Ethereum Outperforms Bitcoin After ETF Launch As ETH/BTC Ratio Soars.

The launch of a spot Bitcoin ETF in the US has put Bitcoin in the spotlight, but focusing solely on price movements can lead to an overly simplistic and shallow representation of the market. It is important to analyze Bitcoin in the context of both cryptocurrencies and traditional assets.

The relationship between Bitcoin and Ethereum has always been meaningful. The interaction between the two largest cryptocurrencies often reveals subtle market trends that are not clearly visible in price action.

The ETH/BTC ratio displays the value of 1 Ethereum relative to Bitcoin, indicating the relationship between the two. An increase in the ratio suggests Ethereum’s increasing dominance or Bitcoin’s relative weakness, while a decrease indicates Ethereum’s underperformance against Bitcoin.

Prior CryptoSlate Our analysis shows that despite short-term spikes and falls in rates, overall volatility, as measured by the standard deviation of past closing prices, has always been relatively flat. This means that over the long term, BTC and ETH typically mirror each other’s movements and experience parallel market trends. However, this does not mean that short-term volatility in rates should be ignored.

If both are experiencing similar bullish or bearish trends, their ratios will remain balanced, further highlighting the importance of short-term discrepancies in their movements.

Since October 2022, ETH/BTC has been in a downward trend. This is likely due to a market correction following the high expectations set by the Merge. Additionally, Ethereum’s price fluctuations are not as pronounced as those of Bitcoin, showing a decrease in its relative value as seen through ratios.

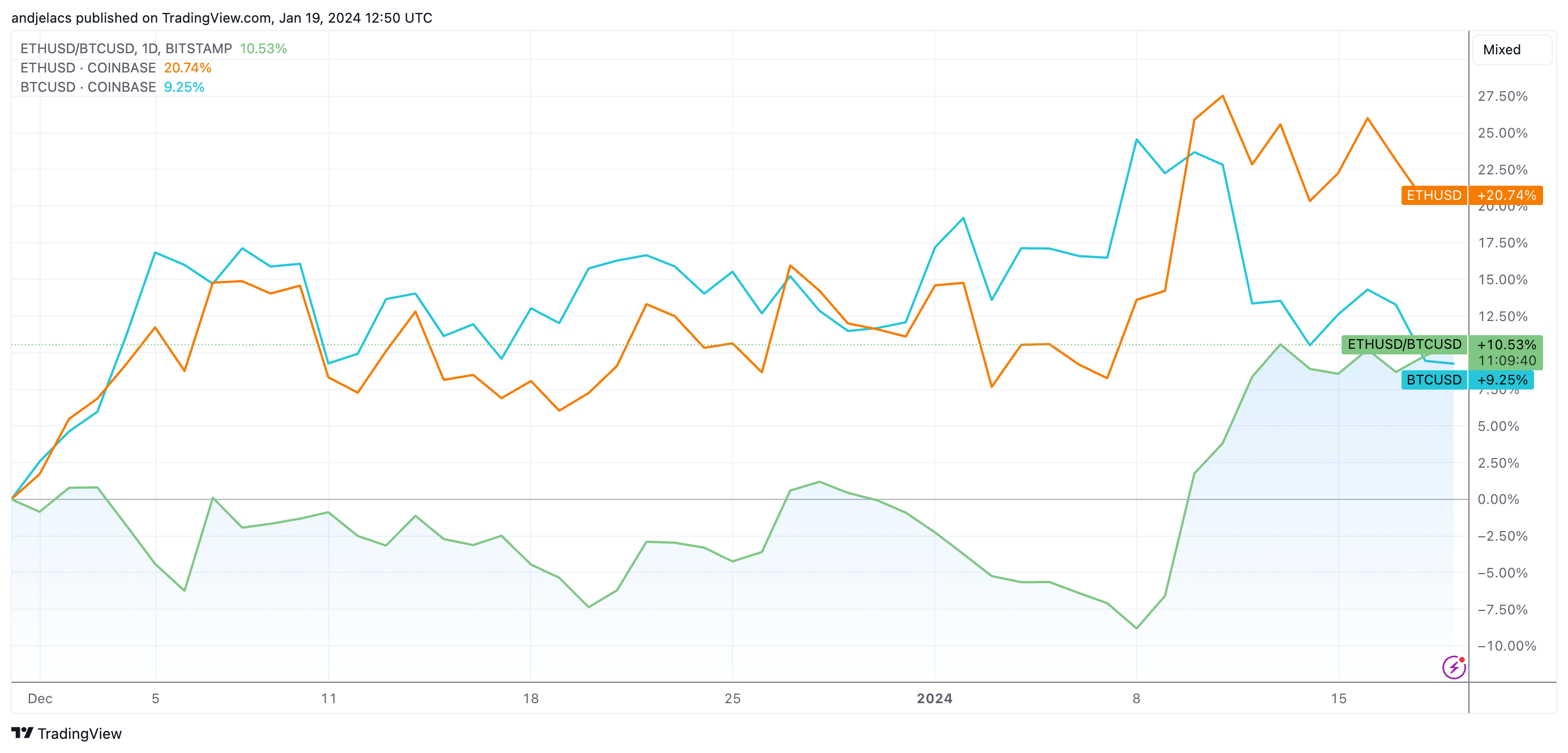

from CryptoSlate Reporting on the ratios revealed a quick and noticeable trend reversal. From November 30, 2023 to January 19, 2024, the ETH/BTC ratio increased by 10.53%. During this period, the price of ETH in USD terms rose 20.74% and BTC rose 9.25%. Ethereum trading volume increased by 4.59% and Bitcoin by 27.23%.

