energy; A long-term reversal in relative strength is coming | RRG chart

key

gist

- Energy sector showing relative strength across three time frames

- near strong resistance area

- A long-term reversal in relative strength appears to be underway.

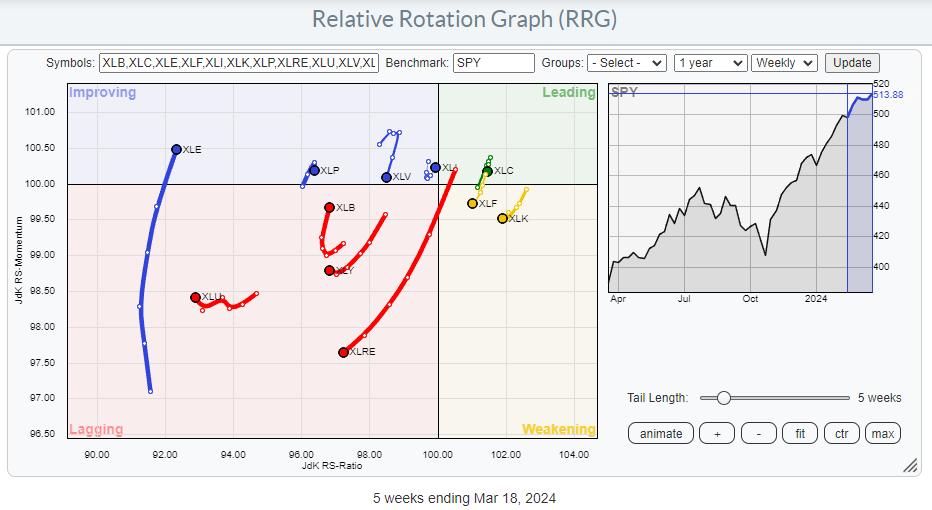

Energy improvements across three time zones

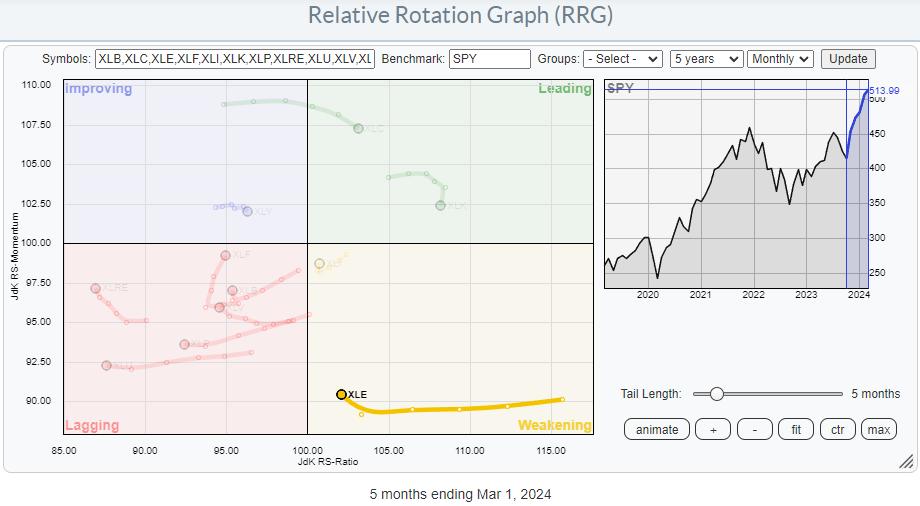

A look at the sector rotation earlier this week shows continued improvement in the Energy Sector (XLE). Despite having the lowest reading on the JdK RS-Ratio scale, XLE has a long tail and has just entered the improving quadrant.

This happens at very low RS rate levels after a very long rotation, but it gets interesting when you combine this rotation with the XLE tail of the daily and monthly RRG.

