Emerging Market Links + The Week Ahead (November 24, 2024)

RANDOM NOTE: On Saturday, I was on my way to a supermarket in the KLCC area and took a detour to the Kinokuniya bookstore below the Petronas Towers only to stumble upon Herald van der Linde, the host of HSBC’s Under the Banyan Tree Podcast and their Chief Asia Equity Strategist, giving a talk about his new book: Majapahit: Intrigue, Betrayal and War in Indonesia’s Greatest Empire.

Herald has also written Asia’s Stock Markets from the Ground Up (a good beginners’ primer on Asian stock markets) plus I remember him mentioning in his podcast about having written a book about the history of Jakarta – this was the first time I had seen a copy of that book: Jakarta: History of a Misunderstood City (Unfortunately, I had no cards on me, just enough cash for groceries…)

Also at the talk was Rose Gan who is writing her fourth book about the history of Penang and its founder Captain Francis Light (Dragon (Penang Chronicles), Pearl (Penang Chronicles) & Emporium (Penang Chronicles)). I suggested to both that someone should write a book about the history of Kuala Lumpur as I am not aware of any book just about the history of the city itself (usually only Hong Kong, Shanghai, and Singapore have city history books written about them).

I also asked Herald if he knew of a good book in English covering the Dutch-Indonesian war of impendence (aka 1945-50ish) and he suggested Revolusi: Indonesia and the Birth of the Modern World that was recently published by a Belgian author who also wrote a bestseller about the Congo (Congo: The Epic History of a People)…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China sends its 150,000,000,000th parcel this year (Momentum Works)

We all know that ecommerce parcel delivery in China is a big industry, powering the country’s gigantic online shopping sector, as well as the fierce competition amongst the top ecommerce platforms: Alibaba (NYSE: BABA), PDD Holdings (NASDAQ: PDD) or Pinduoduo, JD.com (NASDAQ: JD), Douyin, and Kuaishou Technology (HKG: 1024 / 81024 / LON: 0A74 / OTCMKTS: KUASF / KSHTY).

This morning (18 Nov), State Post Bureau of China, the regulator of parcel delivery services, announced that yesterday (17 Nov 2024), the cumulative volume of parcels sent out in China had surpassed 150 billion (or 150,000,000,000) for the 1st time.

You can make sense of this number in the following ways:

🇨🇳 Our thoughts on Alibaba restructuring and PDD earnings (Momentum Works)

On 21 November, two stories rocked China’s ecommerce scene, with global implications.

First was Alibaba (NYSE: BABA)’s announcement to merge its domestic Chinese and international ecommerce businesses into a single unit called Alibaba Ecommerce Business Group. Jiang Fan, hitherto CEO of Alibaba International Digital Commerce Group (AIDC), will head the new unit as CEO. The new unit will also include B2B marketplace 1688 and 2nd hand C2C marketplace Xianyu.

Second was PDD Holdings (NASDAQ: PDD) or Pinduoduo, the parent company of Pinduoduo and Temu, again missing revenue consensus in its Q3 earnings. It also missed on earnings. The stock price plunged more than 10%. Not as drastic as the 30% drop after previous quarter’s earnings and a peculiar CEO remark, but still …

These two events are closely related to each other, signifying the further intensification of the ecommerce platform competition in China. Some of our thoughts:

🇨🇳 (PDD Holdings (PDD US, BUY, TP US$146) TP Change): C3Q24: Painful Reversal of Its Merchant Squeeze (Smartkarma) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo reported C3Q24 top line, non-GAAP EBIT and non-GAAP net income (2.6%), (12.4%) and (6.3%) vs. cons., and (3.4%)

PDD is easing its appeasement of China-platform merchants, positive for profitability, but its transition to the semi-consignment model will likely continue as it tries to improve merchandise selection and logistics quality

We reiterate BUY as PDD is undervalued at 8.1x CY2025 P/E, but we cut its TP to US$ 146 to reflect slower growth amid increasing overseas investment.

🇨🇳 PDD (PDD US): 3Q24, Focuses on Growth, But Not Profit Margin (Smartkarma) $

In 3Q24, PDD Holdings (NASDAQ: PDD) or Pinduoduo released strong revenue growth, but a flat margin.

We believe, in 2025, PDD will continue to focus on growth rather than profit.

We conclude an upside of 43% and a price target of US$167 for 2025. Buy.

🇨🇳 PDD Holdings (PDD) – Amazon’s Greatest Threat? (Bristlemoon Capital) $

A deep dive on the high-growth, e-commerce powerhouse

Welcome to Bristlemoon Capital! We have written previously on APP, IBKR, PAR, AER, PINS, BROS, MTCH, CPRT, RH, EYE, TTD, and META.

So what got us interested in PDD Holdings (NASDAQ: PDD) or Pinduoduo? Well, for starters, it is growing its profits at 156% year-over-year yet trades on a cash-adjusted FY25E P/E of just 6x. We will look at how PDD makes money across its Pinduoduo and Temu businesses, dive into the unit economics of these platforms, and then look at the growth prospects for PDD.

🇨🇳 Nongfu Spring founder attacks livestream sales model and low-price platforms (Caixin) $

Zhong Shanshan, the billionaire founder of Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF), has criticized the livestream sales model and low-price e-commerce platforms such as Pinduoduo, arguing that they harm Chinese brands by lowering price systems and he called on the government to intervene.

Speaking on Tuesday during a visit to a navel orange factory in Jiangxi, he said: “I will never engage in livestream sales, and I distain those entrepreneurs who do so. Those businesses are flat, ours is vertical. We have roots, but they don’t.”

🇨🇳 $BIDU Quick Pitch (The Chop Wood, Carry Water Newsletter)

Founded in 2000 as a search engine platform, Baidu (NASDAQ: BIDU) was an early adopter of artificial intelligence to make content discovery on the internet easier.

Expected Gain: China has unleashed a digital monster. With growth opportunities in AI, cloud, and autonomous technologies, I believe that with an estimated $3 billion in free cash flow and a 10% discount rate, the company could double in value.

🇨🇳 Chinese tech groups build AI teams in Silicon Valley (FT) $ 🗃️

🇨🇳 (KE Holdings Inc. (BEKE US, BUY, TP US$25) TP Change): C3Q24 Review: C4Q24 Rebound but What’s Next? (Smartkarma) $

KE Holdings (NYSE: BEKE) reported C3Q24 revenue in-line with our estimate and consensus but non-GAAP operating profit 26%/25% below, mainly due to higher commission rebate and agent salaries;

Strong rebound in home transaction volumes in October and November, led to our C4Q24 revenue 16% above consensus. But the rebound needs more stimulus to sustain;

We maintain the stock as BUY and raise TP to US$25 to reflect the near term rebound and steady market share gains.

🇨🇳 Trip.com (9961.HK, TCOM): 3Q24, Still Healthy, But Stock Price Exceeded Our Last Target (Smartkarma) $

Trip.com (NASDAQ: TCOM)

The stock has risen by 38% since our last buy rate.

The 3Q24 results are still healthy – both growth rate and operating margin.

We set a downside of 19% for the end of 2025.

🇨🇳 2025 High Conviction: Tencent Music Entertainment (TME) – Music as Promising Future (Smartkarma) $

Our 2024 High Conviction, the stock of Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) has risen by 87% in one year.

We believe the market ignores Tencent Music Entertainment Group (NYSE: TME) because of its flat revenue.

However, we expect TME will significantly benefit from its dominant position in the Chinese music market.

