Emerging Market Links + The Week Ahead (May 19, 2025)

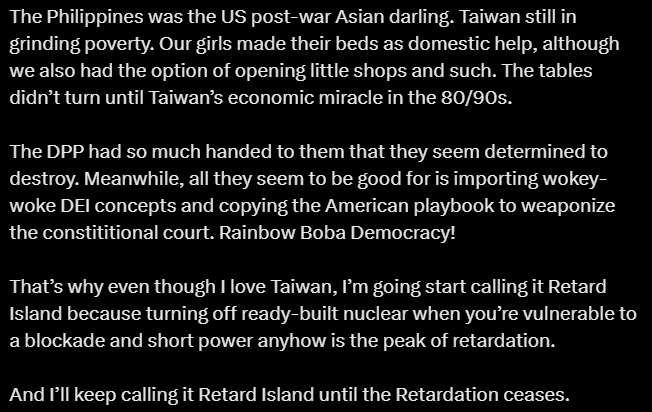

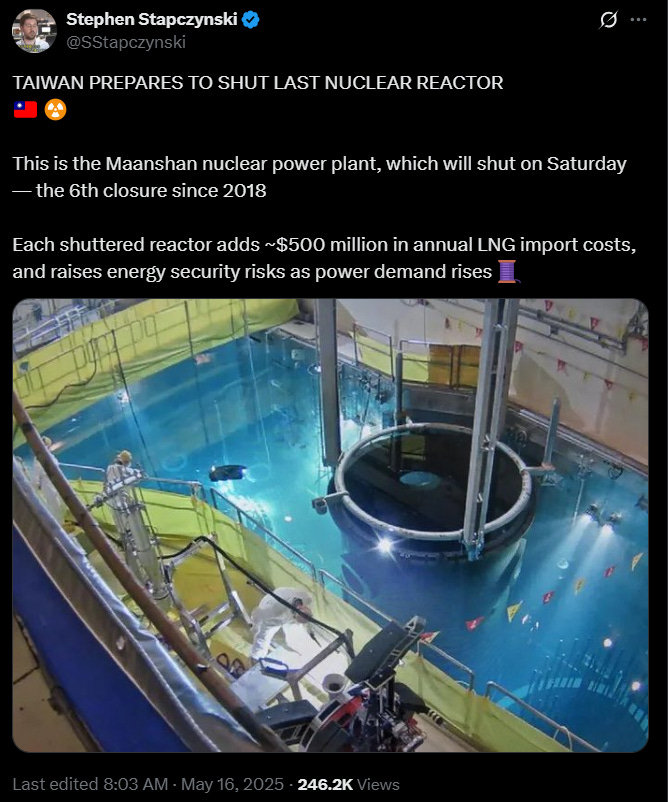

Two interesting tidbits: Net zero type craziness is not just occurring in Europe or parts of the USA as Taiwan is shutting down its last nuclear power plant (being a “nuclear-free homeland” is apparently in the Constitution of the ruling Democratic Progressive Party). This is the 6th closure since 2018 with each shuttered reactor adding ~$500 million in annual LNG import costs (as nearly all energy must now be imported). One Taiwanese took to Twitter to complain:

Smart at politics, retarded in governance. I fear if the DPP continue to hold power, Taiwan is just going to turn into the Philippines.

People forget…at one point the Philippines was more prosperous than Taiwan. People went THERE to find their pot of gold the way the Filipinos come here now, although not in such numbers.

The DPP had so much handed to them that they seem determined to destroy. Meanwhile, all they seem to be good for is importing wokey-woke DEI concepts and copying the American playbook to weaponize the constititional court. Rainbow Boba Democracy!

She ended her tweet by saying she will keep calling Taiwan “Retard Island until the Retardation ceases…” As Taiwan moves backwards, China, meanwhile, is reportedly building at least 10 nuclear powerplants…

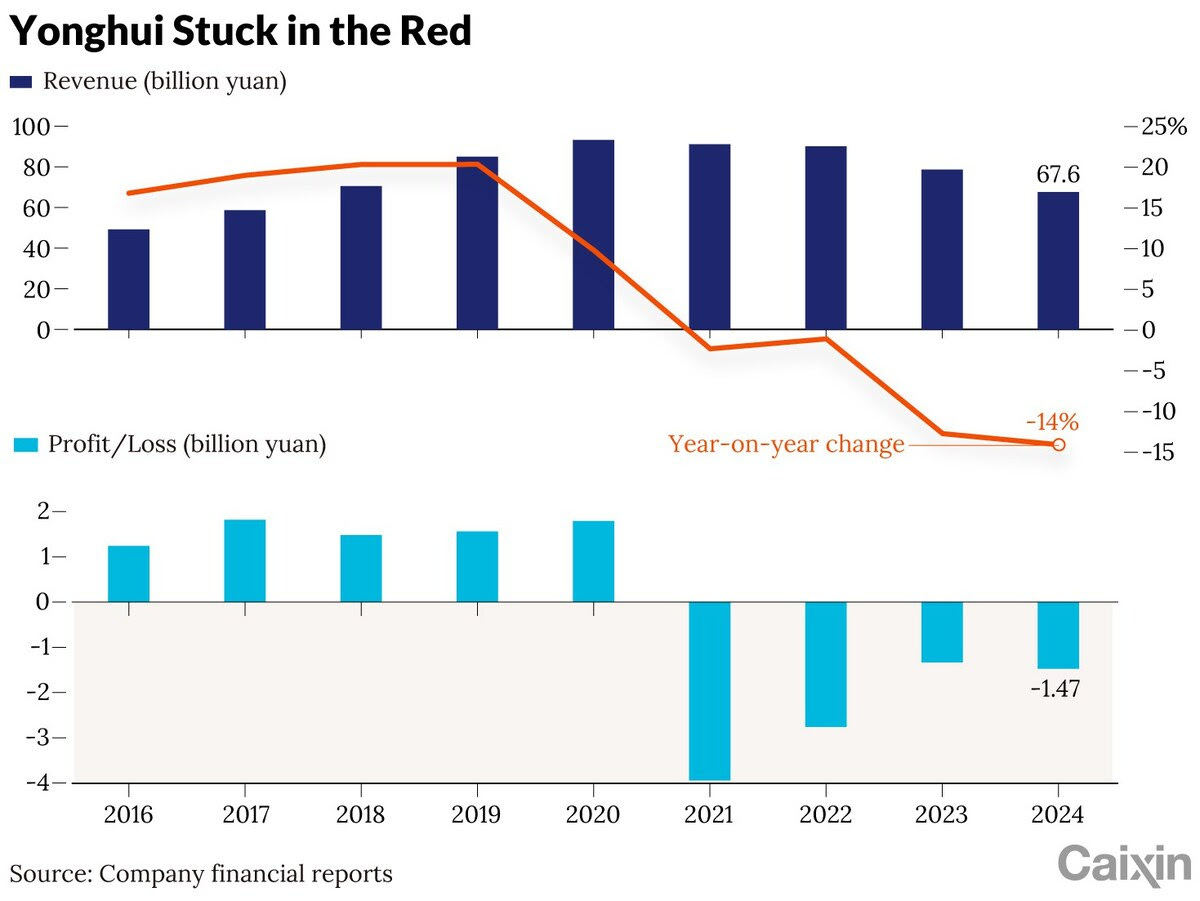

Finally, the billionaire founder, chairman, and CEO of lifestyle retail group MINISO Group Holding (NYSE: MNSO) (a blatant copy of Japanese retail chains) wants to turnaround Yonghui Superstores Co Ltd (SHA: 601933), which he is invested in, and he recently gave out his personal email address to suppliers:

The address came with an invitation to the suppliers: If any of the supermarket chain’s buyers solicit bribes in exchange for some benefit in doing business with the company, he wanted to know about it. “If any of our procurement staff give you trouble, just WeChat me directly,” he said.

