Emerging Market Links + The Week Ahead (March 11, 2024)

In addition to Americans putting their clocks ahead last weekend as part of (annoying…) day light savings time rituals, Ramadan is starting. Harding Loevner has some pieces with a handy table tracking past and future Ramadan dates: Ramadan’s Shifting Dates Have Complex Effects on Businesses + The Ramadan Effect: How Islam’s Holy Month Impacts Businesses. The Islamic calendar is actually shorter than the western one – meaning Ramadan can start 10-12 days earlier every year and will coincide with Chinese New Year and even Christmas in a few years. Naturally, this will have all sorts of impact on business.

Finally, and as discussed in more detail in yesterday’s post, I was evaluating Feedly, Inoreader and other RSS type feed readers or creators. I have not really found a good overall solution to monitor websites that lack good RSS feeds beyond just dumping links into the template I use for paid subscriber posts and checking manually once a week:

As mentioned yesterday, I’ve had enough BAD experiences with tech services changing their terms of service OR completely eliminating a product or service (remember Google Reader?) to want to be locked into using something…

Any ideas or advice on what readers use would be appreciated…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 The rise of Pinduoduo and Temu: profits and secrets (FT Film) 25:28 Minutes

Chinese e-commerce app Pinduoduo (PDD Holdings) (NASDAQ: PDD) is one of the biggest and most profitable retailers in the world. It is spending a huge amount of money on international expansion through a new app called Temu, which analysts say could disrupt everyone from Amazon to high street retailers. However, the company behind Temu and Pinduoduo is extremely secretive and there are questions about its business model, how it operates and how it communicates with investors

🇨🇳 (Tencent (700 HK, BUY, TP HK$362) TP Change): Core Business Is Robust While VA Is Expanding Fast (Smartkarma) $

We expect Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY) to report C4Q23 revenue, IFRS op. profit and IFRS net income in line, (3.3%) and (4.9%) vs. consensus.

The robust topline growth was mainly contributed by fast growing WeChat VA (Video Account) and strong performances of <Dream Star> in December.

We cut our TP to HK$362 to reflect operating margin decline caused by increased sales and marketing.

🇨🇳 JD.com’s Logistics Unit Dada Discloses Financial Fraud, President to Resign (Caixin) $

After a three-month investigation, Chinese e-commerce giant JD.com (NASDAQ: JD)’s logistics unit Dada Nexus (NASDAQ: DADA) confirmed that the company had inflated revenue figures and costs to hit its revenue targets. He Huijian, the Dada President, will resign after the independent review is complete.

Fraudulent transactions resulted in revenue being overstated by about 568 million yuan ($79 million) and operating costs by 576 million yuan from the fourth quarter of 2022 to the third quarter of 2023, according to the investigation.

🇨🇳 Alibaba, Tencent Continue to Tear Down Walls Between Their Meeting Platforms (Caixin) $

Alibaba (NYSE: BABA)’s office messaging and meeting app DingTalk is allowing users of Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY)’ rival social media app WeChat to directly join any meeting initiated on DingTalk without first registering.

DingTalk users can now share a meeting link with WeChat users, who can enter the meeting within WeChat. Previously, DingTalk required participants to download its meeting app and register.

🇨🇳 Lesi Group underwhelms with IPO in crowded online ad market (Bamboo Works)

The Chinese provider of mobile advertising services has finally won IPO approval at the fourth attempt, but faces a muted market reception

Lesi Group (HKG: 2540)’s revenue has been growing but its gross margin fell to 15.5% in the first nine months of last year

The company has a highly concentrated customer base, with more than two thirds of revenue coming from just five clients. It also relies heavily on Alibaba and two other major suppliers

🇨🇳 Full Truck Alliance goes full throttle on user acquisitions (Bamboo Works)

The trucking platform operator boosted its sales and marketing spending 50% in the fourth quarter, double the rate of its revenue growth

Full Truck Alliance (NYSE: YMM)’s revenue rose 25.3% in last year’s fourth quarter, while its net income tripled on strong investment income and new user growth

The company said it will continue spending heavily on sales and marketing this year after its growth in that area accelerated to 49.8% in the fourth quarter

🇨🇳 CIMC Vehicles (301039 CH): Cheap And Steady Long Term Growth Potential (Smartkarma) $

CIMC Vehicles Group (SHE: 301039 / HKG: 1839) is a leading global manufacturer of semi-trailers and various truck bodies that is the mainstay of heavy ground goods transport

9M23 earnings surged by 216% and beat consensus, scope for further earnings upgrade as the business and management outlook statement is very positive

Our target price of CNY12.50 (+31% UPSIDE) is based on 2024 PE 15x – a 10% discount against the industry leader Caterpillar

🇨🇳 As solar construction in China cools, Hainan Drinda looks for relief overseas (Bamboo Works)

