Ethereum Price Prediction: Bitwise Sees Surge to $10,000, ETH Closes at $4,000, Experts Say This Bitcoin Derivative Could Be the Best Cryptocurrency to Buy Right Now.

join us telegram A channel to stay up to date on breaking news coverage

Ethereum prices are trading up 4% at $3,936 as of 4:50 a.m. ET on volume down 23%.

This comes amid growing uncertainty in the cryptocurrency market and with the price of Bitcoin still within a range below the psychological level of $69,000.

Despite this, the price of Ethereum is steadily rising towards $4,000, a level last seen in January 2022.

Meanwhile, a Bitwise analyst said that while Bitcoin is a major topic of discussion that has “captivated all the attention” recently, Ethereum could more than double its current price this year.

ether $ETH “Mostly overshadowed” by Bitcoin $BTC However, the laggard’s price could more than double by 2024, according to Bitwise analysts.

This month’s mid-March Dencun upgrade will make transactions cheaper on layer 2 networks. pic.twitter.com/4P85InbtcH

— DefiDive (@defi_dive) March 8, 2024

Juan Leon, a cryptocurrency research analyst at asset management firm Bitwise, told CoinDesk that the price of Ethereum could rise above $10,000 this year.

“Bitcoin got all the attention with the launch of the Bitcoin ETF, but (ETH) has at least two key catalysts to focus on,” the analyst added.

Why Bitwise Analysts Are Bullish About Ethereum Price

Bitwise analysts attribute their optimism to two bullish fundamentals for the Ethereum network.

-

Denkun Upgrade

Ethereum Core developers said the Dencun upgrade was successfully deployed to the Holesky Testnet early January 31st. With a smooth release, the upgrade is ready for mainnet release and could arrive as early as March 2024.

In a series of posts on social media platform

Deneb’s holski confirmed 😀

The churn limits look good so far and blobs are flowing smoothly!

Next stop is mainnet! https://t.co/MiEsJfHvFz

— Paritosh | 🐼👉👈🐼 (@parithosh_j) February 7, 2024

Looking back, the testnet launch wasn’t an eventful event. This is a result of increased confidence among Ether token holders. Terrence, another key developer, said node participation has decreased by about 5%. He attributed this to node operators being offline. The developer also emphasized that no bugs have been reported.

Holesky was confirmed for Deneb. Another upgrade success!!

Participation has decreased by about 5%, most likely due to node operators being offline. I haven’t seen any bugs reported yet. https://t.co/qlrZFedAnN

— terence.eth (@terencechain) February 7, 2024

For the general public, the Dencun upgrade is expected to make transactions cheaper on Layer 2 (L2) networks. These results will boost network activity while also attracting mainstream, mass consumer demand for Ethereum, Leon said.

Nonetheless, Bitwise analysts acknowledged that “most of the positive sentiment will come weeks and months after the upgrade as the effects of the upgrade take effect.”

-

ETH ETF

Meanwhile, there remains speculation that an Ethereum exchange-traded fund (ETF) will soon hit the market. This assumption comes after the spot BTC ETF was approved in a landmark decision on January 10th.

It’s unclear whether the ETH ETF will follow suit, but considering the odds are lower than BTC alternatives, Bitwise’s Leon said the mere possibility is a source of excitement for community members. This gives analysts a 50%-60% chance of approval.

The possibility of approval would increase Ethereum’s appeal among more conservative institutional investors like BTC.

Other fundamentals that could bode well for the Ethereum price include ETH’s deflationary supply, re-staking offerings, and improved decentralized finance (DeFi) activity.

