Ethereum Deposits at 4-Month High: Are Whales Ready to Sell?

According to on-chain data, there has been a significant surge in netflow on Ethereum exchanges recently, a sign that could lead to a downtrend in the cryptocurrency price.

Ethereum Exchange Netflow recently registered a massive positive spike.

In a new post on X, market intelligence platform IntoTheBlock discussed the latest trends occurring in Ethereum’s exchange netflow metrics.

“Exchange Netflow” here means an on-chain indicator that tracks the net amount of a specific cryptocurrency entering or leaving a wallet associated with a centralized exchange.

Related Reading

A positive value for this indicator means that investors are currently depositing a net amount of tokens on the platform. Typically, one of the main reasons holders move to exchanges is for sale-related purposes, so this trend can have a negative impact on asset prices.

On the other hand, a negative indicator means that the exchange is currently hemorrhaging supply as outflows outpace inflows. This trend could be a sign that investors are accumulating, which could naturally lead them to be bullish on the coin.

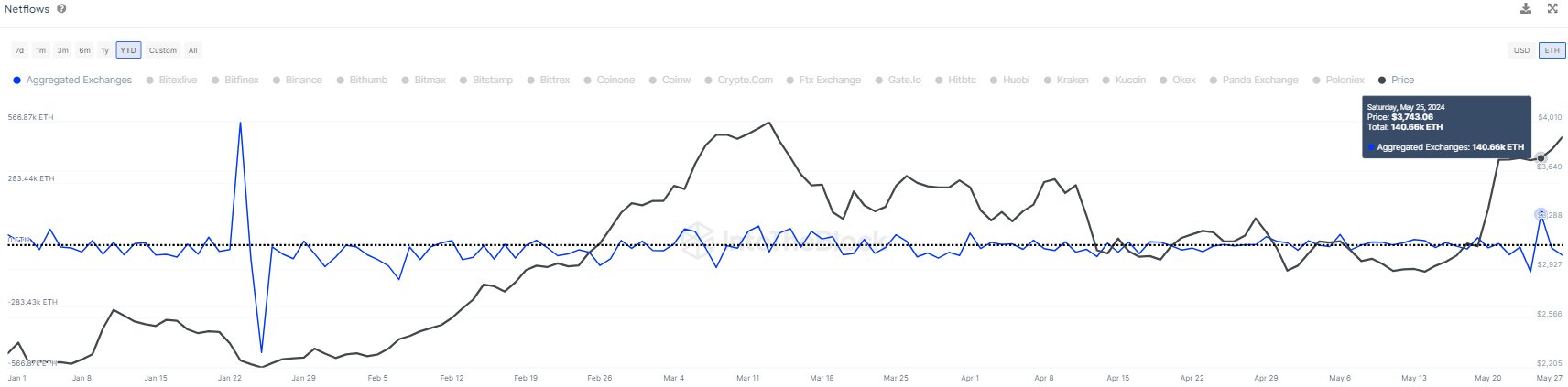

There is now a chart showing the trend of Ethereum exchange netflow since early 2024.

The graph shows that Ethereum exchange netflow has recently recorded a positive spike. At the peak of this surge, the exchange received 140,660 ETH in net deposits.

At the current price of the cryptocurrency, this amount is equivalent to almost $547 million. This is a huge sum and the largest net deposit seen by central agencies since January.

“High inflows to an exchange are usually a sign of selling action as people stake profits or succumb to FUD,” the analytics firm says. But interestingly, asset prices have risen since these deposits came in.

This could suggest that the incoming whales have not yet pulled the trigger on selling those coins, or did not plan to sell them in the first place. Of course, if the whale had actually been sold, market demand might have absorbed the sale.

Ethereum may feel a bearish effect if whales make deposits with the intention of selling but have not yet made any transactions.

Related Reading

Now it is not yet known how the prices of cryptocurrencies will develop in the future and whether these large deposits will play a prominent role.

ETH price

Ethereum had previously been in a downward trend, but the asset has now recovered as the price has once again crossed the $3,900 mark.

Dall-E, featured image from IntoTheBlock.com, chart from TradingView.com