The A-share listed solar company has applied to tap global investors with a second listing in Hong Kong, aiming to use the proceeds to set up factories overseas

Hainan Drinda New Energy Technolgy Co Ltd (SHE: 002865) has filed to list in Hong Kong, reporting its revenue rose 58.7% last year while its profit grew by a slower 16%

The company says it accounted for 10.8% of the global solar cell market last year, ranking fifth worldwide, while it was top-ranked in N-type TOPCon cells with 57.4% of the market

🇨🇳 Chinese education giant XJ International may face liquidation as bondholders demand repayment (Caixin) $

Chinese private education giant XJ International Holdings (HKG: 1765 / FRA: HE1) said it has received a statutory demand from bondholders to repay more than $3 millions of bonds within three weeks. If it doesn’t, the creditors will seek liquidation of the company’s assets.

XJ International received the demand to repay $3.25 millions of principal and interest of the convertible bonds from legal representative of the bondholders on Tuesday, the company said in a statement Wednesday.

🇨🇳 XJ International gets lesson on perils of zero-coupon bonds (Bamboo Works)

The vocational educator said holders of its zero-coupon convertible bonds due in 2026 are asking for a permitted early redemption

Holders of all of XJ International Holdings (HKG: 1765 / FRA: HE1)’s $315 million worth of outstanding convertible bonds are asking to redeem the notes

The company said it is seeking external financing to honor the demand, which is allowed under an option in terms of the notes that were set to mature in two years

🇨🇳 In Depth: Chinese property giant Vanke seeks more time to repay debts as market slump lingers (Caixin) $

China’s prolonged property slump and continuing squeeze on developers’ finances have led to renewed pressure on state-backed China Vanke Co. Ltd. (SHE: 000002 / HKG: 2202 / FRA: 18V / OTCMKTS: CHVKY / CHVKF), one of the country’s most financially robust home builders.

The Shenzhen-based developer is trying to extend around 5 billion yuan ($695 million) of privately issued debt owed to two state-backed insurance sector companies that had already been extended once, sources with knowledge of the matter told Caixin. The liabilities were originally due for repayment on Dec. 11 and in January, respectively, but were extended by three months after talks with creditors and help from regulators, they said.

The extensions are about to expire and Vanke is again seeking to postpone the repayments, according to the sources.

🇨🇳 Fosun Tourism at crossroads as parent shops its two major assets (Bamboo Works)

Fosun International (HKG: 0656 / FRA: FNI / OTCMKTS: FOSUF / FOSUY) is reportedly looking to sell some or all of its tourism unit’s Atlantis Sanya mega-resort, as well as a stake in the unit’s Club Med resort chain

Conglomerate Fosun International is considering a sale of some or all of its tourism unit’s two core assets to raise cash to pay down its large debt, according to Reuters

A sale of one or both assets could drastically alter the picture for Fosun Tourism, which is 78% owned by Fosun International

🇨🇳 (Vipshop (VIPS US, BUY, TP US$20.4)TP Change): Will Live for the Moment Consumption Persist in 2024? (Smartkarma) $

Vipshop Holdings (NYSE: VIPS) reported C4Q23 top-line, non-GAAP EBIT, and GAAP net profit in-line, 6.3% and 7.0% vs. our estimate, and 4.5%, 20.5%, and 23.9%, vs. consensus, respectively;

We expect the two themes of “live for the moment” consumption and consumption downgrade to persist in 2024. The former drives apparel spending, while the latter drives consumers to Vipshop

We maintain BUY and raise the TP to US$ 20.4, implying 7.7x CY24 non-GAAP P/E, and 4.9x CY24 EV/Earnings.

🇨🇳 Hotpot Restaurant Chain Haidilao Serves Up a Franchise Model (Caixin) $

Chinese hotpot chain Haidilao International Holding (HKG: 6862 / FRA: 8HI / OTCMKTS: HDALF) announced Monday that it will launch a franchise model to further support the expansion of its restaurant network.

In a filing with the Hong Kong Exchange, Haidilao said it has set up a franchise department to formulate the details of the franchise model and the business cooperation process.

Franchised restaurants will be provided with central and back-office services, such as staff training, supply chain system, management experience, food safety control, brand marketing services and performance appraisal by the group, to ensure food safety as well as customer experience, the company said.

🇨🇳 Who is Mixue – World’s 4th largest F&B chain, decoded (Momentum Works)

Over the last two years, Mixue Group (MIX HK), China’s biggest freshly-made drinks company, has emerged as the 4th largest in the world – with 36,000 stores by the end of 2023.

By the current speed of expansion, they might overtake Starbucks and Subway any time to be the 2nd largest in the world, just behind McDonald’s. Amongst the 36,000 stores, close to 4,000 are in Southeast Asia.

