Emerging Market Links + The Week Ahead (May 6, 2024)

The Asset has noted how the USA’s China bashing is reminiscent of the Japan bashing in 1980s while The Duran podcast has discussed Blinken’s recent embarrassing and belligerent trip to China in some detail with the latter not planning to give an inch to any American demands (as the Chinese did not appreciate getting bashed and threatened by an American diplomat on their home turf). The Duran thinks sanctions against China have already been decided in Washington DC – despite the fact that the latter can do significant damage to the American economy when they retaliate…

Meanwhile, IOL has a piece discussing South Africa’s disastrous deindustrialization due to energy constraints that has seen many industrial customers leave the country – creating the highest rates of unemployment in the world and making people increasingly desperate. Yet, PwC has a new report out reporting that South Africa is getting a steady stream of FDI…

Finally, Starbucks shares hit two-year low as China and US demand clouds their outlook. What the US media seems to be missing are all the bubble tea chains that have mushroomed in China (that are now spreading to other parts of Asia) plus YUM China (NYSE: YUMC) has launched a new standalone coffee chain attached to existing KFCs.

In addition, Starbucks (along with a number of other Western businesses) is being boycotted in Malaysia and Indonesia (and no doubt in other Muslim countries) over Gaza (e.g. Vincent Tan urges Malaysians to end the Starbucks Malaysia boycott & In Indonesia and Malaysia, boycotts hammer McDonald’s, Starbucks). Chinese bubble tea chains like MIXUE (MIXUE Malaysia seems to be rapidly expanding in Malaysia plus there are plenty of local tea and coffee chains) don’t have these geopolitical type of problems.

$ = behind a paywall

-

🇰🇷 Mirae Asset Securities’ Korean Stock Picks (March-April 2024) Partially $

-

“A Country Without Shareholder Rights” book…

-

April: SK IE Technology Co Ltd, Cosmo Advanced Materials & Technology, Amorepacific Corp, Soop Co Ltd, Hyundai Rotem, GS Engineering & Construction Corp, Hanwha Systems, KT Corp, SK Telecom, Chong Kun Dang Pharmaceutical Corp, Cosmax Inc, Samsung SDS, Samsung Engineering, Classys, Hanwha Solutions, Posco International Corp, Posco Future M Co Ltd, LG Energy Solution, LG H&H, Dentium, Hyundai Glovis, SK Hynix, Krafton, LG Uplus, LG Innotek, HD Hyundai Electric, Samsung Biologics, Samsung C&T Corp, LX Hausys Ltd, SM Entertainment, Dear U Co Ltd, JYP Entertainment Corp, Lotte Innovate Co Ltd, Hyundai Engineering & Construction, HYBE, Shinsegae Inc, F&F Co, ST Pharm, Hyundai AutoEver, Yuhan Corp, LIG Nex1 Co, Korea Aerospace Industries, Hanwha Aerospace, SoluM Co Ltd, OCI Holdings, CJ Logistics, Daewoo Engineering & Construction, GS Engineering & Construction Corp, DL E&C Co Ltd, Samsung Electronics, Korean Air, Wemade, S-Oil Corp, Samsung Electro-Mechanics Co Ltd, Samwha Capacitor, Jin Air Co Ltd and Kakao

-

March: Chong Kun Dang Holdings, HD Hyundai Electric, KEPCO, JYP Entertainment, Cosmax, Samsung Engineering, People & Technology and Creative & Innovative System Corp

-

-

🌐 EM Fund Stock Picks & Country Commentaries (May 5, 2024) Partially $

-

21 lessons from financial history, world class businesses in small economies, insights about EM booms & busts, momentum across Latin America, “Project Zimbabwe” in the US, India Stack stocks, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 BYD (1211 HK): Low Growth in 1Q24, But March Sales and Homemade Batteries to Support a Strong Year (SmartKarma) $

BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF)’s revenue growth is lower than the estimate in our preview note.

However, the recovery of sales volume in March suggests a strong year.

We believe BYD will win the price war due to its homemade batteries.

🇨🇳 Tianqi Lithium plunges into the red on falling prices, troubled Chile investment (Caixin) $

The reversal in fortunes for Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) continues with it swinging into loss in the first quarter, with the major Chinese producer of the material used in electric vehicle batteries blaming the result on falling prices for the metal and a beleaguered investment in a Chilean miner that has proved costly and is at risk of being nationalized.

Shenzhen-listed Tianqi said it swung to a net loss attributable to shareholders of 3.9 billion yuan ($538.5 million) in the first three months of this year compared with a 4.9 billion yuan profit for the same time last year, as revenue plunged 77.4% year-on-year to 2.6 billion yuan, according to its earnings report released Tuesday.

🇨🇳 Tianqi Lithium stuns investors with deep drop into the red (Bamboo Works)

Shares in the Chinese mining giant have plunged about 40% in the past year, as it grapples with falling lithium prices and uncertainties over a deal in Chile

Tianqi Lithium Corp (SHE: 002466 / HKG: 9696 / FRA: 2220) said it was expecting to post a loss of between 3.6 billion yuan and 4.3 billion yuan in the first quarter, prompting the Shenzhen Stock Exchange to seek a written explanation

Market-watchers are worried about Tianqi’s links to a Chilean mining company that is facing a big tax bill and is negotiating a new lithium pact that could sideline the Chinese miner

🇨🇳 Fuyao Glass (3606 HK): Global Champion Benefiting From Structural Uptrend (SmartKarma) $

FuYao Glass Industry Group (SHA: 600660 / HKG: 3606 / FRA: 4FG) is the largest auto glass producer in the world, with an estimated 40% market share globally, and a dominant 65% market share in China.

