Emerging Market Links + The Week Ahead (November 13, 2023)

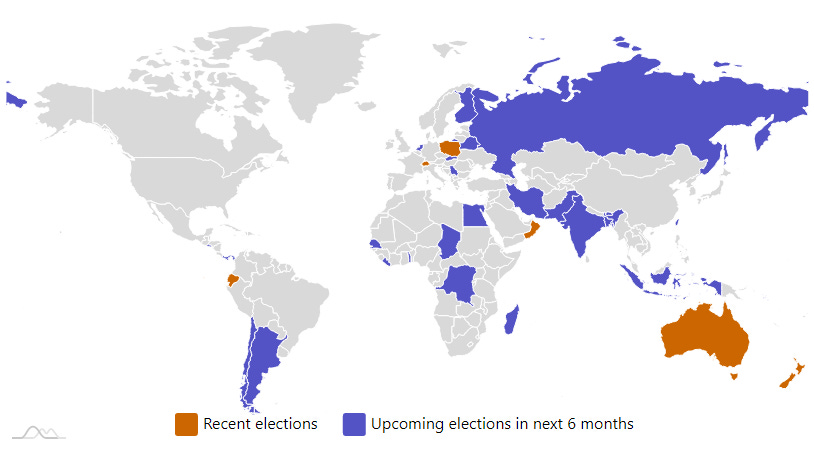

The Financial Times has noted the coming battle between world leaders and bond vigilantes as multiple nations go to the polls next year (a record year of voting since data collection began in the early 1960s – see our election calendar later in this post). This means pre-election spending by governing parties will be punished. Key emerging market countries cited for risks included India (politicians are spending at the state level…), South Africa and Mexico.

