Ethereum’s Dencun Upgrade: An Investment Opportunity

The latest Ethereum upgrade (codenamed Dencun) was successful.

That in itself is a cause for celebration. Ethereum software is large and complex, and the fact that developers continue to release new code with minimal downtime and drama is a significant technological victory.

If you try to understand what Dencun actually does, you’ll end up down a rabbit hole of confusing technical terms like “Proto-Danksharding” and “data blob.” It sounds like something escaped from a cyberpunk novel.

As always, I’ll keep it simple.

Ethereum Dencun Upgrade Will Help You Lower transaction fee costs on Ethereum. – Especially in layer 2. (Read our investment guide on L2 here.)

this is Good for Ethereum investorsbut Not so great for L2 investors.. Here’s why:

Suitable for ETH investors

If you are invested in ETH (like me), this latest upgrade is part of Ethereum’s long-term roadmap.

Ethereum as an investor have It’s a long-term roadmap, and it’s even more encouraging that we’re executing against it.

When I think about Warren Buffett’s recommendation to find “a great company run by competent managers,” I think Ethereum is the epitome of that kind of “company,” but in the cryptocurrency space.

However, Ethereum is not perfect. One of the biggest failures is the ridiculously high transaction fees.

Cryptocurrencies were supposed to free us from fees, but it’s clear that will never happen. In fact, you might pay $2 to withdraw cash from an ATM, but you might pay $3 to make an Ethereum transaction. Or you can pay $30. The more clogged the network, the higher the fees.

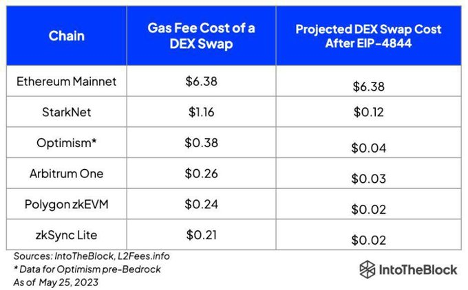

Layer 2 solutions such as Arbitrum (ARB) and Optimism (OP) have created technologies that make trading on Ethereum more affordable. This has made these L2 solutions so popular that their token prices have skyrocketed.

Since the Dencun upgrade lowers the transaction price of these L2s, the net effect is positive for Ethereum. That means more people can make it more deals In Ethereum, cheaper:

This means we more applications and More use cases This is because Ethereum has low fees. More games. More NFTs. There are more RWAs (real world assets) on chain.

Everything that makes Ethereum more accessible and more user friendly This is a good thing for ETH investors. This solidifies Ethereum’s lead as a native layer 1 blockchain.

Take Solana (SOL) as an example, another blockchain that competes primarily on low fees. If Ethereum finds a way to lower fees, Why new developers are choosing Solana over Ethereum?

If Ethereum had the most developers, the most dApps, the largest community, and the best team, and Why would people go somewhere else if the fees are low?

Anything that enhances the Ethereum experience is not only good for Ethereum, it is also good for long-term ETH investors. Dencun increases Ethereum’s already enormous advantage over other L1 blockchains.

Not so good for layer 2 investors

Think of L2 like a gas station.

All gas stations sell the same product: gas. So we find out who is selling it the cheapest. Some gas stations have larger convenience stores or are a little closer to my house so I may pay a few cents extra, but generally We want the cheapest gasoline.

Layer-2 is the gas station because they all offer similar products. (We also call Ethereum transaction fees “gas”.)

Because the Dencun upgrade lowers gas prices across L2 Make gas stations more importantbut it is Does not provide benefits to specific gas stations.

This is like the price of crude oil falling, making gasoline cheaper for everyone.

This is why I haven’t invested in any L2 so far. I don’t know why anyone would choose Arbitrum over Optimism for Ethereum trading.

In fact, we can see a future where user-friendly applications simply route Ethereum transactions over L2, which currently offers the lowest gas prices. This is invisible to the user. I don’t even know which L2 you are using.

memo: this could change.

L2 may find ways to compete by specializing in specific use cases, such as gaming or finance. It could create better developer tools or a stronger community. (Some gas stations say they offer “cleaner gasoline” or slightly cleaner restrooms.)

However, for most L2 investors, the Dencun upgrade is “zero competition” on fees. And the lower the fees, the harder it is for these L2s to make a “profit”. That’s a bad business model.

I want to invest in Apple, which boasts ridiculously high profit margins and products that cost outrageously more than a gas station.

Most of the time, gas stations are a race to the bottom. Layer 2 tokens are gas stations.

Investor Implications

I’m not saying Layer-2 is bad. We need them!

But we need them as a solution to the next problem. Ethereum’s fundamental problem: high transaction fees.

Due to network effects, one Layer-2 may emerge as the winner over time. Perhaps we will have a small number of L2s that will dominate most of the market, specializing in different use cases or different sets of developer tools.

Or maybe Ethereum will continue to improve its technology so that Layer-2 is not needed at all.

It’s too early to tell. And I think that makes L2 tokens a very bad choice.

However, this makes ETH one of the best bets.

Health, wealth and happiness,

John Hargrave

publisher, Bitcoin Market Journal