Unlike other F&B chains whose revenue models are F&B sales or franchise fees, Mixue operates a so-called “interest-aligned franchise model” where its main revenue is sales of ingredients and equipment to franchisees.

In this report, we highlight some key insights from its recent IPO prospectus as well as Momentum Works’s own analysis – which we think are very relevant for stakeholders in F&B and new retail industries, as well as investors and business innovators.

🇨🇳 Auntea Jenny steeped by rivals in flood of bubble tea IPOs (Bamboo Works)

The folksy-named company is the latest chain from an increasingly crowded and cut-throat Chinese premium tea industry to seek investor dollars in Hong Kong

Premium tea chain Auntea Jenny has filed to list in Hong Kong, reporting its profit nearly tripled in the first three quarters of last year to 320 million yuan

The company uses a franchise business model, similar to many of its peers that have also filed for similar recent listings

🇨🇳 Chabaidao joins Hong Kong IPO tea party (Bamboo Works)

The country’s third-largest premium tea chain operator has grown rapidly using a franchise model, and outperforms its peers in terms of gross margin

Chabaidao’s revenue grew 34.8% to 5.7 billion yuan in 2023, as the company has been consistently profitable over the last three years

The premium tea chain operator plans to keep growing through greater penetration in lower-tier cities, expanding overseas and by diversifying into coffee

🇨🇳 Asian Dividend Gems: Precision Tsugami China (Asian Dividend Stocks) $

Precision Tsugami China Corporation Ltd (HKG: 1651) specializes in the production of precision machine tools. Precision Tsugami China is part of the broader Tsugami Corporation, a Japanese company founded in 1923.

The company’s dividend yield increased from 4.3% in FY2021 to 8.9% in FY2022 and 10.1% in FY2023.

🇨🇳 BeiGene still bleeding red ink despite blockbuster drug (Bamboo Works)

BeiGene (NASDAQ: BGNE)

The Chinese developer of next-generation cancer treatments is raking in huge returns from its flagship drug, but R&D and sales costs keep rising

The Chinese biotech reported a 74% surge in annual revenue, driven by sales of its zanubrutinib drug, but offered no specific timetable for turning a profit

Meanwhile, the rights for a second anti-cancer drug, tislelizumab, were returned to the company as its partners pulled out of an increasingly crowded market

🇨🇳 Chicmax finds timeless profit formula in anti-aging skincare (Bamboo Works)

Calculations using new company data show its revenue rose 77% in the second half of last year, while its profit quadrupled

Shanghai Chicmax Cosmetic Co Ltd (HKG: 2145) said it expects to report its revenue rose about 53% last year and its profit tripled on strong sales for its Kans line of anti-aging skincare products

The company increasingly looks like an e-commerce play, with online sales rising to 81% of its total revenue in the first half of last year from 74% a year earlier

🇲🇴 Melco mass rebound in Macau helps it deleverage: S&P (GGRAsia)

Lawrence Ho Yau Lung, chairman and chief executive of Melco Resorts & Entertainment Ltd (NASDAQ: MLCO), had conceded on the firm’s call following its fourth-quarter earnings announcement last week, that the company had lost Macau market share in EBITDA terms during the year.

S&P commented: “During the recent Chinese New Year holiday, the company’s mass GGR was up 22 percent from 2019 levels, as the company benefitted from Chinese arrivals.”

The ratings agency said Melco Resorts’ property EBITDA “was also higher than 2019 levels” in that holiday period.

“Our base case assumes the company’s EBITDA will be 94 percent of 2019 levels in 2024, and 7 percent higher than 2019 levels in 2025,” stated S&P, saying that contrasted with about a 75-percent level in the fourth quarter of 2023

🇲🇴 Lady luck smiles on Wynn Macau with surging gaming recovery (Bamboo Works)

The casino operator was a major beneficiary of the city’s post-pandemic rebound, and is likely to further pare its debt load amid a sustained recovery this year

Wynn Macau Ltd (HKG: 1128 / FRA: 8WY / OTCMKTS: WYNMY / WYNMF)’s revenue rose more than fourfold last year to $3.1 billion, driven by a post pandemic rebound that boosted its gaming, hotel and restaurant businesses

The casino resort operator’s strong performance among mainstream visitors offset declines for its VIP business, giving it a more balanced mix

🇭🇰 Budweiser Brewing: A Hold Considering Mixed Outlook And Peer Valuations (Seeking Alpha) $

Budweiser Brewing Company APAC Limited (HKG: 1876 / OTCMKTS: BDWBY / BDWBF) suffered from a -4% bottom line miss with its FY 2023 financial results, and the company dropped by a high single digit percentage on the earnings announcement day.

The company’s financial prospects are murky, taking into consideration the competitive dynamics of the beer market in South Korea, and its cost outlook.