The investment case for Fuyao include: ASP increase from product mix upgrade; increasing sales volume due to more auto glasses needed per car; and improving margins.

The company has production bases in China with annual production volume of around 32.5 million units, and in US with annual production volume of around 5.5 million units.

🇨🇳 China Comm Const (1800 HK): Continue to Deliver (SmartKarma) $

China Communications Construction (SHA: 601800 / HKG: 1800 / FRA: CYY) maintained healthy earnings growth at 10% in 1Q24, ahead of the consensus expectation of 7.3% for full-year FY24.

A 0.2pp gross margin expansion and positive swing in credit and asset impairments are the drivers, though higher finance costs have offset some of their benefits.

1Q24 new contracts were up 10.8%, and we estimate backlog equals 4.5x FY24F revenue. Despite YTD outperformance, it is still cheap at 2.4x PER and 0.2x P/B.

🇨🇳 Asia Cement hardens into loss column with no relief in sight (Bamboo Works)

The company swung into the red in the first quarter as weak demand from China’s struggling property market pushed cement prices to fresh lows

Asia Cement (China) Holdings Corp (HKG: 0743 / FRA: 4OJ / OTCMKTS: AMNTF) warned it lost nearly 130 million yuan in the first quarter, reversing a 40.7 million yuan profit in the year-ago period

The cement maker’s situation is unlikely to improve in the near-term as prices remain in the doldrums due to weak demand from the struggling property sector

🇨🇳 Beleaguered Country Garden gets some temporary relief from domestic creditors (Bamboo Works)

Some of the struggling developer’s Chinese creditors recently agreed to roll over their maturing obligations, as the company races to restructure its foreign debt

Country Garden Holdings (HKG: 2007 / OTCMKTS: CTRYF / OTCMKTS: CTRYY)’s sales continued to deteriorate in the first quarter, plunging 81% year-on-year

Media reported the Malaysian government was considering allowing gambling in the company’s struggling local Forest City project, though the government denied the reports

🇨🇳 China Property: Sentiment Likely To Improve; Prefer Ever Sunshine Services (1995 HK) (SmartKarma) $

In the Politburo meeting this week, China announced the intention to stabilize the property market and improve housing inventory. Following the meeting, Beijing announced a relaxation of home purchase restrictions.

Given the extreme pessimism on China property, good opportunities exist for select quality companies in the China property space, especially in property management.

One name I would like to highlight is Ever Sunshine Services Group Ltd (HKG: 1995), a non-SOE property management company with a good reputation in terms of execution.

🇨🇳 China-focused Tigermed staves off biopharma gloom (Bamboo Works)

Investors have not been deterred by an earnings slide, wagering that the drugs services company is better placed to weather an industry storm than some biopharma stocks

Hangzhou Tigermed Consulting (SHE: 300347 / HKG: 3347 / FRA: 5HZ1 / OTCMKTS: HTMDF / HNGZY) has been scaling back its clinical programs amid falling demand for drugs research

But the company is less exposed to U.S. policy risks than pharma giant WuXi AppTec Co (HKG: 2359 / SHA: 603259 / OTCMKTS: WUXAY)

🇨🇳 FAST NEWS: CanSino’s quarterly revenue rises, but loss also widens (Bamboo Works)

The Latest: CanSino Biologics (HKG: 6185 / SHA: 688185 / FRA: CJH / OTCMKTS: CASBF) reported Monday its revenue rose 13.7% year-on-year to about 114 million yuan ($15.7 million) in the first quarter, while its net loss widened 21.9% to 170 yuan million.

Looking Up: The company’s R&D spending as a percentage of operating revenue decreased by 41.25 percentage points year-on-year during the period, mainly due to an increase in revenue and reduced investment for its Covid vaccine business.

Take Note: The company recorded an investment loss of 75.4 million yuan during the period as a result of carrying losses on its held investments.

🇨🇳 WH Group brings back the bacon with rising profits (Bamboo Works)

Despite posting a revenue decline, China’s leading pork producer said its profit rose sharply in the first quarter and that it expects its performance to improve this year

WH Group Ltd (HKG: 0288 / FRA: 0WH / 0WHS / OTCMKTS: WHGLY / WHGRF) reported its first-quarter profit rose 73% year-on-year to $301 million, though its quarterly revenue slumped 8.3%

The improving performance follows a major restructuring of the U.S. operations for one of China’s leading pork producers

🇨🇳 Starbucks shares hit two-year low as China, US demand clouds outlook (Reuters)

Price hikes taken last year have forced customers to ditch cafes and restaurants and instead drink coffee at home, hurting business for chains such as Starbucks.

“The inability to stop the traffic leakage from the early signs of pull-back in November to date and the worsening macro and competitive dynamics in China may suggest prolonged challenges and no evidence of light at the end of the tunnel,” Danilo Gargiulo, senior analyst at Bernstein, wrote in a note.