Since buyer-supplier kickbacks in certain sectors (e.g. supermarkets in particular Asian countries) is almost standard operating procedure, its refreshing to see a local investor (in China no less) literally address and make an effort to put a stop to such behavior as part of a business turnaround effort…

$ = behind a paywall

-

🇨🇳 🇭🇰 China & Hong Kong Stock Picks (April 2025) Partially $

-

🇨🇳 China – WuXi AppTec, Shenzhen Mindray Bio-Medical Electronics, Luckin Coffee, BYD Company, Shanghai United Imaging Healthcare, Jiangsu Hengli Hydraulic, China Pacific Insurance (Group) (CPIC), Li Ning, Zhejiang Dingli Machinery, Wingtech Technology, BYD Electronic International Co Ltd, Akeso, Ping An Insurance, Great Wall Motor, Guangzhou Automobile Group (GAC Group), New Oriental Education, ZTE, Zhongji Innolight Co Ltd, Kanzhun Ltd, Sany Heavy Industry, Xtep, iQIYI, InnoScience (Suzhou) Technology Holding Co, Tongcheng Travel Holdings, PICC P&C, Baidu, ANTA Sports Products, BOE Varitronix, Ubtech Robotics Corp, JD.com, J&T Global Express, Alibaba, Naura Technology, XtalPi Holdings, Binjiang Service Group, Yonyou Network Technology, New Hope Service Holdings, Sany Heavy Equipment International Holdings, Intron Technology, Maxscend Microelectronics, Jiumaojiu International Holdings, Tongda Group Holdings & CSPC Pharmaceutical Group

-

🇭🇰 Hong Kong – AIA Group Ltd, Hutchison Port Holdings Trust, Hong Kong Exchanges and Clearing Ltd, WH Group Ltd, Television Broadcasts Ltd, Sa Sa International Holdings Ltd, Sun Hung Kai Properties Ltd, China Overseas Land & Investment Ltd, Hongkong Land Holdings Ltd, Sands China Ltd, CK Asset Holdings Ltd, China Overseas Grand Oceans Group Ltd, Luk Fook Holdings (International) Ltd, Stella International Holdings Ltd, Sunlight Real Estate Investment Trust, EVA Precision Industrial Holdings, Prada SpA, Budweiser Brewing Company APAC Ltd, Galaxy Entertainment Group Ltd & Henderson Land Development Co Ltd

-

CMB 20+ high conviction stock ideas – Geely Automobile, XPeng, Zoomlion Heavy Industry, ANTA Sports Products, Luckin Coffee, Yum China, Proya Cosmetics, China Resources Beverage Holdings (CR Beverage), BeiGene, Innovent Biologics, PICC P&C, Alibaba, Tencent, Kuaishou Technology, Trip.com, Greentown Service Group Co, Xiaomi, BYD Electronic International Co Ltd, Naura Technology, BaTeLab Co, Will Semiconductor Co Ltd, Salesforce, Zhongji Innolight Co Ltd, WuXi AppTec & China Pacific Insurance (Group) (CPIC)

-

-

🌐 EM Fund Stock Picks & Country Commentaries (May 18 2025) Partially $

-

China’s domestic focused stocks, Vietnam’s Resolution 68, India’s economic momentum, all about umbrella funds, opportunities from domestic reforms in EM/FMs, more tariffs/AI research, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 Alibaba’s Spending Spree: From Cautious Buybacks to Full-Blown Investment Mode (The Great Wall Street – Investing in China)

Alibaba (NYSE: BABA)

AI, Instant Retail, Cloud, and E-Commerce Are All Demanding Capital—While Free Cash Flow Starts to Crack

Last quarter, the big talking point was Jack Ma’s unexpected appearance at a high-level government meeting with China’s tech leaders. I’ve written many times about how quickly the political environment in China can shift, and how things tend to move in cycles. When there is a shift, it usually happens fast. The fact that Ma—who technically holds no title—was standing among the top leadership was more than symbolic. It was a signal.

And yet, the significance of that meeting still seems widely underestimated. What I find more surprising than Ma’s appearance is what followed—or rather, what didn’t. This quarter, the focus shifted completely. Analysts moved on, and suddenly everything was about AI and a bit of macro stimulus—trade-in subsidies and new battlegrounds like JD.com (NASDAQ: JD)’s push into food delivery.

What went almost entirely unmentioned was that the government’s stance toward the tech sector has clearly become more supportive. It’s visible. But somehow, nobody thought that was worth discussing.

🇨🇳 Alibaba (BABA): 4Q25, Main Business Growth Recovered to 12% YoY, Buy (Smartkarma) $

Management claimed 4Q25 total revenue should grow by 10% YoY excluding two sold subsidiaries.

The growth rate of customer management revenue rose to two digits in 4Q25.

The main business margin was stable and most of the minor business margins rose YoY in 4Q25.

🇨🇳 🇧🇷 Meituan’s US$1B investment into Brazil, what’s on the table? (Momentum Works)

Meituan (HKG: 3690 / 83690 / SGX: HMTD / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) said that Keeta, its international food delivery subsidiary, will enter Brazil “in the next few months”, whilst the US$1 billion investment commitment will be for the next 5 years.

Wang Xing also said Keeta will build an on demand delivery network in Brazil, “focusing on improving consumer experiences, promoting the development of partner restaurants, and creating more job opportunities” in the country.

But wait, as mentioned at the beginning of the article, what is (literally) on the table? See the photo below:

Sharp-eyed friends will notice the Snow King, mascot of Chinese bubble tea and ice cream chain MIXUE Group (HKG: 2097). With more than 45,000 outlets in China and 11 countries, Mixue is currently the largest F&B chain in the world by store count.

A few additional quick thoughts on Meituan’s incursion into Brazil:

🇨🇳 In Depth: JD.com wants to unseat China’s takeout king (Caixin) $

When a young Beijinger opened his door to grab his takeout meal in April, he was shocked to see a billionaire on his doorstep.

Richard Liu, founder of e-commerce giant JD.com (NASDAQ: JD), had just scooted through the Chinese capital’s streets to personally deliver the meal as well as a clear message to the country’s dominant takeout platforms — JD.com is going to shake things up.

🇨🇳 JD.com loses more money on ‘new businesses’ with costly foray into food delivery (Caixin) $

JD.com (NASDAQ: JD) saw losses deepen in its “new businesses” segment in the first quarter, amid the e-commerce giant’s costly push into China’s highly competitive food delivery sector.

The segment, which includes the company’s nascent ventures such as JD Takeaway, JD Property and its overseas businesses, booked losses of 1.3 billion yuan ($180 million) in the first three months, nearly double the 670 million yuan from the same period last year, according to JD.com’s quarterly results released Tuesday. The loss is equal to 23.1% of the quarterly revenue from “new businesses” — widening from 13.8%.

🇨🇳 CATL’s HK secondary listing aims to raise US$3.99 billion (The Asset) 🗃️

Proceeds from IPO to fund construction of Chinese firm’s EV battery factory in Hungary

Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750), the world’s largest battery manufacturer, which is currently listed on the Shenzhen Exchange, aims to raise via a secondary listing on the Hong Kong Stock Exchange over HK$31 billion ( US$3.99 billion ) of equity from overseas investors to support its construction of a large-scale electric vehicle ( EV ) battery factory in Hungary.

🇨🇳 Polibeli targets SPAC listing using Chenghe Acquisition II Co., with Asia in its sights (Bamboo Works)

Chenghe Acquisition II Co (NYSEAMERICAN: CHEB) shareholders will vote later this month on a merger with the Asia-focused B2B e-commerce company Polibeli

Chenghe Acquisition II Co. hopes to soon complete its SPAC merger with Polibeli, which would then become a U.S.-listed company

Polibeli operates a B2B e-commerce platform that supplies a wide range of products to Asian retailers, with an initial focus on Indonesia, Japan and Hong Kong

🇨🇳 Tencent Music (TME): 1Q25, Unnoticed Growth Continued, 80% Upside (Smartkarma) $

Tencent Music Entertainment Group (NYSE: TME)

The 1Q25 result is quite healthy, but the shrinking minor business, social entertainment, covers the fact.

The main businesses grew by two digits and the operating margin continued to grow by 28% YoY in 1Q25.

We believe the stock has an upside of 83% and a price target of US$26 for the yearend 2025.

🇨🇳 In Depth: How Miniso’s Founder Aims to Engineer a Supermarket Turnaround (Caixin) $

After Ye Guofu sketched out a plan for salvaging one of China’s largest supermarket chains at a conference on March 29, he punctuated one of his proposals for revamping Yonghui Superstores Co Ltd (SHA: 601933) relationship with its suppliers by posting his personal email address onscreen for all to see.

The address came with an invitation to the suppliers: If any of the supermarket chain’s buyers solicit bribes in exchange for some benefit in doing business with the company, he wanted to know about it. “If any of our procurement staff give you trouble, just WeChat me directly,” he said.

