Emerging Market Links + The Week Ahead (October 23, 2023)

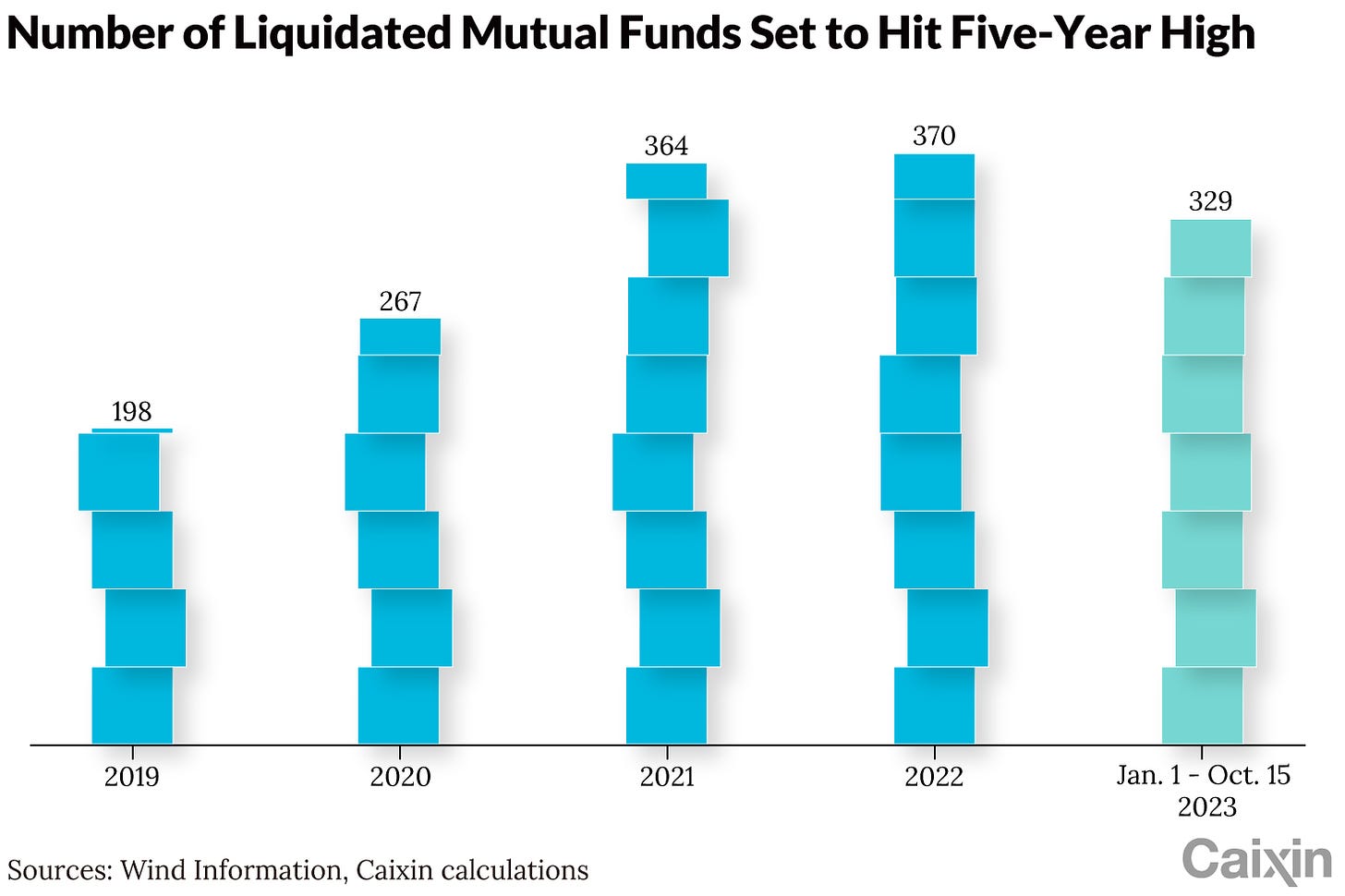

A mix batch of news out of China as Chinese state-owned companies are buying back shares while regulators tighten the rules for short selling to try and support the market as mutual fund liquidations are set to hit five-year highs. A three Child policy is still failing to bear children, but borrowing has reportedly surged among private Shenzhen enterprises – meaning some areas of the economy or country are still growing.

