Emerging Market Links + The Week Ahead (September 3, 2024)

Two interesting pieces to consider as Labor Day weekend marks the end of Summer in the USA. The first comes from the FT (🇨🇳 Chinese offices emptier than during Covid pandemic as slowdown hits 🗃️) which was picked up by alternative media (Zero Hedge): Chinese Offices Emptier Now Than During Peak Of Covid Lockdowns As Economy Crumbles

One week ago, we reported that China had found itself “On The Verge” of collapse as its “Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge.” All of this was the result of Beijing’s very deliberate – and extremely risky – decision to not engage in a massive stimulus this time, unlike every previous occasion of sharp economist slowdown, and risk social unrest at best, or a full-blown revolution as an unthinkable worst case.

Here is the silver lining: all those revolutionaries will have brand new empty offices at their disposal when they finally take over. That’s because as the FT reports, offices in China’s biggest cities are emptier than they were during stringent Covid-19 lockdowns in what is the latest clear sign of how the country’s economic slowdown has crushed business confidence.

However, the Financial Times might want to do some reporting in its own back yard as alternative media, in this case Alex Krainer’s TrendCompass, has just made a lengthy case for why Ukraine’s recent debt default has nearly brought down and eventually will bring down the UK: The coming collapse of Britain

“Everything points… to a horrific cliff-edge looming… an avalanche of debts, defaults, evictions and unpaid bills to follow.”

A series of bizarre developments that have unfolded in Great Britain over the last few weeks suggest that its financial system came to the verge of collapse, probably as a consequence of Ukraine’s debt default.

It would not be the first time in history that financing wars and military adventurism has brought down a country (e.g. France after funding the American Revolution, etc.).

Any readers in the UK (and for that matter, the EU…) might want to think hard about further diversifying any exposure away from local banks and other financial or investment institutions (even British and EU pension funds may no longer be safe from any fall out…) who are directly or indirectly on the hook for Ukraine debt or for financing “Project Ukraine” as another alternative podcast (The Duran / theduran) refers to Western involvement there…

(I should note that even my Dad’s pension took a small hit when Mexico defaulted back in the 1980s – to the apparent surprise of everyone at the company he worked for (“Why were they investing our money in Mexican bonds?!!!” The unhappy owners, who also lost money, ordered the pension to only invest in US bonds and CDs for the next decade+ – missing out on much of the 1980-90s US stock market boom…)…)

$ = behind a paywall

-

🇨🇳 🇭🇰 🇲🇴 China, Hong Kong & Macau Stock Index Partially Partially $

-

This post is an index for all China (201 as of August 2024), Hong Kong (23 stocks) and Macau stocks covered and tagged under our EM Stock Pick Tear Sheets

-

🏛️ State owned 👼🏻 ESG friendly 🅿️ Preference shares available 🌐🌏 Global/regional operations or part of global/regional supply chains

-

-

🌐 EM Fund Stock Picks & Country Commentaries (September 1, 2024) Partially $

-

Picking EM stocks capable of paying long-term dividends, bottom-up Chinese stock picking, China + India focus on fiscal discipline, the creeping reversal of globalisation, global mega themes, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 LiAuto (LI US, BUY, TP:USD25.0): Good 2Q-2024 Results, on Track to Match Consensus (Smartkarma) $

2Q-2024 results is within ours and consensus expectations. Competition is tough, but Li Auto (NASDAQ: LI) managed to remain profitable

Management is boosting R&D expenditure and boost spending on expanding number of charging stations, all for the benefit of its customers.

Our fair value of USD25 implies 16x FY25 PE – average for auto growth stock. A bargain with 3-year CAGR of 38%, net cash, and churns high free cash flow.

🇨🇳 (Li Auto (LI US, BUY, TP US$22) TP Change): Expanding Outside of SUV Is Still the US$mn Question (Smartkarma) $

Li Auto (NASDAQ: LI) reported C2Q24 top line, non-GAAP operating profit and GAAP net income 5.0%, (5.2%) and (20%) vs. our estimates, and in-line, 53% and 6.8% vs. consensus.

We believe the market has oversold the company. But in our view,the key question is LI’s next product entry under the backdrop of Xiaomi (HKG: 1810 / FRA: 3CP / OTCMKTS: XIACF) consolidating its position in the EV sector.

We believe LI should continue to explore its “family car” brand niche in entering the sedan market. If so, volume and margin can co-exist.

🇨🇳 BYD Partners Huawei to Launch Luxury SUV With Self-Driving Features (Caixin) $

What’s new: Chinese electric vehicle (EV) giant BYD Company (HKG: 1211 / SHE: 002594 / OTCMKTS: BYDDY / BYDDF) has signed an agreement with Huawei Technologies Co. Ltd. to use the Chinese tech conglomerate’s advanced autonomous driving system in its luxury SUV Fangchengbao, the companies announced Tuesday.

The Bao 8 SUV equipped with the Huawei’s Qiankun intelligent driving system will be launched in the third quarter of this year. BYD said it will continue to develop new models in the Fangchengbao series with Huawei.

🇨🇳 iMotion stuck with low margins as future hinges on self-developed systems (Bamboo Works)

The autonomous driving company’s revenue grew significantly in the first half of the year, while its gross margins remain meager

iMotion Automotive Tech (HKG: 1274) generated 640 million yuan in revenue in the first half of the year, up 17.1%, as its loss narrowed slightly to 98.6 million yuan

The autonomous driving technology company’s gross margin dropped from an already-low 7.55% in the first half of 2023 to 7.05% in the same period this year

🇨🇳 Temu owner PDD builds $38bn cash pile as it denies investors payouts (FT) $ 🗃️

🇨🇳 Pinduoduo Woke Up and Chose War (Investing in China)

Analyzing PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Q2 2024 Earnings

These financial results could have been framed as a testament to Pinduoduo’s strength and resilience, especially given that major competitors recently reported a dramatic slowdown in GMV (Gross Merchandise Volume) growth.

However, instead of acknowledging the inevitable slowdown, Pinduoduo’s management chose to deliver a starkly different message.

🇨🇳 Evolving Thoughts on Pinduoduo (Investing in China)

Unpacking the Earnings Call- what might really be going on behind the scenes

As I discussed yesterday (here), I still believe that PDD Holdings (NASDAQ: PDD) or Pinduoduo’s earnings numbers were solid—nothing shocking, just in line with expectations. Everything I said yesterday still holds true. However, what continued to puzzle me was the surprising negativity in management’s tone during the earnings call.

Reading the earnings call again, I feel management did all they could to shoot down the stock—this was a masterclass in how to kill the stock on an earnings call. Even if I wanted to do it, I couldn’t have done it better.

Clearly, management knows what they are doing—they are no beginners. In fact, I consider them to be among the top management teams in China.

🇨🇳 PDD Holdings (PDD US): Earnings Call Spooks Investors. Is There More than Meets the Eye? (Smartkarma) $

PDD Holdings (NASDAQ: PDD) or Pinduoduo stock price nosedived 28.5% yesterday wiping away more than USD55 billion in market cap following Management’s call with investors.

During the call, the management guided towards weakening profits in the next quarters and stated that high revenue growth was unsustainable in the long term.