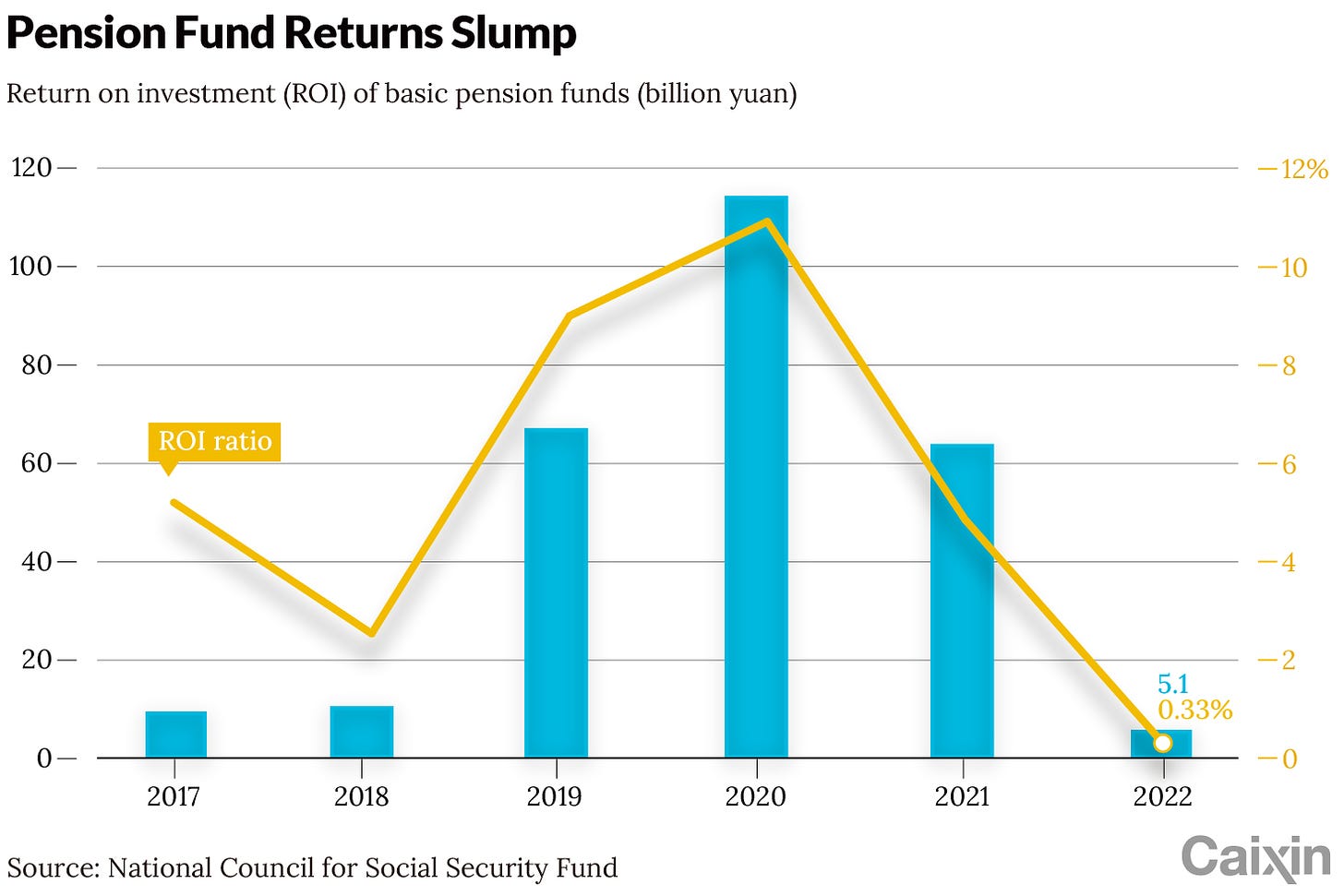

Finally, an official Chinese report has noted that basic pension funds’ had record-low returns of 0.33% last year. Such low returns have no doubt helped to contribute to the property mess in China.

$ = behind a paywall / 🗃️ = Archived article

Note: I am Tokyo until Wednesday when I have a long layover in the Taipei airport (where the old computer I travel with has trouble connecting to the airport Internet). The Tuesday post will likely again be later in the week…

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 EHang: Hollow Order Book And Fake Sales Make This China-Based eVTOL Company Last In Line For Takeoff (Hindenburg Research)

Also see: EHang Responds to Short Seller Report

To summarize, when faced with allegations of suspicious product purchases by a conflicted party, EHang Holdings (NASDAQ: EH) CEO Hu Huazhi seemingly chose to flagrantly mislead shareholders by claiming that the aircraft purchases were arm’s length.

Overall, EHang seems to have a major credibility issue—whether it be by fluffing up its preorder book (which looks to almost entirely be vapor) or by brazenly misleading about early sales that bear all the hallmarks of fake revenue.

Trust is crucial in the aviation industry, both for investors and potential customers who are literally putting their lives at risk. We think the company is a fatal accident waiting to happen, both for investors and for passengers.

🇨🇳 (Li Auto Inc. (LI US, BUY, TP US$47) Target Price Change): Li’s MEGA Can Change the MPV Landscape (SmartKarma) $

Two days before Huawei and Chery releasing their Luxeed S7 sedan to rival Model 3, Li Auto (NASDAQ: LI) unveiled the technical details of its MPV entry MEGA;

We see MEGA taking a meaningful market share from BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF)’s Denza D9, GM’s GL8, GAC’s Trumpchi M8, all selling ~10K a month. We raise MEGA’s 2024 shipment to 57K;

We raise LI’s TP from US$40 to US$47 and maintain BUY.