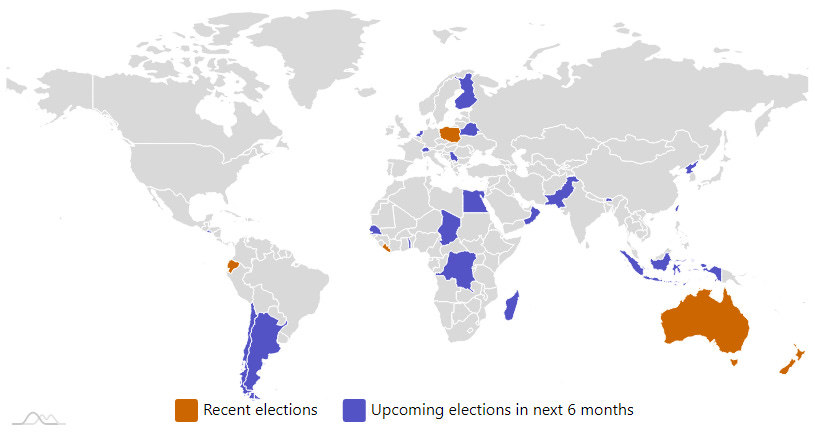

Finally and on the election front, it looks like Poland will be more welded to Brussels while Milei (the libertarian and “unapproved” candidate) will have a runoff with a Leftist Peronist candidate on November 19th. It will be interesting to see IF Argentina ends up with more of the same failed policies or something different – and perhaps some hope for a turnaround.

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Our thoughts on the upcoming J&T Express IPO (Momentum Works)

Note: Draft IPO prospectus

The public equity market in Hong Kong (and many other bourses) remains very challenging;

Undoubtedly the leading last mile logistics company in Southeast Asia, J&T faces pressure including Shopee’s in-house logistics, as well as the price war waged by Flash Express in Thailand;

Some sharp short-term pain for J&T in Indonesia because of the TikTok Shop ban, as J&T was (profitably) carrying the majority of the TikTok Shop’s millions of daily orders;

This ecommerce volume lost by TikTok Shop will eventually recover (but not very fast) – we explain the factors in the article;

China’s competitive landscape is trickier but the logic is probably similar;

J&T’s franchise model is worth studying.

🇨🇳 Cainiao Smart Logistics IPO: The Bull Case (SmartKarma) $

Cainiao Smart Logistics (1437124D HK), a global leader in e-commerce logistics, has filed for a HKEx IPO to raise at least US$1 billion at a US$15-20 billion valuation.

According to CIC, Cainiao is the world’s leading cross-border e-commerce logistics company regarding parcel volume in 2022, with one of the world’s largest logistics networks in terms of geographic reach.

The bull case rests on market share gains in China, improving performance of the largest business (international logistics), and rising gross and operating margins.

🇨🇳 🇺🇸 Chinese-owned pork producer Smithfield prepares for US listing, Wall Street Journal reports (Reuters)

Smithfield Foods’ Chinese owner WH Group Ltd (HKG: 0288 / FRA: 0WH / 0WHS / OTCMKTS: WHGLY / WHGRF) is working with banks to take the U.S.-based pork producer public again in the United States.

Smithfield could list its shares as early as next year, the WSJ reported, adding that the deliberations are ongoing and the timing could change.

The U.S. meat industry has struggled with declining profit and reduced demand from consumers squeezed by inflation and higher interest rates. Amid spiraling feed and labor costs, meat companies have struggled to predict demand for their products.

🇨🇳 Forget about tech. Shiyue Daotian cooks up hot IPO with premium rice (The Bamboo Works)

After first filing for an IPO in March, Shiyue Daotian Group (HKG: 9676) steamed out of the gate with a 60% rise for its newly listed shares in their first week of trading

Shiyue Daotian has sizzled in the week since its trading debut, as investors bet on its position as one of China’s top premium rice sellers

The company’s pre-IPO backers include such big names as HongShan and Mubadala Capital, owned by Abu Dhabi’s sovereign wealth fund

🇨🇳 Lotus EV unit warns of China risks ahead of Spac listing (FT) $ 🗃️

🇨🇳 Xtep International (1368 HK): Strong 3Q23 Retail Sales But At The Expense Of Higher Discounts (SmartKarma) $

Xtep (HKG: 1368 / FRA: 4QI / OTCMKTS: XTEPY / XTPEF) announced yesterday strong retail sales of high-teens growth in 3Q23.

