Emerging Market Links + The Week Ahead (May 26, 2025)

While its Memorial Day weekend in the USA, the ASEAN Summit is being held in Kuala Lumpur with leaders from around SE Asia and beyond (the GCC, etc) jet setting in to celebrate “inclusivity and sustainability:”

For the several million residents of the Klang Valley not included in the festivities and who might get in the way of those who are, its a week of major rush hour road closures (including, at times, the highways to and from the international airports), up to 71 schools who might opt for homebase learning, social media reminders from businesses that they will remain open (and reachable by public transportation), and reminders from the government to use public transportation:

Its too bad Malaysia does not have a purpose built capital city (Putrajaya) close to the international airports or a resort island (Langkawi) where international summits would not impact the lives of those not included along with the economy…

Also late last week, the daughter of Prime Minister Anwar defeated the (said to be…) widely respected, reform-minded, and politically able Rafizi Ramli (more or less making his position as Minister of Economic Affairs untenable) to become deputy President of PKR (her parents’ political party). Apparently, so-called “reformasi” does not cover reforming or ending political dynasties/nepotism…

Needless to say and like in many Western countries, ordinary people are venting their (growing…) frustrations the only way they can – privately and/or online. A young urban, well-educated and liberal Muslim acquaintance of mine (let’s just say his father is in position to know politicians…) bluntly posted on a social media reel: “Perikatan Nasional (The Malay nationalist + Islamic party opposition coalition) will win big next election, and I’ll probably refrain myself from voting for any of these dumb f**ks…”

$ = behind a paywall

-

🇰🇷 Korean Stock Picks (April 2025) Partially $

-

KB Financial Group, Hanwha Aerospace, Woongjin Co Ltd, Krafton Inc, LG Energy Solution, i-SENS, HYBE, Hanwha Systems, Hyundai Engineering & Construction, F&F, LG H&H, S-Oil Corp, Hyundai Mobis, Samsung SDI, Shinhan Financial Group, Hana Financial Group, Kia, Samsung Electronics, Kangwon Land, LG Display, Hanwha Ocean, iM Financial Group, LG CNS, Hyosung Heavy Industries, HD Hyundai Mipo, HD Korea Shipbuilding & Offshore Engineering, Samsung Heavy Industries, OCI Holdings, HD Hyundai Heavy Industries, Hyundai Steel, POSCO Holdings, SK Telecom, Hyundai Motor, Hanwha Solutions, LG Electronics, SK Hynix, LG Innotek, POSCO International, Samsung E&A, Samsung Biologics, HD Hyundai Electric, Samsung C&T, LS Electric, KEPCO, HMM, Hyundai Marine & Fire, Samsung Life Insurance, Hyundai Rotem, Jeju Bank & Douzone Bizon, Coupang, KakaoBank, Samsung Electro-Mechanics, SM Entertainment, JYP Entertainment, Dear U, GC Biopharma, Hugel, Hyundai Elevator, Hanssem, Cosmax, Kakao Corp, Hanmi Pharma, Dongwon F&B Co Ltd & Dongwon Industries, GS Engineering & Construction Corp, Daewoo E&C, Samsung E&A, SK IE Technology, DL E&C, DL Holdings, SK Inc, CJ Logistics, KT Corp, BGF Retail, HiteJinro Co Ltd & Hitejinro Holdings, Samsung SDS, SK Bioscience, Korean Air & Hanjin Kal, Kolmar Korea, KT&G, Grand Korea Leisure, LG Chem, APR, Lotte Tour Development, Hyundai Department Store, Hyundai Glovis, Hanwha Corporation, Kcc Corp & Paradise Co Ltd

-

-

🌐 EM Fund Stock Picks & Country Commentaries (May 25, 2025) Partially $

-

Russia-Ukraine endgame, TWD’s strength, India’s manufacturing opportunity, India PE, from Gutenberg to GPT/AI, Mexican industrial real estate, rebounding Latin American stocks, Milei’s IMF deal, etc.

-

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 In Depth: China’s tax collectors target global investment income (Caixin) $

Liu Mo, an investor from the central Chinese city of Wuhan, was recently contacted by his local tax office. After actively trading U.S. stocks through platforms such as Futu (Futu Holdings Ltd (NASDAQ: FUTU)) and Tiger Brokers in recent years, he received a text message, a tax app alert and a follow-up phone call this month, urging him to review whether he had reported his overseas income dating back to 2021.

Liu’s case reflects a broader development: Many Chinese residents have recently received reminders from local tax authorities that income from overseas investments is subject to China’s global income tax rules.

🇨🇳 Why Is Michael Burry So Bearish on Alibaba (And Other Major Chinese Tech Stocks)? (Douglas Research Insights)

It recently became publicly available that Michael Burry (CEO of Scion Asset Management) started buying put options on numerous Chinese stocks including Alibaba (NYSE: BABA).

We highlight four major reasons why Burry may have turned bearish on Chinese tech names (tariffs, delisting threats, increasing hostile political pressure on China, and China’s 30 year bond yield).

Although we do not know exactly know how Burry has changed his position in 2Q25, he is likely to have reduced put options on major Chinese tech stocks in April/May.

🇨🇳 China’s Robotaxi Race Hits an Inflection Point — But Baidu Risks Falling Behind again (The Great Wall Street – Investing in China)

Baidu (NASDAQ: BIDU) lags as rivals secure huge WeChat and Uber deals

This started as a quick update on Baidu’s earnings. It still is—but it’s also a look at something broader: the shifting dynamics in China’s autonomous driving space. Not a full market overview, but a closer look at the real competitive dynamics now coming into focus. There’s a lot of interesting things happening—and fast. Spoiler: Baidu’s personal nightmare just came true.

🇨🇳 Why Xiaohongshu (RedNote) Became China’s Default Search Engine for Daily Life (The Great Wall Street – Investing in China)

It’s not about algorithms. It’s about answers you actually believe.

What began as a PDF shopping guide for Chinese tourists looking for what to buy overseas has quietly morphed into one of China’s most powerful search engines with 600 million daily searches and more than 330 million monthly active users. Yes, search engine. Not in the Baidu (NASDAQ: BIDU) sense of crawling the open web, but something far more human and—depending on the type of query—arguably more useful: indexing lived experience.

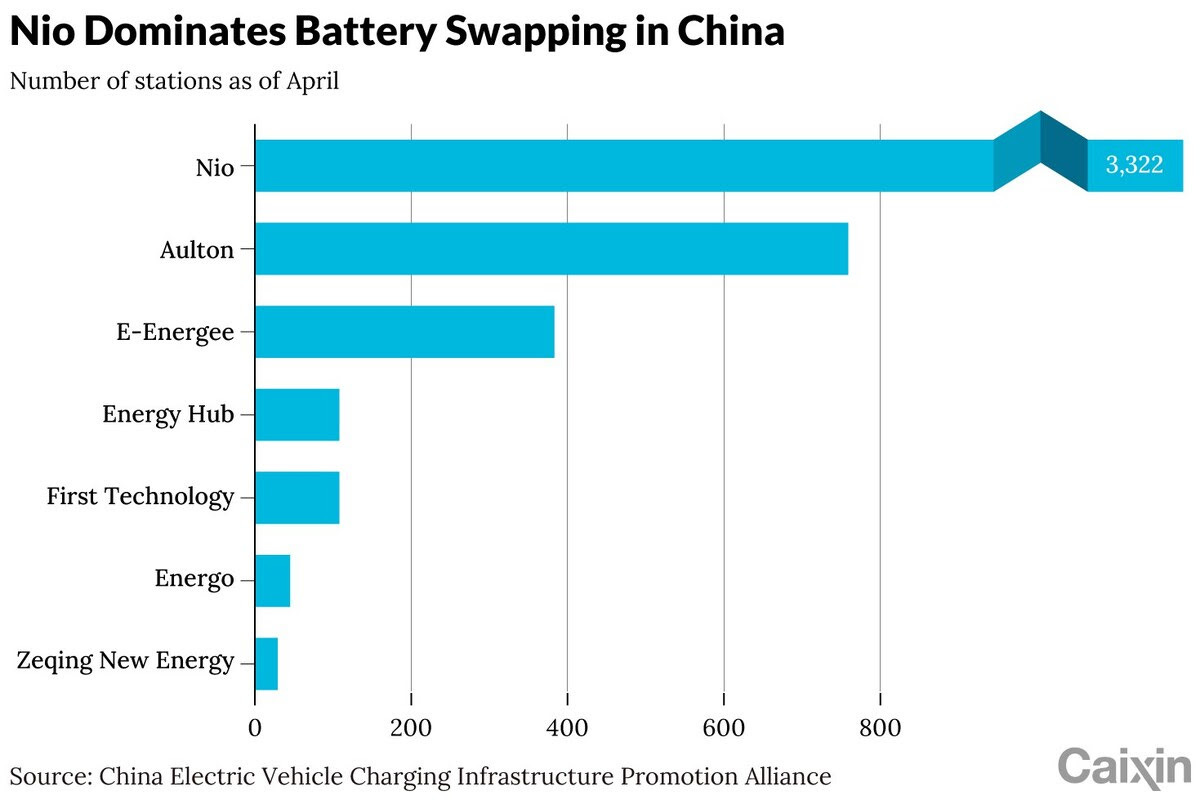

🇨🇳 In Depth: Why CATL is so revved up about battery swapping stations (Caixin) $

🌐 Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) has made it clear that it’s going big on battery swapping stations.

In December, CATL’s billionaire founder and chairman, Zeng Yuqun, announced the electric vehicle (EV) battery-maker’s plan to set up 1,000 swapping stations across China by the end of this year as the next step toward its goal of building 30,000 nationwide. The stations give drivers an efficient way to “fill up” their EVs by swapping a depleted battery with a fully charged one in a matter of minutes.

