Emerging Market Links + The Week Ahead (October 30, 2023)

Caixin has reported that the domestic arm of China’s sovereign wealth fund is buying exchange-traded funds to try and shore up local stock market. Whether that will be enough to make up for foreign fund outflows and local retail investors who are no doubt skittish due to problems in the property sector remains to be seen.

In Latin America, Colombia’s leftist president was dealt blow in local elections. Apparently, Petro’s polarising plans to overhaul health, pension and labour laws have struggled to gain cross-party support in congress while his government and family have been embroiled in scandal (Also see: Global X MSCI Colombia ETF Holdings (September 2023)).

Finally, I had to use up China Airlines frequent flyer miles from before COVID that were about to expire to fly to Tokyo (via longggg layovers in Taiwan due to the lack of redemption seats for Osaka + the autumn Japan foliage season) for a few days, and have just arrived in Kyoto for the next two weeks intending to see as many temples and gardens as possible.

I already have some usual monthly posts almost ready (albeit I might take an extra day to write the Tuesday posts). Later this month, I will do some trip reports for Japan and Taiwan focused more on stocks that you might encounter as a traveler to both e.g. 7-Eleven, etc.

$ = behind a paywall

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Cainiao Smart Logistics IPO: The Bear Case (Smart Karma) $

Cainiao Smart Logistics (1437124D HK), a global leader in e-commerce logistics, has filed for a HKEx IPO to raise at least US$1 billion at a US$15-20 billion valuation.

In Cainiao Smart Logistics IPO: The Bull Case, we highlighted the key elements of the bull case. In this note, we outline the bear case.

The bear case rests on declining global cross-border market share, China logistics decelerating growth, high related-party transactions, and FCF burn.

🇨🇳 Guoquan’s growth goes into simmer mode post-Covid (Bamboo Works)

The home hotpot specialist, one of China’s leading ‘dine-at-home’ brands, has been approved for a Hong Kong IPO

Guoquan Food returned to the black in the first four months of this year, earning a profit of nearly 120 million yuan

The dine-at-home family hotpot brand sharply expanded its network of retail stores during the pandemic, but is entering a slower growth phase as dining patterns return to normal

🇨🇳 Luyuan cruises out of IPO gate on zooming electric two-wheeler sales (Bamboo Works)

The maker of battery-powered scooters and bicycles raised about $90 million in an oversubscribed Hong Kong listing

Luyuan Group Holding Cayman Ltd (HKG: 2451) priced its IPO shares close to the top of their indicative range, though the stock is largely unchanged a week after its trading debut

The company’s revenue doubled in the two years to 2022, with its net profit growing even faster

🇨🇳 Noble Family Wine hopes to be the toast of Hong Kong (Bamboo Works)

Inspired by fellow liquor brand ZJLD Group (HKG: 6979), the Chinese wine distributor plans to pull out of the mainland NEEQ market and list its shares in Hong Kong

Noble Family Wine has been profitable for three years in a row, meeting the criteria for a Hong Kong listing

The company’s revenue from red wine sales almost tripled in the first half of the year, but gross margin on the business plunged 3.3 percentage points to 6.3%

🇨🇳 Ping An Health pins recovery hopes on new leadership (Bamboo Works)

The ailing healthcare platform brought in a whole new management team three years ago to drive a business turnaround but it is changing leaders again

The Covid pandemic boosted traffic to online medical platforms, but a strategy shift meant Ping An Healthcare and Technology (HKG: 1833 / FRA: 1XZ / OTCMKTS: PANHF) could not capitalize on the opportunity, and its revenues fell

The platform has become more dependent on its parent, Ping An (HKG: 2318 / OTCMKTS: PNGAY), with its five main customers all affiliated to the insurer and providing nearly 24% of revenue

🇨🇳 Pop Mart (9992 HK): Strong 3Q23 Operational Update; Thesis Intact (Smart Karma) $

Pop Mart International Group (HKG: 9992 / FRA: 735) announced at noon today a business update on 3Q23.