Starbucks’ forward price-to-earnings multiple, a common benchmark for valuing stocks, is 20.88, compared with 21.54 and 20.83 for industry peers McDonald’s (NYSE: MCD), and Restaurant Brands International (NYSE: QSR), respectively.

🇨🇳 Yum China revs up restaurant expansion, share repurchases (Bamboo Works)

The operator of the KFC and Pizza Hut chains in China spent a record $745 million on share buybacks and dividends in the first quarter of 2024

YUM China (NYSE: YUMC) repurchased 17.9 million of its shares this year through April 23, well ahead of the 12.4 million shares it bought back in all of 2023 and 10.6 million in 2022

The company recently passed the 15,000-store milestone in China and launched a new standalone coffee chain attached to existing KFCs, with plans to ramp up the model

🇨🇳 DPC Dash bakes up hot growth in drive to more cities (Bamboo Works)

The exclusive franchisee of the Domino’s pizza in China said its revenue rose 51% last year, as it reported its first audited annual profit

DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF)’s revenue grew more than 50% last year, as it ramped up its strong push into second-tier Chinese cities

The exclusive franchisee of Domino’s pizza in China aims to double its store count from 768 at the end of last year to more than 1,600 by 2026

🇨🇳 Super Hi boils up overseas with New York listing application (Bamboo Works)

The international arm of hotpot giant Haidilao is trying to whet U.S. investor appetites with 23% revenue growth last year and its first-ever profit

Singapore-based Super Hi International Holding (HKG: 9658 / OTCMKTS: SPHIF) has filed for a New York IPO to complement its current listing in Hong Kong, reporting 23% revenue growth last year and its first-ever profit

The international affiliate of Hong Kong-listed hotpot sensation Haidilao operates 115 restaurants globally, about half in Southeast Asia

🇨🇳 SHEIN IPO: The Biggest IPO in 2024 in London? (Douglas Research Insights)

Although Shein has yet to formally announce the listing destination, there is a growing anticipation that the listing venue could be London, rather than New York.

It has been reported that the company has more than doubled its net profit to more than US$2 billion in 2023.

The company is currently seeking a corporate value of nearly US$70 billion to US$90 billion in the Shein IPO which would be one of the biggest IPOs globally in 2024.

🇹🇼 ASE Technology Q1: Hold With Caution In Mind (Seeking Alpha) $

The latest quarterly report from ASE Technology Holding (TPE: 3711 / NYSE: ASX) gave reason for optimism, but also for caution since demand is not recovering as expected.

ASX is sticking with its prior FY2024 outlook, but it also gave rise to the possibility a downward revision may be needed.

There are a number of possible clues to be gained by looking at the charts with an existing uptrend, but also the possibility of downside in the short term.

Sticking with ASX is warranted for several reasons, but being a buyer is arguably not wise at this point.

🇹🇼 United Microelectronics: A Value Stock With AI Exposure (Seeking Alpha) $

United Microelectronics Corp (NYSE: UMC / TPE: 2303) is a semiconductor company that expects to address the edge AI market in the next few years.

UMC is currently trading at a cheaper price compared to other semiconductor companies, presenting an opportunity for value investors to gain artificial intelligence exposure at a reasonable price.

UMC is dealing with macro headwinds and geopolitical risks, but the market mainly seems concerned that it won’t address the main AI semiconductor market while overlooking edge AI potential.

🇰🇷 DoubleDown: A Profitable Powerhouse With A Cash Cushion – A Buy Recommendation (Seeking Alpha) $

DoubleDown Interactive (NASDAQ: DDI) is a leading developer of social casino games with a strong financial position and substantial cash reserve.

DDI has a focus on high-return marketing expenses, positioning it for continued financial success in a maturing industry.

Despite competition and potential regulatory hurdles, DDI’s undervalued stock price and strategic growth initiatives make it a promising buy for investors seeking stability and value.

🇰🇷 Jusung Engineering: Announces Equity Spin Off + Physical Division Split (Douglas Research Insights)

On 2 May, Jusung Engineering (KOSDAQ: 036930) announced an equity spin-off as well as a physical division split.

We are negative on this combination of equity spin-off and physical division split of Jusung Engineering.

After the two units are listed on 6 December 2024, it is likely that the semiconductor unit (Jusung Engineering Co) will rise while Jusung Holdings Co is likely to decline.

🇰🇷 End of Mandatory Lock-Up Periods for 54 Companies in Korea in May 2024 (Douglas Research Insights)

We discuss the end of the mandatory lock-up periods for 54 stocks in Korea in May 2024, among which 4 are in KOSPI and 50 are in KOSDAQ.

These 54 stocks on average could be subject to further selling pressures in May and could underperform relative to the market.

The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in May include Ecopro Materials (KRX: 450080), Enchem Co Ltd (KOSDAQ: 348370), and Gaonchips Co Ltd (KOSDAQ: 399720).

🇰🇷 Alpha Generation Through Share Buybacks in Korea: Bi-Monthly (Mar and Apr 2024) (Douglas Research Insights)

In this insight, we discuss the alpha generation through companies that announced share buybacks in Korea in March and April 2024.

We provide a list of 30 stocks in the Korean stock market that have announced share buyback programs in the past two months.