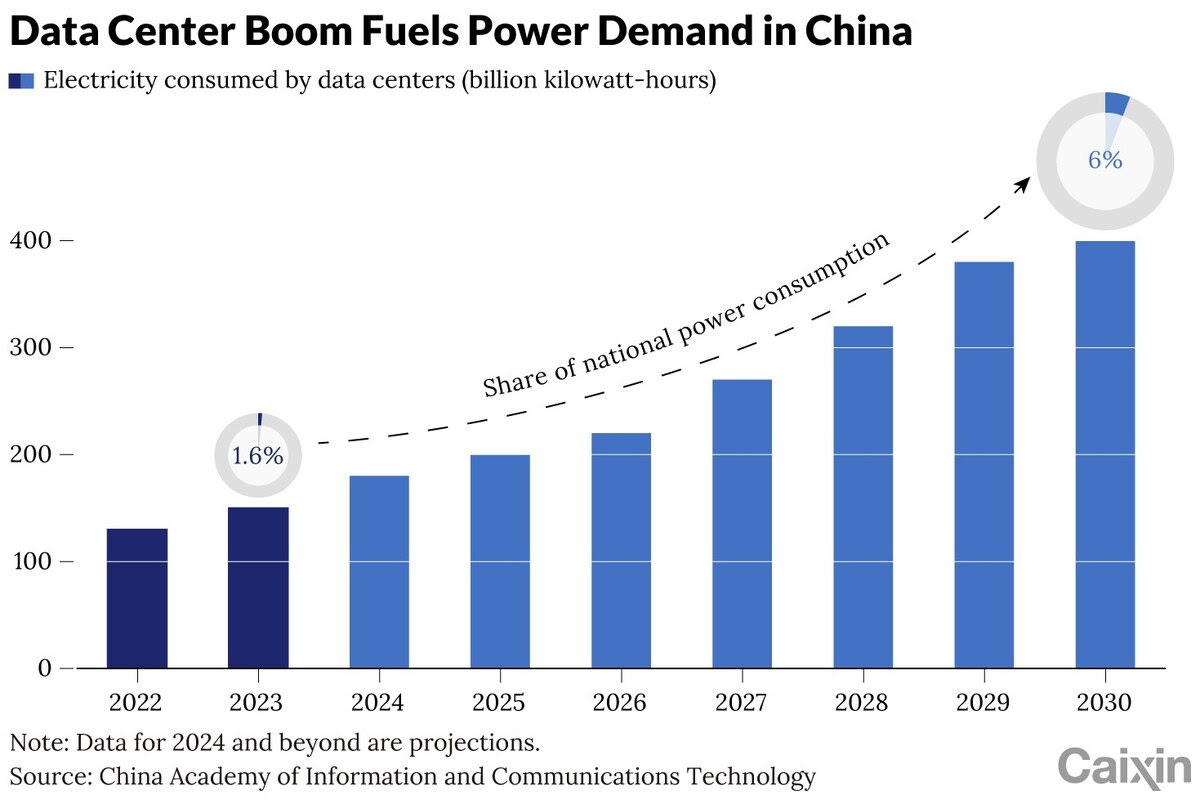

🇨🇳 In Depth: Chinese tech giants’ struggle to power AI data center boom (Caixin) $

China’s rapidly expanding demand for artificial intelligence (AI) computing has sent data centers’ energy consumption soaring. Securing reliable, cheaper electricity is crucial but proving challenging for operators trying to meet the government’s green power targets.

The wind- and solar-rich regions in the west of the country could be a solution, if industry players are willing to relocate from the more developed coastal areas in the east.

🇨🇳 Lenovo: Look Past Headline Earnings Contraction (Seeking Alpha) $ 🗃️

-

🌐 Lenovo Group (HKG: 0992 / FRA: LHL / LHL1 / OTCMKTS: LNVGY / LNVGF) – Designing, manufacturing & marketing consumer electronics, PCs, software, servers, converged & hyperconverged infrastructure solutions, etc. 🇼

🇨🇳 Huawei turns up HarmonyOS volume with launch of PC edition (Bamboo Works)

The company’s latest rollout comes as it tries to convince more app developers to make versions of their products for its operating system

Huawei has launched PCs powered by its Harmony operating system, seeking to challenge the global dominance of Windows and Mac OS

The company’s aggressive drive to a develop a third OS is being hobbled by relatively low app adoption, but could gain government support on China’s tech self-sufficiency drive

🇨🇳 JD.Com: Seriously Mispriced (Seeking Alpha) $ 🗃️

🇨🇳 Trip.com’s overseas journey cruises ahead, as profit wobbles (Bamboo Works)

China’s leading online travel agent, formerly known as Ctrip, wants to be a global player, but spending on such efforts could erode its profits

Trip.com (NASDAQ: TCOM)’s revenue rose 16% to 13.8 billion yuan in the first quarter, as its net profit declined by a slight 0.8% to 4.28 billion yuan

Bookings for the online travel agent’s international platform rose 60% during the quarter from a year earlier

🇨🇳 JOYY: Deep Value And Amazing Shareholder Returns (Seeking Alpha) $ 🗃️

🇨🇳 BYD (1211 HK) Outlook: Near-Term Upside Still Possible, but Rally Looks Stretched… (Smartkarma) $

BYD Company (SHE: 002594 / HKG: 1211 / SGX: HYDD / OTCMKTS: BYDDY / BYDDF) has been rallying hard since its 309.80 bottom in early april, the stock closed at 465.20 last Friday, a +50% rally! Probably well deserved.

This insight analyzes the short-term tactical outlook on a WEEKLY time period basis. Our model finds that the stock is currently very overbought, however some upside is still possible.

You may want to consider hedging your bets with some puts (probably cheap at this point), 1-2 weeks expiry, to protect against a (probably mild), upcoming pullback.

🇨🇳 Xiaomi CEO breaks silence after fatal SU7 crash, pledging to make safety a top priority (Caixin) $

Lei Jun, CEO of Xiaomi (HKG: 1810 / SGX: HXXD / FRA: 3CP / OTCMKTS: XIACF), addressed employees in an internal video leaked Friday, responding for the first time to the fatal SU7 accident that killed three people in March. In the video he pledged to make Xiaomi’s cars the safest in their class.

“We’ve been hit by a storm of doubts, criticism and blame,” Lei said, acknowledged, calling the incident a defining test for Xiaomi’s fledgling car division.

The crash on March 29, involved a Xiaomi SU7 sedan on a highway in Anhui province and led to widespread scrutiny of Xiaomi’s intelligent driving features.

🇨🇳 Sunshine chases investment income amid tepid demand for its insurance (Bamboo Works)

The insurer plans to set up a subsidiary that will run a 20 billion yuan fund investing in stocks and fixed-income instruments

Sunshine Insurance Group Co Ltd (HKG: 6963 / FRA: E57)’s asset management unit will set up a wholly owned subsidiary that will run an investment fund using 20 billion yuan from the company’s life insurance business

The move will allow the insurer to gain from movements in financial markets without directly exposing it to short-term volatility or bringing additional capital charges

🇨🇳 Yatsen CEO declares turnaround with quarterly non-GAAP profit (Bamboo Works)

The cosmetics seller reported a nearly 50% increase in its first-quarter revenue from skincare products as it pivots to the segment from make-up

Yatsen Holding (NYSE: YSG)’s first-quarter net loss narrowed sharply to less than $1 million, as it reported a profit on a non-GAAP basis

Skincare products accounted for 43.5% of the cosmetics seller’s net revenue for the quarter, up from 31.7% a year earlier

🇨🇳 How Heineken tapped into China’s beer market (FT) $ 🗃️

The country’s biggest brewer is using its Dutch partner to reach more of the growing premium segment

In 2023, sales volumes for the Dutch lager maker’s various brands, including Amstel, rose more than 50 per cent. Last year, as the overall mainland China beer market shrank, its volumes increased nearly 20 per cent to just under 700mn litres — almost enough to serve a pint to everyone in the country.

Heineken’s growth comes after a deal agreed in 2018 with CR Beer (HKG: 0291 / FRA: CHK / OTCMKTS: CRHKY / CRHKF), China’s biggest brewer, which gave the state-owned group rights to the brand on the mainland while Heineken took a stake in China Resources Beer and gets royalties from the deal.

🇭🇰 China’s ‘special forces’ tourists flock to Hong Kong but spend little (FT) $ 🗃️

Cost-conscious day-trippers from mainland are replacing luxury shoppers, hitting the retail sector

“We call ourselves special forces travellers,” she said, referring to often young day-trippers who challenge themselves to pack as many points as possible into a brief itinerary, helped by tips shared on China’s Instagram-like Xiaohongshu app.

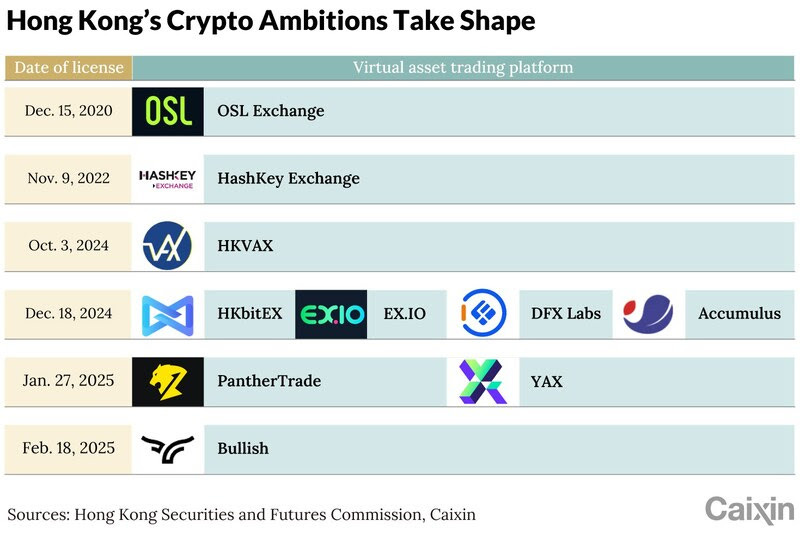

🇭🇰 In Depth: Are Hong Kong’s crypto licenses worth it? (Caixin) $

As Hong Kong positions itself as a global crypto hub, a key question lingers: Are the city’s crypto exchange licenses actually worth it?

Tight compliance requirements and a ban on serving Chinese mainland users have limited the commercial upside for license holders, some industry insiders say.

Still, despite these constraints, the city’s regulatory experiment is drawing international attention — not for its market scale, but for its effort to impose order on a fragmented global crypto landscape.