I maintain my Hold rating for BDWBF, as the stock appears to be fairly valued based on a peer comparison analysis.

🇹🇼 1527:TW Power tool manufacturer, profitable since 98 trading at EV/FCF 3.3 with a 5.85% dividend yield (One foot hurdle)

Basso Industry Corp (TPE: 1527) is a ODM/OEM of power tools such as nail guns and impact wrenchs trading at an absurd valuation. It is profitable since 1998 and is paying dividends 12 years in a row, 22 out of last 23 years. Deep value in Asia many times don’t work but this time it might be different. The company for many years stubbornly sticked to an idiosyncratic and ineffective capital allocation decision but finally corrected such mistake in 2019. That and Basso’s long-term earning power should deserve a richer valuation. It is tradable on Interactive Brokers and English filings are available.

This is a short write-up and it is not a compounder. However I believe in repeatable, simple, incremental wins and Basso is more in this camp. A basket of such stocks should provide a decent performance over time.

🇹🇼 6192:TW a distributor of process control components benefiting from big infrastructure spend (One foot hurdle)

Lumax International Corp (TPE: 6192) is a distributor of process control components with esteemed clientele and long operating history. It is profitable for 25 consecutive years and paying dividends 22 years straight. In recent years the company enjoys improving margins and bottom line. There is an ongoing gigantic overhaul on the nation’s electrical grid and Lumax is set to benefit from it. Investors receive this optionality without paying extra. Its stable earning power and current valuation should provide a high floor. English filings are available and the stock is tradable on Interactive Brokers.

The business model alone should be worth a higher multiple. Coupled with its net cash position, long profitable history and the prospect of earning big orders from Taiwan Power, current price appears to offer an excellent risk-reward. At worst the borrowing rate now is about 2.3~3% and the dividend yield seems to be able to cover it and more. If the company decides to do another return of capital this will also create extra return.

🇹🇼 Silicon Motion: Overvalued For Now (Seeking Alpha) $

Silicon Motion Technology Corporation (NASDAQ: SIMO) is a key player in non-volatile storage technology, but it is currently overvalued.

The company offers SSD controllers, mobile storage solutions, and data center and enterprise solutions.

The NAND flash memory market is growing, but there are potential threats from alternative storage technologies.

My overvaluation conclusion is based on future earnings estimates and its P/E ratio. Therefore, my analyst rating is a Hold.

🇰🇷 Coupang Inc: Amplifying Luxury Retail Reach With The Farfetch Acquisition! – Major Drivers (Smartkarma) $

Coupang (NYSE: CPNG), an e-commerce giant based in South Korea, has reportedly shown significant advancements and growth in their latest fourth quarter earnings.

They boasted a year of accelerating growth, record profits and notably expanded free cash flows in business, with the creation of the ‘wow’ moments for customers deemed as the foundation to their long-term growth, profitability and in turn, shareholder value.

Customer growth and revenues notably accelerated every quarter in 2023, with active customers growing 16% year-over-year.

🇰🇷 Classys: One of Korea’s Top Beauty Medical Device Makers + Higher Shares Cancellation and Dividends (Douglas Research Insights) $

Classys (KRX: 214150) is one of the top beauty medical device companies in Korea. Classys’ main products include Shurink Universe and Volnewmer.

We have a positive view of Classys (214150 KS). Classys is trading at relatively reasonable valuations, considering the company’s strong growth in sales and profits.

On 28 February, Classys announced a shareholder return amount of 38 billion won (including share cancellation of about 25 billion won and dividend payout of 13 billion won).

🇰🇷 Paradise Announces A Switch in Listing from KOSDAQ to KOSPI (Douglas Research Insights) $

On 7 March, Paradise Co Ltd (KOSDAQ: 034230) (operator in South Korea of foreigner-only casino gaming venues) announced that it plans to switch its listing from KOSDAQ to KOSPI.

Paradise will be excluded from KOSDAQ150 when it makes the switch to KOSPI. However, it is not certain if and when the company will be included in KOSPI200.

All in all, we would argue that the valuations are not especially appealing for Paradise, despite the sharp pick-up in business in 2023.

🇰🇷 Kumho Petrochemical – A Significant Shares Cancellation Announcement (Douglas Research Insights) $

After the market close on 6 May, Kumho Petrochemical (KRX: 011780) announced a significant shares cancellation program which is likely to have a positive impact on its share price.

The company announced that it will cancel 430 billion won worth of its common shares in the next three years, representing nearly 10.5% of its market cap.

Park Chul Wan, nephew of Kumho Petrochem Chairman Park Chan Koo, has been very vocal about the need for Kumho Petrochem to improve its corporate governance in past several years.