Major companies that have announced share buybacks in Korea in the past two months include Krafton (KRX: 259960), Celltrion (KRX: 068270), and Woori Financial Group (NYSE: WF).

🇰🇷 South Korean REITs May Have Bottomed (Douglas Research Insights)

There are signs that the South Korean REIT market may have bottomed in the past 3-6 months after significant market underperformance from 2021 to 4Q 2023.

The 16 major Korean REIT stocks are up on average 5% YTD, outperforming KOSPI which is up 1.4% in the same period.

Differential in REIT dividend yield/Korean bond yield, meaningful discount to NAV, and increased capital allocation from Corporate Value Up program have been driving outperformance of Korean REIT stocks this year.

🇮🇩 Astra International (ASII IJ) – Striking a Balance with Finance

Astra International (IDX: ASII / FRA: ASJA / OTCMKTS: PTAIF) just released 1Q2024 results, which reflected the softer auto and heavy equipment markets, although buoyed by better earnings for its finance arm,

The company’s headline net profit was down -14% YoY but stripping out value adjustments was only down -5% YoY, with management optimistic over the longer term.

Astra continues to mirror the Indonesian economy, with its latest investment in geothermal but its nickel businesses also growing. Valuations attractive on 6.6x FY2024E PER and a 7.2% dividend yield.

🇸🇬 DBS Reports Record Profit of S$2.96 Billion and Ups Interim Dividend by 42%: 5 Highlights from the Bank’s 1Q 2024 Earnings (The Smart Investor)

Singapore’s largest bank continues its momentum by reporting an impressive set of results for the quarter.

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) is the first of the three local banks to report its first set of earnings for 2024.

Here are five highlights from the bank’s latest set of financial results.

Total income and net profit at record highs

Slightly improved NIMs and loan book

Fee income surpasses S$1 billion

Quarterly dividend shoots up 42%

Raising its outlook for 2024

🇸🇬 Mapletree Logistics Trust’s DPU Dips Slightly to S$0.09003 for FY2024: 5 Highlights from the Logistics REIT’s Earnings (The Smart Investor)

🇸🇬 Sheng Siong Reports an Increase in Revenue and Profits: 5 Highlights from the Retailer’s Latest Earnings (The Smart Investor)

The supermarket operator continues to expand its store count in Singapore even as it grows its top and bottom lines.

Sheng Siong Group (SGX: OV8 / OTCMKTS: SHSGF) is a familiar name for most Singaporeans.

The supermarket operator has opened 70 outlets across the island selling a wide assortment of products such as live and chilled seafood, meat, vegetables, toiletries and essential items.

Here are five highlights from Sheng Siong’s latest financial report card.

Continued growth in revenue and net profit

Higher gross and net margins

Increasing its store count

A cautious business outlook

Business development initiatives

🇸🇬 Will iFAST Hit S$100 billion in AUA by 2030? (The Smart Investor)

The fintech company reported a record AUA high of S$21.05 billion in 1Q 2024.

iFAST Corporation Limited (SGX: AIY / FRA: 1O3 / OTCMKTS: IFSTF) is progressing in the right direction towards its ambitious goal of achieving assets under administration (AUA) of S$100 billion by 2030.

There are two components in iFAST’s participation in the Hong Kong ePension project.

🇸🇬 WBUY: Initiating coverage of a Southeast Asian community-based buying group (SmartKarma) $

We are initiating coverage of Webuy Global (NASDAQ: WBUY) with a $0.85 target valuation.

Webuy Global is a community-based buying group platform that sells groceries, fresh produce, and packaged travel tours through its app in Indonesia and Singapore.

The company is attempting to leverage its customer relationships to expand into additional markets where group buying has shown promise, like insurance.

🌍🇨🇳 Will Meituan beat DeliveryHero in Saudi Arabia? (Momentum Works)

🇹🇷 Reysaş Logistics Stock: A Speculative Buy On Turkey Corridor Function (Seeking Alpha) $

Reysas Tasimacilik ve Lojistik Ticaret (IST: RYSAS / OTCMKTS: RYSKF) stock has gained nearly 28% compared to 7.3% for the S&P 500.

Difficulty in accessing financial information from the company’s website makes analysis challenging.

The depreciation of the Turkish Lira and inflation pose limited risks, but the company has opportunities in the logistics industry in Turkey.

🇦🇪 NWTN Inc.: The Perfect Fundamental Short (Seeking Alpha) $

NWTN Inc (NASDAQ: NWTN), an electric vehicle company based in Dubai, is overvalued with a market cap of $1.9B despite nominal revenues and significant losses.

NWTN is burning through its cash and has a toxic PIPE financing agreement in my opinion, raising concerns about its financial stability.

NWTN has all the makings of a perfect fundamental short: extremely overvalued, nominal revenues, huge losses, and low short interest.

🇿🇦 Raubex forecasts better-than-expected annual results and a solid order book (IOL)

(Infrastructure development and construction materials supply groups) Raubex (JSE: RBX / FRA: B7P) said yesterday that headline earnings per share (HEPS) of between 451.7 cents and 491.0c was expected for the year to February 29, representing an increase of between 15% and 25%.

The group said in an updated trading statement yesterday the full-year results, expected to be released on May 13, would be based on better-than-expected results achieved in February 2024 across all four divisions, as well as finalisation confirmations on a number of outstanding claims submitted.