🇭🇰 Yue Yuen stumbles on high labor costs, geopolitical uncertainty (Bamboo Works)

The shoemaker’s profit fell 24% in the first quarter on falling margins, as it continues taking preemptive hedging measures against geopolitical risk

Leading shoemaker Yue Yuen Industrial Holdings (HKG: 0551 / FRA: YUE1 / OTCMKTS: YUEIY)’s revenue grew 1.3% in the first quarter, but its profit dropped 24.2%

Rising labor costs in Southeast Asia are squeezing the company’s margins as it diversifies beyond China to hedge against geopolitical risk

🇭🇰 Hysan Development: Eyes On Debt Refinancing And Portfolio Optimization (Seeking Alpha) $ 🗃️

🇭🇰 Wharf Real Estate Investment: Spotlight Is On Financial Health And Business Outlook (Seeking Alpha) $ 🗃️

🇲🇴 Macau GGR average spend per visitor under pressure, govt target for casino revenue might be missed: analysts (GGRAsia)

Macau gross gaming revenue (GGR) per capita among the city’s visitors has been declining year-on-year in 2025, and remains far from being able to support the local government’s 2025 revenue target for the city’s casino industry. That is in the context of a year-on-year rise during the first four months of the year in the total number of visitors, contrasting with a flat overall GGR performance for the same period, noted two finance-sector institutions in separate notes.

GGR per visitor “remains under pressure” while visitor arrival numbers are increasing, “suggesting more leisure visitors (or lower value players),” wrote analysts Jeffrey Kiang and Leo Pan of brokerage CLSA Ltd, in a Wednesday report.

🇲🇴 Melco Resorts reaches halfway point in US$500mln share repurchase programme (GGRAsia)

Global casino promoter Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) had by mid-May repurchased approximately 53.1 million of its American depositary shares (ADSs) on the open market, for an aggregate consideration before expenses of approximately US$277 million.

The information was given by Melco Resorts’ parent, Melco International (HKG: 0200 / FRA: MX7A / OTCMKTS: MDEVF), in a Monday filing to the Hong Kong bourse.

Melco Resorts’ shareholders had approved a share repurchase programme for up to US$500 million – equivalent to approximately HKD3.90 billion – of Melco Resorts shares and/or ADSs over a three-year period from June 2, 2024.

🇲🇴 Sands China to redeem balance of US$1.80bln senior notes due August 8 (GGRAsia)

Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF), the Macau-gaming operations unit of Las Vegas Sands (NYSE: LVS), says it plans to exercise its option to redeem on June 11 the balance of its US$1.80-billion in senior unsecured notes due on August 8.

The Macau unit stated in a Friday filing to the Hong Kong Stock Exchange that the redemption was conditional on the “closing of a financing transaction sufficient to provide funds” to cover it.

At the close of business on May 22, the aggregate outstanding principal amount of the 2025 notes was US$1.63 billion, stated Sands China.

The casino firm said it intends to draw down its 2024 term loan facility “and/or use its internal cash resources” to finance the redemption of the 2025 notes.

🇹🇼 Taiwan dollar rise threatens insurers’ profitability (The Asset) 🗃️

Fitch puts five local life insurance firms on ‘rating watch negative’ as risks to their capital and earnings increase

Taiwanese life insurers, with their large holdings of USD fixed-income assets and short positions in the Taiwan dollar, have been adversely affected and remain exposed to further NTD appreciation.

Those placed on the Fitch RWN list are Cathay Life Insurance (Cathay Financial Holding Co., Ltd. (TPE: 2882 / 2882A / OTCMKTS: CHYFF)), Fubon Life Insurance (Fubon Financial Holding Co Ltd (TPE: 2881 / 2881B / 2881C / OTCMKTS: FUISF / FUIZF)), and KGI Life Insurance (KGI Financial Holding Co Ltd (TPE: 2883 / 2883B)), all with Insurer Financial Strength ( IFS ) Rating of “A”; Nan Shan Life Insurance, with an IFS Rating of “A–“; and Taiwan Life Insurance, with an IFS Rating of “BBB+”.

At the same time, Fitch has placed Shin Kong Life Insurance’s ( SKL ) (Shin Kong Financial Holding Co Ltd (TPE: 2888 / 2888A / 2888B)) IFS Rating of “BBB” on Rating Watch Evolving ( indicating uncertainty about the future direction ), and affirmed Chubb Life Insurance Taiwan Company’s National IFS Rating at “AA–( twn )” with Stable Outlook.

🇹🇼 TSMC (2330.TT; TSM.US): TSMC’s Arizona Subsidiary Sent a Letter in Response to the U.S. Authorities. (Smartkarma) $

The U.S. Department of Commerce’s Bureau of Industry and Security (U.S. BIS) recently released a series of public consultations regarding Section 232 related to semiconductors.

Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) stated that any import measures should not create uncertainty for existing semiconductor investments.

Any measures taken by the U.S. government should not undermine the national security policy objectives of the U.S. government, including advanced semiconductor production at TSMC Arizona.

🇹🇼 Taiwan Semiconductor: An Undervalued Stock Benefiting From Durable Competitive Advantages (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor’s Stock Is Dirt Cheap (Upgrade) (Seeking Alpha) $ 🗃️

🇰🇷 Korea Value Up Index Rebalance Announcement Next Week (Douglas Research Insights) $

Korea Exchange plans to announce the first rebalance of the “Korea Value Up Index” next week on 27 May. The actual rebalance is expected to take place on 13 June.

Korea Exchange plans to reduce the constituents to 100 (from 105 currently) and change 30% of the included stocks in this index to better reflect the Value Up program incentives.

In this insight, we provide a list of 20 potential exclusion candidates and 20 inclusion candidates in the Value Up index rebalance.

🇰🇷 Hyundai Motor Savannah Factory A Hedge Against Tariffs And Electrification Uncertainty (Seeking Alpha) $ 🗃️

🇰🇷 Kangwon Land gains govt approval to increase minimum betting limits for blackjack, Texas Hold’em poker (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land (pictured), a South Korean resort with the only casino in the country open to locals, announced on Tuesday that it had received government approval to raise minimum betting limits on selected mass-market blackjack and Texas Hold’em poker tables.

With effect from Wednesday (May 21), the minimum bet at two selected blackjack tables will be increased to KRW300,000 (US$216), from KRW100,000 previously.

The minimum bet at two selected Texas Hold’em poker tables will also be increased to KRW300,000, from KRW100,000 previously. Such increase will take effect from “early June”, the company said in a filing.

🇰🇷 Kangwon Land Inc to offer cash incentives to foreign travel agencies to bring overseas customers (GGRAsia)

Kangwon Land (KRX: 035250), operator of Kangwon Land, a resort with the only casino in South Korea that is open to locals, has told GGRAsia it is willing to pay the equivalent of about US$7.00 per player to overseas travel agencies able to bring it customers for a foreigner-only gaming zone it has.

While best-known for its unique status as a venue for locals, Kangwon Land’s management has increasingly been eyeing overseas players amid what it says is neighbouring gaming jurisdictions targeting South Korean players as customers.

Kangwon Land Inc gave the information on incentives for overseas travel agents to GGRAsia via email, in response to our enquiry.

🇰🇷 HD Hyundai Marine Solution Block Deal Sale of 8.5% of Outstanding Shares (Douglas Research Insights) $

After the market close today, it was announced that KKR is selling 3.81 million shares (8.5% of outstanding shares) of HD Hyundai Marine Solution (KRX: 443060) in a block deal sale.

The expected block deal sale price is 145,000 won to 148,000 won per share, which represent 7.96% to 9.83% discount to the closing price of 160,800 won on 22 May.

Once this block deal is completed, KKR’s remaining stake in HD Hyundai Marine Solution will be reduced to 11% (4.94 million shares).

🇰🇷 Korea Small Cap Gem #34: Makus (Douglas Research Insights) $

(Non-memory semiconductor solutions) Makus Inc (KOSDAQ: 093520) is #34 in our Korea Small Cap Gem series. Its treasury shares as percentage of outstanding shares is 44%. Net cash as a percent of market cap is 78%.

With greater interest in companies that have a combination of high levels of treasury shares as a percentage of market cap, cheap valuations, and excellent fundamentals, Makus fits the bill.

Makus could be one of the targets for potential tender offers/M&As and likely to outperform the market in the next 1-2 years.

🇰🇷 Samsung C&T: Entrance into the Global Aerospace Industry (Watch What They Do, Not What They Say) (Douglas Research Insights) $

On 20 May, Samsung C&T Corp (KRX: 028260 / 02826K) made an important announcement that it started research and development on a space project that includes a rocket launch facility construction.

This is a signal that the Samsung Group may be interested in expanding in the global defense/aerospace industry once again.

The recent news flow on Samsung’s expansion into aerospace business including Samsung C&T’s development of rocket launch facility is likely to positively impact Samsung C&T’s share price.

🇰🇷 Hanwha Aerospace: Higher Rights Offering Price and Amount (Douglas Research Insights) $

On 21 May, Hanwha Aerospace (KRX: 012450) announced that the rights offering price increased to 684,000 won (up 26.9% from 539,000 won previously) due to recent increase in price.

Due to the higher rights offering price, the scale of the capital raise has increased from 2.3 trillion won previously to 2.9 trillion won (US$2.1 billion).

Issue price is determined by applying a 15% discount rate to the one-month weighted arithmetic average price, one-week weighted arithmetic average price, and the closing price on the base date.

🇰🇷 Samsung Biologics: Creation of a Holding Company to Split CDMO and Biosimilar Businesses (Douglas Research Insights) $

On 22 May, Samsung Biologics (KRX: 207940) announced that that it plans to establish a new holding company called Samsung Bioepis Holdings through a spin-off.

Samsung Bioepis Holdings will fully incorporate Samsung Bioepis as a wholly owned subsidiary. Samsung Bioepis will focus on the biosimilars business. Samsung Biologics will focus on the CDMO business.

There is likely to be mixed reactions to Samsung Biologics’ announcement to create a holding company structure to split the CDMO and biosimilar businesses.

🇰🇷 LS Marine Solution: Rights Offering Capital Raise of 278 Billion Won (Douglas Research Insights) $

After the market close on 26 May, LS Marine Solution (KOSDAQ: 060370) announced that it plans to conduct a capital raise worth 278.3 billion won.

LS Marine Solution plans to issue 19.57 million new shares in this capital raise, which represents 60% of its outstanding shares.

Despite the company’s strong sales and profit growth, LS Marine Solution’s valuation multiples may be a bit too aggressive, especially with the major rights offering that will dilute existing shareholders.

🇰🇷 Dowoo Insys IPO Preview (Douglas Research Insights) $

Dowoo Insys is getting ready to complete its IPO in Korea. Dowoo Insys is one of the first companies in Korea to commercialize ultra thin glass (UTG) for foldable displays.