Though the growth was at the expense of slightly higher overall discounts of 25-30% off during the quarter.

I prefer ANTA Sports Products (HKG: 2020 / FRA: AS7 / OTCMKTS: ANPDY / OTCMKTS: ANPDF) over Xtep given higher visibility in Anta’s bottom line, as Xtep’s growth continues to be of lesser quality than Anta’s.

🇨🇳 Topsports (6110 HK): High Dividend Yield Supported By Strong Free Cash Flow (SmartKarma) $

Topsports (HKG: 6110 / OTCMKTS: TPSRF) announced first half FY24 (fiscal year ending February) results last week, with net profit up 17% yoy.

The company trades at a 7% dividend yield, backed by strong free cash flow.

The stock is not only a yield play, but also a call option on the recovery of Nike and Adidas’ retail performance in China.

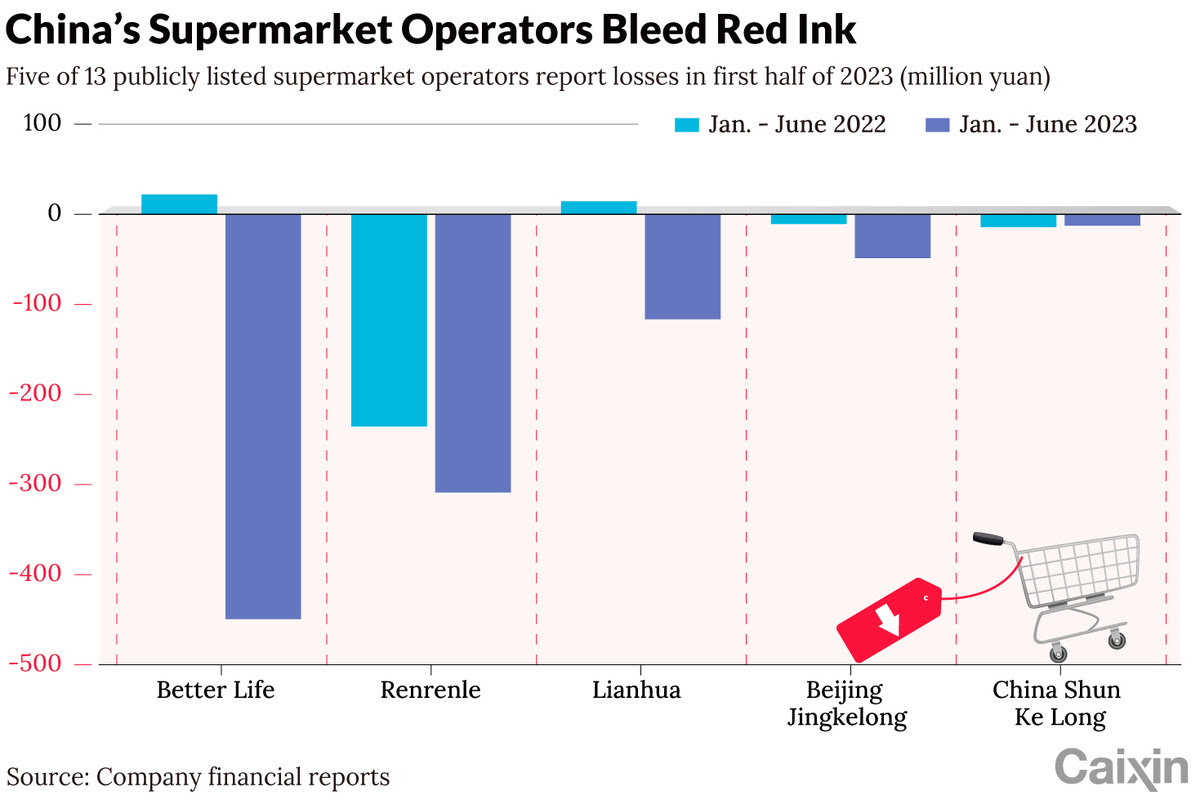

🇨🇳 In Depth: The struggle facing big-box supermarkets in China (Caixin) $

China’s big-box supermarkets are running into trouble.

