Emerging Market Links + The Week Ahead (November 27, 2023)

The other day, I noted a recent article (Trillion Dollar Bailout: What Xi Really Wants From Biden) where you could just as easily swap out the words Xi and China with Biden and USA.

However, China has recently done an unusual sovereign bond issue as they tell financial institutions to bolster the property market while shadow bank Zhongzhi is facing a $36bn shortfall after ‘management ran wild…’

A commenter on Twitter has also observed the massive amount of fictitious wealth creation over the past few decades with much of the Chinese economy organized around it. But now, everyone’s balance sheets (those of households, businesses, banks, the government, etc.) must adjust to new realities.

Meanwhile, a commenter from alternative media has noted something interesting is going on between Saudi Arabia and China e.g. The latter has apparently offered the Saudis a swap line to ensure breaking the dollar peg goes smoothly against the inevitable retaliation from the USA. China can then loan the Kingdom dollars to be repaid in Yuan.

China has also apparently commenced a program where it lends US Dollars to so-called Global South countries (who lack US dollars), but demands Yuan for repayment with the collateral being mining, costal ports, and energy rights in those countries.

All of the above bits of information are very interesting – and not just for investors investing in China…

Finally, the ETF launches (mostly new active funds now) and liquidations lists at the end of this post have also been updated for the last few months. Note that Matthews Asia has recently launched new Asia focused ETFs while some China (several funds), India, and South Africa ETFs are being liquidated.

$ = behind a paywall / 🗃️ = Archived article

-

🇨🇳 🇭🇰 CMBI Research China & Hong Kong Stock Picks (October 2023) Partially $

-

Includes: Tuhu Car, China Life, Innovent Biologics, BYD Company, GoerTek, Tsingtao Brewery, Yonyou Network Technology, Will Semiconductor, Zhejiang Dingli, Shennan Circuit, Shengyi Tech, Hangzhou Tigermed Consulting, Great Wall Motor, Glodon, Guangzhou Automobile Group, Li Ning, Shanghai Jahwa, FIT Hon Teng, Topsports, Luxshare Precision Industry, Kweichow Moutai, CSPC Pharmaceutical, Bilibili, Zhongji Innolight, China Three Gorges Renewables Group Co Ltd (CTGR Group), Kuaishou Technology, Baidu, iQIYI, Budweiser APAC, Xtep, Tencent, Weichai Power, GigaCloud Technology, Sunny Optical, JD.com, ANTA Sports Products, Alibaba, ZTE, China Tourism Group Duty Free, Tongcheng Travel Holdings, CR Power, BYD Electronic International and Samsonite International

-

20+ high conviction stock ideas: Li Auto, Geely Automobile, SANY International, ANTA Sports Products, Weichai Power, Zhejiang Dingli, CR Power, CR Gas, ANTA Sports Products, JNBY Design, Vesync, CR Beer, Tsingtao Brewery, Kweichow Moutai, China Tourism Group Duty Free (CTGDF), Innovent Biologics, China Life, Ping An, AIA, Tencent, Pinduoduo, NetEase, Alibaba, Kuaishou Technology, CR Land, BYDE, Wingtech & Kingdee

-

-

🇰🇷 Mirae Asset Securities’ Korean Stock Picks (October 2023) Partially $

-

Includes: LG Chem, Posco International Corp, DGB Financial Group, Daewoong Pharmaceutical, Industrial Bank of Korea, Hana Financial Group, HL Mando Corp, LIG Nex1 Co, LG H&H, Kia Corp, Hyundai Mobis, Shinhan Financial Group, Hyundai AutoEver, OCI Holdings, Lotte Data Communication, SOCAR, Hyundai Motor, Samsung Card, NH Investment & Securities, Samsung Biologics, JB Financial Group, KB Financial Group, Koh Young Technology, KT Corp, LG Uplus, People & Technology, F&F Co, Samsung Electronics, Hotel Shilla, Hyundai Glovis, Samsung SDS, NAVER, SK Telecom and LX International

-

-

🇮🇳 moneycontrol India Stock of the Day (October 2023) Partially $

-

Includes: Nestle India, Syngene International, PVR Inox, Aavas Financiers, ICICI Bank, Polycab India, Avenue Supermarts Ltd (D-Mart), Syrma SGS Technology, NCC Limited, Ruchira Papers, Computer Age Management Services Ltd, Kotak Mahindra Bank, Dhanuka Agritech, Cera Sanitaryware, Vesuvius India, Central Depository Services (CDSL), Cyient, Apcotex Industries and Sirca Paints

-

$ = behind a paywall / 🗃️ = Archived article

🌏 The Asian pet industry (Asian Century Stocks) $

As you can tell from the chart, the total number of dogs and cats worldwide is increasing at a rate of 2-3% per year. And growth is particularly strong for cats since they are more independent and require less attention.