The IPO price range is 29,000 won to 32,000 won. At the high end of the IPO price range, the expected market cap of the company is 351 billion won.

The bankers used five companies including Synopex Inc (KOSDAQ: 025320), Duk San Neolux (KOSDAQ: 213420), and INNOX Advanced Materials Co Ltd (KOSDAQ: 272290) as comparable companies. The bankers used these companies’ average EV/EBITDA multiple of 15x to value Dowoo Insys.

🇲🇾 British American Tobacco (Malaysia): Vapor Business Exit Brings Both Positives And Negatives (Seeking Alpha) $ 🗃️

🇲🇾 IHH Healthcare: Focus On Near-Term Headwinds And Mid-Term Re-Rating Potential (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇲🇾 Rafizi needed to be out of the way so PH can work with PN in GE16 (Murray Hunter)

Anwar Ibrahim is very well aware that Pakatan Harapan’s position is untenable in the coming general election. PKR and Amanah just don’t have the support in the semi-rural seats they need. Anwar has also come to a realization that UMNO is dragging them down. UMNO’s support is not strong anymore in the rural-heartlands and the Najib addendum issue is an albatross hung around Anwar’s head.

To become prime minister after the next general election, Anwar needs to make a drastic change in the coalition. Bersatu has the electoral support to keep Pakatan Harapan in government.

Many expelled from PKR may soon find their way back in to PKR and the party will slowly build up a working relationship with Bersatu and PAS. There are already some signs there.

🇲🇾 Family first: The crumbling facade of reform under Anwar Ibrahim’s leadership or dealership (Murray Hunter)

In a development that many predicted—but few openly acknowledged—the daughter of Prime Minister Anwar Ibrahim, Nurul Izzah, clinched the deputy president’s post at the recent PKR party congress held in Johor Bahru. While the position was contested, the outcome has reignited criticism of entrenched family politics within Parti Keadilan Rakyat (PKR).

Despite the contest, Rafizi Ramli—a popular and reform-minded figure in the party—was no match for the formidable political weight carried by the Anwar family name. For nearly 15,000 delegates who voted, Nurul’s familial ties appeared to overshadow merit, experience, and policy.

🇸🇬 MAS moves to streamline IPO process and expand investor access (The Asset) 🗃️

Industry leaders welcome proposed reforms to further strengthen Singapore capital markets

The Monetary Authority of Singapore ( MAS ) has proposed streamlining prospectus requirements and broadening investor outreach channels for initial public offerings ( IPOs ) in an effort to enhance the city-state’s appeal as a listing venue.

The proposals focus on three areas: simplifying disclosures for primary listings, easing secondary listings by aligning with international standards, and allowing issuers to engage investors earlier in the IPO process.

🇸🇬 Sea Limited 1Q25 Earnings: Three Engines, One Flywheel (Nikhs)

Shopee, Monee, and Garena are no longer separate stories. Q1 2025 proves the power of Sea Limited (NYSE: SE)’s unified ecosystem as profitability and growth finally move in lockstep.

🇸🇬 SEA: Earnings Can Jump 7x By 2027 (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Improved Gaming Trends On Top Of Record E-Commerce Margins (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: Still Cheap Despite The Monstrous Rally – Maintain Buy (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited Stock: Long-Term Winner, Short-Term Caution (Seeking Alpha) $ 🗃️

🇸🇬 Sea Limited: Becoming Self-Evident (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 GRAB: Platform Power in an Emerging Digital Economy (TickerTango)

Grab has the potential to become Southeast Asia’s dominant super app. It is already the market leader in ride-hailing and food delivery, and its fintech arm is rapidly expanding with digital payments and lending. The app’s ecosystem encourages user retention through a flywheel effect: the more services users adopt, the more likely they are to stay within the platform. According to CEO Anthony Tan, only 6 percent of Southeast Asia’s population currently uses the Grab app on a monthly basis, leaving 94 percent as untapped potential. I find the stock reasonably valued given this growth runway and I have confidence in the management’s ability to execute on their vision.

🇸🇬 Better Buy: First REIT Vs Parkway Life REIT (The Smart Investor)

🇸🇬 5 Singapore Blue-Chip Candidates Reporting Higher Revenue and Profits to Help You Diversify Your Portfolio (The Smart Investor)

🇸🇬 5 Singapore Companies Looking to Grow Despite Trump’s Tariffs (The Smart Investor)

🇸🇬 Construction of Changi Airport Terminal 5 Has Commenced: 5 Singapore Companies That Stand to Benefit (The Smart Investor)

This is an expansion project that will last more than a decade and will position Singapore’s airport to handle the expected surge in air travel within the Asia-Pacific region.

T5 is designed to handle 50 million passengers a year and will effectively double the size of the current Changi Airport, allowing it to handle 140 million passengers yearly, up from the present 90 million.

Construction will intensify in the next few years and peak in 2029, with plans to connect the new terminal to the Thomson-East Coast and Cross Island MRT lines.

Here are five Singapore companies that will benefit in the long run from the brand new T5.

🇸🇬 3 Singapore REITs with Reputable Sponsors Yielding 5.3% and Higher (The Smart Investor)

Income investors should focus on these three REITs, which boast strong sponsors and a good distribution yield.

Here are three dependable Singapore REITs that are yielding 5.3% or higher.

🇸🇬 Singtel Announces a S$2 Billion Share Buyback Programme: 5 Things Investors Should Know (The Smart Investor)

Singapore Telecommunications Ltd (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF) or Singtel is one of them, and the telco also followed up its earnings release with a surprise announcement of a S$2 billion share buyback programme.

The telco’s latest announcement adds one more method to its value realisation arsenal.

Recall that Singtel had announced the payment of a value realisation dividend (VRD) for the previous fiscal year from its capital recycling activities.

Here are five things you need to know about the telco’s latest earnings report.

A solid set of earnings

A dip in Singapore’s market share

Higher operating profits from Optus and NCS

A promising guidance for FY2026

Value realisation: Share buybacks and dividends

🇹🇭 Thai entertainment complex bill to get reading in parliament July 9: report (GGRAsia)

A draft bill on Thai “entertainment complexes” that would each contain a casino is likely to get a reading in the country’s National Assembly on July 9.

The information was given by Danuporn Punnakanta, an MP and spokesman for the Pheu Thai party, a leading member of the country’s current coalition government, and reported by the Bangkok Post news outlet.

🇹🇭 Thai authorities having talks with four international casino operators on country’s legalisation push: report (GGRAsia)

A Thai government official at the centre of the country’s push to introduce casino resorts has been cited saying more than four major foreign investors have already scheduled meetings with the authorities there.

Julapun Amornvivat, deputy finance minister, gave the information on Monday, mentioning talks had taken place already with Wynn Resorts Ltd (NASDAQ: WYNN) and MGM Resorts International (NYSE: MGM), according to a news report in the Bangkok Post.

On Friday, The Nation news outlet had carried a picture of Mr Julapun meeting with Wynn Resorts Ltd. On Tuesday, pictures circulated of Ed Bowers, president of global development at MGM Resorts, attending a meeting said to be with Mr Julapun. According to the Bangkok Post, the MGM Resorts meeting took place on Monday.

🇰🇿 Kaspi: This 7x P/E Fintech Super-App Could Be Your Portfolio’s Energizer (Seeking Alpha) $ 🗃️

-

🇰🇿 KASPI (NASDAQ: KSPI / LON: 80TE / FRA: KKS) – Payments Platform, Marketplace Platform & Fintech Platform. 🇼

🇰🇿 A Shady Kazakh Company Actively Gaming Passive U.S. Markets (Muddy Waters Research)

If you headed a financial services company based in that Market of Dreams known as Kazakhstan and Hindenburg Research published evidence your company “i) brazenly skirts sanctions (ii) shows hallmark signs of fake revenue (iii) commingles customer funds then gambles assets in highly levered, illiquid, risky market bets (iv) and displays signs of market manipulation in both its investments and its publicly traded shares”, how hard would it be for you to generate $140 million in forced stock buying by gaming inclusion into the Russell 1000 index? If your company is Freedom Holding Corp (NASDAQ: FRHC) ($FRHC), it turns out it’s not that hard.

FRHC, which found no merit to Hindenburg’s allegations in its internal investigation, seemingly only needed to rent an office in the U.S. – perhaps not coincidentally in the Trump Building at 40 Wall Street – and then drop that address as its Principal Executive Office in its SEC filings.

🇮🇳 Fairfax India: I Am Buying On Bangalore Bounce (Seeking Alpha) $ 🗃️

🇮🇳 HDFC Bank: Earnings Show Clear Signs Of Growth Ahead (Seeking Alpha) $ 🗃️

🇮🇳 Aarti Industries Q4 FY25 Update: Volume Recovery Drives Sequential Growth (Smartkarma) $

(Specialty chemicals & pharmaceuticals) Aarti Industries (NSE: AARTIIND / BOM: 524208) posted a solid 9% QoQ revenue growth, driven by higher volumes in the energy sector.

The company is navigating external volatility, including US tariffs and geopolitical uncertainty, while maintaining growth through volume recovery and diversification.

The solid volume uptick in key sectors positions Aarti for continued growth in FY26, despite margin pressures.

🇮🇳 JSW Energy: Balancing Strong Growth Aspirations with Elevated Leverage Add Ticke (Smartkarma) $

JSW Energy Ltd (NSE: JSWENERGY / BOM: 533148)

Unveiled a Rs1.3 lakh crore capex program is planned over FY26–FY30 to reach 30 GW total capacity and 40 GWh energy storage by FY30.

Reported a 16% year-on-year increase in Q4 FY25 net profit to ₹408 crore, with revenue rising 16% to ₹3,189 crore.

Trades at ~46x P/E—above Adani Power (~17x) and Tata Power (~33x).

🇮🇳 JSW Energy Q4 FY25 & FY25 Update: Powering Ahead with Landmark Capacity Expansion (Smartkarma) $

FY25 was a landmark year for JSW Energy Ltd (NSE: JSWENERGY / BOM: 533148), crossing 10 GW operational capacity, driven by record wind additions and strategic acquisitions of KSK Mahanadi and O2 Power.

The aggressive inorganic and organic expansion, coupled with a strong focus on energy storage, positions JSW Energy as a diversified player in India’s evolving power landscape, balancing baseload and renewables.

The disciplined capital allocation, robust project pipeline, and strong execution capabilities, despite high leverage, reinforce confidence in achieving the ambitious ’30 by 30′ target and long-term value creation.

