Entegris: Expect accelerated sales and margin expansion going forward

Pony King

summary

Readers can find my previous reporting through this link. Our previous rating was a buy on Entegris.NASDAQ:ENTG) Growth has bottomed and gross margins will expand going forward. Both factors are fueling the rise. Multiple revisions. As of April 8, ENTG stock price has reached the target price of $139.40. So I think it’s time for an update. I reiterate my Buy rating on ENTG as I remain very positive about its strong operating performance going forward.

Finance and Evaluation

ENTG reported almost two months ago, but for those of you who don’t know, Q4 2023 revenue was $812 million, down 9% quarter-over-quarter and down 14% year-over-year, with adjusted EPS of $0.65. By segment, Material Solutions (MS) sales recorded $365 million, down 16% quarter-on-quarter and 20% year-over-year. Microcontamination Control (MC) revenue increased 1% quarter-over-quarter and year-to-date to $288 million. Advanced Materials Handling (AMH) sales decreased 6% quarter-over-quarter and 21% year-over-year to $169 million. However, on a positive note, gross margin increased by 100bps compared to the previous quarter. to 42.4%. Management expects the industry to grow 4% in FY24 and ENTG to outpace market growth by 400 to 500 bps. This implies ~$3.5 billion in FY24 revenue. Additionally, management has set adjusted EBITDA margins of ~29% (implying a 230bps improvement) and adjusted EPS above $3.25. Additionally, ENTG plans to spend $350 million on capex in 2024, a 23% decrease from its FY23 capex spending.

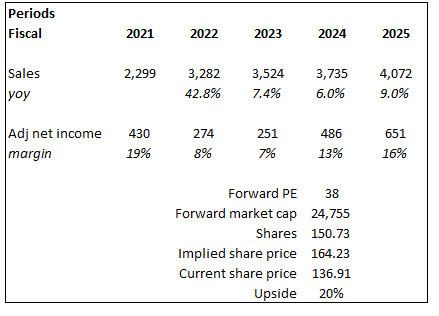

Based on the author’s own math

My view on the business is that ENTG is expected to grow at 6% in FY24 and 9% in FY25. My growth estimates have been adjusted to align with management guidance. U.S. GDP is expected to grow ~1.6% in 2024, which pegs FY24 growth at 6%, based on management guidance that growth is 2x GDP + 300 to 600 bps of outperformance. For FY25, we use US historical GDP growth of approximately 3% as a baseline, which equates to 6% industry growth, and adding the midpoint of management’s long-term guidance (300bps) results in 9% growth in FY25. As mentioned above, margins should expand as volume comes back online and incremental margins begin to expand, leading to margin expansion. Historically, ENTG has driven net profit margins into the low teens during upcycles, and we expect our exit (FY25) net profit margin assumption to remain the same at 16% (a return to FY20 levels, which were at their peak during the COVID period). . Given its strong outlook, we believe ENTG will continue to trade at a premium to its historical average as the market anticipates strong operating performance going forward.

First, we expect the semiconductor industry, our core market, to grow at twice the rate of GDP growth. And we expect to continue to beat the industry by three to six points.

Going forward, we expect top-line growth of 2 to 4 points above industry and operating margins in the low to mid-20s. Source: 4Q23 Performance

comment

We believe ENTG’s upside potential remains attractive, given management’s guidance predicts strong performance going forward. My optimism is supported by my positive view of revenue growth, continued margin expansion, strong FCF generation and business portfolio optimization. First of all, there is no doubt that ENTG will continue to beat the market when it comes to revenue growth. In 2023, it was 6% ahead of the market. This is due to technological changes leading to increased material consumption per wafer and more stringent purity standards, especially in leading-edge logic/foundry and memory fields.

Based on the author’s own math

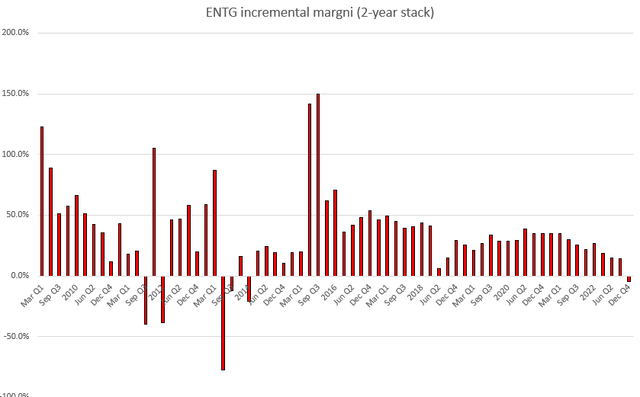

Second, from a gross margin perspective, with volume-related headwinds significantly behind the company (gross margins have fallen from the mid-40s to low-40s), we expect ENTG’s gross margin profile to be in the mid-40s over the next few years as volume increases. It is expected to return to . Back online. ENTG should experience strong operating leverage due to expanding gross margins, given the fixed costs inherent in the business. Based on our analysis of ENTG’s historical incremental EBIT margins (on a two-year stack basis to mitigate volatility), ENTG typically sees its incremental EBIT margins improve (and also decline) during recoveries. Over recent history (FY16-FY23), incremental EBIT margins have been around 20-30%. Using a midpoint of 25%, this suggests that ENTG could see EBIT margins increase by up to 30% in the near term (this is consistent with management guidance on operating margins).

Third, management has demonstrated a very strong focus on inventory management, reducing inventory on the balance sheet for three consecutive quarters as of 4Q23 to $607 million, down 8% quarter-over-quarter and 25% year-over-year, essentially exceeding targets. . It was set for FY23 (the target was a $100 million reduction, but ENTG recorded a $135 million reduction). This essentially translates into a $135 million improvement in FCF (lower working capital requirements). Additionally, 2024 capex is guided to decline 23% to $350 million, resulting in a $90 million improvement in FCF. Just by rationalizing inventory and capital expenditures, ENTG could see an FCF tailwind of approximately $230 million in FY24, which, combined with improved EBIT, could see a sharp acceleration in the coming years.

Finally, we are encouraged by the fact that management has delivered on its commitment to optimize the business portfolio. On March 4, ENTG announced the sale of its Pipeline and Industrial Materials (PIM) business for up to $285 million. By way of background, the PIM business primarily sells drag reducing agents (DRAs) and various valve maintenance products and services to oil pipeline operators. Management has been vocal about selling this division and finally did so, showing the market that they were focused on seeing it through the portfolio optimization process. Notably, this also provides ENTG with cash to pay down the approximately $4.7 billion in debt it has on its balance sheet.

danger

At current valuations, any major macro slowdown affecting the semiconductor industry (due to a slowdown in fab equipment spending) could impact ENTG’s ability to grow as quickly as management guides. ENTG’s current valuation is (forward PER of 38x) and there is a lot of room to return to the past average of 22x.

conclusion

As strong operating performance is expected in the future, we recommend a Buy rating on ENTG. I think ENTG is positioned to benefit from the industry’s slump, with growth exceeding market expectations, especially in the semiconductor segment. This, combined with margin expansion and improved free cash flow generation, will enhance shareholder value.