Energy is on fire | RRG chart

key

gist

- The energy sector is on the rise on the price charts.

- The XLE tail of the relative rotation graph continues to gain strength.

- Even within the energy sector, the exploration and production industry is leading.

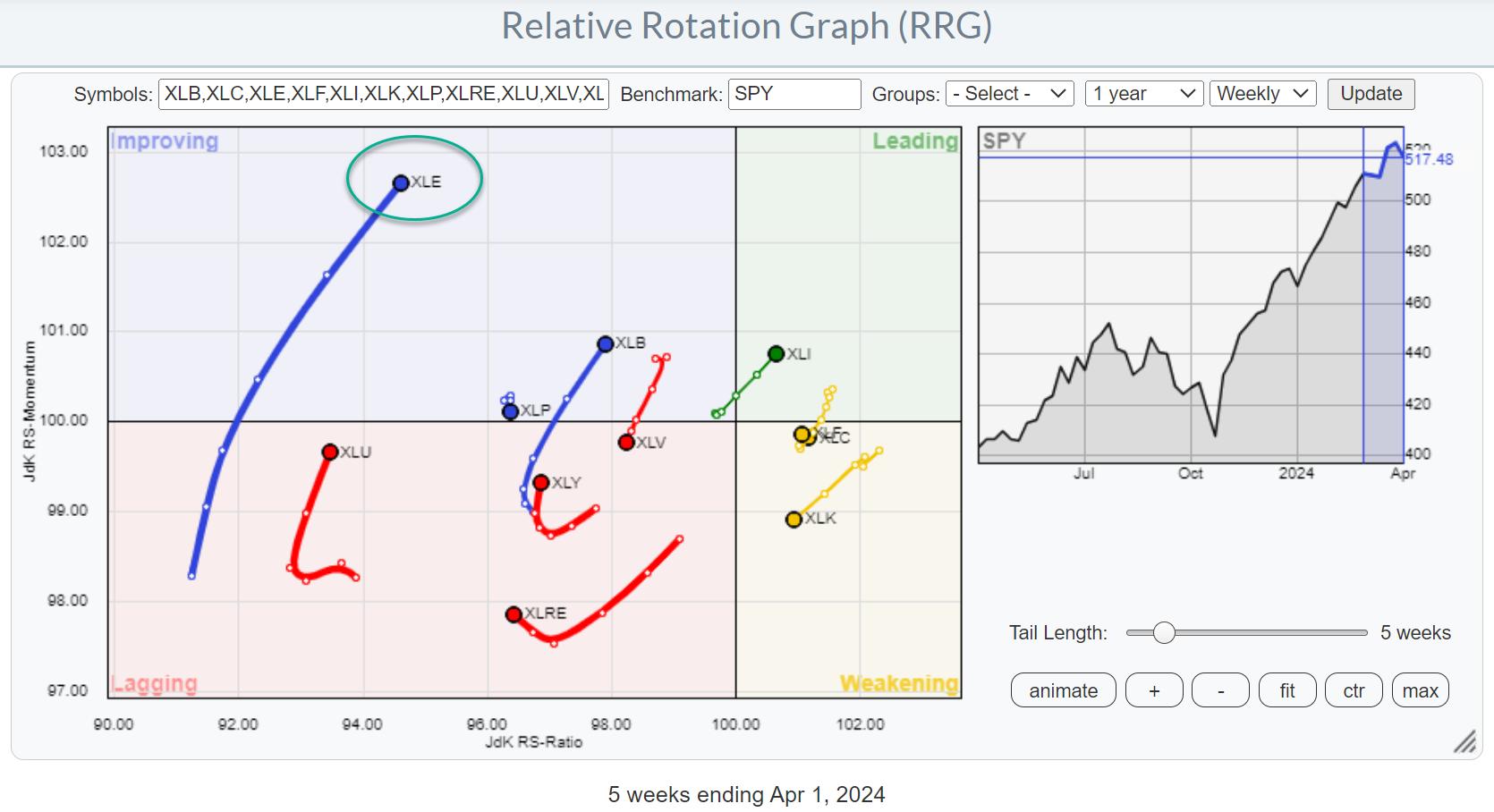

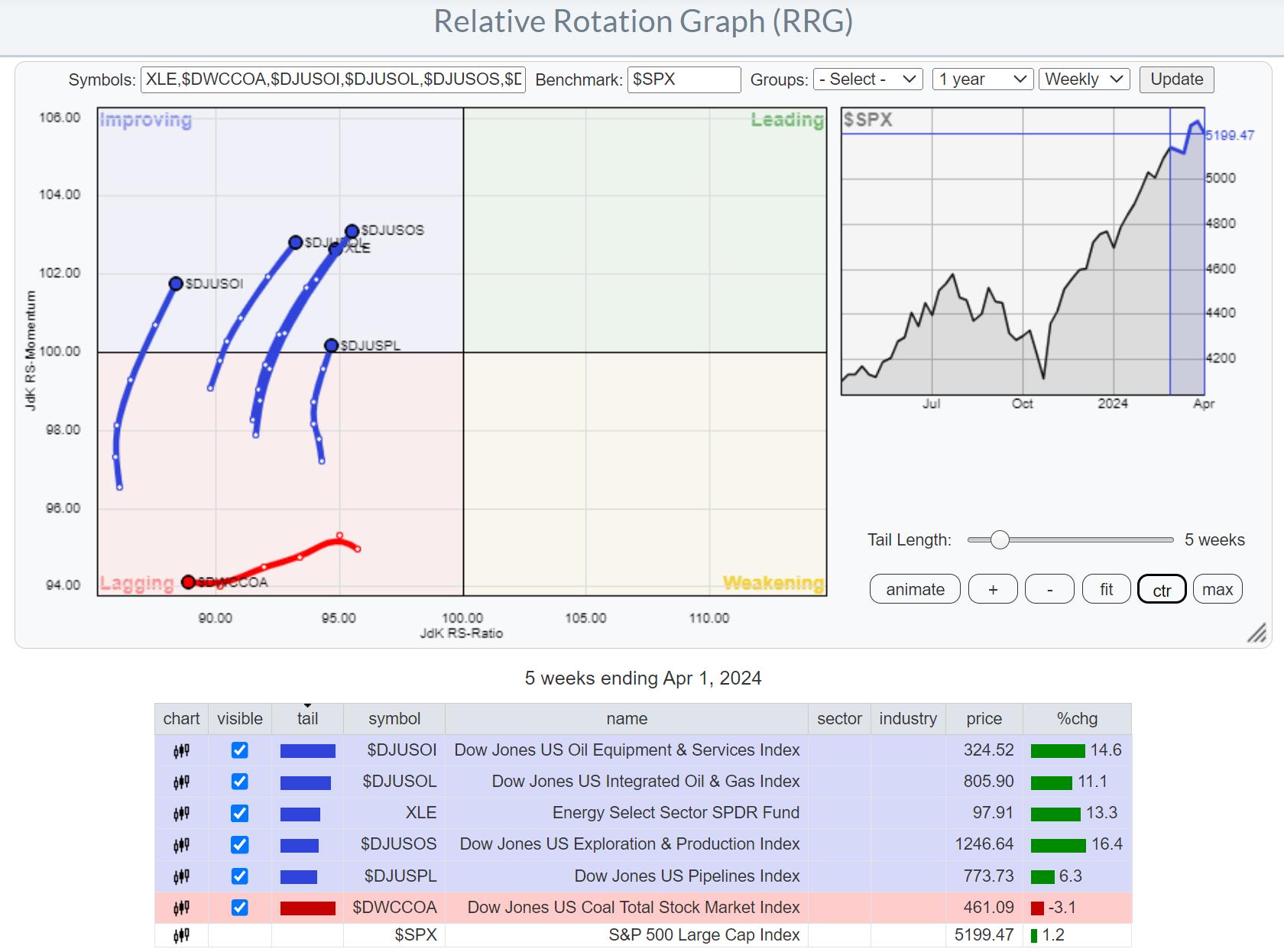

Strong rotation of weekly RRGs

The improvement in the energy sector (XLE) is becoming more and more evident, with the XLE tail lengthening on the relative rotation graph for several weeks already.

