Energy Transfer Stocks: Investor Pessimism Exposed (NYSE:ET)

deepblue4you/iStock via Getty Images

proposition

Energy transfer (New York Stock Exchange:ET) continues to be undervalued compared to most midstream industries. This discounted valuation is a result of negative shareholder sentiment resulting from reduced distribution in 2020. We believe this stigma provides an opportunity for readers to purchase this high-yield stock with less risk than would be inferred if they did not keep an open mind and let the past be the past.

I previously covered May 2023 ET with a Buy rating. Since then, the company has continued to grow its distribution while also making several successful acquisitions. The stock made some gains during that time, but it couldn’t keep up with the company’s operating performance, causing fundamental losses. As a result, we felt it was appropriate to conduct an in-depth analysis to eliminate any concerns. This may leave investors on the sidelines.

This article will cover the history of ET and examine some of its previous mistakes. We’ll then take a look at the self-prescribed medications ET took to improve his financial footing and boost his credit metrics. Finally, I will directly explain mathematically that ET is undervalued and has ample margin to continue to increase its distribution.

Through this in-depth analysis, I hope to show investors that examining a company’s income statement is the best way to find returns on market bets. ET’s financial condition is sound and our investment opinion is BUY.

introduction

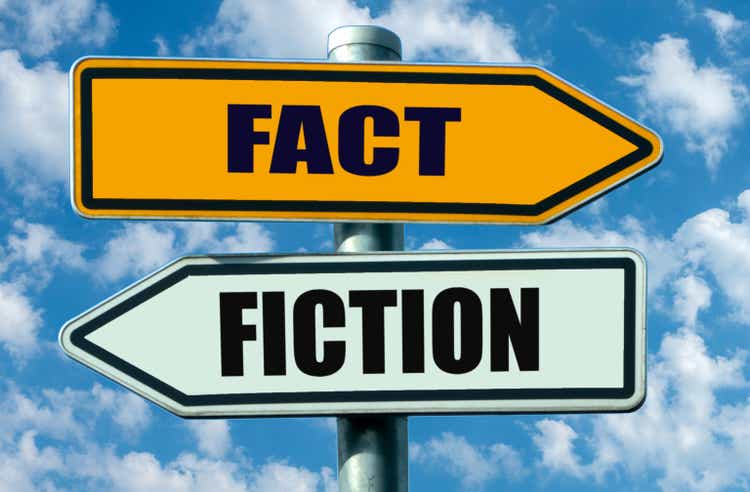

Energy Transfer is a midstream company engaged in the transportation of natural gas, NGLs, crude oil and refined products. The company consists of thousands of miles of pipelines and related infrastructure that help meet the world’s energy needs.

ET Asset Map (ET Investor Presentation)

stigma

In 2020, ET cut its dividend by half. This clearly had a negative impact on the device holder base and gave ET a negative stigma. Pain is a powerful teacher, but this can leave some investors without understanding the essence of energy transfer.

