Fidus Investing: A Great Long-Term Holding for Income Investors? (NASDAQ:FDUS)

Devrimb/iStock via Getty Images

introduction

As a BDC investor, I’m constantly looking for others in the space that have the potential to be great long-term investments. Whenever I’m looking to invest in a company, my goal is to look at a variety of metrics. I make sure it meets the buy-and-hold criteria I typically look for when investing. Business development companies are still considered risky, but in my opinion, they are more powerful than ever. A better management team and a defensively positioned portfolio make it a holdable not only for the near term but also for the future.

One BDC that has recently caught my attention is Fidus Investment (NASDAQ:FDUS). Since their name came up a few times in the comments on my article, I thought I would do some analysis on them. My initial thought was that they reminded me a bit. Another one of my favorites and holdings in that area (we), Capital Southwest (CSWC). The company seems to have all the makings of a superstar. In this article, we explain why we think Fidus Investment is possible. noticeable The sector explains why they can be great long-term holdings for income investors.

Who is FDUS?

Fidus Investment is a business development firm specializing in leveraged buyouts, refinancing, strategic acquisitions, growth capital, business expansion and debt investments. Unlike many other BDCs, they do not invest in turnaround or financially distressed companies.

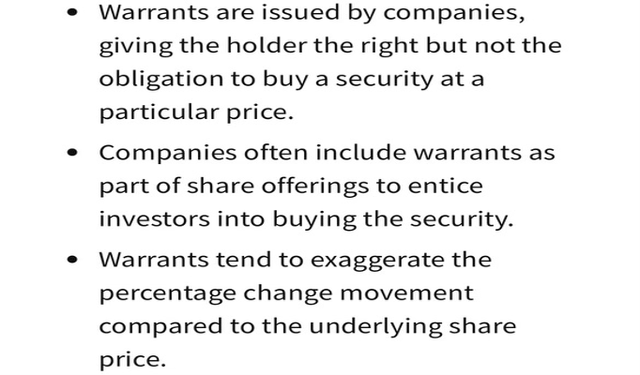

This is why some people prefer not to invest in the sector. This can be a turnoff to investors because most loans are given to financially struggling companies. Another difference is that FDUS invests in warrants and sometimes takes minority stakes in the companies it chooses to invest in. A warrant is similar to an option. and maybe Although it is considered risky, it can yield high returns.

Investopedia

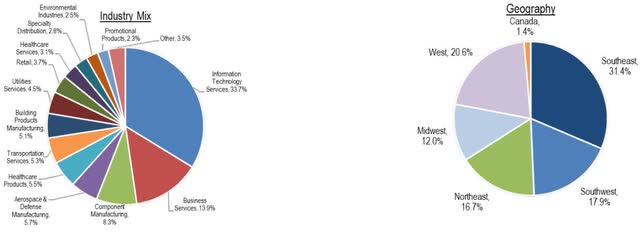

Warrants, similar to options, are offered as call options or put options. This is one way that some BDCs can reward shareholders with very high returns. Another thing that sets FDUS apart is that it has a much higher concentration in the information technology sector than its peers, at nearly 34%.

FDUS Q3 Investor Presentation

This compares to peers Ares Capital (ARCC), which has 23.2% invested in the software and services industry, and Capital Southwest’s portfolio, which has just 3%. FDUS is also geographically diverse, with most of its investments in the Southeast and Southwest regions. A high concentration in the IT sector means that FDUS is in a defensive position and is likely to provide consistent and stable cash flow.

When looking at BDCs, I generally prefer those with longer track records, especially those that predate the financial crisis. Looking at what a company did during turbulent times can reveal not only the company’s financial difficulties, but also the performance of its management team.

Some BDCs had tough times during the 2008-2009 recession, but so did many others. I like people like that better. think about this How would you react if a friend asked you to invest in their business that had just opened for 6 months? Now what about someone who has been in business for the last 20 years?

This is a person who has been in business for 20 years not only through GFC but also through the pandemic of 2020. This doesn’t necessarily mean they are a better business, but it does give them experience during a recession. And even if you face financial difficulties, you will have learned a lesson from them. This is the same concept you look for when researching a company/business.