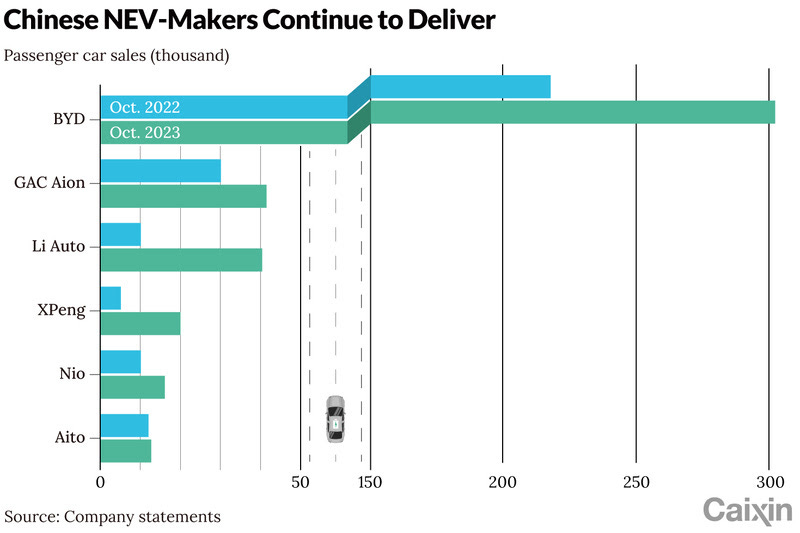

🇨🇳 Chart of the Day: BYD Pulls Further Ahead of Chinese Rivals (Caixin) $

BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) sold far more new-energy vehicles (NEVs) than many of its younger Chinese competitors in October, despite their strong sales.

The privately owned automaker set a new monthly delivery record last month with sales of 301,095 passenger NEVs, a year-on-year increase of 38.4%, according to a stock exchange filing dated Wednesday. Of the cars sold, about 55% were pure electric vehicles (EVs). The rest were plug-in hybrids.

🇨🇳 NaaS zooms ahead with growing focus on EV infrastructure operators (Bamboo Works)

China’s leading provider of electric vehicle charging services said its revenue rose more than 500% in the third quarter, and added the figure could grow as much as six-fold next year

EV services company NaaS Technology (NASDAQ: NAAS) said its revenue rose 536% in the second quarter, powered by a huge jump in its energy solutions business serving infrastructure operators

The Bain Capital-backed company is rapidly expanding outside Mainland China, and expects to get 40% of its revenue from offshore sources next year

🇨🇳 Xiao-I tries to generate buzz in crowded China AI field (Bamboo Works)

The recently listed AI developer has unveiled the nation’s latest large language model ecosystem tool, as it focuses on helping business to automate their processes

Xiao-I Corporation (NASDAQ: AIXI) has introduced its Hua Zang Universal Large Language Model ecosystem, becoming China’s latest company trying to capitalize on demand for conversational AI services

Commercializing the product will be challenging in an increasingly crowded field with more than 100 similar products in the market

🇨🇳 Industry woes chip away at ASMPT, with little relief in sight (Bamboo Works)

The chip packaging equipment maker’s profit nearly evaporated in the third quarter, marking its fifth consecutive quarter of declines

ASMPT’s (HKG: 0522 / FRA: AY7A / OTCMKTS: ASMVF) profit fell 98% in the third quarter, and is unlikely to rebound in the short-term as demand for electronic goods remains weak

The chip packaging equipment maker estimated its fourth-quarter revenue will total between $390 million and $460 million, down 23.2% year-on-year at the midpoint

🇨🇳 New Oriental Education delivers a lesson in business revival (Bamboo Works)

The education giant has sealed its return to financial health with quarterly adjusted profits at a three-year high and revenues back to 92% of their level before a crackdown on the training sector

Since divesting its academic tutoring business, New Oriental Education (NYSE: EDU) has bounced back by developing new education ventures, beating market expectations for both revenue and profit in its latest quarter

The results pushed its share price to a two-year high, prompting major banks to raise their target price for the stock

🇨🇳 Mengniu Dairy (2319 HK): Positive Read-Across From Yili 3Q23 Results And Briefing (SmartKarma) $

The read-across for Inner Mongolia Yili Industrial Group Co (SHA: 600887)‘s 3Q23 results and briefing to China Mengniu Dairy Company (HKG: 2319 / FRA: EZQ0 / EZQ / OTCMKTS: CIADY / CIADF) was overall positive.

For 3Q23, Yili’s sales grew 3% yoy and net profit increased 59% yoy, mainly due to lower raw milk prices, better product mix, cost savings and low base.

