Emerging Market Links + The Week Ahead (November 20, 2023)

There are some interesting developments involving China as they are set to ease the rules for foreign investors in stocks and derivatives just as the US federal pension fund will exclude Hong Kong and China investments. In addition, Caixin has reported how Chinese consumers are being deluged with cheap loans…

However, the really big or interesting news is how there might finally be hope for Argentina as Javier Milei has won the Presidency – apparently by 12 points. Argentina has always been a fascinating country and a warning to other so-called rich or developed countries. While rich in human, natural, and agricultural resources, the country has slid backwards to become a near hopeless basket case when it comes to politics and the economy for what seems like several generations now.

Whether Milei will be allowed to implement any of his ideas to try and fix Argentina remains to be seen as clearly he and his ideas are a threat to not just to his country’s political elite (just read ANY western mainstream media coverage about him…). But regardless of what you think of him and his ideas, you need to remember that one definition of insanity is doing the same thing over and over again – and that’s what Argentina has been doing… for several generations now…

Nevertheless, Argentina ADRs were rallying this morning – be sure to check out our recent post about the Argentina ETF’s holdings: The Flawed Global X MSCI Argentina ETF’s Holdings (September 2023).

$ = behind a paywall / 🗃️ = Archived article

This post was a little late as after I finished using expiring FF miles to visit Japan and returned to Malaysia, I flew to San Francisco ahead of Thanksgiving. SFO (at least the international terminal) was as crowded as I have ever seen it (or at-least in recent years) plus the now streamlined immigration was surprisingly the most efficient I have ever experienced there (a BIG surprise)…

I will start getting caught up on regular posts plus I need to figure out why I can’t save-publish new posts on my website – which is otherwise working (If you have not already, check out all the EM resources on it’s front page)…

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Dahua drives away as big winner from Stellantis’ Leapmotor investment (Bamboo Works)

Zhejiang Dahua Technology (SHE: 002236)

The former Zhejiang Leapmotor Technology Co Ltd (HKG: 9863) stakeholder earned a $600 million profit by selling its shares in the struggling EV maker to the Euro-American parent of Chrysler and Fiat

Leapmotor’s shares initially surged after introducing Stellantis as a major new investor, but quickly went into reverse as investors worried about its future

As part of the deal, Leapmotor founder Zhu Jiangming promised not to sell his stake in his company for a decade

🇨🇳 Zeekr Pre-IPO – The Positives – Has Been Growing Very Fast While Meeting Its Targets & Zeekr Pre-IPO – The Negatives – Remains Highly Dependent on Geely (SmartKarma) $

Zeekr, a premium EV brand by Geely Automobile Holdings (HKG: 0175), aims to raise around US$500m in its US listing.

Zeekr was formed in Mar 2021 as a JV between Geely and its founder. Its first model was launched in Apr 21 with deliveries starting in Oct 21.

🇨🇳 Alibaba International sharpens its merchant appeal with new AI tools (Bamboo Works)

The internationally focused unit of Alibaba (NYSE: BABA) announced the pilot launch of its first suite of AI-powered APIs, drawing on its experience in commerce and troves of industry knowledge

Alibaba International has pilot launched its first suite of AI-powered tools for global commerce merchants, covering functions like multilingual content localization and search engine optimization

The new tools could eventually help the company to diversify its business model and create more potential for additional revenue growth

🇨🇳 Tencent: Domestic Gaming Returns to Growth (SmartKarma) $

Tencent (HKG: 0700 / LON: 0LEA / FRA: NNND / OTCMKTS: TCEHY)’s 3Q2023 revenues fell marginally below consensus, however, OP beat consensus estimates. Domestic games returned to growth after a flat quarter in 2Q2023.

Both Online Advertising and Fintech businesses have seen strong increase in top line with GPM approaching new highs for the two businesses.

Though Tencent’s earnings show a recovery, we would remain cautious given the slowdown in Chinese economy and Tencent failing to make into new game approval list since July 2023.