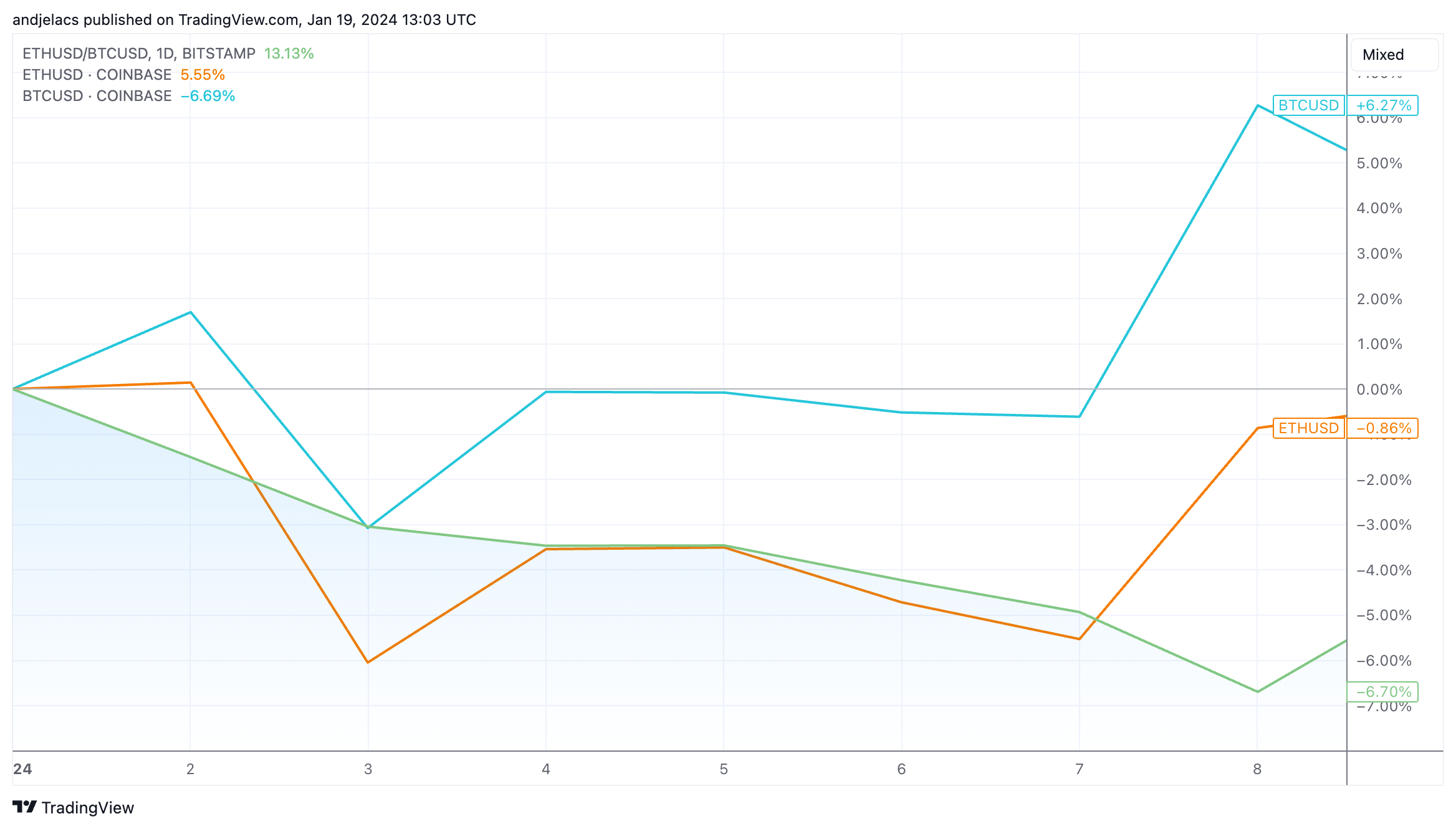

Positive price momentum and volume growth continued into 2024. The new year began with markets eagerly awaiting approval of a U.S. cash ETF, which created tension and pushed prices higher. The ETH/BTC ratio decreased significantly between January 1 and January 8, with the ratio falling 6.70% due to the Bitcoin price increase.

However, with ETF approval imminent on January 8, the market has begun a correction from the tensions that had driven Bitcoin prices higher. The price of Ethereum rebounded, and Bitcoin showed a noticeable decline.