China Mengniu Dairy Co (2319 HK) continues to be a good value play, with reasonable valuation (15x 2024E PE), stable growth (above 10% net profit growth), and proactive shareholder returns.

🇨🇳 Top regulators summon big developers for financial briefings (Caixin) $

🇨🇳 Exclusive: China authorities ask Ping An to take controlling stake in Country Garden (Reuters)

Chinese authorities have asked Ping An (HKG: 2318 / OTCMKTS: PNGAY) to take a controlling stake in embattled Country Garden (HKG: 2007 / OTCMKTS: CTRYF / OTCMKTS: CTRYY), the nation’s biggest private property developer, four people familiar with the plan said.

China’s State Council, which is headed by Premier Li Qiang, has instructed the local government of Guangdong province, where both companies are based, to help arrange a rescue of Country Garden by Ping An, said two of the sources who have direct knowledge of the matter.

🏴 MGM China eyes more of ‘booming’ Macau biz: Hornbuckle (GGRAsia)

🇭🇰 🇹🇼 Asian Dividend Gems: Yue Yuen Industrial (SmartKarma) $

Yue Yuen Industrial Holdings (HKG: 0551 / FRA: YUE1 / OTCMKTS: YUEIY) has a scalable business model with high dividend yield (6.4%). Its sales and net profit are expected to increase by 9.3% YoY and 55% YoY, respectively in 2024.

The company is likely to enjoy higher sales and profits in 2024 due to improved footwear inventory destocking cycle, higher sales and profits at its subsidiary Pou Sheng.

Yue Yuen Industrial is one of the largest footwear and athletic shoe manufacturers in the world. Its major customers include Nike, Adidas, Puma, and Reebok.

🇹🇼 Eclat Textile (1476 TT): Start Of Upcycle (SmartKarma) $

Eclat Textile (TPE: 1476) is a vertically integrated textile company, with around 20% net profit margin, similar to Shenzhou International (HKG: 2313).

The company just reported 3Q23 results, with sales down 26% yoy and net profit down 28% yoy. Starting the next quarter 4Q23, the company is expected to return to growth.

The company now trades at 23x 2024E earnings. I believe the valuation is reasonable as growth returns, and there are potential upside catalysts.

🇹🇼 Gogoro: Great Growth Story But Not Translating Into Actual Growth (Seeking Alpha) $

Gogoro (NASDAQ: GGR)‘s main products are electric motorcycles, batteries, and battery swap stations.

Gogoro’s financial results have been disappointing despite its growing business reach.

Gogoro has partnerships with multiple motorcycle brands and operates in various countries.

Those partnerships are helping the company’s battery business grow but very likely cannibalizing its e-bike business, hurting its growth prospects.

🇹🇼 ASE Technology Holding: Might Be Getting Ready For A Breakout (Seeking Alpha) $

ASE Technology Holding (NYSE: ASX) has gotten caught in sideways action for months, but there is reason to believe change is coming.

ASX has a number of things in its favor, but none more so than an expected return to YoY growth and an end to the recent downturn.

While there are many who are expecting an imminent end to the downturn, it is possible semiconductor demand could surprise by staying weaker than expected.

ASX is a stock worth holding on to for several reasons, but it may be premature to be putting new money to work.

🇰🇷 Paradise Co posts ‘record’ quarterly op profit in 3Q (GGRAsia)

Paradise Co Ltd (KOSDAQ: 034230), an operator of foreigner-only casinos in South Korea, reported net profit attributable to shareholders of KRW35.26 billion (US$27.0 million) for the three months to September 30, according to a presentation published on Thursday. That was up 19.9 percent from the preceding quarter, but down 10.4 percent from a year earlier.

Brokerage NH Investment & Securities Co Ltd suggested in September that the resumption of Chinese group tours should boost South Korea’s inbound visitor traffic and eventually contribute to a “sharp recovery” in the number of mass-market foreign customers to the latter nation’s casinos.