🇰🇷 Angel Robotics IPO Valuation Analysis (Douglas Research Insights) $

Angel Robotics is getting ready to complete its IPO in KOSDAQ in March. The IPO price range is from 11,000 won to 15,000 won.

The IPO offering amount is from 17.6 billion won to 24 billion won. At the IPO price range, the company’s valuation ranges from 154 billion won to 210 billion won.

Angel Robotics is likely to be compared to Doosan Robotics (KRX: 454910) and Rainbow Robotics (KOSDAQ: 277810).

Our base case valuation of Angel Robotics is target price of 20,277 won per share, which represents a 35% upside from the high end of the IPO price range.

We estimate sales of 9 billion won in 2024 (up 75.2% YoY) and 14.9 billion won in 2025 (up 65.3% YoY). Our estimates are more conservative than the company’s estimates.

We like the strong sales growth of Angel Robotics. Many investors are likely to view this positively in this IPO. LG Electronics (KRX: 066570 / FRA: LGLG / LON: 39IB) and Samsung Electronics (KRX: 005930 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) are customers of Angel Robotics…

🇰🇷 Ecopro Materials: Potential Selling by Second Largest Shareholder Post End of Lockup Period in May (Douglas Research Insights) $

We discuss the strong likelihood of potential selling of Ecopro Materials (KRX: 450080) by BRV Capital Management (the second largest shareholder of Ecopro Materials with a 24.7% stake) in May 2024.

BRV Capital Management’s stake in Ecopro Materials is currently worth 3.1 trillion won. In the past seven years, BRV Capital Management has invested about 93 billion won in Ecopro Materials.

On 4 March, Ecopro Materials announced it has entered into a contract to supply precursor to a U.S. auto company. There is some local speculation that this could be Tesla.

🇰🇷 Hyundai Motor: Watch U.S. Sales Data And Potential India Listing (Seeking Alpha) $

Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF)‘s unit sales for the U.S. market increased by +26.9% MoM and +5.8% YoY in February 2024.

According to media reports, Hyundai is contemplating a listing of the company’s Indian operations.

I remain bullish on Hyundai Motor stock, considering the company’s encouraging U.S. sales data and the potential valuation re-rating catalyst relating to the Indian IPO.

🌏 ASEAN banks’ fat interest margins wane as Fed rate cuts loom (Nikkei Asia) 🗃️

Singapore, Thailand and Indonesia anticipate rocky road in loan earnings

Banks in the 10-member ASEAN bloc may be seeing the last of beefy earnings from loans in the current higher financing era as lower interest rates loom.

The three major Singapore financial institutions — DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF), United Overseas Bank (SGX: U11 / FRA: UOB / UOB0 / OTCMKTS: UOVEY / UOVEF) and Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) — refer to Fed rates when setting those for their own loans. Expectations are that growth in interest profits may have peaked.

🇸🇬 DBS, UOB and OCBC: Which of These 3 Banks Should You Buy? (The Smart Investor)

🇸🇬 Does Shopee have a moat? (Momentum Works)

Our thoughts on Shopee’s Q4 results

Sea Limited (NYSE: SE)’s share price swung violently after 2024 Q4 and FY results were released yesterday – going up 13.6%, before nosediving 14.3% into the red, and finally settling at 5.6% up at the end of the trading day.

It shows investors’ ambivalence towards not exactly the set of results announced, but more on the prospects of Shopee in the face of intensified (and now renewed) competition.

🇸🇬 PropertyGuru (PGRU US) (Asian Century Stocks) $

The Zillow of Southeast Asia, but at 2.7x EV/Sales

PropertyGuru Group Ltd (NYSE: PGRU) (US$577 million) is a Singapore-based operator of real estate listing websites. Think of it as the Zillow of Southeast Asia.

Its websites and apps match property owners with potential buyers or renters. 37 million users visit PropertyGuru’s platforms yearly, where they can access 2.9 million property listings.

The only problem is that no one covers the company, and American micro-cap investors probably don’t understand the strength of PropertyGuru’s platforms. After raising capital at a US$1.8 billion valuation, the market cap has now dropped to US$577 million, with an enterprise value of just US$349 million.

🇸🇬 Singapore Technologies Engineering Is A Fairly Valued Defense Play (Seeking Alpha) $

Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF)‘s fiscal 2023 bottom line surpassed expectations, thanks to strong revenue growth for the Commercial Aerospace segment and the profitability improvement for the Defense & Public Security segment.

SGGKF’s Defense & Public Security segment is likely to benefit from higher defense spending, but positives are priced in with the stock trading at above 1 times PEG multiple.

A Hold rating for Singapore Technologies Engineering stock is maintained; I have a favorable opinion of its Defense & Public Security segment’s prospects, but the stock’s valuations are unattractive.