Investors however seemed to be spooked not by negative guidance on profitability/growth but by comments on impact of non-business factors and need to adapt to changing times etc.

🇨🇳 (Meituan (3690 HK, BUY, TP HK$165) TP Change): Better Margin Outlook from Rider Cost and Execution (Smartkarma) $

Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY) reported C2Q24 revenue 1.4%/2.3% higher than our estimate/consensus and adjusted net income 17%/28% higher than our estimate/consensus, thanks to lower rider cost and less subsidies to users;

Although poor economy has plunged Meituan’s merchant base to the loss-making zone, we expect Meituan’s take rate to persist as take-out order represents incremental revenue to offset merchants’ fixed cost.

We reiterate BUY rating and raise TP to HK$165/share. Catalysts are reduced competition, expansion of Pinhaofan, and overseas expansion.

🇨🇳 MT / Meituan (3690 HK): 2Q24, Three-Digit Profit Growth After Three-Year Stock Plunge, Buy (Smartkarma) $

The stock has declined for three years and a half, from HK$460 to HK$100.

Revenue grew by 21% YoY and the operating margin improved significantly in 2Q24.

We conclude the stock has an upside of 131% and a price target of HK$237. Buy.

🇨🇳 Resurging Walmart, shaky JD.com go their separate ways in China (Bamboo Works)

The U.S. retailing giant sold its stake in the Chinese e-commerce major to focus on its own China operations, ending an eight-year marriage

Walmart Inc (NYSE: WMT) has sold its stake in JD.com (NASDAQ: JD) at a time when its Chinese operations are flying on a growing local preference for Costco-style warehouse shopping

JD.com continues to face stiff competition in China’s tough e-commerce market as consumption in the country remains sluggish

🇨🇳 ATRenew posts market-defying growth as partnerships with JD.com, Apple advance (Bamboo Works)

The company’s revenue grew 27% in the second quarter, as it deepened its collaboration to promote recycling with JD.com (NASDAQ: JD)

ATRenew (NYSE: RERE) posted strong revenue growth in the second quarter and predicted similar trends in the third, as it banks on rising demand from value-conscious consumers

The recycling specialist is placing greater emphasis on its higher-margin businesses, which it is pursuing partly through growing ties with partners Apple and JD.com

🇨🇳 Yiren finds big returns in small-loan focus, even as headwinds swirl (Bamboo Works)

The online loan facilitator’s revenue from its main financial services business jumped 46% in the second quarter, as it also sharply raised its bad-loan provisions

Small revolving loans, which Yiren Digital (NYSE: YRD) only started offering in 2020, were a big driver of its 13% revenue growth in the second quarter

The focus on such products is part of the fintech’s efforts to balance risk management and profitability enhancement in China’s difficult economic environment

🇨🇳 Is Youdao finally learning how to earn profits? (Bamboo Works)

The education spinoff of gaming giant NetEase (NASDAQ: NTES) reported narrowing losses in the second quarter and said it expects to be profitable on an operating basis this year

Youdao (NYSE: DAO) reported its revenue grew 14.5% revenue in the first half of 2024, while its operating loss narrowed by more than 90%

The education company’s revenue from online marketing services doubled in the first half, while its learning services and smart devices revenue fell by 4% and 20%, respectively

🇨🇳 Trip.com (9961 HK): Stock Surged After 2Q24 Result, Upside Narrowed to 18% (Smartkarma) $

Trip.com (NASDAQ: TCOM)

In 2Q24, total revenue increased by 14% YoY and hotel booking revenue increased by 20%.

We believe the company has been riding on the recovery of the travel market and will see historical high quarter in 3Q24.

We also believe the stock still has an upside of 18% after one day’s surge.

🇨🇳 SenseTime feels revenue growth return on shift to generative AI (Bamboo Works)

The company once called one of China’s four ‘AI dragons’ reported its revenue rose 21% in the first half of this year, as its generative AI business more than tripled

SenseTime (HKG: 0020 / OTCMKTS: SNTMF) is progressing in its shift to generative AI, which made up 60% of revenue in the first half of this year, even as it faces challenges from price wars and GPU restrictions

Despite the company’s pivot away from more sensitive vision AI technologies, it continued to lose money in the first half, though its loss narrowed

🇨🇳 Zhongsheng Group Holdings (881 HK, BUY, TP:HKD12.5): A Contrarian Play (Smartkarma) $

1H24 results were below expectations, with profits halved YoY. Irrational competition with overzealous discounts, and general decline in preference of traditional luxury cars for NEVs is hurting Zhongsheng Group Holdings (HKG: 0881 / FRA: 5Z0 / OTCMKTS: ZSHGY / ZHSHF)

Signs of bottoming as industry are trying to stop the discounting madness and instill some level of rationality

ZS is trading at 0.47x book, its cash = MCAP, and FY25 PE of 3.7x. Ridiculously cheap for a profitable and positive FCF churning company.

🇨🇳 Pop Mart’s ‘blind box’ toys attract fans, detractors (Bamboo Works)

A week after announcing strong interim results, the company came under a veiled attack from state media for the addictive nature of its collectible toys

Pop Mart International Group (HKG: 9992 / FRA: 735)’s revenue rose 62% in the first half of the year and its profit nearly doubled, as its revenue from outside Mainland China more than tripled

The company’s products came under attack this week from the influential Xinhua news agency for the addictive nature of its collectible ‘blind box’ toys

🇨🇳 China East Education aims to profit from shifting jobs market (Bamboo Works)

The provider of vocational training has posted solid half-year earnings and is focusing on training for the automotive and IT industries

The number of new students enrolled at China East Education (HKG: 0667 / FRA: ZX3) fell 7.7% in the first half of 2024, as the company put a bigger emphasis on high-value recruitment

Demand for places on vocational courses is expected to rise in line with a growing market for blue-collar workers and higher salaries for some skilled jobs

🇨🇳 Hengan eyes new boost from adult nappies as its growth stalls (Bamboo Works)

The hygiene products maker has underperformed the Hang Seng Index this year and is relatively undervalued, leaving room for a rebound of its shares

Hengan International (HKG: 1044 / FRA: HGNC / OTCMKTS: HEGIY)’s revenue fell in the first half of the year, but an improving gross margin helped to lift its profit by nearly 15%

The company faces intense competition in its core tissue and sanitary napkin businesses, but its disposable diapers segment could benefit from the graying of China

🇨🇳 WuXi XDC Cayman (2268.HK) 24H1- High Growth of ADC Market Ensures Investment Logic, but Risks Remain (Smartkarma) $

WuXi XDC Cayman (HKG: 2268 / FRA: L74)’s YoY revenue growth rate fell to double-digit while it was kept triple-digit growth rate in previous periods. How much revenue generated from backlog isn’t within WuXi XDC’s control.

The significance of healthy growth of the global ADC market is that the good story of ADC CXO is able to continue. So, WuXi XDC’s short-term performance growth is guaranteed.

The establishment of an independent biopharmaceutical supply chain based on US national security concerns is inevitable. So, WuXi XDC’s stock price performance is more influenced by geopolitical conflicts than fundamentals.