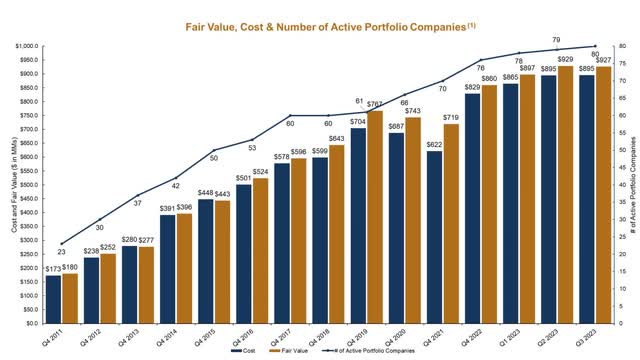

FDUS had its IPO in 2011, so it’s taking some time. Not as much as other peers like ARCC or CSWC, but enough to evaluate their performance and get a picture. Since 2011, BDC has grown its portfolio from 23 companies to 80 companies. Additionally, the majority of debt investments are in first/second lien loans at 67.3%.

FDUS Investor Presentation

Strong Dividend Growth and Earnings

What impressed me most about FDUS was its dividend growth. In 2023, the company rewarded shareholders by paying out a lot of additional profits in the form of special dividends. It also increased its base dividend by nearly 5%, from $0.19 to $0.27, and its supplemental dividend by more than 42%. In the third quarter, BDC paid dividends totaling $0.72. The DGR of FDUS over the past three years was 43.33%. This compares to 39.02% for CSWC.

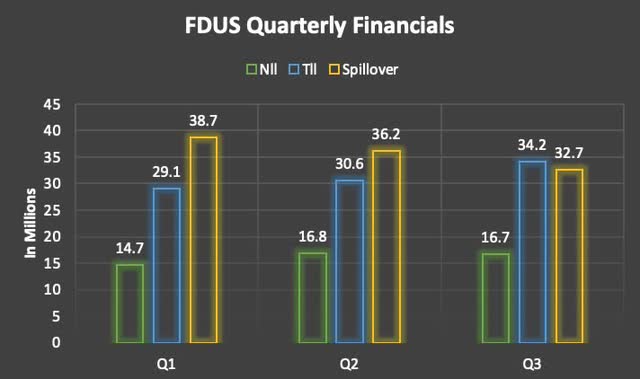

During its third quarter earnings in November, FDUS continued its quarterly financial growth. In the chart below, you can see that both net and gross investment income have increased by double digits. Additionally, BDC continued to carry over additional revenue and recorded excess revenue of $32.7 million, or $1.15, in the third quarter.

Create author

The company also continued its growth path with two new investments worth $80.3 million during the quarter. One was a leading software provider for automobile dealerships, and the other was a leading regional supplier of medical equipment to hospice organizations and subacute care facilities.

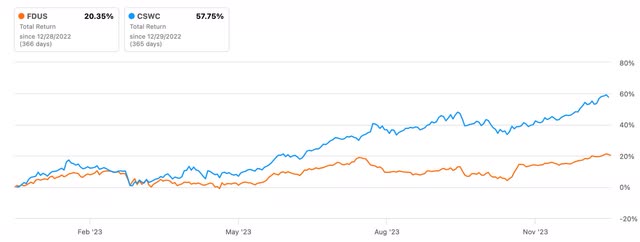

In the chart below, I compare FDUS to CSWC, one of my favorites in the sector. The latter has outperformed most of its peers in terms of total return. They have performed better than Fidus over the past year. We can see that CSWC doubles 20.35% of FDUS.

pursue alpha

However, if we look at a three-year period, we see that the former outperforms CSWC by a significant margin.

pursue alpha

Here again, they performed more than 40% better than CSWC over five years.

pursue alpha

If we look more closely below, we see that CSWC has more than doubled the total return of FDUS over 10 years to over 366%. This is because over 10 years it has reached almost 169%. But that’s still impressive considering it’s a return of over 16% per year and higher than the S&P’s typical annual return.