🇮🇳 Decoding Tata Motors Demerger: The Way Ahead (Smartkarma) $

Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) restructures, separating passenger and commercial vehicle businesses into distinct entities to unlock value in electric vehicles and Jaguar Land Rover unit.

Streamlines operations, enhances shareholder value, and capitalizes on growth opportunities in passenger and commercial vehicle sectors.

Offers investors specialized entities, unlocking hidden value, showcasing proactive adaptation to market changes, and positioning for sustainable growth in the automotive industry.

🇸🇦 Saudi Aramco increases dividend to nearly $100bn despite oil price falls (FT) $ 🗃️

Saudi Arabian Oil Co (TADAWUL: 2222)

🇿🇦 Grindrod dividend soars after good growth in Maputo port volumes (IOL)

Grindrod Limited (JSE: GND) lifted its 2023 dividend by 84% to 72.4 cents following a record performance from the Maputo port operations, from sea freight trade and good deployment of its rail facilities.

Grindrod’s share price traded 0.78% lower at R12.75 yesterday. The book net asset value per share increased to 1 368 cents (1 211 cents), meaning the share price is trading close to Grindrod management’s perceptions of book value.

🇿🇦 Quantum Food’s shares rise whopping 73% as two shareholder blocks face off for control (IOL)

Shares in Quantum Foods Holdings (JSE: QFH) soared 72.93% on the JSE yesterday following the offloading by Astral Foods Limited (JSE: ARL) of its 9.8% interest in the diversified feeds and poultry business this week for R141.7 million to Country Bird Holdings (CBH) in a shake-up that has sparked renewed interest and attention on the South African poultry industry.

“There are two opposing shareholder blocks and there is only about five 5% to 6% free float left in Quantum Foods and whoever controls the remaining free float basically gains control of Quantum Foods because you need 50.1% for that. If I was the owner of the remaining free float I could in theory name my price and clearly someone did that today (yesterday), saying I am selling my stocks at R9m,” he (Anthony Clark, an independent analyst at Smalltalkdaily Research) said.

Other analysts, however, said Quantum Foods was “illiquid, barely followed by the market and hardly owned by any institutional” funds.

🇵🇱 Dino Polska: A Compounder On Early Stages (Seeking Alpha) $

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) is the fastest-growing Polish retailer, with a market capitalization of PLN 42 billion.

The company operates a chain of low-priced supermarkets in rural areas, with a focus on fresh products.

Dino Polska has competitive advantages including cost advantage, regional monopolies, ownership of assets, brand power, and pricing power.

🌎 Ternium: Trading At Less Than 3 Times EBITDA (Seeking Alpha) $

(Luxembourg headquartered) Ternium S.A. (NYSE: TX)‘s investments in growth are starting to pay off, with a total return of over 400% since 2019.

The demand for steel and margins remained robust in Latin America in 2023, contributing to Ternium’s strong financial performance.

Despite high capex commitments in the next few years, Ternium’s healthy balance sheet and anticipated cash flows make it an interesting investment opportunity.

🇧🇷 COPEL: Value Thesis Taken Shape, Best Yet To Come (Seeking Alpha) $

Companhia Paranaense de Energia (COPEL) (NYSE: ELP)‘s transition to privatization has resulted in significant growth, with shares increasing by over 50% in the past year.

Despite initial reservations, the company’s improved operational efficiency and positive cash flow post-privatization justify upgrading the recommendation from neutral to buy.

In Q4 2023, ELP reported impressive results, including a 10% increase in EBITDA and doubled annual profit, showcasing its resilience and potential for future growth.

The company’s strategic capital allocation and focus on securing long-term concessions provide stability and confidence in its future performance.

While dividend resumption remains distant, COPEL’s promising value thesis and real IRR of over 10% make it a compelling investment opportunity.

🇧🇷 Petrobras Q4 Earnings: No Longer A Dividend Powerhouse (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) exceeded earnings and revenue estimates for Q4 2023, yet faced disappointment from investors due to lower-than-expected dividend distributions.

Despite solid financial performance, concerns persist regarding the company’s allocation of resources towards energy transition projects, potentially impacting shareholder value.

PBR stock valuation metrics suggest it is significantly undervalued, trading at a forward P/E of 4.2x and a forward EV/EBITDA of 2.86x, well below industry averages.

Recent governance changes and heightened political risks add uncertainty to Petrobras’ investment thesis, potentially leading it into a value trap.

Despite the potential for a 10% dividend yield in 2024, ongoing state risks prompt a neutral stance on Petrobras, with expectations of reduced dividend payouts in the future.

🇧🇷 Petrobras: Big Pullback Due To Dividend Surprise (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) reported weaker-than-expected earnings and a lower-than-expected dividend, causing its shares to drop by over 10%.

Despite the weaker-than-expected dividend, PBR remains a high-yielding investment with strong profitability and cash flows.