Carrefour China, once the country’s largest foreign supermarket chain with nearly 260 stores in 2017, had fewer than 150 stores remaining at the end of last year. In Beijing, it is currently down to one of its last outlets, with shoppers taking to social media last month to post photos of rows of empty shelves and refrigerators.

Financial trouble is also reflected in the first-half results of China’s 13 publicly traded supermarket operators. Five of them reported year-on-year losses while three posted revenue declines despite making a profit, according to their earnings reports.

🇨🇳 Asian Dividend Gems: Giordano International (SmartKarma) $

Giordano International (HKG: 0709 / FRA: GIO / OTCMKTS: GRDZF), one of the most recognizable apparel business in Asia, has been improving its operations materially with solid growth in sales and profits.

Giordano provides very high dividend yield and payout. The consensus expects DPS of HKD 0.28 for Giordano in 2023, which would suggest a dividend yield of 12.8%.

We like the company’s high dividend yield, loyal customer base, and attractive valuations. It is trading at EV/EBITDA of 3.6x and P/B of 1.5x.

🇨🇳 Canaan: Time To Buy Shovels? (Seeking Alpha) $

Canaan (NASDAQ: CAN)’s ASIC business has been in decline due to the broad softness in the cryptocurrency market.

The company has a large glut of inventory and is moving units at deep discounts.

One of the company’s largest peers, Bitmain, has reportedly had difficulty paying its employees. This could theoretically be an opportunity for Canaan.

I still think it’s slightly early to go long CAN before a post-halving rebound.

🇨🇳 NWD 17 HK: FY23 Results Update, to Reset and Transform, and a Beta Play if Rate Expectation Peaks (SmartKarma) $

In this insight, we summarized New World Development Company (HKG: 0017 / FRA: NWDA / OTCMKTS: NWWDF)’s FY2023 results. We think the gearing and balance sheet, the biggest concern that market has, has been clearly addressed

NWD has announced disposal of its stake in NWS, and will have more corporate actions to come. The dividend expectation is reset

We view most of the negatives are priced in at current valuation. NWD is much better than a Chinese developer, and should not be trading at 0.19x PB

🇨🇳 Gemdale plunges on chairman’s resignation and debt concerns (Caixin) $

Gemdale Corp. (SHA: 600383)’s shares and bonds plunged after the Chinese property developer’s chairman resigned, intensifying investor concerns about its financial sustainability in the face of more than 10 billion yuan ($1.37 billion) of maturing debt.

Chairman Ling Ke stepped down after 25 years, citing health issues, the Shanghai-traded company said Tuesday in a filing. The board accepted Ling’s resignation and named President Huang Juncan to assume his duties, the company said.

🇭🇰 Leaven Partners – Playmates Toys: Once A Screaming Deal (Seeking Alpha) $

Playmates Toys (Playmates) (HKG: 0869 / 0635 / FRA: 45P / OTCMKTS: PMTYF / PYHOF), a Hong Kong-based toy manufacturer, has experienced financial difficulties due to the COVID-19 pandemic.

Despite the challenges, Playmates has diversified its licensing agreements and has a history of treating shareholders fairly.

The company has returned to profitability, doubling revenue in 2021, and recently released new toys based on the Teenage Mutant Ninja Turtles franchise.

🇰🇷 Douzone Bizon: Cooperating with Amazon Web Services to Enter the Global SaaS Market (SmartKarma) $

On 16 October, Douzone Bizon (KRX: 012510) announced that it is entering the global software-as-a service (SaaS) market in cooperation with Amazon Web Services (AWS).

The agreement stipulates that Douzone Bizon will develop global SaaS through AWS support and enter overseas markets.

We believe shares of Douzone Bizon have been oversold. Valuations have become more attractive and its cooperation with AWS is also likely to improve the company’s overseas sales and profits.

🇰🇷 Bluemtec IPO Preview (SmartKarma) $

Bluemtec is getting ready to complete its IPO in KOSDAQ in the next several weeks. Bluemtec operates the number one pharmaceutical e-commerce platform in Korea.

The company is offering 1.4 million shares in this IPO. The IPO price range is from 15,000 won to 19,000 won.

The company sales and gross profit growth increased impressively in the past several years. The company’s sales increased at a CAGR of 60.5% from 2020 to 2022.

