FactSet Research System: Layoffs Impacting License Revenue (NYSE:FDS)

Anyaberkut

investment thesis

Factset (New York Stock Exchange: FDS) missed revenue but reported ahead EPS results on March 21. The stock has fallen since the results and is currently trading around its 200-day moving average. The valuation multiple is that the company The moat is wide, but I think it’s narrowing, and you can see several contracts here. With revenue estimates missing and management repeatedly emphasizing that sales will reach levels below guidance, I recommend Holding FDS.

background

FDS has a strong recurring revenue model based on subscription services for its core desktop products. The company provides data to the financial services industry, particularly buy- and sell-side asset managers and research institutions. Research is the largest component of Annual Subscription Value (ASV), followed by Portfolio Analysis and Risk Management (32% of ASV), and FDS, which is the fastest-growing segment of FDS. The data feed business accounts for 25% of ASV. Users in this segment access data through APIs.

FDS continues to face stiff competition from other research providers such as S&P Capital IQ, Refinitiv and advanced Bloomberg. With many competitors offering similar services, proprietary data is quickly duplicated and loses value over time. Additionally, some data provided by FDS may be considered “nice-to-have” rather than “mission-critical,” making it less important and therefore less competitive for the company. This is not promising, considering that the main source of ASV for FDS is in research generation services.

The company is competitive in terms of analytics and trading solutions. Software in this sector is often embedded and switching costs are high, giving FDS a narrow moat over competition. The same goes for the Data Feeds business. While physical products are available from competitors, the switching costs associated with Quant Fund leveraging data are high and again creates a narrow moat for the company.

finance

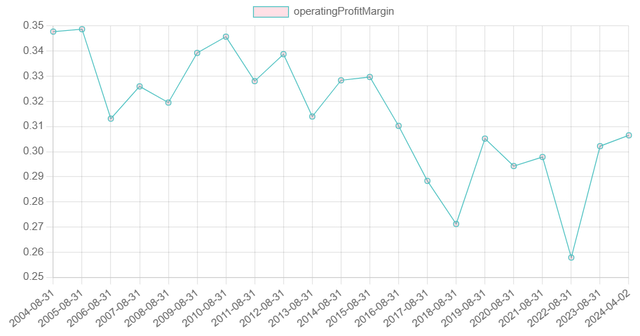

In terms of market share and growth, FDS ranks in the middle of the industry with 12-month revenue of $2.15 billion and a 5-year CAGR of 9.12%. It is behind S&P Global (SPGI), London Stock Exchange (OTCPK:LNSTY), and MSCI (MSCI). It already shows investors that there are alternatives in this industry that are capturing a larger market share and growing faster. The industry is incredibly profitable, with a median EBIT margin of 30%, and FDS has had very stable EBIT margins, fluctuating between 25%-30% over the past six years. This level of profitability lags behind competitors and is just above the industry median. However, looking at a longer period, EBIT margins have declined due to reduced pricing power and increased competition.

Author’s calculations

High operating leverage results in high net margins, resulting in strong free cash flow. FCF return of 23% is significantly higher than the industry average. It also provides strong returns on capital that exceed the cost of capital.

The company’s capital allocation strategy primarily involves returning funds to shareholders in the form of dividends as well as share repurchases. In June 2023, the Board of Directors approved an ongoing $300 million repurchase program. FDS has a strong record of share repurchases, and before the repurchase program was suspended due to the CUSIP acquisition and debt repayment, FDS was spending 20 cents for every dollar of share repurchases.

Net debt to sales is 65%, and the next principal payment will be $375 million in 2025. With their current cash balance and the company generating an average of $520 million in free cash flow, they are well-positioned to service this principal.

FDS reported mixed results for the second quarter, with EPS up 11.1% to $4.20, beating estimates, but revenue missing estimates, up just 6% to $546.1 million. Across the region, the Americas and Asia-Pacific reported strong organic growth, growing 6.5% and 6.4% respectively, with EMEA lagging slightly behind with 4.8% growth. FDS’ ASV was $2.2 billion in the quarter, an organic increase of 5.4% year-over-year. FDS also added 75 customers in the second quarter, bringing its total customer count to more than 8,000. Adjusted operating margin of 38.3% increased 130 basis points, and management expects full-year revenue to be at the lower end of a range of $2.2 billion to $2.21 billion.

rundown

FDS is exposed to employment levels in the buy-side investment industry. Staffing levels impact licensing revenue generation. So one of the main reasons for the weak sales and lowered revenue guidance is the ongoing asset management layoffs. FDS reported the following in its earnings statement:

We are seeing increasing pressure on customer volume as they seek more efficiency gains.

As investors turn to lower-fee products, many asset managers are cutting costs and laying off employees. This is affecting FDS. Because fewer employees mean less customer spending.

evaluation

Author’s calculations

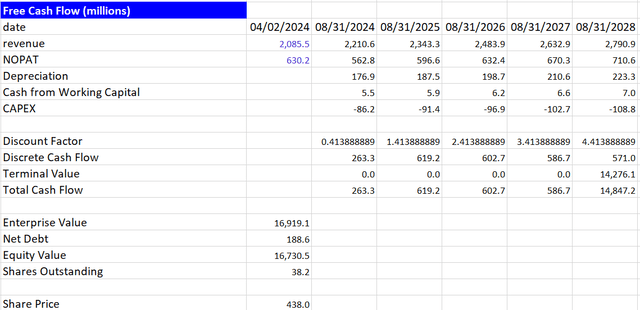

To reach the stock price target of $438, EBIT margin is permanently maintained at 30%, in line with a P/FCF multiple of 25x and WACC of 8.90%. I modeled working capital to increase cash flow by 0.25% and set the 20-year average CAPEX at -3.9%. Since FDS acquired a significant portion of its intangible assets following the acquisition of CUSIP, the amortization rate is 8%. Also adding to my thesis, Seeking Alpha rates the overall valuation an F.

danger

The main assignment of my thesis concerns recruitment and trading activities in the asset management sector. If employment grows again, license revenues and upgrades could be higher. Additionally, although only in beta, FDS is leveraging AI to enhance its research capabilities, which could provide long-term support for growth. But as I mentioned above, I think the same will be true for our competitors. Building a competitive advantage from the data you provide is difficult because it is quickly replicated.

When can I buy it? At current prices, FDS is attractive and the stock has reached my target. I think we are rather nearing the end of asset management layoffs and will continue through 2024.

conclusion

FDS missed out on a company trading at a multiple of close to 30x, which would have implications for its earnings and stock price. I don’t believe this multiple reflects the level of moat this company has, and I could see the company shrinking in the future. Additionally, we do not expect current asset management hiring trends to reverse, so there will continue to be pressure at the top level. Therefore, I am starting a hold on the company.