🇨🇳 Swiss footwear upstart On bets big on China (FT) $ 🗃️

Fast-growing trainer maker backed by Roger Federer joins brands taking global market share from Nike and Adidas

Meanwhile, domestic brands such as ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF), Li Ning (HKG: 2331 / FRA: LNLB / LNL / OTCMKTS: LNNGY / LNNGF), and Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) have gained significant market share and revenue as they tap into the appeal of homegrown companies. Anta, China’s biggest sportswear group, reported better than expected sales in 2024 after benefiting from an endorsement deal with US basketball star Kyrie Irving.

🇨🇳 Midea boosts European footprint in its globalization drive (Bamboo Works)

The home appliance maker has acquired German brand Teka, whose products are used in half of all Spanish households

Midea Group (SHE: 000333 / HKG: 0300 / FRA: 1520 / OTCMKTS: MGCOF) has completed its acquisition of Teka, adding a high-end brand to its stable as part of its drive to move up the home appliance value chain

Despite reporting strong first-quarter results, Midea remains vulnerable to a U.S.-led trade war that could spark a global recession

🇨🇳 Anjoy’s IPO advances in crowded field of food listings (Bamboo Works)

A Hong Kong listing plan by the leading maker of frozen foods like fish balls has received a green light from China’s securities regulator

The Chinese securities regulator has formally registered Anjoy Foods Group Co Ltd (SHA: 603345)’ plan to list in Hong Kong, which would complement its existing Shanghai listing

The frozen foods maker’s revenue began to contract in the first quarter, and its gross margin is also notably lower than many other leading food companies

🇨🇳 Cango takes ‘Mine and Hold’ strategy in its young bitcoin business (Bamboo Works)

The auto trader-turned-bitcoin miner has minted 2,944.8 bitcoins since entering the business last November, but has yet to sell any of those despite recent market volatility

Cango (NYSE: CANG) owned 2,944.8 bitcoins at the end of April, as its costs for producing the cryptocurrency rise due to growing competition from new and existing miners

The bitcoin miner expects to install 18 EH of new capacity by the end of July, bringing its global total to 50 EH spread across four continents

🇨🇳 Ispire’s cannabis dreams going up in smoke? (Bamboo Works)

The American vaping company with strong Chinese ties reported its revenue fell 12.7% in the three months to March, as it rushes to set up a new manufacturing facility in Malaysia

Ispire Technology (NASDAQ: ISPR)’s revenue fell and its loss widened in its latest fiscal quarter, as it overhauled its operation to reduce exposure to the U.S.-China trade war

The company is rushing to open a new factory in Malaysia, mirroring similar moves by other vaping companies to diversify their production away from China

🇨🇳 Kintor Pharma shifts from cancer drugs to cosmetics as funds run low (Bamboo Works)

The cash-strapped biotech has begun generating its first revenue from over-the-counter cosmetic treatments, as it pivots away from its original oncology drugs

Kintor Pharmaceutical (HKG: 9939 / OTCMKTS: KNTPF) is shifting from its origins as a cancer drug specialist with its latest two products for freckle-removing and hair loss treatments

The company has generated its first revenue from over-the-counter cosmetic treatments, but is also continuing clinical trials for its hair loss drug

🇨🇳 BeiGene celebrates profit milestone on soaring drug sales (Bamboo Works)

Buoyed by U.S. demand for its blockbuster cancer drug, the Chinese biopharma firm has delivered its first quarterly profit on a GAAP basis

Global sales of the company’s flagship drug for blood cancers rose 62% to $792 million in the first quarter, while U.S. sales reached $563 million

BeiGene (NASDAQ: ONC) is adopting a new English name, BeOne Medicines Ltd., and is moving its headquarters to Switzerland

🇨🇳 China Hongqiao (1378 HK): Leading the Low-Cost, Low-Carbon Aluminium Shift (Smartkarma) $

China Hongqiao Group (HKG: 1378 / FRA: H0Q / OTCMKTS: CHHQF / CHHQY) has delivered steady ~6 Mt volumes, ~25% EBITDA CAGR, and 15–27% ROCE over the last three years, supported by integration and energy transition gains.

China Hongqiao is relocating 4 Mt of capacity to Yunnan to tap low-carbon hydropower, advancing its green aluminium transition.

China Hongqiao offers strong earnings visibility backed by low-cost operations, while trading at attractive valuations relative to peers.

🇨🇳 In Depth: Mining Giants Pivot as China’s Real Estate Slump Weighs on Iron Ore (Caixin) $

As global demand for iron ore weakens, in part due to China’s real estate slump, the world’s four top producers are hoping to spur growth by supplying minerals used in the global energy transition and artificial intelligence (AI).

The CEOs of these mining giants — BHP Group (NYSE: BHP), Rio Tinto plc (NYSE: RIO), Vale (NYSE: VALE) and Fortescue Ltd (ASX: FMG / FRA: FVJ / OTCMKTS: FSUMF) — told Caixin that these two sectors will require vast quantities of copper, aluminum, lithium and potash. These minerals are essential for power grids, batteries, electric vehicles (EVs), data centers and more.

🇨🇳 Zijin Mining sees gold in IPO for international arm (Bamboo Works)

The company hopes to take advantage of record gold prices to raise big money from a separate listing for its overseas business mining the precious metal

Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF) has announced a plan to spin off its overseas gold assets, which account for nearly 70% of its total gold production

Revenue from the company’s gold mining business represented around half of its total last year

🇭🇰 Hong Kong stocks outperform mainland China by most since 2008 (FT) $ 🗃️

🇭🇰 Swire Properties: Q1 Performance And Capital Allocation Outlook Are Mixed (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇲🇴 Macau’s Chief Executive says no retaliation against U.S.-owned local casino operators despite China–US tensions (GGRAsia)

Macau’s Chief Executive, Sam Hou Fai (pictured), says U.S.-owned casino companies operating in the city will not face any retaliatory action, provided they comply with local laws and regulations. The assurance came amid ongoing geopolitical and trade tensions between China and the United States.

“The six gaming operators in Macau, as long as they comply with Macau law and conduct their operations in a lawful and orderly manner, will be protected and supported by the Macau government,” stated Mr Sam.

He emphasised that law-abiding companies – including those that have U.S.-based investors – had no reason to fear punitive action from the local authorities.

🇲🇴 Sands China eyes ‘big health’-related tourism via new partnership (GGRAsia)

Macau casino concessionaire Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) has signed a memorandum of understanding (MoU) with Guangdong-Macau Traditional Chinese Medicine Technology Industrial Park Development Co Ltd (GMTCM), “to promote the integration of the ‘big health’ tourism industry” in Macau and Hengqin.

The partnership will focus on promoting regional collaboration, stated Sands China in a Friday press release, following the signing ceremony.

🇹🇼 “Retarded Island” (Tweet Via ZeroHedge)

🇹🇼 Himax: Valuation Shows It’s Time To Buy (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Cheap For A Reason – And That’s The Opportunity (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Bizarrely Undervalued (Seeking Alpha) $ 🗃️

🇰🇷 South Korea industry-wide casino GGR up 18pct y-o-y in 2024: govt (GGRAsia)

South Korea’s casinos posted almost KRW3.23 trillion (US$2.30 billion) in gross gaming revenue (GGR) in 2024, according to figures from the Ministry of Culture, Sports and Tourism.

That 2024 industry-wide GGR was up 18.3 percent from KRW2.73 trillion the previous year, according to ministry data.

Last year’s tally was also 10.1 percent up on the KRW2.93 trillion achieved in 2019, the trading year immediately before the Covid-19 pandemic.

The 2024 aggregate GGR figure covers the country’s 17 casinos, including the ones for foreigner-only play as well as Kangwon Land (KRX: 035250), the nation’s only casino that allows locals to bet.

🇰🇷 Paradise Co’s 1Q revenue at US$200mln, net profit up 20pct (GGRAsia)

Paradise Co Ltd (KOSDAQ: 034230), an operator of foreigner-only casinos in South Korea, reported net income of KRW31.13 billion (US$22.1 million) for the first quarter of 2025, a 20.0-percent increase from a year earlier.

