Fed Chairman Powell Finally Reveals the Truth – Analysis and Forecast – April 4, 2024

Federal Reserve Chairman Powell finally revealed the truth. And I admit that I am very, very scared of the FED!

Powell said Wednesday that the central bank will need more evidence that inflation is moving consistently toward its 2% target before cutting interest rates.

He finally acknowledged that inflation was winning. The Fed can no longer promise 2% inflation or that inflation is “temporary.”

At the same time, many people are waiting for a rate reduction!

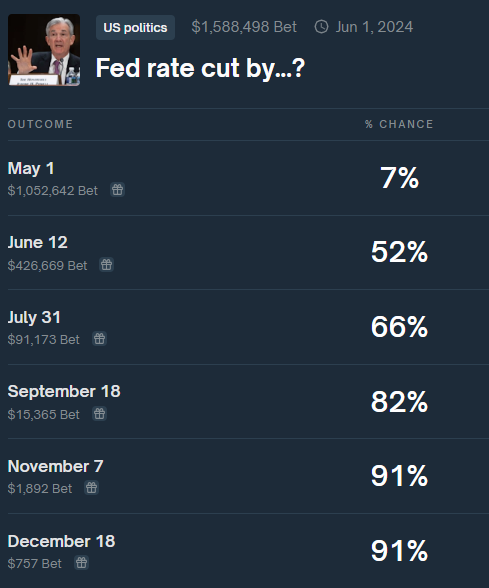

The image above shows the market forecast published by Polymarket.

Most people are confident that interest rate cuts will come soon.

Robert Kiyosaki says:

“The problem is that most people have no idea what the Federal Reserve Chairman’s admission means to them, their families, or the world. In my simple words, it means, “We’re F’d.” That’s what I said 27 years ago at RDPD. As we have warned, “protectors are losers.” The dollar has lost 95 percent of its purchasing power since 1913, the year the Federal Reserve and IRS were created.”

So basically people are waiting for the next interest rate cut and the dollar index to fall. Typically, when the dollar index falls, gold prices rise. But wait!

Currently, the dollar index remains stable. But gold prices go to the moon. This simply means that many people think the dollar is overvalued!

This can now lead to two scenarios:

1) If the dollar price is correct, the price of gold will fall to 2000 in the coming months.

2) If the FED cuts interest rates as expected, the value of the dollar will fall and the price of gold will remain the same or rise.

I would say the second scenario is more likely. 😁

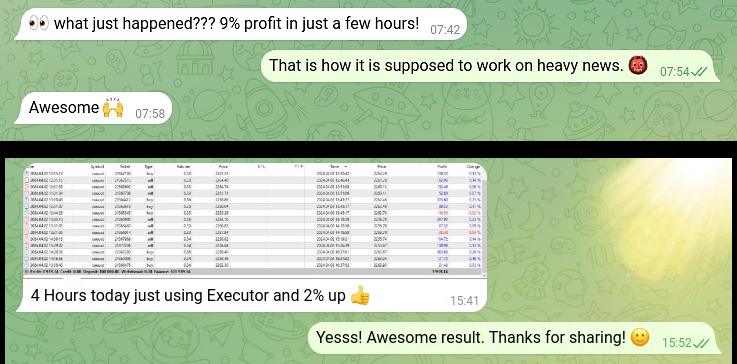

Such a scenario would lead to stressful market conditions and many panic runs.

As algo traders, we must be ready to take advantage of this and apply expert advice built to rob the market when it is “uncertain.”

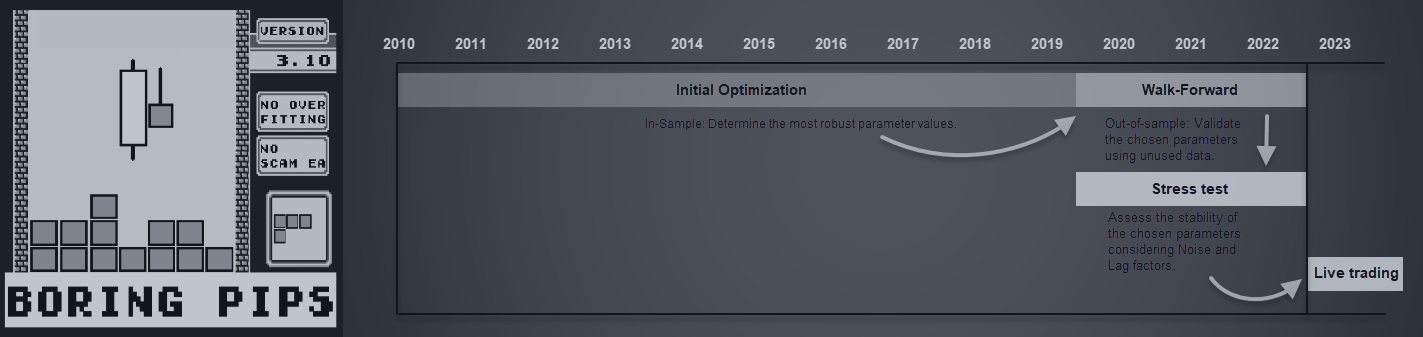

The BFG9000, which sounds like a weapon, is a highly recommended Expert Advisor.

EA is still unknown to most people and only a few people are aware of it. But be careful. It’s really a financial weapon and may not be right for you.

![]()