Ethereum (ETH) Aiming for $3,000: Data Suggests Imminent Breakout

Ethereum is in a classic accumulation phase after the recent correction, currently targeting the $3,000 price range. After dropping to $2,116 just 20 days ago, ETH has experienced a significant price surge and recovered to higher levels, suggesting that bullish momentum is building.

Related Materials

This accumulation phase has caught the attention of analysts and investors alike, who are now closely monitoring Ethereum’s price action to look for signs of a larger uptrend. The recovery from recent lows has sparked renewed optimism, with some market experts predicting that ETH could reach $3,000 in the coming days.

This potential rally is a significant milestone in Ethereum’s ongoing market cycle, reflecting investor confidence in Ethereum’s strength and long-term value. As Ethereum continues to accumulate and consolidate, the market is bracing for what could be a major breakout, setting the stage for new all-time highs in the near future.

Ethereum Price Structure Suggests Breakout Is Coming

After a relatively long period of consolidation, Ethereum now looks set to move higher.

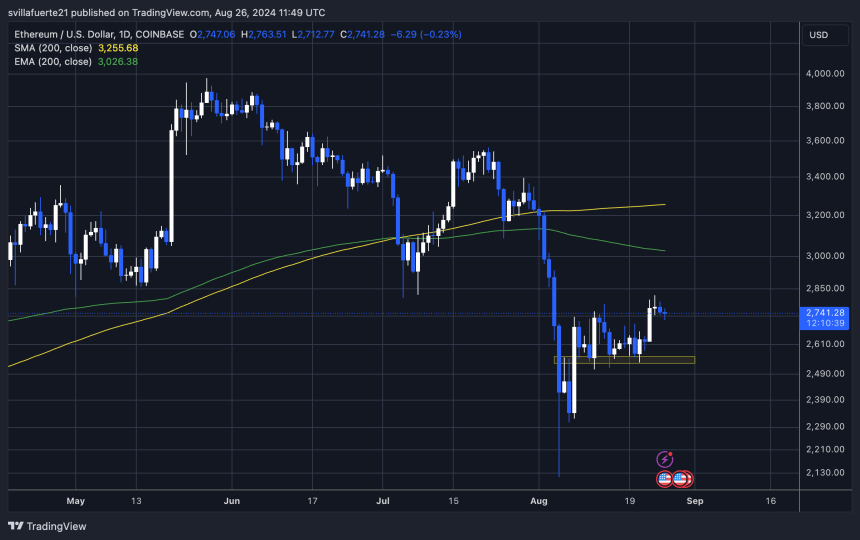

Analyst and Trader Castillo Trader We shared our technical analysis on X, highlighting potential changes in ETH trajectory.According to Castillo, ETH is likely to retest the low demand at $2,611 before targeting the significant $3,000 mark. The 4-hour chart suggests that this consolidation period has reached a turning point and a significant move could be imminent.

The $3,000 level is not only a psychological barrier, but it has also served as a support level in recent months before the breakout earlier this month, making it a significant resistance that is difficult to break. If Ethereum successfully breaks through this level and consolidates, it could pave the way for a sustained uptrend.

Related Materials

This anticipated breakout could start a new bullish phase for Ethereum as the market moves past the recent downturn and toward new highs. Investors and traders are watching this development closely, and the next few days could be crucial in determining the direction of Ethereum.

ETH Technical Analysis

Ethereum is trading at $2,743. The next move could go either way. ETH could retest the lows near $2,500 before pushing towards the $3,000 mark. This retest could help the market build a stronger foundation for a continued uptrend. However, given the recent volatility, it is also possible that Ethereum bypasses the retest and pushes towards $3,000.

Volatility shows that anything can happen, and the sharp price swings are proof of this unpredictability. An important technical level to watch is the daily 200 exponential moving average (EMA), currently at $3,026. This EMA acts as a resistance point, and a break above it strongly suggests continued strength for Ethereum.

Related Materials

If Ethereum breaks the psychological level of $3,000 and closes above the 200 EMA, the bullish move will be confirmed. This will solidify the bullish sentiment among traders and investors and position Ethereum for a longer rally.

Featured image made with Dall-E, charts from Tradingview.com