Geographically, China has been the fastest-growing market, followed by Europe, the Middle East & Africa. This is due to the much lower penetration rates in China. In the United States, the number of pets per household is already 67% compared to just 26% in South Korea and 17% in China. Asia is where the growth opportunity is.

When I dug into the industry over the past few days, I realized that most listed companies are based in the United States or Europe. But I’ve also found several pet-related companies in Asia, for example, pet food producers in Thailand and a pet insurance company in Japan. So let’s dig into it.

🇨🇳 (Xiaomi Inc.(1810HK,SELL,TP HK$12.6) Earnings Review): Mi14 Success Does Not Alter Overall Headwinds (SmartKarma) $

Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) reported C3Q23 top-line, non-GAAP EBIT, and GAAP net profit (2%), 7% and in-line vs. our est., and in-line, 4%, and 13%, vs. consensus respectively.

Xiaomi’s recent run could be short lived, as (1) Huawei will soon launch mid-range 5G handsets, (2) the Mi 14 will soon face new high-end Android competition;

And (3) its underinvested EV project could disappoint. We maintain our SELL rating and HK$ 12.6 TP, implying 28x CY24 P/E.

🇨🇳 Why do Alibaba’s acquisitions often fail? (Momentum Works)

The following are excerpts from an article published in Chinese. The author, Dongqi Yu, is a renowned business commentator.

For Alibaba (NYSE: BABA), which once excelled in organisational capabilities, today’s problem ironically stems from the organisation itself.

Next, I’ll start with one of Alibaba’s noticeable problems.

🇨🇳 Bidding war for Hollysys leaves shareholders demanding more input (Bamboo Works)

A consortium led by two investment firms raised its bid for the automation systems maker last week, as it vies with two other groups to privatize the company

A consortium led by two investment firms has upped its bid to privatize Hollysys Automation Technologies (NASDAQ: HOLI), as minority shareholders agitate for a special meeting to discuss a sale

The offer tops a bid two days earlier from a China-focused private equity firm, as well as one from the company’s own management team

🇨🇳 Shaky Vanke finds stabilizing friend in Shenzhen government (Bamboo Works)

Shenzhen SASAC and Shenzhen Metro Group offered the hometown property champion their support after investors worried about its ability to repay its debt

Vanke (HKG: 2202 / SHE: 000002 / FRA: 18V / OTCMKTS: CHVKF / CHVKY) has no more overseas debt coming due this year, but could face challenges in 2024 as 11 billion yuan in three tranches of overseas debt matures

The company believes pressure caused by falling sales and rising supply in China’s property market over the last two years will ease in the second half of next year

🇨🇳 Autohome’s posts fifth quarterly profit rise, driven by interest income (Bamboo Works)

The car services provider’s profit continued to improve in the third quarter, as strong gains in its online marketplace were offset by weakness in its other two main divisions

Autohome (NYSE: ATHM)’s revenue rose 3.5% to 1.9 billion yuan in the third quarter, while its net profit grew nearly 14% to 564 million yuan

The company’s online marketplace was the best performer of its three main businesses, posting 25% revenue growth year-on-year

🇨🇳 Education provider TAL counts on AI devices and MathGPT (Bamboo Works)

The learning solutions company has swung into the black after investing in AI-powered educational devices and developing a newly approved MathGPT tool

TAL Education Group (NYSE: TAL)’s revenue rose 40% in the second quarter, propelling the education group from a loss to a net profit of $37.9 million.

Competition over educational AI is heating up in China, as companies develop large-scale AI models and launch intelligent learning devices

🇨🇳 Mastercard gets go-ahead to get into China’s trillion-dollar bank card clearing business (Caixin) $

Mastercard (NYSE: MA) has gotten approval to run a yuan-denominated bank card clearing service in China through a joint venture (JV), the central bank said, giving the U.S.-based company a shot at a slice of the fees generated by the trillions of dollars in card transactions made in the country each year.

The People’s Bank of China (PBOC) granted the clearing license to Mastercard NUCC Information Technology (Beijing) Co. Ltd., a JV between Mastercard and NetsUnion Clearing Corp. (NUCC), according to a PBOC statement Sunday.