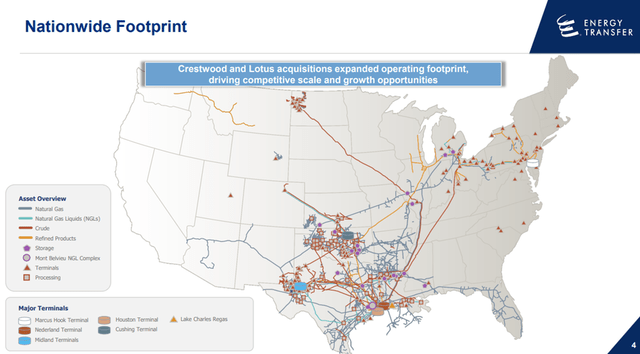

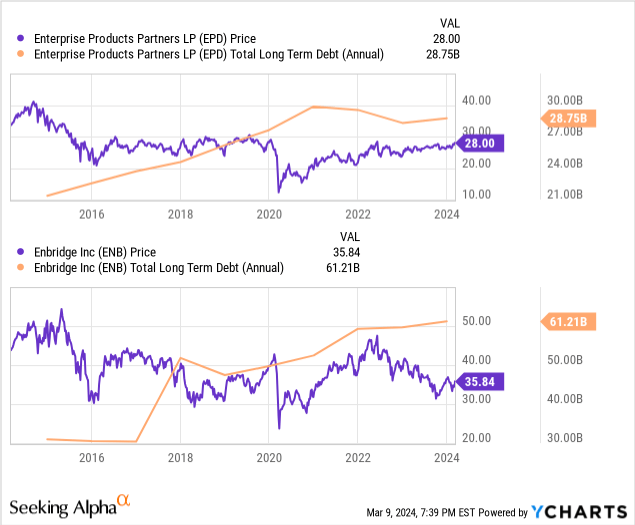

This stigma is accelerated when we look at past price-performance after distribution cuts have opened the door. ET is currently less than half of its 2015 high. The situation gets even worse when you look at how debt has grown over the past decade. The bears must be doing something here.

Clearly, there is some truth behind ET’s decline. But is ET really such a strange person?

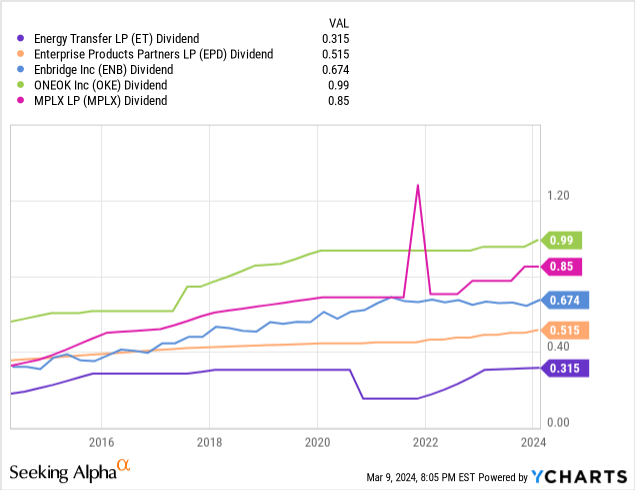

If you compare the price performance and debt profile of EPD and Enbridge (ENB) over the past decade, you will find a nearly identical chart. Just to be clear, we compared several other large midstream companies and found similar results for ONEOK (OKE) and MPLX (MPLX). So clearly ET is not an outlier, but actually follows the same practices as most of the midstream industry.

After showing that ET is not unique in its stock performance or debt accumulation, our high-level bear case for ET has now been boiled down to one variable. Distribution cut. If you go back 10 years, ET is the only company in the group to do so.

Many investors in the midstream space rely on their investments as a form of income, so it’s natural to seek consistency. To address this issue, we’ll look at what made this cut necessary and what allowed deployment to be restored in a relatively short period of time.