Revenue for the first three months of 2025 rose by 7.0 percent year-on-year, to KRW283.31 billion, according to a Monday filing to the Korea Exchange

🇰🇷 🇯🇵 Shareholder Returns of Japanese Trading Companies Invested By Warren Buffett Vs Top Korean Trading/Holdcos (Douglas Research Insights) $

“In the next 50 years… we won’t give a thought to selling those (Japanese trading companies)…. Japan’s record has been extraordinary.” (Warren Buffett)

In this insight, we provide detailed comparisons of the five major Japanese trading companies and five major Korean holdcos/trading companies.

Japanese trading companies have higher points for market cap, ROE, DPS increase, and shares cancellation. Korean holdcos have higher points for dividend yield, deb/equity ratio, ROIC, and valuations.

🇰🇷 Top 100 Korean Firms with Highest Treasury Shares as % of Market Cap (Tender Offer and M&A Targets) (Douglas Research Insights) $

We provide an analysis of the top 100 companies with the highest percentage of treasury shares as a percentage of market cap.

These 100 companies are prime targets of tender offers and M&As. Many of these companies have low PBR ratios.

Number five in this list is Telcoware Co Ltd (KRX: 078000) which just announced a tender offer by the CEO who is trying to take the company private.

🇰🇷 A Pair Trade Between LG Electronics and LG Display (Douglas Research Insights) $

In this insight, we discuss a pair trade between LG Electronics (KRX: 066570 / 066575 / FRA: LGLG / LON: 39IB) (long) and LG Display (NYSE: LPL) (short).

LG Display is likely to face greater margin pressures than LG Electronics this year, which could lead a bigger consensus estimates downward revisions for LG Display than LG Electronics.

Both LG Electronics and LG Display are trading at 0.6x P/B multiples. Given LG Electronics’ much higher ROE vs LG Display, LG Electronics should be trading at higher valuation multiples.

🇰🇷 A Pair Trade (Basket) Of Korean Banks Vs Securities (Douglas Research Insights) $

🇰🇷 Hanjin Group Chairman Cho Fights Back Against Hoban Group for Control of Hanjin Kal (Douglas Research Insights) $

On 15 May, Hanjin Kal Corp (KRX: 180640 / 18064K) announced that it will contribute 440,044 shares of its treasury stock to the company’s welfare fund, representing 0.7% of its common shares.

This is a clear indication of Hanjin Kal Chairman Cho Won-Tae and his allies launching a management rights defense against Hoban Group which recently increased its stake in Hanjin Kal.

The higher probability scenario is for Hanjin Kal’s shares to retrace down to below 100,000 won level as a full blown M&A fight is not likely in the near future.

🇰🇷 LG Chem: To Issue Exchangeable Bond Worth US$1 Billion (Douglas Research Insights) $

On 15 May, LG Chem (KRX: 051910 / 051915) announced that it plans to issue foreign currency exchangeable bond worth US$1 billion using shares of its subsidiary LG Energy Solution (KRX: 373220) as the underlying asset.

The purpose of this EB issue is to repay the amount of EB issued two years ago.

The exchange price premium was lowered from 130% in 2023 to 110-115% this time, and the maturity has been shortened from 7 years to 3 years.

🇰🇷 Sibling Conflict Between Yoon Sang-Hyun (Brother) And Yoon Yeo-Won (Sister) At Kolmar Group (Douglas Research Insights) $

There is a brewing sibling conflict at the Kolmar Group. Kolmar Holdings Co Ltd (KRX: 024720) and KolmarBNH Co Ltd (KOSDAQ: 200130 / OTCMKTS: KHCLF) have clashed regarding the reorganization of Kolmar BNH’s board of directors.

Yoon Sang-Hyun (brother) wants to shake things up. Yoon Sang-Hyun wants to appoint new members at Kolmar BNH’s BOD but his sister Yoon Yeo-Won is opposing this.

We see a higher upside for Kolmar Holdings. Our base case valuation of Kolmar Holdings is NAV per share of 14,675 won (57.5% upside from current levels).

🇰🇷 Classys: Block Deal Sale of 6% By Bain Capital Raises Overhang Concerns (Douglas Research Insights) $

After the market close on 16 May, Bain Capital sold about 6% stake in Classys (KRX: 214150) in a block deal sale.

Bain Capital sold 3.93 million shares of Classys at 57,915 won per share (this price is 10.9% discount from Classys’ closing price the previous day).

Bain Capital’s decision to sell a 6% stake in Classys via a discounted block deal, rather than offloading its entire 60.2% controlling stake, indicates a share overhang on future sales.

🇰🇷 Telcoware: Tender Offer To Take the Company Private (Douglas Research Insights) $

Telcoware Co Ltd (KRX: 078000) announced that the largest shareholder and CEO of the company (Keum Han-Tae) will be undertaking a tender offer of 2.332 million shares (25.24%) to take the company private.

Tender offer price is 13,000 won per share. Tender offer period is from 19 May to 10 June.

Telcoware has 4.08 million treasury shares, accounting for 44.1% of outstanding shares.

🇰🇷 POSCO Future M: A Rights Offering Capital Raise of 1.1 Trillion Won (Douglas Research Insights) $

(Korea’s largest quicklime producer) Posco Future M Co Ltd (KRX: 003670) announced today that it plans to complete a rights offering capital raise of 1.1 trillion won.

The capital raise will involve 11.483 million new shares, representing 14.8% of current outstanding shares. The expected rights offering price is 95,800 won, which is 15.8% lower than current price.

We have a Negative view on POSCO Future M and this capital raise, which is likely to have a negative impact on its shares due to the dilution risk.

🇰🇷 Magnachip Semiconductor Upgraded To Buy (Seeking Alpha) $ 🗃️ (?)

🇮🇩 Indonesia’s old guard wants its old world back (Pearls and Irritations)

Awas! This could turn nasty if the vets hold firm

Formal demands have been lodged by 332 retired senior soldiers and cops to sack Indonesia’s Vice President, and return the 25-year-old democracy to military rule – cries that should frighten Australia’s new government.

Yesteryear’s warriors want a return “to the original 1945 Constitution as the political legal system and government order”. The founding document has been amended four times since first written in 1945.

Till now the oldies’ move has been mainly the rattling of walking sticks; now its powerful Forum Purnawirawan TNI-Polri (Forum of Retired Military and Police) has reportedly asked the Parliament to dismiss VP Gibran Rakabuming, former President Joko ‘Jokowi’ Widodo’s eldest son.

🇮🇩 ANTAM (IDX: ANTM): Operational Momentum, Expansion Ahead, Valuation Still Attractive (Smartkarma) $

Aneka Tambang Tbk PT (IDX: ANTM / ASX: ATM / FRA: AKTA)’s Q1 2025 EBITDA surged over 250% YoY, supported by strong gold and nickel sales and improved cost efficiencies.

Plans include new RKEF and HPAL plants in East Halmahera, targeting growth in battery-grade nickel output.

Despite a recent rally, ANTAM trades at just 7x forward P/E—well below regional peers—while its strong cash balance of IDR 462 per share offers downside support, stock is attractively valued.

🇲🇾 Who will be Malaysia’s next prime minister? (Murray Hunter)

There is a high probability that there will be a new prime minister in Malaysia after the next general election.

With Anwar Ibrahim’s poor performance over the last two years, and the major diplomatic embarrassment in Russia last week, there is much talk about who will be the next prime minister. Anwar is calculating on holding the unity government together and continuing with the job of prime minister after the election, due to incumbency. However, Anwar has disappointed almost everyone and cannot rely upon incumbency to keep his job. Any candidate who looks like they could be a competent prime minister will be looked at seriously by the Agung, if they can show they have the numbers in another ‘hung parliament’ scenario, expected after the coming general election.

Most likely the parliament will run its full term, unless other factors intervene. For Anwar, the longer before the next general election the better. This means a general election in the second half of 2027.

The next potential prime minister will most probably come from these people below.

🇲🇾 Just How Accurate Are Malaysia’s Major Economic Indicators? – Analysis (Murray Hunter)

Back in 2006, a brave economic historian Dr Lim Teck Ghee claimed that the Bumiputera equity target of 30 percent set out in the 1971 New Economic Policy had been surpassed. This was based upon a study he led by the Centre for Policy Studies (CPPS) and the Asian Strategy and Leadership Institute (ASLI). The study results showed that Bumiputera equity had far exceeded 30 percent. The government was embarrassed after being caught out. This created an outcry leading to Dr Lim’s resignation, where he went onto continue working in the United States.