Overall sales in 3Q23 grew 35-40% yoy, with domestic China sales up 25-30% yoy and international sales up 120-125% yoy.

Thesis intact, as the 3Q23 update showed that the international business continued to grow rapidly at 120-125% yoy growth.

🇨🇳 Asian Dividend Gems: Tingyi Holding (Smart Karma) $

Shares of Tingyi Holding (HKG: 0322 / FRA: TYG / OTCMKTS: TCYMF / TYCMY) are oversold. It has high dividend yield and attractive valuations. Its core instant noodles and beverage businesses are turning around this year.

The consensus expects DPS of HKD 0.62 for Tingyi in 2023 which would suggest a dividend yield of 6.1%. Tingyi Holding’s dividend yield averaged 5% annually from 2018 to 2022.

Tingyi’s “Master Kong” instant noodle is one of the best known brands in China. The company is also one of the largest producers and distributors of beverages in China.

🇨🇳 Travel rush is not golden enough for investors in CTG Duty Free (Bamboo Works)

Shares in China’s leading operator of duty-free stores have slumped after the company failed to meet high expectations for a post-pandemic rebound

China Tourism Group Duty Free (CTGDF) (HKG: 1880 / SHA: 601888)’s revenues jumped nearly 28% in the third quarter and net profit surged 93%, but the recovery from Covid lows was not vigorous enough to satisfy shareholders

The death of the company chairman, a pivotal figure at the firm, could add to market jitters as CTG’s fourth-quarter performance comes under scrutiny

🇨🇳 Nayuki brews up traditional teahouse concept (Bamboo Works)

The premium tea seller opened its first teahouse concept store in Shenzhen over the weekend, serving traditional-style teas and snacks at affordable prices,

Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF) is experimenting with a new store format selling traditional-style teas at affordable prices, with the opening of a concept store in Shenzhen

The premium tea seller recorded its first-ever adjusted profit in the first half of this year, but could face challenges as consumers rein in their spending

🇨🇳 Domino’s China partner serves up profits, new milestone in rapid growth story (Bamboo Works)

DPC Dash (HKG: 1405 / FRA: X12) opened its 700th store of the U.S. pizza chain last month, and said it’s on track to open 180 new stores in China this year

DPC Dash said it’s on track to open 180 new Domino’s stores in China this year – and plans to more than double its total store count to 1,500 by the end of 2026

The company’s stock has risen by nearly 70% since late August after it posted its first-ever profit and became accessible to Mainland China-based traders

🇰🇷 Hansoh Pharmaceutical (3692 HK): New Licensing Deal Boosts Conviction on Innovative Pipeline Prowess (Smart Karma) $

Hansoh Pharmaceutical Group (HKG: 3692 / FRA: 3KY / OTCMKTS: HNSPF) entered into a license agreement with GlaxoSmithKline PLC (GSK LN) for a B7-H4 targeted antibody-drug conjugate candidate, HS-20089, targeted toward gynecological cancers.

Hansoh will receive an upfront payment of $85M and be eligible to receive milestone payments of up to $1.485B subject to achievement of relevant milestone events with respect to HS-20089.

Currently, HS-20089 is in phase 1 clinical trial in China. GSK plans to begin phase 1 trial of HS-20089 outside of China in 2024.

🇰🇷 LS Materials IPO Preview (Smart Karma) $

LS Materials is getting ready to complete its IPO in Korea in late November. The IPO price range is from 4,400 won to 5,500 won per share.

According to the bankers’ valuation, the expected market cap after the IPO is from 298 billion won to 372 billion won.

LS Materials is one of the largest players globally in the large-size ultracapacitors, which stabilize power supply and are used to replace and supplement primary batteries and lithium-ion batteries.

