Ethereum (ETH) is struggling to break above $2,600. What is causing ETH to fall?

This article is also available in Spanish.

Ethereum (ETH) has been trading between $2,300 and $2,800 on a daily basis since early August. Over the past three days, the price has struggled to break above $2,600, raising concerns among analysts and investors.

Related Materials

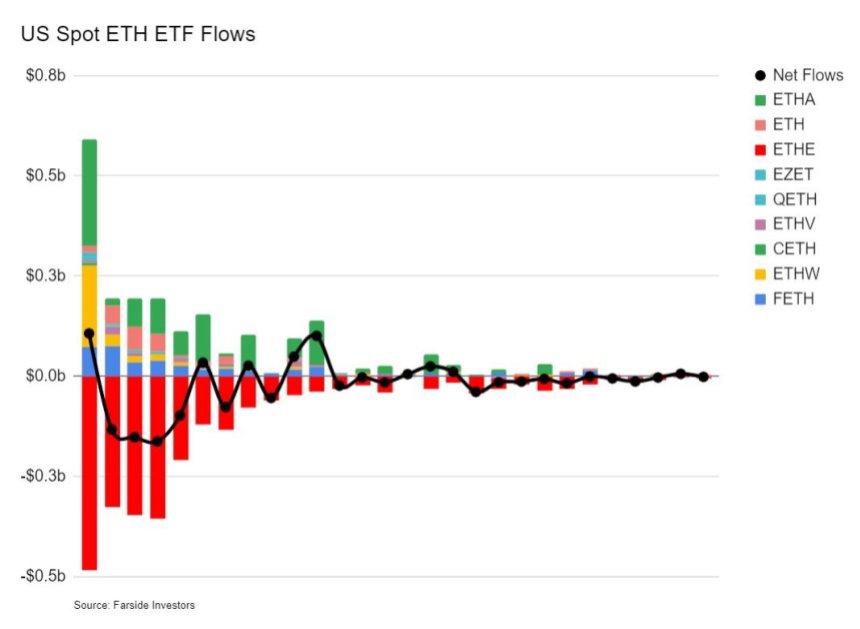

This performance has been disappointing, especially when compared to Bitcoin’s strong performance this year. Key data from Farside Investors shows that interest in Ethereum ETFs is declining, adding to the cautious sentiment surrounding ETH. This decline in interest could indicate broader concerns about Ethereum’s future performance.

With ETH facing resistance at the $2,600 level, the market is still uncertain whether ETH can break higher. The next few days will be crucial to determine whether Ethereum can regain momentum or continue to lag behind in other price ranges. The market is watching this trend closely, and this could be a crucial moment for ETH.

Disappointing performance of Ethereum ETFs

The launch of the Ethereum ETF was highly anticipated, but quickly became a “news sell” event. According to data from Farside Investors, the Ethereum ETF has underperformed since its launch. Both inflows and outflows have been virtually zero, showing a lack of sustained investor interest. This response is in stark contrast to the enthusiasm before the launch.

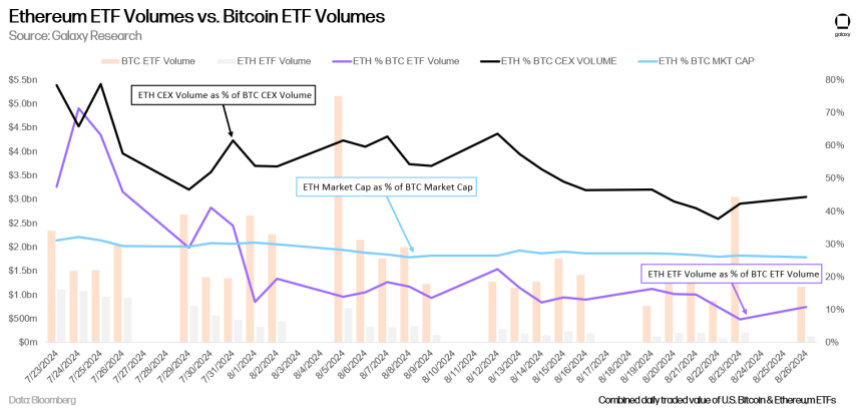

Furthermore, Bloomberg data shared by Galaxy Research highlights that Ethereum ETFs are trading at significantly lower volumes than Bitcoin ETFs. This discrepancy is especially noticeable when considering the ETH/BTC volume and market cap ratio on centralized exchanges (CEXs). Despite Ethereum’s strong market presence, these ETFs are not attracting as much investor attention as their Bitcoin counterparts.

Current data suggests that investors are either favoring Bitcoin in the prevailing market conditions or even looking to alternatives like Solana over Ethereum. The lack of enthusiasm for an Ethereum ETF underscores the broader market sentiment that Bitcoin continues to dominate while Ethereum and its financial products lag behind. This development raises questions about the future appeal of an Ethereum ETF and whether it will gain traction in an increasingly competitive market.

Related Materials

ETH Price Activity

Ethereum (ETH) is currently trading at $2,522, reflecting a period of uncertainty as it has been below $2,600 since last Tuesday. This range is important because $2,600 has been a strong support level for most of August. The fact that it has now turned into resistance suggests that ETH could face further downside in the short term.

A break above the $2,600 resistance is crucial for the bulls to regain control and push the price higher. If this level is broken, the next target will be the local high of $2,820, signaling a potential bullish reversal. However, if Ethereum fails to reclaim the $2,600 level, the current downtrend could continue, with the next major support level being $2,310.

Related Materials

This battle between support and resistance shows how important the $2,600 level is in determining Ethereum’s short-term price direction.

Cover image is from Dall-E, charts are from Tradingview.