🇨🇳 Lufax takes on more risk, makes Hong Kong acquisition, as its lending shrivels (Bamboo Works)

The online loan facilitator’s revenue plunged 39% in the third quarter, as its loan delinquency rates rose sharply from a year earlier

Lufax Holdings (NYSE: LU)’s new loan originations fell 59% in the third quarter, as creditworthy customers became harder to find in China’s slowing economy

The online lender announced it will purchase a Hong Kong-based virtual bank from sister company OneConnect Financial Technolgy (NYSE: OCFT) for HK$933 million, in a move to diversify beyond Mainland China

🇨🇳 Trip.com Q3 Quick Take: Net Inc > Consensus | Progress on Expenses | But Not a Game-Changer (SmartKarma) $

Trip.com (NASDAQ: TCOM) reported strong Q3 earnings, reflecting 2023’s ongoing tourism revival

Net Income beat expectations, and company made progress on expense control

But we don’t see “game-changing” numbers in Trip.com’s latest earnings release

🇨🇳 Huya revenues sag 30%, looks ahead to diversification plan (Bamboo Works)

A leading game live streaming platform in China.

The company has been rocked by a series of challenges over the last two years, and is hoping to find stability by lessening its dependence on livestream gaming revenue

Huya Inc (NYSE: HUYA) continued to report large revenue declines in the third quarter, but hopes to improve its situation through a diversification plan announced in August

The company was profitable in the first three quarter of this year, but said it may report a loss for the fourth quarter due to heavy seasonal expenses

🇨🇳 Atour glides as economic slowdown fails to dent Chinese travel demand (Bamboo Works)

The mid- to upscale hotel brand’s revenue rose 93% in the third quarter, as nearly all of its major metrics exceeded pre-pandemic levels

Atour Lifestyle Holdings (NASDAQ: ATAT)’s revenue nearly doubled and its profit rose by an even stronger 136% in the third quarter, driven by “breakthroughs” in its main business lines

The hotel operator’s shares are up 70% from their IPO price a year ago, buoyed by strong growth as China’s tourism sector rebounds post-pandemic

🇨🇳 Dingdong rings up more profits as revenue sags (Bamboo Works)

The online grocer’s revenue fell in the third quarter, as it continued to report profits in China’s fiercely competitive food delivery sector

Dingdong (NYSE: DDL)’s revenue decreased about 14% year-on-year in the third quarter as it withdrew from less profitable cities

The company is resorting to cost cuts and interest income to stay in the black, while trying to boost sales of higher-margin private label products

🇨🇳 Mixue Bingcheng brews up success with age-old formula: low prices (Bamboo Works)

The leading ice-cream and tea chain is preparing to open its first store in Hong Kong, boosting its image locally as it reportedly gets set to list in the city next year

Mixue Bingcheng reportedly plans to raise up to $1 billion in a Hong Kong listing, after abandoning earlier plans to list on China’s A-share market in Shenzhen

The tea and ice cream chain has more than 25,000 stores, including outlets outside China in Vietnam, Malaysia and Indonesia

🇭🇰 Playmates Toys: Toy maker trades below Cash and less than 5x 2023 earnings (Treasure Hunting)

Playmates Toys (Playmates) (HKG: 0869 / 0635 / FRA: 45P / OTCMKTS: PMTYF / PYHOF) is a Toy maker trading below net-cash. It designs and produces toys for Teenage Mutant Ninja Turtle (“TMNT”), Ladybug Miraculous, Star Treck and Spy Ninjas. The company has a long relationship with Teenage Mutant Ninja Turtle, Playmates Toys is listed on the Hong Kong Stock Exchange. While this may be a red flag for some investors, I believe the company has no more exposure to HK/China than the average US toy company. Revenues are generated in the US (about 60%) and Europe (about 30%). CEO Michael Chan graduated from Yale and worked with KKR’s private equity team in Menlo Park, California. Playmates Toys is owned and controlled by Playmates Holdings, which is also controlled by the Chan family. Historically, their results have been highly correlated with the demand for TMNT toys, as this is the largest toy line they produce. A Nickelodeon series of Teenage Mutant Ninja Turtle was released in 2012, followed by a movie in 2014. The EBIT and share price pretty much followed these developments, peaking at HKD 2.1 billion in revenue and around HKD 640 million in EBIT in 2014

🇲🇴 Melco focus debt cutting, caution on spending: analysts & Melco CoD Mediterranean cuts jobs, Israel-Hamas war cited (GGRAsia)

Casino operator Melco Resorts & Entertainment Ltd (NASDAQ: MLCO) is likely to “continue to exercise caution in managing its spending,” as it aims to bring down its leverage “closer to pre-pandemic levels,” suggests a note from S&P Global Ratings.

