24.6% from earlier highs.

With a ₹22,700 Cr order book, BDL is expanding via new plants in Jhansi, Amravati, and Ibrahimpatnam backed by ₹600+ Cr capex.

At 100x PE and 75xPE FY27e valuations appear stretched, leaving limited margin of safety despite strong execution and order visibility.

🌍 🇮🇱 🇯🇴 🇸🇦 🇹🇷 🇦🇪

🇮🇱 Teva Pharmaceuticals ($TEVA): Pivoting to sustainable growth and long-term returns (Kontra Investments)

Teva Pharmaceutical Industries Ltd (NYSE: TEVA) held its Strategy and Innovation Day on May 29th confirming and expanding on its “Pivot to Growth” strategy as originally launched in May 2023.

Teva has long been a cornerstone in the pharmaceutical industry, renowned primarily as a generics powerhouse. However, after the difficult period following debt increase, opioid lawsuits and key patent expiry, Teva is underway with a notable pivot toward innovative pharmaceuticals, making Teva increasingly attractive from an investment standpoint. With an optimistic but grounded perspective, this analysis delves into Teva’s strategic direction, promising pipeline, and compelling valuation dynamics.

🇸🇦 Acwa Power to invest up to US$10 billion in Malaysia green energy (The Asset) 🗃️

Saudi-based energy and water desalination giant Acwa Power Company SJSC (TADAWUL: 2082) has signed a series of landmark agreements with Malaysian stakeholders to develop up to 12.5 gigawatts of sustainable energy capacity by 2040.

The deals, announced during the recent Asean-GCC summit in Kuala Lumpur, mark one of the largest potential foreign investments in Malaysia’s renewable energy sector, with an estimated value of up to US$10 billion.

🇦🇪 YALLA Short Report (Pelican Way Research)

🌍 Yalla Group (NYSE: YALA) is a UAE-based voice-centric social networking and gaming company (similar to ‘Spaces’ on X.)

Yalla’s reported revenue metrics and reported downloads sharply contrast with trusted third-party sources and our proprietary calculations.

Yalla’s app reviews exhibit signs of extreme artificial activity, including repeated and generic language.

Even by Yalla’s own reported metrics, paying users peaked in Q1 2023 and have declined by 13% as of Q1 2025.

Yalla has continued to use KPMG Huazhen LLP as auditor despite regulators finding serious deficiencies in 100% of KPMG Huazhen’s audits.

🌍 Airtel Africa: Ongoing Opportunity Is Now Fully Priced In (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇿🇦 Prosus: Several Ways To Own Tencent (Seeking Alpha) $ 🗃️

🇿🇦 Remgro: CIVH Deal Looks In Trouble (Seeking Alpha) $ 🗃️

-

🌍 Remgro Ltd (JSE: REM / FRA: RE7 / OTCMKTS: RMGOF) – Investments in the healthcare, consumer products, financial services, infrastructure, industrial & media. 🇼 🏷️

🇱🇺 Codere Online: Turning Positive As Listing Concerns Are Resolved (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇵🇱 Kino Polska TV SA (Quality Value Investing Substack)

TV broadcasting company with 25% ROE trading at 5x P/E, 1.2x P/B.

Kino Polska TV SA (WSE: KPL), majority-owned by the Canal+ Group, distributes and produces content for television, video on demand (VOD) platforms, streaming services and cinemas, and sells programming licenses. It also broadcasts thematic TV channels distributed in digital terrestrial television, cable networks and satellite platforms. The main TV channels include Kino Polska, Kino Polska Musyka, Zoom TV, Stopklatka, Kino TV, and Filmbox. It is quite a niche market player, with a 2.58% share of the Polish market in 2024. In 2024, advertising amounted to 43.2% of revenue. Geographically, while the main market is Poland, the Company also generated 28% of its revenue in international markets, including Spain, Hungary, the Czech Republic, Slovakia, the United Arab Emirates, Serbia, and Romania.

