Ethereum has been experiencing increasing inflation for over a month as fees hit record lows.

Ethereum has become a deflationary asset since switching from proof-of-work to proof-of-stake in 2022. The total circulating supply of Ethereum (ETH) is currently 120,105,358 ETH, which is 415,680 ETH lower than the supply level observed prior to The Merge..

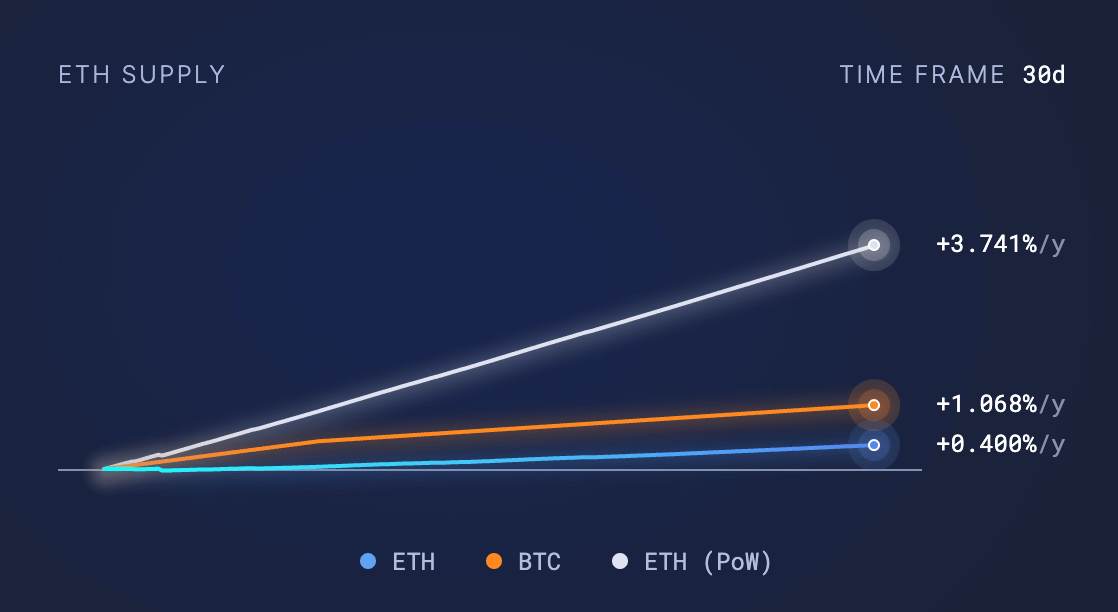