The task of calculating aggregate GDP is made more difficult with the size of the informal sector in Malaysia being between 30-50 percent, depending on how the informal sector is defined and who is measuring this aspect of the economy. The Malaysian economy has the 6th largest informal sector in the world, after Uzbekistan, Cyprus, Greece, Botswana, and Costa Rica. Just how well this can be measured is questionable. Very few economists even mention the informal sector in public discussions, even though it is a major part of the economy.

🇲🇾 Hidden champions of Malaysia (Asian Century Stocks) $

Top 25 companies of Malaysia.

Malaysia is a small economy in Southeast Asia with a population of 36 million people.

I think it’s underrated in many ways: it has a dynamic export sector, excellent disclosures, strong corporate governance practices, English disclosures and trading access to 1,000 stocks via Interactive Brokers

I’ve gone through the entire list of publicly listed companies with more than US$50 million in market cap and picked out 25 companies that I consider to be hidden champions. These operate within the healthcare, finance, consumer, tech industries and more.

🇲🇾 Bursa Malaysia: Divergent Prospects For Its Major Businesses (Seeking Alpha) $ 🗃️

🇵🇭 International Container Terminal: Still Bullish Considering Tariff Developments And Q1 Outperformance (Seeking Alpha) $ 🗃️

🇸🇬 Marina Bay Sands hotel revamp completed as ‘most significant milestone’ of US$1.75bln reinvestment (GGRAsia)

Marina Bay Sands – one half of Singapore’s casino resort duopoly – announced on Tuesday that hotel room renovations had been completed, meaning the property now has a “full inventory” of approximately 1,850 rooms, including 775 suites.

It marked the complex’s “most significant milestone” in its US$1.75-billion multi-year refurbishment programme, according to the statement from Marina Bay Sands Pte Ltd, a unit of Las Vegas Sands (NYSE: LVS).

As of last week, about 1,480 rooms and suites (example pictured) under the ‘The Sands Collection’ branding had been “fully refreshed”, the update said.

🇸🇬 GEN Singapore 1Q profit down 41pct y-o-y; CEO Tan Hee Teck retires at 70 (GGRAsia)

Casino operator Genting Singapore (SGX: G13 / FRA: 36T / OTCMKTS: GIGNF / GIGNY) posted first-quarter net profit after tax of nearly SGD145.0 million (US$111.4 million), down 41.4 percent from the prior-year period.

Aggregate revenue for the first three months of 2025 stood at just under SGD626.2 million, a 20.2-percent decrease from a year earlier. Quarterly revenue was up 2.3 percent sequentially, according to a Wednesday announcement.

Genting Singapore is the operator of Resorts World Sentosa (pictured), one of Singapore’s two casino resorts. The firm is a subsidiary of Malaysian conglomerate Genting Berhad (KLSE: GENTING / OTCMKTS: GEBHY).

In a separate announcement on Wednesday, Genting Singapore said its chief executive Tan Hee Teck is to retire at the end of May. Mr Tan is also to step down as CEO of Resorts World at Sentosa Pte Ltd, the operating entity of Resorts World Sentosa.

🇸🇬 Singapore Exchange: Increased Market Volatility And Growing Investor Interest Are Positives (Seeking Alpha) $ 🗃️

🇸🇬 BitFuFu: On Track For Strong Operating Income Growth In 2026 (Seeking Alpha) $ 🗃️

🇸🇬 Grab: Two Major Catalysts Ahead (Seeking Alpha) $ 🗃️

🇸🇬 Bitdeer Q1 Earnings Review: Ambition Meets Execution Risk (Seeking Alpha) $ 🗃️

🇸🇬 SeaGroup rebrands its digital financial services business (Momentum Works)

Last week, Shopee parent Sea Limited (NYSE: SE) rebranded its digital financial services arm SeaMoney as Monee. The group CEO Forrest Li said the name “Monee” was “simple & cute”.

Of course, Monee is already a sizable business, which means explosive growth will become harder and harder. That said, it still has at least good upsides in the following areas: ShopeePay, lending beyond the Shopee platform (and Shopee operating countries), digital insurance, and digital banking.

These upsides can come in the forms of deeper penetration, more efficient operations, and certain new business areas. While there is a lot of reference from China’s Ant Group, some of Monee’s challenges are probably very distinct.

🇸🇬 ST Engineering’s Share Price Plunged 7% from Its High: Is This a Buying Opportunity? (The Smart Investor)

After announcing its five-year targets, the engineering firm just released its latest business update.

This year, Singapore Technologies Engineering Ltd (SGX: S63 / FRA: SJX / OTCMKTS: SGGKF), or STE, is the best-performing blue-chip stock.

The engineering and technology firm saw its share price soar 65% year-to-date to hit an all-time high of S$7.67.

However, STE experienced a sudden, 7% share price plunge on 13 May, bringing it down to S$7.09.

Could this be a buying opportunity, or should investors stay cautious?

An encouraging business update

Investor Day targets

A progressive dividend policy

Encouraging business developments

A rich valuation

Get Smart: Promising but expensive

🇸🇬 Frasers Hospitality Trust is Being Privatised at S$0.71 Per Unit: Should Securityholders Accept the Offer? (The Smart Investor)

Frasers Property Ltd (SGX: TQ5 / FRA: 1IQ), or FPL, is trying its luck for the second time in three years.

The property giant is attempting to privatise Frasers Hospitality Trust (SGX: ACV), or FHT, through a trust scheme of arrangement at S$0.71 per unit.

The offer price of S$0.71 represents a healthy 36% premium to the hospitality trust’s volume-weighted average price (VWAP) and implies a price-to-net asset value (NAV) multiple of 1.11 times.

Should securityholders accept the offer this round, or are there other factors to consider?

A detailed strategic review

Structural challenges for FHT

Continued headwinds impacting valuation and growth prospects

A clean exit

Get Smart: Scheme meeting and delisting timeline

🇸🇬 4 Attractive Singapore Stocks That Could Raise Their Dividends This Earnings Season (The Smart Investor)

🇻🇳 Moody’s keeps stable outlook for Vietnam banks (The Asset) 🗃️

US tariffs to weigh on real GDP growth, higher public investment to offset expected FDI slowdown

Moody’s has maintained a stable outlook for Vietnam’s banking system at “Ba2 stable”, highlighting supportive domestic operating conditions but warning that high US tariffs can negatively impact the nation’s economic growth.

“We expect the operating environment for banks to remain stable as higher government spending and public investment will partially offset the immediate negative impact of US ( ‘Aaa negative’ ) tariffs on the country’s economic growth, consumer and business confidence,” according to Moody’s latest study on Vietnam. US President Donald Trump has announced a 46% tariff on imports from the Southeast Asian nation.

🇰🇿 Freedom Holding Corp.: Time To Take Profits (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇰🇿 Kaspi: Smartphone Registering Rules Slow Online Activity (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇮🇳 HDFC Bank: Valuations Look Appealing, But They Aren’t (Seeking Alpha) $ 🗃️

🇮🇳 Dr. Reddy’s Continues To Be A Good Buy At Current Valuation (Seeking Alpha) $ 🗃️

🇮🇳 MakeMyTrip: Growth Runway Still Visible And Clear (Seeking Alpha) $ 🗃️

🇮🇳 Novelis: Cautious Outlook Amid Heavy U.S. Capex and Scrap Volatility (Smartkarma) $

Hindalco Industries (NSE: HINDALCO / BOM: 500440)

Novelis posted $1.8B EBITDA on 3.76Mt volume, with weakness in North America offset by aerospace and packaging recovery in Europe and Asia.

Management withheld guidance citing demand uncertainty; Bay Minette capex rose to $4.1B with commissioning now in 2H FY26.

Scrap supply tightness and tariff pressures may hit margins; company expects prolonged impact despite mitigation efforts underway.

🇮🇳 The Beat Ideas: KDDL- Precision Engineering with Luxury Retail (Smartkarma) $

(Luxury watch maker / retailler) KDDL Ltd (NSE: KDDL / BOM: 532054)‘s precision engineering division, Eigen, is expanding its manufacturing capacity with a new facility and further upgrades planned, aiming to capture high-growth sectors like aerospace, automotive, and medical devices.

This expansion enhances KDDL’s competitive edge in precision engineering, a high-margin segment, and aligns with the company’s goal of making Eigen a significant revenue contributor, targeting 40-50% of manufacturing revenue.