Melco Resorts’ total debt stood at US$7.77 billion at the end of September, a reduction of US$100 million compared to the total debt balance as of June 30, 2023, according to the company.

The debt figure was “about 70 percent higher than the level in 2019,” stated the ratings agency. “This was a result of three years of cash burn amid strict Covid-19 restrictions in Macau and China, and investments in Studio City Phase 2, and City of Dreams Mediterranean,” wrote analysts Aras Poon and Sandy Lim.

🇰🇷 South Korean defence industry rides global order wave (FT) $

After decades of preparation for war with North Korea, the country has become a top 10 defence exporter since the start of Ukraine conflict

Investor interest in international defence companies, including Hanwha Aerospace (KRX: 012450), has surged since Russia’s invasion of Ukraine in February 2022 on expectations of higher military spending by western governments. Shares in Hanwha have more than doubled over the period.

🇰🇷 Classys (214150 KS): Record High Quarterly Performance in Q3; 2024 to Continue to Be Radiant (SmartKarma) $

Specializes in medical aesthetics technologies.

Classys (KRX: 214150) reported solid performance in 3Q23, with revenue and operating profit growing 45% and 41%, YoY, respectively, mainly driven by export in devices and domestic sales of consumables.

Despite being an offseason, Q3 2023 witnessed increase in both the number of countries selling the new product Ultraformer MPT and the monthly average domestic sales of Volnewmer.

Continued improvement in equipment sale and increasing consumables contribution should drive growth in 2024. Entry into the U.S. and China will be the key for re-rating of the stock.

🇰🇷 2024 High Conviction: Orion Corp (SmartKarma) $

One of the three largest food companies in South Korea.

We are positive on Orion Corp (KRX: 271560). Regardless of the overall market movement next year (up or down), we believe Orion Corp could outperform KOSPI in the next 6-12 months.

The company has millions of loyal customers in major overseas countries including China, Russia, and Vietnam. Despite difficult operating conditions, Orion continues to generate stable growth in sales and profits.

Orion Corp’s valuations are attractive. Orion Corp is currently trading at 2024E EV/EBITDA of 4.4x (42% lower than average valuation multiple from 2019 to 2023).

🇰🇷 DS Dansuk IPO Preview (SmartKarma) $

A global resource recycling company.

DS Dansuk is getting ready to complete its IPO in Korea in the next several weeks. The IPO price range is from 79,000 won to 89,000 won.

The book building for the institutional investors will be from 5-11 December. The IPO offering amount is from 96.4 billion won to 108.6 billion won.

According to the bankers’ valuation, DS Dansuk’s valuation would range from 462 billion won to 522 billion won.

🇸🇬 Should Meituan acquire Foodpanda? (Momentum Works)

Last week, Bloomberg reported that Meituan is in talks to acquire Foodpanda from Germany-based Delivery Hero SE (FWB: DHER).

This news came after German media reports that DeliveryHero and Grab Holdings Limited (NASDAQ: GRAB) were discussing the latter’s acquisition of Foodpanda’s Southeast Asian business for €1 billion. In Between there was also the saga of Foodpanda Asia Pacific CEO being dismissed for leaking confidential information about the deal to his girlfriend who posted it on social media.

🇸🇬 Sea: The Quarter of Reckoning Approaches (The Wolf of Harcourt Street)

🇮🇩 Telekomunikasi Indonesia: Many Things To Like (Seeking Alpha) $

Telkom Indonesia (Persero) Tbk PT (NYSE: TLK) appears to be actively exploring value unlocking opportunities for its non-core businesses based on recent news flow.

Telekomunikasi Indonesia’s outlook has become more favorable, considering the realization of cross-selling synergies, and the creation of a new infrastructure business.

I think there is lots to like about TLK, which means that a Buy rating for Telekomunikasi Indonesia is warranted.

🇮🇩 Erajaya Swasembada (ERAA IJ) – Coming Out a Squall (SmartKarma) $

An integrated mobile telecommunication device importer, distributor and retailer…

Erajaya Swasembada (IDX: ERAA) had a tempestuous 3Q2023, with one-off write-downs of inventory in both Indonesia and Malaysia, despite booking strong sales and gross profit growth overall.

