Fiat vs Cryptocurrency: Key Differences

Money is a fundamental requirement for the functioning of society through financial transactions. It is also one of the most commonly accepted stores of value worldwide. In some societies, livestock were used as money, which gradually evolved into conch shells, and later metal coins were introduced. Today, the term money generally refers to fiat currency, which is a government-backed legal tender.

Why do we need a fiat currency vs. cryptocurrency debate when there are reliable forms of money like cash and coins? Interestingly, the evolution of money has paved the way for cryptocurrencies to become a major force for change in widely accepted forms of money and value. The differences between fiat currency and cryptocurrencies can play a significant role in defining the future direction of financial development. Let’s take a closer look at the differences between fiat currency and cryptocurrencies.

Build your identity as a certified blockchain professional with a blockchain certification from 101 Blockchains, which provides enhanced career prospects.

What is fiat currency and how does it work?

The best way to compare cryptocurrencies and fiat currencies is to learn about their definitions. Fiat currency, or fiat money, is a specific type of currency issued by a country’s government or central bank. It is important to note that fiat currencies are not backed by physical goods such as gold. Conversely, the value of fiat currencies is determined by the trust people have in the government that issues the currency. Common examples of fiat currencies include the US dollar and the euro.

The most notable aspect of the definition of fiat currency is its centralized nature. It is controlled by a central authority, such as a central bank or government. Centralization is one of the key factors when comparing fiat currencies to cryptocurrencies, as it defines the level of control that users have over their assets. The central authority controlling fiat currency can set interest rates, establish new monetary policies, and control the supply of fiat currency.

Fiat money has been the backbone of many economies for centuries. Governments issue fiat money and control its supply to maintain economic stability. Central banks, on the other hand, are responsible for managing fiat money by adjusting the money supply by printing more fiat money or withdrawing it from circulation.

If you want to learn the basics of cryptocurrencies and how blockchain technology powers them, enroll in our Cryptocurrency Fundamentals course today.

What is cryptocurrency and how does it work?

Cryptocurrencies are digital currencies that utilize cryptography and blockchain technology to provide decentralization and better security. Questions such as “Are cryptocurrencies better than fiat currencies?” arise from the fact that cryptocurrencies use blockchain technology. Blockchain acts as a distributed ledger that records all cryptocurrency transactions, ensuring the immutability, transparency, and security of transactions. The most prominent feature of cryptocurrencies is decentralization, meaning that they are not issued or controlled by a central authority.

Cryptocurrencies are created through minting or mining, depending on the design of the cryptocurrency. For example, Bitcoin uses cryptocurrency mining to create new cryptocurrencies. On the other hand, Ethereum and other altcoins use proof-of-stake technology instead of mining. Cryptocurrencies have an advantage in the cryptocurrency vs. fiat currency debate because they emphasize privacy and security. While transaction details on public blockchains are visible to everyone, users’ personal information remains anonymous. In addition, they provide flexibility when designing decentralized financial systems.

The unique nature of cryptocurrencies also draws attention to their limited supply. While fiat currencies can be printed by central banks as needed, most cryptocurrencies have a pre-determined maximum supply. For example, Bitcoin has a maximum supply of 21 million BTC. The difference between fiat and cryptocurrencies also points to the transparency of cryptocurrencies. Blockchain technology records all transactions in a public ledger, ensuring transparency along with accountability for all users across the network.

The working mechanism of cryptocurrencies allows users to conduct transactions faster than traditional methods such as credit card payments and remittances. Most importantly, cryptocurrency owners do not need to rely on banks or other financial intermediaries to store and manage their money. Users can store their cryptocurrency assets in their wallets and have full control over how they handle their assets. However, cryptocurrencies have some limitations due to regulatory uncertainty and the volatility associated with them.

Familiarize yourself with cryptocurrency terminology with our cryptocurrency flashcards.

What is the difference between fiat currency and cryptocurrency?