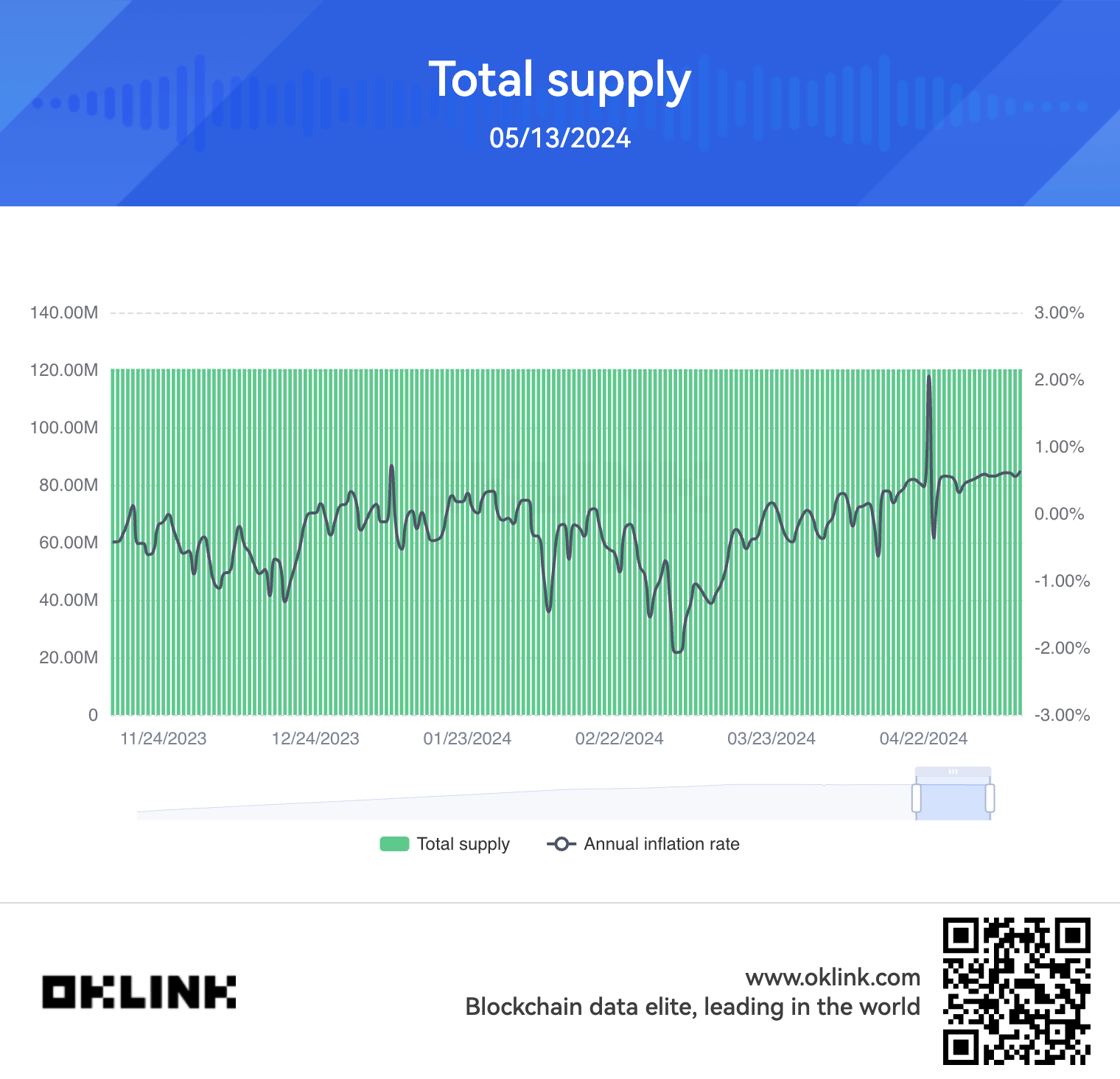

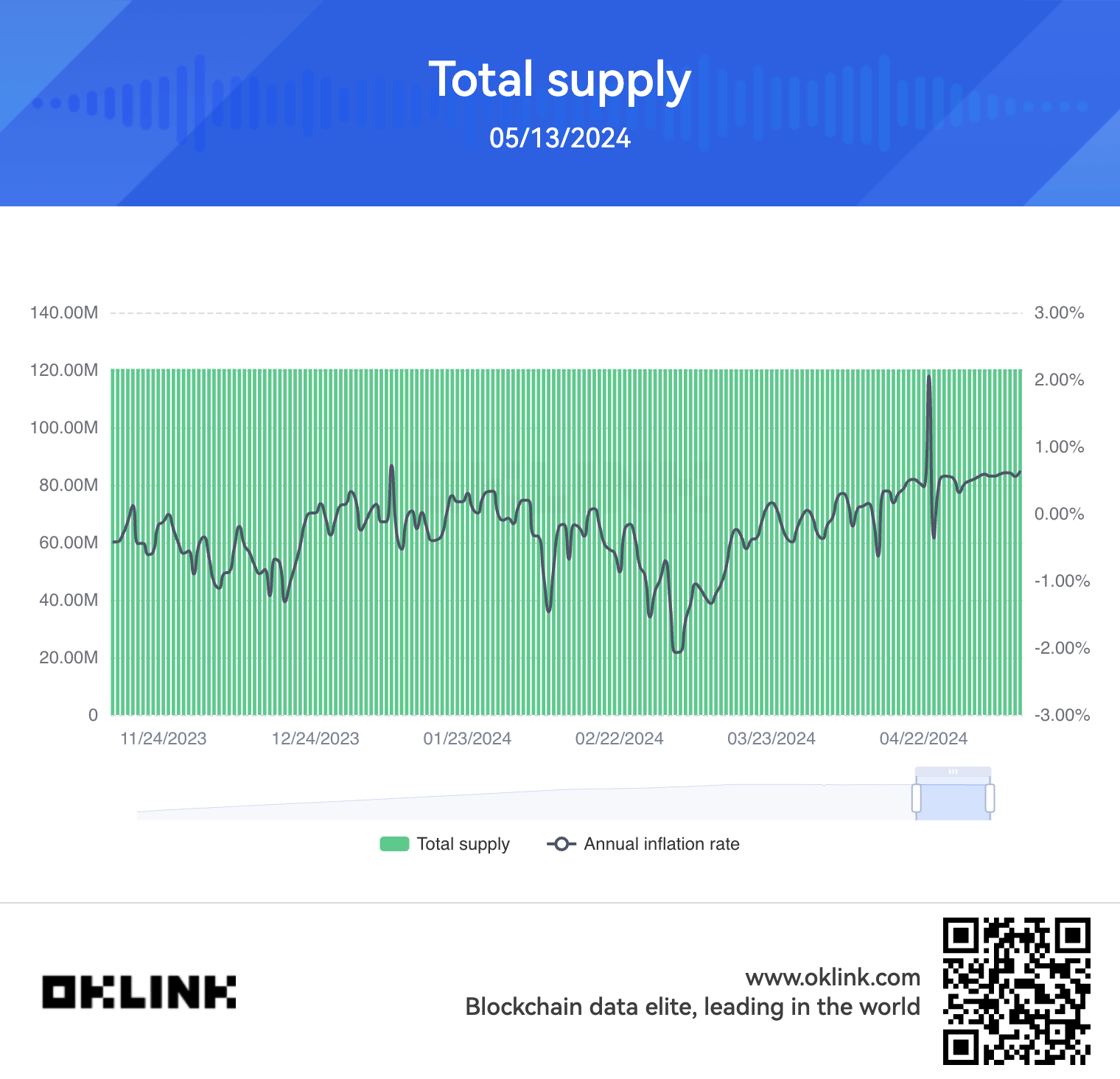

However, over the past 30 days, Ethereum’s supply dynamics have changed, with 35,548.72 ETH being burned (removed from circulation) and 75,072.43 ETH being issued to validators as block rewards. The net result is an increase in supply of 39,523.71 ETH over this period. Based on supply changes over the last 30 days, Ethereum’s current annual inflation rate is around 0.4%, according to data from Ultrasound Money.

In comparison, Bitcoin’s inflation rate was 1.068%, while Ethereum’s proof-of-work (pre-merge) inflation rate was significantly higher at 3.74%. If the current 30-day interest rate continues, next year’s forecast predicts that approximately 433,000 ETH will be burned and 914,000 ETH minted, generating a net profit of 481,000 ETH.