The recent weekly RRG’s rotation from lag to improvement is now starting to gain momentum, moving higher on the RS ratio scale, indicating further improvement in relative strength.

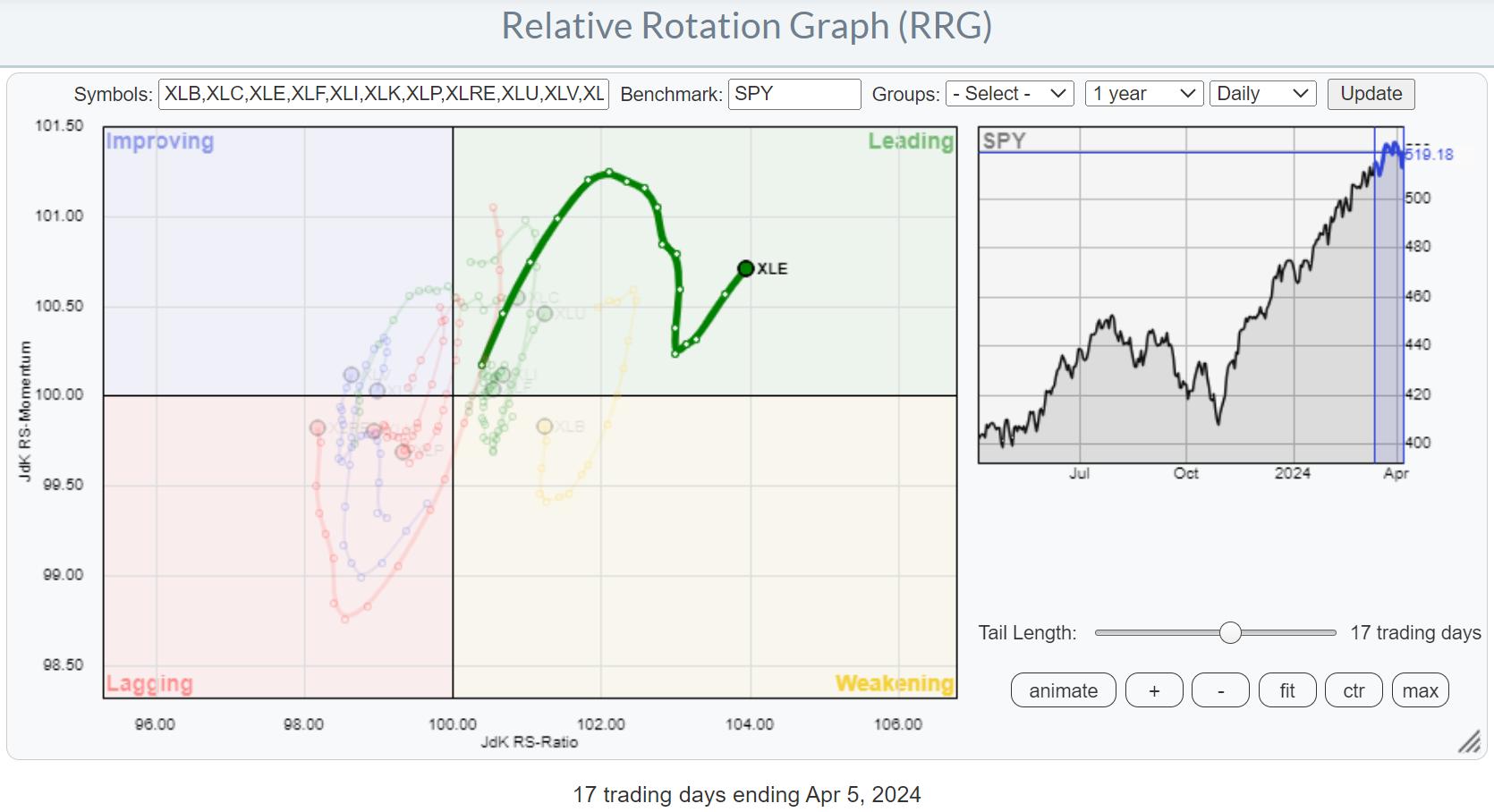

Daily circulation confirms strength

This improvement is further highlighted in the daily RRG, where the XLE tail is found well within the leading quadrant with a recent “hook” back up after a decline in relative momentum.