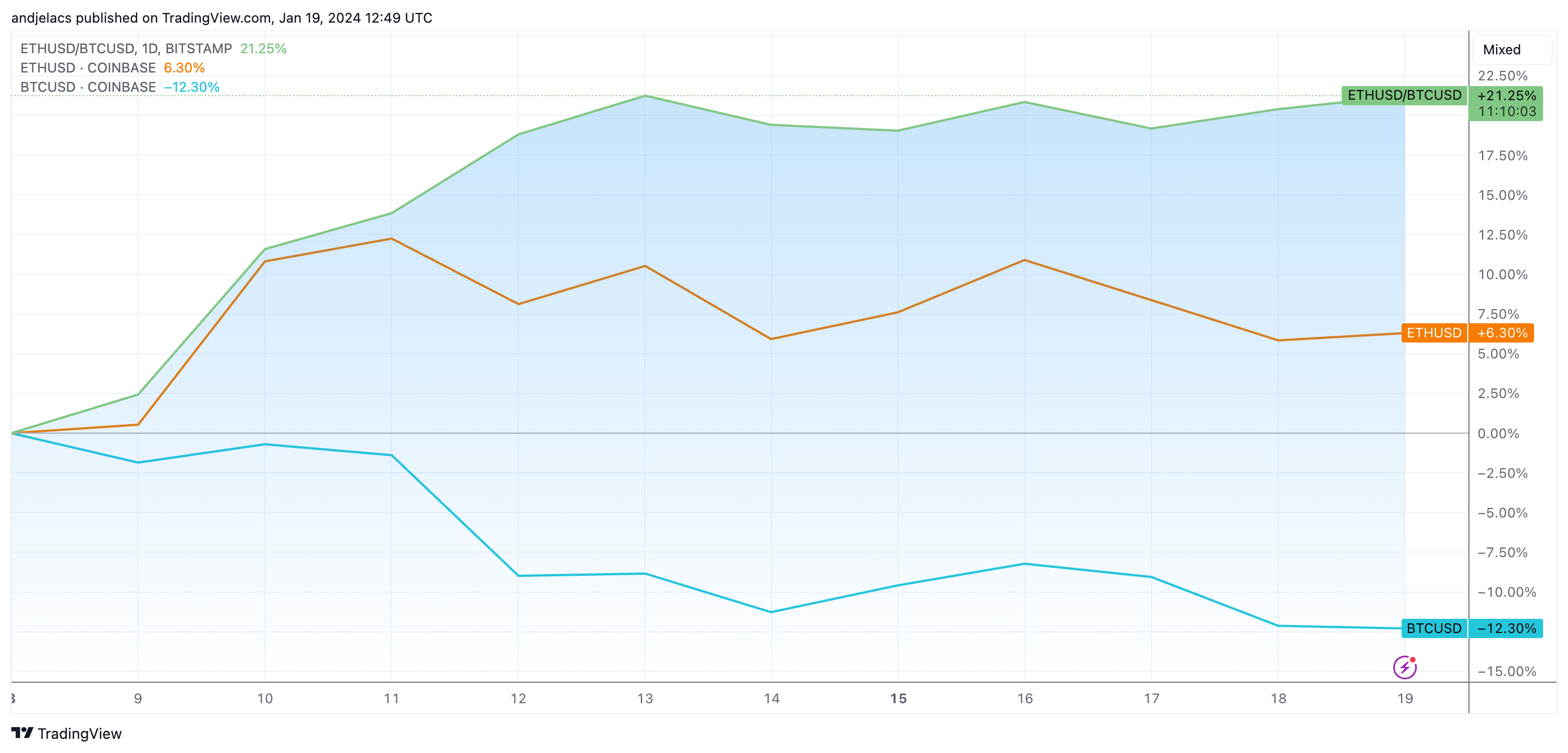

From January 8 to January 19, the price of Bitcoin fell 12.30% as the ETF launch failed to provide the rally the market expected. Looking at the 6.30% rise in the price of ETH, it appears that at least some of the capital from Bitcoin has moved to Ethereum. This discrepancy in price increases caused the ETH/BTC ratio to increase by 21.25%.

This difference in price trajectory suggests increased trading volume for Ethereum, as it typically follows price increases from buying and selling activity on exchanges. However, during this period, Ethereum trading volume decreased by 4.15%. On the other hand, Bitcoin trading volume increased by about 34%.

This suggests that the Bitcoin price decline cannot be attributed solely to declining market interest. Institutional movements triggered by ETF approval and the resulting surge in ETF inflows and trading volume are likely to have caused the increase in trading volume. At the same time, prices fell due to retail sales.

The lack of structured Ethereum-based trading products means that the recent ETH surge potentially originated from retail activity. Conversely, Bitcoin’s market reaction appears to be driven more by institutional movements, showing the impact of spot ETFs on both cryptocurrency markets and traditional financial markets.

The post Ethereum Outperforms Bitcoin After ETF Launch As ETH/BTC Ratio Soars appeared first on CryptoSlate