Empire State Real Estate: Occupancy Growth and Dividend Hike Potential (NYSE:ESRT)

batuhanozdel/iStock via Getty Images

Empire State Realty Trust, Inc.New York Stock Exchange:ESRT) had an outstanding year, defying the Bear’s widespread doom calls for the end of U.S. urban office real estate. The REIT is up 44% year-to-date to post a remarkable recovery. This is due to a Fed-induced selloff. Although there are concerns about whether the rally has been overextended, the near-term outlook for REITs is strong with headline CPI continuing to decline, setting the stage for a rate cut in the first half of 2024. REITs have positive duration risk. It has been a near-toxic investment since the Federal Reserve began its fight against inflation. Currently priced at 9.7x annualized Q3 2023 FFO multiple, whether or not to build a position in ESRT will depend on the direction of currently bullish macroeconomic indicators. US GDP is growing, inflation is falling, and the Fed is They signaled at least three interest rate cuts next year. This is a Goldilocks scenario for bulls and a worst-case scenario for REIT bears.

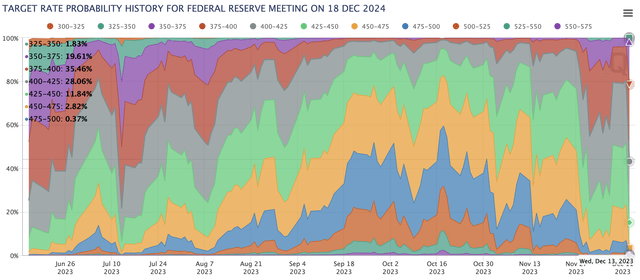

CME FedWatch Tool

The odds of interest rates remaining between 5.25% and 5.50% by the end of 2024 are essentially zero in the market, according to pricing in the CME FedWatch tool. In other words, there is a possibility that the interest rate will be reduced by 150 basis points to 3.75% to 4.00%. Taking next year as a baseline scenario, ESRT had a total debt balance of $2.24 billion at the end of the third quarter, with about 3.86% of this balance, or about $86.54 million, maturing next year. Critically, the rate cut will set the stage for a favorable debt refinancing, with ESRT facing higher principal payments from 2025 onwards. It is difficult to see a weak base remaining until 2024.

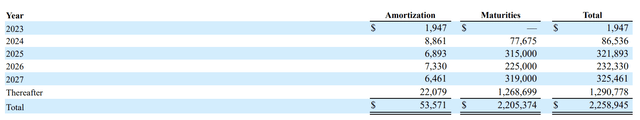

Empire State Real Estate Trust Fiscal 2023 Third Quarter Form 10-Q

Increased occupancy and NOI growth

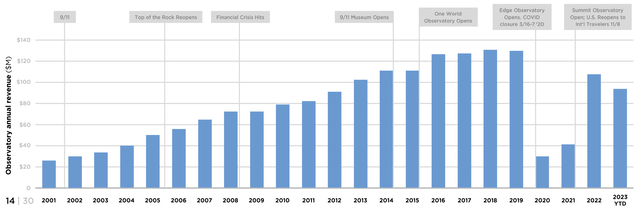

To be clear, ESRT had $447 million in total cash, investments and restricted cash at the end of the third quarter. This is sufficient liquidity to cover maturities through 2026. Therefore, the REIT does not face any default risk in the medium term as recessionary analysis of the trajectory of office real estate suggests. ESRT’s portfolio is also very diverse, and at the end of the third quarter consisted of 8.6 million square feet of Manhattan office space, 700,000 square feet of retail space, four multifamily properties with 727 units, and the Empire State Building observation deck experience on the 102nd and 102nd floors. The 86th floor of New York’s most popular building.