approximately

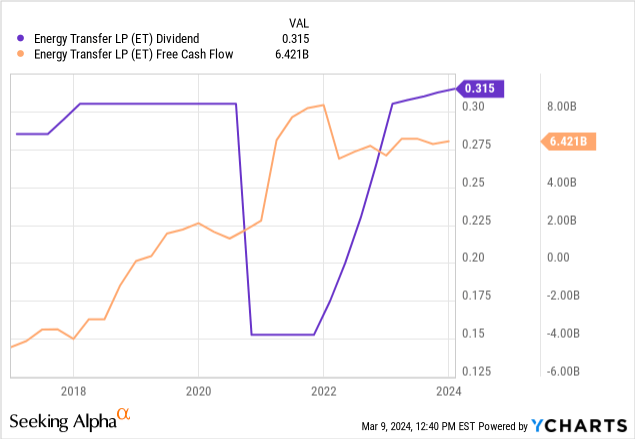

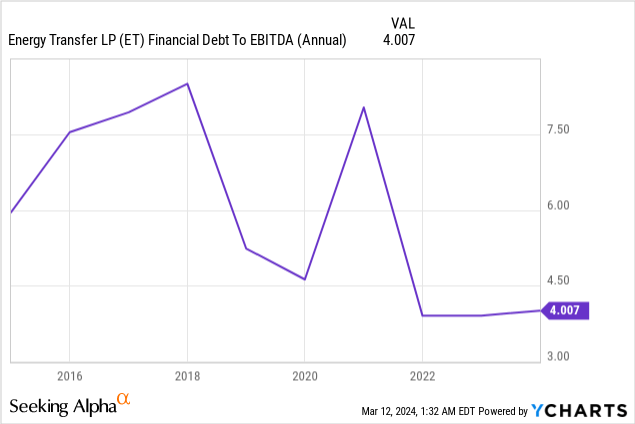

Hindsight is always 20/20. But looking back, it’s not surprising that distribution at the time wasn’t sustainable. 2019 was the first year the company was free cash flow positive. At the time, ET was heavily leveraged, with a debt-to-EBITDA ratio of approximately 5.25x.

With minimal free cash flow, rapid debt growth and economic uncertainty due to the pandemic, ET faced a credit rating downgrade from credit rating agencies. With over $50 billion in debt at the time, raising interest rates by just 1% would have a significant financial impact. ET has chosen the quickest treatment for your problem. Reduce distribution by 50%. This allowed ET to free up $1.7 billion per year and allocate those funds to its balance sheet.

Chairman and CEO Kelcey Warren discussed the rationale for the distribution cut during the company’s third quarter 2020 conference call.

The distribution reduction is a proactive decision to strategically accelerate debt reduction amid our continued focus on achieving a leverage target of 4-4.5x and a solid investment grade rating on a credit rating agency basis.

We expect that the distribution reduction will generate approximately $1.7 billion of additional cash flow on an annualized basis, which will be used directly to repay debt balances and maturities. This is an important step in Energy Transfer’s plan to increase financial flexibility and lower capital cost caps. We are exploring ways to return additional capital to unitholders once we reach our leverage target.

The effect of this decision was immediate. By the end of the following year, the company had paid off $6.3 billion in debt and was reinstating its dividend. By the end of 2022, distributions had been restored to previous levels and leverage ratios had been lowered to around the 4x range.

math

Now it’s time to address the pesky notion that ET is set to repeat the distribution truncation scheme. Let’s start with how ET expects 2024 to unfold.

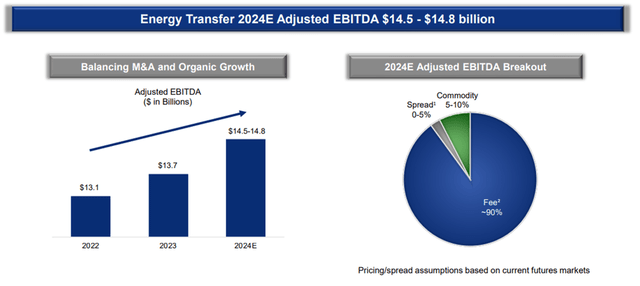

The company expects EBITDA to increase 7% in the new year. This increase is primarily due to the full year of operations of the Crestwood Partners and Lotus Midstream acquisitions.

The company also plans to spend approximately $2.5 billion on organic growth projects in 2024. The majority of this spending will be allocated to NGL export (55%) and natural gas transportation (25%) projects.

2024 EBITDA Estimates (ET Investor Presentation)

To understand how this all fits into deployment stability, you need to analyze the various components of your ET budget and how they affect your deployable cash flow. Below we have created a table showing the key items in the ET financial model.

| Estimated 2024 | |

| Evita | $14.5 billion |

| interest cost | (USD 2.84 billion) |

| tax cost | ($0.34 billion) |

| Growth CAPEX Cost | ($2.6 billion) |

| Maintenance CAPEX costs | ($840 million) |

| Distributions to non-controlling interests | (USD 1.86 billion) |

| Distribution to Common Unit Holders | ($4.24 billion) |

| FCF remaining | $19.4B |

This model included the following assumptions:

- Low-end EBITDA guidance.

- Advanced CAPEX spending guidance.

- Maintenance CAPEX, interest expense and non-controlling distributions increase by 10%.