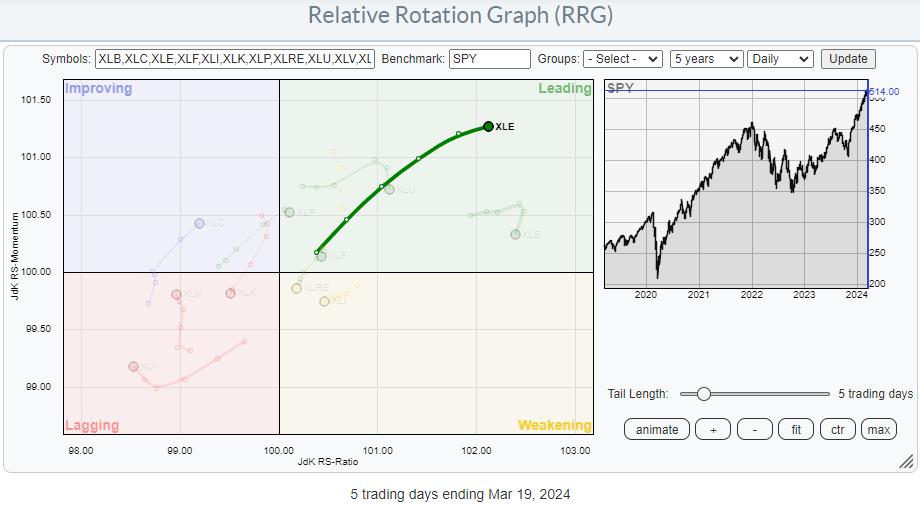

In the daily RRG, the tail is located inside the leading quadrant and is still moving higher due to strong momentum. The RRG direction has slowed down a bit, but is still within the 0-90 degree range.

In the monthly RRG, the XLE tail is still within the weakening quadrant and is starting to reconnect. This is interesting because it signals the potential start of a new uptrend in an already existing relative uptrend.

Overall, this means that we are seeing positive developments for the energy sector in all three periods.

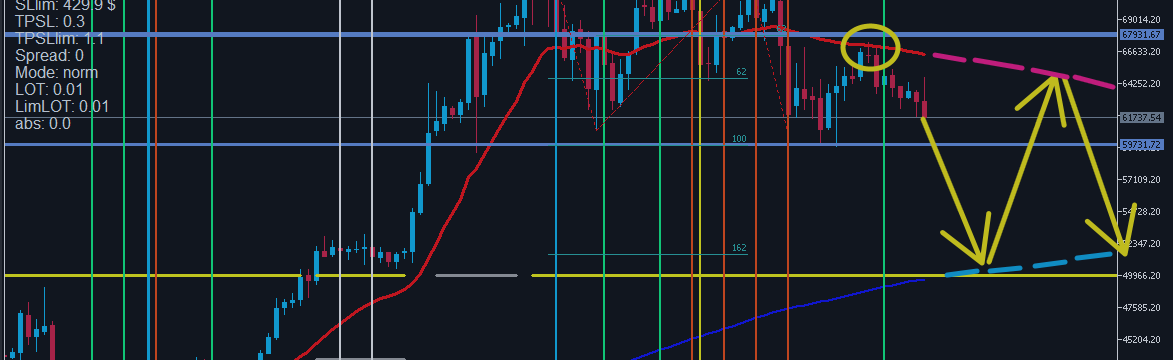

Close to major overhead resistance area

And the improvements aren’t just relative. On the price chart, XLE is now moving towards the overhead resistance provided by 4 major highs since 2022, all set just below 95.

Looking at the massive rallies that have occurred in major markets and sectors, it would be easy to think that breaking XLE’s 95 barrier would mean hitting a new all-time high. This is not the case with energy. sector. As you can see in the monthly chart below.

The 95 area is undeniably an important resistance level and a breakdown of this level would certainly fuel a further rally towards XLE’s all-time high of 101.52 from June 2014. It was almost 10 years ago.

