FIBONACCI on Forex Market – Analysis and Forecast – February 16, 2024

Forex traders utilize Fibonacci retracements to help identify possible keys. level support and resistance. These levels are used as a guideline for traders looking to enter or exit the market with appropriate levels. risk management skills.

How to Create a Fibonacci Retracement in Forex Pairs

Before looking more closely at real-world examples, traders should have a basic view of the overall market being analyzed (such as EUR/USD or USD/ZAR). This starts with identifying trends. Depending on your trading style, this could be long-term, medium-term or short-term. There are a variety of methods you can use to identify trends, including simple methods. price actionIndicators such as: moving Mean (MA) and other methods. The reason identifying trends is important is because the Fibonacci tool itself does not determine trend bias, but rather identifies key support and resistance levels.

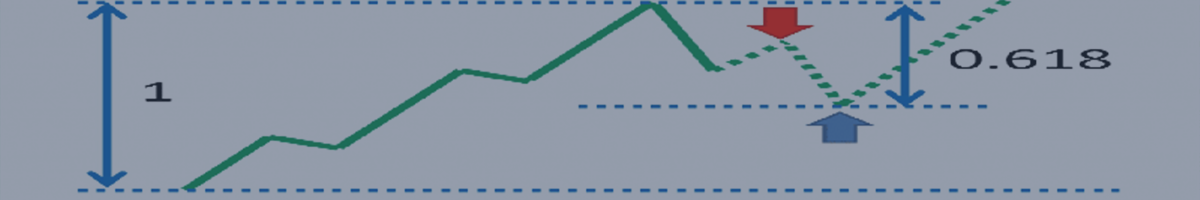

To implement a Fibonacci retracement, you need to identify large up/down movements on forex price charts. It uses the Fibonacci metric to generate key levels. nature of duel forex pairs There is a mean reversion trend that can create major moves that can lead to Fibonacci retracements.

Key levels to watch out for are 38.2% and 61.8% respectively. Although the 50% level is not technically a Fibonacci level, it is often included in charting packages and is considered an important threshold. This level simply marks half way through the market’s movement between the initial high and low and vice versa. The chart below shows a simple implementation of a Fibonacci retracement. GBP/ZAR daily chart. The parts highlighted in black are the relevant items. from low to high Dots used to mark Fibonacci levels.

GBP/ZAR daily chart – Rising trend:

Traders can also utilize Fibonacci retracements. From high to low Price levels are as indicated USD/SGD Chart below.

USD/SGD daily chart – downward trend:

Once Fibonacci retracements are drawn, traders can use these price levels whenever possible. entrance signal. that much USD/CAD The example below shows the tendency of price action to revert to various Fibonacci levels. The blue rectangle highlights the area between the 61.8% and 38.2% Fibonacci levels. It is clear that the price respects these two key support and resistance points. Traders can enter a short position at 61.8% as a result of the previous downtrend, with initial support starting at the 38.2% level.

It is important to note that Fibonacci points should be viewed as guidelines or reference points rather than specific levels. Prices do not always trade at the correct level. It is common for prices to fall short or exceed levels that can frustrate traders looking at the exact levels. When it comes to stop and limit orders, traders must give themselves some leeway for potential price movements around Fibonacci levels. The chart below shows an example above the 23.6% level (yellow) where an uptrend pushes the price higher but quickly moves back below the 23.6% level.

USD/CAD daily chart:

This is the simplest form of Fibonacci retracement within the forex market. The versatility of the Fibonacci retracement function means that it is not limited to one time frame, as you can see above. A more complex approach involves multiple Fibonacci retracements. different time zones. Enactment Multiple time zone analysis Multiple Fibonacci retracements derived from major movements can be accepted. The next article in the Fibonacci series will cover more in-depth real-world examples to show how exactly traders can implement this strategy.

FIBONACCI retracements help you see the bigger picture

Forex traders often make the mistake of taking positions in the market based solely on Fibonacci levels, but this can be detrimental as it can make them too one-dimensional. Different indicators, chart patterns, candlestick pattern The fundamentals are essential to create a better overall strategy. And ultimately, informed trade decisions are made. Fibonacci can be a very powerful tool in forex trading, so fully understanding the basics of Fibonacci can be helpful to any trader looking to implement the tool within their own trading. trading strategy.

Learn more fibonacci and other trading-related topics by subscribing to our channel.