🇨🇳 Tuya: Improving Sales Growth and Profit Margins Help to Clinch Investment by 65 Equity Partners (Douglas Research Insights) $

On 18 November, it was announced that 65 Equity Partners (backed by Temasek) will invest US$100 million (S$134 million) for a 13% stake in (internet of things services provider) Tuya Inc (NYSE: TUYA).

Net cash as a percentage of market cap is currently at 92%. Tuya’s sales growth and improvement in operating margin in 1Q-3Q 2024 have also been impressive this year.

Comps are trading at average EV/EBITDA of 13.7x in 2025 versus 2.3x for for Tuya. If Tuya continues its turnaround, its valuation gap versus its peers could decrease further.

🇨🇳 EHang finds more lift in its long flight to profits (Bamboo Works)

The company’s third-quarter revenue surged as it continues to achieve milestones in the journey to commercialize its autonomous aerial vehicles

EHang Holdings (NASDAQ: EH)’s third-quarter revenue soared 348% as its order book swelled after its self-flying aircraft got a key green light from China’s aviation regulator last year

The company is getting close to starting commercial operations of its unmanned aircraft in China as it clears a growing number of regulatory requirements

🇨🇳 XPeng Launches its First Store in Singapore: 3 Things You Should Know About This Chinese EV Company (The Smart Investor)

Recently, Chinese electric vehicle maker, XPeng (NYSE: XPEV), announced its official entry into the Singapore market. Here are several interesting facts about this company.

With a market capitalisation of US$12.3 billion, XPeng ranks as one of China’s more successful EV companies.

The company brands itself as a leading Chinese smart EV company that manufactures vehicles for technologically-savvy middle-class consumers.

Let us find out more about this smart EV company, which has recently expanded its operations in Singapore by opening its first showroom at UOB Plaza in July.

🇨🇳 NaaS drives into third quarter with first-ever quarterly non-IFRS profit (Bamboo Works)

The provider of services for EV charging station operators also posted its highest-ever gross margin in the third quarter, as it shifted its focus to an asset-light business model

NaaS Technology (NASDAQ: NAAS) reported its first non-IFRS quarterly profit in the three months to September, as well as a record-high gross margin

As China’s leading provider of services to EV charging station operators, NaaS has wound down its low margin offline business to focus on higher-margin platform-based management services

🇨🇳 Zeekr’s IPO honeymoon ends with forced marriage to Lynk & Co. (Bamboo Works)

The recently listed maker of luxury electric vehicles controlled by Geely Automobile Holdings (HKG: 0175 / FRA: GRU / OTCMKTS: GELYY / GELYF) will pay $1.3 billion for 51% of one of its parent’s units that only recently entered the EV market

ZEEKR Intelligent Technology Holding Limited (NYSE: ZK)’s shares fell 27% after it announced its plan to purchase a majority of the Lynk & Co. brand from its parent for 9.4 billion yuan

Zeekr’s vehicle deliveries grew 51% in the third quarter, down sharply from growth rates in the previous two quarters, as it said it was on track to reach its annual sales target

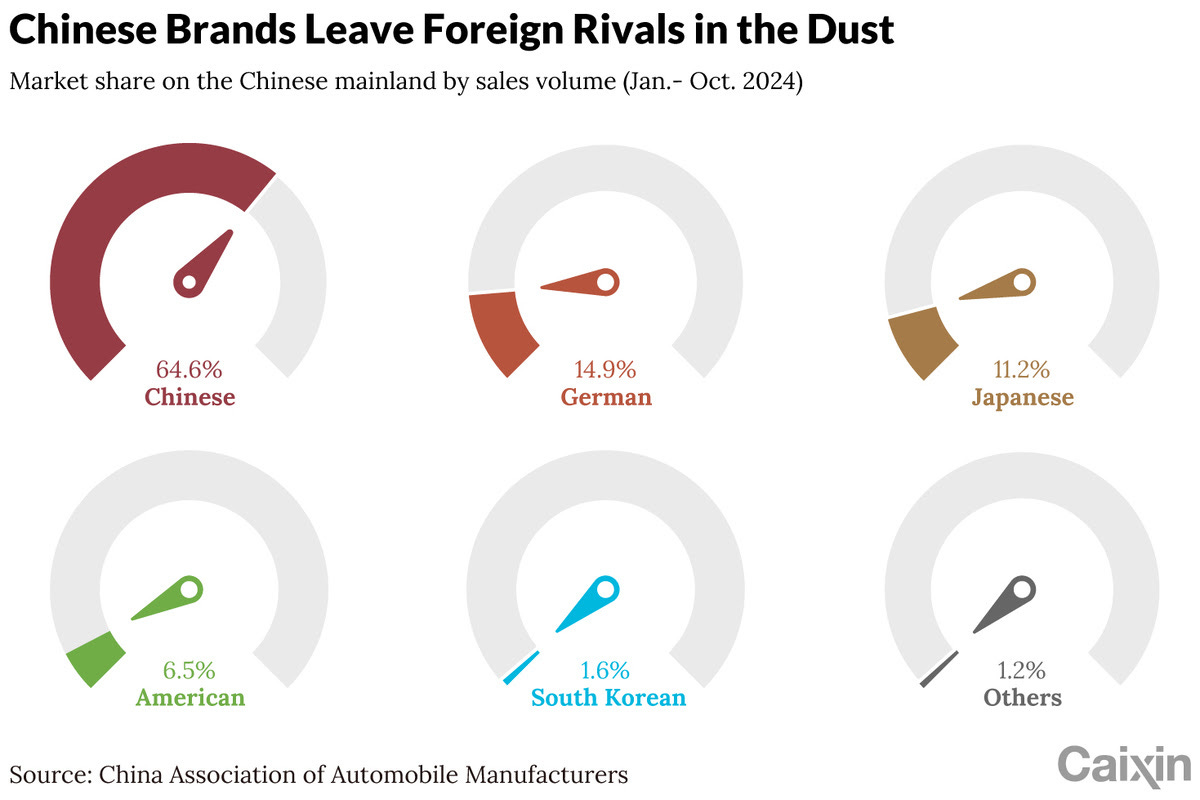

🇨🇳 In Depth: How BMW, Audi and Mercedes Ended Up Also-Rans in China (Caixin) $

As a price war has raged in the world’s largest auto market, Volkswagen AG’s luxury brand Audi has increased the average discount that it’s offering on vehicles to nearly 30%, well above the average of 14% across the entire domestic market, according to Chinese auto consultancy firm Ways. BMW followed by boosting its average discount to 25%, and Mercedes-Benz with nearly 20%.

And yet sales have fallen. For the first half of 2024, Mercedes-Benz’s deliveries to China slumped 9% year-on-year, according to company data. BMW’s sales were down 4.3% from the same period in 2023, while Audi’s fell 2%.

There was a time when the BMW name was enough of a status symbol in China that the average car buyer could be easily talked out of choosing a less expensive luxury vehicle from a domestic automaker.

A former BMW salesperson recently recalled how he once tried to persuade a customer to buy an i3 electric subcompact over the BYD luxury model they were also considering.

🇨🇳 Rebounding RLX plots course beyond China (Bamboo Works)

Tacking against regulatory headwinds in its home market, China’s leading vaping company has begun aggressively diversifying overseas

RLX Technology (NYSE: RLX)’s third quarter revenue rose 52%, as its gross margin rose more than 3 percentage points to 27.2% following a regulatory crackdown in 2021

A year after expanding beyond its China base, international business accounted for more than half of the vaping company’s revenues in the third quarter

🇨🇳 (Atour (ATAT US, BUY, TP US$37) Review): Small Differences Here & There but Overall Case Intact (Smartkarma) $

(Portfolio of lifestyle hotel brands) Atour Lifestyle Holdings (NASDAQ: ATAT) reported C3Q24 revenue 2.3% lower than our estimate but 4.8% higher than consensus. The net income beat our estimate/consensus by 6.6%/9.5%, thanks to disciplined cost controls.