The focus on precision engineering and premium retail through Ethos positions KDDL for sustained growth, balancing stable manufacturing revenue with high-margin luxury retail.

🇮🇳 Tata Steel: Strategic Pivot in Capital Allocation (Smartkarma) $

Tata Steel Ltd (NSE: TATASTEEL / BOM: 500470) reported resilient India performance in Q4 FY25 with strong volumes, though consolidated margins remained under pressure due to ongoing European losses.

The Kalinganagar CRM line and Ludhiana EAF are progressing toward completion. The company’s $2.5 billion infusion into its overseas arm marks a strategic pivot, potentially weighing on returns.

We apply a lower EV/EBITDA multiple of 6x (vs. 7.5x earlier) to reflect the weaker capital allocation stance, flattish steel price outlook, and relatively subdued growth versus peers.

🇮🇳 Raymond Lifestyle: Governance Crisis? (Smartkarma) $

(Makes/retails branded apparel) Raymond Lifestyle Ltd (NSE: RAYMONDLSL / BOM: 544240)’s stock plummets 60% in six months post-demerger, due to lots of governance lapses.

Corporate Governance Crisis: CEO,CFO, Director Resignations, Delayed disclosures, Controversial Remuneration and Many More.

The company gave excuses such as inflation, an IT incident, etc. in their management meeting after not being able to deliver the performance.

🇮🇳 Tata Motors Q4 & FY25 Update: Strong Financial Performance with Focus on EV Growth (Smartkarma) $

Tata Motors (NSE: TATAMOTORS / BOM: 500570 / LON: 0LDA) posted its highest-ever annual revenue and PBT for FY25, with strong sequential growth in Q4 driven by robust performance in both commercial and passenger vehicle segments.

The company successfully managed to navigate global trade and tariff challenges, improved its profitability through cost-saving measures, and expanded its leadership in electric mobility.

The results demonstrate Tata Motors’ resilience and long-term growth strategy, especially with a continued focus on electric vehicles and new product innovations.

🇮🇳 Akzo Nobel India (India M&A): JSW Likely Buyer – Investors Should Assess Strategic Impact (Smartkarma) $

Akzo Nobel N.V. earlier announced its plans to exit India to focus on core markets where it holds a position of “differentiating scale.

JSW Paints has reportedly entered exclusive talks to acquire Akzo India, edging out Advent–Indigo and Pidilite Industries (NSE: PIDILITIND / BOM: 500331).

Shareholders may tender in the open offer or stay invested for potential upside via JSW which has a long stellar track-record.

🇮🇳 Asian Paints: Navigating Growth Challenges Amid Evolving Industry Dynamics (Smartkarma) $

Asian Paints Ltd (NSE: ASIANPAINT / BOM: 500820)

Q4 FY25 volumes grew 1.8%, value declined; FY26 guidance is for low growth with 18–20% margins supported by integration and cost control.

Grasim Industries Ltd (NSE: GRASIM / BOM: 500300) and JSW are aggressively expanding with large capex and dealer networks, intensifying pricing pressure in decorative paints.

Stock corrected 15–20% but still trades at ~55x P/E, which remains expensive given slowing growth and rising competitive risks.

🇮🇳 GMDC (GMDC IN): Steady Core Performance with Hidden Asset Optionality (Smartkarma) $

Gujarat Mineral Development Corporation (NSE: GMDCLTD / BOM: 532181) delivered strong FY25 results with 8MT of lignite sales and Rs992 crore in EBITDA, its second-best performance.

The company is focused on scaling lignite and coal volumes through new mines within Gujarat and Odisha. It also plans to diversify into rare earths and critical minerals.

While valuations appear slightly elevated, upside optionality exists from the revival of Akrimota power plant and operationalization of new mines.

🇮🇳 Hyundai Motor India – Navigating Domestic Industry Stress (Smartkarma) $

Domestic Demand Sluggish: Hyundai Motor India (NSE: HYUNDAI / BOM: 544274)‘s Q4 FY25 profit declined 3.7% YoY as weak domestic sales persisted, partly offset by 14% YoY export growth and price hikes.

SUV Focus Drives Mix Shift: SUVs formed 69% of domestic volumes in Q4, benefiting from rising first-time buyer interest and driving improved average selling prices.

Valuation Fair; Profitability to Soften: Stock trades at ~27x EPS. Near-term margins may be pressured by depreciation from the underutilized new Pune plant ramping up in FY26.

🇮🇳 Belrise Industries IPO: Strategic OEM Partner, Deleveraging Move Faces Structural Headwinds (Smartkarma) $

Belrise Industries, founded by the Badve family, is a leading auto component maker launching its Rs2,150 crore IPO from May 21–23, 2025, at a price band of Rs85–90.

It supplies key chassis and metal parts to top OEMs like Bajaj Auto Ltd (NSE: BAJAJ-AUTO / BOM: 532977), Hero Motocorp Ltd (NSE: HEROMOTOCO / BOM: 500182), and HMSI, playing a critical role across ICE and EV platforms.

While most proceeds are earmarked for debt repayment, high working capital needs suggest leverage could rebuild as the business scales.

🇮🇱 Ituran: Still Undervalued While Compounding With A 5% Dividend Yield (Seeking Alpha) $ 🗃️

-

🌐 🇧🇷 Ituran Location And Control Ltd (NASDAQ: ITRN) – Leader in the emerging mobility technology field, providing value-added location-based services, including a full suite of services for the connected-car. 🇼 🏷️

🇮🇱 Mobileye: Focus Shifting To Robotaxis (Seeking Alpha) $ 🗃️

🇮🇱 Tower Semiconductor Q1: Solid Quarter, But It’s A ‘Wait And Watch’ Stock (Seeking Alpha) $ 🗃️

🇯🇴 International General Insurance: Soft Q1, Still A Strong Business (Seeking Alpha) $ 🗃️

🇿🇦 Anglo American: Becoming A More Focused Copper-Iron Ore Producer (Seeking Alpha) $ 🗃️

-

🌐 Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) – World’s largest primary producer of platinum metals (platinum, palladium, rhodium, iridium, ruthenium & osmium; base metals as in copper, nickel, cobalt sulphate, sodium sulphate & chrome; & precious metals as in gold). 🇼 🏷️

🇿🇦 Lesaka Technologies: Still Firing On All Cylinders (Seeking Alpha) $ 🗃️

🇿🇦 Sasol: Deep Value And Clear Catalyst (Seeking Alpha) $ 🗃️

-

🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇧🇦 Adriatic Metals Continues To Make Progress Towards Commercial Production (Seeking Alpha) $ 🗃️

🌎 Globant: Thoroughly Discounted For A 2026 Rebound (Seeking Alpha) $ 🗃️

🌎 DLocal Q1: Payment Volume Surge Offsets Take Rate Concern (Seeking Alpha) $ 🗃️

🌎 Pan American Silver: Strengthened By MAG Silver Acquisition (Seeking Alpha) $ 🗃️

🇦🇷 Pampa Energia: The Potential Of Argentina’s Energy Sector Leader (Seeking Alpha) $ 🗃️

🇧🇷 China suspends chicken imports from Brazil due to detection of bird flu (FT) $ 🗃️

South American nation had been the last big producer not affected by the outbreak

BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3), the world’s largest poultry exporter, did not immediately respond to a request for comment. Protein company JBS SA (BVMF: JBSS3 / FRA: YJ3A / OTCMKTS: JBSAY) referred the Financial Times to the Brazilian Animal Protein Association, which said the situation was “under control”.