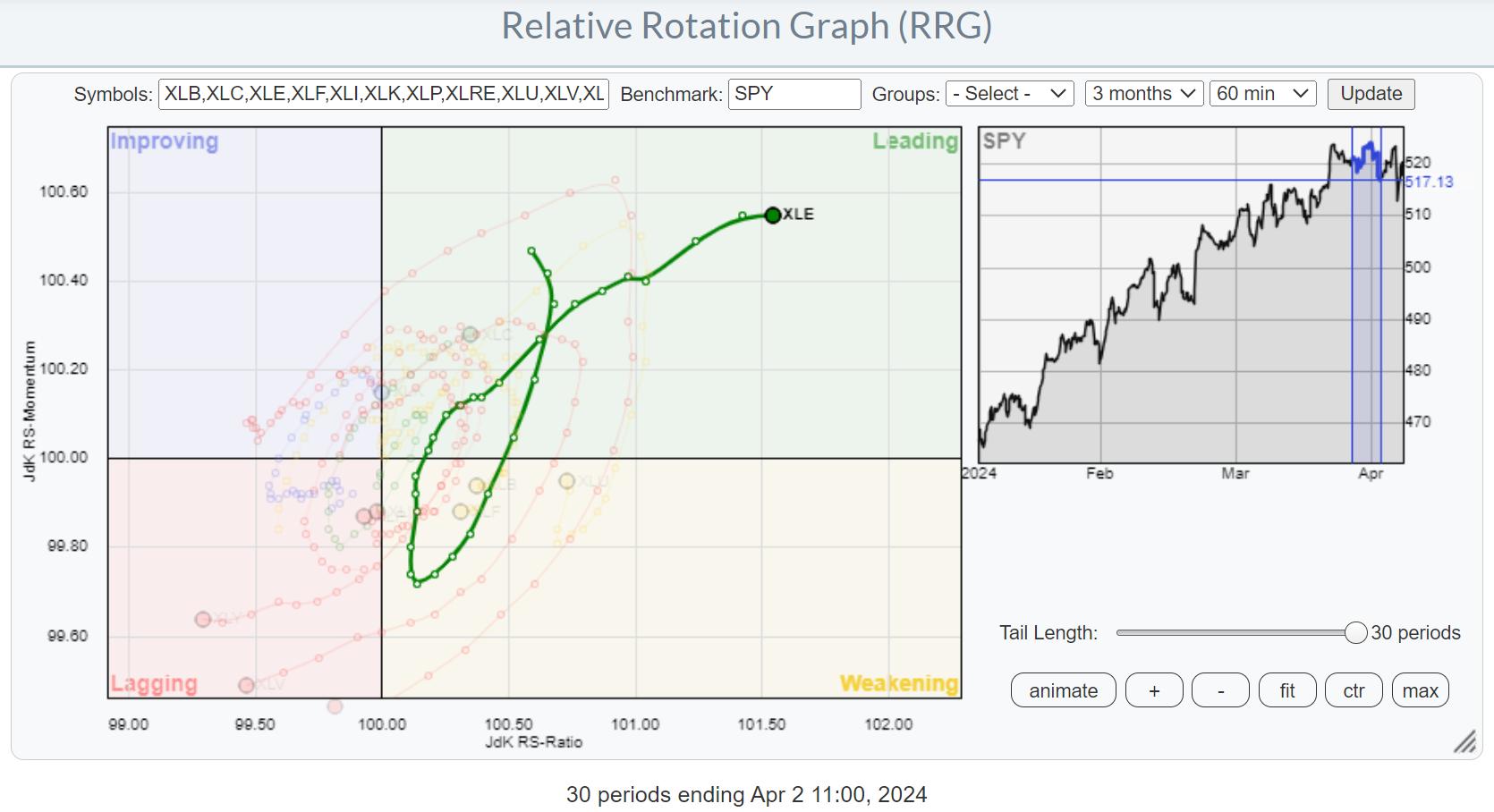

clockwise vs counterclockwise

For reference, this is a good example where the tail appears to rotate counterclockwise. However, in reality you will see a clockwise rotation on a smaller time frame.