Although RevPAR weakened in C3Q24 as expected, turnaround is coming already in C4Q24. We also expect moderate RevPAR growth in 2025.

We keep the TP at US$37/ADS and maintain a TOP BUY on Atour.

🇨🇳 Jiangxi Rimag Group Lock-Up Expiry: Cornerstone Investor May Sell Shares After 200%+ Post-IPO Gains (Smartkarma) $

Shares of Jiangxi Rimag Group Co Ltd (HKG: 2522), a medical group with focus on medical imaging in China, rose 200%+ since IPO and massively outperformed Hang Seng Index.

A Nanchang-based medical imaging center operator priced its IPO at HK$14.98/share and raised ~HK$183M in June. Cornerstone investors have agreed to acquire ~8M H shares.

I expect key cornerstone investor may sell shares after 200%+ post-IPO gains as early lock-up period will end on December 6th, 2024.

🇨🇳 Xingda (1899 HK): Go Figure As Offer Turns Unconditional (Smartkarma) $

Back on the 24 September, tyre component manufacturer Xingda International Holdings Ltd (HKG: 1899 / FRA: XDH / OTCMKTS: XNGIF) announced a zero-premium $1.30/share cash Offer from Liu Jinlan, chairman and executive director.

Liu and concert parties held 37.03%, and the Offer was conditional on a 50% acceptance hurdle. The IFA concluded the Offer was not fair.

Surprisingly, 23.73% of shares out have tendered, and the Offer is now unconditional in all respects. The Offer will remain open to acceptances until the 29th November.

🇨🇳 Zijin Mining’s prospects glitter on acquisitions, rising gold and copper prices (Bamboo Works)

China’s leading gold and copper miner has also gotten a lift from low interest rates and could benefit from growing demand for electricity with the rise of EVs and AI

Zijin Mining Group (SHA: 601899 / HKG: 2899 / FRA: FJZB / OTCMKTS: ZIJMF) has acquired several new projects this year, including the latest involving a gold mine in Peru

The Fed’s new cycle of policy easing and elevated federal U.S. debt could pressure the U.S. dollar, in turn boosting gold prices

🇨🇳 Ping An Insurance – Set For Success (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇭🇰 Tam Jai results leave sour taste of dining downturn (Bamboo Works)

Tam Jai International Co Ltd (HKG: 2217 / FRA: 29S)

Hong Kong’s biggest chain of rice noodle shops has posted sharply lower half-year profits and is having to rethink its Asian expansion strategy

The company’s net profit more than halved in the first half of the year, squeezed by price competition and weak consumer confidence

The dining chain is planning to scale back its network in mainland China and Singapore

🇭🇰 Prada (1913 HK) (Asian Century Stocks) 22:23 Minutes

High fashion at 14x EV/pretax profit with an alt-data catalyst

It’s an Italian fashion group listed in Hong Kong, of all places. Many European and American investors ignore the name, which has caused Prada SpA (HKG: 1913 / FRA: PRP / PRP0 / OTCMKTS: PRDSY / PRDSF) to trade at a considerable discount to its peers.

🇲🇴 Galaxy Entertainment: Consider Company’s Recovery Progress And Thailand’s New Casino Plan (Seeking Alpha) $ 🗃️

-

🇲🇴 Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) 🇭🇰 – Develops & operates a large portfolio of integrated resort, retail, dining, hotel & gaming facilities in Macau. Operates 3 flagship destinations. 🇼 🏷️

🇲🇴 Cabo Verde govt cancels Macau Legend casino project rights (GGRAsia)

The government in the West African island nation of Cabo Verde says it has terminated the concession for Hong Kong-listed casino services firm Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) to develop and operate a casino resort there.

The authorities said Macau Legend “flagrantly and repeatedly” breached its obligations regarding the project’s development, reported on Tuesday Portuguese news agency Lusa.

In May, the company completed the disposal of its Laos casino resort, Savan Legend Resorts in Savannakhet, Laos. In Friday’s filing, Macau Legend said it recorded a profit of HKD75.0 million from the discontinued operation during the reporting period.

🇲🇴 Macau Legend to contest Cabo Verde casino deal cancellation (GGRAsia)

In an annoucement to the Hong Kong Stock Exchange on Friday, Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) confirmed it was “seeking legal advice in Cabo Verde” on the “appropriate course of action” to defend its interests.

The firm “intends to vigorously contest these allegations to safeguard the interest of the company and its shareholders,” Macau Legend stated.

🇲🇴 EBITDA a focus in Macau market share battle: Jefferies (GGRAsia)

Banking group Jefferies expects Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) and Galaxy Entertainment (HKG: 0027 / OTCMKTS: GXYEF) to be share gainers in Macau’s six-operator casino market during 2025, noting the quality and range of their hotel offer – including additional rooms – can boost gaming volumes.

“We expect mild shift in market share among the six operators in 2025/26 with Sands/Galaxy gaining share with the reopening of Londoner’s hotel capacity and opening of Galaxy’s Capella,” stated the institution in a Thursday report.

🇹🇼 Asian Dividend Gems: Teco Electric & Machinery (Asian Dividend Stocks) $

TECO Electric Machinery Co Ltd (TPE: 1504) is one of the leading companies in Taiwan that specialize in electrical machinery and industrial automation.

Teco Electric & Machinery provides high dividend payout and solid dividend yield. From 2020 to 2023, the company’s dividend payout and dividend yield averaged 72.9% and 4.6%, respectively.

The company is one of the beneficiaries from the need to upgrade the global energy distribution and storage networks to support the higher usage of AI in the coming years.

🇰🇷 DoubleDown Interactive Q3: KPIs Are On A Decline, Not Enticing Right Now (Seeking Alpha) $ 🗃️

🇰🇷 KB Financial Group: Not A Value Trap, I’m Staying Long (Seeking Alpha) $ 🗃️

🇰🇷 SK Square: A Solid Corporate Value Up Plan Likely to Lead to Continued Outperformance (Douglas Research Insights) $

SK Square (KRX: 402340) announced a solid corporate value up plan pushing up its share price by 8.8% to 87,500 won on 22 November.

Major highlights of the corporate value up plan included cancellation of 200 billion won of treasury shares, higher ROE target, and achieve 1x PBR ratio (nearly double the current ratio).

Our NAV analysis of SK Square suggests NAV of 15.2 trillion won or 112,822 won per share, representing 29% higher than current share price.

🇰🇷 A Step Closer to Samsung Life Insurance Finally Selling Its Shares in Samsung Electronics? (Douglas Research Insights) $

Amid Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) announcing a huge buyback of 10 trillion won, one of the issues that has resurfaced is the potential sale of Samsung Electronics by Samsung Life Insurance (KRX: 032830).

The total amount of Samsung Electronics that could be sold by Samsung Life Insurance and Samsung Fire & Marine Insurance (KRX: 000810 / 000815) is 25.6 trillion won (at current prices).

We remain Positive on Samsung Electronics. The 10 trillion won buyback program is a positive sign on the company’s willingness to provide higher shareholder returns.

🇰🇷 Samsung’s princeling heir Lee Jae-yong grapples with corporate crisis (FT) $ 🗃️

🇰🇷 LG Corp: Key Highlights from Its Corporate Value-Up Plan and Updated NAV Valuation (Douglas Research Insights) $

In this insight, we provide the major highlights of the solid Corporate Value Up plan announced by LG Corp (KRX: 003550 / 003555) on 22 November.