🇲🇾 Bank cuts GEN Malaysia 2024-25 earnings on sales tax hike (GGR Asia)

Maybank Investment Bank Bhd is cutting by 4 percent and 5 percent respectively, its forecast for 2024 and 2025 earnings at Genting Malaysia (KLSE: GENM), operator of Resorts World Genting (pictured), the only licensed casino complex in Malaysia. That is due to a 2 percentage point rise in service tax in that nation, it said.

“The increase in service tax rate… is effectively a ‘gaming tax’ hike for Resorts World Genting,” said analyst Samuel Yin Shao Yang in a Thursday memo.

Maybank noted that based on a Malaysian budget proposal tabled on October 13, the country’s service tax rate was – from March 1 next year – to be raised to 8 percent, from 6 percent currently.

“Other catalysts” for Genting Malaysia investors, were if the group succeeded in “securing a full casino licence in New York City and writing back its Mashpee Wampanoag investment,” stated the analyst.

🇲🇾 Hartalega update (HART MK) (Asian Century Stocks) $

Hartalega (KLSE: HARTA / OTCMKTS: HHBHF) is one of Malaysia’s largest producers of disposable gloves. They’re primarily sold to the North American and European healthcare industries but also labs, food & beverage companies, etc.

The glove industry enjoys secular demand growth of about 10% per year. But since the outbreak of COVID-19, the industry has experienced a boom-bust period that has yet to end. The current cycle was made worse because glove makers accumulated cash during the pandemic and used it to expand capacity.

Today, the industry suffers from oversupply. Average selling prices are at rock-bottom levels, and customer inventory remains higher than normal.

There are now early signs that average selling prices are bottoming out. Some customers are starting to restock their inventories. In my view, it will most likely take about 2-3 years for supply & demand to return to balance.

🇮🇳 MakeMyTrip: Lofty Valuation And Insider Selling (Seeking Alpha) $

Makemytrip (NASDAQ: MMYT) has experienced strong growth since the pandemic driven by travel recovery and market share gains.

The Indian travel industry has secular tailwinds, and we remain positive on the growth story which is further likely to be boosted by the ongoing Cricket World Cup.

We initiate with a Sell as we believe the lofty valuations of the Street’s exuberance do not comprehend the downside risks accurately.

Insiders have been selling MMYT stock aggressively since its peak in August, totaling $43 million in sales over the past three months.

🇮🇳 Indian opposition calls for Adani Group probe over coal price allegations (FT) $ 🗃️

Note: Adani Enterprises (NSE: ADANIENT / BOM: 512599) is the flagship company of the Adani Group. See our Sept 12th post for all the listed companies.

🇫🇷 L’Oréal sales growth curbed by muted China (FT) $ 🗃️

L’Oreal SA (EPA: OR / FRA: LOR / OTCMKTS: LRLCF)

🇭🇺 Hungary Investment Trip – What We Learned (Undervalued Shares)

The Budapest Stock Exchange has 151 listed companies. If you ask anyone about Hungarian stocks, OTP Bank (BUD: OTPB / FRA: OTP / OTCMKTS: OTPBF) (ISIN HU0000061726, BUD:OTP) is one of the two they are likely to mention first. Hungary’s leading bank makes up 30% of the Hungarian market’s entire market cap.

ANY Security Printing Company / ANY Biztonsági Nyomda Nyrt. (BUD: ANY / LON: 0JC5) (ISIN HU0000093257, BUD:ANY) once was the “State Printing Company of Hungary”. However, it was privatised a long time ago and has since transformed its product line from traditional printing products to secure identification documents on paper, out of plastic, and digitally.

Erste Group Bank AG (VIE: EBS / FRA: EBO / EBOR / ETR: EBO / OTCMKTS: EBKDY) (ISIN AT0000652011, VIE:EBS) is the opposite to ANY, inasmuch as it’s a highly liquid stock of a company that has huge brand name recognition. In Central and Eastern Europe, “Erste” is one of the top brand names in banking (despite the fact that only German speakers will realise the name stands for “First”).

Interestingly, even the Budapest Stock Exchange (Budapesti Értéktőzsde) (BSE: BUD) (ISIN HU0000063078, BUD:BET) itself is now a publicly listed company.

Other companies that we visited included Magyar Telekom (BSE: MTEL / LON: 0NUG / FRA: MGYB / OTCMKTS: MYTAY) (ISIN HU0000360128, BUD:MTELEKOM), the former national telecoms operator.