Given the degree of conservatism built into the model, there is a considerable margin to ensure that the deployment is safe. In fact, ET is expected to have $1.9 billion in discretionary funds that can be allocated to its balance sheet or acquisitions.

In the worst-case scenario I modeled, the company still has a distribution reach of about 1.5x. Removing conservatism improves coverage by a factor of approximately 1.65. Both of these values are widely considered healthy for the MLP structure business.

With 90% of ET’s expected EBITDA structured around fee-based contracts and minimal commodity exposure, we conclude that there is little risk to distribution in the near future.

value proposition

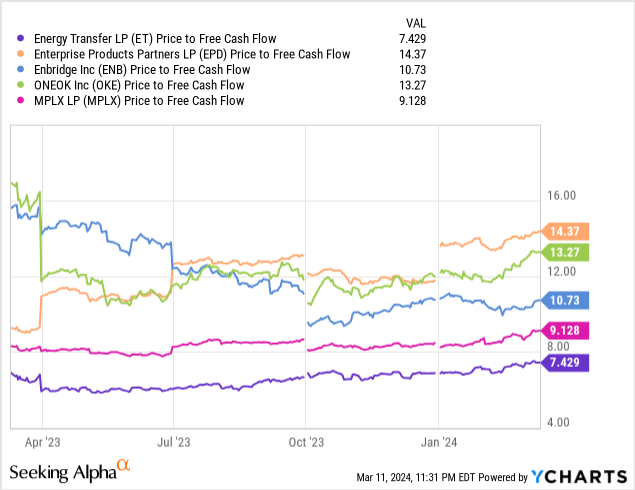

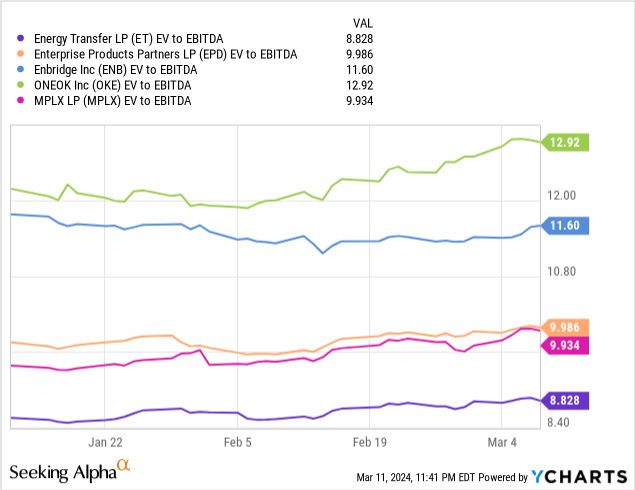

To demonstrate ET’s value proposition, let’s compare it again to the general midstream sector. Using the same peer group, we can see that ET is trading at multiple multiples lower on both price-to-free cash flow and EV-to-EBITDA.

In this case, I think the EV to EBITDA metric is the most insightful. Enterprise value includes both market capitalization and total debt on the company’s books. This metric helps penalize or reward companies based on their debt/cash profile. Despite the notion that ET is overleveraged, it still scores highly. In fact, ET has a lower overall multiple than EPD, which has one of the best balance sheets in the industry.

Trading at a low EV to EBITDA ratio means Energy Transfer is either on a slower growth trajectory or its financial fundamentals are deteriorating. With $2.5 billion in projects under construction and nearly $2 billion in FCF, it’s hard to accept this story.

Instead, I subscribe to the notion that time heals all wounds. The further we get from distribution cuts, the less likely the negative impact will be. I believe that as ET continues to rebuild its track record of EBITDA and distribution growth, the company will experience multiple expansions that could close the gap with its peers.

Experiencing one additional turn-in multiplier would result in a stock price of $18.30 per share at the midpoint of projected 2024 EBITDA. This implies a 22% upside potential from the current stock price. I expect this transition to be gradual, and it may take another year to 18 months of increased distributions to fully convince investors that ET is a reliable distribution payer.