The key highlights include about 500 billion won worth of share cancellation by 2026, improved dividend policy, and higher ROE target.

Our base case NAV valuation analysis of LG Corp suggests implied NAV of 16.1 trillion won or NAV per share of 102,426 won, which is 33.4% higher than current price.

🇰🇷 Korea Value Up Index Rebalance on 20 December (Douglas Research Insights) $

🇰🇷 CJ Cheiljedang: Considering a Potential Sale of Its Bio Business (Douglas Research Insights) $

(Food ingredients, ambient, frozen and chilled packaged food products, pharmaceuticals and biotechnology player) CJ Cheiljedang Corporation (KRX: 097950) announced that it is considering on potentially selling its bio business for about 5-6 trillion won which could be more than its market cap.

CJ Cheiljedang’s bio business is expected to have more than 4 trillion won in sales and about 700 billion won in EBITDA in 2024.

We are positive on the company’s efforts to sell its Bio Business and reinvest it in its food business.

🇰🇷 Kioxia IPO Preview (Douglas Research Insights) $

Kioxia plans to complete its IPO on 18 December, valuing Kioxia at 750 billion yen ($4.8 billion), down nearly 50% from the initial market value estimates about 2-3 months ago.

Kioxia had revenue of 909.4 billion Yen (up 84.6% YoY) and EBITDA of 449.6 billion Yen in 1H FY24, driven by the recovering demand for data center and enterprise SSDs.

As of 2Q 2024, Samsung Electronics (KRX: 005930 / 005935 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF) was the largest player in the global NAND Flash market with a 36.9% market, followed by SK Group (22.1%), and Kioxia (13.8%).

🇵🇭 PLDT: Potential Growth Opportunities Amid The Philippine Economic Recovery (Seeking Alpha) $ 🗃️

🇸🇬 Bitdeer Technologies: Managing The New Economics Of Bitcoin Mining (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇸🇬 Canaan: Q3 Earnings, Is The ‘Digital Gold’ Rush Coming? (Seeking Alpha) $ 🗃️

🇸🇬 Marina Bay Sands tapping US$9bln loan to expand: report (GGRAsia)

The Marina Bay Sands (MBS) casino resort (pictured) in Singapore is seeking a circa SGD12-billion (US$8.96-billion) loan amid planned expansion of the property, said business news outlet Bloomberg in a report published on Tuesday, citing people it did not identify, but who were said to be familiar with the matter.

GGRAsia approached the resort’s parent company, Las Vegas Sands (NYSE: LVS), regarding the report. The firm said it had no comment.

🇸🇬 Marina Bay Sands projects 40pct EBITDA leap post extension (GGRAsia)

The promoter of the Marina Bay Sands casino resort in Singapore is forecasting a 40 percent leap in adjusted property earnings before interest, taxation, depreciation and amortisation (EBITDA) once a new phase – dubbed “MBS IR2″ – is operating. Currently, Las Vegas Sands (NYSE: LVS) expects the US$8-billion expansion project to be completed by mid-2029.

🇸🇬 SATS: Lower Risk Investment Opportunity To Capitalize On Air Travel And Freight Demand (Seeking Alpha) $ 🗃️

🇸🇬 Singapore Airlines: Declining Earnings And Poor Fundamentals Make It A Sell (Seeking Alpha) $ 🗃️

🇸🇬 SATS 1H FY2025 Results: Revenue Soars Amid Aviation Recovery (The Smart Investor)

SATS delivers 116.4% revenue growth and returns to profitability in 1H FY2025, driven by aviation recovery, strategic partnerships, and sustainability.

SATS Ltd (SGX: S58 / FRA: W1J / OTCMKTS: SPASF), a leader in in-flight catering, ground handling, and gateway operations, has reported a remarkable performance for the first half of FY2025.

Driven by the rebound in international travel and strategic operational improvements, the company has returned to profitability.

Here’s what investors need to know:

Impressive Revenue Growth

Profitability Returns Amid Cost Pressures

Strategic Partnerships and Sustainability Focus

Dividend and Financial Position

🇸🇬 Keppel: Strategic Transformation to Asset Manager (Report 3) (Corporate Monitor)

🇸🇬 Keppel DC REIT Announces a S$1.4 Billion Acquisition: 5 Things That Income Investors Need to Know (The Smart Investor)

The data centre REIT’s assets under management will jump sharply and the transaction will also be DPU-accretive.

With interest rates poised to decline, many REITs have been more active in acquisitions and capital recycling.

One of these REITs is Keppel DC REIT (SGX: AJBU / OTCMKTS: KPDCF).

The data centre REIT announced a major acquisition of two data centres in a S$1.4 billion transaction involving its sponsor, Keppel Ltd (SGX: BN4 / FRA: KEP / KEP1 /OTCMKTS: KPELY / KPELF.

Here are five aspects of this deal that investors should know about.

Details of the acquisition

Data centres are AI-ready

Transaction is DPU-accretive

Potential for further growth

An advance DPU and equity fundraising exercise

Get Smart: A worthy billion-dollar acquisition

🇸🇬 Want More Dividends? This Singapore Blue-Chip Stock Has Paid Increasing Dividends and Could Potentially Pay Out More (The Smart Investor)

DBS Group (SGX: D05 / FRA: DEVL / DEV / OTCMKTS: DBSDY / DBSDF) has increased its dividends dramatically over the last three years and looks poised to pay out more.

Let’s find out more about the lender and how it can potentially return more capital to shareholders.

🇸🇬 StarHub Posts 11% Profit Growth in Q3 2024 Despite Revenue Dip (The Smart Investor)

(Communications, entertainment & digital services) StarHub (SGX: CC3 / FRA: RYTB / OTCMKTS: SRHBY / SRHBF) reported an 11% rise in Q3 FY2024 net profit, driven by cost efficiencies under its DARE+ program, despite a 4.1% decline in revenue. Key highlights include progress in its 5G rollout and a strong focus on innovation and customer experience.

🇮🇳 Indian Billionaire Gautam Adani Indicted For ‘Massive Fraud’ And ‘Multi-Billion Dollar’ Bribery Scheme (ZeroHedge)

Indian billionaire Gautam Adani has been indicted in New York for ‘massive fraud’ and a ‘multi-billion dollar’ bribery scheme, according to multiple reports Wednesday afternoon.

According to NBC, Gautam Adani and others are accused of paying over $250 million in bribes to Indian officials to secure solar energy contracts expected to yield $2 billion in profits over 20 years. Prosecutors allege Adani personally met with officials as part of the scheme.

Adani, his nephew Sagar Adani, and Vneet Jaain, both Adani Green Energy (NSE: ADANIGREEN / BOM: 541450) executives, also face wire and securities fraud charges for misleading U.S. investors and lenders to obtain funding, the U.S. Attorney’s Office in Brooklyn stated.

U.S. Attorney Breon Peace commented: “The defendants orchestrated an elaborate scheme to bribe Indian government officials to secure contracts worth billions of dollars and Gautam S. Adani, Sagar R. Adani and Vneet S. Jaain lied about the bribery scheme as they sought to raise capital from U.S. and international investors.”

A DOJ press release reads:

🇮🇳 Adani Group’s Crucial Disclosure Lapses About Bribery & US Investigation (Smartkarma) $

Adani Group’s handling of U.S. FCPA investigation disclosures highlights significant lapses in transparency, including delayed and contradictory statements.

Inconsistent disclosures and wrong disclosure about US investigations raising red flags for regulatory compliance and governance.