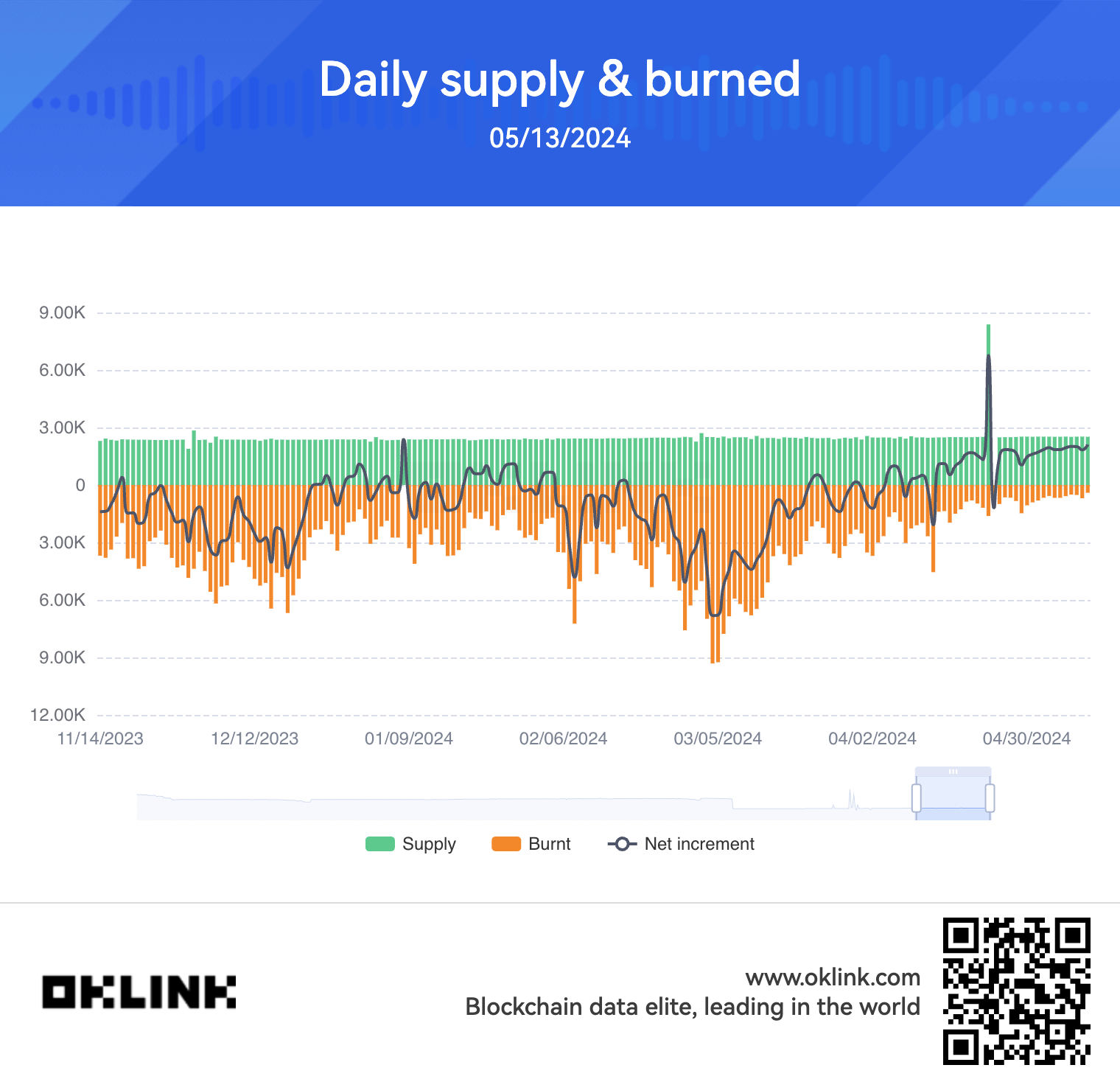

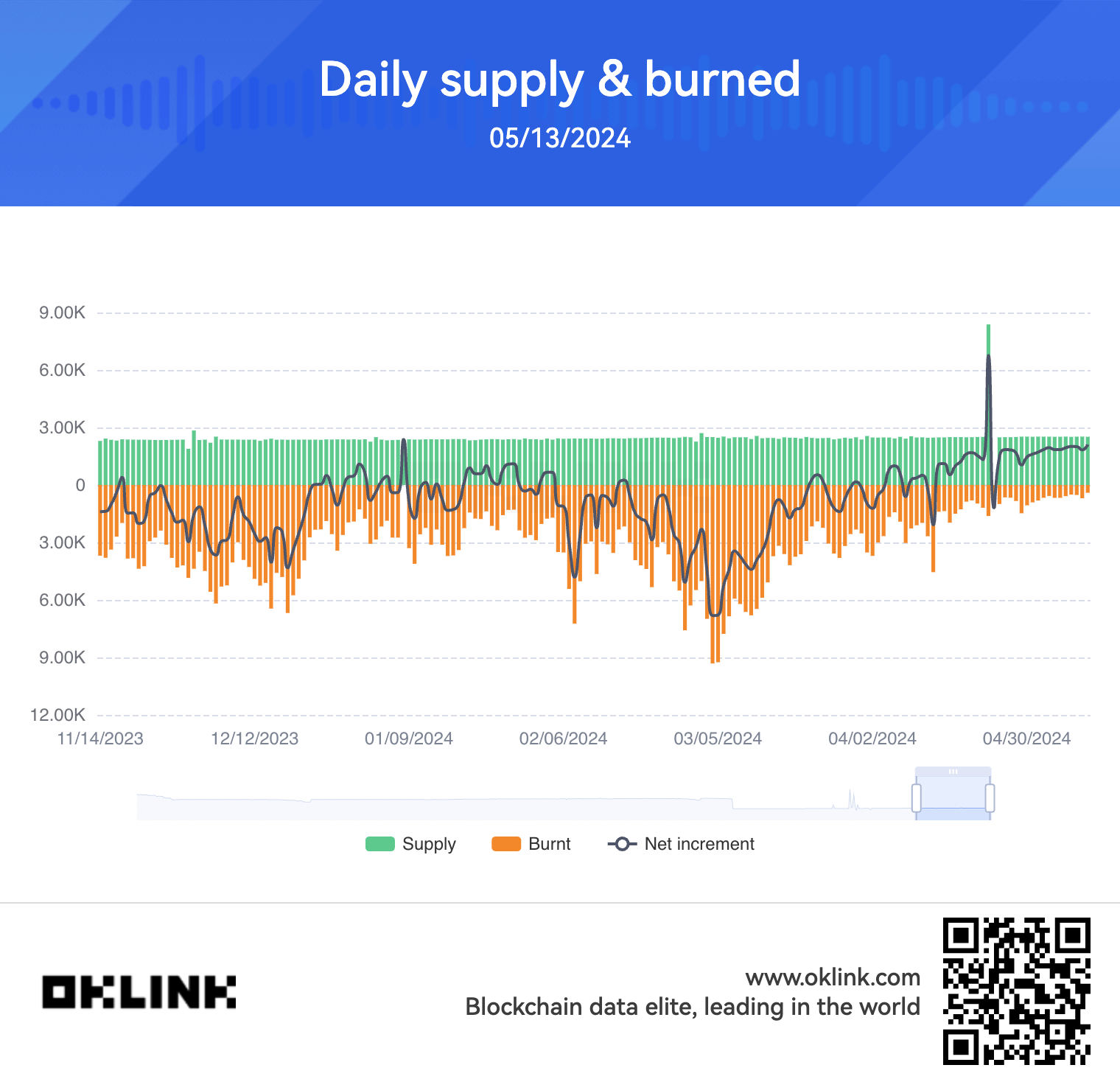

Data from OKLink shows a steady decline in ETH burned since March, when an average of about 6,000 ETH was burned each day. Since early May, only about 900 ETH has been burned each day, the lowest average since The Merge.

The recent Dencun upgrade of the Ethereum network has had a notable impact on the ecosystem. The upgrade reduced Layer 2 transaction fees and overall network activity. In turn, this appears to lower burn rates and push Ethereum supply back to an inflationary state.