🇰🇷 NCsoft: Launch of Highly Anticipated Throne and Liberty MMORPG Game (SmartKarma) $

NCSoft Corp (KRX: 036570) plans to launch the highly anticipated new MMORPG game called Throne and Liberty in Korea on 7 December 2023.

NCsoft reported operating profit of 16.5 billion won (down 89% YoY) and revenue of 423.1 billion won (down 30% YoY) in 3Q 2023.

Throne and Liberty has a solid chance to become successful globally through Amazon Game platform, which is likely to drive a strong turnaround of NCsoft’s sales and profits.

🇰🇷 Celltrion (068270 KS): Record High Revenue and Operating Profit in 3Q23 Solidify Merger Stance (SmartKarma) $

In 3Q23, Celltrion (KRX: 068270) reported revenue and operating profit of KRW672B (+4% YoY) and KRW268B (+25% YoY), respectively, driven by broad-based growth across biosimilar portfolio and CMO revenue.

Operating profit margin is approaching 40% level, highest level in last two years, driven primarily by sales growth around high margin products. Net profit jumped 33% YoY to KRW221B.

In Oct’23, Celltrion received FDA approval for Zympentra, which is Celltrion’s first product approved as a new drug in the U.S., and is expected to receive patent protection until 2040.

🇮🇳 Kotak Mahindra Bank’s Uday Kotak: ‘It is better to be stupid now than sorry later’ (FT) $

Kotak Mahindra Bank (NSE: KOTAKBANK / BOM: 500247)

🇹🇷 Turkcell: Masterclass In Managing Inflation (Seeking Alpha) $

Turkcell (NYSE: TKC) has successfully managed its business in the face of high and persistent inflation in Turkey.

The company’s Q3/2023 financial results showed revenue growth exceeding inflation, leading to margin expansion and a surge in earnings.

Turkcell’s valuation appears cheap compared to the Communications Sector, but macro risks in the Turkish economy remain.

🇵🇱 Allegro – a new cycle for the Polish e-commerce giant? (Undervalued Shares)

For the month of October, Poland was the world’s best-performing equity market.

The WIG20 index soared an impressive 13%, even though it’s made up of the country’s heavyweight companies.

However, there is also Allegro.eu SA (WSE: ALE / FRA: AL0 / OTCMKTS: ALEGF), the homegrown version of Amazon.

The stock of Allegro reached a high of EUR 21 in 2020, but it has since come down to less than EUR 7. All the while, the underlying business hasn’t just grown by leaps and bounds, but it has also evolved in other (sometimes surprising) ways.

🇵🇱 Refining Profits: Why Orlen’s Valuation Spells Opportunity (Seeking Alpha) $

Polski Koncern Naftowy ORLEN Spólka Akcyjna (WSE: PKN / FRA: PKY1) recently finalized the consolidation of the Polish oil and gas sector by merging with Lotos and PGNiG.

The company has the ambitious goal to double its EBITDA by 2030, mainly driven by investments in both renewable energies and gas.

Orlen’s state-owned status, with the government holding a 49% stake, reduces regulatory uncertainties.

Despite oil and gas price volatility/cycle uncertainties, Orlen offers a strong value proposition due to its low debt, vertical integration, and growth potential in the enduring oil and gas demand.

🇧🇷 Lojas Renner: Time to Buy Brazil’s Largest Clothing Retailer? (Brazil Stocks)

In response to requests from readers, today we are going to talk about a well-known company in the Retail sector: Lojas Renner (BVMF: LREN3 / OTCMKTS: LRENY).

It is known for being the first Brazilian full corporation, a company without a defined controlling shareholder.

The largest shareholder is BlackRock with 10% of the shares.

The Board of Directors holds 0.40% of the shares and, the Management, 0.05%.

The remaining shares are scattered across the market.

🇧🇷 Nu Holdings Q3 Preview: Premium Valuation At Risk With Upcoming Headwinds (Seeking Alpha) $

Nu Holdings (NYSE: NU) beat Q2 earnings expectations, but shares are still overvalued based on valuation metrics.