The fiat vs. crypto debate has become a prominent highlight as the crypto market continues to move in a bullish direction. This has led everyone to believe that cryptocurrencies will eventually replace fiat currencies as a generally accepted store of value. However, the decline in crypto prices has restored the balance in the comparison between fiat and cryptocurrencies. Here is an overview of some notable factors that differentiate fiat from cryptocurrencies.

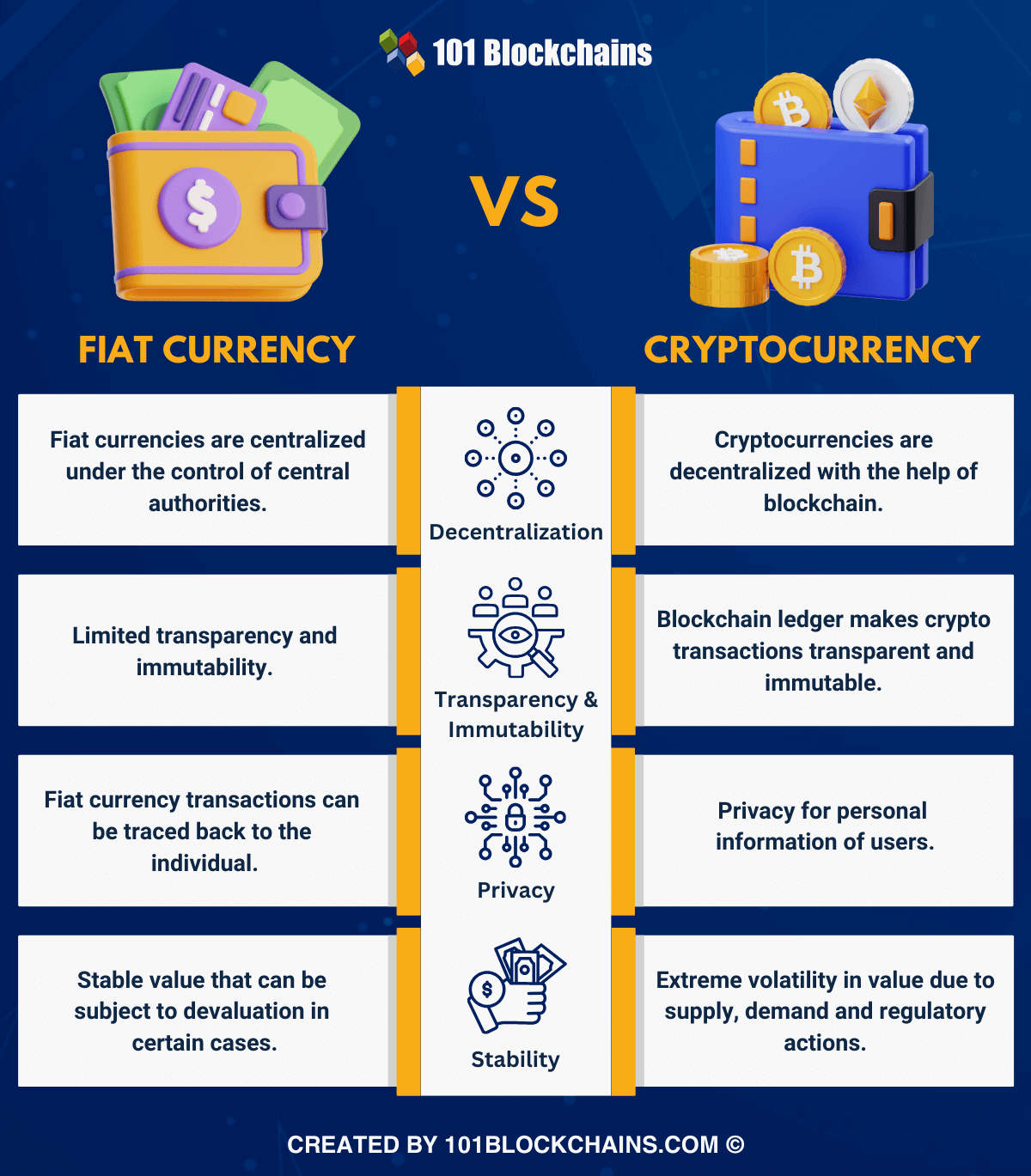

The biggest difference between cryptocurrencies and fiat currencies is decentralization. Fiat currencies are centralized because they are issued and regulated by a central authority, such as a central bank or government. This difference between fiat currencies and cryptocurrencies is revealed in the fact that the central authority has complete control over the money supply and interest rates. In addition, the central authority can also determine monetary policy.

Cryptocurrencies leverage the power of decentralization through blockchain technology. A network of nodes in a blockchain contribute to verifying and confirming transactions before they are added to the network. The best part about decentralization is that no single entity can completely control a cryptocurrency network. Most importantly, a consensus mechanism governs the verification process, making cryptocurrencies resistant to tampering and censorship.

Want to gain a deeper understanding of crypto fundamentals, trading and investment strategies? Enroll in our Crypto Fundamentals, Trading And Investing Course today.

-

Transparency and immutability

The differences between fiat and cryptocurrencies also raise concerns about the transparency and immutability of the system. These factors are key differentiators in the cryptocurrency vs. fiat currency debate, as blockchain provides a transparent and immutable ledger for cryptocurrency transactions. All transactions are recorded chronologically and cannot be modified without the consensus of network participants.

Traditional banking systems do not have the same immutability and transparency. Banks and financial service providers maintain records of transactions, but their accessibility to the public is limited. Furthermore, records can be modified or manipulated by a central authority. This does not apply to cryptocurrencies, as cryptocurrencies provide greater trust and security for transaction data.

