Exploring the Future of Tokenized Assets with Standard Chartered

According to a report by Standard Chartered, the tokenized real-world asset market is expected to reach $30.1 trillion by 2034.

This significant market growth highlights the growing role of tokenization in transforming global trade and finance by improving liquidity, accessibility, and efficiency. The report highlights the shift toward integrating digital assets into mainstream finance, reflecting the widespread adoption and scalability of blockchain technology and DeFi applications.

Kai Fehr, Global Head of Trading at Standard Chartered, said:

“We see the next three years as a pivotal moment for tokenization, with trade finance assets emerging as a new asset class. Industry-wide collaboration across all stakeholders, from investors and financial institutions to governments and regulators, is critical to unlocking this trillion-dollar opportunity.”

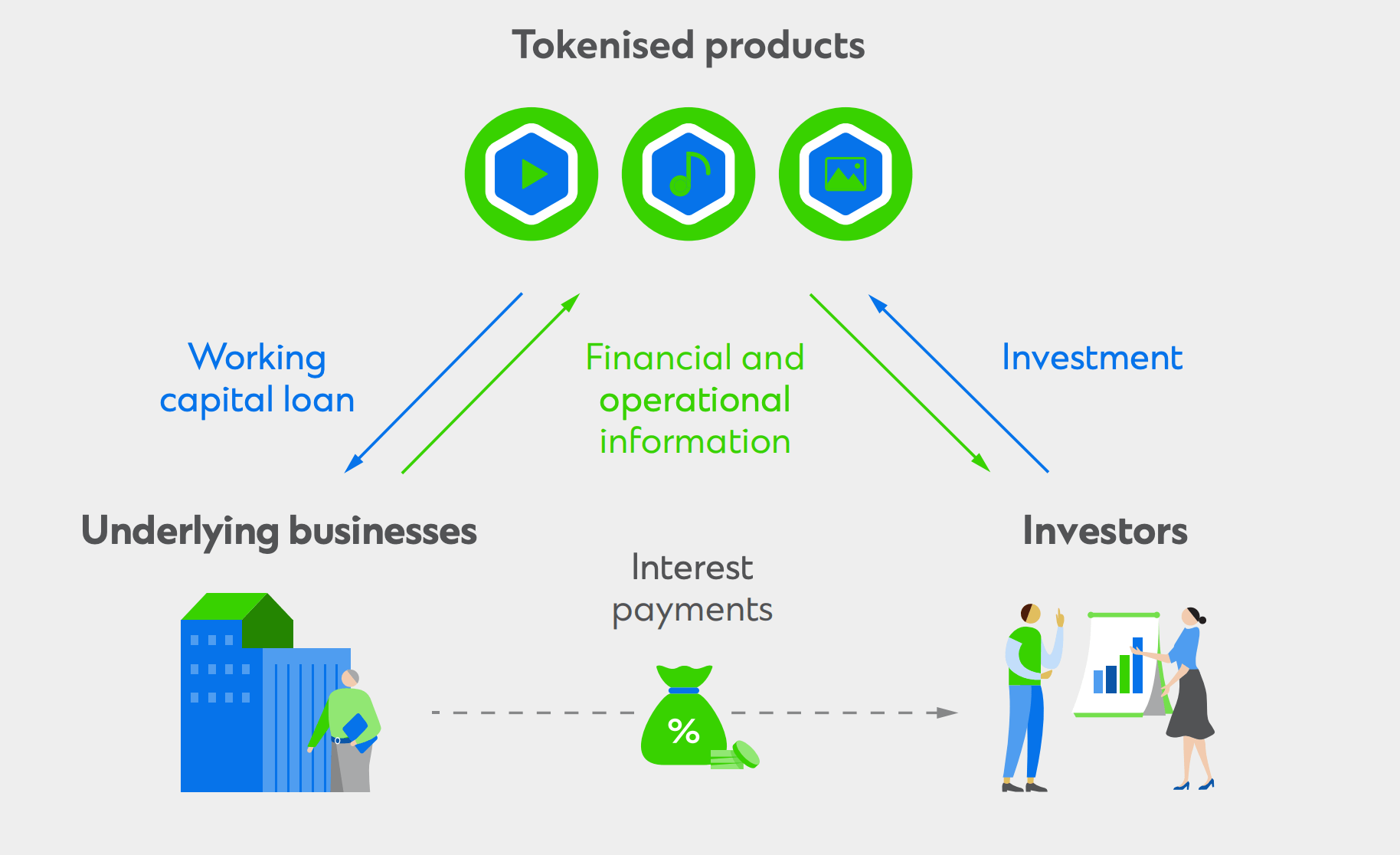

Standard Chartered’s analysis highlights the transformative impact of tokenizing trade finance assets, which are traditionally under-invested but offer strong risk-adjusted returns and lower default rates. Tokenization enables fractional ownership, operational efficiencies, and improved financial market infrastructure, which analysts say will open up new opportunities for investors and help fill the $2.5 trillion global trade finance gap.

The report highlights that the evolution of tokenization has been rapid, with significant milestones such as the introduction of Bitcoin in 2009 and Ethereum in 2015, which ushered in smart contracts and decentralized applications into the financial ecosystem. It also notes that regulatory frameworks and industry collaborations such as Project Guardian, led by the Monetary Authority of Singapore, have further demonstrated the viability and benefits of tokenized assets.

As the tokenized asset market expands, Standard Charter anticipates demand to soar, predicting that 69% of buy-side firms will invest in tokenized assets by 2024. This growing interest is driven by the promise of reduced transaction costs, improved liquidity, and access to a new asset class. While the current market size of tokenized real-world assets, excluding stablecoins, is approximately $5 billion, the potential addressable market, including the trade finance gap, is estimated at $14 trillion.

Standard Chartered’s successful pilot of asset-backed security tokens on the Ethereum blockchain highlights the practical applications of tokenization in improving market access and operational efficiency. The report advocates for greater collaboration between financial institutions, regulators and technology providers to create an enabling environment for tokenization, highlighting the need for standardized processes, regulatory compliance and interoperability.

The report concludes that the financial industry is at a critical juncture where tokenization is poised to transform asset management, trade finance and global economic activity. Standard Chartered believes that by embracing tokenization, stakeholders can improve capital efficiency, expand market access and drive innovation, paving the way for a more inclusive and resilient financial ecosystem.