Expro Group: The Rising Trend in International Offshore Projects (NYSE:XPRO)

Lild Lily Boe

XPRO hinges on overseas interests

I am Expro Group Holdings NV (New York Stock Exchange:XPRO) strategy from the previous article. Over the past few quarters, we have witnessed a rapid shift in international deep-sea activity. 4 year contract Well flow management and production optimization in Norway is evidence of current momentum. We recently acquired PRT Offshore, which helps us access wells safely, increase efficiency and reduce costs. We also extended credit maturities following recent acquisitions, bringing stability to our balance sheet.

Key challenges in the third quarter were reduced activity and lower prices for athletics tubular running services. Increasing costs associated with LWI are another challenge. The stock appears to be somewhat undervalued compared to its peers. The current momentum should more than offset the headwinds. So, I am continuing to extend my medium-term ‘buy’.

industry outlook

Energy services are expected to be strengthened in 2024. On the demand side, economic data indicates the resilient state of China, the United States and Europe. But Europe’s strong natural gas reserves and Asia’s slow demand growth could be a problem. On the supply side, the development of a long cycle of deepwater developments and increased project approvals in 2023 could lead to increased supply in 2024. Growth momentum can be seen in a variety of regions, including Norway, Angola, India, Indonesia, Brazil and Guyana. This scenario will see increased demand for XPRO’s subsea intervention and vessel-deployed LWI solutions.

Last November, XPRO signed a four-year contract to provide well flow management and production optimization services to Equinor on the Norwegian Continental Shelf. The contract is considered one of Norway’s largest surface well testing operations and will use the company’s CoilHose Light Well Circulation System.

Key challenges

pursue alpha

In the third quarter, XPRO faced challenging issues related to an incident in Australia that occurred on one of Expro’s ship-deployed Lighting Boat Intervention (LWI) systems. Accordingly, the company suspended LWI operations deployed on board the vessel. The company has not yet determined the time and cost needed to return the system to operating condition. In this context, investors may note that the projected annual revenue for the ship-deployed LWI business is between $50 million and $75 million.

In North America and Latin America, not only have LWI-related costs increased, but the recent slowdown has also reduced activity. In the third quarter, revenue for our U.S. Onshore Tubular Running Services (TRS) business decreased 10% due to continued declines in activity and lower prices. Quarterly margins from this operation also declined in the third quarter. TRS capacity is believed to exceed demand in the onshore U.S., which has led many service providers to lower prices to capture higher market share.

response to challenges

To overcome challenges in the TRS market, XPRO has streamlined its TRS operating footprint in the U.S. land market. We have also repositioned our equipment to select U.S. and international basins for better utilization, pricing and returns. Drilling-related slowdowns in the U.S. and Latin American offshore markets also impacted the company’s business. However, management expects international activity to rebound in the fourth quarter.

Another strategy for the company was to take the acquisition route to accelerate growth. Last October, it acquired PRT Offshore, which provides onshore and offshore well completion, intervention and decommissioning services. This acquisition will enable XPRO customers to safely access wells, increase efficiency and reduce costs.

New projects and backlog

XPRO has strengthened its position following the acquisition of DeltaTek. This acquisition complements our offering of open, low-risk cement solutions, including pure technology. In the third quarter, XPRO delivered solid cement projects in the U.S. Gulf of Mexico. In another project, we designed and built an onshore LNG preprocessing facility for the Eni Congo project. First production is scheduled for the first half of 2024. In the Middle East and North Africa, Expro has completed the installation of Kinley check valves.

During the third quarter, XPRO secured $235 million in new work orders. This includes $30 million in compensation from the Norwegian Integrated Services Agreement. The company will provide drilling, well testing, subsea and coil hosting services. The order backlog increased from $2 billion in the previous quarter to $2.4 billion.

Q3 driver

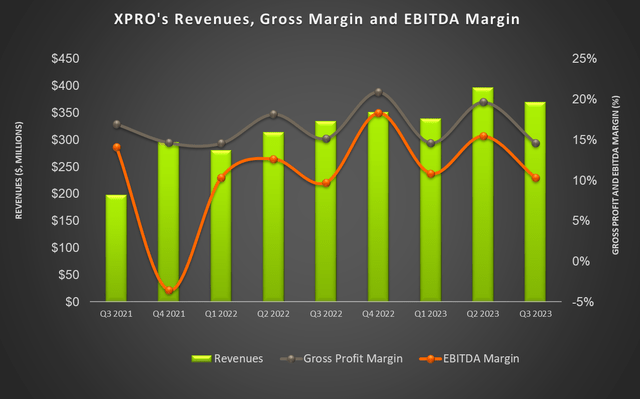

Submissions from XPRO

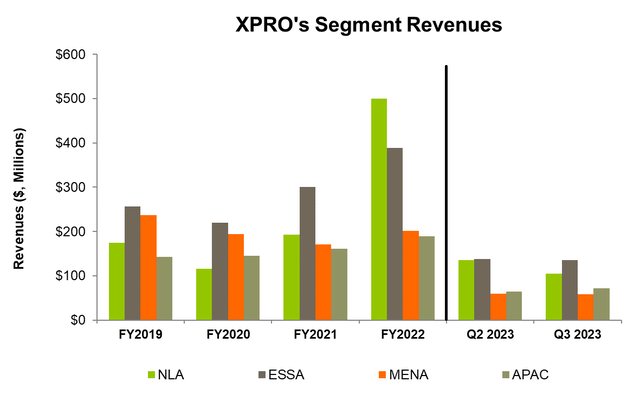

From the second quarter to the third quarter, the company’s sales fell 7%. Regionally, the North America and Latin America (or NLA) division recorded the steepest decline (down 22%) during this period. Meanwhile, Europe, sub-Saharan Africa (ESSA) and the Middle East remained relatively stable. Asia Pacific (or APAC), on the other hand, showed impressive gains (up 10%). The company’s Adjusted EBITDA margin declined sharply for the third consecutive quarter (down 510 basis points) despite LWI-related margin headwinds.