The company has also expanded its store network more aggressively in 9M2023, which meant higher opex and financing to build the new inventory, whilst stores take time to ramp up.

Erajaya should see a recovery in 4Q2023, given plans to limit store expansion plus a lack of write-offs. Trading on 5x FY2024E PER with forecast +25% EPS growth is attractive.

🇻🇳 2024 High Conviction: VinFast (VFS US) – Heading for Trouble (SmartKarma) $

VinFast Auto Ltd. (NASDAQ: VFS), a Vietnamese EV manufacturer and a majority-owned affiliate of Vingroup Jsc (HOSE: VIC), completed its merger with Black Spade on 14 August.

Due to the low float, the shares have been on a wild ride, with the last close of US$6.56 materially below the high of US$82.35 per share.

VinFast remains an avoid due to related party-driven EV sales, declining customer traction, operating losses, cash burn, equity raise overhang and frothy valuation.

🇮🇳 MakeMyTrip: Gross Bookings Growth Encouraging (Seeking Alpha) $

Makemytrip (NASDAQ: MMYT) Limited has the potential for continued growth based on strong growth in gross bookings.

I take a bullish view on MMYT.

I also acknowledge that the company needs to keep showing strong growth in bookings, revenue, and earnings for the upside to continue from here.

🇮🇳 Tata Technologies IPO: Valuation Insights (SmartKarma) $

🇮🇳 Rajesh Exports (NSE: RAJESHEXPO) (Valuewala)

Incorporated in 1989 and headquartered in Bangalore, Rajesh Exports (NSE: RAJESHEXPO / BOM: 531500) is a global leader in the gold business, and the only company in the world with a presence across the entire value chain of gold- from refining to retailing.

🇵🇱 Auto Partner: A Boring Business with Brilliant Results (The Wolf of Harcourt Street)

Also see our June 27th post.

Auto Partner SA (WSE: APR / FRA: 6KF) Q3 2023 Earnings Analysis

Auto Partner is a distributor of spare parts for cars, light commercial vehicles and motorcycles based in Poland and listed on the Warsaw Stock Exchange. It operates as a sales and logistics platform managing just-in-time deliveries of spare parts to geographically dispersed customers and providing its services mainly to repair shops and automotive retailers. Its product portfolio includes spare parts for car systems, parts and accessories for motorcycles, filters, oils, car chemicals and accessories.

The company can be categorised as a small-cap stock, given its market capitalisation of approximately €770 million. It remains significantly under followed, and I suspect that the majority of readers may not be familiar with it. The company does not release a recording of its earnings call, but I was invited to participate, and I duly obliged. Consequently, the analysis presented here stands as some of the most unique available.

🇸🇮 Nova Ljubljanska Banka The Cheapest Bank in Europe? (Iggy’s Substack)

A deep dive in to Slovenia’s largest and Europe’s cheapest bank

Nova Ljubljanska Banka D.D.Ljubljana or the NLB Group (LON: 55VX / FRA: N1V2) is the largest bank in the Republic of Slovenia and a major player in the South Eastern European market. I believe the stock is exceptionally undervalued, given its outstanding performance since being privatized and going public in 2018. Over the last five years of being public, NLB achieved an average return on equity of 14%. However, today the bank trades at only 0.59 of its book value and has a trailing twelve-month PE ratio of ~4x in the current higher interest rate environment.

Even in a low/negative yield environment, which is typically unfavorable for banks, NLB has managed to achieve ROEs of above 10%. So, even in a worse rate environment, the bank trades at a PE of approximately 6x. Furthermore, the bank currently offers a dividend yield of 6%, which I expect to grow, providing solid downside protection.

🇿🇦 Sibanye Stillwater Convertible Bond Offering (Calvin’s thoughts) $

Breaking down the terms of the offering and the pricing

Though I’m surprised the company felt it needed to raise cash, I guess they are serious about staying close to zero net leverage while still being able to fund acquisitions. Sibanye Stillwater Ltd (NYSE: SBSW) bought a PGM (platinum group metals) recycler recently for $200M, and today announced they are adding $500M to their balance sheet via a convertible bond.

🇿🇦 Spar forecasts a big decline in earnings after SAP system failed to launch (IOL)

The Spar Group (JSE: SPP / OTCMKTS: SGPPF) share price fell more than 4% yesterday after it forecast sharply lower earnings for the year to September 30, with the failure of a new SAP information technology system largely to blame.