🇨🇳 Luckin Coffee profits get added kick from liquor-laced lattes (Bamboo Works)

With a boozy new brew, the once scandal-tainted coffee chain has boosted its quarterly earnings and store numbers despite a brutal price war

Luckin Coffee (OTCMKTS: LKNCY)’s revenue and profit both jumped more than 80% in the third quarter, helped by the runaway success of its coffee flavored with Chinese Moutai spirits

The company’s co-founder and CEO, Guo Jinyi, said Luckin would carry on indefinitely with a 9.9 yuan per cup promotion, adding more fuel to China’s coffee price wars

🇨🇳 Henderson Land gets $7.7 billion helping hand in drive to become new ‘King of Central’ (Bamboo Works)

Lee Shau-kee has extended the developer HK$60 billion in loans as it expands its land holdings through pricey purchases in Hong Kong’s Central business district

Hong Kong’s Henderson Land Development (HKG: 0012 / FRA: HLD / OTCMKTS: HLDCY / HLDVF) has received $7.7 billion in loans from majority shareholder Lee Shau-kee with no collateral requirement or fixed repayment period

The Hong Kong developer had net liabilities of HK$77.9 billion at the end of June and a net liability ratio of just 24%

🇨🇳 E-House in rebuilding mode with latest plan to repay defaulted debt (Bamboo Works)

The real estate services provider wants to raise money through a new share sale as part of a complex plan to restructure its defaulted bonds

E-House (China) Enterprise Holdings (HKG: 2048 / FRA: 1VC) is working on a plan to raise HK$483 million by selling new shares through a rights offer

The funds raised would be part of a scheme to give cash and equity in the company’s key businesses to holders of its defaulted bonds

🇨🇳 Will Junshi Bio’s loss-making headaches ease with landmark U.S. drug approval? (Bamboo Works)

The FDA has given the nod to the Chinese company’s PD-1 drug, but most of the benefits will go to a third-party licensee

Junshi Bio (SHA: 688180) will receive milestone payments and 20% of sales of its PD-1 drug Toripalimab in the U.S., following the drug’s recent approval by the FDA

The drug maker’s revenue fell 19% year-on-year in the first nine months of 2023, as its net loss narrowed to 1.41 billion yuan

🇨🇳 Anta Sports takes its game to Southeast Asia (Bamboo Works)

A store opening in Bangkok marks the latest milestone for the sports apparel giant’s quest to tap international markets

After setting up a Southeast Asian department just last year, ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) has quickly set up shops in the Philippines, Malaysia, Singapore, Qatar and now Thailand

Anta’s revenue outside China has been negligible so far, but that may soon change as its new network gains traction

🇨🇳 Yonghe Medical’s share repurchase gets results, but can’t hide a receding profit line (Bamboo Works)

A big run-up in wages and marketing costs related to its aggressive expansion pulled the hair restoration company into the red in the first half of this year

Yonghe Medical Group (HKG: 2279 / FRA: L97)’s gamble on growing demand for its hair transplant services led to losses in the second half of 2022 and first six months of 2023

A stock repurchase plan announced late last month propped up its shares, but the stock is still down by about three-quarters from its 2021 IPO price

🇨🇳 Hygeia Healthcare Group (6078 HK): Double-Digit Revenue Growth in 1H23; Business Expansion Continues (SmartKarma) $

In 1H23, Hygeia Healthcare Group (HKG: 6078) reported revenue growth of 15% YoY to RMB1,760 million, mainly driven by a 16% YoY growth in hospital business.

Hygeia’s gross profit margin contracted 20bps YoY to 32.4%. Riding on 5.6x increase in government grant, operating profit jumped 33% YoY to RMB420M, leading to 320bps margin expansion to 23.9%.

In July, Hygeia acquired Chang’an Hospital for RMB1,660 million. The acquisition will provide Hygeia with greater room to expand its business in the northwest region of the PRC.

🇭🇰 Asian Dividend Gems: Dream International (SmartKarma) $

Based in Hong Kong, Dream International (HKG: 1126 / OTCMKTS: DRMMF) is one of the largest toy manufacturers in the world. It specializes on plush stuffed toys and plastic figures.

Despite the global toys markets going into destocking cycle, the company has generated significant growth in operating profit in the past year driven by strong demand for plush stuffed toys.

If we assume a moderate 20% YoY increase in dividends in 2023, this would imply DPS of HKD 0.48 and this would suggest a dividend yield of 12.7% current prices.

🇰🇷 SK Telecom: Three Key Catalysts (SmartKarma) $

In this insight, we discuss three key catalysts that are likely to positively impact SK Telecom (NYSE: SKM / KRX: 017670 / FRA: KMBA) in the next several months.