In this case, the midpoint of the daily tail was 4/1 (no joke). This is the case when using hourly RRG to zoom in on April 1st and the days surrounding it. A clear clockwise rotation appears.

Main resistance breaking price

The energy sector was also mentioned in a previous article as one of the sectors that was close to breaking a key overhead resistance level.

This is happening now. Now that the excess supply around $94 has disappeared, new upside potential has emerged. This will certainly help further enhance the relative strength of the sector.

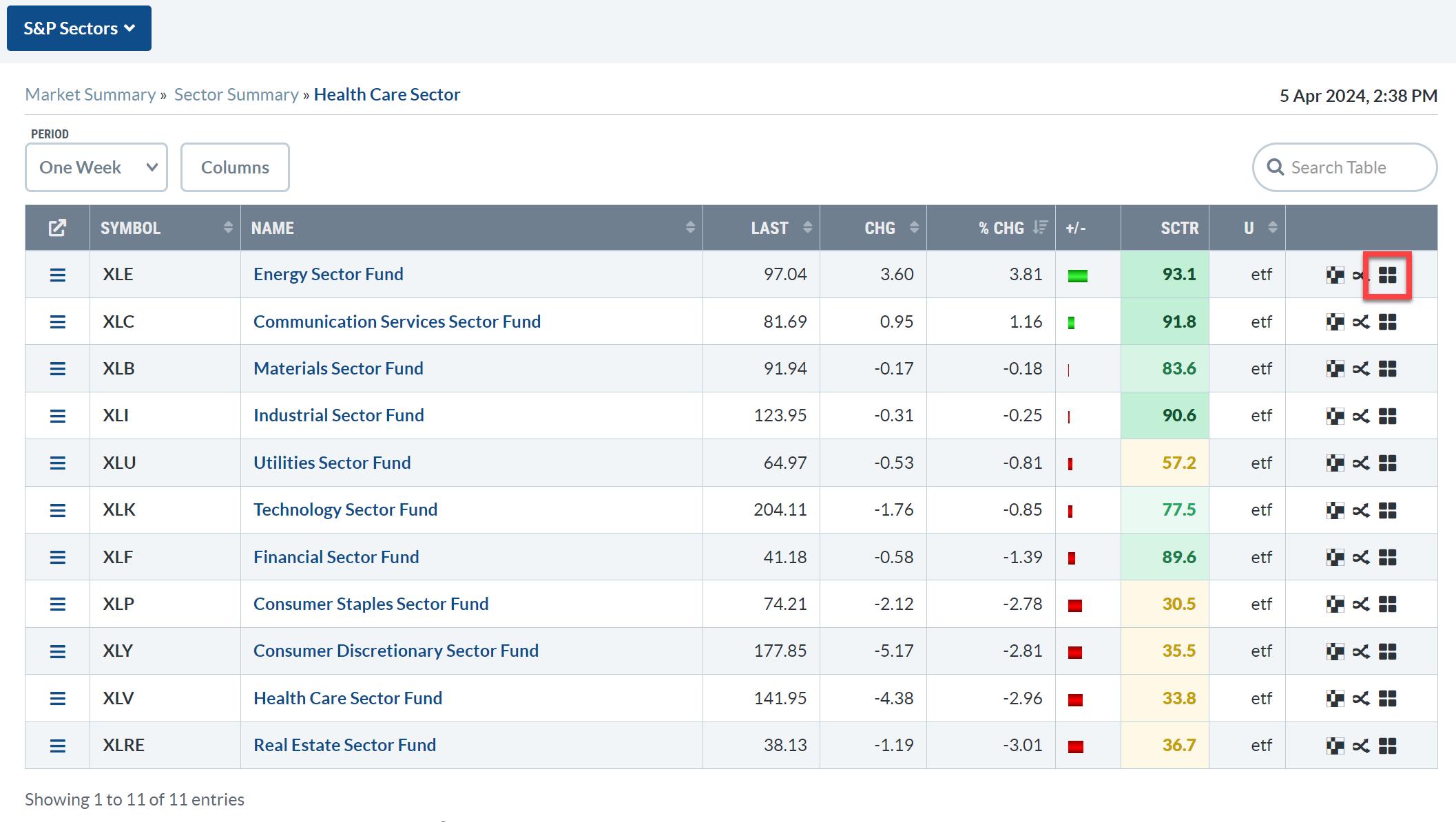

industry

You can dive deeper into the Energy sector by opening the RRG on the Sector Summary page, which shows the rotation of various industries within the sector. Just click on the little RRG icon at the end of the line.

Initially, this RRG uses the $SPX index as its benchmark. The overall strength of the sector is evident across all groups except coal, moving inside the improving quadrant in the direction of positive RRG.