The grocery store group said in a trading statement yesterday that it expected diluted headline earnings per share (Heps) to fall by between 53% to 43% for the year. The share price was last seen trading at R112.56. The price has fallen in a steady trendline by 42.5% over three years.

🇧🇷 PagSeguro Q3: Positive Trends Amid Brazil’s Interest Rate Slowdown (Seeking Alpha)

PagSeguro Digital (NYSE: PAGS) reported record-breaking net profit in Q3, showcasing resilience in the face of challenges in Brazil’s credit environment.

The company’s valuation and potential to benefit from a favorable fiscal landscape strengthen the optimistic outlook.

Regulatory risks, including a law imposing revolving credit limits, could affect revenues for banks and acquiring companies like PAGS.

🇧🇷 Lavoro Limited: Undervalued Company With A Solid Upside Potential (Seeking Alpha)

The first distributor of agricultural inputs in Latin America to have its shares listed on Nasdaq.

Lavoro Limited (NASDAQ: LVRO) recently posted impressive Q4 FY23 and FY23 results, showing strong growth in tough market conditions.

The company’s revenue and gross margin increased, driven by solid growth in its Brazil Ag Retail segment.

Cheap valuation and positive outlook make LVRO a potential buying opportunity.

🇧🇷 Banco do Brasil Q3 Earnings: Not Brilliant, But Yet Solid (Seeking Alpha) $

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY)‘s Q3 earnings, while not stellar, reflect solid performance with a 21.3% ROE, outperforming domestic peers.

Mild concerns have surfaced due to the rise in delinquency rates and a decline in net profit growth for the quarter.

The credit portfolio expanded, driven by individual, companies, and agricultural segments, showing strong year-over-year growth.

Valuation multiples remain attractive, with a heavily discounted P/E of 3.7x for 2024E and a P/B below 1.

Despite a likely growth slowdown in 2024, Banco do Brasil’s focus on credit expansion and favorable interest rate trends in Brazil means a positive outlook.

🇧🇷 Time To ‘BUY’ JBS, The World’s Biggest Butcher? I Say Not Yet (Seeking Alpha) $

JBS SA (BVMF: JBSS3 / OTCMKTS: JBSAY) is the world-leading company in several types of consumer meats and packaged foods. The company has a long history and is likely to be a continued market leader.

The company is currently in a declining trend, making it an attractive prospect for long-term investment, as long as the fundamentals hold up.

I give you my view on JBS S.A., which at this time is a positive view with upside, and a “BUY” rating.

🇧🇷 Brazil’s Maturing Private Markets Attract U.S. Investment Firms (WSJ) $

Ares Management’s $100 million deal with Brazilian private-equity shop Vinci Partners gives it a foothold in the vast market.

Brazil’s private-capital industry continues to mature and is attracting U.S. asset managers looking to expand in new regions, as investment risks increase in other markets such as China.

Publicly traded U.S. firm Ares Management (NYSE: ARES), which oversees about $395 billion mostly in private credit operations, recently formed a partnership with Brazilian private-equity manager Vinci Partners Investments (NASDAQ: VINP) that involves marketing new funds offered by both firms. As part of the deal, Ares invested $100 million in Rio de Janeiro-based Vinci.

🇨🇴 GeoPark Limited: Risks Are Baked In And The Dividend Too Good To Pass On (Seeking Alpha) $

Also see: GeoPark Ltd (NYSE: GPRK): Positioned for a Latin American Oil Boom

GeoPark Ltd (NYSE: GPRK / LON: 0MDP / FRA: G6O)‘s stock price has declined over 30% in the last 12 months, but now offers a 5% yield.

The company has diversified its operations across multiple regions, with Colombia being the primary contributor to oil production.

Despite softer oil prices impacting revenues, GeoPark has been returning large amounts to shareholders through dividends and buybacks.

🇺🇾 MercadoLibre Is On The Path To Creating The Super App For Latin America (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) is building a comprehensive digital ecosystem in Latin America and has the potential to become a “super app” for the region.

The company’s Q3 earnings showed impressive growth and profitability, with net revenues reaching $3.8 billion.

MercadoLibre’s loyalty program, MELI+, and its expansion into entertainment streaming and fintech services are enhancing user engagement and increasing the value of transactions.

$ = behind a paywall

🇨🇳 Trillion Dollar Bailout: What Xi Really Wants From Biden (Oilprice.com)

Despite a significant economic crisis in mainland China since 2015, Xi has taken minimal steps to address it.