I expect Q3 revenue and EPS to miss analysts’ estimates due to potential growth stagnation and market penetration challenges.

Rising delinquencies and high P/E and P/B ratios indicate a potential decline in customer growth and an overvalued stock.

🇧🇷 Afya: Poised For Growth, But Likely Fairly Valued (Seeking Alpha) $

Afya (NASDAQ: AFYA) is a leading Brazilian medical education group focused on lifelong medical learning.

The company’s growth is driven by acquisitions, robust cash flow, and rebounding demand post-pandemic.

Concerns about stock-based compensation, capital expenditures, and macroeconomic risks in Brazil are factors to consider.

Valuation multiples are below historical averages, suggesting a balanced investment stance.

AFYA’s outlook is characterized by ambitious growth plans for 2028.

🇧🇷 Itaú Unibanco: Bullish With Multiple Growth Tailwinds Into 2024 (Seeking Alpha) $

Itau Unibanco (NYSE: ITUB)‘s Q3 earnings were highlighted by solid growth.

An ongoing digital transformation of the bank as a broader theme across Latin America is driving cost efficiencies and supporting margins.

We see shares climbing higher through 2024 alongside a new credit growth cycle as regional Central Banks begin to cut interest rates.

🇧🇷 Gol: The Long And Winding Road (Seeking Alpha) $

Gol Linhas Aereas Inteligentes Sa (NYSE: GOL / BVMF: GOLL4)‘s 3Q23 results were decent, with a lower yield but a better load factor.

The airline has downgraded its guidance due to lower pricing and higher non-fuel costs.

The recent warrant issue and debt for equity swap have negatively impacted minority shareholders and GOL’s equity appreciation potential.

🇲🇽 Becle (Jose Cuervo) Company Write Up🥃🌵 (Secret Sauce Investing)

The market leader is Jose Cuervo, whose parent company, Becle SAB de CV (Cuervo) (BMV: CUERVO / FRA: 6BE / OTCMKTS: BCCLF), is the world’s largest tequila producer. Based in Mexico, the company trades on the Mexican stock exchange under the ticker $CUERVO.

Becle is a family owned business in the 11th generation of Cuervo family. The business produces, markets and distributes over 30 spirits, ready-to-drink cocktails and non-alcoholic brands in over 85 countries. Almost two thirds of sales are generated by tequila.

The company is facing the headwinds of inflation and the challenges of increased competition. The share price was down more that 18% after October’s poorly received results, the largest single day decline since it began trading six years ago.

$ = behind a paywall

🇨🇳 Chart of the Day: China Basic Pension Funds’ Record-Low Returns (Caixin)

China’s basic pension funds entrusted for investment saw a record-low rate of return of 0.33% last year, earning just 5.1 billion yuan ($758.2 million), an official report showed Saturday.

The return rate dropped for the second year in a row from its peak of 10.95% in 2020, according to the report released by the National Council for Social Security Fund (NCSSF).

🇨🇳 China should avoid a real estate ‘hard landing,’ former Chongqing mayor says (Caixin) $

China should take steps to avoid a hard landing for the distressed property market, such as the government building affordable housing and increasing people’s incomes, former Chongqing Mayor Huang Qifan said Monday in a forum.

He argued that China needs to avoid a 30–50% drop in home prices, land auction prices and home sales — defined as a hard landing —as the sector is undergoing a deep structural adjustment. He is currently executive academic vice president of the China Institute for Innovation & Development Strategy.

🇨🇳 China’s economy falls back into deflation in blow to recovery (FT) $

Tumbling pork prices undercut growth as consumer confidence lags

Producer prices fell for a 13th consecutive month, dropping 2.6 per cent year on year, against a 2.7 per cent decline forecast by economists and following a 2.5 per cent contraction in September.

🇵🇱 Rightwing Polish PM given chance to form next government (FT) $

🌐 The coming battle between world leaders and bond vigilantes (FT) $

As multiple nations go to the polls next year, pre-election spending by governing parties will be punished

As I noted early this year, ballots in more than 30 nations will offer a say to two out of every three adults in the democratic world — a record year of voting since data collection began in the early 1960s.