Search warrants for Sagar Adani, Nephew of Gautam Adani issued in Mar-23, which is not disclosed in fundraising documents as well as Annual Report.

🇮🇳 Adani scandal will rock Indian market’s coming of age (FT) $ 🗃️

🇮🇳 Mamaearth’s Inventory Issue Could Be Bigger and Long Lasting (Smartkarma) $

All India Consumer Products Distributors Federation (AICPDF) has again raised concerns about Mamaearth (Honasa Consumer Ltd (NSE: HONASA / BOM: 544014)), claiming that distributors and retailers are stuck with around INR 300 crore worth of unsold products.

The quantum inventory concern that distributors are raising is almost 5x of what Honasa has taken the hit.

This could bring some serious repercussions on the company’s working capital and growth plans

🇮🇳 A Deeper Look into Mamaearth’s Inventory Saga: Unpacking the Red Flags and Forensic Insights (Smartkarma) $

Mamaearth (Honasa Consumer Ltd (NSE: HONASA / BOM: 544014))‘s journey to the stock market has been marred by allegations of channel stuffing, inventory mismanagement, and inconsistent communication from management.

The company’s struggles in Q2 FY25 have raised concerns about their financial health and transparency.

The forensic analysis is a deeper look into the allegations, redflags and bigger problems that require investor’s attention

🇮🇳 The Beat Ideas: EFC(I) Limited – The Indian Wework! (Smartkarma) $

EFCI Ltd (NSE: EFC / BOM: 512008) is one of few companies in the Flex Space Operator Business present in the entire value chain providing an unbeatable edge in Cost competitiveness.

Management target is to double revenue in FY25 capitalising on sector tailwinds driving exponential growth in all business verticals.

Completed Backward Integration through manufacturing furniture which will help increase margins as furniture comprise 40-50% of total fitout cost.

🇮🇳 Enviro Infra Engineers Limited IPO Analysis (Smartkarma) $

Enviro Infra Engineers Limited

The company is in the business of designing, construction, operation and maintenance of water and wastewater treatment plants and supply schemes with all related services.

It has an order book worth Rs. 1906+ cr. as of June 30, 2024 and 750Cr+ of operation & maintenance order book in their hand.

Company has in-house capability to build and design water plants which enhance the margins of the company vs its peers.

🌍 Africa Oil: Like I never left (AlmostMongolian)

Africa Oil Corp (TSE: AOI / STO: AOI / FRA: AFZ / OTCMKTS: AOIFF) has not been a strong performer this year but based on multiple catalysts all happening during the first half of 2025 and the stock price being depressed by the weak oil price and tax loss selling currently. I see a high chance of a rerating of the stock from the current price during the first half of 2025.

🇿🇦 SA Inc shares still have potential to surprise to the upside – PSG (IOL)

Roughly only half of the South African stock market can be classified as “SA Inc” companies, while the remaining 50% is evenly split between JSE-listed rand hedges (such as Naspers (JSE: NPN / FRA: NNWN / OTCMKTS: NPSNY), Prosus (AMS: PRX / JSE: PRX / OTCMKTS: PROSY / OTCMKTS: PROSF / ETR: 1TY), Richemont (SWX: CFR / JSE: CFR / FRA: RIT1), and British American Tobacco plc (NYSE: BTI)) and the resources sector.

Within the “SA Inc” segment, many peer portfolios are heavily concentrated in three sectors: banks, retailers, and consumer staples (including drug and grocery stores and food producers). This concentration is largely due to the relative size and liquidity of companies within these sectors compared to others.

🇿🇦 Navigating South Africa’s banking landscape: Capitec thrives while Absa falters (IOL)

Capitec Bank (JSE: CPI / OTCMKTS: CKHGY / CKHGF)’s business model is evolving beyond traditional banking. This reporting season, Capitec posted strong results, far-exceeding the big-four banks, printing stellar revenue growth, both from lending and non-lending activities.

Standard Bank (JSE: SBK / FRA: SKC2 / OTCMKTS: SGBLY)‘s recent trading update highlighted decent earnings growth that continues to build as the year progresses.

FirstRand (JSE: FSR / FRA: FSRA / OTCMKTS: FANDY)’s sentiment remains soft given the ongoing UK MotoNovo motor commission claims risk.

Absa (JSE: ABG / OTCMKTS: AGRPY) has been a poor relative performer within the banking sector significantly underperforming its peers over the past year. Asset quality lags behind peers and management instability compounds concerns.

🇿🇦 Astral Foods’ earnings surge 245% amid recovery from avian flu outbreak (IOL)

Astral Foods (JSE: ARL / OTCMKTS: ALFDF)’s share price rose 1.9% to R169.33 yesterday after reported that it had rebounded from massive load shedding and avian flu-related losses in 2023 and increased headline earnings per share by 245% in the 12 months to September 30.

Revenue increased 6.4% to R19.4 billion, with the increase primarily attributable to the recovery by the Poultry Division from a loss-making position to a profit.

Profit before interest and tax increased by 281%.

🇿🇦 Mr Price Group leads retail rally on stock market after reporting sales upturn (IOL

Mr Price Group (JSE: MRP / FRA: M5M1 / OTCMKTS: MRPLY)’s share led a rally in many retail sector stocks on the JSE yesterday, surging 7.1% to R292.30 per share just a week before Black Friday and on the day of another interest rate cut, after the value clothing and homeware group said there were signs that South Africa was finally entering an upward economic cycle.

“The increasing sales momentum in the second quarter and the strong start in the second half with sales up 12.4% in the first 7 weeks is encouraging,” CEO Mark Blair said in a statement.

🇿🇦 Telkom reports strong financial performance amid mobile and fibre revenue surge (IOL)

Telkom SA SOC (JSE: TKG / FRA: TZL1)’s share price surged 5.5% to R30.42 yesterday after it reported market-beating results for the six months ended 30 September, driven by gains in mobile and fibre revenue while containing costs, leading to adjusted headline earnings per share from continuing operations gaining 68% 146.9 cents per share.

At the half-year, Telkom had strengthened its balance sheet, with free cash flow turning positive at R768m, compared to negative R478m in the previous period. Interest-bearing debt reduced by R885m.

🇿🇦 Anglo American: Portfolio Simplification Means A Special Situation (Seeking Alpha) $ 🗃️

-

🌐 Anglo American Plc (LON: AAL / JSE: AGL / OTCMKTS: NGLOY) – World’s largest primary producer of platinum metals (platinum, palladium, rhodium, iridium, ruthenium & osmium; base metals as in copper, nickel, cobalt sulphate, sodium sulphate & chrome; & precious metals as in gold). 🇼 🏷️

🇿🇦 Sasol Limited: Still A Hold In Line With Cost Management Transition Plan (Seeking Alpha) $ 🗃️

-

🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇭🇺 Wizz Air Stock Has Huge Upside On Capacity Recovery Prospects (Seeking Alpha) $ 🗃️

-

🌍🌏 Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2) – Ultra low-cost carrier. Short-haul & medium-haul point-to-point routes in Europe, Middle East, North Africa & Northwest Asia. 🇼

🌎 Liberty Latin America: Salvage Probability Is Starting To Decline (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Buy The Unwarranted Pullback, Credit Growth Headwinds Are Temporary (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Knock Knock, You Are Not Alone Jeff! (Capitalist Litters)

The most attractive opportunity in the market with giant, giant MOAT and attractive valuation!

MercadoLibre (NASDAQ: MELI) has one of the strongest moats I have ever seen.

This is nearly impenetrable.