The company’s undervalued stock and attractive dividend yield make it an appealing investment option, although political risks should be considered.

🇧🇷 Equatorial Energia: A Brazilian Utility Bond Proxy Worth Monitoring (Seeking Alpha) $

Equatorial Energia (BVMF: EQTL3 / OTCMKTS: EQUEY) is a leading player in Brazil’s energy distribution sector, serving approximately 10 million customers across six concessionaires in various Brazilian states.

The company’s diversified operations extend beyond energy distribution to include transmission, sanitation, renewable energy, distributed generation, energy sales, and telecommunications.

Equatorial has demonstrated robust financial performance, with strong growth in EBITDA and adjusted net income driven by strategic capital allocation and operational efficiency.

Despite its solid performance, Equatorial faces risks such as regulatory challenges, acquisition risks, and high financial leverage, which could impact its future growth prospects and shareholder returns.

🇧🇷 Nu Holdings: Expanding Revenue But Questionable Valuation (Seeking Alpha) $

Nu Holdings Ltd (NYSE: NU) operates a digital bank and offers various digital solutions in Brazil, Mexico, and Colombia.

The company has successfully leveraged customer data to provide better services and cross-sell products.

Nu Holdings has expanded into Colombia, which provides an optimistic growth trajectory for the company.

🇨🇴 Ecopetrol: Colombian Oil Producer Offers 14.7% Dividend On Stable Oil Prices (Seeking Alpha) $

Ecopetrol SA (NYSE: EC)‘s strong financials offer a great reward against the risks of the leftist government and potential decreasing oil prices.

As long as oil doesn’t fall too much, Ecopetrol will likely return high returns per share to shareholders.

I believe the market is overestimating the risk of the left-wing Colombian leader and the increasing debt levels on Ecopetrol.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Beijing’s ‘broker butcher’ sparks state-driven stock rally (FT) $ 🗃️

🇨🇳 Morgan Stanley cuts 9% of China fund unit staff amid market rout, sources say (Reuters)

Morgan Stanley’s China fund unit started reducing headcount in December, sources say

Morgan Stanley cuts China fund staff amid shrinking assets, operating losses

Morgan Stanley rebranded unit as wholly owned in June 2023

China’s CSI300 index sank to five-year lows last month

🇨🇳 ‘No one is number 2’: Xi Jinping looms larger than ever over China (FT) $ 🗃️

🇨🇳 In Depth: Hong Kong Embarks on Economic Makeover (Caixin) $

Hong Kong has set in motion an ambitious strategy to revive growth, aimed at diversifying from a property-focused economy to fostering more sustainable and high-value growth sectors.

As part of a sweeping plan to restore confidence and bolster the ailing property sector, Financial Secretary Paul Chan announced in his budget speech on Feb. 28 that cooling property measures to curb housing demand would be abolished immediately. These include the special stamp duty, buyer’s stamp duty and new residential stamp duty — introduced one after the other from 2010 to curb speculative investments as Hong Kong’s property prices soared.

🇲🇴 Macau 2024 GGR likely 80pct of 2019 level: Fitch (GGRAsia) & Fitch Affirms Macao at ‘AA’; Outlook Stable (Fitch Ratings)

Fitch Ratings Inc forecasts Macau’s economic growth to be about “15 percent” year-on-year in 2024, on assumption that the city’s casino gross gaming revenue (GGR) recovers to 79.5 percent of 2019′s, compared to 62.6 percent of pre-pandemic level in 2023.

🇰🇷 Locals Driving Corporate Reforms and 10 Korean Companies Recently Announcing Share Cancellations (Douglas Research Insights) $

In a recent discussion with a client, one of the questions that was raised was regarding the impact the local investors are having on the corporate governance reforms in Korea.

The number of local investors in the Korean stock market has jumped in the past few years from 5.3 million in 2017 to 14.4 million in 2022.

All in all, I think Korea is about 3-5 years behind Japan in various corporate governance reforms. So it has a lot of catching up to do.

🇮🇳 Hedge funds threaten to pull India investments due to regulatory crackdown (FT) $ 🗃️

