Enad Global: Deep Dive (OTCMKTS:ENADF)

SOPA Images/LightRocket via Getty Images

introduction

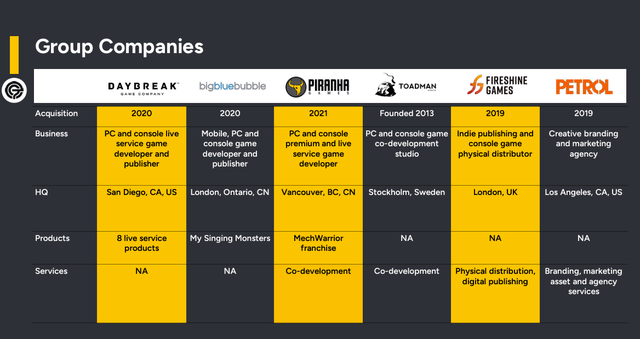

Enad Global (OTCPK:ENADF) is engaged in the development, distribution and publishing of digital games. We have a portfolio of popular IPs (EverQuest 1 and 2, Planet Side 2, DC Universe, The Lord of the Rings Online, Dungeons and Dragons Online, My Singing). Monsters and MechWarriors 5).

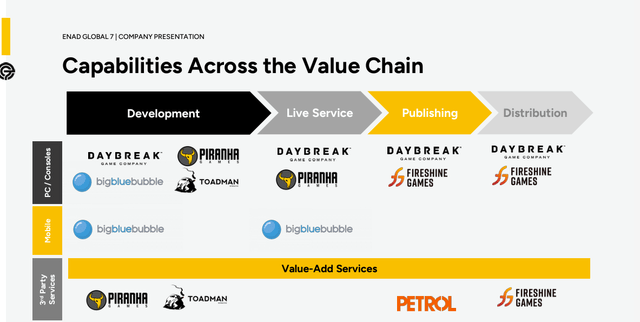

The business can be divided into two parts.

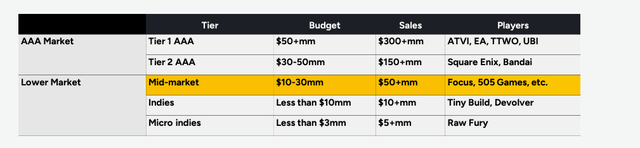

- The gaming segment includes game production and consulting assignments. They transitioned from being an independent game developer to an employment business. This reduces risk and provides greater predictability for cash flow, but it still wants to develop its own game. They use the 80-10-10 strategy. This means using proven IP (80%) that continues to be in demand in the market, improving the game by 10%, and introducing new features (10%). This strategy is used by larger players to mitigate risk. They think they can utilize this strategy Create space for your product in the mid-market.

market tier (Company announcement)

- The service sector refers to consulting activities on game development strategies and marketing, and as a publisher, it is a business that distributes games digitally and offline.

investment thesis

Alta Fox owns small-cap stocks with a very solid gaming portfolio, and its management team (new for 2022 and beyond) has a very good track record of doing M&A in that space (I’m a former PE). Portfolio diversity expands your revenue streams and leads to solid cash generation. The goal is to increase growth by building a game franchise based on proven IP from its own portfolio and external IP. They aim to generate $300 million in revenue and $100 million in EBITDA in 2026. The current market capitalization is $123 million.

business

The main source of revenue is the gaming segment. They have a proven brand (games) with over 20 years of history that can generate additional revenue. With this portfolio, the company has built a pipeline of three game releases over 2024-2026.

The biggest problem with this model is the limited number of players in the market that need to be interested in existing games. They are also planning to create a new franchise with a new game, but it has not yet been proven and the market’s response is uncertain.

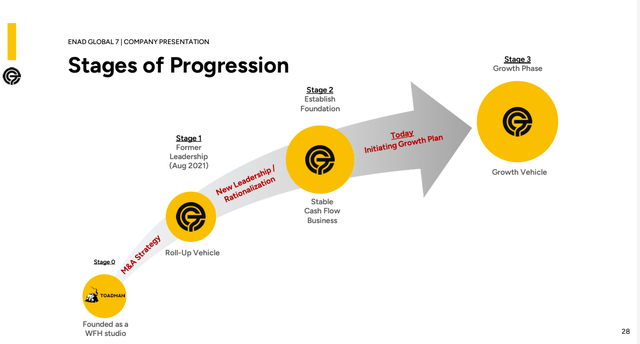

They will need to reinvest in new ventures or existing games to support the growth the company can achieve. We are at a point where we are generating significant cash flow and can reinvest this cash flow into further growth (between stages 2 and 3).

progress stage (Company announcement)

The publishing sector has been in the red until this year. The contribution will help the company reach its 2026 goals.

group company (Company announcement) Group companies across the value chain (Company announcement)

Profitability is improving due to product mix, but existing game sales are generally flat or decreasing. They invested $15 million in publishing rights to games developed by third parties. This will improve the revenue and profitability of the publishing sector (due to its scale) with a very low risk of it becoming an unprofitable investment. They share a 30%-70% revenue sharing model with developers.