🌎 DLocal Reports Record Gross Profit (Steve Wagner | Invest)

Taking a Look at (Cross-border payment platform for global merchants) Dlocal (NASDAQ: DLO) Earnings Report.

Personally, I’m happy with the quarter. I decided to add right before they released their earnings, and it turned out to be a good move in the short-term with the stock up over 10%. I will find ways to add to my position, but I won’t be as aggressive as I am with my other top positions.

🌎 Tenaris: Trump Policies Offer Promise, But Opportunity Seems Fully Priced In (Seeking Alpha) $ 🗃️

🌎 Digesting Millicom’s Tower Monetization (No Deep Dives)

Sale-leaseback announcement with SBAC leaves TIGO stock unmoved. Clarity on 2025 capital allocation is what investors need now.

Two weeks ago, on October 28th, Millicom (NASDAQ: TIGO) ( TIGO 0.00%↑ ) finally announced its long-awaited tower sale. This sale-leaseback of (part of ) the tower portfolio has been anticipated as a potential catalyst for years.

🇦🇷 🇲🇽 Vista Energy: Attractive Valuation, Superior Growth Profile For This LATAM Oil Stock (Seeking Alpha) $ 🗃️

-

🇦🇷 🇲🇽 Vista Energy (NYSE: VIST / FRA: 1CIA / BMV: VISTAA)’s – Mexico HQ’d. Main asset in Argentina is the largest shale oil & shale gas play under development outside North America. 🏷️

🇦🇷 🇺🇸 Lithium Americas: Long-Term Value And Growth As US Poised To Dominate Lithium By 2035 (Seeking Alpha) $ 🗃️

🇦🇷 Banco BBVA Argentina: Not The Best Play Among Argentine Banks (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: Understanding Stock Pullback (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇧🇷 StoneCo: I Keep My ‘Buy’ Despite The Heavy Dip (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings’ Growth Potential Outweighs Brazilian Economic Woes (Seeking Alpha) $ 🗃️

🇧🇷 Nu Holdings: An Emerging Market Beauty (Seeking Alpha) $ 🗃️

🇧🇷 NU: Customer Base Surges to 110 Million (The Wolf of Harcourt Street)

🇧🇷 PagSeguro: A GARP Opportunity That Doesn’t Pan Out (Rating Downgrade) (Seeking Alpha) $ 🗃️

🇧🇷 TIM S.A.: When Compelling Dividends Finally Meet Attractive Valuations (Seeking Alpha) $ 🗃️

🇨🇱 Bancolombia: Concerning Guidance Obscures The Bank’s Strengths (Seeking Alpha) $ 🗃️

-

🌎🅿️ Bancolombia (NYSE: CIB / BVC: PFBCOLOM) – First Colombian financial institution listed on the NYSE. It provides banking products & services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda & Guatemala. 🇼 🏷️

🇨🇱 18% Pure Colombian Dividend Yield Ladies & Gentlemen. Disco Sh*t! (The ROI Club)

Ecopetrol SA (NYSE: EC) is very much a ‘cigar-butt’ deep value, cyclical play. Market fears of a lack of maintenance capex and the current political regime in Colombia have led to the stock being currently offered at a ~30% free cashflow yield, ~18% dividend yield. Current reserve life estimates imply 8 years of stay-flat production which should provide a satisfactory return in and of itself, with strong tail wind catalysts likely to be realised with upon an anticipated change of government in the May 2026 presidential elections.

🇨🇱 An Announcement, A Visit, A Stock Pitch (Exploring with Alluvial Capital)

Introducing Tactile Fund, hitting the road, and a look at Cementos Argos SA (BVC: CEMARGOS / OTCMKTS: CMTOY)

Bottom line, the Cementos Argos of the future will have better assets, a less levered balance sheet, more liquid shares, and a higher profile than the company of yesterday. If Quikrete buys Summit Materials (NYSE: SUM), the company will be sitting on a mountain of cash. In any case, I think Cementos Argos shares are primed to trade closer to net asset value over the next 12-18 months.

🇬🇾 Guyana and the mystery of the largest ranch in the Americas (Undervalued Shares)

The country has seen some of the world’s largest offshore oil discoveries, and its economy is on steroids.

Are there any investible assets?

Could a locally listed farm be the most interesting Guyana investment there is?

Today’s Weekly Dispatch explores these questions.

As we touch upon in the video, investing in Guyana is possible through a range of options.

Energy stocks with Guyana exposure

Going local – the Guyana Stock Exchange

Guyana’s mystery farm

🌐 Playing Monopoly With Brookfield: The Asset King That Keeps Beating The Market (Seeking Alpha) $ 🗃️

-

🌐👼🏻 Brookfield Corp (NYSE: BN) – Asset management, renewable power & transition, infrastructure, private equity, real estate & other alternatives. 🇼

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 China Is Making Sure Its Low-Altitude Economy is Ready for Takeoff (Caixin) $

China is looking to the skies for future growth as it nurtures its nascent low-altitude economy with efforts to launch pilot programs for new aviation services.

The National Development and Reform Commission (NDRC), the country’s top economic planner, is to create a Low-Altitude Economy Department to oversee the sector as it takes off, according to Chen Zhijie, director of the State Key Laboratory of Air Traffic Management System and Technology.

At the same time, the central government is drawing up detailed industry guidelines to establish a regulatory framework for the sector, Chen said at a Monday forum.

At a separate event, Sun Weiguo, a senior official at the China Air Transport Association, said that the Air Traffic Control Commission (ATCC), is to launch pilot programs for electric vertical take-off and landing (eVTOL) aircraft operations in six cities, including Shenzhen.