🇿🇦 Remgro: Maziv Deal Pending Antitrust Reviews (Seeking Alpha) $

Remgro Ltd (JSE: REM / FRA: RE7 / OTCMKTS: RMGOF) is a major holding company in South Africa with a substantial NAV discount, but there are outstanding challenges that mitigate possible catalysts.

One possible catalyst though is the pending review of a wireline infrastructure transaction that should value Remgro assets highly.

The merger of Remgro’s beverage businesses with Heineken South Africa has faced challenges due to weak volumes and competition, and the write-off caused a sell-off in stock.

This may be a decent time to consider a position. The ZAR remains generally weak, though, and politics in South Africa are unfortunately considerations.

🇿🇦 SA a hotbed for mining M&A activity amid BHP’s bid for Anglo American (IOL)

“Certainly we can say that we’re seeing a lot of M&A activity in SA mining at the moment. Balance sheets in the industry are generally quite strong which certainly paves the way for M&A,” (Anchor Capital’s mining and investment analyst Seleho Tsatsi) Tsatsi said.

For example, Sibanye Stillwater Ltd (NYSE: SBSW) has been doing several deals in the battery metals space.

“We have seen several mining companies look to acquire copper assets over the past few years,” added Tsatsi.

Anchor Capital believes that there are two reasons for BHP Group (NYSE: BHP)’s interest in Anglo-American (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) and these include “Anglo’s copper volume growth” and “the copper price outlook” which many believe is more lucrative that other metals.

🌎 🇰🇾 Patria Investments: How To Play The Drop On Q1 Earnings (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) is a ‘best in class’ Asset Manager with a leadership position in Latin America.

PAX has grown quickly and profitably – more to come.

PAX offered value before earnings, but a post earnings drop creates opportunity.

🌎 MercadoLibre: Another Staggering Quarter (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) recently delivered a stellar quarter with strong revenue and EPS growth.

The company’s financial position has significantly improved, with a $6 billion cash pile and a rapidly improving net cash position.

MELI’s business is spread across multiple Latin American economies, mitigating geographic concentration risks.

My valuation analysis suggests that MELI’s shares are more than two times undervalued.

🌎 Ternium: Expected Margin Contraction Makes Me Avoid This Stock Despite A Cheap Valuation (Seeking Alpha) $

Ternium S.A. (NYSE: TX) is a leading steel manufacturing company with a strong market presence in the Americas, primarily in Mexico.

Topline should continue to expand with strong demand in the Mexican region.

Margins are expected to be under pressure in the coming quarters, which makes this stock a hold despite a discounted valuation.

🇧🇷 Brazilian Steel Tariffs – Two Companies in Focus (Calvin’s thoughts)

A look at Companhia Siderurgica Nacional SA (NYSE: SID) – A Brazilian industrials conglomerate with heavy steel exposure, and Metalurgica Gerdau SA Preference Shares (BVMF: GOAU4 / GOAU3), the largest producer of long steel in the Americas

Looking at recent earnings presentations from Gerdau and CSN, we can see the impact that Chinese dumping has had on domestic sales for Brazilian steelmakers. Gerdau pulls no punches and highlights a volume increase of imports of around 50% in 2023 vs 2022.

CSN has held up better than Gerdau, but both have seen their sales volumes decrease. In the case of both companies, we can see that working capital has deteriorated recently. CSN has taken on leverage versus recent years, though it remains well below Debt/EBITDA levels seen in the 2010s. CSN has run with more leverage than GGB for decades. Working capital changes for both companies have been historically significant, showing recession level deteriorations.

🇧🇷 Ambev S.A.: Diversify Out Of U.S. Assets With Beer Made In Brazil (Seeking Alpha) $

The potential for an outlier U.S. dollar decline and the need for portfolio diversification make Ambev (NYSE: ABEV) an attractive foreign investment.

Ambev is trading at its cheapest valuation since the 2009 recession low and has a strong 6.5% dividend payout, 5x the S&P 500 rate.

The company’s stable brand-name business model, high profit margins, low-debt balance sheet, and undervaluation including 10% in free cash flow generation, highlight an attractive buy choice.

🇧🇷 Embraer explores options for aircraft to rival Airbus and Boeing (FT) $ 🗃️

🇧🇷 The Petrobras Absurdity: Yield Exceeds P/E (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) stock currently has a 7% dividend yield and a low P/E ratio of 4x.

Thus, PBR stock offers an attractive package combining value, current income, and international exposure.

I disagree with the consensus estimates of its EPS growth, which are too pessimistic given the catalysts I am seeing.

With its single-digit P/E ratio and the market’s pessimistic sentiment, any EPS growth has the potential to trigger an outsized price rally.

🇧🇷 Banco Santander (Brasil): ROE Still Low And Competition Ahead (Seeking Alpha) $

The bank (Banco Santander Brasil (NYSE: BSBR)) gradually moves from a conservative strategy to a more daring one, characterized by increased competition and delinquency.

The company is taking steps to modernize, but I am skeptical about the bank’s ability to compete in the new banking dynamics.

The bank has worse financial indicators than its peers, but its multiple includes a premium. The valuation doesn’t make sense to me.