The current gap between SK Telecom’s 2023 expected dividend yield (6.6%) and US 10 year treasury note (4.47%) is 2.13%.

The gap between SK Telecom’s dividend yield and US 10 year treasury note yield could widen to 3-4%+ in 2024, making SK Telecom’s dividend yield more attractive.

🇰🇷 POSCO Holdings: Sell Or Short The Stock, A Bearish Trend Is On (Seeking Alpha) $

Posco (NYSE: PKX) has experienced significant growth since converting to a holding company structure in 2022.

PKX’s shares have been dropping since hitting a 52-week high, indicating a potential bearish trajectory.

The market has had mixed reactions to the company’s developments, and its over-ambitious plans may hurt its long-term growth.

Based on my technical analysis, I recommend selling this stock or initiating short positions.

🇸🇬 DBS Group: Recent Regulatory Challenges And Peak NIMs Mask Upside Potential (Seeking Alpha) $

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) faces regulatory challenges and penalties for digital banking service disruptions, but it has set aside funds to improve its systems.

DBS Bank’s long-term outlook is positive, with potential loan growth from the ASEAN region’s emergence as a global supply chain hub benefiting net income.

There is potential for a special dividend as DBS Bank carries excess capital on its balance sheet.

🇸🇬 Sea Ltd (SE US) – Paying the Price for Market Leadership (SmartKarma) $

Sea Limited (NYSE: SE) saw its 3Q2023 result swing back to a loss after turning on investment at Shopee during 3Q2023 in the face of competition.

The company was open about its renewed investment in growth during the previous quarter in the face of threats from TikTok Shop, which may have lessened post its Indonesia expulsion.

Sea Ltd may not have engendered itself with investors impressed with its ability to pivot like no other to actual profitability, now introducing an element of uncertainty. Valuations reflect this.

🇸🇬 Our thoughts on Sea’s 2023 Q3 earnings (Momentum Works)

The loss is, in our opinion, not the main concern. The lack of growth (GMV growth YoY of 5%, and QoQ probably lower than 5%) after doubling sales & marketing expenses (from US$493.6m to US$913m) is.

One key reason was that Shopee was trying various ways to defend its market share against TikTok Shop. This would be hard and expensive – as Sea Limited (NYSE: SE) CEO Forrest Li warned their entire team earlier.

The ban of TikTok Shop in Indonesia will not benefit Shopee as much as people might have thought; and Shopee probably anticipated TikTok Shop to come back one way or another, sooner or later.

🇸🇬 Our thoughts on Grab’s 2023 Q3 results (Momentum Works)

This is a good set of results but not the end – Grab Holdings Limited (NASDAQ: GRAB) still has milestones of positive free cash flow and eventually positive net income to hit. It has enough cash liquidity to do so;

Review of Grab’s acquisition of Singapore taxi operator Trans-cab by the country’s competition watchdog will last a while; while the Foodpanda leak will likely affect price expectations, not outcome of the negotiations.

How Grab achieves growth in MTUs and ads revenue are interesting to dissect (read the article for more details).

🇸🇬 Singtel Reports Higher Underlying Net Profit and Declares an Interim Dividend of S$0.052: 5 Highlights from the Telco’s Latest Results (The Smart Investor)

The telco made progress on its strategic reset but warned of macroeconomic headwinds that may dampen business sentiment.

Here are five highlights from Singtel (SGX: Z74 / FRA: SIT / SIT4 / OTCMKTS: SGAPY / SNGNF)’s fiscal 2024 first half (1H FY2024) earnings announcement.

A higher underlying net profit

Increase in customer base for Singapore offset by lower ARPU

Higher customer base and data usage for Optus

A strong performance from Digital InfraCo

Increased dividend payout ratio

🇸🇬 Singapore Airlines: Supply Dislocations Will Underpin Strong Profits for Much Longer (SmartKarma) $

Dearth of international flights from Chinese and Russian carriers — 2nd & 3rd biggest global aviation market, will distort supply, underpins strong yields and profitability.

Singapore Airlines (SGX: C6L / FRA: SIA1 / OTCMKTS: SINGY / SINGF)‘s cost management is superior thanks to high asset utilisation, stable SGD vs. the USD, and access to attractive financing. SIA’s competitors severely lack these attributes.