Ethereum Price Outlook As Bitwise Analyst Speculates More Profits for ETH

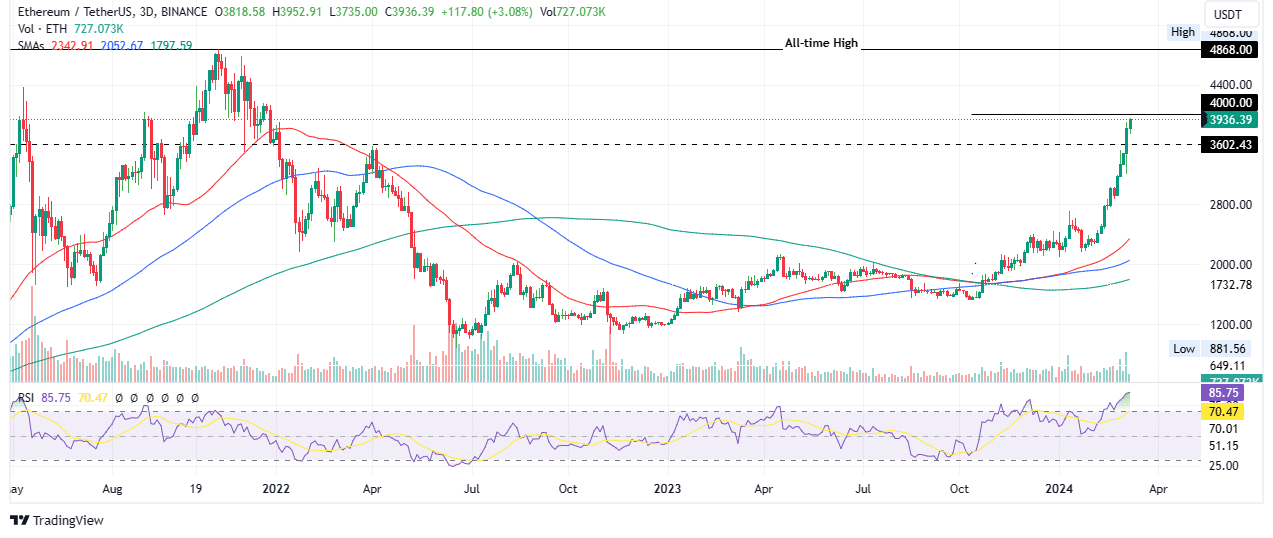

Ethereum price is approaching the psychological level of $4,000, and given that momentum is rising quickly, it could come soon. This can be seen as a rising RSI (Relative Strength Index) and is highlighted by the growing bars on the volume indicator. The latter suggests a bullish trend that is only getting stronger.

If Ethereum price closes the candlestick above $4,000, it would pave the way for Ethereum to regain its all-time high of $4,868. Such a move would be 23% above current levels. In a very optimistic case, the price of Ethereum could surpass its all-time high and break the psychological level of $5,000.

TradingView: ETH/USDT 3-day chart

On the other hand, profit booking can hinder a rally and lower the price of Ethereum. This means that ETH could offer another buying opportunity around the $3,602 threshold before the next step up.

Meanwhile, many investors are looking at GBTC, a BTC derivative that many experts say may be the best cryptocurrency to buy right now.

A promising alternative to Ethereum

After raising approximately $2.5 million from investors attracted by the ongoing Bitcoin bull market, GBTC is growing well. This is the ticker of the Green Bitcoin Ecosystem, a project of revenue forecasting built on top of Ethereum infrastructure using the ERC-20 token standard.

$2 million raised!

We are very excited to have you all join us in this green revolution.

We’re building something huge! pic.twitter.com/RDOvEyCyGW

— GreenBitcoin (@GreenBTCtoken) March 6, 2024

GBTC is a gamified staking platform where participants receive rewards for predicting the price of Bitcoin. It combines staking and gamified predictions to reward GBTC holders, with up to 100% token bonuses for challenges delivered live each week. There are daily and weekly BTC price prediction challenges that offer attractive rewards.

Introducing Green Bitcoin: A revolutionary yield prediction token.

Join the Gamified Green Stake platform where your predictions can turn into profits!

Website: https://t.co/dG5cEeCtRs

Telegram: https://t.co/bWanoe0vHv pic.twitter.com/eXuGQBkxio— GreenBitcoin (@GreenBTCtoken) December 3, 2023

The project also presents a sustainable staking model called ‘Gamified Green Stake’, which allows users to earn passive income through staking rewards. The initiative adopts a sustainable approach to attract environmentally conscious investors and ESG-focused institutions.

Adopting the Ethereum network’s energy-efficient proof-of-stake mechanism, the project reduces energy consumption by 10,000 times compared to Bitcoin’s proof-of-work model.

Green Bitcoin has already raised $2.47 million of its $2.535 million target. The token is selling for $0.6882 and the price increase will occur within 4 days.

Visit GBTC here to purchase.

Also read:

Green Bitcoin – Gamified Green Staking

- Coinsult’s contract audit

- Early Access Presale Now Live – greenbitcoin.xyz

- Profit Forecast – Cointelegraph Feature

- Staking Rewards and Token Bonuses

- Over $1 million raised

join us telegram A channel to stay up to date on breaking news coverage