Enbridge: Dip An Opportunity For Appreciation And Income As Dividend Approaches 8% (ENB)

PM Images

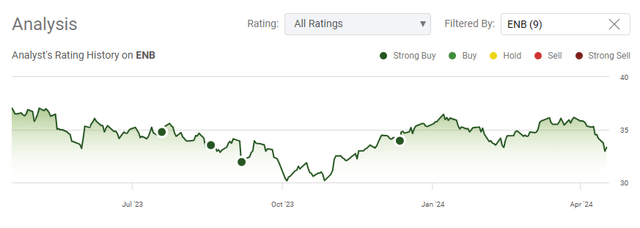

Enbridge Inc. (NYSE:ENB) hasn’t had the best start to 2024 as its shares have declined by -6.62%. Shares of ENB have been in a perpetual decline as they have shed -9.36% of their value over the past five years, and -29.08% over the last decade. ENB reached $46.81 on May 30, 2022, and since then, shares have fallen below $40 and never looked back. Some may ask why to focus on income-producing companies such as ENB that have trouble just treading water rather than focusing on capital appreciation. There are many ways to invest, as personal finance is unique, and goals can vary from person to person. ENB has been looked at as a dividend stock, and while I hold it in an income-producing portfolio, I believe that shares are undervalued and present an opportunity for capital appreciation. Unlike equities that don’t pay a dividend, ENB is paying you a growing dividend while you wait. I think that ENB shares are significantly undervalued, especially after extending its growth outlook. I think that income investors who pick up ENB under $35 and have time to wait will be rewarded with a dividend that continues to compound and appreciate in the future.

Seeking Alpha

Following up on my last article about Enbridge

In my last article about ENB, which was released on December 12, 2023 (can be read here), I discussed why ENB was my top income idea for 2024. ENB had just increased its annualized dividend by 3.1%, and shares were trading at $34.97. Since then, shares have declined by 3.77%, and after the quarterly dividend that was paid is factored in, ENB’s total return has been 1.83%. ENB recently held its Investor Day Conference, and there was a lot to be excited about heading into Q1 earnings. I am following up on my investment idea as I feel Mr. Market is looking right past the extended growth outlook and the value proposition that ENB offers investors. I am going to go through my updated investment thesis and outline why I am very bullish about ENB at these levels.

Seeking Alpha

Risks to investing in Enbridge

ENB operates in the oil and gas industry and is subject to additional risks compared to other companies. Traditional energy sources have been in the spotlight as more voices have been rallying around the cry for eradicating fossil fuels. We have seen the current administration cancel the permit for the Keystone XL pipeline and create a more favorable narrative toward renewable energy sources. ENB spans Canada and the U.S., which means it must deal with two sets of federal regulations and can sometimes get caught between bilateral agreements. This increases the risk landscape because ENB has to deal with a volatile regulatory environment in two federal jurisdictions, and they have minimal control over changing sentiments toward the oil and gas industry.

Outside regulatory and political risks, ENB faces additional risks from commodity pricing, interest rates, and unexpected malfunctions. ENB has a portion of its earnings fixed to fluctuating commodity pricing, which won’t impact the outcome of those contracts, but there is a portion of the portfolio that is exposed to changing commodity prices. While fluctuations in commodity prices can put downside pressure on earnings, so can rising rates, as ENB’s board has approved a maximum of 30% of its debt can be floating rate. As rates increase the cost to service the debt can follow, which can impact margins. Operational malfunctions can also impact ENB, and if ENB’s assets break it’s not nearly the same as a printing press stopping. ENB can face environmental risk, political backlash, community outrage, and a loss of earnings, as a pipeline spill would put fossil fuels directly into the environment. Some investors stay away from the sector for these reasons, and I can’t blame them, but energy is a necessity, not a want, and I think the traditional fossil fuel sector will thrive in the coming years as the population increases and the demand for sustainable energy grows.