🌎 MercadoLibre’s 50x PE Is Unjustified (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: High-Quality, But Don’t Buy Now (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Perfect Time For CEO Transition (Seeking Alpha) $ 🗃️

🌎 Arcos Dorados: An Argentinian Recovery Is Materializing (Seeking Alpha) $ 🗃️

🌎 Arcos Dorados: Not Such A Golden Outlook (Seeking Alpha) $ 🗃️

-

🌎 Arcos Dorados Holdings Inc (NYSE: ARCO) – World’s largest independent McDonald’s franchisee. Exclusive right to own, operate & grant franchises of McDonald’s restaurants in 20 Latin American & Caribbean countries & territories. 🇼 🏷️

🇦🇷 Cresud Has Plenty Of Assets, But Fair Results (Seeking Alpha) $ 🗃️

🇦🇷 Galicia: Strong On Fundamentals, Brutal On The Upside (Seeking Alpha) $ 🗃️

🇦🇷 Real Estate As A Refuge: IRSA In The New Argentine Cycle (Seeking Alpha) $ 🗃️

🇦🇷 Transportadora de Gas del Sur: Unlocking The Potential Of Vaca Muerta (Seeking Alpha) $ 🗃️

🇦🇷 Transportadora De Gas Del Sur: Expanding Earnings, Compressing Multiples (Seeking Alpha) $ 🗃️

🇦🇷 Telecom Argentina: Between The Weight Of Its History And The Fragility Of Its Present (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: A Bargain During Hard Times For Oil (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Will These Investments Be Attractive Now? (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras’ Recent Weakness Means Opportunity (Seeking Alpha) $ 🗃️

🇧🇷 Sabesp: The Brazilian Utilities Stock Your Portfolio Desperately Needs (Seeking Alpha) $ 🗃️(?)

🇧🇷 Gerdau: Latin American Steelmaker Benefits From Tariff Hike (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 B3 Has A High Price But It’s Justified By Its Infrastructural Position In Brazilian Markets (Seeking Alpha) $ 🗃️

🇧🇷 The Purple Way: How Nubank Rewired Banking — and What Comes Next (Nikhs)

From São Paulo frustration to global fintech ambition, this is the full story of how Nu Holdings (NYSE: NU) is redefining what a 21st-century financial platform can be — and where it’s heading next.

The purple revolution that began in Brazil is no longer merely about disrupting traditional banking. It has evolved into something more profound: reimagining what a financial institution can be in the digital age. As Nu ventures beyond Latin America and beyond banking, the question isn’t whether the company will continue disrupting financial services – it’s how far the purple wave will spread, and which industries and geographies it will transform next.

For incumbents, the warning is clear: the purple threat is evolving faster than traditional responses can contain it. For customers, the promise is equally evident: financial services designed around their needs rather than institutional convenience are becoming the new normal. And for observers of business strategy, Nu offers a compelling case study in how disciplined innovation, customer obsession, and strategic patience can reshape an industry once considered impervious to disruption.

🇧🇷 Embraer: What Are The Impacts After Azul Files For Chapter 11? (Seeking Alpha) $ 🗃️

🇨🇱 Compania Cervecerias Unidas: Improved Q1 Results And Upcoming Election Catalyst (Seeking Alpha) $ 🗃️(?)

🇨🇱 Compania Cervecerias Unidas’ Argentina Boost Might Be About To Revert (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Centro Norte: A Strategic Player In The Mexican Sky (Seeking Alpha) $ 🗃️

🇲🇽 PINFRA Has Appreciated As U.S.-Mexico Trade Faces Great Challenges (Rating Downgrade) (Seeking Alpha) $ 🗃️

🌎 Ternium: Latin Steelmaker Betting Big On Nearshoring – And It’s Dirt Cheap (Seeking Alpha) $ 🗃️

🌎 Ternium: A Value Opportunity In The Regional Steel Industry (Seeking Alpha) $ 🗃️

-

🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🌐 Nebius: A Top AI Investment Pick (Seeking Alpha) $ 🗃️

🌐 Nebius: Explosive Growth At What Is Still A Reasonable Valuation (Seeking Alpha) $ 🗃️