We forecast FY24 net profit of SGD2.4b (+13.1% YoY) and peg it to 10x PE to derive a TP of SGD8.07, +30% UPSIDE potential.

🇸🇬 SATS Tripled its Revenue and Turned in an Operating Profit: 5 Highlights from the Airline Caterer’s Latest Results (The Smart Investor)

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF)

The ground handler enjoyed higher revenue from its consolidation of WFS but still reported a small net loss.

Here are five highlights from the group’s latest financial report.

A surge in revenue led to an operating profit

A jump in operating metrics

Promising business developments

Rising cargo volumes

Focusing on the 3 Rs

🇿🇦 Life Healthcare lines up R2.1bn SA investment next year (IOL)

Life Healthcare Group Holdings (JSE: LHC / FRA: L53 / OTCMKTS: LTGHY / LTGHF) is bumping up its South African capital expenditure for the year to September 2024 to R2.1 billion to purchase a hospital it currently leases as well as spending on product development for its Life Molecular Imaging (LMI) unit.

Life Healthcare’s South African operations experienced strong demand for its services as it became the preferred network provider for medical aids. This led to higher utilisation of its hospitals and related services which delivered growth of 9.5%

In the outlook, Life Healthcare is anticipating continued growth across its southern African operations driven by growth in admissions from network deals and doctors recruited, with an expected growth in paid patient days of 3%.

🇿🇦 Sasol Limited: Undervaluation Presents Excellent Opportunity (Seeking Alpha) $

Sasol (NYSE: SSL) pays out a solid dividend that rewards shareholders with consistent income.

Sasol’s innovation strategy will improve margins and its product line resulting in compounding growth.

Assuming my DCF figures, Sasol is currently undervalued resulting in a buy rating.

🇵🇱 CD Projekt RED: A Stock I’m Putting In The Madeleine Portfolio (SmartKarma) $

CD Projekt SA (WSE: CDR / FRA: 7CD / 7CD0 / OTCMKTS: OTGLY / OTGLF) has the potential for significant growth in the gaming sector in the next 10 years, although with execution risk.

The company’s unique culture and focus on creativity have earned them a legendary reputation among gamers.

Despite the initial setbacks with Cyberpunk 2077, the game has received high ratings and CD Projekt RED has learned valuable lessons for future projects.

Future conservative estimates might indicate more than 800 million in sales for its next big hit, which means you’re paying only 3x future sales.

CD Projekt RED is definitely a takeover target for larger media or gaming companies.

🇧🇷 Petrobras aims to transform Brazil into global energy power (FT) $

Rising output from these vast deepwater reserves underpins an ambitious target by the Brasília government to reach fourth place by the end of the decade with 5.4mn b/d, ahead of the likes of Iran, Canada and Kuwait.

🇧🇷 Petrobras: Gained 90% Over One Year – Don’t Expect The Same (Seeking Alpha) $

Petrobras (NYSE: PBR / PBR-A) investors have outperformed their energy sector peers with a 1-year total return of over 90%, dismantling the bearish thesis convincingly.

The company’s relatively attractive valuation and strong production outlook have bolstered investor confidence. However, growth headwinds relating to its CapEx spending need to be considered.

Petrobras has benefited from Brazil’s falling inflation rates, as the “Lula discount” likely declined. However, PBR has struggled to regain its upward momentum above the $16.5 level.

I argue why PBR is still a rock-solid buy at steep pullbacks but not at the current level.

🇧🇷 Vale Is A Terrific Rotation Play With Significant Long-Term Potential (Seeking Alpha) $

Vale (NYSE: VALE) remains resilient in the face of global economic challenges, benefiting from a robust iron ore market.

Strong Q3 results demonstrate efficiency and cost-reduction efforts.

The company’s share buyback program reflects confidence in long-term value creation and potential earnings growth

🇧🇷 TIM S.A. Q3 Earnings: Attractive Developments In Dividend Payouts (Seeking Alpha) $

TIM Brasil (NYSE: TIMB) reported strong Q3 results, including robust revenue and EBITDA growth.

Concerns linger about TIM’s current unattractive valuation despite positive earnings.

The strategic move to increase future payouts reflects confidence in sustained dividends.

The sale of TIM Group’s Italian infrastructure aligns with restructuring efforts.

TIM’s overall performance is promising, but cautious investment is advised due to valuation concerns.