I am bullish on pipelines in general, but I think the strong economy will prove well for Enbridge

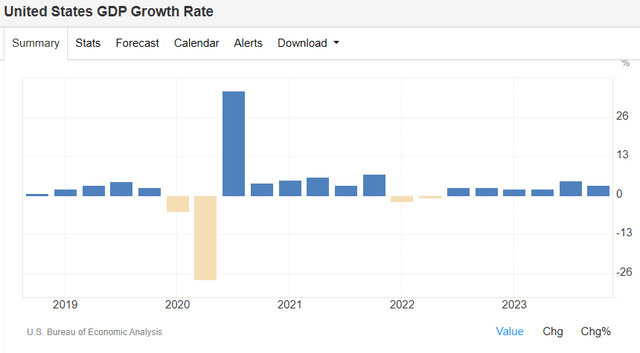

Over the previous five years, the U.S. has only had four quarters of negative GDP growth. The first two were during the pandemic, and the next two were during 2022. When I look at Canada, they have had five quarters of negative GDP growth over the past five years, and three of them were basically flat as the worst negative quarter since Q2 of 2020 was a decline of -0.3%. Despite an inflationary environment that forced the Fed to raise rates quicker than any period since the early 1980s, the economy continued to grow throughout the rate cycle. The Fed’s last rate hike was in July 2023, and the economy has continued to expand well after rates reached 5%.

Trading Economics

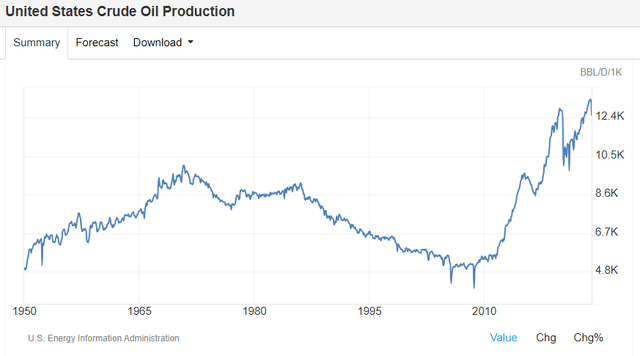

U.S. crude production is at its highest levels despite a seasonal dip in January to 12.5 million bpd. Canada is also seeing record levels, and in December 2023 they were producing 4.97 million bps. This is important because the strong economy has led to increased oil production, and ENB transports 30% of the crude produced in the U.S., 65% of Canadian exports, and 40% of the crude imported in the U.S. ENB also transports roughly 20% of all the natural gas consumed in the U.S. as its network spans 31 states and four Canadian provinces.

Trading Economics

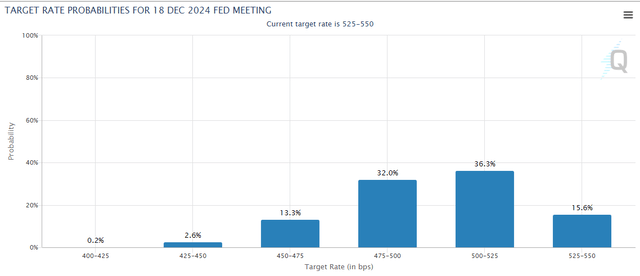

The next Fed meeting is less than two weeks away, and everyone will be waiting to see what Fed Chair Powell says. CME Group has basically taken a rate cut off the table in May as there is a 1.9% chance that the Fed pivots. There is a 41.5% chance that a pivot will occur at or before the July meeting and an 84.4% chance that a pivot will occur sometime in 2024. The probabilities continue to be a moving target, but a lower rate environment is expected; we’re just going to have to wait and see what Fed Chair Powell says in his remarks. I think that the undecided nature of rate cuts is putting a bit of pressure on ENB, but once a firm path is determined, I think that we will see shares of ENB respond to the upside.

CME Group

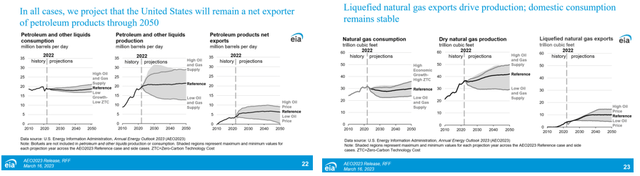

The projections from the Energy Information Agency’s (EIA) Annual Energy Outlook look validated to a degree as they indicated production of petroleum and other liquids in addition to natural gas, would slowly increase through 2050 in their reference case. This report is more than a year old, and the U.S. oil production numbers validate their outlook. When rates finally start to decline, I think we will enter a more business-friendly environment and see GDP expand as the cost of capital declines. If this occurs, then we should see the demand for traditional fossil fuels increase, which should correlate to more fuel being moved by Enbridge. Recently, Enbridge updated its growth outlook, and it looks like everything is aligned with the pipeline industry. I am bullish on ENB as I feel it’s undervalued, and their growth story may not be able to be ignored in the back half of 2024.