🌐 Nebius: I Can’t Stop Buying This Stock | 40% Of My Portfolio Now (Seeking Alpha) $ 🗃️

🌐 Nebius Reality Check: Why Its Premium Valuation Doesn’t Add Up (Seeking Alpha) $ 🗃️

🌐 Nebius: Hyperscaler Aiming For Hypergrowth (Seeking Alpha) $ 🗃️

🌐 Nebius: Rally Occurred Overly Fast, Reversing Momentum May Be Painful (Rating Downgrade) (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

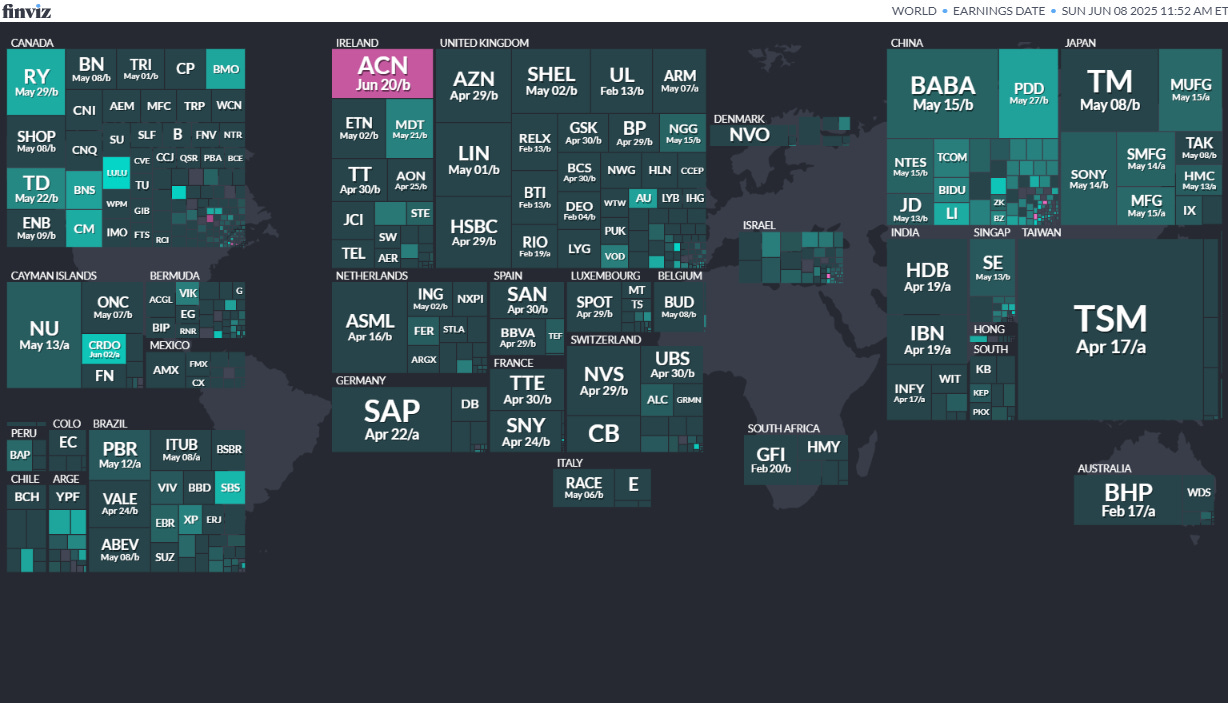

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

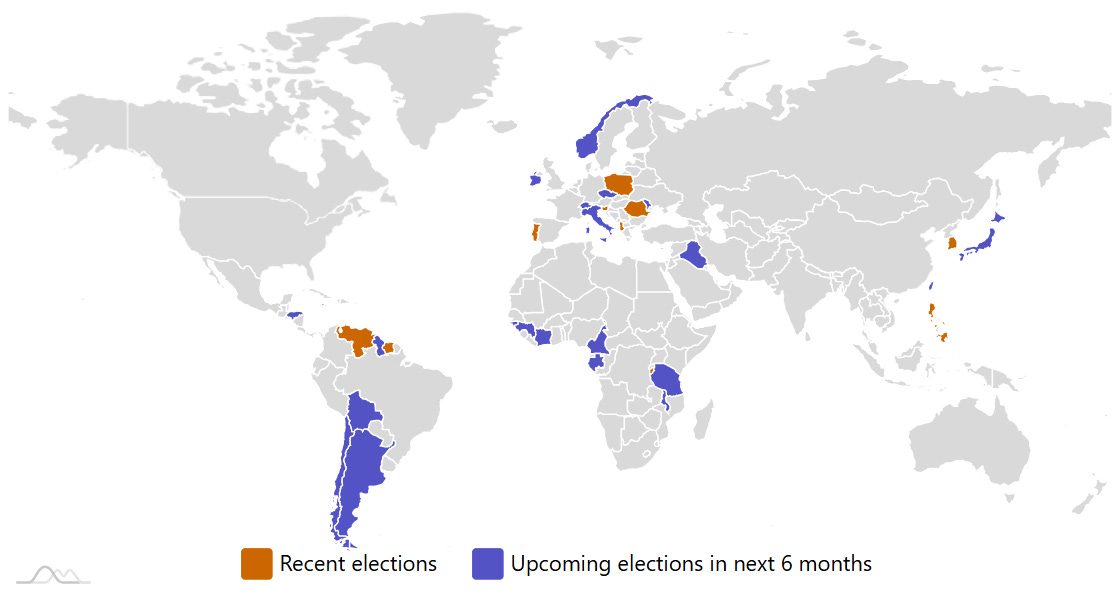

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

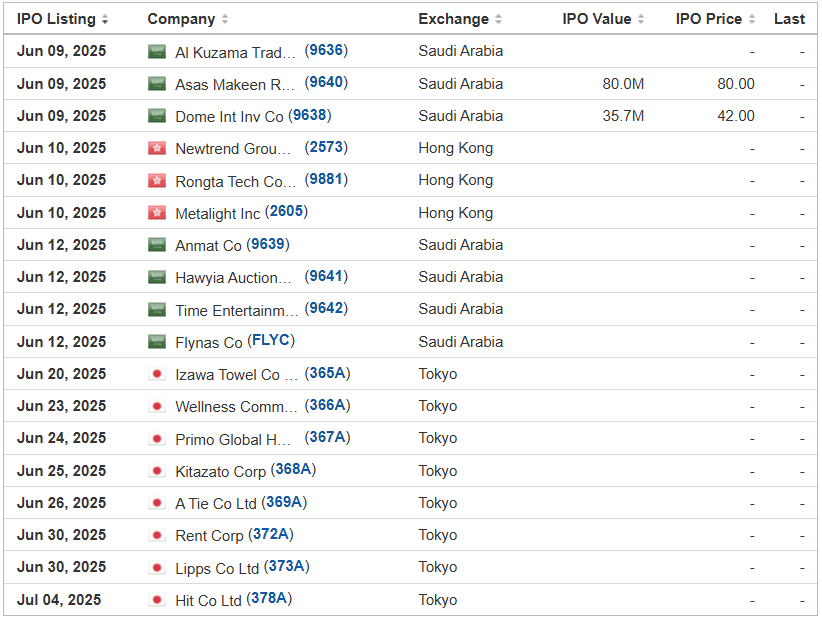

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/12/2025 Week of

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

Vantage Corp. (Singapore) VNTG Network 1 Financial Securities, 3.3M Shares, $4.00-5.00, $14.6 mil, 6/12/2025 Thursday

We are a shipbroker that connects ship owners with charterers. Our focus is on dirty petroleum products, petrochemicals, biofuels and vegetable oils. (Incorporated in the Cayman Islands)

We have three subsidiaries, namely Vantage BVI, Vantage Singapore and Vantage Dubai. Vantage BVI is a wholly owned subsidiary of the issuer, Vantage Cayman; and both Vantage Singapore and Vantage Dubai are wholly owned by Vantage BVI.