🇨🇳 Wuxi Biologics (2269.HK) 24H1 – The Best Semi-Annual Report for the Next Three Years? (Smartkarma) $

Wuxi Biologics (HKG: 2269 / OTCMKTS: WXXWY / OTCMKTS: WXIBF)‘s 24H1 performance is disappointing. Since XDC has become new growth driver for WuXi Bio, why continue to invest in WuXi Bio instead of directly investing in WuXi XDC?

Production capacity expansion is aggressive, with high personnel salaries/cost pressure. Without sustained growth in high-margin orders, WuXi Bio’s profitability will continue to decline. Gross margin may not bounce back quickly.

The mid-to-late stage order increment in US would be dominated by Japanese/Korean CXO. Without a definitive long-term logic, valuation cannot return to previous highs. Any rebound is difficult to sustain.

🇨🇳 Novel drugs lift Sino Biopharm earnings, easing price-cap pain (Bamboo Works)

Sino Biopharmaceutical Ltd (HKG: 1177 / FRA: SMZ1 / OTCMKTS: SBMFF / SBHMY)

The pharmaceutical company posted an 11% rise in half-year revenue, helped by growing income from innovative medicines, as it pivots away from the generic drug business

Revenue from innovative and biosimilar drugs grew 14.8% in the first half of the year, with four products gaining marketing approval

The company is speeding up its exit from the generics business while stepping up work on new drugs through in-house R&D and industry partnerships

🇨🇳 4Paradigm: Near-Term Selling Pressure May Persist As IPO Lockup Ends Next Month (Smartkarma) $

Beijing-Based 4Paradigm shares have underperformed the Hang Seng Index (+4.3%) in 2024 with shares down ~20% year-to-date. IPO investors are down ~28%.

I expect near-term selling pressure on the stock as IPO lockup ends in September and at least 265M shares will be available for sale by the end of next month.

4Paradigm has made considerable progress and with a clear profitability trajectory, the stock looks undervalued relative to peers in Mainland China and worldwide.

🇨🇳 Pre-IPO Zhou Liu Fu Jewellery – The Potential Risks and Concerns Brought by the Business Model (Smartkarma) $

The franchise model of Zhou Liu Fu is the biggest performance contributor, which is also the main reason for the Company’s rapid expansion and high gross profit margin.

However, the CSRC questioned the rationality of franchise model and thus rejected its A-share IPO. We think the high revenue growth/profit margin may not be sustainable in the long term.

Pre-IPO post-investment valuation was approximately 7.407 billion yuan. Zhou Liu Fu has applied for H-Share full circulation, which may put pressure on stock price performance after the lockdown period expires.

🇭🇰 Hyfusin Group Holdings United. (Eloy Fernández Deep Research)

A double-edged sword.

Hyfusin Group Holdings Ltd (HKG: 8512) is a Hong Kong-based investment holding incorporated in the Cayman Islands, principally engaged in the manufacturing and sale of candle products.

The products are manufactured in factories owned by the company in Vietnam. Around 97% of non-current assets are located in Vietnam.

🇭🇰 CK Infrastructure listing in London: valuation & comparison (Bos Invest Substack)

CK Infrastructure Holdings Ltd (HKG: 1038 / LON: CKI / FRA: CHH / OTCMKTS: CKISF / CKISY) is listing in the UK. A good time for a valuation of a complicated beast + my view on UK water companies.

CK Infrastructure is preparing to list in London. This is something that makes sense given that the business gets the largest part (40%) of its profits directly from the UK (more through Power Assets). The higher valuations prevalent in England compared to Hongkong are probably an additional reason.

Given my previous coverage on CK Hutchison & CK Asset I thought covering CK Infrastructure would be nice given that this would give a more complete insight into the CK business empire.

The stock has run up 34% YTD mostly in anticipation of the UK listing and has a 147B HKD market cap. The company trades at a p/e of 18. This does not look cheap.

🇲🇴 Retailer DFS has ’5pct Macau staff exit amid market changes’ (GGRAsia)

Luxury goods retailer DFS Group (LVMH Moët Hennessy Louis Vuitton (EPA: MC / OTCMKTS: LVMUY / LVMHF)) – which has a presence in a number of Macau casino resorts – has recently seen the exit of “5 percent” of its Macau workforce.

That is according to the retail group’s response to local Chinese-language news outlet, AllIn Media. The latter’s report, which cited an anonymous source, claimed that DFS Group had recently “laid off” 80 staff members of the Macau sales team, all of them “imported” labour. That was understood to be a reference to non-resident workers. It was not clear whether the 80-people figure accounted for the 5 percent reduction.

🇲🇴 Paradise Ent posts US$15mln 1H profit, flags dividend (GGRAsia)

Macau-based gaming equipment supplier and casino services firm Paradise Entertainment Ltd (HKG: 1180 / FRA: LIL3 / OTCMKTS: PDSSF) reported a profit attributable to its owners of just above HKD116.1 million (US$14.9 million) for the first half of 2024. That compared to a profit of HKD680,000 in the prior-year period, according to a Wednesday filing.

The first-half result was on revenue that rose 72.4 percent year-on-year, to HKD425.3 million. Costs of sales and services increased by 26.7 percent year-on-year, to HKD167.0 million.

Paradise Entertainment, which supplies casino equipment under the LT Game brand, also has a service agreement for a satellite gaming venue at Casino Kam Pek Paradise (pictured) in downtown Macau, with SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) as its licence partner.

🇲🇴 Sands China led 2Q mass table, VIP GGR share: analysts (GGRAsia)

Casino operator Sands China (HKG: 1928 / FRA: 599A / OTCMKTS: SCHYY / OTCMKTS: SCHYF) led the market for the second quarter in Macau, in terms of mass-market and VIP gross gaming revenue (GGR) and hold adjusted earnings before interest, taxation, depreciation and amortisation (EBITDA).

That is according to an analysis in a Tuesday note from banking group JP Morgan, following the completion of Macau’s second-quarter and first-half earnings season, with the interim results of SJM Holdings Ltd.

JP Morgan said that after accounting for differences in terms of the way the Macau regulator and the operators report the mass-market table to VIP GGR split, it estimated Sands China had 24.5 percent of mass table GGR.

🇲🇴 MGM China to spend US$172mln on special dividend (GGRAsia)

The board of Macau-based casino operator MGM China Holdings Ltd (HKG: 2282 / FRA: M04 / OTCMKTS: MCHVF / MCHVY) has declared the payment of a special dividend of HKD0.353 per share to the company’s shareholders.

The Hong Kong-listed company said in a filing on Thursday it expected to spend just above HKD1.34 billion (US$172.0 million) on the dividend, which it anticipates will be paid on October 4.

“The board has resolved to declare the special dividend after further consideration of the group’s latest general financial position, existing cash flow, capital requirements going forward and other factors that the board considered relevant,” stated the firm.

🇲🇴 Macau Legend narrows loss in 1H, breaches covenants (GGRAsia)

Gaming and hotel services firm Macau Legend Development Ltd (HKG: 1680 / OTCMKTS: MALDF) reported revenue of HKD390.4 million (US$50.1 million) for the first half of 2024, up 16.5 percent from the prior-year period.