EIA

Why long-term investors should be excited about Enbridge

Nobody enjoys seeing their investment account with a lower balance than the last time they looked, but investing is a long-term game. When I think about companies with moats, ENB is right up there with Microsoft Corporation (MSFT). Nothing is impossible, but it wouldn’t be probable to replicate ENB’s infrastructure. ENB is the only pipeline company anchored by a utility company and a large renewable portfolio. The recent utility acquisition makes ENB the largest natural gas utility company with the largest liquid pipeline network in North America. Putting the replacement cost aside, there are regulatory hurdles, capital requirements, operational expertise, permitting, land requirements, and connectivity issues to accomplish to compete in the space. ENB’s assets and the regulatory environment are its moat as you don’t have new companies popping up looking to compete in the sector the way you do in the SaaS environment. ENB is a best-in-class energy infrastructure conglomerate, and Mr. Market is discounting how important it really is to everyday life. As the economy expands, there will be an opportunity for ENB to shine, and I think the current valuation is going to look ridiculous.

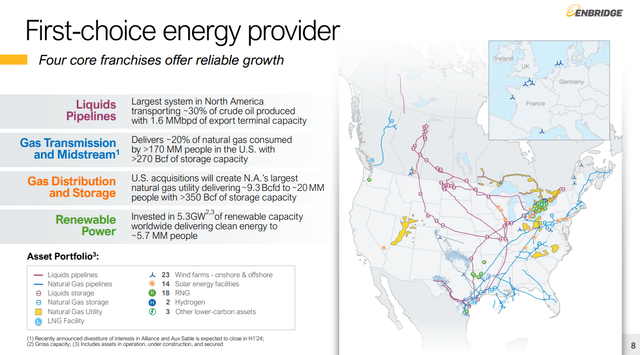

Enbridge

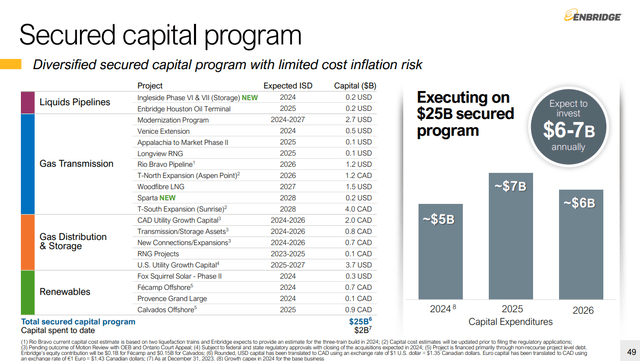

ENB solidified a lot at its recent Investor Day as they delivered an updated presentation on future profitability. Recently, ENB said it was acquiring export docks and storage tanks to support its Ingleside Energy Center in Texas from Flint Hill Resources for $200 million. This is part of a $500 million expansion to increase their capacity along the U.S. Gulf Coast. All the recent acquisitions have placed ENB in a position where they were able to extend their projected growth. ENB is projecting that they will deliver 7-9% in EBITDA on an annual basis over the next three fiscal years. This will correlate to 4-6% of annualized EPS growth and 3% distributable cash flow growth (DCF). This is all underpinned by an extensive expansion program where ENB is expected to invest up to $7 billion annually across its four business segments to facilitate growth. From now until the end of 2028, projects will come online, and ENB believes that it will continuously monetize its assets.

When you combine the EIA energy projections and ENB’s capital investment program, there is a lot to be excited about. There is a growing need for takeaway pipeline capacity, storage, and distribution, and ENB delivers to every segment. As the demand for energy increases, so will ENB’s network, and this will deliver additional earnings. ENB is so confident that they believe after the 2026 fiscal year is over, they will continue to drive an additional 5% in Adjusted EBITDA, DCF, and Adjusted EPS on an annualized basis. ENB is putting itself in a position where they will generate elevated levels of profits for years to come, and the dividend will continue to grow on an annual basis.