During his visit to San Francisco, Xi, seemingly desperate, requested a substantial $900-billion bailout for the Chinese economy from President Biden.

The leak came from within the CCP, indicating a faction eager to bring down Xi.

🇨🇳 Five things to know about China’s unusual sovereign bond issue (Caixin) $

The Chinese government took a rare and unexpected decision in October to issue 1 trillion yuan ($141 billion) of additional sovereign bonds in the fourth quarter to finance infrastructure spending, widening the budget deficit as a percentage of GDP for 2023 to a record high of 3.8%.

The announcement, which surprised economists and investors, has fueled debate about whether this heralds a change in the leadership’s approach to fiscal policy.

🇨🇳 China tells top financial institutions to bolster the property market (Caixin) $

The Chinese government told China’s most important financial institutions to balance loan offerings and make credit plans for the last two months of this year and next year to bolster the real estate market and halt a deepening skid of the economically important sector.

In a meeting Friday, the People’s Bank of China, the National Administration of Financial Regulation and the China Securities Regulatory Commission ordered financial institutions to meet the reasonable funding needs of property developers no matter their ownership structure.

🇨🇳 Chinese shadow bank Zhongzhi faces $36bn shortfall after ‘management ran wild’ (FT) $

🇨🇳 🇸🇦 What Are the Saudis Really Preparing for? (Gold Goats ‘N Guns)

The announcement of the swap lines is likely a pre-announcement of an Economic Hitman-style attack on Saudi Arabia by the US. It’s not really that difficult to foresee.

For historical context, Russia was hit hard in 2014/15 by the collapse in oil prices. In retaliation for “stealing Crimea” an attack on oil prices was organized by President Obama and the gaggle of usual suspects to trash the oil price.

China offers the Saudis a swap line to ensure breaking the peg goes smoothly. In other words, China will loan the Kingdom dollars to be repaid in yuan, just like they did for Russia and are currently doing today for their Southeast Asian trading partners trying to defend their currencies against the Dollar’s milkshake suction.

🇨🇳 🇯🇵 Less than 30% of Japanese firms plan China expansion – survey (Reuters)

In an annual survey by the Japan External Trade Organisation, a semi-governmental export promotion agency, 27.7% of 710 companies said they were expecting to expand operations in China in the next a year or two.

The percentage declined from 33.4% last year and 40.9% in 2021.

Some 31 firms attributed their downsizing to economic uncertainty and a sluggish market, while 15 blamed a slump in Japanese auto sales in China, the world’s top car market.

🇨🇳 China adds six countries to 15-day visa-free program (Caixin) $

China plans to expand its visa-free program to citizens of France, Germany, Italy, Malaysia, the Netherlands, and Spain on a one-year trial basis beginning in December, the foreign ministry said Friday.

From Dec. 1 this year to Nov. 30, 2024, travellers holding ordinary passports from the six countries will be able to travel to China and stay for 15 days without a visa, Ministry of Foreign Affairs spokesperson Mao Ning said at a daily briefing.

🇹🇼 Investors are funding 85% of dividends at one Taiwan ETF (FT) $

Regulator has introduced mandatory disclosures of dividend composition after receiving complaints

The Fuh Hwa Taiwan Technology Dividend Highlight ETF (00929.TW), one of the most popular ETFs listed in Taiwan this year, disclosed last week that 85.7 per cent of its monthly payout had come from the equalisation mechanism, while only 14.3 per cent came from actual dividends.

🇮🇳 India’s back-office boom sparks ‘war’ for IT service workers (FT) $

International companies are rushing to set up their own back offices in India as they seek to develop technology in house, sparking a “huge war for talent” with traditional IT service providers such as Infosys (NYSE: INFY) and Tata Consultancy Services (NSE: TCS / BOM: 532540), said industry experts.

🇧🇩 Beyond Fashion: Unraveling Bangladesh’s Garment Industry Challenges (SmartKarma) $

Bangladesh’s garment industry grapples with a 14% export dip, prompting worker unrest over wage discrepancies.

Efforts by a wage board fall short as workers advocate for a Tk25,000 minimum, seeking fair compensation.

Economic turbulence looms as 3,500 factories, constituting 85% of exports, confront closure amid widespread unrest.