🇧🇷 Natura Takes A Bath To Pass On Body Shop Stink (Seeking Alpha) $

Natura & Co Holding (NYSE: NTCO)’s discounted sale of The Body Shop may help breathe new life into the eco-friendly brand.

Six years after snapping it up from L’Oréal for $1.1 billion, the $4 billion Brazilian cosmetics giant has agreed to sell the struggling maker of shower gels and body balms to private equity group Aurelius for 207 million pounds ($258 million).

The discounted price gives a whiff of distress, but in passing the buck, Barbosa can finally focus on turning around the rest of his company.

For The Body Shop, a full makeover is still risky, even when it comes this cheap.

🇧🇷 Gerdau: Q3 Earnings, Limited Short-Term Catalysts, Raises Concerns (Seeking Alpha) $

Metalurgica Gerdau SA Preference Shares (BVMF: GOAU4 / GOAU3)‘s 3Q23 results revealed continued weakness in most operating figures, with a downward trend on both sequential and year-on-year basis.

Challenges stem from diminished steel demand within Brazil and increased competition from Chinese steel, leading to a pricing battle in the domestic market.

The company is grappling with increased capital expenditures for maintenance and expansion, contributing to concerns about short-term cash flow generation.

Despite Gerdau’s appealing dividend, the combination of rising CapEx and contracting EBITDA makes the company less compelling for a dividend portfolio, warranting a neutral stance with a slightly more pessimistic outlook.

🇧🇷 JBS: Q3 Earnings, Strain Continues, But Glimmers Of Recovery (Rating Upgrade) (Seeking Alpha) $

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) faces challenges in 2023 linked to increased exposure to the North American market.

Q3 performance highlights ongoing issues in Beef North America but shows improvements in the U.S. beef sector.

Financial metrics reveal increased leverage but reduced net debt, with free cash flow rising in Q3.

Despite challenges, positive indicators and anticipated improvements in 2024 make JBS shares more appealing.

I’m shifting my recommendation from neutral to overweight, considering the potential for share appreciation, the upcoming dual listing, and the positive trajectory in the cattle cycle

🇨🇱 SQM: We Are Not There Yet (Seeking Alpha) $

Sociedad Química y Minera de Chile (NYSE: SQM) stock has dropped over 55% from its all-time highs due to declining lithium prices.

SQM’s financial results for Q3 2023 showed lower average sales prices in the lithium and fertilizer businesses.

The company’s outlook for lithium demand and prices remains uncertain due to an oversupply of lithium in the short term and potential negative impact from a global recession.

We remain patient waiting for a lower entry points as our model shows modest returns during the following three years.

🇨🇱 Sociedad Química y Minera de Chile: Bottom Setting In (Seeking Alpha) $

Sociedad Química y Minera de Chile (NYSE: SQM) reported below consensus 3Q23 results due to lower lithium prices and volumes.

Consensus estimates are expected to fall further as analysts update their models, potentially overestimating the impact of lower prices.

The bottom may have been reached at 9x PE YE24 reduced estimates.

Catalyst dependent on LCE prices and Atacama concession resolution.

🇨🇴 Ecopetrol – Colombian Supreme Court Delivers Massive Victory to Minority Shareholders (Calvin’s thoughts) $

Gustavo Petro’s government had introduced a change in royalty deductibility for income tax calculations. The measure had a material impact on Ecopetrol SA (NYSE: EC) bottom line results and was just struck down.

🇰🇾 Patria Investments Adds AUM As Challenging Conditions Persist (Seeking Alpha) $

Patria Investments Limited (NASDAQ: PAX) reported Q3 2023 financial results with distributable earnings of $0.23 per share and organic fund inflows of $1.3 billion.

The company provides access to alternative investment opportunities in Latin America and has a wide range of limited partners.

Despite positive performance, I remain neutral on Patria Investments Limited due to uncertainty about portfolio valuations in the near term.

$ = behind a paywall

🇨🇳 China Eases Rules for Foreign Investors in Stocks and Derivatives (Caixin) $

China is revising rules on the management of foreign institutional investors’ funds trading in domestic securities and futures, easing requirement for the funds’ registration and currency conversions.

The revisions are intended to attract foreign investors to domestic financial markets amid a decline in foreign investment due to concerns about economic growth and better returns elsewhere.