🇲🇽 CEMEX: Weak Volumes Point To A Bumpier Road Ahead (Rating Downgrade) (Seeking Alpha) $

We recap CEMEX (NYSE: CX)‘s Q1 earnings report.

The company has benefited from higher pricing and easing cost pressures, balancing weaker volume trends.

Limited upside in margins and slowing growth could pressure Cemex’s stock with more volatility going forward.

🇲🇽 CEMEX: Still A Good Buy As Volume Recovery Continues (Seeking Alpha) $

CEMEX (NYSE: CX) is experiencing volume decline but expects growth in the coming quarters due to improving weather conditions and economic conditions in the U.S. and EMEA regions respectively.

Q1 2024 performance saw significant volume declines in the EMEA and US regions, but robust results in the Mexican segment.

The company’s long-term prospects look promising, with potential volume recovery, strong pricing, and growth in the Urbanization business. Valuation is still at a discount.

🇵🇪 Cementos Pacasmayo Margins Are Still High, But The Stock Is Not An Opportunity (Seeking Alpha) $

Cementos Pacasmayo (NYSE: CPAC) is a cement manufacturer with a quasi-monopoly in the Northern region of Peru.

The Peruvian cement industry has been shrinking in 2023 and 2024, leading to lower volumes for Pacasmayo.

Pacasmayo’s higher prices and cost-saving measures have helped maintain margins.

However, if demand continues to shrink, I believe Pacasmayo will need to reduce prices and its margins will shrink. Under that scenario, the dividend is not covered.

Although the company trades at low multiples even under my more bearish scenario, I do not believe it is an opportunity, given there is still room for demand to shrink.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 US’ China bashing reminiscent of Japan in 1980s (The Asset) 🗃️

Past tensions limited to economics, but current extend to political, ideological realms

In remarks to the American Chamber of Commerce in Guangzhou on April 5, visiting US Treasury secretary Janet Yellen voiced concern about “production capacity that significantly exceeds China’s domestic demand, as well as what the global market can bear”.

Echoing US gripes about Japanese exporters in the late 1980s and early 1990, she added: “Overcapacity can lead to large volumes of exports at depressed prices.”

Three days later in Beijing, the former US Federal Reserve board chairwoman noted that China “has long had excess savings” – another familiar American complaint about Japan in the late 20th century.

“The real issue at hand is not Chinese overcapacity, but rather Washington’s over-anxiety,” Chinese news agency Xinhua wrote in a commentary (Xinhua Commentary: Washington should stop double-dealing when it comes to U.S.-China relations) on April 28, “that originates from its stubborn denial of the undeniable trend of the Global South’s increasing prominence in globalization.”

🇨🇳 It’s the End of the Foreign Exchange Reserves as We Know It – Don’t Feel Fine About it. (Gold Goats ‘N Guns)

In their April 26th livestream, the Alexes at The Duran brought up the brilliant point that the real target of this move to seize Russia’s forex reserves wasn’t Russia, but China. (START AT the 3:00)

Sec. of State Antony Blinken’s ‘performance’ in Beijing was nothing short of a declaration of war, as Alex Mercouris put it, and he’s absolutely right. It’s good to see both of them come to the same conclusion I reached during the first days of the Bii-Denn! Junta…

🇨🇳 Blinken warns China. Sanctions, Proxy War and Regime Change (The Duran) 16:42 Minutes (CLIP)

🇨🇳 The Folly of China’s Real-Estate Boom Was Easy to See, but No One Wanted to Stop It (WSJ) 🗃️

🇨🇳 Shift in economy sees rural migrant workers seeking jobs closer to home (Caixin) $

More rural migrant workers are looking for jobs near their home, rather than working at factories in the Yangtze River Delta or Pearl River Delta regions, a report by the National Bureau of Statistics (NBS) shows.

The property sector’s downturn has significantly reduced the number of migrant workers it needs in construction and more rural workers are seeking jobs in the service sector in big cities, according to the 2023 report on migrant workers.

🇨🇳 Chinese airlines cut Labor Day holiday fares as travelers favor rail (Caixin) $

Airlines in China have been forced to cut fares for this year’s Labor Day holiday after overestimating the recovery in demand for domestic flights, according to recent travel data.

In comparison, figures revealed that following the pandemic, more Chinese are opting to travel via rail for shorter-distance trips, amid pervasive low consumer confidence and reduced business travel. Tickets on the country’s official online vendor sold out within hours of going on sale.

🇭🇰 Hong Kong rallies close to bull market territory (FT) $ 🗃️

Hang Seng set for strongest April performance among major stock indices

Property and finance stocks led gains in the broader market in Hong Kong on Monday. Sentiment was boosted by insurance group AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF), which reported a 27 per cent increase in new business value, a key indicator of its future profitability.

🇱🇰 New form of bond emerges from Sri Lanka’s $13bn restructuring talks (FT) $ 🗃️

🇿🇦 Moody’s rings alarm bells on structural reforms if ANC loses elections (IOL)

Moody’s Investor Services has warned that the administration that takes power following South Africa’s 29 May general election will face a handful of long-standing structural issues that weigh on the country’s economic growth and creditworthiness.

Moody’s yesterday said these issues included stimulating years of sluggish economic growth, curbing chronic power shortages and reducing very high unemployment.