🇮🇳 Adani Ports: Anchored on Scale, Navigating Towards 1BT Ambition by FY30 (Smartkarma) $

Targeting 1 billion tonnes of cargo by 2030 with ~2,000 MMT capacity. Gangavaram Port timely expansion is crucial.

FY26 guidance implies strong revenue growth (₹36,000–38,000 Cr) and rising cargo volumes, but the PAT outlook appears conservative.

Trades at 17x EV/EBITDA FY27 which is in-line with historic multiples. High margin business with strong cash conversion provides visibility to achieve FY30 targets.

🇮🇳 Apcotex Industries Q4 FY25 Update: Strong Volume Growth and Margin Recovery (Smartkarma) $

(Emulsion Polymers) Apcotex Industries (NSE: APCOTEXIND / BOM: 523694) reported a robust 12.5% YoY revenue growth in Q4 FY25, driven by strong volume and export growth.

Despite external challenges like crude price volatility and global overcapacity in latex, the company showcased strong operational performance.

The recovery in margins, driven by improved capacity utilization and higher exports, supports optimism for FY26 despite market uncertainties.

🇮🇳 Archean Chemical Industries Q4 & FY25 Update: Strong Volume Growth & Strategic Expansions (Smartkarma) $

Archean Chemical Industries Ltd (NSE: ACI / BOM: 543657) posted strong operational performance, driven by robust export growth and stable demand across key segments.

Despite external market challenges, Archean’s diversified product portfolio and strategic acquisitions provide a solid foundation for future growth.

Archean is well-positioned to continue expanding, with significant upside in bromine derivatives and energy storage, supporting its long-term growth trajectory.

🇮🇳 Godawari Power: Expansion Led Growth Ahead Despite Near-Term Delays (Smartkarma) $

Godawari Power and Ispat Limited (NSE: GPIL / BOM: 532734)

Iron ore mining capacity expansion from 2.35 MTPA to 6 MTPA and pellet capacity from 2.7 MTPA to 4.7 MTPA expected by 3QFY26 with full ramp-up by Q4 FY26.

4QFY25 consolidated revenues of ₹1,468 crore, with EBITDA at ₹318 crore and PAT at ₹221 crore, reflecting a slight decline year-on-year due to lower realizations.

Valuations appear reasonable driven by steady earnings growth backed by capacity addition, mine expansion and operational efficiencies.

🇮🇳 ABDL Q4 Update: A Transformational Year with Record Performance and Premiumization Drive (Smartkarma) $

Allied Blenders & Distillers (NSE: ABDL / BOM: 544203)‘s FY25 marked a pivotal shift with record profitability, fueled by premiumization, cost efficiency, and expansion into international markets, notably through its luxury portfolio.

Record profitability and a strengthened balance sheet position ABDL for aggressive expansion in the high-margin super-premium and luxury segments, supported by strategic CapEx.

ABD’s transformation into a premium-focused brand with significant global expansion potential, particularly in luxury segments, positions it for sustained growth and higher margins.

🇮🇳 Borosil Renewables Q4 FY25 Update: Domestic Strength Shines Amidst Overseas Challenges (Smartkarma) $

Borosil Renewables Ltd (NSE: BORORENEW / BOM: 502219)

Definitive anti-dumping duty (ADD) imposed on solar glass imports from China and Vietnam until December 2029; Standalone Indian operations showed significant improvement in Q4 and FY25.

The ADD provides a stable pricing environment and growth catalyst for domestic solar glass manufacturing. Improved domestic performance underscores resilience despite international market volatility.

Reinforces a positive outlook for the Indian business due to favorable regulatory support and robust demand. However, the German subsidiary’s performance remains a key monitorable.

🇮🇳 Business Breakdown: Precot Limited – A Strategic Weave of Yarn and Technical Textiles (Smartkarma) $

Precot Ltd (NSE: PRECOT) has shifted focus from its spinning division to the high-margin Technical Textiles, with EBITDA margins in this rising to 33% in 1HFY25 from 26% in FY24.

This shift towards TT has transformed Precot’s revenue mix, improving profitability and reducing reliance on the cyclical spinning business. However, the company faces customer concentration risk in the TT segment.

With the TT segment now driving 76% of total EBITDA in 1HFY25, Precot’s growth strategy is clearly focused on margin expansion, making it a resilient player in the textile sector.

🇮🇳 Event Driven: Bajaj Auto Acquired Majority Control of Austrian KTM (Smartkarma) $

Bajaj Auto Ltd (NSE: BAJAJ-AUTO / BOM: 532977) will take majority control of KTM AG by buying out its Austrian partner in Pierer Bajaj AG and injecting €800 million to close KTM’s court-approved restructuring.

The deal rescues a flagship European brand from insolvency, safeguards KTM’s supply chain, and vaults Bajaj into the global premium-sport segment as an OEM rather than a contract partner.

Bajaj’s pivot from passive investor to turnaround owner adds earnings volatility near-term, but long-term it secures technology, brand equity, and a bigger share of high-margin 400-1,000 cc bikes.

🇮🇳 JSW Steel: Positioned for a Sharp Earnings Rebound in FY26 Despite BPSL Overhang (Smartkarma) $

JSW Steel Ltd (NSE: JSWSTEEL / BOM: 500228) has guided for 10% volume growth in FY26, with operating leverage and cost efficiencies poised to drive significant margin expansion.

The Supreme Court ruling on BPSL has created new challenges, the issue is not expected to derail JSW’s growth trajectory or cash flows and production.

Earnings could surge over 85% in FY26, supported by higher steel prices, lower input costs, and ramp-up of new capacities like JVML and Dolvi.

🇮🇳 AVTL: Storage Platform Poised for Growth Amid Demand Visibility (Smartkarma) $

Aegis Logistics (NSE: AEGISLOG / BOM: 500003)

Aegis Vopak Terminals is raising Rs2,800 crore via a fresh issue to repay debt and fund expansion, marking its transition into a listed infrastructure platform.

LPG capacity is set to triple by FY26, with new industrial terminals planned under a Rs4,500 crore capex; revenue and EBITDA are projected to grow 20–25% CAGR through FY27.

Key risks include high dependence on group entities for revenue, delayed utilization of new capacity, and exposure to regulatory or energy demand shifts affecting LPG and chemical flows.

🇮🇳 Schloss Bangalore (Leela Hotels) IPO: High-ARR Play with F&B Strength, but Valuation Rich (Smartkarma) $

Schloss Bangalore’s Rs3,500 crore IPO includes a Rs2,500 crore fresh issue largely earmarked for debt repayment, with limited allocation toward growth investments.

The company operates 13 ultra-luxury hotels under The Leela brand, delivering premium ARR and F&B-led revenue, but with relatively modest scale versus larger peers.

While expansion plans are underway with 678 new keys by FY28, the IPO is priced at a rich ~12x EV/Sales—significantly above Oberoi’s (Oberoi Realty Ltd (NSE: OBEROIRLTY / BOM: 533273)) ~8x, despite being half its size.

🇮🇱 Why Investors Should Watch Teva Despite Regional Risks (Seeking Alpha) $ 🗃️

🇦🇪 Yalla rallies on share buyback, hopes for upcoming midcore game (Bamboo Works)

The Middle Eastern social media and gaming company announced it will launch a highly anticipated self-developed midcore game in the third quarter

Yalla Group (NYSE: YALA) reported its revenue rose 6.5% in the first quarter, as it recorded its strongest user growth in more than two years

The social media and gaming company plans to roll out one or more midcore games this year, including its first title in the third quarter, in a bid to jumpstart its growth

🇿🇦 Sibanye Stillwater’s Turnaround Ignites, The Upside Is Still There (Seeking Alpha) $ 🗃️

-

🌐 Sibanye Stillwater Ltd (JSE: SSW / NYSE: SBSW) – World’s largest primary producers of platinum, palladium & rhodium & is a top-tier gold producer. Projects & investments across 5 continents. 🇼 🏷️

🌎 Mercado Libre = Amazon E-commerce + Paypal (Deep Dive Act II) (Lorenzo2cents)

MercadoLibre (NASDAQ: MELI)‘s unstoppable: Pioneering Latin America’s Digital Future Amid Macro Challenges and Stablecoins

If you missed Part 1 of this deep dive, I strongly recommend reading it before proceeding with this second and final part of the analysis.

Index

MELI+: A Strategic Loyalty Program Enhancing User Engagement and increasing Switching Cost

Mercado Pago vs. Nubank: A Deep Dive into Latin America’s Fintech Race

Addressing the Bear thesis

Mercado Libre Business Ontology

Conclusion

🌎 MercadoLibre Is Crushing It — But I’m Not Buying (Yet) (Rijnberk InvestInsights)

LatAm’s digital king just crushed Q1 —MercadoLibre (NASDAQ: MELI) could easily 3x by 2035, but the current setup isn’t perfect despite my bullish stance.

🌎 DLocal Investment Case! (Global Equity Briefing)

Emerging Markets Fintech, growing payments volumes by 45% per year!

In this article, I will present the Dlocal (NASDAQ: DLO) Investment Case, which is largely driven by:

The development of new products

Acquiring new merchants

Growing market share with existing merchants

Let’s take a look!

1. Business Model

2. The Opportunity

3. Financials

4. Valuation

5. Conclusion

🇨🇦 🇪🇨 Lundin Gold: Excellent Cash Flow, But Stock No Longer Discounted Compared To Peers (Seeking Alpha) $ 🗃️

🇦🇷 Javier Milei courts undeclared cash to dollarise Argentina’s economy (FT) $ 🗃️

🇦🇷 Lithium Argentina: Deeply Undervalued And Strong Production Outlook (Seeking Alpha) $ 🗃️(?)

🇦🇷 Vista Energy: My Preferred Oil Stock Due To Key Competitive Advantages Against Big Oil (Seeking Alpha) $ 🗃️

-

🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇧🇷 Nu Q1 2025 Earnings Update! (Global Equity Briefing)

Nu Holdings (NYSE: NU) Strong Customer Growth, Huge Profits, and Affordable Valuation!

There was quite some optimism going into the earnings, but unfortunately, according to the market, Nu didn’t deliver, sending the stock down 8%!

The market quickly corrected, and Nu, at the time of writing this, is down 2.8%!

So, what caused this panic?

