Ethereum Rises Above $3,700 as Big Whale Accumulates: $4,900 incoming?

At spot prices, Ethereum has been inching lower and recently retested immediate support at $3,700. Although the coin is still hovering around this level, optimism is high that it will surge higher in the coming days.

Ethereum whales are now accumulating

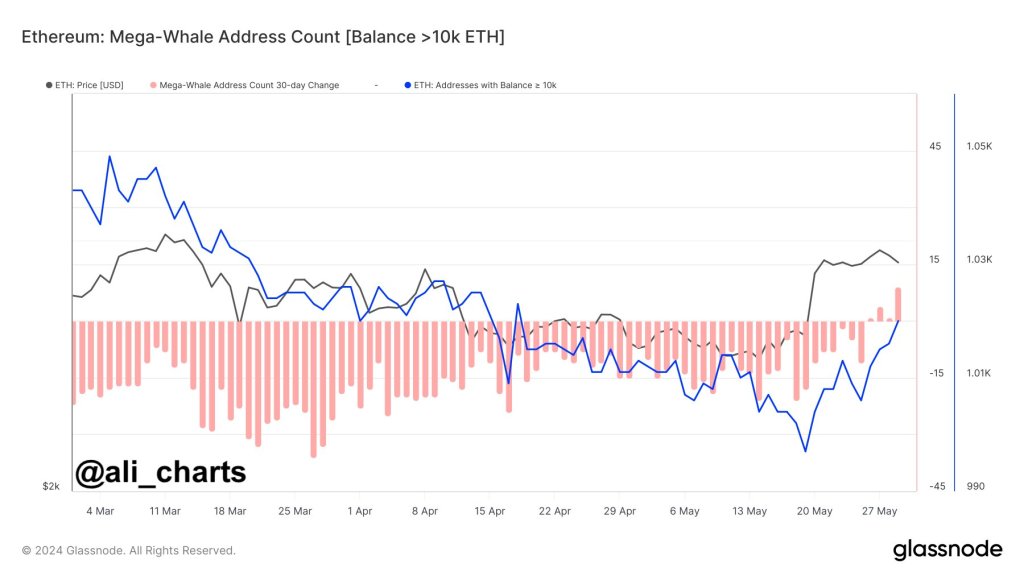

One analyst cited on-chain events to solidify this outlook: note An optimistic story may unfold. Noting the sharp increase in Ethereum addresses controlling more than 10,000 ETH, the analyst is confident that investors have now completed their distribution and are anticipating further price gains without accumulation.

According to cited Glassnode data, the number of addresses controlling more than 10,000 ETH has been on the rise since May 20th. especiallyTodayprice shooting stronglyIt broke through $3,300 and $3,700.

Related Reading

The bullish trend may explain why whales are currently accumulating and are not choosing to liquidate, and why they have accepted to exit their positions following the recent correction of $3,900.

At the time of writing, ETH is trading at around $3,700, up almost 20% from its May 2024 low. On the daily chart, the coin is still within a bullish breakout formation after clearing two important resistance levels (current support) at $3,300 and $3,700.

So, despite the retracement at $3,900, the uptrend remains intact. Reading the candlestick arrangement on the daily chart, the coin is likely to fall above $4,100 as buyers eye $4,900 or 2021 highs.

These whales are institutions, and most of them are optimistic about what lies ahead and are positioned to stay one step ahead. The rapid increase in the number of whales means institutions are becoming increasingly confident in the vast Ethereum ecosystem.

Hope for continued development and spot ETH ETF

One reason for this positive outlook is continued development. In ~ Ethereum network. Following the successful activation of Dencun last March, platform developers are now focusing on the upcoming Pectra upgrade.

This hard fork is expected To further strengthen the network, making transaction processing more efficient and cost-effective. This continuous development Positioning The network as the preferred host for decentralized finance (DeFi) and meme coin activities.

Related Reading

In addition to platform-related factors, the U.S. Securities and Exchange Commission (SEC) recently approved the listing of an all-spot Ethereum exchange-traded fund (ETF).

The institution has not yet clarified its position on the status of ETH. However, this will change with the approval of all S-1 registration forms for spot ETFs. Analysts believe that if these forms were approved, the second most valuable coin would have gained much-needed clarity.

Featured image by DALLE, chart by TradingView