🇿🇦 Energy crisis is SA’s defining anthem for past 30 years of democracy (IOL)

South Africa unfortunately suffers all the symptoms of a failed state as it faces the triple challenges of poverty, unemployment and joblessness.

The middle class and ultra-rich in our society meted out all sorts of criticism over the July unrest, but what most failed to take note of is that the poor are getting desperate as living conditions deteriorate, making it harder for people to even buy food amid a cost of living crisis.

This as South Africa’s rate of unemployment is the highest in the world. Why? Because over the past 30 years South Africa has been shutting down its economy and phasing out all forms of industrialisation.

🇿🇦 SA is still receiving a steady stream of FDI inflows, says PwC (IOL)

Foreign investors in South Africa have moderately positive impressions of public governance and the country’s business ecosystem due to a number of positive attributes in the economy.

This is according to the PwC Economic Outlook report for 2024 focusing on foreign direct investment (FDI) which was released yesterday.

🇿🇦 El Niño: SA farmers cautious in 2024/25 winter crop season (IOL)

Local farmers have remained cautious about the 2024/25 winter crop season after witnessing the damage of unfavourable weather conditions during the 2023/24 season.

This is according to Agricultural Business Chamber (Agbiz) chief economist Wandile Sihlobo as farmers of wheat, barley, canola, oats, and sweet lupines appeared to lack appetite to plant.

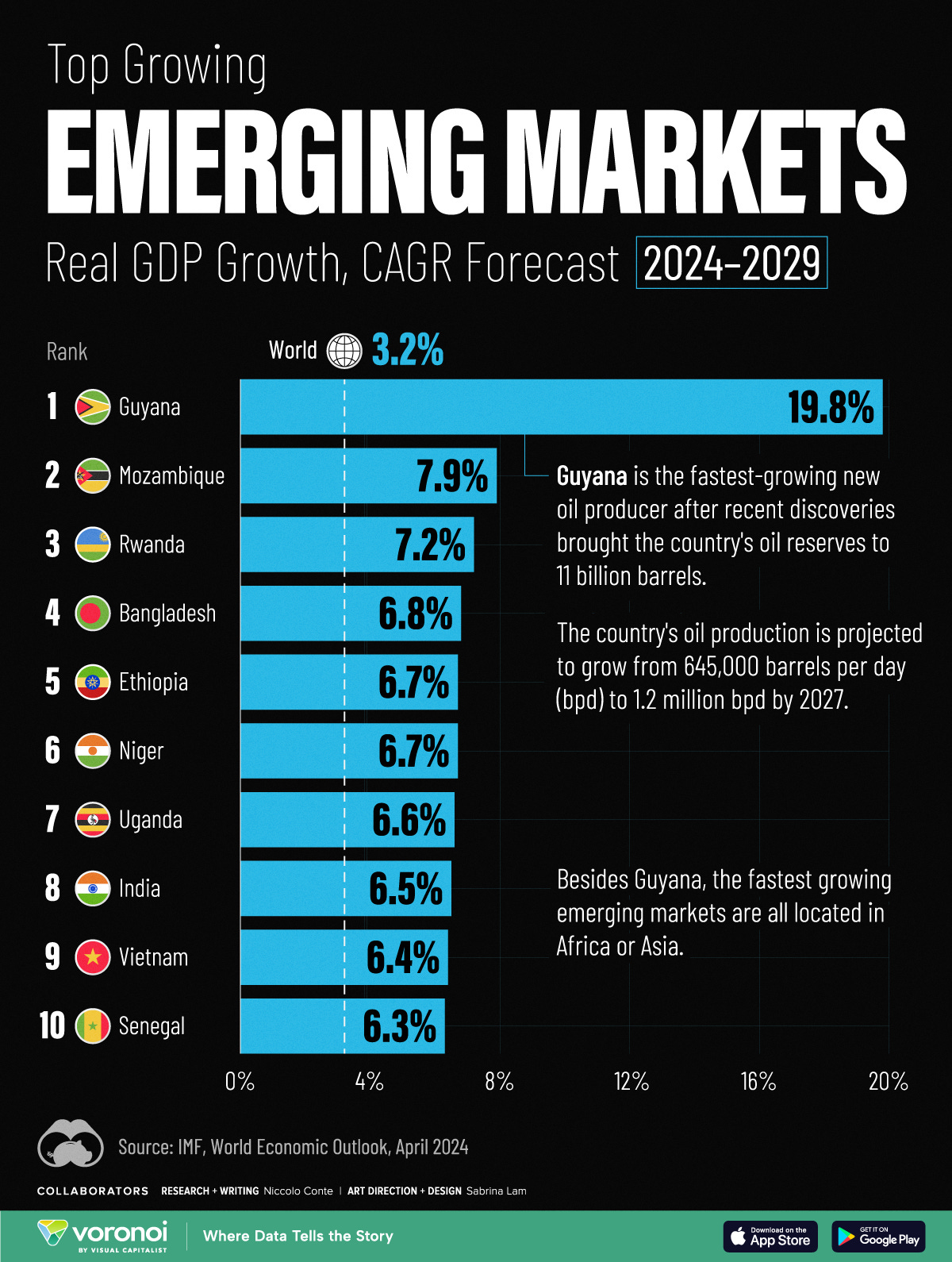

🌐 The World’s Fastest Growing Emerging Markets (2024-2029 Forecast) (Visual Capitalist)