The next important difference between fiat and cryptocurrencies is privacy. Since it is an important requirement in finance, we can evaluate the difference between fiat and cryptocurrencies in terms of privacy. Fiat currency transactions can show a clear trace leading to the person making the transaction.

On the other hand, cryptocurrencies stand out in terms of privacy because cryptocurrency transactions are clearly visible on the public blockchain. However, the difference is that only the wallet address is visible, not the personal information of the sender and receiver. Emphasizing anonymity in cryptocurrency transactions makes it difficult to trace the origin of the transaction.

Another difference between cryptocurrencies and fiat currencies is stability. Fiat currencies are generally more stable than cryptocurrencies in terms of price. However, when comparing cryptocurrencies to fiat currencies, it is important to note that fiat currencies are not completely immune to devaluation. For example, the Zimbabwean dollar lost about 76% of its value in 2022.

Cryptocurrencies have been infamous for their volatility. The price of cryptocurrencies can fluctuate from day to day, causing huge losses or huge profits for users. However, stablecoins were created to solve the problem of extreme price volatility of cryptocurrencies.

Embrace the technological leaps and global adoption expected in the upcoming bull market of 2024-2025 with the Crypto Bull Run Ready Career Path.

Last words

Debates about questions like “Are cryptocurrencies better than fiat currencies?” appear during bullish cycles in the cryptocurrency market. As the cryptocurrency market prepares for the next bull market, it is important to see if cryptocurrencies can finally outperform fiat currencies. However, there is no way to completely abandon fiat currencies, as they are the backbone of the global economy in many ways.

On the contrary, the benefits of cryptocurrencies are likely to attract more users. For example, cryptocurrencies can provide you with complete control over your money and protect your privacy. Moreover, the common criticism of cryptocurrencies based on price volatility also applies to fiat currencies in some cases. Therefore, it is important to learn more about the differences between cryptocurrencies and fiat currencies in order to choose the ideal option for various applications.

*Disclaimer: This article should not be taken as investment advice and is not intended to provide investment advice. The claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains is not responsible for any losses suffered by anyone relying on this article. Do your own research!