pursue alpha

well-accumulated debt

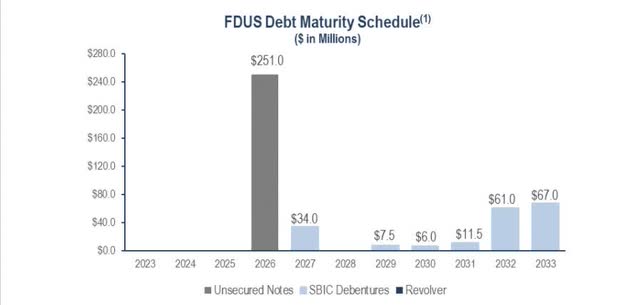

FDUS also has an impressive balance sheet with a growing portfolio and dividends. The BDC has no debt maturing until 2026, and interest rates are expected to be significantly lower by then. And even then, after having to pay $251 million over the next two years, there’s little left to mature in the next few years. All of their debts had a weighted average interest rate of 4.1%. Additionally, it had $100 million in borrowings under its revolving credit facility and $80.3 million in cash.

FDUS Investor Presentation

2024 BDC will continue to reward shareholders

I recently wrote an article titled “Don’t Give Up on BDCs in 2024.” With three interest rate cuts expected next year, some may be concerned about the industry. We expect some prices to be pulled back once this begins, but high-quality products will still continue to pay additional revenue in the form of specials and supplements.

That’s because many of them have enjoyed excess income and are likely to carry that into the new year. As portfolios grow and earn more than dividends, many can and will use the additional income to continue to reward shareholders. So, with interest rates expected to fall, BDC earnings will still increase.

FDUS management addressed this issue in its recent third quarter earnings call. The CEO stated that the company plans to continue paying out 100% of excess profits going forward. And as they do so, I expect their share prices to continue to reflect this and trade above NAV like many of their peers.

And I also see their management taking advantage by issuing stock and raising capital while prices continue to rise. FDUS recently issued 3.2 million shares at an average price of $19.54, generating net proceeds of $61.5 million. So 2023 was a great year and 2024 and beyond look promising.

Risk and Value Assessment

FDUS has done a good job of monitoring unfunded funds. Peers like TriplePoint Venture Growth (TPVG) have risen significantly due to the high interest rate environment. I discussed this in a recent article. Fidus’ proportions were very manageable. At the end of the third quarter, accruals amounted to just 1.3% of the portfolio at fair value. This was 1.2% at the end of 2022, so the company has done well in keeping this ratio low. It also speaks to the quality and financial strength of the portfolio companies.

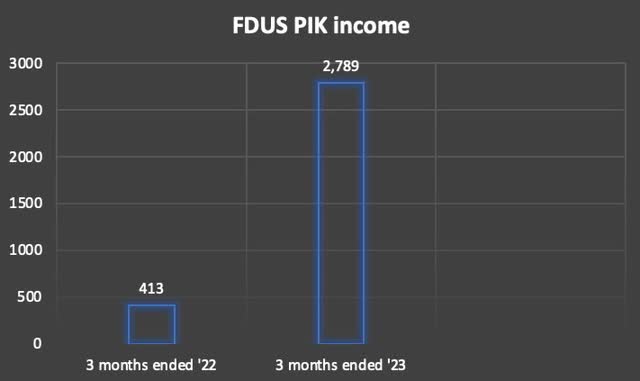

However, one thing that has increased from 2022 has been PIK interest income. This is more than double the number in 2022. This doesn’t necessarily mean there are concerns about the portfolio, but it’s something to keep an eye on going forward.

Create author

Moreover, the stock is currently trading at a premium to its NAV of $19.28. At a price of $19.67 at the time of writing, the BDC has little upside compared to its target price of less than $21. And while I expect the price to trade around here for the foreseeable future, I would advise investors to wait for the price to drop before adding or initiating positions.

conclusion

FDUS has all the makings of a future superstar in the field. Additionally, they performed well in 2023 and expect this to continue in 2024, rewarding shareholders with additional income. Additionally, they have been steadily growing their portfolio and have a strong balance sheet with well-funded debt maturities. However, the price is expected to fall, so we expect the price to decline in the near future.

Additionally, while PIK income has grown significantly over the past year, management has managed to keep payables below the KBW BDC average. Despite its performance over the past three to five years, we believe BDC continues to have something to prove going forward. Due to PIK earnings growth and valuation above NAV, we currently rate the stock as a Hold.