The company posted a net loss of just above HKD109.9 million for the six months to June 30, compared with a HKD182.5-million loss a year earlier, according to a Friday filing.

The Hong Kong-listed firm has business linked to one casino in Macau – Legend Palace (pictured) – under a so-called services agreement with Macau licensee SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY).

🇲🇴 SJM trims 1H loss and EBITDA leaps 276pct y-o-y (GGRAsia)

First-half loss at Macau casino operator SJM Holdings (HKG: 0880 / FRA: 3MG1 / KRX: 025530 / OTCMKTS: SJMHF / SJMHY) narrowed to HKD162.4 million (US$20.8 million) from HKD1.26 billion in the first half of 2023.

Total group revenue for the opening six months of 2024 rose 47.4 percent year-on-year, to HKD13.80 billion, the company said in a Tuesday filing to the Hong Kong Stock Exchange.

Net gaming revenue went up 48.3 percent year-on-year, to nearly HKD12.90 billion in the six months to June 30.

Daisy Ho Chiu Fung, chairman of SJM Holdings, said in a press release issued on Tuesday: “Throughout the first half of 2024, the group made significant progress in both gaming and non-gaming sectors, achieving steady growth through continuous innovation and service optimisation.”

🇹🇼 1475:TW Under the radar niche textile chemical company (One foot hurdle)

Big Sunshine Co (TPE: 1475) is a textile auxiliaries supplier that remains relatively unknown, even within the Taiwanese investing community. The textile auxiliaries industry is a $USD 8B market and is estimated to grow at a CAGE of 3.9%. I believe Big Sunshine is worth considering due to the following reasons: 1) Its ability to leverage resources from its affiliates, 2) Its mission-critical, recurring, and high-touch product offerings, and 3) The limited coverage it receives. Trading is available on Interactive Brokers and English filings are accessible.

🇰🇷 Alpha Generation Through Share Buybacks in Korea: Bi-Monthly (July and August 2024) (Douglas Research Insights) $

In this insight, we discuss the alpha generation through companies that have been buying back their shares in the Korean stock market in July and August 2024.

On average, the share buyback announcements by 46 companies represented 2% of outstanding shares.

Major companies that have announced share buybacks in Korea in the past two months include KT&G Corp (KRX: 033780), Mirae Asset Securities (KRX: 006800), and POSCO Holdings (NYSE: PKX).

🇰🇷 End of Mandatory Lock-Up Periods for 49 Companies in Korea in September 2024 (Douglas Research Insights) $

We discuss the end of the mandatory lock-up periods for 49 stocks in Korea in September 2024, among which 3 are in KOSPI and 46 are in KOSDAQ.

These 49 stocks on average could be subject to further selling pressures in September and could underperform relative to the market.

The top three market cap stocks including those of which at least 1% of outstanding shares could be sold in September include LS Materials (KOSDAQ: 417200), Creative & Innovative System Corp (KOSDAQ: 222080), and Kyobo Securities (KRX: 030610).

🇰🇷 Alpha Generation from the New Entries in the ‘KOSDAQ Rising Stars’ (Douglas Research Insights) $

In this insight, we discuss the potential alpha generation from new entries in the “KOSDAQ Rising Stars.”

For the KOSDAQ Rising Stars New Entries in 2023, there was a massive outperformance. Of course, we want to reiterate that past performance is NOT indicative of future performance.

On 28 August 2024, KRX provided a list of 39 KOSDAQ Rising Stars companies (including 29 existing ones and 10 new companies).

🇰🇷 Kum Yang: A Major Capital Raise Possible in 4Q24 Which Is Likely to Dilute Existing Shareholders (Douglas Research Insights) $

In the past week, there were numerous local news accounts about a rights offering of nearly 800 billion won by Kumyang Co Ltd (KRX: 001570). This has not been confirmed by the company.

Although Kum Yang has not committed to a rights offering, there is a high probability of such capital raise in 4Q24 which is likely to dilute existing shareholders.

Kum Yang remains a highly speculative stock. The management has lost so much credibility in the past year. We would stay away from it as far as possible.

🇰🇷 LG Corp Plans to Purchase 200 Billlion Won of LG Electronics and 300 Billion Won of LG Chem (Douglas Research Insights) $

On 29 August, LG Corporation announced that it plans to purchase about 200 billion won worth of LG Electronics (KRX: 066570 / FRA: LGLG / LON: 39IB) and about 300 billion won worth of LG Chem (KRX: 051910) – Parent of LG Energy Solution (KRX: 373220).

After these share purchases, LG Corp’s stake in LG Electronics will increase from 30.47% to 31.59%, and its stake in LG Chem will increase from 30.06% to 31.29%.

LG Corp plans to purchases these shares starting 1 November 2024. The share purchases will be conducted in two stages and will be completed by 31 March 2025.

🇰🇷 LG Corp: Three Key Catalysts + NAV Valuation (Douglas Research Insights) $

Three key catalysts for LG Corporation include potential inclusion in Korea Value Up Index, an IPO of LG CNS in 1Q 2025, and an increasing probability of higher shareholder returns.

An IPO of LG CNS is likely in 1Q 2025. LG CNS is currently valued at about 7 trillion won and LG Corp has a 50% stake.

Our base case NAV valuation analysis of LG Corp suggests implied NAV of 15.3 trillion won or NAV per share of 96,957 won, which is 19.8% higher than current price.

🇰🇷 POSCO Group Corporate Value Up Pre-Announcements: Trading Angle (Douglas Research Insights) $

On 29 August, the three major POSCO Group companies including Posco (NYSE: PKX) announced that they plan to provide detailed explanations of their Corporate Value Up plans in 4Q 2024.

In general, the companies that have provided more detailed plans for their Corporate Value Up plans have done better recently.

However, now there are cases such as the three main POSCO Group companies whose share prices are rising just by announcing that they will provide Corporate Value Up plans later.

🇰🇷 Hyundai Motor Announces Its Corporate Value Up Policies (Douglas Research Insights) $

On 28 August, Hyundai Motor (KRX: 005380 / FRA: HYU / OTCMKTS: HYMTF) announced its Corporate Value Up policies, including a minimum dividend per share this year targeting 10,000 won per share for common shares.

Hyundai Motor plans to implement a shareholder return policy based on a total shareholder return (TSR) of 35% or more from 2025 to 2027.

Hyundai Motor’s Corporate Value Up plan of providing TSR of 35% or more from 2025 to 2027 is certainly better than what it provided in the past three years (26%).

🇰🇷 Doosan Group Cancels Plans to Merge Doosan Robotics and Doosan Bobcat (Douglas Research Insights) $

On 29 August, the Doosan Group (KRX: 000150) announced that it is cancelling the merger between Doosan Robotics (KRX: 454910) and Doosan Bobcat (KRX: 241560).

However, the plan to split Doosan Enerbility (KRX: 034020) into a newco and then merge Doosan Bobcat with the newco will remain in place.

Doosan Group is still trying to complete the first two portions of reorganization (Split of Doosan Enerbility and Merger Swap Between Doosan Enerbility and Doosan Robotics), resulting in continued uncertainty.