According to analysts’ estimates, they should be able to fund all of their growth with cash flow from operations and reserves (they have 35% of their market capitalization in cash) and without debt.

This is also evident in the earnings call, where management said:

“EG7 reiterates its guidance for 2023 and said the company will incrementally invest to support revenue growth from new games, with MechWarrior 5: Clans coming in 2024, the Cold Iron multiplayer action game coming in 2025, and H1Z1 in 2026. is increasing. In the third quarter of 2023, EG7 invested SEK83m in ongoing projects, the largest portion of which, SEK50m, was related to the Cold Iron publishing deal, in which the company has now invested SEK81.5m, with a total investment of USD23m. While investments are growing, the company continues to generate strong cash.“Our operating flows (SEK113m in the quarter) and net cash position were unchanged at SEK358m in the third quarter of 2023 compared to SEK361m in the second quarter of 2023.”

evaluation

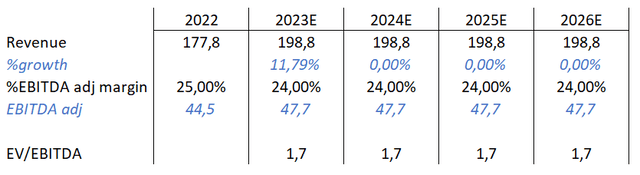

At first glance, the company appears to be extremely undervalued, even taking into account the unpredictability of its earnings. Under the no growth assumption and the following average adjusted EBITDA margins, we arrive at the following multiples:

Drainage (moat investment)

The market is valuing these companies so low because of the significant risks they face. The digital gaming industry is a mature sector with some leading companies and smaller companies like EG7 trying to develop new games that can generate good revenue. It’s all about content creation. This means developing new games, earning royalty fees, and taking advantage of opportunities to release new games. They are naturally at a disadvantage compared to the larger players due to their low development budgets.

The main source of revenue is existing IP. This is a limited-life asset on the balance sheet that can be leveraged through the release of new game editions or through third parties paying royalties to EG7.

Red flag: A strange move by management given their involvement in recent investments. They are investing $23 million in a deal with Cold Iron Studios to acquire publishing rights to games in development. In the deal, Cold Iron Studios agreed to pay the company, co-owned by its executives and EG7, a valuation of $8 million to develop the game. So they’re investing $15 million. Given that management has direct ownership of the developer, the deal appears ambiguous.

How to approach valuation

For these kinds of companies, finding a value that allows for some margin of safety does not mean a potential return, as it means betting on the unpredictable success of some of the developments the company undertakes.

Current assets have a limited life and require reinvestment in the business to ensure future returns. Let’s look at it in the following way:

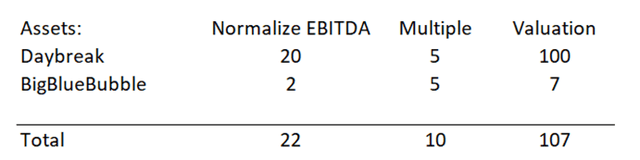

Asset Value:

Considering the high amount of goodwill, looking at equity is not helpful.

Weekly rest: 8 operational IPs. They generate normalized EBITDA of approximately $20 million per year.

Big Blue Bubble: Their one game has grown in popularity over the past three years. However, before it reached its peak of popularity, normalized EBITDA was around $2 million per year. It’s now at $34 million, but we can’t expect that to continue, especially given the rapidly changing pace of new content creation.

The rest of the company is a subdivision of developers. There are no valuable assets and future returns cannot be predicted. While the fast-moving content creation environment can be advantageous for this, any independent development (not paid for by a third party) carries significant risk until it succeeds/failures in the market. I believe it is possible to make a conservative estimate that the three existing sub-segments dedicated to development may offset themselves and result in no profit or loss.

Gasoline (Publisher): It’s a similar situation with developers. Because revenues are somewhat predictable and fixed costs are low, it has little impact on the P&L (less than $1 million in revenue), but has always been profitable.

Sector Evaluation (moat investment)

Atai Capital uses a base case of 5x EBITDA for the company, so they are using the same for the sub-segments as well.