🇧🇷 JBS Q1: Good Results, And Even Better Prospects (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Solid Fundamentals In A Turbulent Political Environment (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Q1: Higher CapEx, Weaker Oil Prices, And Fewer Dividends Ahead (Seeking Alpha) $ 🗃️

🇧🇷 Engie Brasil: Quietly Positioning For The Next Wave Of Energy Demand (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings’ First-Quarter Earnings: Markets Overreact To A Tiny Miss (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings Q1: Bullish On The Business, Cautious On The Stock (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Inter: Long-Term Story Still Impresses, Even As Q1 Didn’t (Seeking Alpha) $ 🗃️

🇧🇷 Inter & Co Q1: Lower Risk Products Deliver Results (Seeking Alpha) $ 🗃️

-

🇧🇷 Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) – Holding company of Inter Group & indirectly holds all of Banco Inter’s shares. Inter is a Super App providing financial & digital commerce services. 🏷️

🇧🇷 Why I Don’t Feel Banco do Brasil Is A Bargain After An Ugly Q1 (Seeking Alpha) $ 🗃️

🇧🇷 Vinci Partners Is Taking Long To Execute, But I Keep My Buy Rating (Seeking Alpha) $ 🗃️

-

🇧🇷 Vinci Partners Investments Ltd (NASDAQ: VINP) – Alternative investments platform. Specialized asset management, wealth management & financial advisory services to retail + institutional clients in Brazil. 🏷️

🇧🇷 TIM S.A. Q1: Good Results And Momentum Are Interesting, But Not Enough (Seeking Alpha) $ 🗃️

🇨🇴 Ecopetrol: Too Much Value To Give Up, Too Many Doubts To Enter (Seeking Alpha) $ 🗃️

-

🇨🇴🏛️ Ecopetrol SA (NYSE: EC) – Organized under the form of a public limited company, of the national order, linked to the Ministry of Mines & Energy. Mixed economy company of an integrated commercial nature in the oil & gas sector. 🇼 🏷️

🇲🇽 Vista Energy: Growth, EBITDA, And Proven Reserves Will Pave The Way (Seeking Alpha) $ 🗃️

-

🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇲🇽 GCC Advances In Odessa With Risks On The Oil Market (Seeking Alpha) $ 🗃️

-

🇲🇽 GCC SAB de CV (BMV: GCC / FRA: AK4 / OTCMKTS: GCWOF) – Gray Portland cement, ready-mix concrete, aggregates, coal & construction-related services. 🏷️

🌐 ArcelorMittal: Not Enough Upside To Justify The Risks (Seeking Alpha) $ 🗃️

🌐 Glencore: Two Cash Cows Are Better Than One (Seeking Alpha) $ 🗃️

🌐 Nebius Group: Scaling The AI Backbone For Profits (Seeking Alpha) $ 🗃️

🌐 Nebius Q1 Preview: All About ARR (Seeking Alpha) $ 🗃️

🌐 Nebius: Poised For A Game Changing Q1 (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

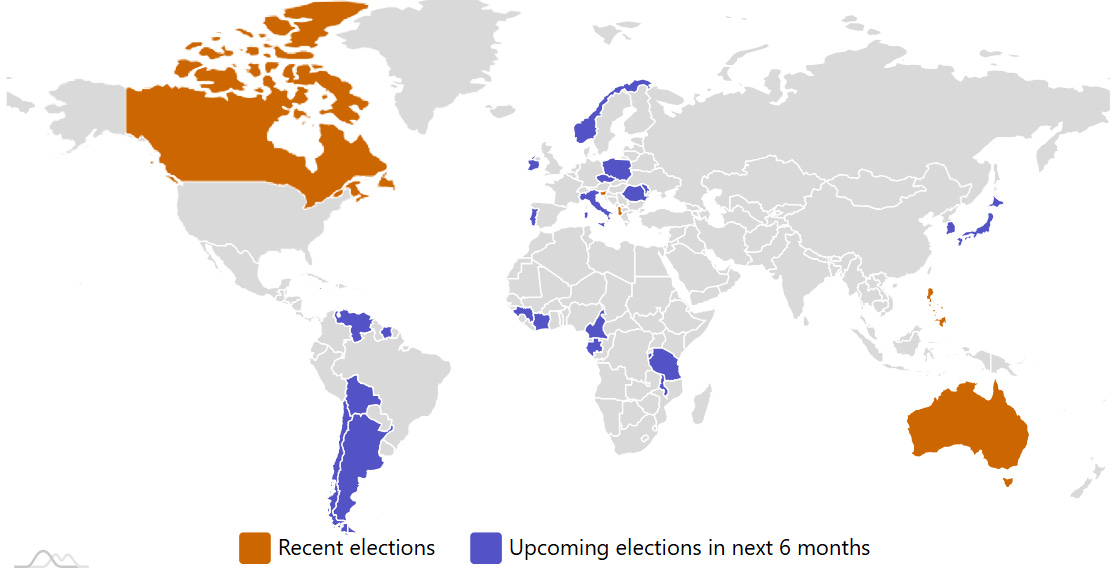

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

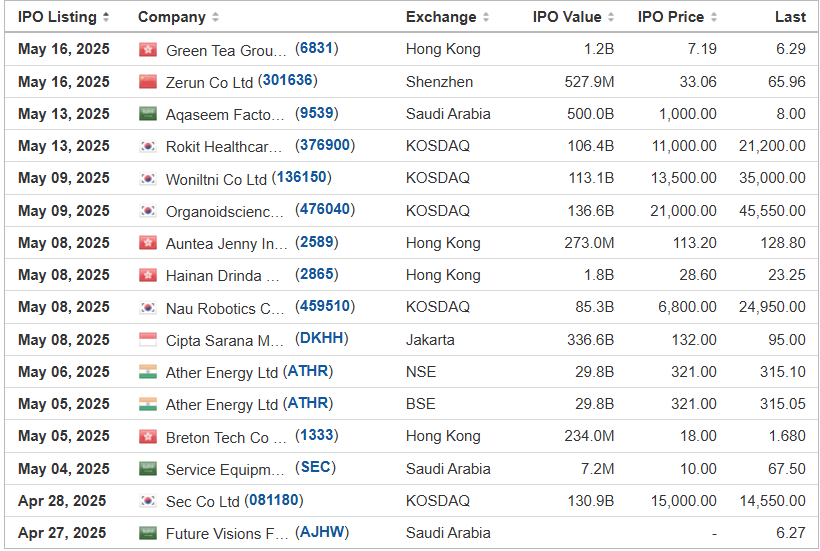

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

OFA Group OFAL R.F. Lafferty & Co., 3.4M Shares, $4.50-4.50, $15.1 mil, 5/20/2025 Tuesday

(Incorporated in the Cayman Islands)

Through our wholly owned operating subsidiary, Office for Fine Architecture Limited, we provide comprehensive architectural services, including design and fit out services for commercial and residential buildings. The design service includes both the consultation with our staff and the actual design work and the Company provides a specific conceptualized design with layout plans, detailed design drawings, advice relating to, among other things, budgetary consideration, optimal use of space, the materials, fittings, furniture, appliances and other items to be used with an aim to produce a preliminary design plan and quotation for clients’ considerations. Fit out works include installing protective materials to cover floors or walls, installing or constructing partition walls, windows and window frames and decorative fittings, furniture or fixtures, installing plumbing systems as well as installing switches, power outlets, telephone wiring, computer outlet covers and other electrical and wiring works.

Our mission is to leverage our expertise in architectural design to maximize the potential of every property, ensuring that its unique attributes are highlighted and enhanced through thoughtful innovations. We are focused on innovation, efficiency, and scalability in our business model and service offerings. While we currently operate on a traditional project-based model, we utilize various technological tools to enhance our design process, including Houzz, a commercially available software platform that includes automated visualization capabilities. Through Houzz’s platform, we convert two-dimensional building plans into three-dimensional models and efficiently generate various design alternatives by applying different materials and equipment options. This functionality helps expedite our design process and facilitates client decision-making by providing rapid visualization of different design options. Based on our market research, we believe the use of such visualization tools is not yet widespread among architectural firms in Hong Kong, which we believe provides us with certain operational efficiencies compared to traditional design methods.

We currently utilize Houzz’s standard commercially available features as a regular platform user, which includes basic listing and networking capabilities. As part of our growth strategy, we continuously monitor developments in architectural design and visualization technologies, and may explore potential collaborations or partnerships with various technology providers to enhance our service offerings in Asian markets. However, we have not initiated any discussions regarding such partnerships, and there can be no assurance that any such agreements will be reached in the future.

We have developed extensive industry relationships through our operating subsidiary’s 10-year membership in the Hong Kong Institute of Architects (“HKIA”) and maintain an active network of approximately 100 clients and numerous industry relationships throughout Hong Kong. As we continue to grow, we plan to leverage these relationships and our local market expertise to explore potential technological partnerships and enhanced service offerings for the Asian market. However, our ability to implement such enhancements would depend on reaching formal agreements with technology providers, and there can be no assurance that such agreements will be reached or that enhanced services will be developed.