🇰🇷 Increasing Probability of Kakao Corp Losing Its Controlling Shareholding of Kakao Bank (Smart Karma) $

In this insight, we discuss the increasing probability of Kakao (KRX: 035720) losing its controlling shareholding of KakaoBank (KRX: 323410).

The FSS Chairman Lee Bok-Hyun emphasized that the FSS may punish Kakao Corp for a potential stock manipulation of S.M.Entertainment amid the M&A tender offer process earlier this year.

At this point, the higher probability event appears to be a combination of fine and Kakao Corp selling at least 10% of its stake in Kakao Bank to another company.

🇰🇭 🇭🇰 NagaCorp says on track to repay fully its 2024 notes (GGRAsia)

NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF), operator of NagaWorld, a casino resort monopoly in the Cambodian capital Phnom Penh, says it will have “sufficient” capital to repay its US$472.2-million outstanding notes, maturing in July 2024.

The company had “cash and bank balances” of US$324 million as of October 17, it stated in a Thursday filing to the Hong Kong Stock Exchange.

Last week the casino firm said it got a loan of US$80 million, at 8.0-percent annual interest. The lender is ChenLipKeong Capital Ltd, a company controlled by The Sakai Trust, a family trust established by Chen Lip Keong. Mr Chen is the controlling shareholder and senior chief executive of NagaCorp.

🇸🇬 These 4 Singapore Stocks’ Share Prices Are Touching Their 52-Week Lows: Are They a Bargain? (The Smart Invvestor)

Raffles Medical Group (SGX: BSL / FRA: 02M1 / OTCMKTS: RAFLF), or RMG, is an integrated healthcare player operating in 14 cities within five countries in Asia.

The Hour Glass (SGX: AGS), or THG, owns a chain of 55 luxury watch boutiques across nine cities in the Asia Pacific region.

City Developments Limited (SGX: C09 / FRA: CDE / OTCMKTS: CDEVY), or CDL, is a global real estate company with a presence in 143 locations within 28 countries.

Wilmar International (SGX: F34 / FRA: RTHA / RTH / OTCMKTS: WLMIF / WLMIY) is a leading agribusiness group with an integrated business model that encompasses the entire value chain of the agricultural commodity business.

🇮🇳 ICICI Bank: Earnings Beat Overshadowed By NIM Contraction And Competition (Seeking Alpha) $

ICICI Bank (NYSE: IBN)‘s bottom line expanded by +36% YoY in Q2 FY 2024, and this was +9% above market expectations.

But ICICI Bank’s outlook isn’t that favorable, considering expectations of continued net interest margin compression, and competitive risks.

My Hold rating for IBN stock remains intact, taking into account both its second quarter performance and its near-term prospects.

🇵🇱 Dino Polska: Where is it headed? A destination analysis (Atmos Invest – Hunting for 100-baggers)

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY)

Nick Sleep popularized the term destination analysis in his letters. (if you haven’t read them, please do, you’ll learn a lot and they are excellently written). My goal is to perform such an analysis in order:

To paint a picture of where Dino could be going in 20 years

To get to a better understanding of the business, to get to the DNA of the company

To identify what management can do to get there in the future (for example are they perhaps sacrificing short-term gains to benefit their long-term destination)

To see the risks, what could prevent the company from reaching its destination

To evaluate if Nick Sleep would buy the company

🇦🇷 Central Puerto: More Risk Than Reward (Seeking Alpha) $

Central Puerto (NYSE: CEPU) is a poor investment choice due to unappealing valuation, deteriorating macroeconomic landscape, and unconvincing acquisitions.

The company’s vulnerability to the fluctuating Argentine peso and the shaky national economy poses significant risks.

Central Puerto’s financial performance has shown extreme volatility and lacks clear growth, further impacting its investment potential.

🇦🇷 Telecom Argentina: Improvements Don’t Justify Its Premium Valuation (Seeking Alpha) $

Telecom Argentina SA (NYSE: TEO) has faced challenges in recent years due to the Argentine debt crisis and increased competition in the telecommunications industry.

