Fennec Pharmaceuticals: Great Sales Progress – Not Yet Reflected In Stock (NASDAQ:FENC)

FatCamera

Fennec Pharmaceuticals – Revenue Guidance and EU Launch

Fennec Pharmaceuticals (NASDAQ:FENC) (the Company), is a small cap, commercial-stage biotech company with a single drug, PEDMARK®. PEDMARK is a unique formulation of sodium thiosulfate specifically developed for pediatric patients. PEDMARK is FDA-approved to reduce the risk of ototoxicity or hearing loss associated with cisplatin in pediatric patients 1 month of age and older with localized, non-metastatic solid tumors. The drug is used in children who receive platinum-based chemotherapy.

PEDMARK was launched in the fall of 2022. The Company recently released its sales guidance for Q4 2023 and 2023, a range between $9.2-$9.7M and $20.7-$21.2M, respectively. Analyst consensus for Q4 2023 was $8.1M – a solid beat. Additionally, at that revenue level, the Company should be cash flow positive, reducing the financing risk.

The next big event for the Company is the EU launch. The Company received approval from the European Medicines Agency (“EMA”) in June 2023, and has been preparing for EU launch since then. Wisely, they did not wait for a deal to start the regulatory filings to sell in Europe. According to management, they expect to be able to start selling in Germany in May or June 2024.

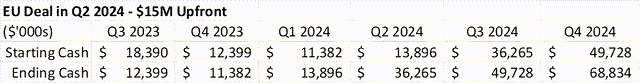

The Company has expressed the desire to have an EU partnership to facilitate a more complete launch than they would be able to do on their own. Assuming an upfront payment, an EU partnership would be a huge catalyst for the stock, providing validation for the asset, proof that the management team can consummate a deal and increase the balance sheet (which has been an overhang on the stock).

The Company is enrolling a bridging study in Japan, which they hope will complete enrollment by end of year. That timing should allow any potential Japanese partner to initiate the regulatory approval process early next year.

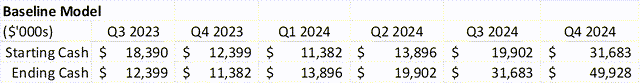

Cash Balance – Net Negative

The Company finished Q3 2023 with $12.3M in cash. In Q4 2023, revenue grew faster than street expectations, but there were additional expenses to support the EU launch that likely kept them from being cash flow positive. If revenues keep growing at $3M+ per quarter, then they technically do not need additional funds.

Analyst Model

However, because needles are hard to thread, and a manufacturing run could cost more than 30% of cash on hand at the end of 2023, there is likely an overhang on the stock until there is more cash buffer.

If the Company is able to sign an EU partnership before they launch the drug in late Q2 2024, then the cash balance is no longer an issue. The overhangs likely dissipates when the Company has more than 1 year of expenses in the bank – currently their annual operating expenses are around $26M. An EU deal with a $15M upfront (very conservative guess), would solve the issue. As would time, in the baseline model.

Analyst Model

Progress with the P&T Committees – Net Positive

The Company initially targeted hospitals and cancer centers that provide pediatric cancer treatments in either the out-patient (deliver chemotherapy and leave that day) and the in-patient (stay the night) setting. Children with cancer are treated at specialized children’s hospitals, of which there are approximately fifty major centers throughout the United States. Each of these hospitals have a pharmacy and therapy (“P&T”) committee that approves the use and costs of all new drugs.

After 15 months in the market, the Company believes they have worked through north of 25% of the P&T committees of the top 100 sites, with a lot of activity picking up after the FDA letter (see below). Once in, the process of selling shifts from working through a bureaucratic process, to detailing the product benefits to the oncologists.

FDA Rebuke of Non-PEDMARK Formulations – Large Net Positive

There is still an issue that some sites are using compounding pharmacies to provide sodium thiosulfate to patients. In February, the Company announced that the FDA sent out a communication on the potential risks of using non-PEDMARK® formulations of sodium thiosulfate.

The cause of the communication was a response to an issue with a patient who was dosed with sodium thiosulfate, not from the Company. The incident was reported to the Company as a reportable event, but PEDMARK was not used. This event validates the need to use PEDMARK, and not a compounded form of the drug. The communication also provides the Company with support to finally convert those sites who have been resistant to purchase the branded product.