Our current service enhancement initiatives focus on utilizing existing visualization tools to improve design efficiency, exploring potential development of specialized software tools for building code compliance, and continuing to evaluate and implement commercially available technology solutions that could benefit our clients. We believe these initiatives can help us deliver more efficient services to our clients, though the implementation and success of these initiatives involve various risks and uncertainties as described in “Risk Factors – Risks Related to Our Business and Industry – Our utilization of artificial intelligence and machine learning technologies may materially impact our business operations and financial result.”

In addition, we have entered into a definitive co-development agreement with Alan To AI Consultancy Co. Limited (“Alan To AI”), a Hong Kong-based firm specializing in IT solutions, for the development of an automated building code compliance review system. This project aims to develop an AI-enabled tool that can analyze architectural drawings and provide feedback based on local building codes and regulations. The development scope encompasses the creation of specialized review systems, integration of regulatory databases, and development of user interface components. The project includes system testing and validation phases, as well as plans for ongoing optimization and enhancement of the technology.

Note: Net loss and revenue are for the 12 months that ended Sept. 30, 2024.

(Note: OFA Group increased its IPO’s size to 3.36 million shares – up from 1.5 million shares initially – and kept the assumed IPO price at $4.50 – to raise $15.12 million, according to its F-1/A filing dated April 11, 2025. Background: OFA Group is offering 1.5 million shares at an assumed IPO price of $4.50 to raise $6.75 million, according to its F-1 filing dated Feb. 20, 2025.)

Dalu International Group DLHZ Revere Securities, 1.5M Shares, $4.00-6.00, $7.5 mil, 5/23/2025 Week of

We provide property management services as well as real estate leasing services in China. (Incorporated in the Cayman Islands)

We are an integrated property management services and commercial operation services provider, and we operate a real estate leasing business in Chengdu, the capital city of Sichuan Province, China.

With an operating history of two decades, our PRC subsidiaries have been focusing on providing property management services to owners, developers and occupiers of residential and commercial properties in Chengdu. Our PRC subsidiaries have accumulated extensive experience in the property management services sector. In addition, to drive our value growth and diversify our revenue streams, we also provide a variety of commercial operation services, primarily consisting of brand planning, market research and positioning consultancy, tenant sourcing and management, marketing and business support to owners and developers of commercial properties, and (we) engage in real estate leasing business.

We are a well-known property management brand in Chengdu, having undertaken property management and related services for well-known projects in some of the most prosperous commercial areas, such as the fashion center of Chengdu and one of the most popular pedestrianized shopping streets, Chunxi Road, and South Renmin Road in Chengdu’s central business district.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended September 30, 2024.

(Note: Dalu International Group is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, according to its F-1 filings with the SEC.)

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/23/2025 Week of

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

Delixy Holdings Ltd. DLXY Bancroft Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/26/2025 Week of

We trade crude oil and oil-based products, including fuel oils, gasoline, additives, gas condensate, in Southeast Asia and East Asia. (Incorporated in the Cayman Islands)

We are principally engaged in the trading of oil related products, which can be broadly categorized into (i) crude oil and (ii) oil-based products such as fuel oils, motor gasoline, additives, gas condensate, base oil, asphalt, petrochemicals and naphtha (heavy gasoline), in Southeast Asia and East Asia..

We have the financial capability to provide our customers with financing alternatives and credit terms

We are able to provide our customers with credit terms of up to 90 days by leveraging our strong balance sheet position as well as short term credit facilities available to the Group. Our ability to extend these advantageous credit terms to our customers allows us to cater to the diverse needs of our customers across multiple countries and to provide them with the financial flexibility they may require for their business operations. As of the date of this prospectus, the amount outstanding with respect to these credit facilities is zero.

We have an experienced management team with strong relationships across our value chain

Our management team headed by our Executive Chairman, Chief Executive Officer and Executive Director Mr. Xie, has decades of trading experience and experience in oil trading as well as in the oil industry generally, including oil refining and logistics. We also maintain strong relationships with our suppliers, storage facilities providers and fleet and logistics providers, and are able to effectively service our clients and ensure a reliable supply of crude oil and oil-based products.

We have robust and strong risk management and internal controls capabilities

We believe that the ability to manage risk is one of our key strengths. Risk management is a core function under the supervision of our senior leadership structure. Our sound risk management practices have contributed to our positive performance through the volatile market environment in recent years and have helped to mitigate earnings volatility.

We are strategically located in Singapore, Asia’s refined products trading hub.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Delixy Holding Corp. is offering 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, according to its F-1/A filings. Of the 2.0 million shares in the IPO. Delixy Holdings Ltd. is offering 1.35 million ordinary shares and the selling shareholders are offering 650,000 ordinary shares.)

FG Holdings FGO American Trust Investment Services/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/26/2025 Week of

We are a holding company whose Hong Kong subsidiaries run a FinTech platform that provides mortgage loan brokerage services. (Incorporated in the British Virgin Islands)

We offer – through our operating subsidiaries – a FinTech platform for mortgage loan brokerage services available through private credit and banks. The company gives borrowers mortgage application simulation and access to several mortgage loan options from various lenders.

Since our inception in 2019, FG Global has helped match 528 borrowers with more than $906 million in loans. That loan volume includes $401 million for the fiscal year that ended June 30, 2024.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: FG Holdings filed its F-1 on Nov. 18, 2024, and disclosed the terms for its small-cap IPO: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million. Background: FG Holdings submitted confidential IPO documents to the SEC on Dec. 28, 2023.)

Vantage Corp. (Singapore) VNTG Network 1 Financial Securities, 3.3M Shares, $4.00-5.00, $14.6 mil, 5/29/2025 Thursday

We are a shipbroker that connects ship owners with charterers. Our focus is on dirty petroleum products, petrochemicals, biofuels and vegetable oils. (Incorporated in the Cayman Islands)

We have three subsidiaries, namely Vantage BVI, Vantage Singapore and Vantage Dubai. Vantage BVI is a wholly owned subsidiary of the issuer, Vantage Cayman; and both Vantage Singapore and Vantage Dubai are wholly owned by Vantage BVI.

We were founded in 2012 by five seasoned shipbrokers with a mission of providing exceptional shipbroking services. We commenced operations with a team of over 20 specialists proficient in their various roles in the tanker markets which involves trading different types of oil and petrochemical products through vessel transportation, including clean petroleum products (“CPP”) and petrochemicals. Over the years, we underwent significant growth and evolution, expanding our shipbroking services to cover dirty petroleum products (“DPP”), biofuels and vegetable oils. Additionally we established a sales & projects team, a research/strategy team and an IT team. We have expanded to over 50 dedicated professionals as of May 2024, with offices in both Singapore and Dubai.

We specialize in providing comprehensive shipbroking services, including operational support and consultancy services, tailored to the tanker markets. Rooted in our expansive network and decades of collective experience within the marine sector, we have emerged as a trusted intermediary, facilitating transactions between shipowners and charterers across diverse segments of the tanker market, and ensuring smooth logistical flow for cargo deliveries to timely demurrage and claims settlements.

Our suite of shipbroking services is designed to optimize outcomes for our clients, offering a holistic approach to addressing their needs and objectives. As a pivotal link between oil companies, traders, shipowners, and commercial managers, we deliver a range of services including: identifying market opportunities and information for our clients, recommending interested parties (shipowners and cargo owners) to each other, advising interested clients on strategies on vessel deployment or fleet mix, specifications and capabilities, facilitating contract negotiations, ensuring smooth logistical flow, as well as resolving issues that arise during the execution of chartering agreements.

Our Industry

The global shipbroking market was valued at $1.56 billion in 2022, with the oil tanker sector (excluding gas carriers) valued at $422 million. The oil tanker shipbroking sector is poised to grow at a CAGR of 3.32% between 2022-2027. According to the 2023 Shipbroking Market report by Technavio, the European and Asia Pacific shipbroking market collectively account for about 81% of the global shipbroking market.

Note: Net income and revenue are in U.S. dollars for Fiscal Year 2024, which ended March 31, 2024.

(Note: Vantage Corp. filed an F-1/A dated Nov. 20, 2024, in which it disclosed its proposed symbol “VNTG” and the terms for its IPO: The company is offering 3.25 million shares at a price range of $4.00 to $5.00 to raise $14.63 million. Background: Vantage Corp. filed its F-1 for its IPO on Oct. 9, 2024, with estimated initial proceeds of about $16 million. Vantage did not disclose a proposed stock symbol in its F-1 filing.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (May 19, 2025) was also published on our website under the Newsletter category.