The company has managed to offset some costs despite extreme inflation levels in Argentina, and its leverage situation has improved.

The valuation of Telecom Argentina remains elevated compared to its peers in Latin America, as indicated by the high multiples in forward P/E, EV/EBITDA, and Price/Cash Flow ratios.

🇧🇷 BrasilAgro: Real Estate Resilience During A Challenging Harvest (Seeking Alpha) $

Brasilagro – Co Brasileira De Proprieda (NYSE: LND) should report a lower yield due to challenging factors in the 2022/23 harvest, but maintains a positive outlook for the future.

The company’s strategy revolves around efficient real estate transactions and profitable agricultural production, with an emphasis on mitigating risk.

Despite dividend concerns and market fluctuations, BrasilAgro remains an attractive option for income-oriented investors, with the potential for strong returns and appreciation in its stock value.

🇧🇷 Suzano: Still A Buy Despite Cyclical Weakness (Seeking Alpha) $

Suzano S.A. (NYSE: SUZ) has seen a 16.5% increase in its stock price since my previous article.

Suzano will release its third quarter 2023 results on October 26 and hold an annual investor day the next day.

In this article, I assess how our investment thesis has fared so far and review the factors that have been driving the recent share price gains.

Suzano stock seems to still be cheap and to have a major catalyst down the road, making this industry leader an attractive target to buy.

🇧🇷 Klabin: Q3 Earnings, Resilience In The Face Of Industry Challenges (Seeking Alpha) $

Klabin (BVMF: KLBN3 / OTCMKTS: KLBAY)’s Q3 results show resilience in the face of challenging sector conditions, particularly low pulp prices.

The paper unit showed promising results with a recovery in packaging sales, while the pulp division had a weak performance.

Despite weak net profit, Klabin’s performance in its paper unit and substantial volume of pulp sales are positive highlights.

The company is expected to continue distributing substantial dividends, with a potential yield of 5% to 6%.

🇧🇷 Nu Holdings Stock: Finally Following Warren Buffett’s Lead (Seeking Alpha) $

Nu Holdings (NYSE: NU) is among the best-performing portfolio constituents of Berkshire Hathaway this year.

Wall Street analysts, including JPMorgan and Morgan Stanley, have expressed bullish sentiments about Nu Holdings, citing the potential for market share gains and cost advantages.

Latin America remains underpenetrated and underserved by traditional banks, offering a growing market for Nu Holdings to thrive.

Nu’s current valuation, in my opinion, is reasonable because of a few main reasons.

🇨🇱 Enel Chile: An Undervalued Company With A Solid Yield (Seeking Alpha) $

Enel Chile (NYSE: ENIC) is a Chilean electricity utility company involved in the complete energy supply chain, including generation, transmission, and distribution.

The company achieved notable growth in its Generation segment, driven by increased solar and hydroelectric production.

However, the Distribution & Networks segment experienced a decline in operating revenues due to changes in the company’s consolidation perimeter.

Despite rising sharply over the past year, ENIC stock remains undervalued amid its <2x forward EV/EBITDA and high dividend yield.

🇨🇴 Ecopetrol: A Beneficiary Of Rising Oil Prices, Macro Risks Still Apparent (Seeking Alpha) $

Global oil prices remain high amid geopolitical tensions, offering risks and opportunities for Energy sector stocks and dividend investors.

I am upgrading Ecopetrol SA (NYSE: EC) from sell to hold due to its decent operating performance and stabilizing earnings.

The company faces risks from debt, volatile oil prices, and political instability in South America.

I outline key price levels to watch on the chart ahead of Q3 earnings due out next month.

🇺🇾 DLocal: Hypergrowth Leaves Room For Stock Appreciation (Seeking Alpha) $

Dlocal (NASDAQ: DLO) has immense revenue growth with a most recent quarterly growth of 59%.

The company operates a payment processing platform in emerging markets, with a current large focus on Latin America.