MOL Magyar Olaj- és Gázipari Nyilvánosan Muködo Részvénytársaság (BSE: MOL / FRA: MOGB / MOGG / OTCMKTS: MGYOY) (ISIN HU0000153937, BUD:MOL) is the other obvious stock to pick when seeking exposure to the Hungarian market, given that it single-handedly contributes 20% of the market cap of Hungary’s publicly listed company sector (see also my recent Weekly Dispatch on Hungary for a more extensive assessment of the gargantuan oil and gas company).

🇰🇾 Consolidated Water: Good Prospects Likely Baked In (Seeking Alpha) $

Consolidated Water Company Ltd (NASDAQ: CWCO)

1H 2023: solid performance with double-digit revenue and income growth.

Long runway for growth driven by strategic expansion into new desalination markets, and acquisitions.

Strategic expansion to the U.S. opens significant growth potential. Competitive advantages due to vertical integration and strong presence in drought-hit U.S. West Coast position the company well.

Risks include desalination adoption hampered by environmental concerns and material deterioration in financial performance due to the Cayman Islands license restructure.

🇵🇦 Is Copa Airlines Still A Top Growth Stock With Big Potential? (Seeking Alpha) $

Copa Holdings stock has declined since July, in line with other airline stocks.

The company redeemed its 4.50% Convertible Senior Notes due 2025, resulting in minimal dilution for existing shareholders.

Despite concerns about unit revenues and oil prices, Copa Holdings is still considered a strong buy with significant upside potential.

🇨🇦 🇵🇦 First Quantum Minerals – Copper Panama approval triggering social unrest (Calvin’s thoughts) $

Panama is bracing for major protests over the coming weeks as protestors set to block dozens of roads across the country

Reuters reported on Friday that Panama’s President, Nito Cortizo, just gave final approval on a new long term contract for the copper mine in Cocle Province operated by Canadian company First Quantum (TSE: FM / FRA: IZ1 / OTCMKTS: FQVLF).

However, there are still dragons. In this post I’ll provide some on the ground intel and analysis of the company’s valuation and balance sheet. While I see the deal as financially beneficial to Panama, there is major push back.

As the Panama mine makes up more than half of First Quantum’s revenue, it’s good to understand the significant risk from social tensions. I’ve been involved in mining deals in the past, and when people get angry enough, they sometimes blow up.

🇧🇷 Banco do Brasil: Outperforming And Reasonably Valued (Seeking Alpha) $

Banco do Brasil (BVMF: BBAS3 / FRA: BZLA / OTCMKTS: BDORY) has performed well in a tough environment for Brazilian banks, with its profitability still near cycle highs.

There are multiple risks to consider, but non-performing loans look well-covered and the bank’s loan book skews heavily to agribusiness, with the Brazilian agriculture sector generally doing well right now.

Risks notwithstanding, on multiple measures these shares look cheap.

🇧🇷 Sendas Distribuidora: A Pre-Q3 Buy Opportunity (Seeking Alpha) $

Sendas Distribuidora S.A. (NYSE: ASAI) or Assaí Atacadista is about to release its Q3 results amid challenges from food disinflation and high-interest rates, but it has managed them well compared to peers.

The company is expected to benefit from improving economic conditions, with lower interest rates on the horizon, potentially leading to a 41% upside.

With its resilience and firm performance in the Brazilian cash and carry sector, Assaí stock presents an attractive investment opportunity.

🇧🇷 BRF: Uncertainty Persists Despite Commodity Cycle Advantage (Seeking Alpha) $

BRF Brasil Foods SA (NYSE: BRFS / BVMF: BRFS3) has outperformed the Brazilian stock market in 2023, rebounding from challenges posed by high global corn and soybean prices, which pressured its margins.

Second-half performance likely to benefit from lower commodity prices, improving margins, and supporting debt reduction.

Marfrig Global Foods Sa (BVMF: MRFG3 / FRA: MGP1 / OTCMKTS: MRRTY)‘s increased stake bolsters BRF’s shares, but the elevated valuation prompts me to explore alternative options with more favorable pricing.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 State-owned companies buy back shares to boost investor confidence (Caixin) $

About 50 Chinese state-owned companies are trying to bolster investor confidence by rolling out share buybacks or plans by big stockholders to expand their holdings after a series of other measures to prop up the stock market fell short.

