FCG ETF: Buy the Bottom of Natural Gas Prices (NYSEARCA:FCG)

drink

proposition

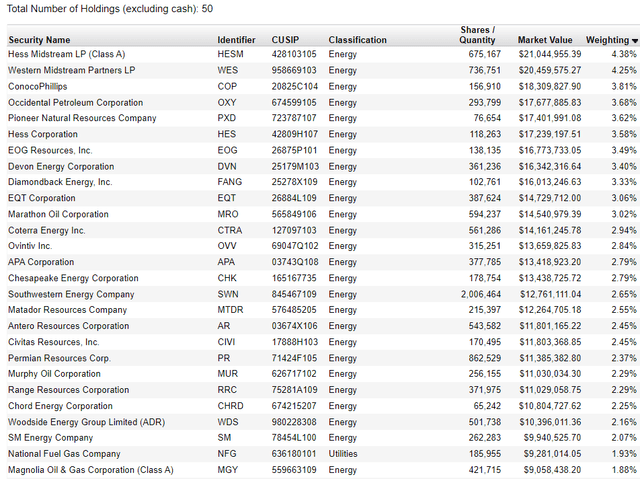

First Trust Natural Gas ETF (NYSEARCA: FCG) is a stock exchange-traded fund. Despite the name, which may give the misleading impression that the fund invests in natural gas futures, the vehicle actually holds an oil and gas portfolio. stock. FCG seeks investment results that correspond to the price and yield of an equity index generally referred to as the ISE-Revere Natural Gas™ Index. The index includes a mix of transportation companies and exploration and production companies. This fund, through its composition, reflects both the profits earned from the sale and transportation of natural gas.

Traditionally, both transportation and E&P companies have had two major risks associated with their business models: natural gas prices and balance sheet structure. The first risk is fairly simple. Because natural gas is higher. Prices make it more profitable to extract it and to some extent transport it. The second risk factor is that we have experienced a major reset during the Corona crisis, with many companies in our portfolio experiencing ‘near-death’ experiences.

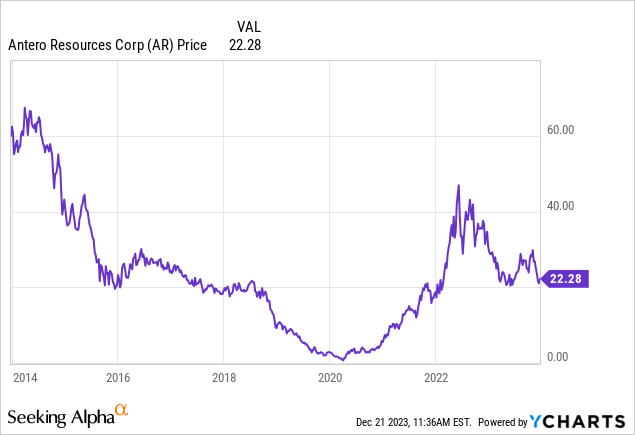

Antero Resources (AR) is a natural gas E&P company, and as you can see in the graph above provided by YCharts, the company almost went bankrupt during COVID-19. On the one hand, lower natural gas prices led to lower profitability, but AR’s dire situation was largely driven by its balance sheet during the period. The company had many short-term debt maturities and had a poor liquidity position on the revolver side. However, COVID-19 has provided a very difficult lesson for many companies, who have understood the importance of managing their balance sheets in a conservative manner and the need to prepare for another recession. Most companies in FCG’s portfolio today have very healthy balance sheets with debt repaid in a zero interest rate environment in 2020/2021 and large revolving facilities with 3-5 years remaining to maturity. Moreover, most have significantly reduced leverage to 1x EBITDA, not only ensuring survival during today’s bear cycle, but actually ensuring solid share prices.

Natural gas prices are back to square one.

Natural gas prices have been on a roller coaster ride over the past few years.

Natural gas PX (Trading View)

Natural gas prices, which rose to $9/MMBtu in 2022, have now fallen to $2.43/MMBtu, but more importantly, have fallen more than -30% since October. Seasonality plays a role, with warmer-than-expected winds in both the U.S. and Europe contributing to lower-than-expected demand patterns.

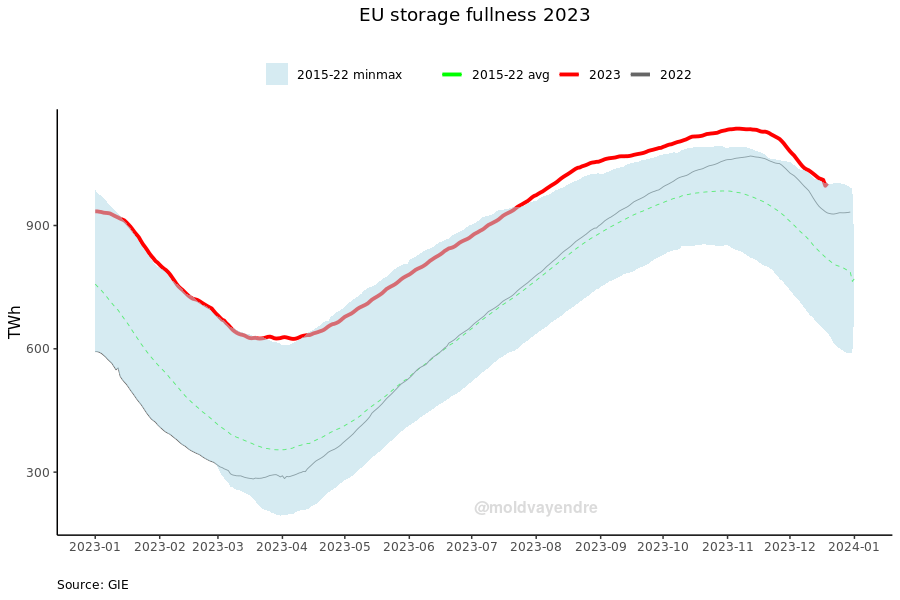

EU storage (Twitter-moldvayendre)