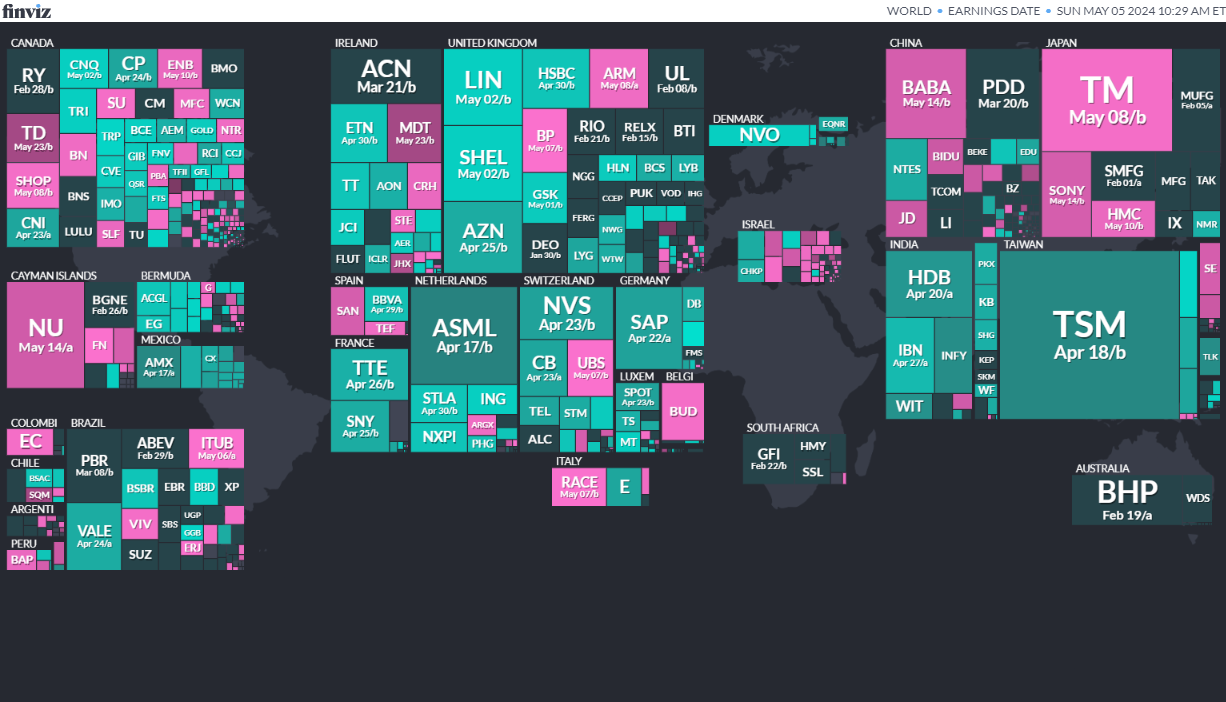

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

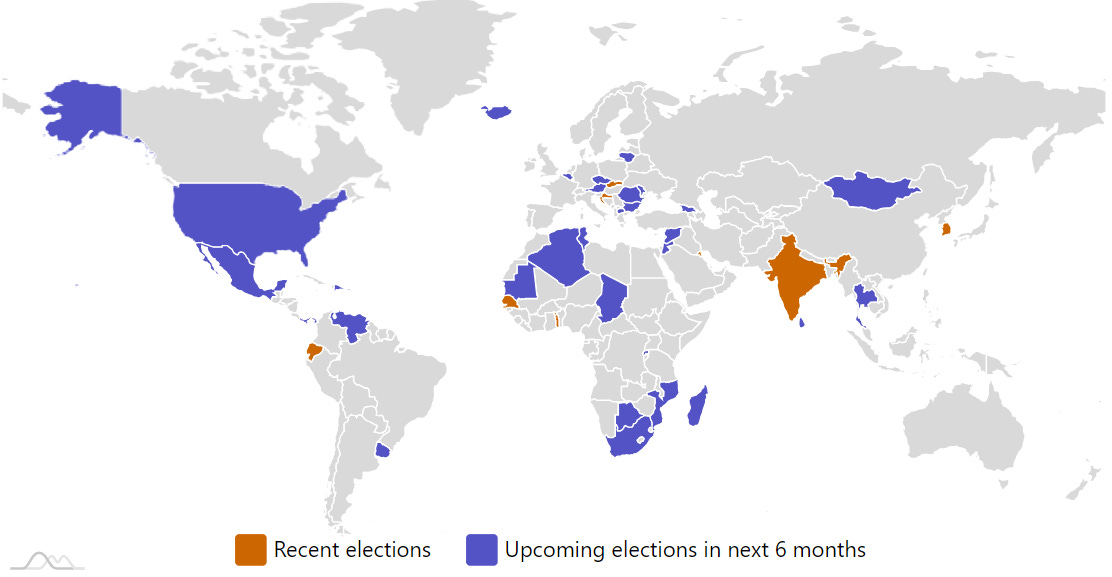

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

India Indian People’s Assembly Apr 19, 2024 (d) Ongoing Apr 11, 2019

-

PanamaPanamanian National AssemblyMay 5, 2024