These assets generate operating cash flow of between $20 million and $35 million annually. Considering the return on expected market value is 20-30%, that’s not bad at all. However, this ignores the significant cash outflow that must be deployed to maintain cash flow.

Overall, this $107 million valuation could be against the company’s permanent capital requirements. That’s all the cash outflow you need to keep up with the market.

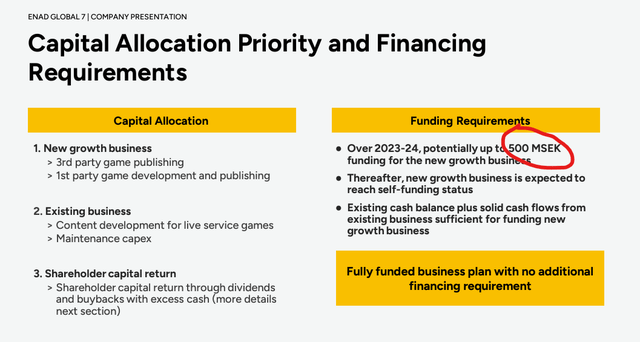

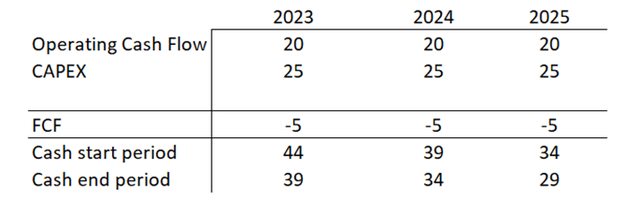

Looking at our cash flow statement, we can see that the minimum required investment we have made over the past few years to increase and maintain our current cash production is approximately $16 million. They are making more aggressive estimates, expecting to generate $25 million in cash per year over the next two years.

capital allocation (Company announcement)

This can be achieved through current operating cash flow and cash on hand (an additional $44 million).

The most important thing to note here is that the company was heavily leveraged and had been working to eliminate it over the past two years. Paying off debt was a key catalyst for Alta Fox and Atai Capital to purchase shares.

eyesight

Overall, you get the following outlook:

- The current asset will produce $20 to $35 million over the next three years, but its value will decline over time. A conservative estimate is $20 million over three years.

- To maintain current revenues, the company will need to deploy between $16 million and $25 million in capital expenditures. Management plans to commit $25 million to sustain growth.

- There is no more leverage, so there are no more financing cash outflows.

- It has $44 million in cash.

cash position (moat investment)

This level of capital deployment should maintain current assets ($107M) without loss of value (Capex includes growth above).

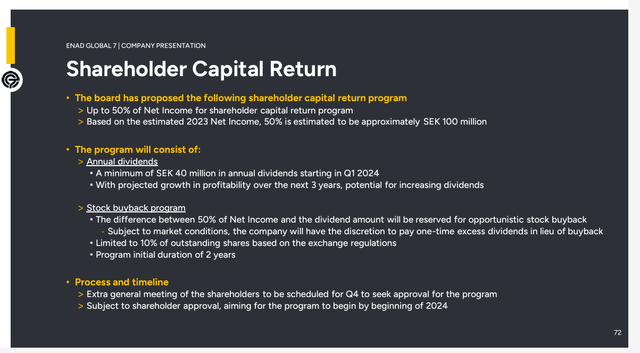

The company is valued at $123 million, so the market currently sees no value in management’s actions toward creating value. Any increase in current value must come from management’s growth efforts (an additional $9 million invested above maintenance capital expenditures). Management is shareholder friendly and plans to return 6% to shareholders.

The goals in the image and projected revenue for 2023 are very consistent with what I expected. Net profit of $20M (SEK 100 million) (+ $20M non-cash items (installments) = $20M operating cash flow.

return on capital (Company announcement)

conclusion

The market currently values IP at market value ($100-$120 million) and does not expect the value of these assets to grow.

This also means that management’s current capital deployment will not be successful. I believe that management can create value at some point. Perhaps it’s because they’re overinvesting beyond maintenance capital expenditures to generate asset growth. However, this growth is not guaranteed and cannot be predicted.

Considering the current cash reserves, the current valuation is not burdensome. A positive outcome for the company would result in a significant boost to the stock. The bad thing is that the future of EG7 is very difficult to predict, as all value creation must come from development/M&A activities to acquire IP.

Surprises beyond negative assumptions about the company’s future would generate significant returns for the stock, although content creation is a very capital-intensive and tough sector competing with large corporations.

Important note: We are considering recent balances (since 3Q) that do not reflect the value of recent investments. We’ve already invested $15 million (in the partnership mentioned in the red flag), but we’re not seeing any returns yet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.