We were founded in 2012 by five seasoned shipbrokers with a mission of providing exceptional shipbroking services. We commenced operations with a team of over 20 specialists proficient in their various roles in the tanker markets which involves trading different types of oil and petrochemical products through vessel transportation, including clean petroleum products (“CPP”) and petrochemicals. Over the years, we underwent significant growth and evolution, expanding our shipbroking services to cover dirty petroleum products (“DPP”), biofuels and vegetable oils. Additionally we established a sales & projects team, a research/strategy team and an IT team. We have expanded to over 50 dedicated professionals as of May 2024, with offices in both Singapore and Dubai.

We specialize in providing comprehensive shipbroking services, including operational support and consultancy services, tailored to the tanker markets. Rooted in our expansive network and decades of collective experience within the marine sector, we have emerged as a trusted intermediary, facilitating transactions between shipowners and charterers across diverse segments of the tanker market, and ensuring smooth logistical flow for cargo deliveries to timely demurrage and claims settlements.

Our suite of shipbroking services is designed to optimize outcomes for our clients, offering a holistic approach to addressing their needs and objectives. As a pivotal link between oil companies, traders, shipowners, and commercial managers, we deliver a range of services including: identifying market opportunities and information for our clients, recommending interested parties (shipowners and cargo owners) to each other, advising interested clients on strategies on vessel deployment or fleet mix, specifications and capabilities, facilitating contract negotiations, ensuring smooth logistical flow, as well as resolving issues that arise during the execution of chartering agreements.

Our Industry

The global shipbroking market was valued at $1.56 billion in 2022, with the oil tanker sector (excluding gas carriers) valued at $422 million. The oil tanker shipbroking sector is poised to grow at a CAGR of 3.32% between 2022-2027. According to the 2023 Shipbroking Market report by Technavio, the European and Asia Pacific shipbroking market collectively account for about 81% of the global shipbroking market.

Note: Net income and revenue are in U.S. dollars for Fiscal Year 2024, which ended March 31, 2024.

(Note: Vantage Corp. filed an F-1/A dated Nov. 20, 2024, in which it disclosed its proposed symbol “VNTG” and the terms for its IPO: The company is offering 3.25 million shares at a price range of $4.00 to $5.00 to raise $14.63 million. Background: Vantage Corp. filed its F-1 for its IPO on Oct. 9, 2024, with estimated initial proceeds of about $16 million. Vantage did not disclose a proposed stock symbol in its F-1 filing.)

ALE Group Holding Limited ALEH D. Boral Capital (ex-EF Hutton), 1.5M Shares, $4.00-6.00, $7.5 mil, 6/13/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: D. Boral & Company (formerly E.F. Hutton) is the sole book-runner. Background: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Happy City Holdings Limited HCHL Dominari Securities/Pacific Century Securities/Revere Securities, 1.0M Shares, $5.00-7.00, $6.0 mil, 6/13/2025 Week of

(Incorporated in the British Virgin Islands)

We are a restaurant operator that runs three all-you-can-eat hotpot restaurants through our wholly owned operating subsidiaries in Hong Kong. We have been in the restaurant services industry serving the Hong Kong market for over 5 years, which is a relatively short operating history compared to some of our established competitors. Our restaurants serve all-you-can-eat Thai and Japanese hotpot to our customers under the brand names “Thai Pot (泰金鍋)” and “Gyu! Gyu! Shabu Shabu (牛牛殿堂日式火鍋放題)”. As of the date of this prospectus, we operate three restaurants located in the Tsuen Wan District in the New Territories, the Mong Kok District in Kowloon, and the North Point District on Hong Kong Island.

For the years ended August 31, 2024, and August 31, 2023, our revenue was generated from providing food and beverage to customers in our restaurants in North Point, Mong Kok and Tsuen Wan.

We give customers set time limits for dining.

Note: Net income and revenue are in U.S. dollars for the year that ended Aug. 31, 2024.

(Note: Happy City Holdings Limited filed its F-1 on March 17, 2025, and disclosed the terms for its small-cap IPO: The company is offering 1.0 million shares at a price range of $5.00 to $7.00 to raise $6.0 million, if priced at the mid-point of its range.)