In this article, I will review Nu’s Q1 2025 financial results. If you are interested, I wrote a full Deep Dive about Nu, which covers all of the most important aspects an investor needs to know about the company.

🇧🇷 Nu Holdings: A Top Fintech Play For 2025 (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: It Could Be An Ideal Time To Buy And Hold After Mixed Q1 Results (Seeking Alpha) $ 🗃️(?)

🇧🇷 XP Inc. Q1: Strong Results Support Rating Upgrade (Seeking Alpha) $ 🗃️

-

🌎 XP Inc (NASDAQ: XP) – Wealth management & other financial services (fixed income, equities, investment funds & private pension products). 🇼

🇧🇷 Banco Do Brasil Q1: Good Investment Theses Also Have Setbacks (Seeking Alpha) $ 🗃️

🇧🇷 Patria Investments: Rising Interest From Global Investors In Latam (Rating Upgrade) (Seeking Alpha) $ 🗃️

-

🌎🇰🇾 Patria Investments Limited (NASDAQ: PAX) – Asset management services to investors focusing on private equity, infrastructure development, co-investments, constructivist equity & real estate & credit funds. 🏷️

🇧🇷 Azul: It Looked Like Rock Bottom, But There Was Another Level Down (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Ambev Q1: Good Results Confirm The Recommendation (Seeking Alpha) $ 🗃️(?)

🇧🇷 BB Seguridade: Dividends Still Shine But The Upside’s Getting Slim (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 Afya Limited Continues To Grow, But Limits Are Also Evident (Seeking Alpha) $ 🗃️

🇧🇷 BRF Q1: This Merger Changes The Whole Thesis (Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 JBS says shareholders approve US listing for world’s largest meatpacker (FT) $ 🗃️

Green light overcomes opposition from environmental and governance advocates.

The world’s largest meat processor JBS SA (BVMF: JBSS3 / FRA: YJ3A / OTCMKTS: JBSAY) said shareholders approved a plan to list its shares in New York, fulfilling a long-held desire of the Brazilian billionaire brothers who transformed their family slaughterhouse into a global colossus.

🇨🇱 The Long, Hard End of the Chilean Nitrates Industry (Asianometry)

For decades, modern agriculture depended on fertilizing nitrates mined out of a South American desert. These mines were the world’s only such sources of nitrates. So valuable that three countries went to war over them. These nitrate riches, monopolized by foreigners, were wiped away thanks to one of the most famous chemical processes in history. But it took longer than you think. In this video, the glorious nitrates mining boom, the countries who bled for it, the men who monopolized it, and the technologies that ended it.

🇲🇽 Orbia’s Recent Refinancing Gives It Air To Breathe During The Worst PVC Downturn In Recent History (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Carso Sees Profitability Deteriorate With Less Government Infrastructure Work (Seeking Alpha) $ 🗃️

🇵🇪 Cementos Pacasmayo’s Region Shows Growth, But The Name Is Still A Hold (Seeking Alpha) $ 🗃️

🌐 Why Nebius Group (NBIS) Is My Largest Position: A Deep Dive

The story of Nebius Group NV (NASDAQ: NBIS) begins inside one of the most iconic tech companies to emerge from Eastern Europe: Yandex. Often dubbed the “Google of Russia”, Yandex was a digital powerhouse, dominating search, maps, ride-hailing, e-commerce, and AI in Russia and surrounding markets. At its peak, it was a $30B company and one of the most successful tech stories in the region.

Then, everything changed.

At its core, this isn’t just another tech stock. Nebius Group (NBIS) represents something rare in public markets — a misunderstood, undercovered company building critical infrastructure at the heart of the AI revolution, led by one of the most accomplished tech entrepreneurs of our time.

🌐 Nebius Group: Setting Cash On Fire (Seeking Alpha) $ 🗃️

🌐 Nebius: Reiterate Sell On Insurmountable Headwinds (Seeking Alpha) $ 🗃️

🌐 Nebius: Potential To Be The Next Big Winner (Seeking Alpha) $ 🗃️

🌐 Nebius: Wait For The Bubble To Burst First (Seeking Alpha) $ 🗃️

🌐 Nebius: Don’t Let Greed Kick In – Sell The +90% Rally (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

🌐 Rio Tinto Doubles Down on Lithium: A Late Entrant with Long-Term Intent (Smartkarma) $

Rio Tinto plc (NYSE: RIO) has been confirmed as the preferred partner for Chile’s Salares Altoandinos project, marking a major step in scaling its lithium ambitions.

Lithium demand is expected to grow over 5x by 2040, driven by electric vehicles and energy storage, though rising supply and tech shifts may cap long-term pricing.

Zijin Mining Group (HKG: 2899 / SHA: 601899 / FRA: FJZB / OTCMKTS: ZIJMF) is a preferred play given its diversified -copper and gold and expanding lithium footprint & lower valuation. Albemarle could face pressure from intensifying competition, rising low-cost supply etc.

🌐US Treasury Market: Imminent Collapse? (The Pareto Investor)