China’s benchmark CSI 300 Index has dropped more than 6% this year, despite supportive government policies that included halving the stamp duty on stock trades and lowering the minimum ratio for stock purchases through margin financing in August. The index gained 0.35% Tuesday.

🇨🇳 China tightens rules for short selling to prop up stocks (Caixin) $

Stock investors on the Chinese mainland will have to set aside more in collateral when they borrow securities to sell, according to new rules announced by the China Securities Regulatory Commission Saturday.

The tightened rules on securities borrowing — an important tool for short selling — raised the minimum margin ratio for borrowers to 80% from 50%. For privately offered securities investment funds, the minimum ratio will be 100%. These changes go into effect on Oct. 30.

🇨🇳 Chart of the Day: China’s Mutual Fund Liquidations Set to Hit Five-Year High (Caixin) $

Mutual funds in China are getting liquidated at an increasingly fast pace amid fierce competition and a slump in the stock market.

As of Sunday, 329 mutual funds had been closed this year, putting the annual total of liquidations on track to surpass that of last year, according to Caixin calculations based on data compiled by Wind Information Co. Ltd. By contrast, for 2022 as a whole, 370 funds were closed.

At the current pace, 2023 looks set to mark a five-year high for fund closures.

🇨🇳 Borrowing surges among private Shenzhen enterprises (Caixin) $

Private companies in Shenzhen borrowed more in September, signaling reviving business confidence in southern China’s tech hub as effects of government’s supportive policies take hold.

As of the end of September, loans taken out by privately owned companies in Shenzhen totaled 2.97 trillion yuan ($407 billion), up 11.6% from the same time a year earlier, according to the Shenzhen branch of the People’s Bank of China (PBOC).

🇨🇳 China’s three-child policy isn’t leading to a surge in births, data shows (The China Project)

There’s a new sense of urgency to China’s looming demographic crisis

China’s three-child policy, introduced two years ago, is not boosting the country’s flagging fertility rate. Newly released data paints a bleak picture of China’s demographic woes, and has prompted calls from population experts for the government to beef up incentives to encourage childbirth.

🇮🇳 Chartbook X Unhedged: Investing in India – a “wager on the strong”? (Chartbook)

But the most enthusiastic buyers of Indian stocks are Indians themselves. One form this takes is retail investors swapping stock tips in WhatsApp groups and driving hyped-up small-cap stocks to ridiculous valuations. But another is the steady rise of systematic investment plans, which put a preset amount of money from your bank account into the stock market. A gradual increase in these schemes has driven domestic equity flows for the past few years (in green, below; chart from Macquarie):

A stable base of domestic equity buyers is good for global investors. Some markets, like China, suffer from flighty retail investors. Others, like Japan, just have too few of them; households are in the aggregate lightly allocated to stocks.

If there is a drawback for India investors, it is that the story has become too popular. The stocks look expensive. At a price/earnings ratio of 23, the Sensex is near the top of its historical range and at a premium to the US, world and EM indices.

🇮🇳 India Expected To Reject Russian Demand To Pay For Oil In Chinese Yuan (OilPrice.com)

Russia and its companies need Chinese currency as Russian trade has become much more reliant on China after Putin’s invasion of Ukraine and the sanctions on Russia. Moscow has a lot of Indian rupees, but it can’t spend them all while it needs yuan.

Russian oil companies have been asking lately for payments in yuan, but the Indian government – which owns 70% of the refiners in the world’s third-largest crude oil importer – will not agree to these demands, according to Bloomberg’s sources.

State-run Indian Oil Corporation Ltd (NSE: IOC / BOM: 530965) has settled purchases in yuan previously, while Bharat Petroleum Corporation Ltd (NSE: BPCL / BOM: 500547) and Hindustan Petroleum (NSE: HINDPETRO / BOM: 500104) have not yet resorted to the Chinese currency, though direct Russian suppliers have requested this.

🇦🇷 Massa overturns odds in Argentina election, will face Milei in November run-off (Buenos Aires Times)

With 76% of polling stations reporting, Sergio Massa leads the race for the Presidency with 35.9% of the vote; Javier Milei set to join him in run-off after taking 30.5%; Bullrich all but out with just 23%.

To woo voters, Massa went on a pre-election spending spree, slashing income tax for much of the population in a move analysts say will only make the country’s fragile financial situation worse.