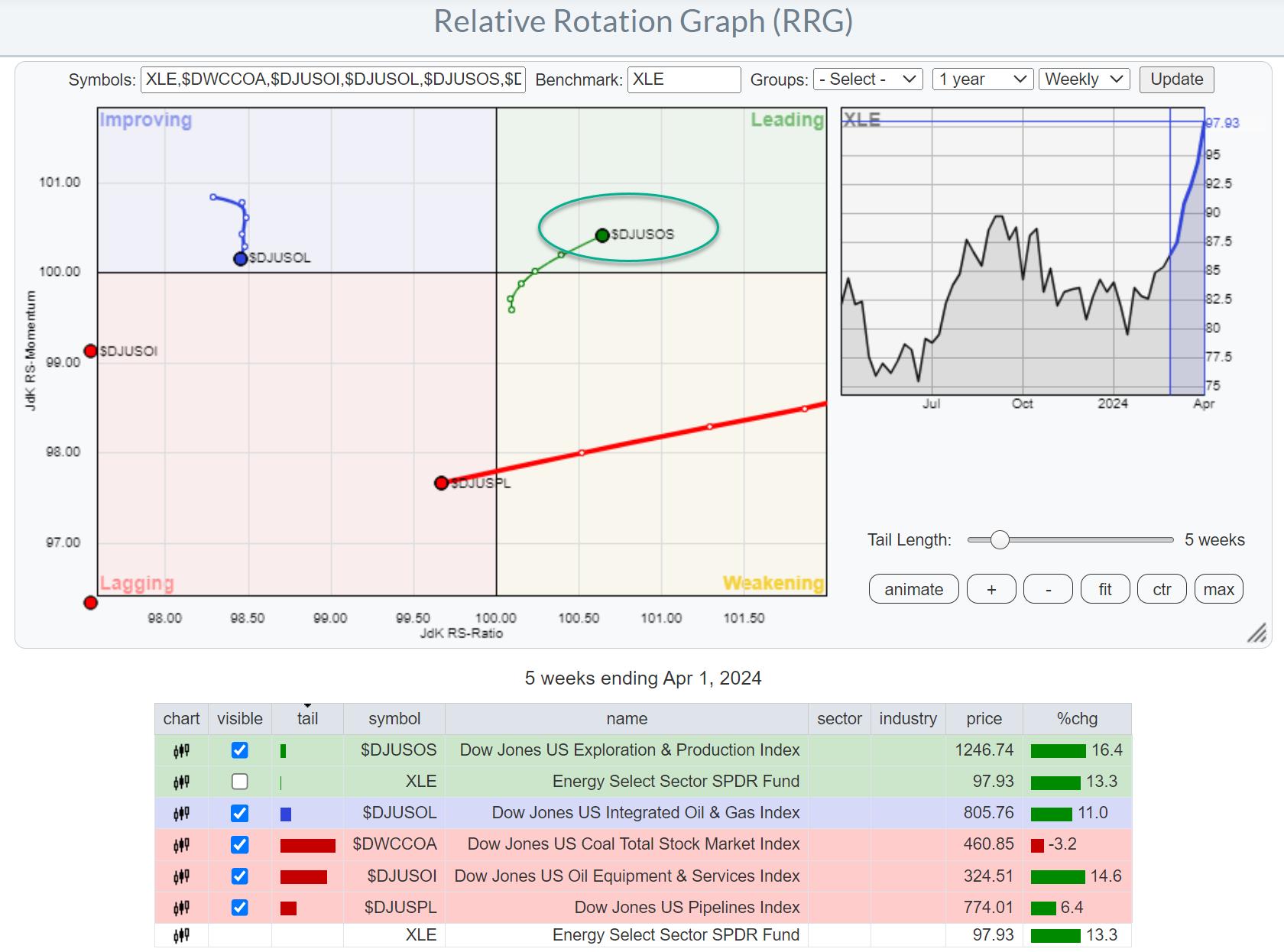

But things change when we switch the benchmark to XLE, which allows us to see these groups rotating within their own world. We already know that the sector is doing well, but which industries should you pay attention to?

Exploration and production stand out.

This changes the situation tremendously and immediately shows that the leading group