🇰🇷 Tenstorrent – To Chip Away Market Share from Nvidia? (Douglas Research Insights) $

Tenstorrent is an AI chip company headed up by its CEO Jim Keller, a chip design legend who has previously worked at AMD, Apple, Intel, and Tesla.

Tenstorrent has received numerous funding from major Korean conglomerates including Hyundai Motor Group and Samsung.

According to Tenstorrent, its Galaxy systems are nearly 1/3 less expensive than Nvidia’s DGX system AI servers.

🇰🇷 Initial Thoughts on the Kioxia IPO – Impact on SK Hynix and Samsung Electronics (Douglas Research Insights) $

Kioxia is getting ready to complete its IPO in Japan as soon as in October. Kioxia’s valuation is expected to exceed JPY 1.5 trillion (about USD 10.3 billion).

SK Hynix (KRX: 000660)‘s stake in Kioxia (through Bain led consortium) is 19%. SK Hynix’s stake in Kioxia would rise to 34% if the CBs are converted into equity.

The IPO of Kioxia has mixed implications for SK Hynix which is a major shareholder. However, the IPO of Kioxia has a more direct negative impact on Samsung Electronics (KRX: 005930 / LON: BC94 / FRA: SSUN / OTCMKTS: SSNLF).

🌏 Donaco back to annual profit, flags Thailand risk (GGRAsia)

Donaco International Ltd (ASX: DNA), an operator of several border casinos in Southeast Asia, returned to profit in the financial year to June 30, it said in a Friday filing to the Australian Securities Exchange.

Donaco’s non-executive chairman, Porntat Amatavivadhana, acknowledged the potential for a longer-term competitive threat to DNA Star Vegas’ border trade, if Thailand legalises casino resort business.

He stated: “While we are very pleased by the latest results and remain committed to executing our strategy, we are currently evaluating potential disruptors such as the proposed Integrated Entertainment Business Act in Thailand and the separate Aristo tax audit, as we navigate Southeast Asia’s evolving gaming landscape.”

🇰🇭 🇭🇰 NagaCorp bosses outline mass-market strategy to ramp biz & NagaCorp circa US$1mln 1H loss on Russia impairment (GGRAsia)

Cambodian casino operator NagaCorp (HKG: 3918 / FRA: N9J / OTCMKTS: NGCRF) – which runs the NagaWorld casino resort complex in the country’s capital, Phnom Penh – has been expanding the areas for mass-market high-limit table play, and has added side-bet options to help ramp the business in the post-pandemic era.

So said Mike Ngai (pictured, second left), NagaCorp’s chief operating officer (COO), as part of responses to several questions from GGRAsia during the company’s Wednesday press briefing in Hong Kong on the firm’s interim results.

🇮🇩 Aspirasi Hidup Indonesia (ACES IJ) – The Ace Hardware Separation Is a Rebranding Opportunity (Smartkarma) $

Ace Hardware Indonesia (IDX: ACES / FRA: 4AH1 / OTCMKTS: ACEHF) has been rebranded to Aspirasi Hidup Indonesia (IDX: ACES / FRA: 4AH1 / OTCMKTS: ACEHF) after the franchise agreement with ACE US was not renewed. Given ACES’s long-standing independence, we see this as an opportunity.

The new names for the company will not be the brand names for the stores and Ace Hardware products are a tiny portion of the Indonesian company’s SKUs anyway.

Concerns over the separation look overblown with ACES seeing a strong YTD performance above guidance with valuations looking attractive after recent share price weakness, with new store rollout ongoing.

🇲🇾 IHH Healthcare: Procedure Mix Improvement And Bed Capacity Expansion Key Growth Drivers (Rating Upgrade) (Seeking Alpha) $ 🗃️

🇲🇾 Bursa Malaysia: A Mix Of Positives And Negatives (Seeking Alpha) $ 🗃️

🇲🇾 GEN Malaysia interim dividend as 2Q profit doubles y-o-y (GGRAsia)

Net profit at global casino operator Genting Malaysia (KLSE: GENM) reached MYR62.7 million (US$14.5 million) for the three months to June 30, up 70.9 percent sequentially from first quarter’s MYR36.7 million, and 107.1-percent higher year-on-year. It took first-half 2024 profit to just under MYR99.4 million, compared to a MYR15.1-million loss in first-half 2023.

The board announced on Thursday an interim single-tier dividend of MYR0.06 per ordinary share, which it said was “in line with the group’s commitment to providing sustainable returns to shareholders”. It’s expected the interim dividend will be paid on October 7, said the firm in a filing to Bursa Malaysia.

🇲🇾 RGB posts US$4mln profit in 2Q, revenue down 70pct y-o-y (GGRAsia)

Malaysian casino equipment supplier and distributor RGB International Bhd (KLSE: RGB) reported a second-quarter profit attributable to its shareholders of just under MYR18.9 million (US$4.3 million), down 28.8 percent from a year earlier. Such profit fell by 14.9 percent sequentially.

The company reported revenue of MYR99.6 million for three months to June 30, down 70.2 percent from a year ago, and 52.6-percent lower than in the preceding quarter, according to a Monday filing to Bursa Malaysia.

RGB said in Monday’s filing that the group’s prospects “remain robust, bolstered by the promising market conditions, especially in … the Philippines”.

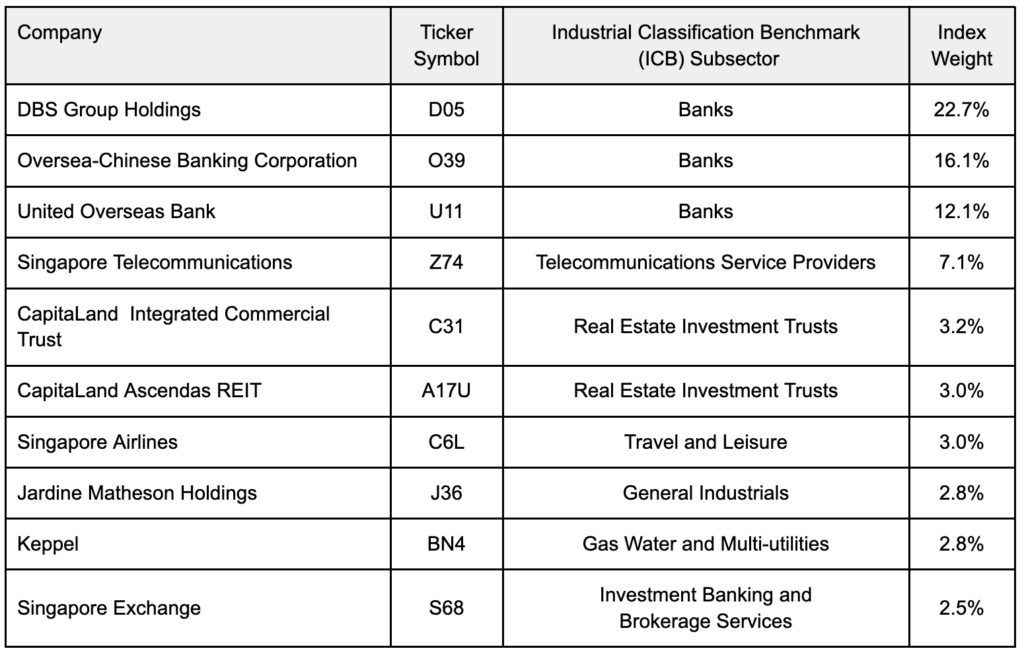

🇸🇬 The Top 10 Most Influential Blue Chips in the Straits Times Index (The Smart Investor)

🇸🇬 Singapore Airlines Stock Is A Sell (Seeking Alpha) $ 🗃️

🇸🇬 🇨🇳 China Yuchai: Staying Positive On Policy Tailwinds And Significant Repurchases (Seeking Alpha) $ 🗃️

🇮🇳 Apollo Hospitals Enterprise (APHS IN): Upside Momentum to Continue on Promising Business Outlook (Smartkarma) $

Apollo Hospitals (NSE: APOLLOHOSP / BOM: 508869) reported strong Q1FY25 result, with 15% revenue growth and a massive 83% jump in net profit. EBITDA margin improved to 13.3% (Q1FY24: 13.0%).