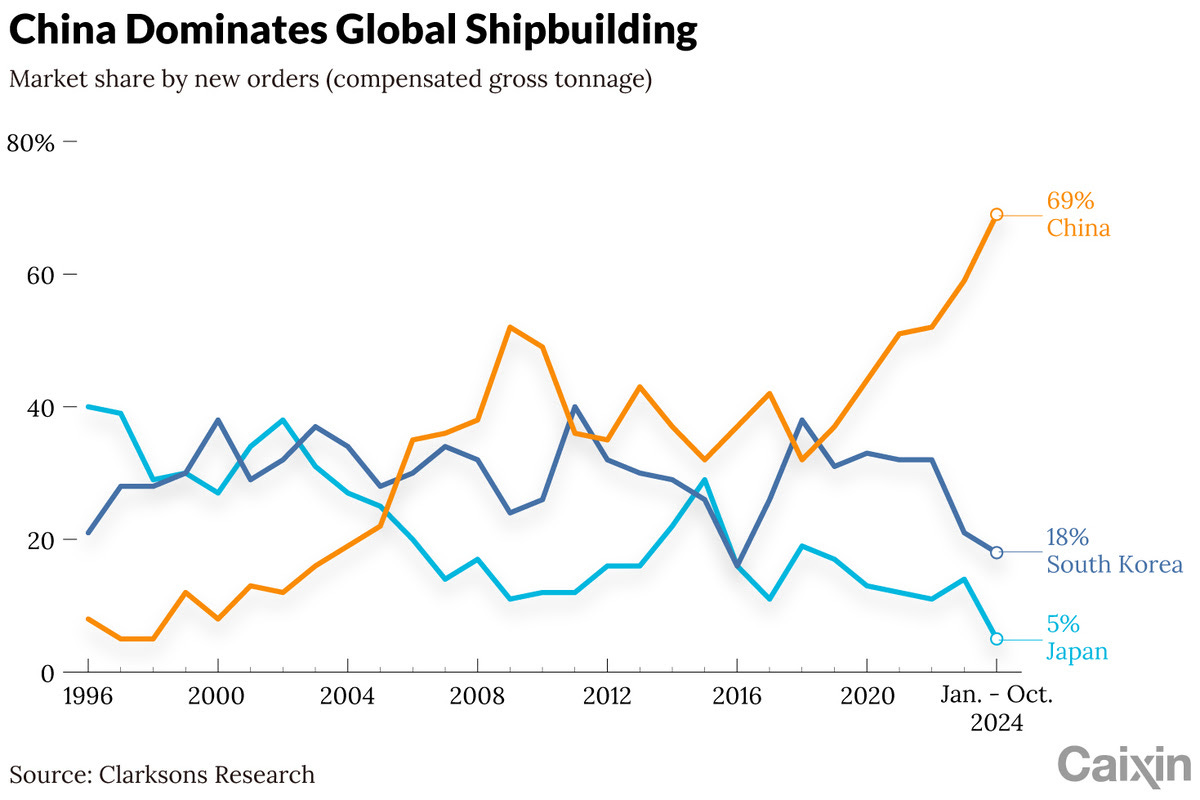

🇨🇳 In Depth: Overcapacity Poses Only Distant Threat to China’s Shipbuilding Boom (Caixin) $

Chinese shipyards are at the forefront of this year’s global shipbuilding boom, benefiting from a demand surge that has filled orderbooks and sparked an expansion in production capacity for the first time in years.

From January to October, Chinese shipbuilders secured orders totaling 37.5 million compensated gross tonnage (CGT), according to shipping consultancy Clarksons Research. That figure represents about 70% of new ship orders worldwide.

🇨🇳 Oppo Isn’t Giving Up on Selling High-End Handsets in Developing Markets (Caixin) $

While its affordable offerings have proved popular in Southeast Asia and Latin America, Oppo Co. Ltd. isn’t giving up on its goal of selling more premium smartphones in the regions despite limited success so far.

In the third quarter, Oppo overtook Samsung to become Southeast Asia’s largest smartphone vendor by number of devices shipped for the first time, with a market share of 21%, according to a recent report by research firm Canalys, which attributed this success to the popularity of its entry-level A3x and A3 models.

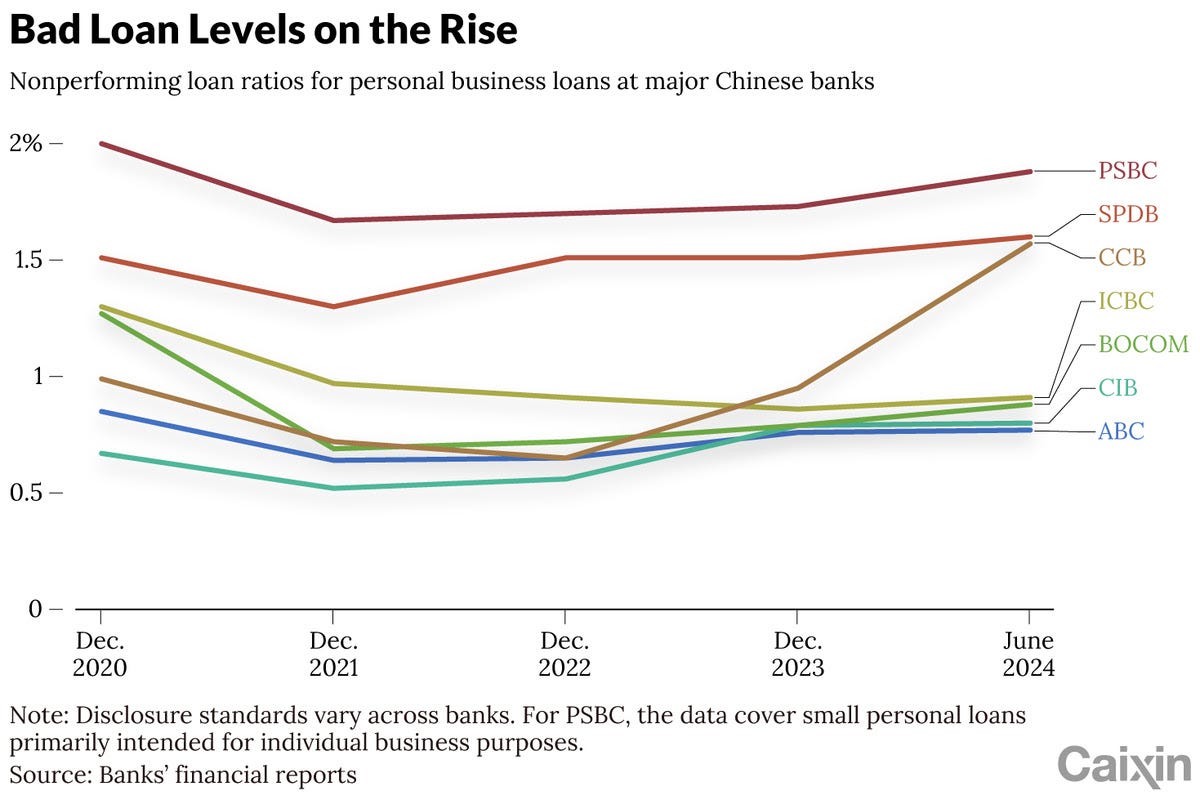

🇨🇳 In Depth: Pandemic-Era Helping Hand Comes Back to Haunt China’s Banks (Caixin) $

A government-encouraged surge in lending designed to be a lifeline for small businesses during the pandemic has started to worry Chinese banks, as misappropriation has caused the loans to sour at an increasing rate due in part to China’s stubborn real estate slump.

The rise in banks’ nonperforming loan (NPL) ratios for personal business loans (PBLs) shows how gaps in banks’ due diligence can cause funds designed for one purpose to end up being used for something else — in ways that are damaging to lenders’ financial health.

🇨🇳 China’s cash-strapped shoppers drawn to second-hand luxury items (FT) $ 🗃️

🇲🇴 Macau 3Q GDP up 5pct driven by investment, gaming exports (GGRAsia)

Macau’s gross domestic product (GDP) rose 4.7 percent year-on-year in real terms in the third quarter this year, according to data from the city’s Statistics and Census Service. “The overall economic output corresponded to 87.3 percent of its size in the same quarter of 2019,” said the statistics bureau in a report published on Monday.

In October, the International Monetary Fund lowered its forecast for Macau’s economic growth in 2024 by 3.3 percentage points. The institution now expects Macau’s GDP to grow by 10.6 percent this year, down from a previous estimate of 13.9 percent made in May.

🇲🇴 Macau 2025 GGR could top US$30bln govt forecast: Citi (GGRAsia)

Citigroup thinks from the outset, that Macau’s 2025 casino gross gaming revenue (GGR) could exceed the local government’s forecast made public this week, of MOP240 billion (US$29.9 billion).

🇲🇴 Macau to get 36mln visitors in 2025: Secretary Lei (GGRAsia)

Macau’s 2025 visitor tally could reach 36 million, or a circa 9-percent gain on this year’s projected 33 million. So said Lei Wai Nong (pictured in a file photo), the city’s Secretary for Economy and Finance, in comments at the Legislative Assembly on Thursday.

🇰🇷 Major M&A Rule Changes Approved by the Korean Government (Douglas Research Insights) $

On 19 November, the Financial Services Commission (FSC) announced major rule changes on corporate mergers and acquisitions have been approved by the Korean government.

Revised rules have three specific goals: Improve rules on calculating and determining merger prices when M&As take place between nonaffiliated business entities, strengthen disclosure duties, and improve external evaluation system.

