Ethereum whales raised $230 million in ETH in one week.

In the past week, some of the biggest Ethereum whales holding between 1 and 10 million ETH have amassed an impressive 100,000 ETH, worth a whopping $230 million.

This aggressive buying stance from influential investors highlights their unwavering belief in Ethereum’s long-term potential despite recent price corrections.

Despite recent price declines, recent signs of Ethereum whale activity suggest continued confidence in the continuation of the bull market.

Wealthy traders amass millions with Ethereum

Following a promising start to early December 2023, various cryptocurrency assets, especially Ethereum, have shown strength.

Crypto whales have reportedly gobbled up hundreds of millions of dollars worth of Ether, a major altcoin, over the past seven days, according to a respected expert.

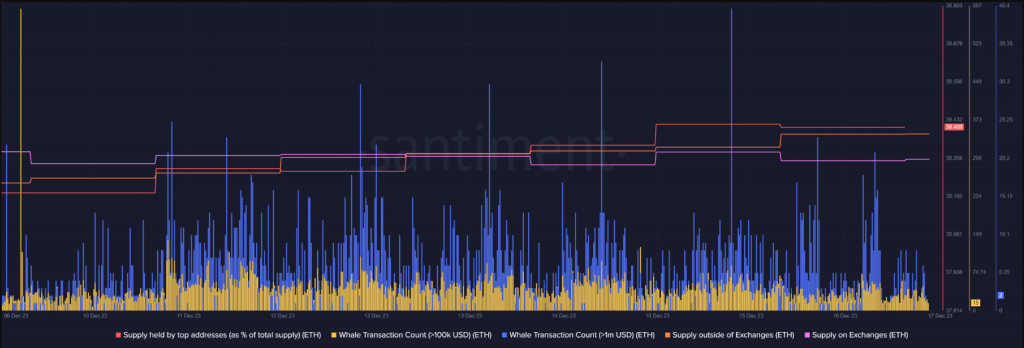

some of the biggest #Ethereum The whales were a hit, with more than 100,000 caught. $ETH Last week alone – it reached a whopping $230 million! pic.twitter.com/jWHY6MXDgs

— Ali (@ali_charts) December 16, 2023

On social networking site

Price increases are usually caused by excessive buying demand from wealthy investors, and recent whale accumulations indicate this to be the case.

On December 7, Santiment Feed linked a whale accumulation pattern to a surge in ETH, which broke the $2,350 price range to a 19-month high.

In general, whale activity affects cryptocurrency asset prices. The recent activity of ETH whales indicates that a price rally is coming.

Ethereum currently trading at $2,235 on the daily chart: TradingView.com

There is a lot of buying pressure in the market right now, but caution is needed as the bottom has not yet been reached.

RSI and stochastic neutrality, Ethereum uncertainty

According to data from CryptoQyant, both the Relative Strength Index (RSI) and Stochastic are currently in the neutral zone. Despite the buying activity, there is still uncertainty about the true bottom of the market.

We looked at the liquidation heatmap to estimate the likely support levels for Ethereum. Analysis shows an increase in liquidations in the $2,140 to $2,170 range.

This means that the Ethereum price is likely to fall below this level before starting the next bullish bounce. However, for an upside to occur, Ethereum would have to overcome significant resistance levels near $2,380.

Source: Santiment

Ethereum’s short-term price movements are difficult to predict due to the complex interaction of market indicators and clearing data.

Meanwhile, analysis of the ETH daily price chart shows that the $2,148 price appears to be a near-term support level for the asset. Bulls will be hoping that this level holds to increase the chances of another rally before the end of 2023.

A breakout below may indicate the formation of a more complex bullish continuation chart pattern, similar to a bullish flag. In the shorter term, this pattern could resemble a descending channel and dampen expectations of another big rally in 2023.

The value of Ethereum and other cryptocurrencies is sensitive to a variety of external variables, including general macroeconomic sentiment. Ethereum is already up 81% year-to-date at current prices.

Featured image from Shutterstock

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.