🇦🇷 Javier Milei prepares shock therapy to cure Argentina’s sickly economy (FT) $

🇦🇷 Consider This: Argentina’s economic policy evolution (Franklin Templeton)

The unique blend of populism, socialism, protectionism and nationalism launched by Juan Perón, who won the presidency in 1946, broadly drove the evolution of economic policy since that time. “Peronism” survives to this day, having won 10 of the 14 elections it has disputed, without evolving much. The outgoing government of Alberto Fernandez is only the latest iteration. It has brought the country to an inflation level of nearly 150% and gross domestic product (GDP) growth that the International Monetary Fund estimates will be -2.5%.1 The population is impoverished, with 39% living below the official poverty line.2

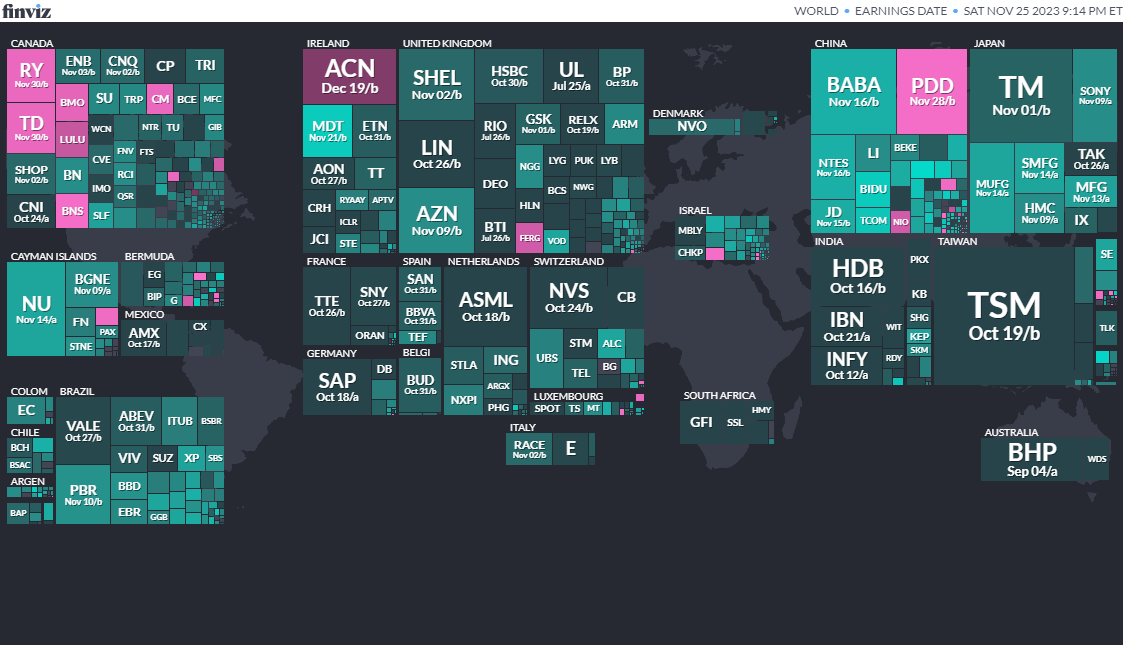

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

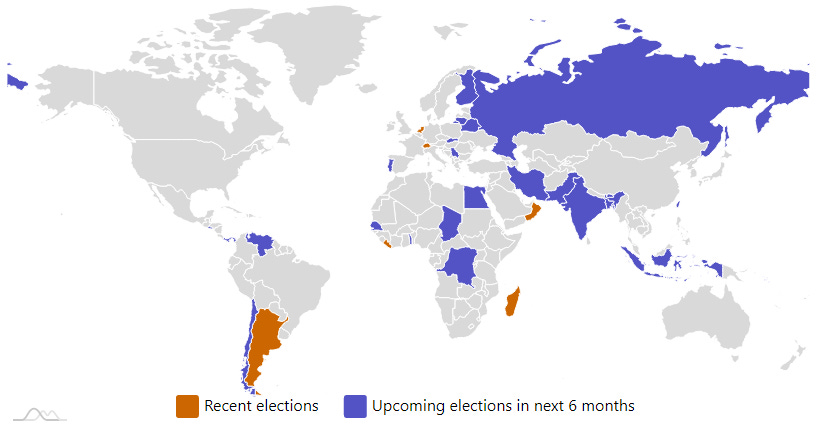

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

ArgentinaArgentinian PresidencyNov 19, 2023 (d) Confirmed Oct 22, 2023 -

Venezuela Referendum Dec 3, 2023 (d) Confirmed Feb 15, 2009

-

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023