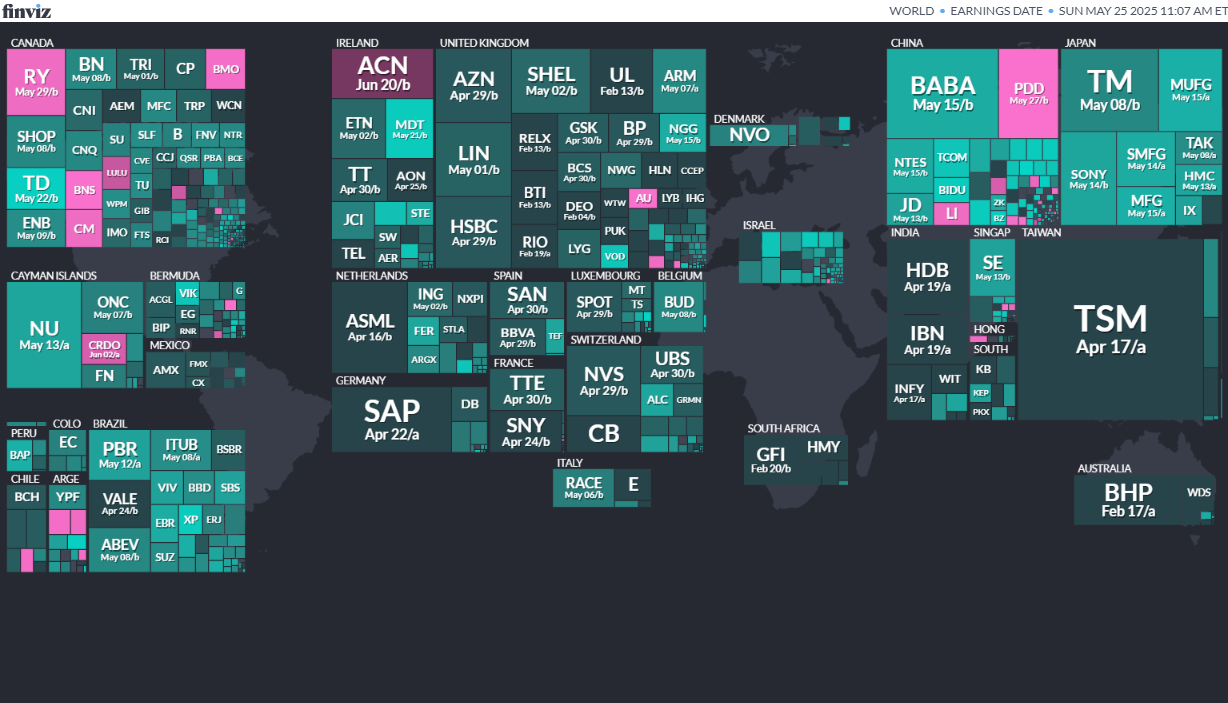

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

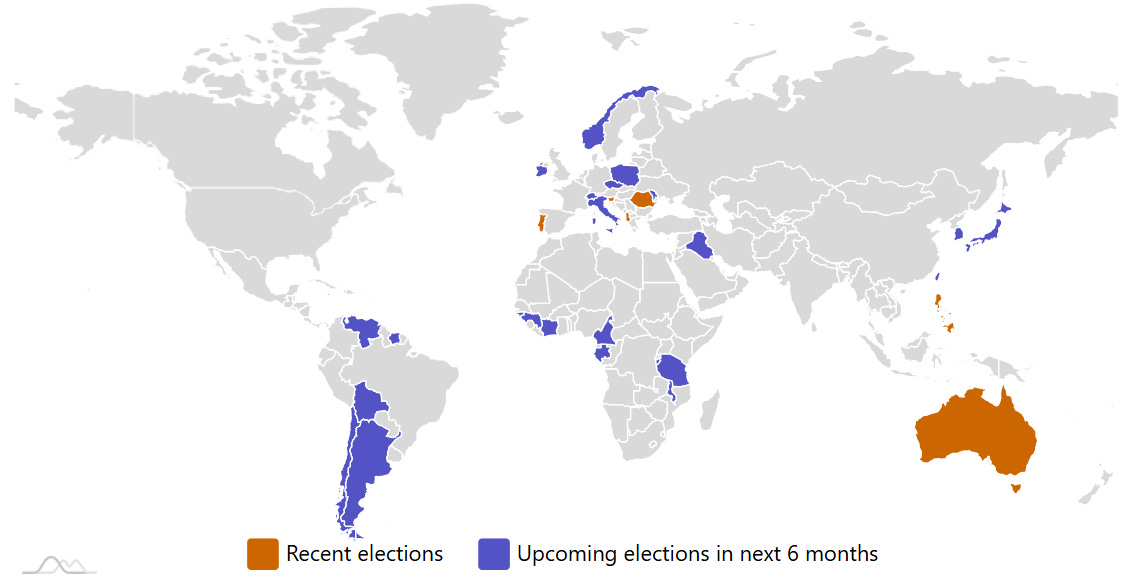

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

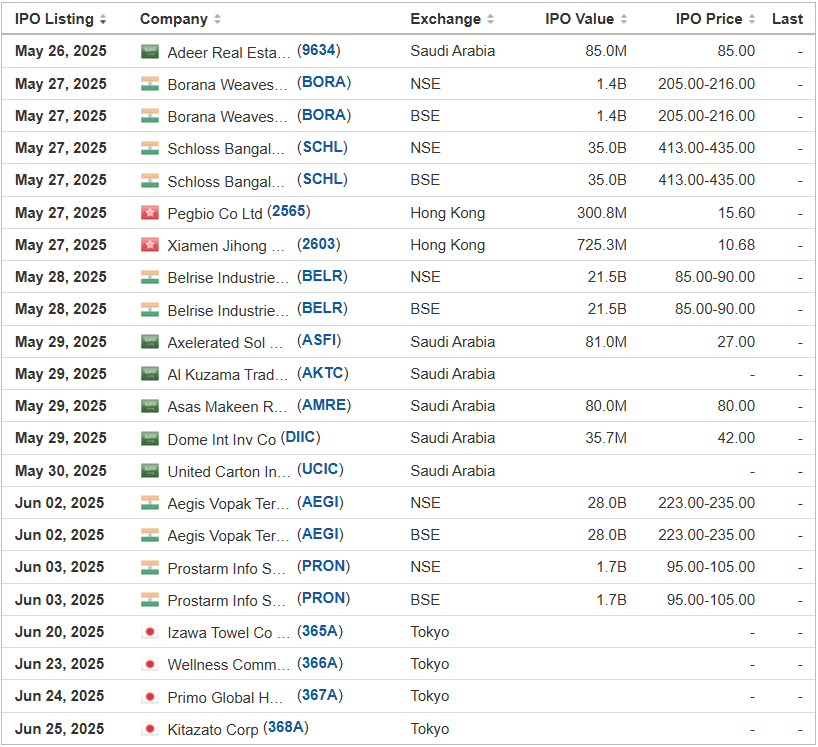

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

Fast Track Group (New IPO Filing) FTRK, Alexander Capital/Network 1 Financial Securities, 3.8M Shares, $4.00-4.00, $15.0 mil, 5/23/2025 Priced

Note: Fast Track Group re-filed its IPO plans in a new F-1 filing dated April 14, 2025 – the same date that it withdrew its previous IPO plans in a letter to the SEC dated April 14, 2025.

(Incorporated in the Cayman Islands)

Fast Track Events Pte. Ltd. was incorporated as an exempt private company limited by shares in Singapore on March 8, 2012 as an operating company of our businesses. We are a regional entertainment-focused event management and marketing company that provides a full range of services including experiential marketing, artiste endorsement and management, movie premiere organizations, grand openings and concerts. In addition to our expertise in event and concert management, we offer comprehensive value-added services tailored to meet specific client demands. These include media planning and PR management to boost event visibility, technical production planning for seamless execution of audiovisual requirements, and event manpower support for logistical efficiency. Internally, we handle project management and select media press releases, while sourcing technical support from specialized suppliers across event locations. This integrated approach ensures that we deliver high-quality, customized solutions that meet the diverse needs of our clients, enhancing the success and impact of each event we undertake.

Since our inception, we have been instrumental in creating, developing, organizing, hosting, and managing a diverse range of events and concerts for our clients. Leveraging our extensive experience, we have successfully orchestrated large-scale events featuring renowned Asian bands and artistes such as B.A.P, BTS, and David Tao. Additionally, we have hosted international speakers including Michael Franzese and Michelle Yeoh, as well as organized appearances by global celebrities like John Cena and Steven Seagal. Notable milestones include organizing Malaysia’s inaugural Hollywood Movie Premiere Red Carpet event for “Baby Driver,” as well as the acclaimed 2015 BTS Live Trilogy: Episode II The Red Bullet concerts. Furthermore, we managed the successful 2018 Wild Kard Tour showcases held in Sydney and Melbourne, Australia. These events underscore our capability to deliver memorable experiences and highlight our expertise in managing high-profile engagements across different regions and entertainment genres.

We derive a significant portion of our revenue from a small number of customers. For example, one major customer accounted for 100% of our total revenue for the year ended February 28, 2023, and approximately 75% of our total revenue for the year ended February 29, 2024 was generated from two major customers, who are also related parties. Due to the nature of our business, our portfolio of major customers may vary from year to year as our customers may only be holding one or two events and/or concerts in a year and such events and/or concerts may not be held on a regular basis. We may continue to have a concentration of customers in the future, and we face the risk of losing a significant source of revenue if our major customers do not engage our services and we cannot secure new customers on time. Part of our diversification strategy involves expanding into various facets of the entertainment industry, including Live Entertainment and Agency services, which would allow us to not be reliant on a single revenue source and maintain stability even when one segment faces challenges.

Note: Net income and revenue are in U.S. dollars for the Fiscal Year that ended Feb. 29, 2024.

(Note: Fast Track Group priced its small-cap IPO at $4.00 – the low end of its $4.00-to-$5.00 price range – and sold 3.75 million shares – the number of shares in the prospectus – to raise $15.0 million on Thursday night, May 22, 2025.)

(Note: Fast Track Group revived its IPO plans in a new F-1 filing dated April 14, 2025 – the same date that it withdrew its previous IPO plans in a letter to the SEC – and disclosed the new terms for its revived IPO: The company is offering 3.75 million shares – up from 3.0 million shares in the old and withdrawn prospectus – and kept the price range at $4.00 to $5.00 – the same price range as in the old and withdrawn prospectus – to raise $16.88 million – with Alexander Capital added as the “lead left” joint book-runner. Alexander Capital and Network 1 Financial Securities, the original sole book-runner, now make up the joint book-running team.)

(Note: Fast Track Ltd. cut its IPO’s size to 3.0 million shares – down from 3.75 million shares initially – and kept the price range at $4.00 to $5.00 – to raise $13.5 million, according to an F-1/A filing dated Nov. 15, 2024. Background: Fast Track Ltd. disclosed the terms for its IPO in an F-1/A filing on Sept. 6, 2024.)

Dalu International Group DLHZ Revere Securities, 1.5M Shares, $4.00-6.00, $7.5 mil, 5/26/2025 Week of

We provide property management services as well as real estate leasing services in China. (Incorporated in the Cayman Islands)

We are an integrated property management services and commercial operation services provider, and we operate a real estate leasing business in Chengdu, the capital city of Sichuan Province, China.

With an operating history of two decades, our PRC subsidiaries have been focusing on providing property management services to owners, developers and occupiers of residential and commercial properties in Chengdu. Our PRC subsidiaries have accumulated extensive experience in the property management services sector. In addition, to drive our value growth and diversify our revenue streams, we also provide a variety of commercial operation services, primarily consisting of brand planning, market research and positioning consultancy, tenant sourcing and management, marketing and business support to owners and developers of commercial properties, and (we) engage in real estate leasing business.

We are a well-known property management brand in Chengdu, having undertaken property management and related services for well-known projects in some of the most prosperous commercial areas, such as the fashion center of Chengdu and one of the most popular pedestrianized shopping streets, Chunxi Road, and South Renmin Road in Chengdu’s central business district.

Note: Net income and revenue are in U.S. dollars for the 12 months that ended September 30, 2024.

(Note: Dalu International Group is offering 1.5 million shares at a price range of $4.00 to $6.00 to raise $7.5 million, according to its F-1 filings with the SEC.)

Delixy Holdings Ltd. DLXY Bancroft Capital, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/26/2025 Week of

We trade crude oil and oil-based products, including fuel oils, gasoline, additives, gas condensate, in Southeast Asia and East Asia. (Incorporated in the Cayman Islands)

We are principally engaged in the trading of oil related products, which can be broadly categorized into (i) crude oil and (ii) oil-based products such as fuel oils, motor gasoline, additives, gas condensate, base oil, asphalt, petrochemicals and naphtha (heavy gasoline), in Southeast Asia and East Asia..

We have the financial capability to provide our customers with financing alternatives and credit terms

We are able to provide our customers with credit terms of up to 90 days by leveraging our strong balance sheet position as well as short term credit facilities available to the Group. Our ability to extend these advantageous credit terms to our customers allows us to cater to the diverse needs of our customers across multiple countries and to provide them with the financial flexibility they may require for their business operations. As of the date of this prospectus, the amount outstanding with respect to these credit facilities is zero.

We have an experienced management team with strong relationships across our value chain.

Our management team headed by our Executive Chairman, Chief Executive Officer and Executive Director Mr. Xie, has decades of trading experience and experience in oil trading as well as in the oil industry generally, including oil refining and logistics. We also maintain strong relationships with our suppliers, storage facilities providers and fleet and logistics providers, and are able to effectively service our clients and ensure a reliable supply of crude oil and oil-based products.

We have robust and strong risk management and internal controls capabilities

We believe that the ability to manage risk is one of our key strengths. Risk management is a core function under the supervision of our senior leadership structure. Our sound risk management practices have contributed to our positive performance through the volatile market environment in recent years and have helped to mitigate earnings volatility.

We are strategically located in Singapore, Asia’s refined products trading hub.

Note: Net income and revenue are in U.S. dollars for the year that ended Dec. 31, 2024.

(Note: Delixy Holding Corp. is offering 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million, according to its F-1/A filings. Of the 2.0 million shares in the IPO. Delixy Holdings Ltd. is offering 1.35 million ordinary shares and the selling shareholders are offering 650,000 ordinary shares.)

FG Holdings FGO American Trust Investment Services/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/26/2025 Week of

We are a holding company whose Hong Kong subsidiaries run a FinTech platform that provides mortgage loan brokerage services. (Incorporated in the British Virgin Islands)

We offer – through our operating subsidiaries – a FinTech platform for mortgage loan brokerage services available through private credit and banks. The company gives borrowers mortgage application simulation and access to several mortgage loan options from various lenders.

Since our inception in 2019, FG Global has helped match 528 borrowers with more than $906 million in loans. That loan volume includes $401 million for the fiscal year that ended June 30, 2024.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: FG Holdings filed its F-1 on Nov. 18, 2024, and disclosed the terms for its small-cap IPO: 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million. Background: FG Holdings submitted confidential IPO documents to the SEC on Dec. 28, 2023.)

Fuxing China Group Ltd. (Current Deal) FFFZ Craft Capital Management/Boustead Securities, 1.0M Shares, $4.00-6.00, $5.0 mil, 5/29/2025 Thursday

Through our operating subsidiaries in mainland China and Hong Kong, we are principally engaged in the production and sale of zipper sliders and zipper chains, trading of textile raw and auxiliary materials used in zipper production, and provision of zipper processing services in mainland China and Hong Kong. (Incorporated in Bermuda)

Since our establishment in 1993, Fuxing Group has built up a credible track record and market reputation with a diversified customer base of over 1,600 customers in China, including many renowned brands such as Anta, Septwolves, LiNing, 361°, Samsonite and Northpole China. We aim to become one of the leading zipper product manufacturers and to achieve recognition as a market leader for our brand name, quality of products and research and development (“R&D”) capabilities.