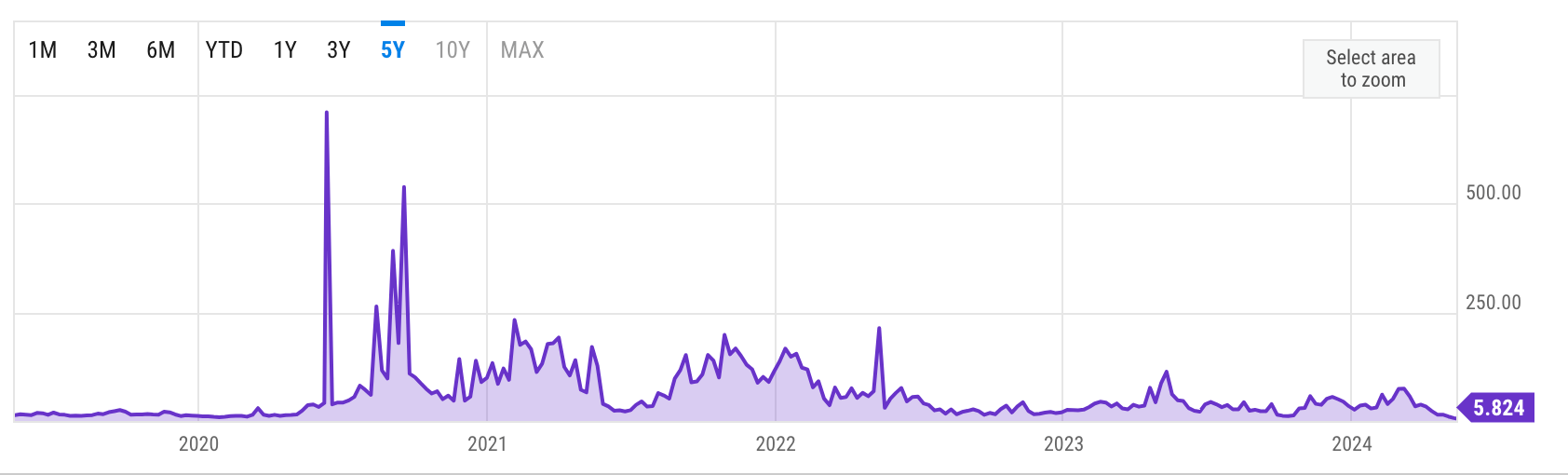

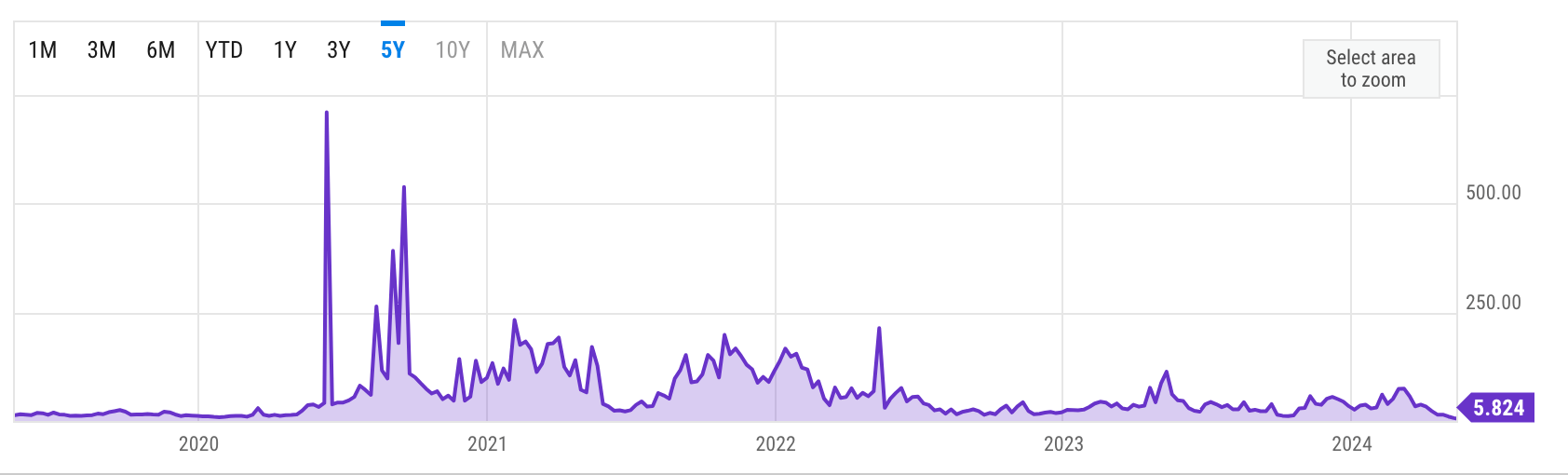

Gas prices also fell to around 5gwei, the lowest on record, according to data from Etherscan and Ycharts.

Interestingly, Ethereum’s inflation rate has moved closer to Bitcoin’s, especially since the Bitcoin halving last month. According to data over the past seven days, Ethereum’s inflation rate last week was 0.54%, just 0.29 percentage points higher than Bitcoin’s post-halving inflation rate of 0.83%.

Ethereum’s inflation rate has been steadily increasing since February, when it reached a regional low of -2%.

Ethereum’s supply has experienced some short-term inflation due to reduced network activity and lower burn rates, but overall supply is still decreasing on a net basis. This may be due to EIP-1559, which introduced a burn mechanism for a portion of transaction fees.

Going forward, Ethereum’s inflation rate and supply dynamics will likely be influenced by future network upgrades and adoption trends. If transaction fees and burn rates remain low, Ethereum may continue to experience inflationary pressures in the near term. However, its long-term trajectory will depend on the success of the upcoming upgrades and the overall growth of the Ethereum ecosystem.

The adoption of layer 2 networks and the recent increase in layer 3 network activity will reduce the load on the Ethereum mainnet, but this comes at a cost. However, the current increase in L2 and L3 activity is not enough to generate enough L1 transactions to keep Ethereum deflationary. Only time will tell whether Ethereum’s ultra-sound monetary concept will hold up in a world dominated by L2 and L3.