The company has achieved good profitability while growing with stable cash flows.

My DCF model estimates a good upside for the stock, leading to a buy-rating.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 In Depth: China banks jump on AI bandwagon to cut costs (Caixin) $

Banks in China are turning to artificial intelligence to save on labor costs and improve efficiency, but the transition faces both technical and regulatory hurdles, according to experts in the field.

The worldwide AI fervor driven by ChatGPT, the intelligent chatbot developed by Microsoft-backed OpenAI, has led industries across the spectrum to start integrating the smart helpers into their daily operations. Banking is no exception.

🇨🇳 Central Huijin steps up investment to bolster stock market (Caixin) $

Central Huijin Investment Ltd., the domestic arm of China’s sovereign wealth fund China Investment Corp., bought exchange-traded funds Monday in an apparent move to shore up the sagging stock market.

Central Huijin didn’t elaborate on the amount of ETFs it purchased but said it will keep expanding such holdings in the future. It was the second time this month that the state-run fund disclosed its open-market investment, following a 477 million yuan ($65.7 million) purchase of shares in the nation’s Big Four lenders.

🇨🇳 China tech IPOs decline as regulators turn tough on start-ups (FT) $ 🗃️

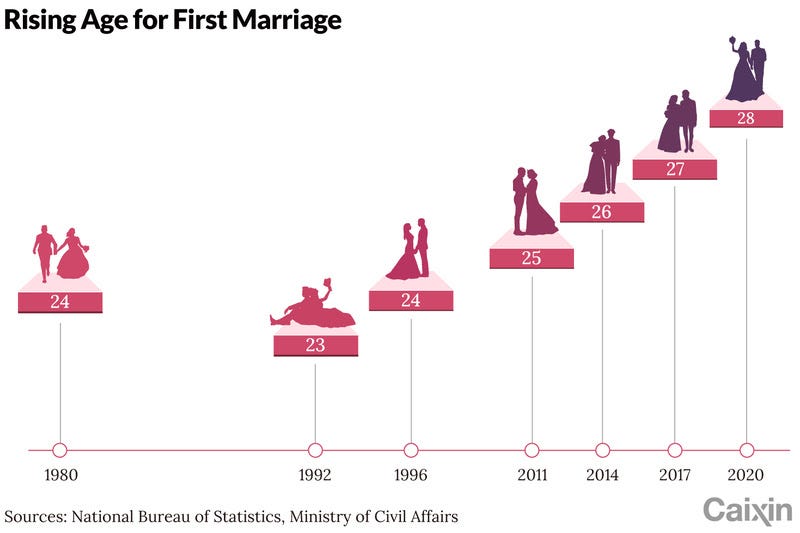

🇨🇳 Charts of the Day: Marriage loses its luster in China (Caixin) $

The number of marriage registrations in China plunged last year to the fewest in 43 years as more young people opted to stay single. The decline adds to pressure on the country’s sliding birth rate, which is driving a profound demographic shift.

Marriage registrations dropped 10.6% year-on-year to 6.8 million couples, according to data from the Ministry of Civil Affairs released earlier this month. The marriage rate was 4.8 per thousand, declining 0.06 of a percentage point from the previous year.

🇨🇳 🇹🇼 Foxconn: China probes warn Taiwanese to Gou figure (FT) $ 🗃️

Note: Gou is running for President of Taiwan.