India’s risks are partially offset by the fact that it has a higher economic growth rate and showed fiscal restraint through the pandemic. But many state leaders have of late been engaging in a game of competitive populism.

South Africa is also at high risk. It has an unpopular candidate for re-election managing a widening deficit, and a large share of government bonds — 25 per cent — owned by foreigners.

🌐 Convergers and Laggards in Emering Markets (The Emerging Markets Investors)

Convergers in emerging markets can broadly be separated into two categories: first, countries attracting foreign direct investment and participating in the globalization of trade; second, countries starting from a very low base and achieving high growth because of successful economic reforms leading to increases in productivity. Highly successful convergers (e.g., China, Vietnam) have benefited both by launching economic reforms and by integrating into the global economy.

Finally, Latin America is the major outlier in emerging markets in its sustained poor economic performance and lagging GDP per capita growth. This conundrum has been called by economists the “Middle-Income Trap” and is loosely attributed to inconsistent and poorly designed policies and deteriorating “institutions.” Other possible contributors to Latin America’s decline have been extreme wealth concentration and sustained human and capital flight. Also, the region’s excessive and increasing dependence on commodity exports have subjected countries to highly destabilizing boom-to-bust cycles (referred to in economics as the “Natural Resource Curse).

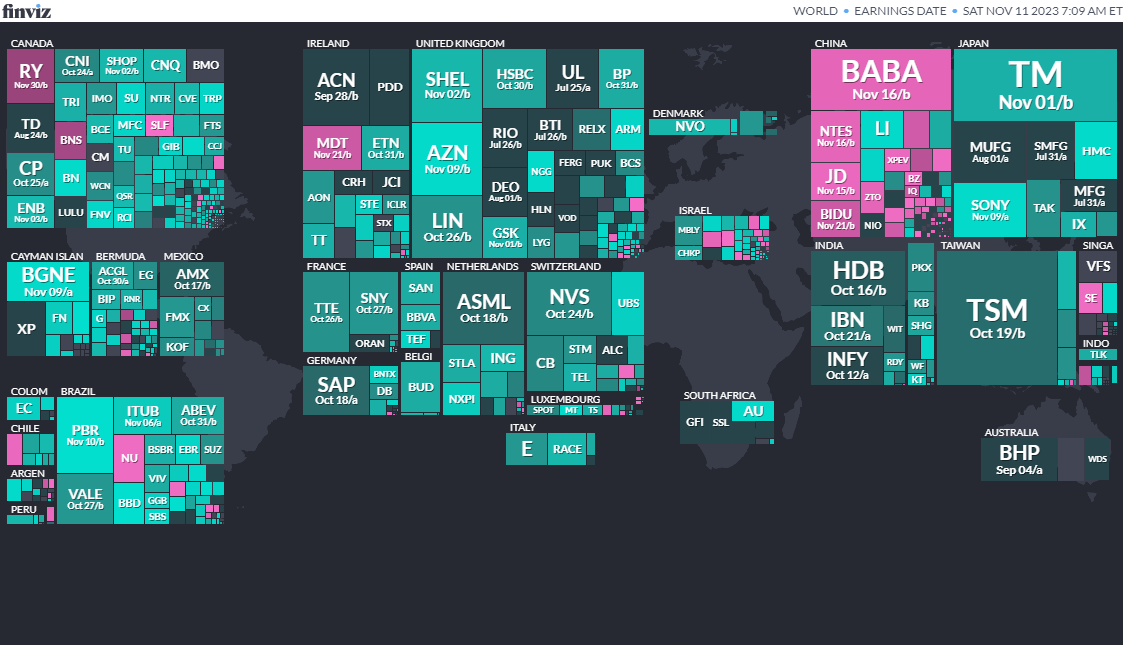

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Argentina Argentinian Presidency Nov 19, 2023 (d) Confirmed Oct 22, 2023

-

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023