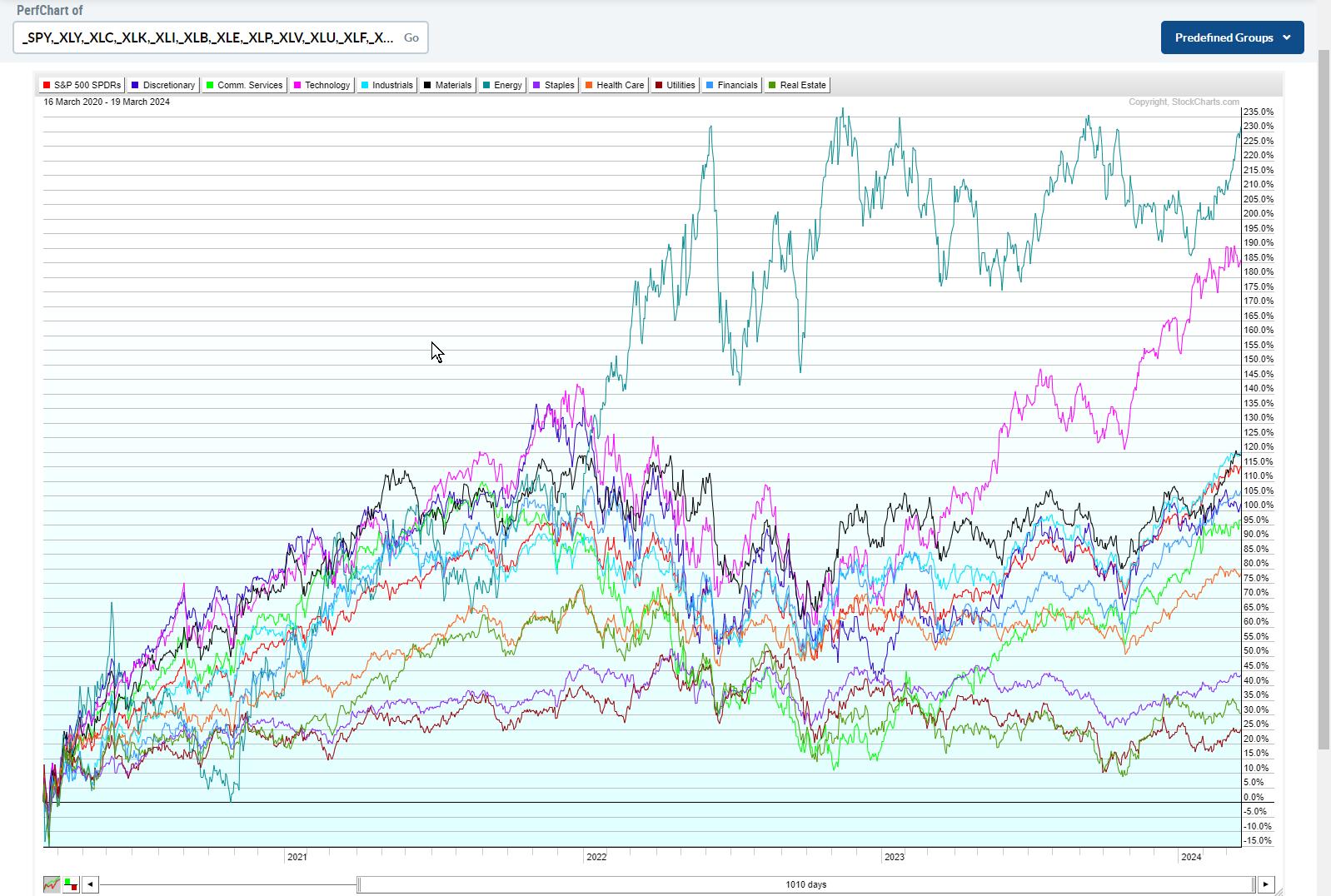

What’s also interesting is that XLE has tested support at lows dating back to around 20 in 1999 and 2002. It was 2020, just four years ago. Out of that low came a 475% rally, with XLE rising from 26 to 95 higher. More than any other industry during the same period

This PerfChart shows the performance of all sectors since the March 2020 lows. The teal line at the top is XLE. Only the purple XLK comes close to the XLE’s performance, thanks to a rally that began in October 2022.

Long-term turnaround underway

It is this tremendous performance that has maintained the

When a hook backup occurs inside a weakened quadrant, the general message is to initiate a new uptick within an already rising relative trend.

Looking at the monthly chart of XLE combined with RRG-Lines and raw RS above, this appears to be exactly what is happening. And this is happening after an initial rally that ended XLE’s relative downtrend that began in 2008.

If the raw RS value of Energy vs. SPY rises above 0.25, relative strength will accelerate and a much larger rally in favor of Energy is possible.

–Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more