Added TAM from NCCN AYA Guidelines – Net Positive

As of April 1, 2023, PEDMARK has an effective J-code (J0208), which opened an easily reimbursable billing pathway for patients treated in the outpatient setting. Laat year, sodium thiosulfate was added to the National Comprehensive Cancer Network’s Adolescent and Young Adult (“AYA”) Oncology guidelines, which includes ages 15-39.

“Ototoxicity – Routine evaluations for tinnitus and periodic audiogram to monitor hearing loss associated with platinum-based chemotherapy. Consider sodium thiosulfate (STS) to reduce the risk of ototoxicity associated with cisplatin in pediatric patients with localized, non-metastatic solid tumors. There are concerns about the use of STS in the metastatic setting.” Source: NCCN Guidelines

The inclusion of this statement in the AYA Oncology guidelines effectively provides support for PEDMARK®’s use in a broad set of adolescent and young adult cancers, which are often treated outside of the major children’s hospitals. Groups like Texas Oncology provide care to a broad range of patients, including AYA patients. These centers mostly provide outpatient care, which allows them to fully utilize the J-code for reimbursement and collect a margin on the therapy.

The Company mentioned that the AYA market could be as large as 30,000 patients per year, and each AYA patient could use twice the number of vials as the younger patients under 15. The TAM for the AYA community cancer center market could be as large as $600M.

The Company added new sales FTEs with AYA sales experience starting in September of 2023. Those sales folks have been connecting with the community hospitals and the GPOs that support them. Most AYA patients are treated on an outpatient basis and are worth ~2.5x the value of a younger pediatric patient to the Company. To the provider, who can make 5% or more on top of the average selling price of PEDMARK® through the J-code reimbursement, there is less resistance to the drug’s use, than if they needed to include the drug in a bundled payment. As the Company makes traction in this market niche, the revenue has the potential to grow quickly.

Patent/Litigation – Net Negative

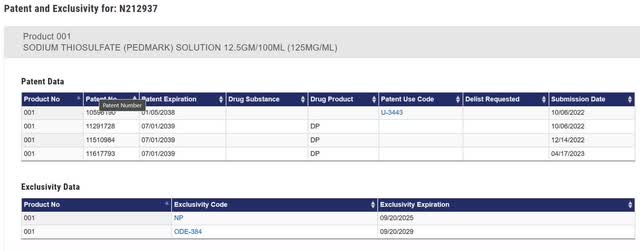

One patent lawsuit was closed out. In 2021, Hope Medical Enterprises, Inc. (“Hope”) filed two petitions for an inter partes review (“IPR”) with the US Patent Office. Hope was trying to invalidate US patent # 10,596,190 (“190”), which relates to a method of use, and US patent # 10,792,363 (“363”), which relates to an anhydrous form a method of manufacture. The Patent and Trial Appeal Board ruled in favor of Fennec in September 2023.

One lawsuit remains open. CIPLA, a generics manufacturer, filed for an ANDA for a generic version of PEDMARK. The Company filed suit with CIPLA In January of last year. The litigation is ongoing, and the Company does not expect a resolution until early next year. At worst, if all of the patents are declared invalid (very, very low odds), CIPLA would need to wait until the end of the orphan drug protection in 2029 to begin sales. At best, patent law is upheld and CIPLA would need to wait until 2039 to begin sales.

In the FDA Orange Book, there are four patents listed. Of the four patents filed with the FDA, US patent # 11,617,793 (“793”). 793 covers the final formulation in the product labeling, which includes boric acid. Any generic that wants to reference the data in PEDMARK’s regulatory filing would need to also include boric acid, and therefore should be blocked in the US until 2039.

US FDA

Figure 1: PEDMARK Orange Book Listing

Management Team

In 2023, to improve the probability of a successful US launch and to manage the preparatory work for an EU launch, Adrian Haigh stepped down from the Board of Directors. He has managed orphan disease launches multiple times and was an optimal choice for the effort.