Sequential improvement is expected in Q2 and Q3. The company believes ARPOB growth will improve over the next few quarters with stronger growth in surgical volume and better case mix.

The company believes enhanced volume growth, improvement in case and payer mix, and a focus on cost optimization will drive margin expansion by 100bps over the next 3–4 quarters.

🇮🇳 The Beat Ideas: EID Parry’s Strategic Transformation- Cane to Consumer (Smartkarma) $

Eid Parry India (NSE: EIDPARRY / BOM: 500125) A Murugappa Group Company setting stage for transformation from cyclical sugar business to more stable consumer and high margin business.

The company has diversified into the non-sweetener segment and is emphasizing an asset-light model to drive further expansion.

Eid Parry India (EID IN) is also the holding company of Coromandel International (NSE: COROMANDEL / BOM: 506395), which holds substantial intrinsic value.

🇸🇦 Saudi Aramco: The Giant Beneath the Desert Sands (Quartr AB)

In the vast, sun-baked deserts of Saudi Arabia lies a treasure trove of liquid gold. This is the home of Saudi Aramco (Saudi Arabian Oil Co (TADAWUL: 2222)). As the largest oil company in the world, Saudi Aramco is a titan whose story is deeply intertwined with the history of modern Saudi Arabia and the global energy landscape. Let’s investigate the story behind what is currently the world’s sixth-largest company by market cap, generating annual profits equal to the combined totals of Amazon, NVIDIA, and Meta.

🇿🇦 Harmony Gold: A High-Cost Miner Significantly Leveraged To Gold Prices (Seeking Alpha) $ 🗃️

🇵🇱 Dino Polska’s origin (The Dutch Investors)

Imagine a supermarket chain that quietly yet powerfully transforms a nation’s grocery habits, one rural town at a time. Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY), a fast-growing supermarket chain in Poland.

If there is only one key point you should take away from this article, it’s this:

Dino Polska has become as popular in Poland as Walmart in the U.S. It started with just one store in 1999 and now has over 2500 stores by the middle of 2024. Dino’s expansion strategy and its potential to continue growing make it a very interesting business to watch.

Want to know more? Keep reading, then.

🇵🇱 A Deep Dive into Dino Polska (DNP.WA) (Mindful Compounding with Luuk)

Unpacking the Quality, Risks, and Future Potential of Poland’s Retail Giant

Just like I did with my Interactive Broker deep dive, I’m going to tackle Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) by breaking it down into the following key questions to keep things clear and structured:

What does Dino Polska do?

Is it a high-quality business?

Is it run by a competent management team?

Is it available at a reasonable valuation?

What are the risks?

🇨🇿 🇸🇰 Komercni banka: Your CEE Banking Play (Seeking Alpha) $ 🗃️

🇵🇱 How Allegro Managed To Fend Off Amazon In Poland (Seeking Alpha) $ 🗃️

🌎🇦🇷 Why Despegar.com Stock Is A Hold Amid Market Challenges (Seeking Alpha) $ 🗃️

🇦🇷 Loma Negra Is Feeling The Argentinian Recession; The Stock Is Not An Opportunity (Seeking Alpha) $ 🗃️

🇦🇷 Pampa Energia’s Segments Are Hamstrung Until New Regulations Are Implemented (Seeking Alpha) $ 🗃️

🇦🇷 🇨🇦 What’s Next For Lithium Americas? (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Focus On The Rich Yields & Discounted Valuations – Volatility Is Inevitable (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Is Still A Solid Hold (Seeking Alpha) $ 🗃️

Vale: A Cautious Hold Amid New CEO And Rising Iron Ore Prices (Seeking Alpha) $ 🗃️

Vale: A Solid First Half, New CEO, Eyeing Chart Developments (Seeking Alpha) $ 🗃️

Vale S.A.: The Peak Earnings Cycles Of The Past Are Likely Finished (Seeking Alpha) $ 🗃️

🇧🇷 Ultrapar’s Turnaround Complete: Time To Consider A Buy Rating (Seeking Alpha) $ 🗃️

🇧🇷 Afya: Q2 2024 Was Not Surprising, Still An Opportunity Despite New Info On Market Supply (Seeking Alpha) $ 🗃️

🇨🇴 🇨🇦 Parex Resources: A Hiccup (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Centro Norte: A Buy Despite Headwinds (Seeking Alpha) $ 🗃️

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Chinese offices emptier than during Covid pandemic as slowdown hits (FT) $ 🗃️

Vacancy rates rising in big cities including Beijing, Shanghai, Guangzhou and Shenzhen while rents are falling

🇨🇳 Chinese Offices Emptier Now Than During Peak Of Covid Lockdowns As Economy Crumbles (Zero Hedge)

One week ago, we reported that China had found itself “On The Verge” of collapse as its “Welfare State Crumbles, Explosion In Social Unrest As Youth Unemployment Soars, Strikes Surge.” All of this was the result of Beijing’s very deliberate – and extremely risky – decision to not engage in a massive stimulus this time, unlike every previous occasion of sharp economist slowdown, and risk social unrest at best, or a full-blown revolution as an unthinkable worst case.

Here is the silver lining: all those revolutionaries will have brand new empty offices at their disposal when they finally take over. That’s because as the FT reports, offices in China’s biggest cities are emptier than they were during stringent Covid-19 lockdowns in what is the latest clear sign of how the country’s economic slowdown has crushed business confidence.

🇨🇳 Chinese central bank’s $56bn debt purchase sparks talk of bond market intervention (FT) $ 🗃️

🇨🇳 Chinese Localities Adopt ‘Sell Everything to Save the Day’ Policy to Ease Debt (Caixin) $

Chinese local governments are desperately seeking new revenue streams by leveraging government-owned assets to address mounting debt pressures and dwindling coffers.

A document from Bishan District in Chongqing, southwest China, went viral online, outlining the formation of a “Sell Everything to Save the Day” task force aimed at monetizing state-owned assets.

🇨🇳 In Depth: China’s Tightening Rules Put Foreign High-Frequency Futures Traders in Limbo (Caixin) $

High-frequency futures traders in China have seen the viability of algorithmic strategies come under pressure as costs have ballooned.