🇮🇳 How can UK retail investors get into India? (FT) $ 🗃️

🇨🇴 Colombia’s leftist president dealt blow in local elections (FT) $ 🗃️

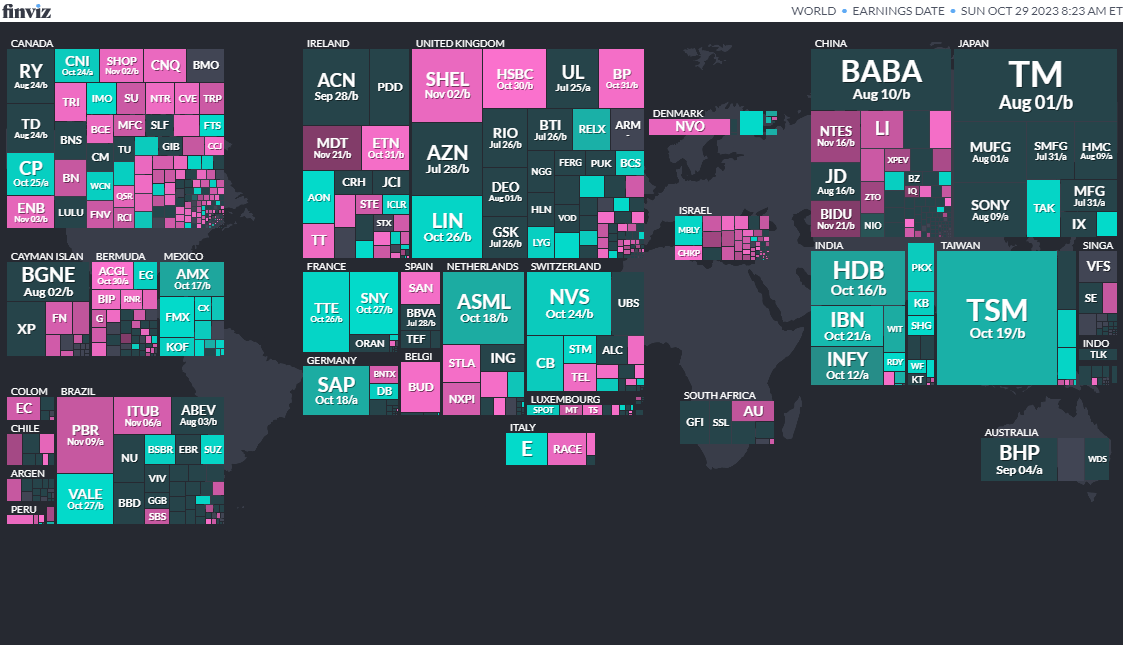

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

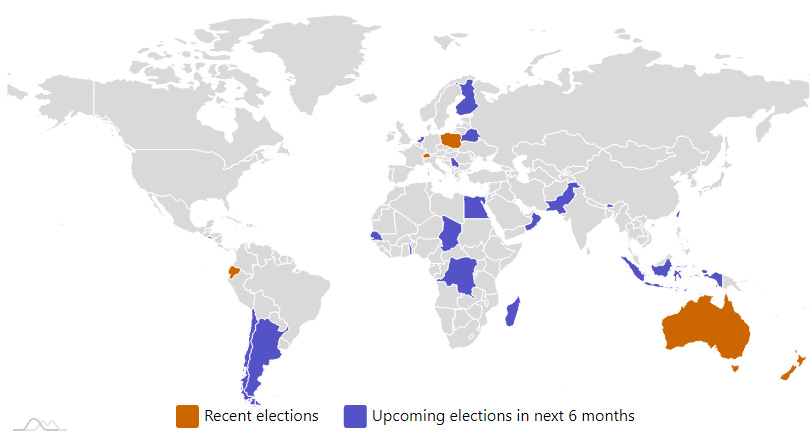

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

ArgentinaArgentinian Chamber of DeputiesOct 22, 2023 (d) Confirmed Oct 24, 2021 -

ArgentinaArgentinian SenateOct 22, 2023 (d) Confirmed Nov 14, 2021 -

ArgentinaArgentinian PresidencyOct 22, 2023 (d) Confirmed Aug 13, 2023 -

ArgentinaArgentinian Presidency Nov 19, 2023 (d) Confirmed Oct 22, 2023

-

Egypt Egyptian Presidency Dec 10, 2023 (d) Confirmed Mar 26, 2018

-

Chile Referendum Dec 17, 2023