In 2023, the management team was highly incentivized to sell the company, with over $4M in additional bonused to close a sale before the end of the year. The fact that a sale did not happen, suggests that the Company did not have any offers that met their expectations, or that they had no bona fide offers. Either way, the team needs to continue to build a business, and prove to the market that they can get a deal done – hopefully for the EU given the pending launch.

|

Chairman |

Dr. Khalid Islam

|

|

Chief Executive Officer |

Rostislav Raykov

|

|

Chief Operating Officer |

Adrian Haigh

|

|

Chief Financial Officer |

Robert Andrade

|

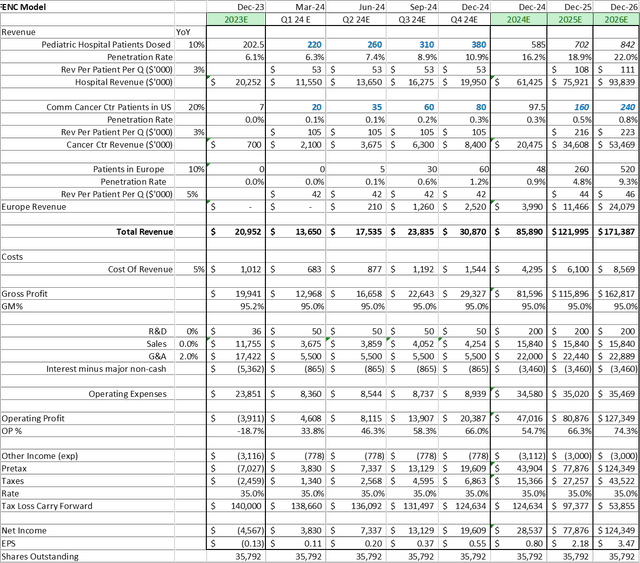

Proforma Model

When updating the model for the Company, I have made the following updates to the assumptions:

- Increased the 2030 penetration rate to 28% in the core pediatric market – reflecting the increased conversion of sites onto PEDMARK®

- Decreased the 2030 AYA market penetration rate to 1.5% – reflecting a more conservative assumption

- Increased the Sales and G&A Expenses – reflecting a more conservative assumption on costs relating to the EU launch

- Adjusted Shares Outstanding to cover conversion of 3rd tranche of Petricor loan

Analyst Model

Assuming one maintains a 20% discount rate, these model changes cause the share price target to drop to $23, from $27 in my last report.

However, if the Company signs an EU partnership, from a modeling perspective, the following changes would occur:

- Net EU revenue would decrease, but ~$2M of cost per quarter would be eliminated as early as Q2 2024.

- Likely, an upfront payment would increase the cash balance.

- The increased cash balance, and the validation stemming from a partnered geography would allow for a lowered discount rate to 15

The net result of these model adjustment would increase the stock price target to $31. Either way, the models suggest a greater than 100% upside potential from today’s price.

Potential Risks and Potential Surprises

- Financing: Given the Q4 2023 sales guidance, the Company’s US operations were likely cash flow positive. However, the cost of the EU launch likely kept the EBIT negative. The Company still has a balance sheet overhang. Based on the low net loss, even a small upfront with an EU partnership could mitigate this overhang.

- Valuation: Since Q4 2023, the biotech market has surged. Good news is once again resulting in an increase in stock prices. Valuation models once again may have relevance to stock price.

- Partnership or Sale: The best-case scenario is a whole-company sale occurs for north of $20 soon. In lieu of perfect, if the Company can secure an EU distribution partner with a reasonable upfront payment, then the Company can take its time to maximize the value of the US, Japan and rest of world. For investors who have been in the name a long time, the worst-case scenario is that they do not sell or partner any geographies, and decide to grow an orphan, pediatric oncology specialty pharma. There is still hope for a whole-company sale, but the longer the Company goes without being bought, the higher the probability of a piece meal exit.

- EBIT Company: In the event of no sale or partnership, then the Company will shift to being valued on earnings. The valuation will shift to a multiple of EBIT, and require a different kind of operational management.

Conclusion

FENC is a single asset, de-risked, commercial stage company whose most likely near-term path is an EU partnership, hopefully followed by a buy-out in 2025. With all of the de-risking, one has to wonder why Fennec is still not valued more highly.

- The Q4 2023 revenue guidance exceeded analyst expectations, suggesting the Mr. Haigh is running an effective sales force, and perhaps seeing progress in the AYA market.

- The Company should now be cash flow positive in Q1 2024, lowering the financing risk.

- The FDA guidance to avoid compounded alternatives to PEDMARK® should increase adoption in the US.

- The biotech market has rebounded, with many companies seeing substantial stock price gains with good news.

The two pieces of the puzzle that could be the cause of the overhang are the cash balance and the lack of partner validation. I believe it is only a matter of time before management completes a transaction (EU partnership or company sale), which will also solve the cash balance question. Patience will hopefully reward all of the Fennec longs.