Dalu International Group Ltd. DLHZ Revere Securities, 1.5M Shares, $4.00-6.00, $7.5 mil, 6/16/2025 Week of

We provide property management services as well as real estate leasing services in China. (Incorporated in the Cayman Islands)

We are an integrated property management services and commercial operation services provider, and we operate a real estate leasing business in Chengdu, the capital city of Sichuan Province, China.

With an operating history of two decades, our PRC subsidiaries have been focusing on providing property management services to owners, developers and occupiers of residential and commercial properties in Chengdu. Our PRC subsidiaries have accumulated extensive experience in the property management services sector. In addition, to drive our value growth and diversify our revenue streams, we also provide a variety of commercial operation services, primarily consisting of brand planning, market research and positioning consultancy, tenant sourcing and management, marketing and business support to owners and developers of commercial properties, and (we) engage in real estate leasing business.

We are a well-known property management brand in Chengdu, having undertaken property management and related services for well-known projects in some of the most prosperous commercial areas, such as the fashion center of Chengdu and one of the most popular pedestrianized shopping streets, Chunxi Road, and South Renmin Road in Chengdu’s central business district.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended September 30, 2024.

(Note: Dalu International Group Ltd. is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, according to its F-1 filings with the SEC.)

Delixy Holdings Ltd. DLXY Bancroft Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/16/2025 Week of

We trade crude oil and oil-based products, including fuel oils, gasoline, additives, gas condensate, in Southeast Asia and East Asia. (Incorporated in the Cayman Islands)

We are principally engaged in the trading of oil related products, which can be broadly categorized into (i) crude oil and (ii) oil-based products such as fuel oils, motor gasoline, additives, gas condensate, base oil, asphalt, petrochemicals and naphtha (heavy gasoline), in Southeast Asia and East Asia..

We have the financial capability to provide our customers with financing alternatives and credit terms

We are able to provide our customers with credit terms of up to 90 days by leveraging our strong balance sheet position as well as short term credit facilities available to the Group. Our ability to extend these advantageous credit terms to our customers allows us to cater to the diverse needs of our customers across multiple countries and to provide them with the financial flexibility they may require for their business operations. As of the date of this prospectus, the amount outstanding with respect to these credit facilities is zero.

We have an experienced management team with strong relationships across our value chain.

Our management team headed by our Executive Chairman, Chief Executive Officer and Executive Director Mr. Xie, has decades of trading experience and experience in oil trading as well as in the oil industry generally, including oil refining and logistics. We also maintain strong relationships with our suppliers, storage facilities providers and fleet and logistics providers, and are able to effectively service our clients and ensure a reliable supply of crude oil and oil-based products.

We have robust and strong risk management and internal controls capabilities

We believe that the ability to manage risk is one of our key strengths. Risk management is a core function under the supervision of our senior leadership structure. Our sound risk management practices have contributed to our positive performance through the volatile market environment in recent years and have helped to mitigate earnings volatility.

We are strategically located in Singapore, Asia’s refined products trading hub.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Delixy Holding Corp. is offering 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, according to its F-1/A filings. Of the 2.0 million shares in the IPO. Delixy Holdings Ltd. is offering 1.35 million ordinary shares and the selling shareholders are offering 650,000 ordinary shares.)

FG Holdings FGO American Trust Investment Services/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 6/16/2025 Week of

We are a holding company whose Hong Kong subsidiaries run a FinTech platform that provides mortgage loan brokerage services. (Incorporated in the British Virgin Islands)

We offer – through our operating subsidiaries – a FinTech platform for mortgage loan brokerage services available through private credit and banks. The company gives borrowers mortgage application simulation and access to several mortgage loan options from various lenders.

Since our inception in 2019, FG Global has helped match 528 borrowers with more than $906 million in loans. That loan volume includes $401 million for the fiscal year that ended June 30, 2024.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: FG Holdings filed its F-1 on Nov. 18, 2024, and disclosed the terms for its small-cap IPO: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million. Background: FG Holdings submitted confidential IPO documents to the SEC on Dec. 28, 2023.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-