Short-term softness and structural issues with tubular operating services within well construction in the U.S. Gulf of Mexico contributed to the decline. The decline was partially mitigated by rising demand for subsea intervention and ship-placed mining well solutions in the APAC region.

Cash flow and liquidity

Driven by revenue growth, XPRO’s operating cash flow became significantly positive in September 2023 compared to a negative CFO a year ago. Despite the increase in facility investment, free cash flow also turned into surplus.

As of September 30, XPRO had $50 million in debt related to the closing of the PRT Offshore deal, but has since repaid $35 million. As of September 30, liquidity was approximately $350 million. We recently revised our revolving credit facility and extended its maturity by three years.

What does relative valuation mean?

Author created and looking for alpha

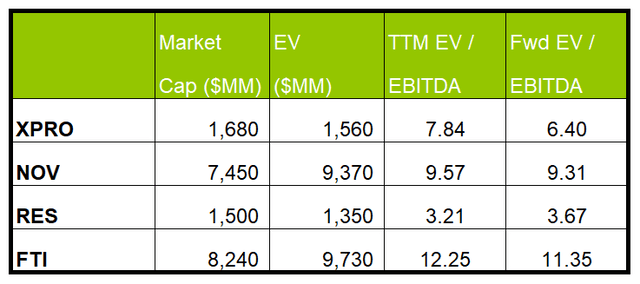

XPRO’s future EV/EBITDA multiple (7.8x) is expected to contract compared to its current EV/EBITDA multiple (6.4x). The shrinkage rate is steeper than the average decline of its peers (NOV, RES, FTI), which means higher EBITDA growth, which means higher EV/EBITDA multiples. The stock’s current multiple is slightly below its peer average. Therefore, the stock is undervalued compared to its peers.

The stock is currently trading at a significant discount to its historical average. Given concerns about a U.S. economic recession, stock prices are unlikely to improve significantly in the short term. However, in the medium term, expansion of multiples near their historical levels could result in a sharp rise from current levels.

Target price and analyst evaluation

pursue alpha

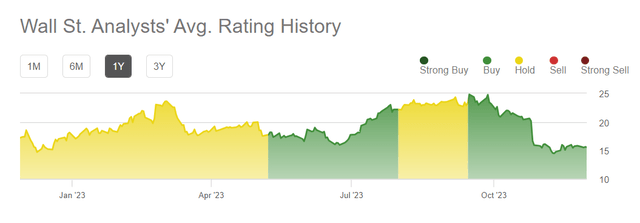

In the last 90 days, 4 Wall Street analysts have rated XPRO a “buy” rating. Two analysts have rated the stock with a ‘Hold’ rating, while none have recommended a ‘Sell’ rating. The consensus target price is $22.3, which suggests a 48% upside from the current price.

Why does my currency remain unchanged?

I considered the XPRO a “Buy” in my previous article. LWI system sales declined in the second quarter. Additionally, customer budget constraints have made the outlook uncertain. However, well flow management, well interventions and product line integrity have kept production levels stable. I wrote:

As offshore project approvals increase, project sanctions are expected to increase by 2030. It has also entered the carbon capture business. The second quarter showed significant growth in revenue and adjusted EBITDA, particularly in the APAC region, demonstrating momentum.

As the dynamics of the offshore energy market improve, we expect demand for subsea intervention and ship-placed well intervention solutions to increase. Last November, XPRO signed a four-year contract to provide well flow management and production optimization services in Norway. Cash flow may continue to improve in 2024. Therefore, despite the decline in drilling activity in the U.S., I reiterate my “buy” view on the stock.

What is your assessment of XPRO?

pursue alpha

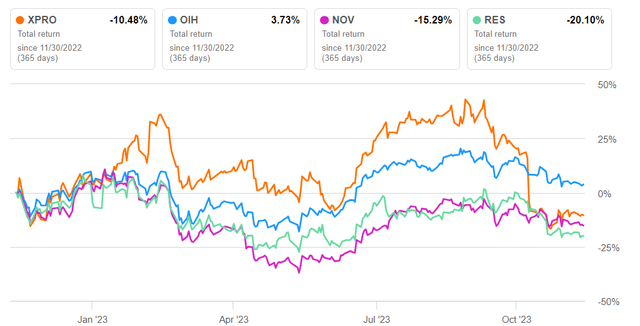

We expect long-term deepwater development and increased project approvals to support XPRO’s prospects in 2024. However, XPRO suffered a setback last September when an accident occurred in Australia, forcing the company to suspend LWI operations on board its ships in the region. The company’s onshore tubular driving services have also come under pressure. As such, the stock has underperformed the VanEck Oil Services ETF (OIH) over the past year.

However, as the offshore drilling market becomes more active, the balance of the energy industry appears to be changing. It could also get a boost from the company’s recent acquisitions. We could win several new projects in the third quarter, boosting our topline into the fourth quarter and into 2024. Considering relative valuations, we once again highlight the call to ‘buy’ for healthy returns over the medium to long term.