Some were set up as goods trade companies by big-name foreign firms to evade restrictions on overseas investment in the country’s commodities futures market, and have operated in a regulatory gray area for years.

They earned huge returns with advanced algorithms that enable them to execute vast numbers of transactions in the blink of an eye.

🇨🇳 Charts of the Day: Beijingers Spurn Eating Out Amid Sluggish Economy (Caixin) $

Beijing’s major food and beverage (F&B) companies saw their combined profits slump almost 90% year-on-year in the first half of the year, government data show, underscoring the weak state of consumption in China’s big cities amid the country’s patchy post-Covid recovery.

In the January-to-June period, their total profits nosedived 88.8% year-on-year to 180.3 million yuan ($25.3 million), according to recently published data by the Beijing Municipal Bureau of Statistics covering firms whose F&B annual revenue is at least 2 million yuan.

🇨🇳 In Depth: China’s Used-Car Dealers Face a Bumpy Ride as Price Wars Intensify (Caixin) $

China’s second-hand car market is growing rapidly as more motorists take to the road. Industry players have little to celebrate, however, as the fledgling sector is still like the Wild West while profit margins are shrinking.

Some 16.26 million vehicles changed hands in China during the first half of this year, half as many again as the same period in 2023. Sales of used cars grew 7% year-on-year to 9.38 million, while 9.84 million new passenger vehicles were sold, according to the China Automobile Dealers Association (CADA).

🌏 Hunting for alpha in Asean (The Asset) 🗃️

Equities in robust regional market remain largely undervalued and under-researched

Valverde Investment Partners has expanded its team in the region, with a key member based in Bangkok and analysts in Jakarta and Ho Chi Minh City. “Our head of research, who has covered Asean for 30 years , is Swedish, and based in Kuala Lumpur. We have a diverse and interesting group of people, including a seasoned English investment specialist who has also covered Asean for 30 years and a Thai national both based in Bangkok.”

This insight underscores the importance of both country and stock selection in generating alpha. “For instance, despite an overall down year for Asean markets in 2020, we identified stocks with returns exceeding 30%, demonstrating (our) proficiency in uncovering high-performing investments within a broader market downturn,” he says.

🇬🇪 Why I travelled to Georgia during the anti-government protests of May 2024 (Pyramids and Pagodas)

Taking a look back at a trip during a tumultuous time, the country’s investment horizons, and some interesting stocks along the way

🇬🇧 The coming collapse of Britain (Alex Krainer’s TrendCompass) & Podcast Episode #190 – Alex Krainer and How All Financial Fuses Lead to London (Guns Goats N’ Gold)

“Everything points… to a horrific cliff-edge looming… an avalanche of debts, defaults, evictions and unpaid bills to follow.”

A series of bizarre developments that have unfolded in Great Britain over the last few weeks suggest that its financial system came to the verge of collapse, probably as a consequence of Ukraine’s debt default. The last thing the people in power will tell us is the truth, but if we dig in dark places and connect the dots, I believe the conclusion practically makes itself. The consequences for Britain, and probably for “his majesty’s” other dominions will be extreme. Let’s dive in…

🇲🇽 Mexico – AMLO reform scenarios – August 2024

Investors are worried about AMLO’s judicial reform. Also, investors are worried that investors are worried.

This reform push has led Mexico’s peso to drop. Investors are having doubts about President-elect Sheinbaum’s upcoming term in office. Why?

🌐 When will emerging stocks finally emerge? (FT) $ 🗃️

The story is always compelling but the returns are not

Sharma also reminded us that many western countries are heavily debt dependent, with expensive stocks to boot. Emerging economies in aggregate are less stretched. Likewise, their stock markets trade at deep discounts to developed equities.

And yet and yet. The problem for me is that I remember reading such arguments back when I was wearing pinstripe suits (no belt, obviously) and Hermès ties. The buy-pitch never seems to change.

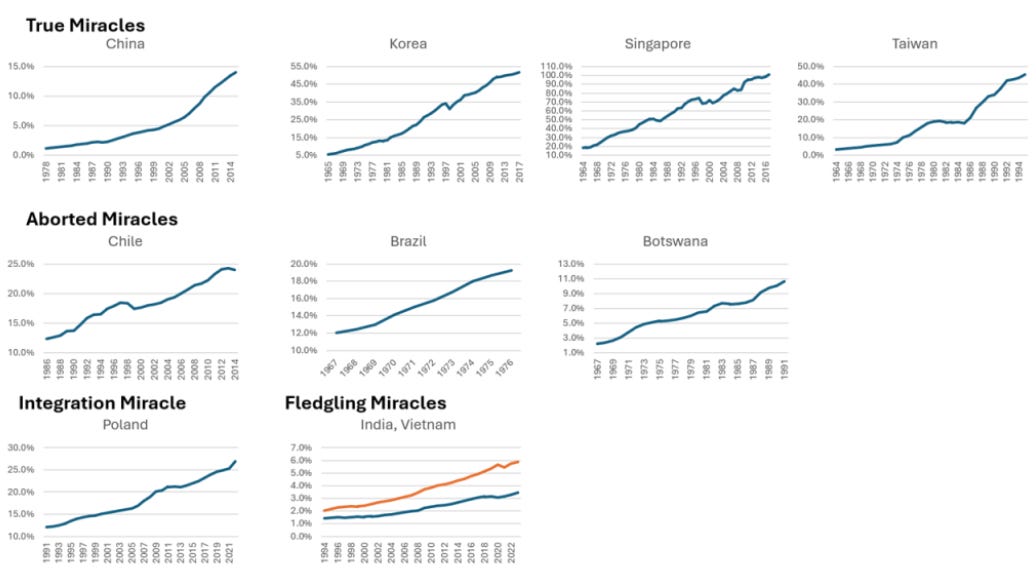

🌐 Emerging Market Miracles are Few and Fleeting (The Emerging Markets Investor)

Much of the excitement that investors have for emerging markets is anchored in the idea that developing countries grow faster than the sclerotic rich countries of the West and that this growth brings opportunities for extraordinary portfolio returns. Unfortunately, this is largely wishful thinking, as the evidence shows that countries in the developing world have experienced mediocre growth. Nevertheless, there have been important exceptions. A select group of countries have achieved periods of “miracle growth,” allowing them to significantly reduce the income gap with rich countries.