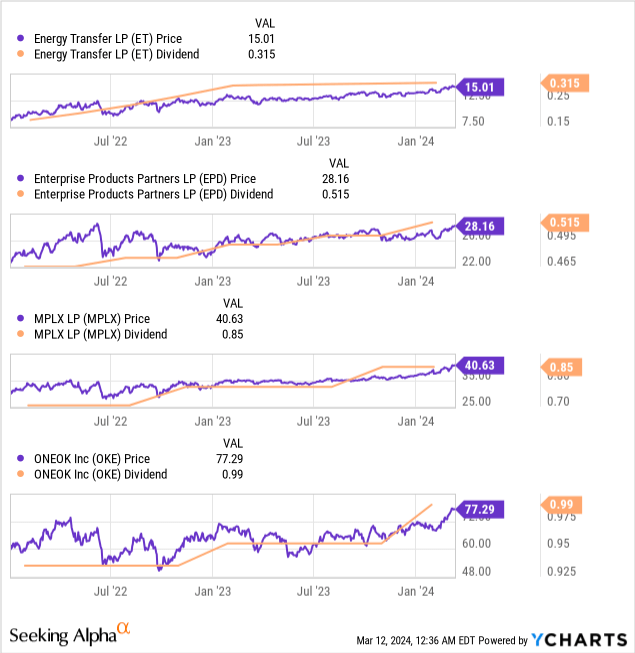

As a final point on value, I’d like to address the common misconception that ET (or the midstream sector in general) is just a high yield or bond substitute. As previously mentioned, ET is investing approximately $2.5 billion in organic growth projects this year. This comes after spending $1.6 billion and $1.9 billion in 2023 and 2022, respectively.

These investments were made to continue to grow our partnerships and capital distribution growth. Distribution growth leads to increased capital appreciation because higher returns attract more investors. As you can see below, over the past two years, the midstream space has experienced capital appreciation as each company has grown its distribution.

As long as ET can continue to invest in organic growth and/or acquisitions, distribution should be expected to continue to grow. This will force capital gains over the long term.

danger

The midstream sector generally has low downside risk thanks to the protection provided by take-or-pay style contracts. However, an interruption in steady free cash production could hinder operational and distribution growth.

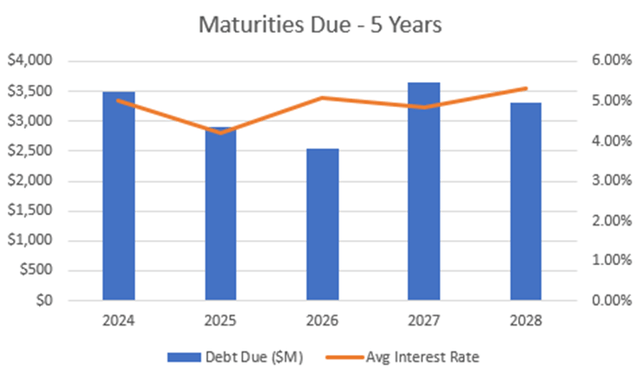

Over the next five years, ET’s annual debt maturities range from $2.5 billion to $3.6 billion. This level exceeds the amount of FCF available after distributions and CAPEX expended to retire all maturing debt. Therefore, a certain amount of refinancing is required.

The average interest rate on maturing debt is 5%. Given the rising interest rate environment, alternative debt may become more expensive, resulting in increased interest costs.

In its current form, interest expense accounted for approximately 19% of ET’s 2023 EBITDA. Changes in this area can therefore have a very measurable impact. The additional interest costs will reduce both distribution growth opportunities and distribution reach.

ET Debt Maturity (ET 10-K Report)

summary

In this article, I have outlined some of the common misconceptions about ET as a company and stock. The clear conclusion I have to make is that the pessimism surrounding ET is unwarranted and the company’s financials are sound.

This misconception about the company indicates an attractive valuation for a high-yield company. At current prices, the stock has a yield of 8.4%, and our financial model shows ample margin exists to support distribution growth, acquisitions, and debt reduction.

As a result, I rate Energy Transfer as a ‘Buy’ based on the stock price of $15.01/piece as of March 12, 2024.