🇨🇳 US federal pension fund to exclude Hong Kong and China investments (FT) $

The $771bn Federal Retirement Thrift Investment Board said on Wednesday that it would change the benchmark index followed by its international fund. The move will mean a shift away from an index that includes Hong Kong-listed equities.

FRTIB’s decision to switch benchmark indices comes in response to mounting geopolitical risks

🇨🇳 In Depth: Chinese consumers deluged with cheap loans (Caixin) $

In the space of a month or so, three or four banks came knocking on the door of a top internet company in Beijing with some juicy offers — cheap personal consumption loans for staff in a group-buying arrangement.

The deals included loans of 300,000 yuan ($41,175) to as much as 500,000 yuan with some carrying annualized interest rates as low as 2.8%. Many were interest-only loans that allowed borrowers to repay the principal at the end of the three-year term.

🇨🇳 Government borrowings boosted China’s credit growth in October (Caixin) $

China’s credit growth continued strong in October, mainly boosted by government bond sales, but households borrowed less amid the protracted housing market slump.

New yuan loans reached 738.4 billion yuan ($101.3 billion) in October, up 17% of 105.8 billion yuan from a year earlier, according to data released Monday by the People’s Bank of China. The total beat the 700 billion yuan estimated by economists surveyed by Caixin.

🇦🇷 Argentina’s US-Traded Stocks Jump, With YPF Up 30% on Milei Win (Bloomberg Live Blog)

Libertarian outsider Milei trounces Economy Minister Massa to win presidency

Bonds losing steam after initial boost, US-listed stocks up premarket

Milei took 56% of vote, compared to 44% for incumbent Peronist rival

Focus now turns to specifics of Milei’s policies and cabinet picks

🇦🇷 Argentina’s fed-up farmers lean towards Javier Milei (Buenos Aires Times)

Here in the pampas, Argentina’s vast and fertile grasslands that stretch as far as the eye can see, farmers are fed up with excessive government controls and taxes that have long choked the agricultural industry.

After the country’s worst drought in a century saw agricultural exports plummet, leading to a shortfall of US$20 billion in revenue, the industry is expecting an excellent harvest in 2024.

In 2022, the agricultural sector exported 49.581 billion dollars, 8.5 percent more than in 2021 – vital support for Argentina’s indebted economy.

🇦🇷 Don’t anoint Milei just yet (Don Surber)

But Milei is a minor character at present. The big story was once again a country has used the ballot box to assert itself against the globalist wave of a world run by bureaucrats and billionaires who see humans as objects.

Axios reported, “The chaos in Argentina is nothing new. The country has already defaulted on its foreign debt nine times — in 1827, 1890, 1951, 1956, 1982, 1989, 2001, 2014, and 2020.

“A 10th default seems all but certain, given the degree to which the peso has devalued — it’s hard to pay dollar-denominated debts when your currency is in freefall.”

🇧🇷 Brazil raises $2 billion in ESG sovereign bonds debut (Reuters)

Brazil raised $2 billion on Monday with its first-ever ‘green’ bond issuance, part of an effort to set a benchmark for the private market while channeling funds toward the government’s ambitious sustainability agenda.

The seven-year bonds featured a 6.5% yield, said Finance Minister Fernando Haddad, confirming details reported earlier by Reuters.

