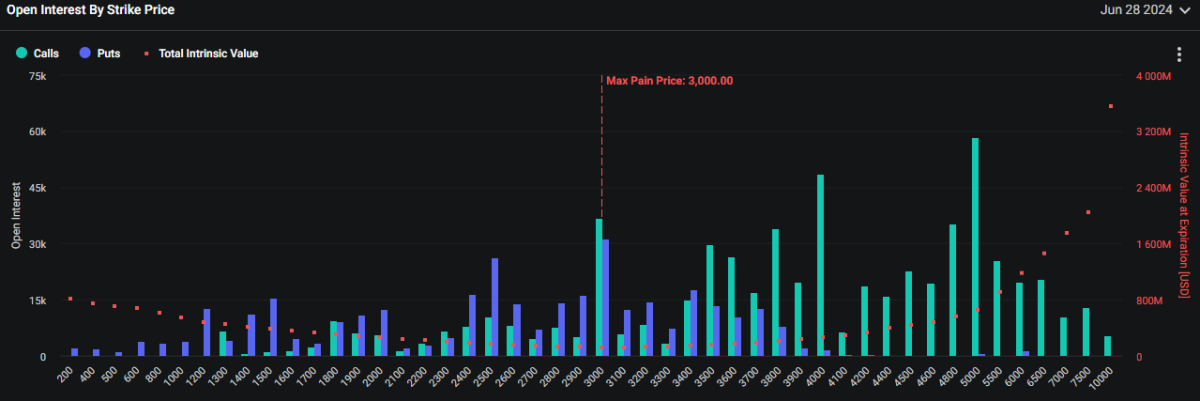

Ether options open interest is centered around the $5,000 call expiring at the end of June.

The largest cluster of open interest for Ethereum options is currently the $5,000 call expiring at the end of June, indicating a bullish outlook with traders taking positions using call spreads between $4,000 and $5,000 to hedge against a potential price rise. analysts said.

“An examination of derivatives data shows that the highest open interest on Ethereum currently is the June $5,000 call option,” Rachel Lin, co-founder of SynFutures, told The Block.

This observation is supported by data from the Deribit derivatives exchange. The largest concentration of Ether options open interest is the call option with a strike price of $5,000.

Bullish call spread for end-June expiration

According to QCP Capital’s latest analysis of options distributions, the data indicates a bullish outlook for Ether in the coming month. Traders can profit from a possible rise in the price of Ether within the $4,000 to $5,000 range.

The analysis demonstrated how traders buy a call option with a strike price of $4,000 and sell a call option with a strike price of $5,000. Both expire at the end of June 2024.

“The desk is observing strength in Ether, with large buyers at the end of June 2024, with Ether call spreads reaching $4,000 to $5,000,” QCP Capital analysts said.

Open interest in Ether options on Deribit shows that it is most concentrated in calls with a strike price of $5,000. Image: Deribit.

The put-call ratio indicates bullish skewness.

Lin added that ether open interest is “65% for calls and 35% for puts.” This is consistent with data from Deribit, which shows a put-call ratio of 0.56 for late-June expiration. A put-to-call option ratio less than 1 means call volume exceeds put volume, indicating bullish sentiment in the market.

“Even with the spot market consolidating, options markets remain optimistic about June and if current trends continue, another bull rally could begin in the near future.” Lin added.

However, The Block’s data dashboard shows put-call rates for Ether options on several derivatives exchanges rising throughout the past week. The increase follows the U.S. Securities and Exchange Commission’s approval, rather than the launch, of a spot Ether exchange-traded fund. This suggests that some traders are considering hedging strategies against the potential downside of a delayed launch of these financial instruments on exchanges. .

Ether Spot ETF It was approved by the U.S. Securities and Exchange Commission (SEC) on Thursday, May 23rd. However, unlike the Bitcoin ETF, which begins trading the day after approval, the Ether ETF may not be active for some time. Weeks or months. According to QCP Capital analysts, a potential breakout in Ethereum price will have to wait until there is more clarity on the S-1 approval.

According to The Block’s pricing page, the price of Ether has risen slightly by 0.22% over the past 24 hours, trading at $3,728 at 5:27 AM ET. The GM 30 Index, which represents the top 30 cryptocurrencies, rose 0.3% to 143.29 during the same period.

Ethereum price rose 0.22% the previous day. Image: Block.

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.