Our zipper products consist mainly of zipper sliders and zipper chains and are widely used in apparel (including sportswear), shoes, camping equipment, bags, such as handbags, briefcases, luggage and laptop bags, and upholstery furnishings, such as bedding and sofa covers. Our products are sold mainly to China local manufacturers of apparel and footwear products, camping equipment, bags, manufacturers of upholstery furnishings, as well as other zipper manufacturers which further process or assemble our zipper products in order to customize these according to their customers’ needs. Some of the zipper products which we sell are manufactured under our “3F” brand name. In addition, we sell to trading companies which export our zipper products to overseas markets, including Australia, European countries, such as Russia, Turkey, Spain, Italy, Poland, Belgium, Greece, Slovenia and Lithuania, and Asian countries, such as South Korea, Thailand, Vietnam and Indonesia.

Our operating subsidiary, Fook Hing Trading in Hong Kong, is primarily engaged in the trading of textile raw and auxiliary materials, including rubber thread, nylon fabric and nylon yarn.

Our operating subsidiaries, Fulong Zipper, Fuxin Electroplating and Jianxin Weaving, provide zipper processing services, including color dyeing of fabric tapes for zippers, electroplating services for zipper sliders and manufacturing and sales of dyed yarn.

Our manufacturing facilities are located in Jinjiang City, Fujian Province. Our manufacturing operations are highly integrated, and we have an extensive range of machinery and equipment at our manufacturing premises. Building on our technical knowledge and our manufacturing expertise, we are able to integrate our operations and business to cater to our customers’ needs. We have the ability to manufacture the entire zipper product from mold-making for the production of our zipper sliders to the manufacturing of fabric tape for zipper chains. Our range of manufacturing machinery also enables us to produce our zipper chains and zipper sliders using a wide range of materials, colors, and sizes in accordance with our customers’ requirements. Most of our raw materials are mainly procured from our suppliers located in Fujian Province.

We accord high priority to quality control during the production processes of our products. Our subsidiary, Fookhing Zipper, was awarded the GB/T 19001-2016/ISO 9001:2015 Quality Management System Certificate, valid through September 2025, by the World Standards for Certification Center Inc. (“WSF”) (北京世标认证中心有限公司), a third-party certification body headquartered in China.

To ensure continual innovation in product quality and improved efficiency, we place strong emphasis on product and technical R&D. As of July 31, 2024, we had an R&D team comprised of 20 members. Our R&D team leader, Mr. Yanming Luo, has 20 years of industry experience and was the inventor of 69 valid patents related to zipper design as of August 2024.

We generate revenue primarily from three sources, (i) production and sale of zippers, including zipper chains and zipper sliders (the “Zipper Segment”), (ii) trading of raw textile and auxiliary materials (the “Trading Segment”), and (iii) zipper processing services (the “Processing Segment”).

Note: Net income and revenue are for the 12 months that ended March 31, 2024.

(Note: Fuxing China Group Ltd. filed an F-1/A on Aug. 21, 2024, and cut its IPO’s size: The number of ADS was cut to 1.0 million American Depositary Shares (ADS) – down from 2.0 million ADS – and the price range was revised to $4.00 to $6.00 – from $4.00 to $4.50 previously – to raise $5.0 million.)

Vantage Corp. (Singapore) VNTG Network 1 Financial Securities, 3.3M Shares, $4.00-5.00, $14.6 mil, 5/29/2025 Thursday

We are a shipbroker that connects ship owners with charterers. Our focus is on dirty petroleum products, petrochemicals, biofuels and vegetable oils. (Incorporated in the Cayman Islands)

We have three subsidiaries, namely Vantage BVI, Vantage Singapore and Vantage Dubai. Vantage BVI is a wholly owned subsidiary of the issuer, Vantage Cayman; and both Vantage Singapore and Vantage Dubai are wholly owned by Vantage BVI.

We were founded in 2012 by five seasoned shipbrokers with a mission of providing exceptional shipbroking services. We commenced operations with a team of over 20 specialists proficient in their various roles in the tanker markets which involves trading different types of oil and petrochemical products through vessel transportation, including clean petroleum products (“CPP”) and petrochemicals. Over the years, we underwent significant growth and evolution, expanding our shipbroking services to cover dirty petroleum products (“DPP”), biofuels and vegetable oils. Additionally we established a sales & projects team, a research/strategy team and an IT team. We have expanded to over 50 dedicated professionals as of May 2024, with offices in both Singapore and Dubai.

We specialize in providing comprehensive shipbroking services, including operational support and consultancy services, tailored to the tanker markets. Rooted in our expansive network and decades of collective experience within the marine sector, we have emerged as a trusted intermediary, facilitating transactions between shipowners and charterers across diverse segments of the tanker market, and ensuring smooth logistical flow for cargo deliveries to timely demurrage and claims settlements.

Our suite of shipbroking services is designed to optimize outcomes for our clients, offering a holistic approach to addressing their needs and objectives. As a pivotal link between oil companies, traders, shipowners, and commercial managers, we deliver a range of services including: identifying market opportunities and information for our clients, recommending interested parties (shipowners and cargo owners) to each other, advising interested clients on strategies on vessel deployment or fleet mix, specifications and capabilities, facilitating contract negotiations, ensuring smooth logistical flow, as well as resolving issues that arise during the execution of chartering agreements.

Our Industry

The global shipbroking market was valued at $1.56 billion in 2022, with the oil tanker sector (excluding gas carriers) valued at $422 million. The oil tanker shipbroking sector is poised to grow at a CAGR of 3.32% between 2022-2027. According to the 2023 Shipbroking Market report by Technavio, the European and Asia Pacific shipbroking market collectively account for about 81% of the global shipbroking market.

Note: Net income and revenue are in U.S. dollars for Fiscal Year 2024, which ended March 31, 2024.

(Note: Vantage Corp. filed an F-1/A dated Nov. 20, 2024, in which it disclosed its proposed symbol “VNTG” and the terms for its IPO: The company is offering 3.25 million shares at a price range of $4.00 to $5.00 to raise $14.63 million. Background: Vantage Corp. filed its F-1 for its IPO on Oct. 9, 2024, with estimated initial proceeds of about $16 million. Vantage did not disclose a proposed stock symbol in its F-1 filing.)

Kandal M. Venture Ltd. FMFC Dominari Securities/Revere Securities, 2.0M Shares, $4.00-5.00, $9.0 mil, 5/30/2025 Friday

(Incorporated in the Cayman Islands)

Through FMF, our operating subsidiary, we are a contract manufacturer of affordable luxury leather goods with our manufacturing operations in Cambodia. We primarily manufacture handbags, such as shoulder bag, crossbody bag, tote bag, backpack, top-handle handbag, satchel, and other smaller leather goods, such as wallets. Our customers are well-known global fashion brands that are headquartered in the United States.

With our craftsmanship and extensive knowledge of the leather goods manufacturing process, our product engineers convert our customers’ vision and design into leather goods products. Our products are primarily affordable luxury products that are made of leather and/or other materials.

Our Competitive Strengths

We believe the following competitive strengths differentiate our operating subsidiary from its competitors:

• Having long-term and strong business relationships with renowned global fashion brands but we cannot assure continued good relationships with them, and they are not obligated in any way to continue placing orders with us at the same or increasing levels, or at all;

• Having long-term collaborative relationships with our suppliers but their services are susceptible to fluctuations in pricing, timing, and quality, and we have limited control over their operations and compliance with regulations as we do not have long-term contracts with them;

• Having extensive understanding of leather goods manufacturing process, up-to-date machinery and efficient management resulting in competitive pricing while maintaining quality and high efficiency; and

• Having experienced management team with extensive knowledge of the leather goods manufacturing industry where we operate but we cannot assure the retention of key executives and personnel necessary to maintain or expand our business, and the loss of any member of our management team could negatively impact our business plan and expansion.

Our Strategies

We aim to accomplish our business objective, further strengthen our market position and continue to be a competitive manufacturer of leather goods by pursing the following key strategies:

• Broadening our customer base by expanding our geographical market reach to other key markets, including the European markets but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results;

• Enhancing our production capacity but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results; and

• Establishing a new design and development center for enhancing our product development capabilities but failure to implement the growth strategy in a timely or commercially acceptable manner may adversely affect our business growth and operating results.

Corporate History and Structure

KMV is a holding company registered and incorporated in the Cayman Islands, and is not a Cambodian operating company. As a holding company with no material operations, we conduct our core business operations in Cambodia through our operating subsidiary, FMF.

On April 5, 2017, FMF is the Group’s key operating subsidiary and was established under the laws of Cambodia to engage in the business of leather goods manufacturing. FMF’s skilled craftsmanship and high-quality manufacturing capabilities are the cornerstones of the Group’s operations and reputation, allowing us to attract business from leading global brands. Customers issue letters of authorization directly to FMF which grant FMF the right to produce and export leather goods using their trademarks, and they frequently visit the production site of FMF located in Cambodia to inspect orders and conduct quality checks. PFL was incorporated under the laws of Hong Kong on November 3, 2016 as a trading company for the Group’s material procurement and customer invoicing.

Note: Net income and revenue are in U.S. dollars (converted from Cambodia’s currency) for the 12 months that ended March 31, 2024.

(Note: Kandal M. Venture Ltd. trimmed its small-cap IPO’s size to 2.0 million shares – down from 2.8 million shares originally – and kept the price range at $4.00 to $5.00 – to raise $9.0 million, according to its F-1/A filing dated Feb. 18, 2025.)

(Note: Dominari Securities and Revere Securities are the new joint book-runners, replacing the original book-running team of Cathay Securities and WestPark Capital.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

04/02/2025 – Goldman Sachs India Equity ETF – GIND

-

03/21/2025 – FT Vest Emerging Markets Buffer ETF – March – TMAR

-

02/25/2025 – Touchstone Sands Capital Emerging Markets ex-China Growth ETF – TEMX

-

02/19/2025 – abrdn Emerging Markets Dividend Active ETF – AGEM

-

02/14/2025 – GMO Beyond China ETF – BCHI

-

02/06/2025 – PLUS Korea Defense Industry Index ETF – KDEF

-

01/04/2025 – Simplify China A Shares PLUS Income ETF – CAS

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).