in the energy sector is actually one group. That’s exploration and production.

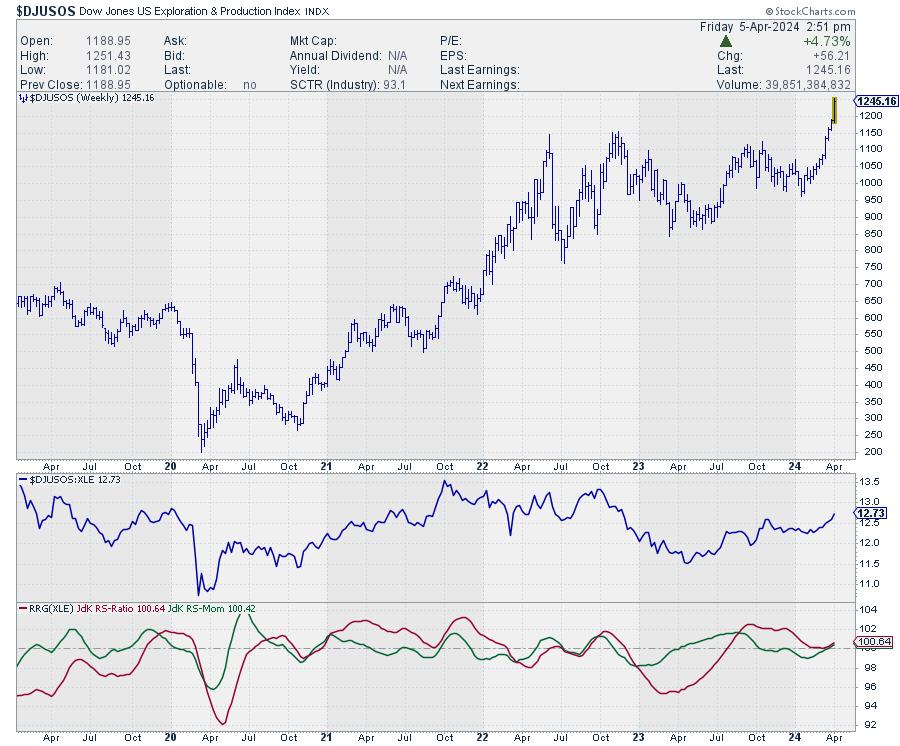

The price chart of this group speaks volumes. The upward breakout already happened a few weeks ago, and now the relative strength is really picking up speed. Both RRG lines rise above the 100 level and the tail pushes further into the leading quadrant of RRG.