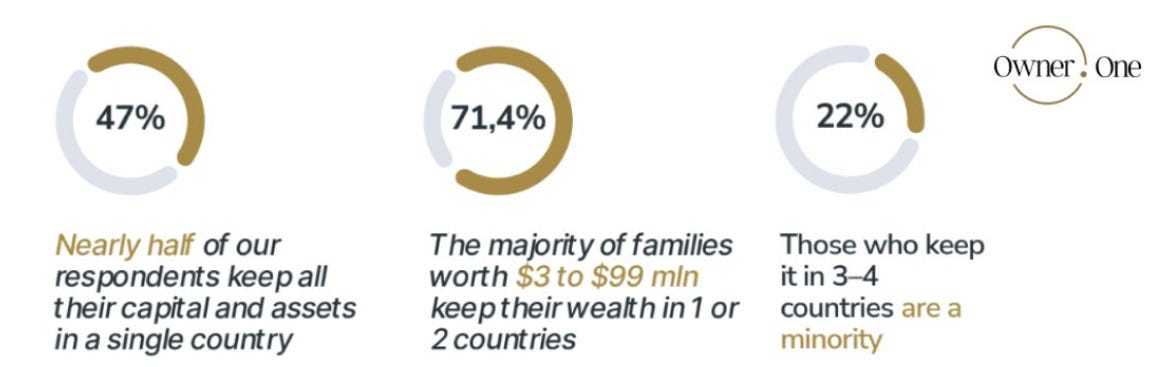

🌐 Most wealth owners hold assets in just one or two countries (The Asset) 🗃️

Global study highlights difficulties affluent individuals face in asset diversification and regulatory compliance

The study was conducted across 18 countries in Africa, the Middle East, Asia, the European Union, the United Kingdom, and North America. It covered 13,500 individuals with net worth ranging from US$3 million to US$99 million.

🌐🇿🇦 PGM market review 1Q24 (TheOldEconomy Substack)

The green energy transition has significantly affected the PGMs (platinum group metals). Initially, the transition was expected to be swift, leading to the obsolescence of ICE cars and, consequently, PGMs. However, the role of PGMs in auto-catalytic converters has proven to be more resilient than anticipated. The transition to EVs, while significant, has not made PGMs redundant yet. ICE cars will stay with us for the foreseeable future.

Running a mining business in South Africa is challenging. PGM producers are well-trained to navigate the country’s intricacies. Hence, the PGM industry will keep facing difficulties. The point is whether they increase or decrease.

🌐 Part 1: Uranium Market Overview (TheOldEconomy Substack)

Supply, demand, and catalysts

So, it’s time to talk about yellow cake. This is the first of three parts covering the uranium market. Today, the topic is the big picture, i.e., demand, supply, and catalysts.

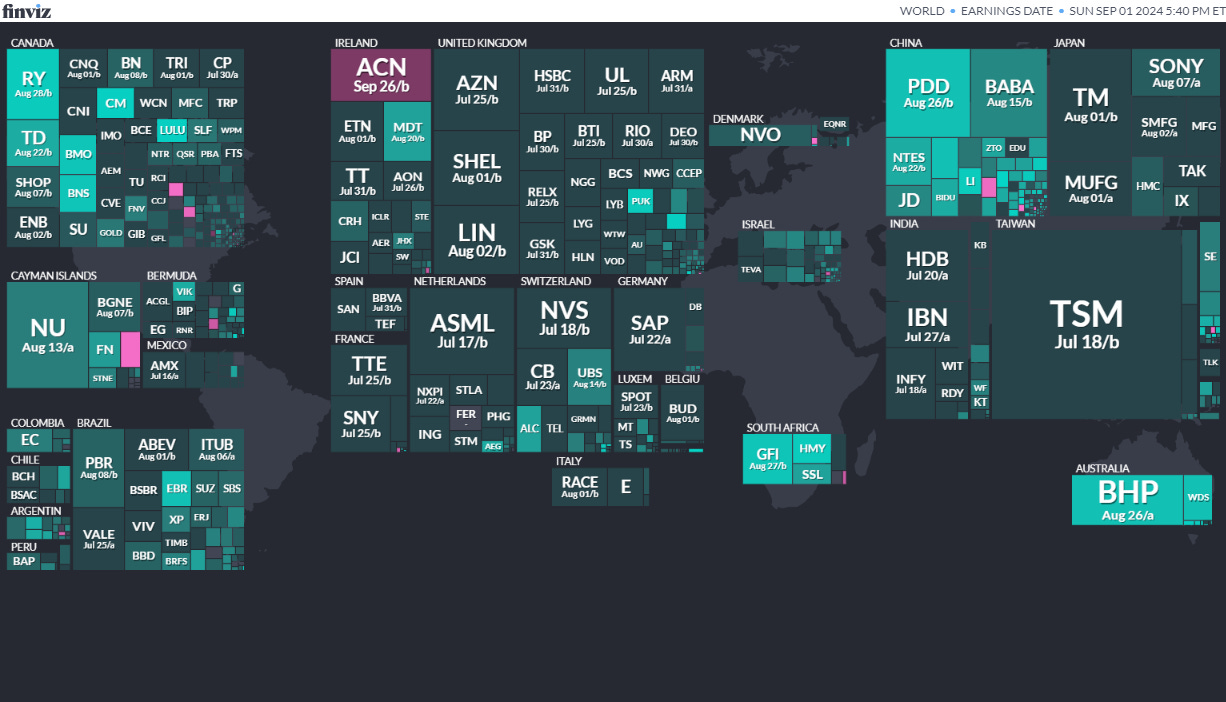

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

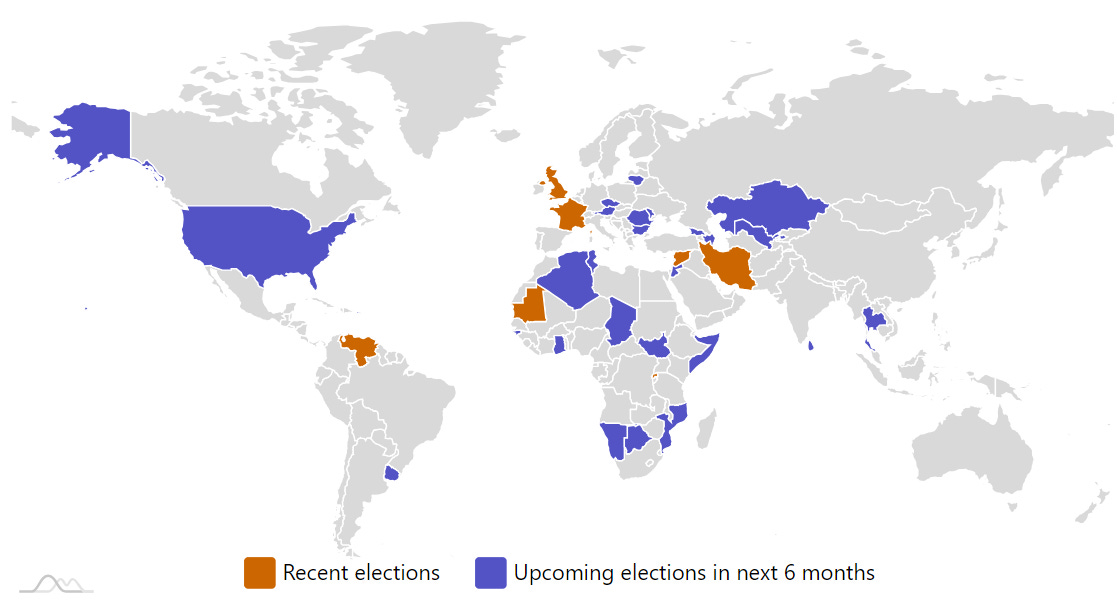

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

Jordan Jordanian House of Deputies Sep 10, 2024 (d) Confirmed Nov 10, 2020

-

Czech Republic Czech Senate Sep 20, 2024 (d) Confirmed Sep 23, 2022

-

Sri Lanka Sri Lankan Presidency Sep 21, 2024