If the Korean government is really serious about making positive rule changes, they need to apply these new laws not just for NON-AFFILIATED companies but more importantly for AFFIILATED companies.

🇰🇷 Overseas Equity ETFs Surpass Domestic Equity ETFs For the First Time in 17 Years (Douglas Research Insights) $

One of the biggest trends impacting the fund flow in Korea this year has been the huge capital inflow into overseas equity ETFs.

The net asset value of the listed ETFs in Korea investing in overseas stocks surpassed the ETFs investing in domestic stocks for the first time in 17 years.

The ETFs that invest in overseas stocks were 35.8 trillion won on 12 November 2024, up 111% from 12 January 2024.

🇮🇳 NIFTY200 Momentum30 Index Rebalance Preview: More Changes with New F&O Stocks (Smartkarma) $

There could be 17 changes for the Nifty200 Momentum 30 Index that will be implemented at the close on 30 December. Some changes from earlier following 45 new F&O stocks.

If all changes are on expected lines, one-way turnover is estimated at 61.5% and that will result in a one-way trade of INR 63.4bn (US$752m).

The potential inclusions to the index have outperformed the potential deletions since the start of June. This trend could continue for a couple of weeks till the changes are announced.

🇳🇬 Nigeria’s Richest Man Confronts ‘Oil Mafia’ With New $20B Refinery (OilPrice.com)

The $20 billion Dangote Refinery, with a capacity of 650,000 barrels per day, began producing gasoline in September 2024.

The refinery faces resistance from Nigeria’s entrenched “oil mafia,” oil theft, and limited crude supply from NNPC.

Oil theft remains a major problem for the Nigerian energy sector, and could hinder the refinery from buying all of its crude locally.

🇦🇷 Javier Milei: President of Argentina – Freedom, Economics, and Corruption | Lex Fridman Podcast #453 (Lex Fridman) 1:57:09 Hours

🌐 Strong dollar set to hit emerging market bonds, warn investors (FT) $ 🗃️

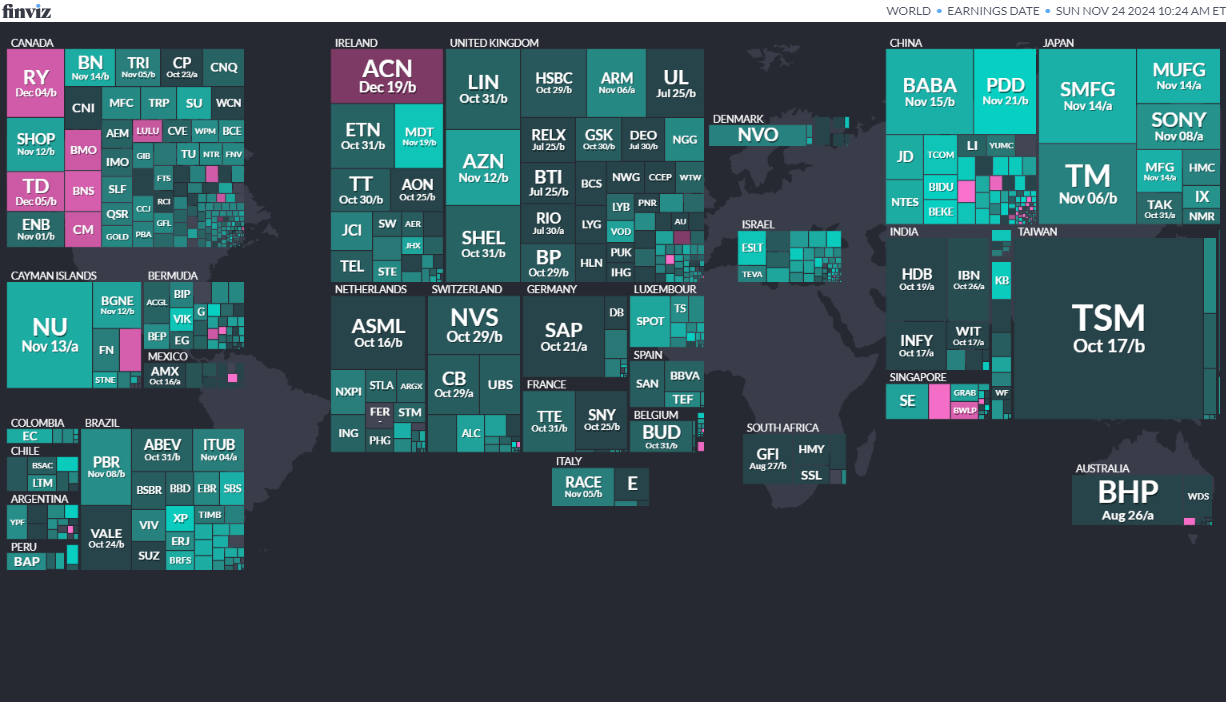

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

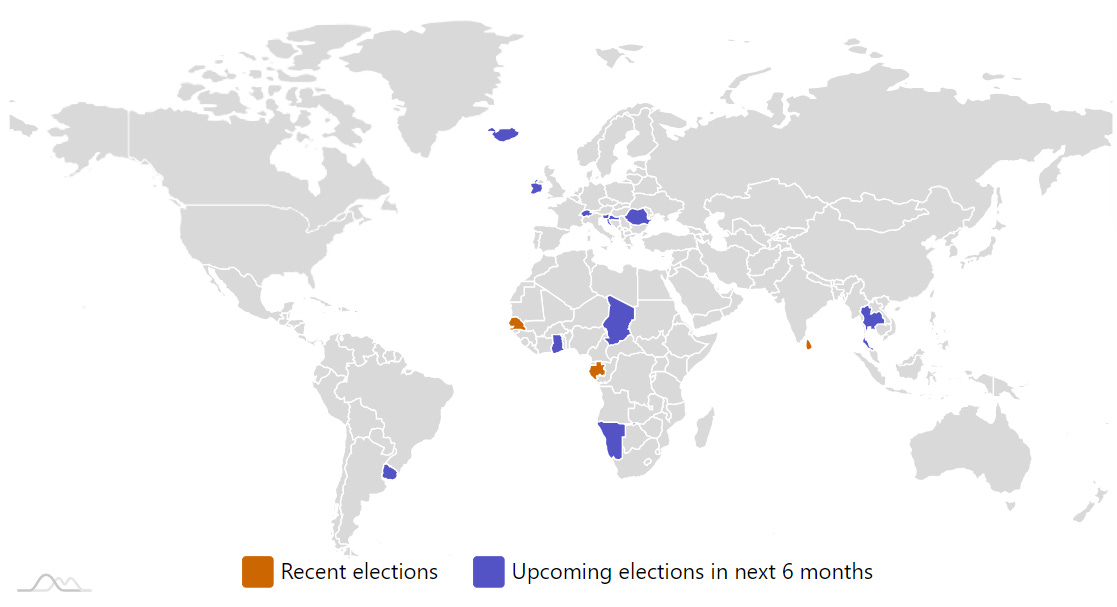

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

RomaniaRomanian PresidencyNov 24, 2024 (d) Confirmed Nov 24, 2019 -

SloveniaReferendumNov 24, 2024 (d) Confirmed Jun 9, 2024 -

UruguayUruguayan PresidencyNov 24, 2024 (d) Confirmed Oct 27, 2024 -

Namibia Namibian Presidency Nov 27, 2024 (d) Confirmed Nov 27, 2019

-

Namibia Namibian National Assembly Nov 27, 2024 (d) Confirmed Nov 27, 2019

-

Romania Romanian Senate Dec 1, 2024