Due to the Russia/Ukraine conflict, Europe has been very active in gas supply and consumption for the injection season. Extremely cold winders could theoretically have driven the continent to a shortage of heating and industrial resources. Fortunately for Europeans, the situation was quite the opposite. As you can see in the graph above, EU storage space is at historic highs and most countries are now exploring how best to deal with higher cost purchases.

In the US, looking at the Henry Hub, we see spot prices moving back close to the long-standing support of $2/MMBtu. This is a very well-established technical and fundamental support level outside of Covid. why? Essentially, most producers break even from a profitability perspective when natural gas is in the mid-2% range, so maintaining natural gas at $2/MMBtu for an extended period of time will reduce inventory drilling and extraction. The cycle takes a long time to run, but that’s why historically this level represents both technical and basic support levels.

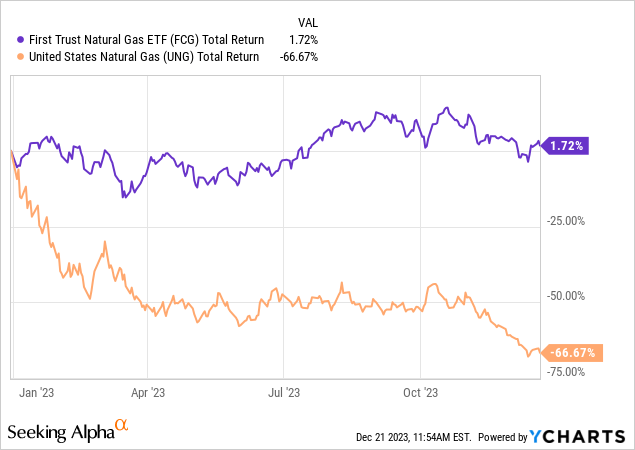

FCG performed very well in 2023 as well.

Boasting a 3.4% yield, the fund has performed very well in 2023 from a total return perspective, considering the absolute destruction of natural gas spot prices.

The United States Natural Gas (UNG) ETF is an exchange-traded fund that uses futures to provide returns on the spot price of natural gas (readers can view UNG-related articles on the Seeking Alpha platform). The fund went bankrupt in 2023. -66%. FCG, on the other hand, was able to maintain positive performance despite the slump in prices of key raw materials. reason? As explained in the ‘Paper’ section, FCG’s components have made tremendous progress in cleaning up its balance sheet, so the market is now pricing in its future rather than its imminent demise. As long as the futures curve is upward sloping, the market sees greater future gains discounted into the present, so the price impact on stock prices is not as sudden as investing in commodities.

Buy low, sell high.

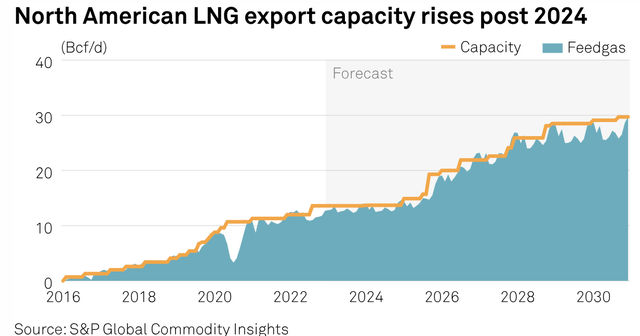

In our opinion, FCG is not a true buy-and-hold, but rather a cyclical play as many commodity funds. Retail investors must follow the principle of ‘buy low, sell high’ by following the price of natural gas, which is the main risk factor here. Should I have bought FCG when natural gas prices were always high? no. Should you consider buying FCG now that natural gas prices are so close to historical support levels? We think so. We believe it will take many years for the energy transition to occur and until then oil and gas will follow a cyclical pattern, providing additional benefits for natural gas from LNG terminals. The development of LNG terminals will essentially ‘boost’ natural gas spot prices in the US in line with the higher levels in Europe and Asia.

LNG capacity (S&P)

Looking to the future, we see significant increases in production capacity beyond 2024, which will lead to increased revenues for the components that make up FCG collateral. These developments take time and progress is indeed closely monitored in the spot market, which sometimes records large moves when delays are announced. However, higher export capacity will translate into higher prices on a more permanent basis.

Fund components are large oil and gas companies or transportation MLPs and can benefit from:

landlord (Fund website)

conclusion

FCG is an exchange traded fund. Its fleet includes a portfolio of natural gas producers and transporters. The underlying entity has done a 180 in terms of restructuring its balance sheet post-Covid through debt reduction, refinancing and extensions. Essentially, all of our portfolio companies are in much better shape than they were three years ago. This explains the fund’s solid performance in 2023 despite a -66% decline in natural gas prices reflected in the UNG ETF.

As natural gas approaches historic support levels of $2/MMBtu, retail investors should consider investing in FCG. Natural gas prices are cyclical and volatile, but the development of LNG export facilities will lead to structurally higher prices. We believe that today’s low price environment for natural gas provides a good entry point for E&P producers and transportation companies, as reflected in FCG.