Enbridge

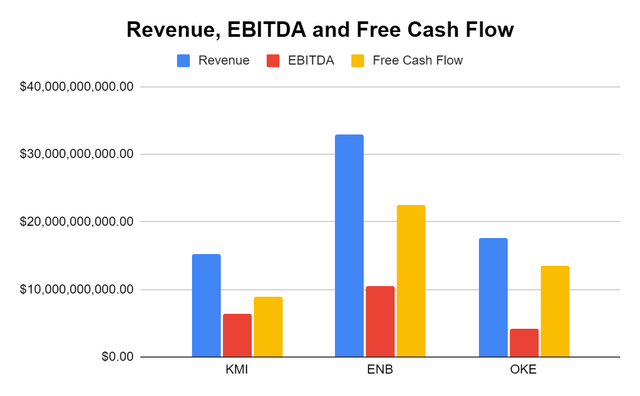

When I compare ENB to Kinder Morgan, Inc. (KMI) and ONEOK, Inc. (OKE), ENB looks very interesting. ENB generates the largest amount of revenue, EBITDA, and FCF of the three companies. ENB trades at 6.92x EBITDA and 10.01x FCF. ENB trades at the lowest price to FCF multiple, with OKE trading at 16.08x FCF and KMI trading at 17.55x FCF. From an EBITDA perspective, ENB and KMI are neck and neck, with KMI trading at 6.3x EBITDA and ENB trading at 6.91x EBITDA, while OKE trades at 10.77x the amount of EBITDA it generates. ENB operates at a 31.66% EBITDA margin while having a 21.87% FCF margin. I think that paying 10 times FCF is a great deal for ENB especially as it has projected growth across all the major key performance indicators (KPIs) over the next several years.

Steven Fiorillo, Seeking Alpha

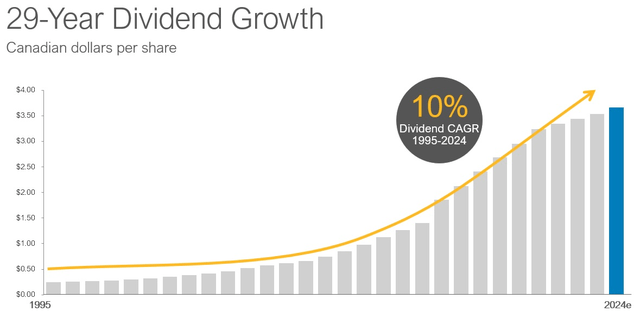

ENB continues to deliver a large amount of income to its shareholders, which is expected to increase as time passes. For almost three decades, ENB’s dividend has had a CAGR of 10%, and most recently, ENB has increased the dividend by 3.1%. ENB has targeted a payout ratio that is between 60-70% of its DCF, which is expected to increase by 3% through 2026, then after 2026, it could increase by 5% annually as more growth projects come online. Based on the USD to CAD conversion, ENB pays a $2.64 dividend in USD, which is a 7.93% yield. If ENB grows its dividend by 3% in 2025 and 2026, the dividend will be $2.80 for the 2026 fiscal year. If ENB bumps up the growth to 5% in 2027 and 2028, the dividend would be $3.03 per share in 2028. I am ecstatic about ENB’s dividend program and plan on reinvesting all the dividends while I wait for my investment thesis to play out. ENB is a premier dividend company, and I still think it’s one of the best dividend plays in the market today.

Enbridge

Conclusion

We didn’t get a rate cut in March, but the economy is still booming despite inflation ticking higher. I think the higher-for-longer environment is a blessing for long-term investors looking to front-run capital that is bound to end up in the equity markets as the risk-free rate of return eventually declines. I think ENB allows investors to generate capital appreciation and income as shares look undervalued, and the dividend continues to grow. The narrative around traditional energy is starting to change, and there isn’t nearly as much talk about eliminating fossil fuels as there once was. ENB is a company that is needed for our way of life to exist, and that’s a rare aspect to find. I think energy infrastructure, in general, is trading at a discount, and ENB’s multi-year outlook of increased profitability will be enticing when rates start to decline. I think we will see shares of ENB much closer to $40 when 2024 closes rather than near $30, and for long-term investors, this could be a great opportunity to facilitate growth and income within the same investment.