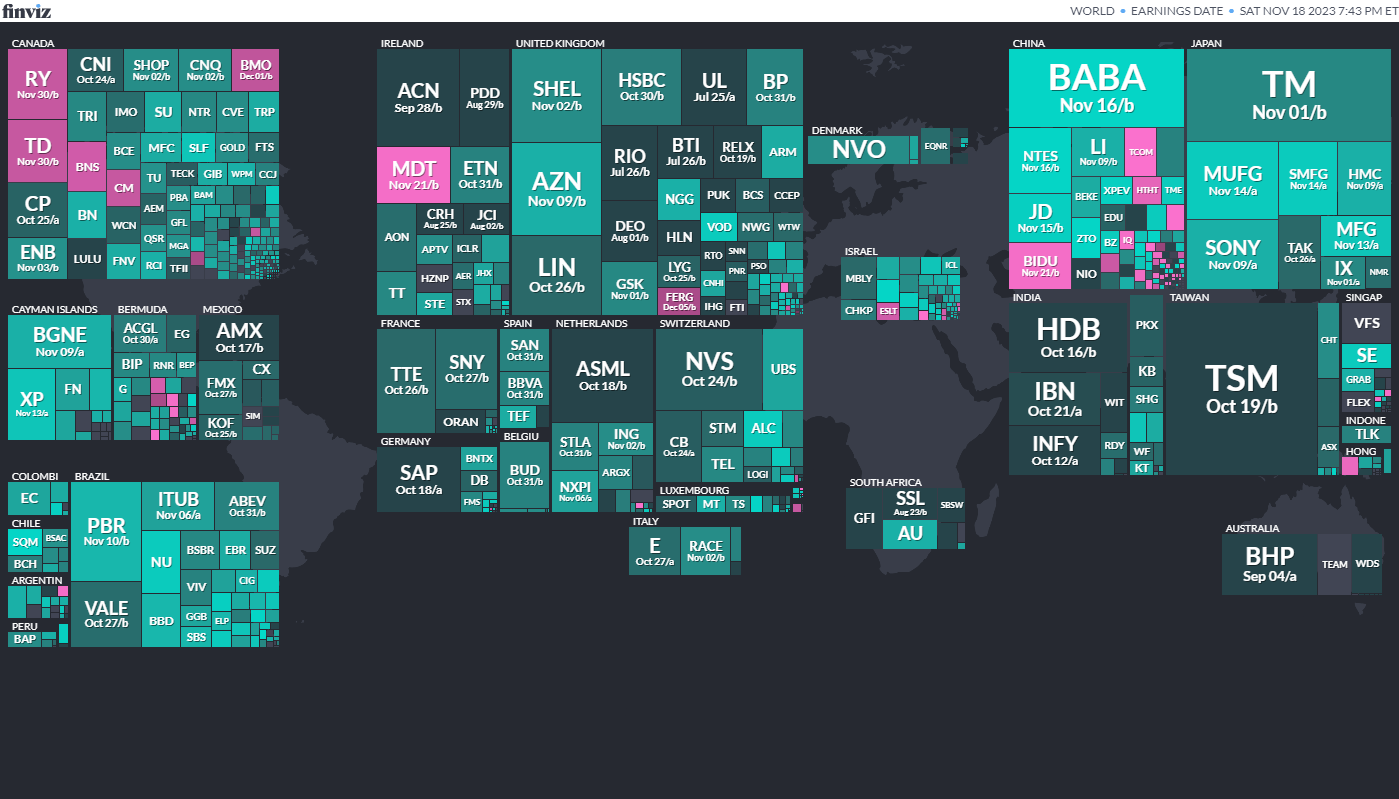

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

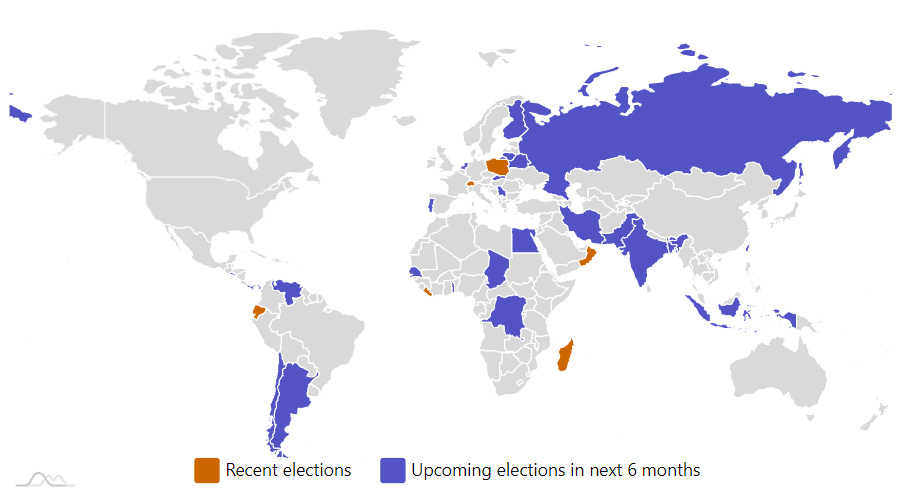

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

ArgentinaArgentinian PresidencyNov 19, 2023 (d) Confirmed Oct 22, 2023 -

Venezuela Referendum Dec 3, 2023 (d) Confirmed Feb 15, 2009

-

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023