🇻🇪 Venezuela’s bonds rally after US trading ban lifted (Reuters)

Prices more than doubled for some sovereign bonds, with a 2018 Venezuela issue up 8.75 cents at 17 cents. A 2020 note of state oil company PDVSA was up 13 cents at 66.5 cents.

Venezuela and PDVSA, which have more than $60 billion in debt, stopped paying bondholders at the end of 2017 and several creditors filed lawsuits in court.

Small funds and investors outside the United States had looked to increase their exposure to Venezuelan bonds on the expectation of debt renegotiations.

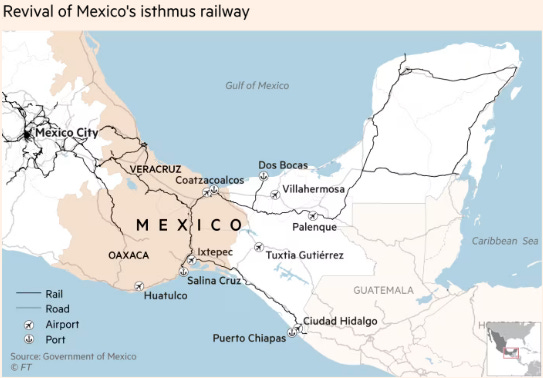

🇲🇽 Mexico revives century-old railway in $2.8bn bid to rival Panama Canal (FT) $ 🗃️

The $2.8bn Tehuantepec isthmus corridor will feature a 308km railway between renovated ports at Salina Cruz in Oaxaca state and Coatzacoalcos in Veracruz, and industrial parks close to transport hubs, including airports, along the route. Trains have already traversed the route on test runs ahead of its opening in December.

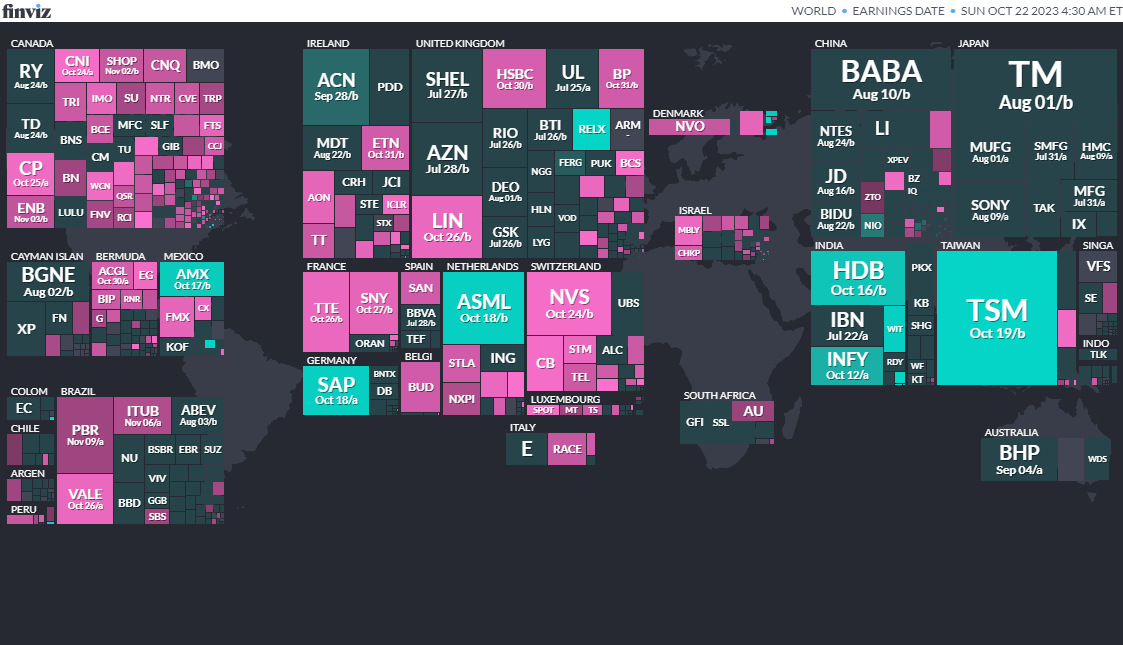

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

EcuadorEcuadorian PresidencyOct 15, 2023 (d) Confirmed Aug 20, 2023 -

PolandPolish SejmOct 15, 2023