ETH price plummets due to $35 million selling

Celsius Networks, which is currently undergoing bankruptcy proceedings, has participated in a significant Ethereum transaction that has had ramifications in the digital currency landscape.

Over the past 10 hours, LookonChain’s on-chain analysts have detected notable transfers, including a 13,000 ETH deposit ($30 million) to Coinbase and an additional 2,200 ETH ($5 million) to FalconX. These deals signal Chelsea’s proactive stance in resolving their ongoing financial problems.

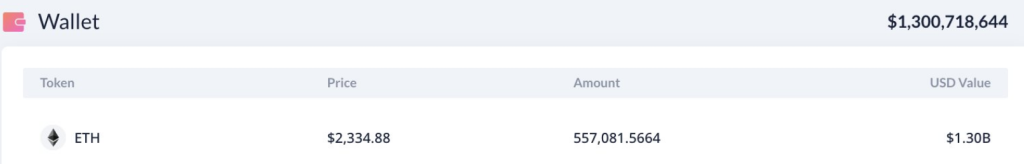

Celsius sells $125 million of ETH and maintains $1.3 billion in reserves.

According to Arkham Intelligence, Celsius sold $125 million worth of Ethereum (ETH) coins between January 8 and January 12. The main goal of this auction is to repay creditors.

Dune Analytics also revealed broader redemption patterns, with over $1.6 billion of staked Ethereum being redeemed during the same period. The redemption volume recorded since the Shanghai update last year is the highest ever.

that much #Celsius Deposit 13K into your wallet $ETH($30.34M) ~ #Coinbase and 2,200 $ETH(USD 5.13 million) ~ #FalconX Again in the last 10 hours.

There are currently two staking wallets. #Celsius Still holds 557,081 $ETH($1.3 billion).

Address: https://t.co/3gGOucC9gYhttps://t.co/zodN4gzVHKhttps://t.co/Jjt9fCN2Ej pic.twitter.com/E9DIZ9KDAH

— Lookonchain (@lookonchain) January 23, 2024

Despite the financial constraints imposed by the courts, Chelsea still holds a significant amount of Ethereum reserves. These holdings amount to over 557,000 coins across two staking wallets, with a total value of approximately $1.3 billion. The size of these reserves adds complexity to Celesius’ current financial situation and highlights the evolving story within the cryptocurrency space.

Source: LookOnChain

As part of its obligations to its creditors, Chelsea has been actively liquidating its Ethereum holdings. These auctions, aimed at repaying outstanding debts, are integral to Chelsea’s insolvency proceedings.

Source: LookOnChain

The market reacted to these Ethereum transactions, with the price of ETH falling 4%. The cryptocurrency fell below the $2,350 mark, sparking concern among analysts, especially as ETH teetered below a critical demand zone between $2,380 and $2,461.

Analysts predict that if this level is not maintained, there is a possibility of a decline towards the $2,000 level.

Ethereum currently trading at $2,307.2 on the daily chart: TradingView.com

Wealthy Investors Trigger Ethereum Profit Taking

Historical data from Santiment shows that significant transactions by wealthy investors, commonly known as whales, often trigger profit-taking activity among regular ETH holders. This phenomenon intensifies selling pressure and influences prices to fall.

Meanwhile, the decline in funding rates hints at underlying optimism in the market, suggesting a cooling in previously overheated perpetual markets is possible. This situation leaves room for ETH to rebound once selling pressure subsides.

As the Celsius bankruptcy drama unfolds, the scrutiny of Ethereum trading and resulting market dynamics will continue. Investors and observers are closely monitoring the situation and eagerly awaiting further developments and the wider implications for both Chelsea and the cryptocurrency ecosystem.

Featured image from Shutterstock

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.