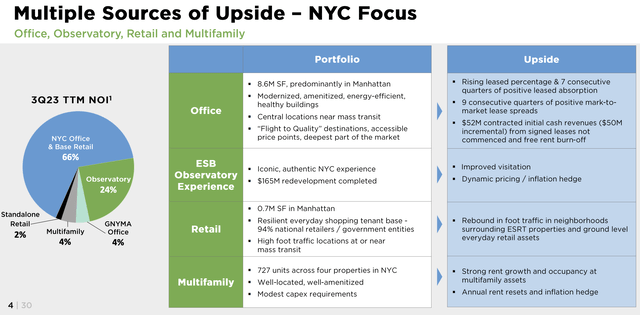

Empire State Real Estate Trust October 2023 Investor Presentation

ESRT derived approximately 24% of its net operating income in the third quarter from observatories, with the largest portion of its NOI, 66%, coming from office assets. The REIT generated revenue of $191.53 million in the third quarter, up 4.3% year-over-year and beating consensus estimates by $6.14 million. Third quarter core funds from operations of $0.25 per share increased 4 cents year-over-year, driven by same-store property cash NOI, which increased 8.8% year-over-year. Additionally, the office component of the portfolio ended the third quarter with a occupancy rate of 91.9%, up 30 basis points sequentially and up 250% compared to the same period last year. As of the end of the third quarter, 90.5% of the total commercial portfolio was leased.

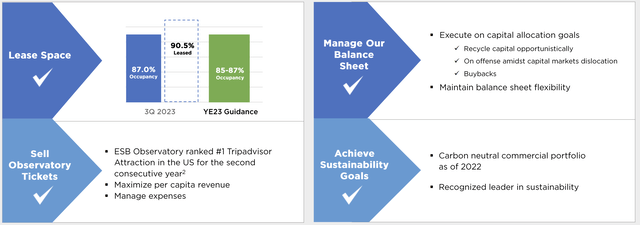

Empire State Real Estate Trust October 2023 Investor Presentation

ESRT aims to increase its commercial portfolio share by 200 basis points by the end of 2023, from 85% at the end of the third quarter. This represents an increase of 460 basis points since the end of 2021 and marks the REIT’s seventh consecutive quarter of positive rental rate absorption. The REIT’s 100% carbon-neutral commercial portfolio benefits companies seeking new office space while working to achieve their sustainability goals. The REIT achieved a positive market share of 11% in office lease spreads in the third quarter, highlighting the strength of its portfolio.

A possible dividend hike helps set the scene for 2024

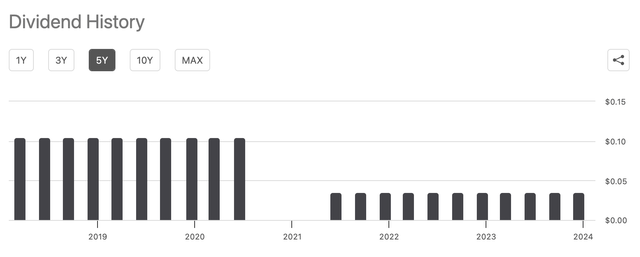

pursue alpha

The internally managed REIT last paid a quarterly cash dividend of $0.035 per share, unchanged from previous years, based on a forward dividend yield of 1.45% per share. In the third quarter, we paid out 14% of our FFO as dividends. Critically, the distribution is still well below the $0.1050 per share paid out before the pandemic. ESRT has always been a high-profile victim of the pandemic, but its recovery is well underway, with NYC tourism numbers growing and on track to surpass pre-pandemic levels. The observatory has significant upside potential as its revenues grow. This will continue to fuel the REIT’s FFO growth.

Empire State Real Estate Trust October 2023 Investor Presentation

ESRT is now guiding for core FFO of $0.85 to $0.87 per share for full-year 2023. This is an increase from previous guidance for core FFO of $0.83 to $0.86 per share. So we could see some pretty significant dividend increases, providing a path to making debt more affordable, especially in response to the Fed’s interest rate cuts. The REIT is holding off on 2024, when the potential for dividend increases, continued NOI growth, and occupancy growth are expected to further drive shareholder value creation.