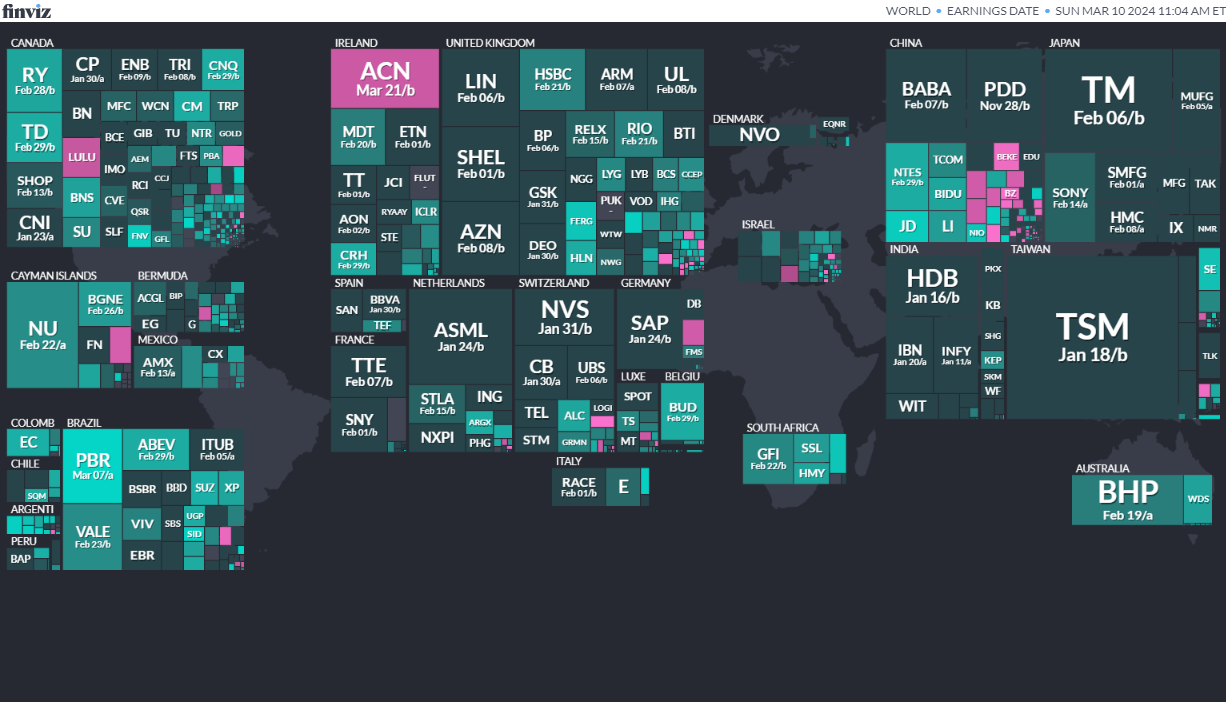

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

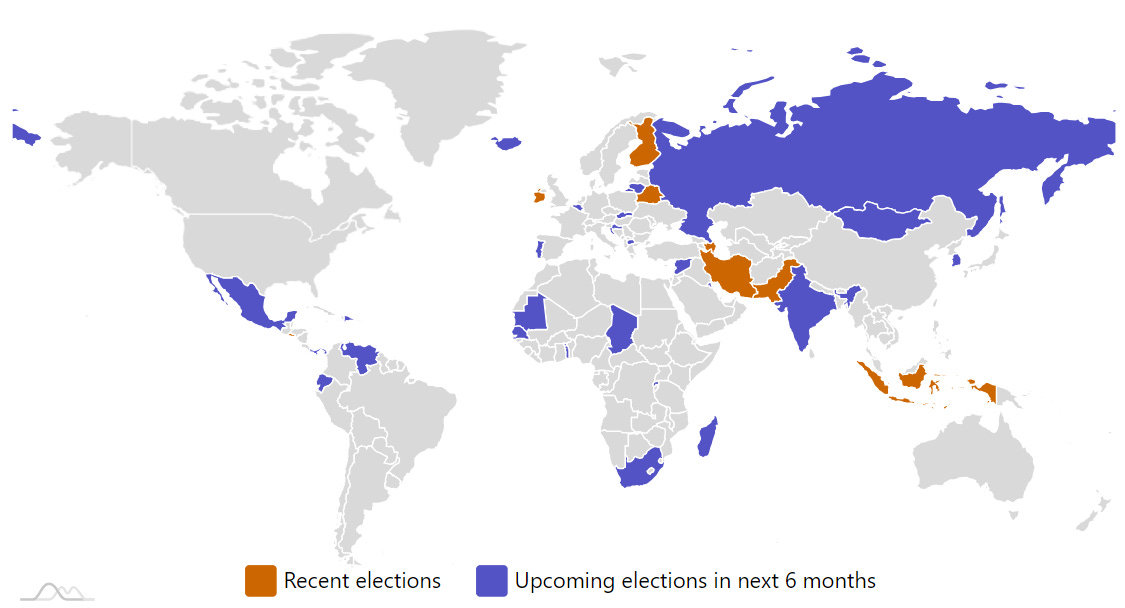

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Russian Federation Russian Presidency Mar 17, 2024 (d) Confirmed Mar 18, 2018

-

South Korea South Korean National Assembly Apr 10, 2024 (d) Confirmed Apr 15, 2020

-

India Indian People’s Assembly Apr 30, 2024