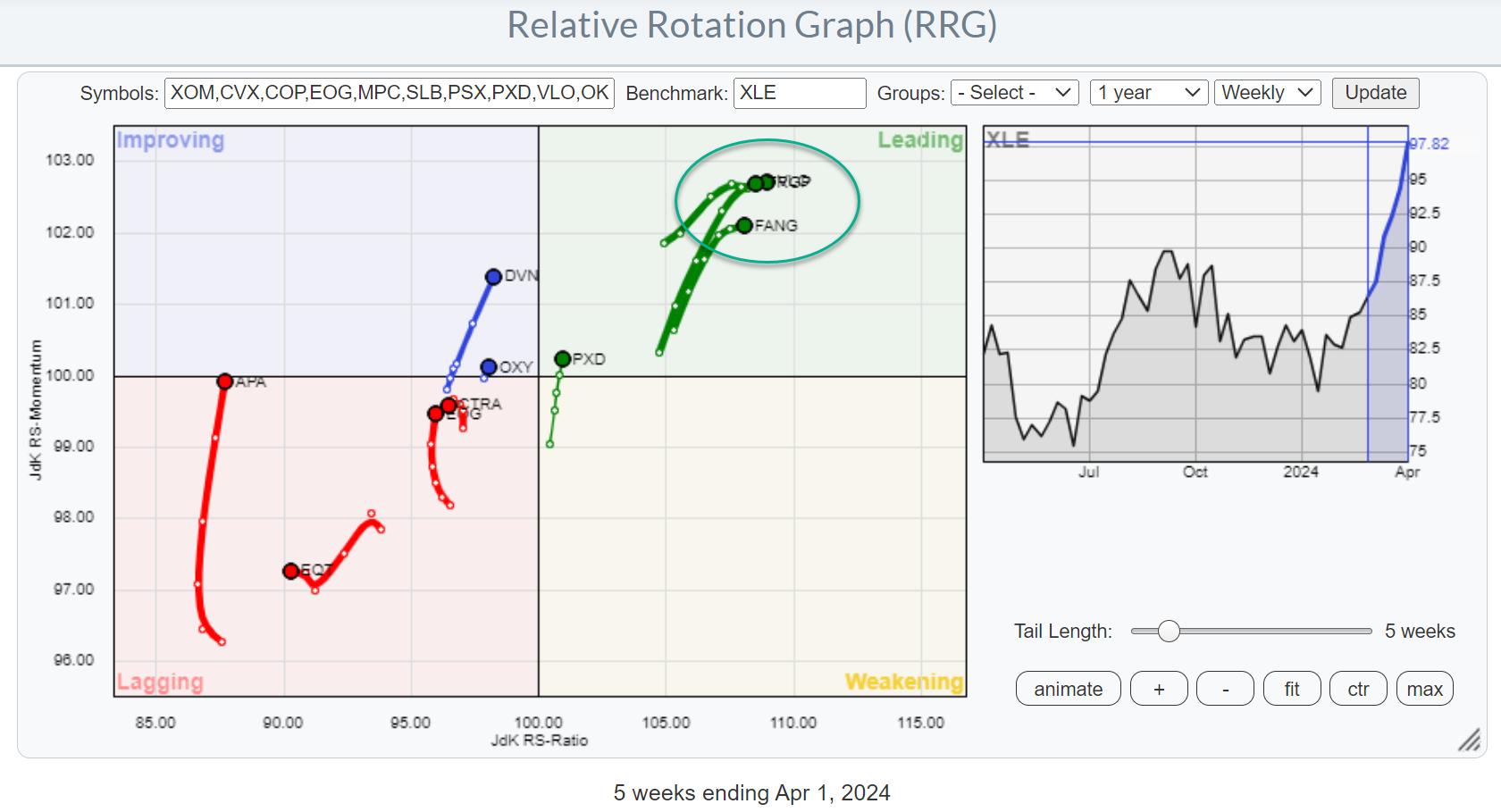

Zoom in on individual stocks

Loading predefined RRGs for energy sector members and then hiding tails/inventories that are not present in exploration and production will give you the above RRGs.

Looking at the individual price charts, we can see that stocks inside the leading quadrant (green cluster) have already seen significant gains in price. They have led the group’s early rallies.

When looking for better risk/reward opportunities, tails a little further to the left and even inside the trailing quadrant may offer better odds. Sectors and groups are already performing well, so when using $SPX as a benchmark, remember that these stocks are within the improving or leading quadrant and moving in a strong direction.

One of these stocks is OXY. The tail is still short but moving in the right direction, moving into the improvement quadrant. The upward trend on the price chart this week will certainly help in further improvement in its relative strength and is likely to make it one of the new leaders in the industry.

#StayAlert Have a great weekend, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more